Credit card issuers generally don’t release all that many statistics about cardmember demographics, as they’d rather keep that info to themselves. That’s why I think some people will be interested in what Monkey Miles has found…

In this post:

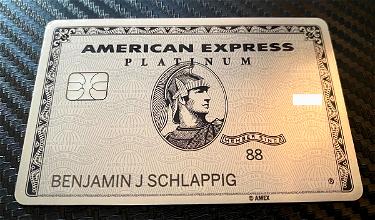

Amex Platinum cardmember stats

Departures is the magazine for Amex Platinum cardmembers. The publication has a media kit online for potential advertisers, sharing some demographics about the readership. Since the magazine is specifically for those with the Amex Platinum, I think it’s safe to assume that this is also intended to reflect Amex Platinum cardmember demographics.

According to this, the average Departures reader (and therefore average Amex Platinum cardmember):

- Has a net worth of $4.3 million

- Has a household income of $474,000

- Is 56 years old

- Owns 3.6 properties

Amex Centurion cardmember stats

In addition to Departures, there’s also the Centurion magazine, exclusively for Amex Centurion cardmembers. The Centurion Card is often referred to as “the Black Card,” and it’s invitation-only.

According to this, the average Centurion reader (and therefore average Amex Centurion cardmember):

- Has a net worth of $11.4 million

- Has a household income of $1.8 million

- Is 57 years old

- Owns 6.0 properties

These numbers are way higher than I was expecting

Let me again emphasize that the above numbers are according to a magazine for cardmembers, rather than from Amex directly. In other words, it’s possible that this comes from reader surveys rather than from Amex data. Nonetheless I think these are numbers people will find interesting.

A few thoughts based on these numbers:

- All of these numbers seem way, way higher than I was expecting

- I would imagine that the median net worth and income is significantly lower than the average, given that there are probably quite a few uber-wealthy cardmembers

- 3.6-6 properties?!? Taking care of that many places seems like a full-time job in and of itself

- Nowadays I feel like so many millennials have picked up this card for the perks, and you’d think in general that would lower these numbers significantly

Bottom line

The exclusive magazines for Amex Platinum and Centurion cardmembers have a media kit that shares some alleged statistics about readers (and therefore cardmembers). This includes net worth, income, age, and properties owned.

These numbers really surprised me — cardmembers are older, richer, and have more properties, than I would have expected.

What do you make of these alleged Amex cardmember demographics?

I'm an Amex Plat member and I do not make this much annually. I am 51 yo and I do have a rental property, have 3 different businesses and have a full time job. I do get busy with work which I love anyway. I travel 5 or more times per year. I do not consider myself wealthy but I feel very comfortable, happy and grateful with what I make. :)

It's true that millennials (or at least people under 50) have this card, but I'm willing to bet it doesn't lower the average age much since not as many hold the card at any one time due to the churning nature (of said millennials) for the benefits. In other words, the younger ages with this card hold it only when the benefits are useful and they easily break even. The mid-upper end of the age range holds the card regardless of benefit/break even.

Averages are useless for these purposes.

As you point out the median would be a better metric or better yet a percentile / quintile based net worth graph.

My household income in nowhere near those numbers on the downside

Median is a much more reliable statistic than Mean for things like this for all the reasons you point out. Averages can be skewed by a small group of outliers.

2nd, it is well-documented in many surveys of self-reported net worth that people wildly over estimate the value of real estate, especially their primary residence.

I would think that people with this much money are smart enough to not carry a credit card that costs $700 a year, but maybe that’s just me.

Entirely not surprised. Amex would not be profitable if a substantial number of cardholders were churners and MSers. Median household income for a new C class buyer is close to 160k, and that’s for the “C for Cheap” class. At the local Ferrari dealership, an overwhelming number of customers have an Amex card as primary due to their excellent customer service.

They are. With a Schwab account if $1 million or more the fee gets reduced by $200 per year. The $500 AF therefore pays for itself with benefits and convenience. Eg. Yearly Uber/Uber Eats credit of $300. $100 yearly Saks credit. Offers throughout the year to save $. Hotel upgrades and benefits. Elite memberships. Convenience.

You should drop by the centurion club (airports)overcrowded.

As a platinum card holder, this almost precisely describes my life . Age, income and net wealth and property ownership.

Why would Amex disclose such demographics ? Doesn't make any sense

Where in the world did they get these inflated statistics?

I’ve been a platinum AMEX card holder for years and don’t even come close to any of those numbers in terms of salary or net worth. One can only wish.

This has to be an ad for AMEX. Marketing is genius now, do you all see it or not?

I, on the other hand, was underreported bigley in this report.

It explains right in the article how they got these numbers. From the demographics of the included magazine subscriptions that come with each card.

Ummm. I have had the platinum card since I was 20. I’m now 42. I make a little over$ 70,000 and have one property. Soooo that info bull.

It’s not true. The black card no need these average. I know because ..I KNOW

It’s a specific requirements. And is not a 1,8M income. And no need more then 1 single house. And age it’s not true.

It’s diferent. But yes you must get an invitation. just depends how did you spend your money and trust me. 5 stars in a Restaurant it’s not enough

These figures are so far from accurate. The AMEX Platinum card is very popular. Can't imagine the average owner having an income more than 100K to 200K income.

