Admittedly I spend a larger percentage of my income on travel than most others, given that I basically live in hotels and on planes. Fortunately there are several credit cards that offer bonus points for travel purchases, which takes just a bit of the sting out of some travel purchases. After all, the more you spend, the more points you earn. 😉

What’s interesting, however, is that each card defines travel in a different way.

So I figured I’d look at four of the most popular “flexible” travel rewards cards, and how they each define travel differently. This includes the:

- Chase Sapphire Preferred® Card

- Citi Premier® Card

- American Express® Gold Card

- Barclaycard Arrival® Plus World Elite Mastercard®

The one caveat I’d like to add is that what really matters is how the merchant categorizes themselves. In some cases merchants aren’t categorized correctly, in which case you may not earn bonus points. In other words, if you’re staying at an independent hotel and they’re not coded as a hotel/motel/lodging, you may not earn bonus points.

With that in mind, let’s look at how each of these four cards define travel:

Chase Sapphire Preferred® Card

This is possibly the most popular card in our hobby, as it offers 2x points on travel and 3x on dining purchases. Since those are the two categories I spend a good chunk of my money on, the card works great for me. Here’s how the card defines “travel” purchases, which are eligible for 2x points:

airlines, airports, car rental agencies (including truck, trailer, and RV), cruise ships, hotels and motels, timeshares, local and commuter transportation (including trains, buses, taxis/limos, ferries, bridges, tolls and parking), travel agencies

Even parking qualifies as a travel purchase

Citi Premier® Card

This card is in the process of a revamp, making it extremely competitive with the other cards out there. As of April 19, 2015, the card offers 3x points on travel, including gas. It’s worth noting that this is the only card I know of which includes gas purchases in the travel “umbrella.” Here’s how the card defines “travel” purchases, which are eligible for 3x points since April 19, 2015:

airlines, hotels, car rental agencies, travel agencies, gas stations, commuter transportation, taxi/limousines, passenger railways, cruise lines, bridge and road tolls, parking lots/garages, campgrounds and trailer parks, time shares, bus lines, motor home/RV Rental and boat rentals

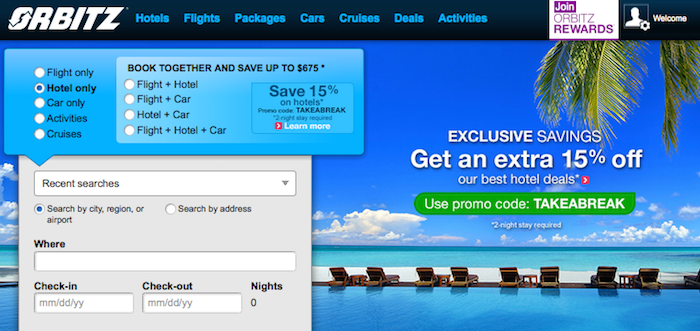

Purchases through an online travel agency qualify as travel

American Express® Gold Card