Feel like this article is just a big promotion to stand the card up lol

Need to talk to some one about my accounts

Good for them, they worked for it. Stop knocking people with money.

They invite me but I don't travel that much, all the point benefits are booking flights and hotels. Stick my gold and get X4 on dining, take out and supermarkets, X3 on flights, plus all the other credits.

In that case, 1. Customer service should be much better and, 2. You can expect the annual fee to increase further.

So, if i get the card, my wealth will substantially increase. Nice.

Ha! I'm bringing the income average way down.

I'm a platinum card member and although I have good income it's nowhere near 3.4 MM annually. Those stats are entirely too high and not reasonable. But you need a solid income to carry this card because of the high annual fee, but worth every penny.

They need to show the media vs average (mean).

However, with the exception of the number of properties, their stats are pretty close!

Should see the mean. Average is tilted because of extreme high earnings.

Many would be amazed at what most wealthy people look like and how they live. As a member of this group these numbers seem fine. Most live in average homes and drive good older cars. (Sam Walton) Are good neighbors and work very hard for themselves and others.

Hollywood and society has made up what we should look like. We currently own (no mortgage) 19 properties all but one commercial. They are the investments...

Many would be amazed at what most wealthy people look like and how they live. As a member of this group these numbers seem fine. Most live in average homes and drive good older cars. (Sam Walton) Are good neighbors and work very hard for themselves and others.

Hollywood and society has made up what we should look like. We currently own (no mortgage) 19 properties all but one commercial. They are the investments for our future which we have obtained over several years. So 3-6 average should be realistic. Don't judge us all by unrealistic standards. Continue to dream and work hard for yourself, family and business and never forget others. (That order) and you will enjoy youe own rewards. Our platinum card is one of those. Not for the prestige but because it makes business sense.

Platinum definitely is skewed. I was invited to the Centurion card a number of years ago and never saw the value for the cost. I would say that these stats for either card are not relevant. The deciding factor on the Centurion is volume spent in a calendar year. I have always used our Platinum for business expenses and that hovered around $230k a year for some time. However, we used a different card for...

Platinum definitely is skewed. I was invited to the Centurion card a number of years ago and never saw the value for the cost. I would say that these stats for either card are not relevant. The deciding factor on the Centurion is volume spent in a calendar year. I have always used our Platinum for business expenses and that hovered around $230k a year for some time. However, we used a different card for company travel expenses. When the Platinum travel benefits became more attractive we solely used the Platinum card. Once we broke $300k spending a year and never carried a balance. After the 3rd year I received the phone call as well the luxurious invitation in the mail. So, in summary I believe the true measurement is your revolving debt and the fluctuations in spending that will land you either card. It’s just easier to qualify with the aforementioned stats.

I am just poor white trash from Marin that they mistakenly issued a card to!

Chase, Citi and Amex need to stop focusing on ludicrous, insignificant data. We want the best lounges!

I still work a 9-5 and I’m definitely a platinum card member. Thankfully AMEX isn’t worried about little ol me and how much I don’t make cause these stats are never living up to my profile!

Average != median

You do realize AMEX does not check these figures; they are given by card holders by and about themselves I believe.

When I use my Amex platinum, people see that your doing great, then they start to ask you questions, like, if your income was one hundred and seventy-five billion dollars, would you give 1 million dollars to each particular person in the nation, so our nation can achieve greatness, I would but, with that type of power, you have to believe, even in the right people's hands, there will always be differences in the iterations...

When I use my Amex platinum, people see that your doing great, then they start to ask you questions, like, if your income was one hundred and seventy-five billion dollars, would you give 1 million dollars to each particular person in the nation, so our nation can achieve greatness, I would but, with that type of power, you have to believe, even in the right people's hands, there will always be differences in the iterations of responsibilities, and for other nations to witness this transition, it just wouldn't be fair, well, as long as everyone follows the same strategy to respect, and help each other, only then it might work.

I'm voting for this guy.

This guy basically said nothing is changing in nice words and he already got a vote from @JK.

You gotta love politicians.

I’ve been a platinum member for years. Main reason, best service in the industry. When you travel and have employees spread out, that’s very important.

As for the stats- nailed it

I'm a Platinum holder and I will never want to own 3 properties, or ever earn such outrageous income as described in this article. However, I'll take the perks all day, any day!

Not surprised at all about the black card. The platinum card yes.

Average vs median

Not surprising at all if you look at the wealth gap.

Income, wealth, and age seem right. Property too high

Welcome to all loyal families, who chooses on American Express. Good morning ' Aloha* I had American Express/try not to owe them . FEDS actually came trying to collect me. No, biggy but true story.

Well, my wife and I earn the "AMEX Pt" salary and are quite young, but don't have the card and have only 2 properties. Where do we belong - 'stupid' or 'dumb' category?

I'd say neither. I think 2 properties is reasonable. The Platinum is overrated and pricey. Save your money and invest in real estate or hege funds.

AmEx is a very sophisticated and long-term direct marketer. As such, AmEx knows how to overlay its files with geo-demographic data, thus knowing--not guessing, but knowing--the crad members' incomes, age, marital status, number of children, residential type (single family versus multi-family), etc., etc. The numbers are real sports fans.

I've known people over the course of time who have been able to get the green, gold, platinum and black cards by inflating their incomes--substantually! So no, the income is not as important as your cedit report, for instance. It's the card members ability to pay the annual fees that AMEX counts on.

Also,

CC companies rely on self reported income and net worth numbers.

They are likely overstated to a certain extent.

I've been a Centurion member for years. I would caution "Number of properties owned" (if asked that question of myself) would include all properties, investment properties, think rental houses, apartments etc. So if one member, owned 300 apts, and they only surveyed 100 people, you could see how this could skew the results. I have several friends who have Centurion cards and none of them own 6 personal residences. Most have one or two.

Yes those that are American Express platinum cardholders are in that demographic as Surveys don’t lie .

eponymous has it exactly correct! Like average retirement savings, these numbers are right skewed. I wonder what the median figures are for assets and income. Probably a lot more realistic, but not as thrilling for advertisers. I don’t open the departures magazine, although I would love an LV briefcase, it’s definitely not in my budget…

For me the key takeaways from the post and the discussion are:

1. The different metrics are independent of each other. Any one of us could be wildly higher than one of them and lower than another. That doesn't change the validity of the data (however accurate it is, or not).

2. Those of us in here who care about the individual benefits of the card or even our MR balances are a niche part...

For me the key takeaways from the post and the discussion are:

1. The different metrics are independent of each other. Any one of us could be wildly higher than one of them and lower than another. That doesn't change the validity of the data (however accurate it is, or not).

2. Those of us in here who care about the individual benefits of the card or even our MR balances are a niche part of AMEX's target demographic for the card. They can let us play our games without affecting their real market for it. And they will still make some money when we use whichever of the benefits we choose to take up.

While most of the readers here are way off the average, I don't believe this means the group is not Amex's target demographic.

If so Amex wouldn't bother with all these hard to use credits or once a lifetime bonus. They wouldn't even need a Platinum card segment, just straight up Centurion.

Let's not forget, having 100x more wealth doesn't equal to spending 100x more on Amex cards. Elon Musk or Jeff Bezos probably are not spending $50M a month on credit cards.

It is hardly surprising. Remember those two cards are not credit cards but charge cards. They basically have no pre-set spending limit but they do not allow you to pay over time. You need to pay the bill in full when it is due. The age has to do with two factors I think. First is because they may be more willing to pay that kind of annual fee. Second is because they may primarily...

It is hardly surprising. Remember those two cards are not credit cards but charge cards. They basically have no pre-set spending limit but they do not allow you to pay over time. You need to pay the bill in full when it is due. The age has to do with two factors I think. First is because they may be more willing to pay that kind of annual fee. Second is because they may primarily charge there not considering the offers and returns that other cards provide. Not everyone effectively maximizes the points and miles game.

My Platinum AmEx does allow pay over time, actually. You pay extra for the privilege, but it does exist.

Is it a credit card now?

If one clicks a little bit on that departures Website, one can see that the audience of this magazine is outside the US, with almost 200k living in Asia and 167K in Europe amongst others.

From that point of view I think the numbers make total sense;)

I feel a great sense of underachievement however, as I am not even close to these averages.

Maybe not every Platinum member receives the Departures...

If one clicks a little bit on that departures Website, one can see that the audience of this magazine is outside the US, with almost 200k living in Asia and 167K in Europe amongst others.

From that point of view I think the numbers make total sense;)

I feel a great sense of underachievement however, as I am not even close to these averages.

Maybe not every Platinum member receives the Departures magazine? Given how easy it is to get the card, I found that the number of copies is a little low.

Not sure about all, but I received my departures magazines in the U.S. regularly. When I temporarily moved outside the U.S., the continued sending it to me to my overseas address. Did you forget to opt in or maybe opt out somehow?

For the record, I’m on the higher side of all those averages.

What an absolute crock. My wife and I have a platinum card each. If you multiply our net worth by 100 and then add on the Queen of England, along with the entire Royal family's worth, then you'd still be short by some margin.

numbers aside, who manages his/her own properties when you have more than 3 and scoop 1/2 million a year. Nobody. I’d have thought the writer knows more about money and asset management. Apparently not

This makes no sense. With only 3 properties an $500k, you would totally manage your own properties.

Those numbers seem way high. I think you have hit something by differentiating average and median. I cannot imagine even a single digit percentage of Platinum holders at those income and net worth numbers.

allow me to drag down the average.

net worth of umm 500k on a good day

household income 120k

38 years old

owns 1 properties

No way that's true. It's only 695 per year. I have it to get in the sky club.

Umm, I don't know where they got these stats but I've been a platinum card holder for 22 years and no where near those statistics. Doing well and working hard but come on now.

Age: 38

NW: Poor as hell but knows how to work a buffet and open bar

Income: None of your business

Properties: 1 house

Let's get real here. Bezos has a card, and everybody else gets lifted up to $4.3 MM avg. net worth.

They're trying to sell ads for fractional jet ownership and luxury brands (i.e., the goods the EU has exempted from Russian sanctions) in a rapidly non-relevant paper magazine...

Age: 38

NW: Poor as hell but knows how to work a buffet and open bar

Income: None of your business

Properties: 1 house

Let's get real here. Bezos has a card, and everybody else gets lifted up to $4.3 MM avg. net worth.

They're trying to sell ads for fractional jet ownership and luxury brands (i.e., the goods the EU has exempted from Russian sanctions) in a rapidly non-relevant paper magazine targeted at aging boomers.

The card can be useful for those who know how to work it, but it's just a charge card. They'll issue it to anyone with an SSN willing to put monthly bills on the card. Remember, Wal-Mart membership is a benefit now. It's not über luxury.

To add to my comment, the property figures are suspect. In the real estate business, most wouldn’t register the properties directly to themselves but rather through LLCs or a business. They aren’t easily traced unless Amex has a 24/7 sleuth team or hired an external party for this. Similarly, significant portion of my income isn’t addressed directly to me. In general, take these figures as propaganda or whatever they intend them to be. Won’t many...

To add to my comment, the property figures are suspect. In the real estate business, most wouldn’t register the properties directly to themselves but rather through LLCs or a business. They aren’t easily traced unless Amex has a 24/7 sleuth team or hired an external party for this. Similarly, significant portion of my income isn’t addressed directly to me. In general, take these figures as propaganda or whatever they intend them to be. Won’t many young earners actually be turned off by figures? I find that accumulation and flaunting of wealth is refreshingly low amongst the younger populace; for reference, I’m 35.

I’m definitely surprised by the age, although these are averages so give us little information of the population on their own. The median should also be described to give an idea of the complete distribution. I suspect it’s heavy but easily offset by outlying high earners.

Still, the income and capital instruments don’t surprise me. My peers and I have the said cards and fit with the numbers. The age on the other hand...

I’m definitely surprised by the age, although these are averages so give us little information of the population on their own. The median should also be described to give an idea of the complete distribution. I suspect it’s heavy but easily offset by outlying high earners.

Still, the income and capital instruments don’t surprise me. My peers and I have the said cards and fit with the numbers. The age on the other hand surprises me greatly. Where income outliers can be skewed and impact the mean, age outliers are less influential in the descriptive statistics. I assume that Amex basically hands this card to a lot of long term clients with equity.

I also don’t think that owning proprieties is really that tough. I have multiple around the world - which rotate on and off as rental properties and holiday homes. Ultimately they are investments. Just like anything else, this is just another job.

The income for the black card is lower than I expected. I actually thought it was even more exclusive.

Had Amex since 1988. Platinum since 1995. I think the numbers are fairly accurate.

Age: 39

NW: $3 million

Income: $600,000 / year

Properties: 1 primary home, 2 Real Estate syndication deals

I'm no genius; however, the stats don't look to be accurate and they're misleading due using an average and not using the median. Rerun the data and find the mean for a more accurate reflection of Amex Plat users. I certainly don't fall within their criteria. Check a lot of boxes though, but those stats are hefty.

Military members bringing the average way down lol

This is a basic statistics principle, but averages are prone to being skewed (basically pulled in one direction) by outliers. A MEDIAN here would be more of interest, and also a 25th/75th percentile - obviously that likely would be more than what Amex would like to reveal...

Can we see the 50% median card member?

Id be more inclined to believe the accuracy of the Black Card statistics. The Platinum, not so much. I know a couple guys who have a Platinum and their incomes are no where near those figures. They couldnt even spend enough to make the introductory offers work for them. It was just the prestige of being able to say they had one

Takeaway, averages are bad metric. Start using median. Really interested to know median figures than averages.

This is a bad data journalism in my view.

It doesn't surprise me. A lot of tech workers in San Francisco or Seattle make $200K to $400K on their own

Amex doesn’t ask about property ownership beyond your primary residence (own vs rent on application). I’m very skeptical of those figures.

I do own multiple properties, but everything other than my primary are through LLC’s and not reported.

Wow I have had one for years and I am not even close to the medium

Net worth $2.2m

42 years

2 physician household

Gross 2021 household income $825,000

Properties: 1 primary home, 2 rental homes, 1 urban parking space

Yes, this kind of thing proves that our medical system is screwed. Physicians should be getting 1/4 of what they're getting and there should be 10 times as many as what we have now. Modern physicians only interest is helping their bank accounts instead of sick people.

After they spend 8 to 10 years training and pay exorbitant education then insurance fees they make too much? Let’s ask an ER doc today after two years of selfless service in the Covid era whether it’s too much. I’m thinking maybe it’s not enough!

Why would u say that?

I started school at 18 and got my first job in medicine at 30 with a household net worth of -$700,000. Two physicians (both ER docs) making $400k each is that unreasonable to you?

- OP

If you'd been helped to 'not die' by a top surgeon in their field, as I have, you might have a more fresh perspective. Rather than suffering from such resentful penis envy, as you so evidently do, mate.

That's a rude comment. Doctors make very little straight out of school unless you specialize. Know many that don't make a lot and many that do well.

Urban Parking Space aka that slum lord charging $40 a day to park.

Slum lord? I own a residential parking space in a large condo building and rent it to someone in the building who wants an extra space. Jeez, you people are crazy.

How do you have a household income of 825k but net worth is only 2.2m... I'm making nowhere near you but my net worth isn't THAT far off..

He and the missus clearly piss everything up against the wall.

This is what happens when you start education at 18 but get your first job at 30 with a negative net worth of over $700,000 between the two of us. Plus, we weren't always making that much. We've both been working double these past 2 years in the ER because of COVID because of all the retiring physicians and people who jumped specialties. More work = more income.

I doubt that's true, AMEX must be excluding the military. For Plat, AMEX waives the AF for active military, I see them all the time in the airport lounges (90% chance if they're fit, clean shaven and have a buzz cut, they're military) and very few make even six-figures...

Why the heck am I here?

Net worth ~5.9m

35 years

Gross household income 2021 - 1M

Properties 4 (commercial)

I’m not paying for that annual fee they went from $450 to 550 now almost $700 keep that bs

That’s why I love chase and capital one

We have two places and OMG it's nonstop maintenance and money. Think we will skip the 3rd. LOL

I’m a Amex Platinum card member and I can only wish to have such income

I’ve been a platinum card holder for 10 years. I’ve never, ever - ever - read Departures magazine.

Those numbers are intended to get advertisers onboard, not to provide accurate demographics. Take their figures with a boulder of salt. Only a fool would take them at face value.

And you know what I find it most amusing.

After all these years, you or any other 10+ year cardholder, have you ever got a survey from Amex even once, asking for how many properties you own.

They don't have to send you a survey, most of these data are public record (like the number of properties you own) and are put together by marketing firms behind the scenes. They also ask you for your income from time to time, so they know that. They have access to your credit report as well. So all sorts of marketing data are available. The surveys (and I've answered quite a few about product over...

They don't have to send you a survey, most of these data are public record (like the number of properties you own) and are put together by marketing firms behind the scenes. They also ask you for your income from time to time, so they know that. They have access to your credit report as well. So all sorts of marketing data are available. The surveys (and I've answered quite a few about product over the years) also reveal a lot. I have to say I don't think about points at all, and I'm sure I'm like the VAST majority of Platinum holders. I do enjoy the discounts, however, and with almost no effort I get the cost back on the card anyhow. I don't think it's a bad thing to be a point enthusiast, but honestly, having a Platinum Card and worrying about points is a bit like driving a Ferrari and worrying about the price of premium gas.

@Marcus

If they are just using public records, I can assure you the number is lower than reality.

Once you reach that point, you will learn how to organize your assets differently.

Well the way gas prices are going up lately…..

This.

Mean average of income is completely meaningless given the enormous outliers in the pool. They use these stats to send to advertisers who are none the wiser.

Or are they?

Some brands actually do advertise in these elusive group but seen by mass medium. They want brand recognition from the mass. So the next musician from the ghetto can talk about something other than sneakers.

It helps fulfil their egos of having a status symbol that isn't gold chains and Nike shoes.

For people with income in the top 1% and are 56-57 yrs old, I'd think the asset/income ratio should be much higher than 6-9x.

Another person tricked by statistics.

The average person...

Has a net worth of $4.3 million

Has a household income of $474,000

Is 56 years old

Owns 3.6 properties

....Is NOT one same person.

I too find the figures too be too high to be credible. It is like reading the ramblings of the drunk stationed at a bar in cheap chain restaurant: more bravado than accuracy.

If they are including rental property then it's not much work if you have a property manager

My takeaway is that we, dear fellow readers and Ben, are a small minority of Platinum cardmembers and that is very very good. Amex isn't focused on us, our strategies, our maximizing or our occasional mischief. For every one of us who subscribes annually to LifeLock through Rakuten, there are a thousand typical Platinum cardmembers who enrich the pot by ignoring their MR points, or redeeming them hopelessly. It's a very rich pot, which is...

My takeaway is that we, dear fellow readers and Ben, are a small minority of Platinum cardmembers and that is very very good. Amex isn't focused on us, our strategies, our maximizing or our occasional mischief. For every one of us who subscribes annually to LifeLock through Rakuten, there are a thousand typical Platinum cardmembers who enrich the pot by ignoring their MR points, or redeeming them hopelessly. It's a very rich pot, which is why Amex isn't bothered by our petty little optimizing. Yes, the statistics are inaccurate, and isn't it fascinating to debate "mean" vs. "average"? The stats are, to some extent, misleading and unscientific. But it's reasonble to surmise that we're not the principal profile of the Platinum cardmember. Rich indifferent people are leaving a lot of value on the table and we're scooping it up.

Exactly, thankfully our group is small enough to not warrant much attention. Just look at JPMorgans 10-K over 90% of points are just used for cash back or spent on gift cards. For everyone one of us that "maximizes" value on points there are 99 who "waste" them. This is good for us because as long as the numbers stay like this these card will have incentives that we can take advantage of.

ROFL.

Statistics are accurate. People are just misled by the labels.

People get misled by basic statistics because they can't even differentiate between median and mean.

And FYI "mean" is also called "average". There is no "vs." between the two.

Stats are scientific. But science is hard for too many people.

And being on a different end of wealth in this statistics doesn't mean you are worthless or insignificant as a customer.

...ROFL.

Statistics are accurate. People are just misled by the labels.

People get misled by basic statistics because they can't even differentiate between median and mean.

And FYI "mean" is also called "average". There is no "vs." between the two.

Stats are scientific. But science is hard for too many people.

And being on a different end of wealth in this statistics doesn't mean you are worthless or insignificant as a customer.

With facts out of the way. Let's go to opinions.

While most readers here don't change the mean, you're forgetting that you still represent a large group of cardholders.

If Amex doesn't care about the maximizing group, they would have just a Centurion card and call it a day. They still have a product that targets this group. Let's not forget, if Amex doesn't care, why would Amex impose the once per lifetime rule?

So even if you never make it to the top 1% doesn't mean Amex doesn't care about you.

One thing to remember is that, with the distribution of wealth, averages get "pulled up" by the few people who earn way more than everyone else (bell curve (normal distribution) vs. power law (pareto distribution)). Still probably large, but the "average" you're thing of as the majority of people isn't quite as large as you were originally thinking (phew!). Here's a good example to illustrate if you're interested: https://moontowermeta.com/in-power-law-world-average-doesnt-exist/

(A less intuitive type of...

One thing to remember is that, with the distribution of wealth, averages get "pulled up" by the few people who earn way more than everyone else (bell curve (normal distribution) vs. power law (pareto distribution)). Still probably large, but the "average" you're thing of as the majority of people isn't quite as large as you were originally thinking (phew!). Here's a good example to illustrate if you're interested: https://moontowermeta.com/in-power-law-world-average-doesnt-exist/

(A less intuitive type of curve is the pareto distribution or power law curve. It shows that the bulk of an outcome can be driven by just a few or even a single observation. If you are an hourly wage earner in an Amazon distribution center and Jeff Bezos walks in the room, the average person in the room’s wealth is now that of a “one-percenter”. This computed average, of course, is meaningless to describe how an actual worker in this room is actually living. Wealth is distributed according to pareto curves, not bell curves.)

I'm a Gen Xer in my mid 40s, with one property (i.e. my house). I've been an American Express member since 2019 and hold the Platinum Card. I'm here to announce that I am well below average (per these stats) lol.

Age: 21

NW: $25K

2021 income: $20K

No properties

Lol

Unless you're an authorized user or has been one for 21 years, you are probably the other extreme end of outliers. How you even got approved for Amex Plat amazes me.

I was approved for the platinum while I was in college with no real income. These stats are BS give the sample size. They should have used median.

Platinum card holder

net worth approx $4 Million (business, investments, home equity )

2021 income $602,217 (S-Corp)

55 years old, 56 later this year

only 2 homes...

Pretty close

I check a lot of boxes for great credit and decent financials, but those stats are hefty. Maybe they screwed up and showing the black cards stats. In all seriousness, when you see "average" antennas always go up. I'm happy with my gold card and bought a priority pass for airport lounges for $100 per year. Close enough for me.

Average and median are two very different things. The true outliers at the top end (ultra high net worth individuals) always greatly skew numbers like this.

It's very easy to skew the average/mean like the Bill Gates and cat example shared earlier.

A better measure might be the median, or the middle 50% of the entire population.

The kind of perks and offers Amex is adding tells a different story. Case in point, the Walmart+ benefit.

In this data, I see the flaw of averages, and not the law of averages.

These statistics make absolutely no sense

First… if you have a 500K annual income (even late in your career) at 56, a net worth of 4M is quite low -> shows people are spenders.

Second… the average of 6 properties and 12M net worth does not make sense. Even if you have a few people who own dozens of rental properties and the average owner has 2-3 properties, the ratio of 6 properties to 12M...

These statistics make absolutely no sense

First… if you have a 500K annual income (even late in your career) at 56, a net worth of 4M is quite low -> shows people are spenders.

Second… the average of 6 properties and 12M net worth does not make sense. Even if you have a few people who own dozens of rental properties and the average owner has 2-3 properties, the ratio of 6 properties to 12M net worth doesn’t make sense… even if these are people buying up multiple <300K properties with debt. You would expect that these people would have a MUCH higher net worth if 6 properties owned is average. Think… if one or two people had 6 properties of 5M each… that net worth would be hundreds of millions. It just doesn’t make sense

Interesting data though… big thing I see is these people are BIG spenders

Another person tricked by statistics.

The average person...

Has a net worth of $11.4 million

Has a household income of $1.8 million

Is 57 years old

Owns 6.0 properties

....Is NOT one same person.

The age is spot on.

The rest? Not so much.

Proud Amex Plat low outlier!

You mean normal Plat and not the billionaire outliers.

I carry the Platinum card, and I have declined the Centurion invitations multiple times. Statistically I'm sure that I'm one of the many who drives the numbers down in every category. LOL

Take that with a spoon ful of salt, having a decent income, a good credit score amd especially little to no debt will get you any of these cards. By the way, the Departures magazine is one of those little perks I look forward to reading every month.

I wouldn't be as quick as Ben to assume that the stats being touted in Departures' media kit necessarily extend to Platinum cardholders in general. I am guessing that I am very close to the median cardholder, and I generally chuckle as I briefly thumb through the "magazine of things I can't afford," as I like to call Departures.

Lucky, if you are surprised, about this, that's because you're committing the common human fallacy of assuming your own experience is universal, because you exist in an orbit of fellow credit card and points enthusiasts who assess the value proposition of having an Amex Platinum. Points enthusiasts are a niche market for the card.

To everyone else, the Amex Platinum is a status symbol first and foremost, and it is priced like one. The people...

Lucky, if you are surprised, about this, that's because you're committing the common human fallacy of assuming your own experience is universal, because you exist in an orbit of fellow credit card and points enthusiasts who assess the value proposition of having an Amex Platinum. Points enthusiasts are a niche market for the card.

To everyone else, the Amex Platinum is a status symbol first and foremost, and it is priced like one. The people who sign up to spend $695 a year for a credit card are also those with second or third homes, high-end luxury cars, expensive designer clothing, private schools for their kids, etc. $695 is not a big deal to them and might even be seen as necessary to be at parity with their peers who also have one.

But to someone making, say, $150,000 a year, which is still a lot of money to most people, they're still going to think twice or three times before spending $695 on a credit card, if the perception of the value of the credit card is, after all, to conveniently defer payment for purchases. Which is what most people use credit cards for.

I saw this not with authority but with anecdata; I am a professional who charges high rates to individuals for my field, and many of these kinds of people in NYC are my clients, and many of them pay me with Amex Platinums (and the occasional Centurion). If they were "our" kind of people, they'd be paying with a Blue Business Plus or an Everyday Preferred or a Freedom Unlimited. But they're not. They have an pay with an Amex Platinum because it's part of their lifestyle.

I have a Platinum card because I can get more than I pay for right off the bat. I get about $1K in value out of the card without any of the points thingies.

I don’t know how anyone would consider a credit card a “status symbol”. It stays in my wallet, I don’t wear it around my neck. It really makes no sense to see a credit card as a “lifestyle”.

It might make no sense to you, but that doesn't change the facts on the ground. Your typical Platinum card holder, based on my experience, is not performing the value analysis that you are. They're instead assessing brand value.

How would you know this? Why is your experience “the facts on the ground”? It feels like speculation without any benefit of insider knowledge.

As I wrote in my original post, "I saw this not with authority but with anecdata..." and in my followup, "based on my experience." *Of course* it's speculation based on experience; I said as much. "The facts on the ground" are not the objective data I don't have access to -- maybe it was a poor choice of phrase -- but the facts of whatever limited insight I might have based on my personal experience.

...As I wrote in my original post, "I saw this not with authority but with anecdata..." and in my followup, "based on my experience." *Of course* it's speculation based on experience; I said as much. "The facts on the ground" are not the objective data I don't have access to -- maybe it was a poor choice of phrase -- but the facts of whatever limited insight I might have based on my personal experience.

I'm saying that it might make no sense to you, because you're assessing product value, but my experience is that my clients who pay me with it assess brand value instead, and those clients tend to be quite well heeled.

The datapoints included are only for cardholders outside of the US, where platinum card is a lot more of a mini centurion whereas it's a mass-market product in the states

Stop any transaction that not from this phone

Average != median. There are very likely some folks who drag that number way up based on the number of income properties they own.

I though you needed minimum of 60K income and over 700 credit score?

Owned properties could include investment rentals. That isn’t specified.

I just got the Amex Platinum and I know I brought these numbers down lol

Funny people still don't believe in statistics.

Numbers don't lie.

It's the people who package you the numbers who lie.

The top 1% wealth in USA is almost equal to the bottom 90% combined.

Talking about average, the top 1% is worth 16 times more than the bottom 50%.

And here we still argue over AOC flying First Class.

Sadly in this case, Amex is trying to sell ads. Most of the...

Funny people still don't believe in statistics.

Numbers don't lie.

It's the people who package you the numbers who lie.

The top 1% wealth in USA is almost equal to the bottom 90% combined.

Talking about average, the top 1% is worth 16 times more than the bottom 50%.

And here we still argue over AOC flying First Class.

Sadly in this case, Amex is trying to sell ads. Most of the magazine readers probably can't afford a vacation home in Italy, mega yachts, exotic cars, or luxury swiss watches.

Yep.

If those numbers did come from the magazine's information for advertisers they're audited by a third party that's unlikely to allow false information to get to the advertisers.

As has been said, there are three kinds of lies....(lies, damn lies, and statistics).

This information is from READER SURVEYS, not sworn statements of their accountants.

Just like you say, Amex is trying to sell ads.

Makes sense, if you go based on average. I know a number of people worth over a hundred million that have platinum cards and don't care for a centurion card. So each one of those would bring up the average of around 25 people.

Haha nope!

The income seems plausible. But even the very rich people I know have 2-3 homes not more. I don't see how the average can be above 3. But wow.

Your definition of homes, is actually residences. And the site says properties owned.

How many piece of real estate do you think (not even a billionaire) Trump owns?

You can do hypothetical math to see how ONE high income can skew the average. For example, all you need is ONE household (out of 100) making $30 million per year, with the rest of the 99 households averaging $150,000/yr (probably closer to many folks on this forum), to get an AVERAGE income of $448,000/year.

Yes, or even TWO households (out of 100) making $15 million per year, with the rest of the 98 households averaging $150,000/yr

Interesting metrics. Us avgeeks feel like we’re getting away with murder with bonus signups and free first class tickets. Maybe we’re just a needle in the haystack and they don’t care about us as we don’t affect their bottom line. Yay !

Exactly.

Anyone reading this site is in the insignificantly tiny minority of "active points & miles" credit card users.

While 3.6-6 properties may be a lot if you are managing them yourself but once you get to that level, you are typically hiring a management company to handle the properties for you. The small fee is worth the time to someone worth that much money.

As countless others have said, I’d be very intrigued in the difference between the average (mean) and median. My guess is the very high earners (and self-reporters if this is survey based) are skewing the arithmetic average really high.

Solely based on the number of military members who have the Platinum card there is no way in my mind that the average income/net worth is that high.

MATH 310 In My Mind Statistical Sampling

was my favorite class in college!

I might not believe. I should be the poorest Amex plat holder ever and im getting 80000 avíos offer For not downgrading the card... Sounds too much offer For a very bah customer

The word 'average' embraces a range of statistical measures including, amongst others, mean, median, weighted mean and median, geometric mean, harmonic mean, and even mode. So the 'average' word may well mean median: I would certainly be having sharp words with our marketing team if they used the mean in this context as it would make us look like we couldn't do maths.

Are the numbers credible? The top 1% of US earners have an...

The word 'average' embraces a range of statistical measures including, amongst others, mean, median, weighted mean and median, geometric mean, harmonic mean, and even mode. So the 'average' word may well mean median: I would certainly be having sharp words with our marketing team if they used the mean in this context as it would make us look like we couldn't do maths.

Are the numbers credible? The top 1% of US earners have an income of at least $488K according to Bloomberg; the UK is slightly lower at $248K. So the 'average' departures reader is just outside the top 1% of US earners, but well within the top 1% in the UK.

This passes my sniff test.

You're confused about math.

Average = mean

Average ≠ median

That's simply not true, as a 30 second glance at the opening paragraph of the relevant Wikipedia page would tell you.

Many 'averages' are not a mean. In the UK, inflation (CPI) is measured using a geometric mean, for example. And if you attempted to take the average price/earnings ratio of an investment portfolio by simply calculating the mean of the individual PEs, you would be making a very, very big error.

I find the Platinum numbers to be a load of crap. Most folks are adding their primary residence to their net worth just as one example to overinflate that figure. Primary residence that isn't paid off at that. People overestimate in all facets of life, money is at the top of the list. Go hang out in Atlanta and Miami and you'll see exactly what I mean.

Pure fiction for the platinum. Probably true for the Centurian.

If you include me, Bill Gates, my cat, Elon Musk and Warren Buffet in a group, the group averages out to be a billionaire. ;)

You got a card for your cat? My dog was turned down.

I've had mine since 1988. And that's not that far off.

And realistically, those numbers are not unusual for the lower upper class... the top 10%-4% of wealth. I chose to invest early, worked in high-tech, and it's paid off.

Most don't realize that the last 40 years of America's trajectory means massive inequality.

What amazes me is what Warren Buffet said: "There’s class warfare, all right, but it’s my class, the rich...

I've had mine since 1988. And that's not that far off.

And realistically, those numbers are not unusual for the lower upper class... the top 10%-4% of wealth. I chose to invest early, worked in high-tech, and it's paid off.

Most don't realize that the last 40 years of America's trajectory means massive inequality.

What amazes me is what Warren Buffet said: "There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning."

So, if you are scraping by on $50k a year, and complaining about "woke cancel culture", telling everyone that the former orange guy is Americas savior, realize: you are the pawn of the rich class. They can't wait to pay you less! And don't you even THINK about benefits or retirement.

Very well said. Political facts

Whose the orange savior Jesus?

These make sense to me.... I know that more millennials are getting the card just for the perks, but they tend to be high earning millennials if they are are traveling often enough to make a $700 card worth it for them. This is still a high end travel card, and the perks tend to benefit wealthier travelers (private jet perks, airport lounges, bonus points on airfare alone...). More savvy travelers can get value out...

These make sense to me.... I know that more millennials are getting the card just for the perks, but they tend to be high earning millennials if they are are traveling often enough to make a $700 card worth it for them. This is still a high end travel card, and the perks tend to benefit wealthier travelers (private jet perks, airport lounges, bonus points on airfare alone...). More savvy travelers can get value out of it, but the main demographic are high net worth individuals who spend quite a bit of time traveling.

The properties statistic is interesting, but remember that many millennials (and other generations) have started moving away from the "go to college, find a good career, work 30 years" mentality, and are increasingly taking on side hustles, investment properties, et cetera to supplement and/or replace their main income. As an older millennial, a good number of my friends and family have real estate investments at this point, so that number doesn't surprise me.

Would be more interested in the median. Might be representative for centurion. Highly highly sceptical that platinum is anywhere near that high

In the second of what’s going to be a long line of similar comments…

Average ≠ Median

I am not surprised. The majority of people who own these cards do not care about points, the $200 airline credit or the centurion lounge. I do agree that the average gets pulled up by outliers on the high end but i feel like our community constantly forgets that we are not the target market for these premium cards and that most people are not like us, we just feel that way because of the...

I am not surprised. The majority of people who own these cards do not care about points, the $200 airline credit or the centurion lounge. I do agree that the average gets pulled up by outliers on the high end but i feel like our community constantly forgets that we are not the target market for these premium cards and that most people are not like us, we just feel that way because of the bubble we live in online and on social media where we get so much good points info these days we think its widespread and common knowledge to the public when really our points-group is beyond tiny in the grand scheme of things.

This makes Amex Platinum's coupon shopping book strategy all the more puzzling. They seem to be targeting towards much more price-sensitive customers.

'Puzzling' is the same word that came to mind when I read these stats and thought about the 'coupon book' strategy. Counterintuitive, yeah?

in my country you only need to have around $400,000 in your account to get amex platinum card.

Right, because price-sensitive people are famous for booking five star hotels, paying for cutting lines at airports, and getting Equinox memberships.

Those are some high numbers, but it's worth considering that they're averages encompassing upper income earners. A few billionaire cardholders with properties all over the place are going to skew those numbers a lot.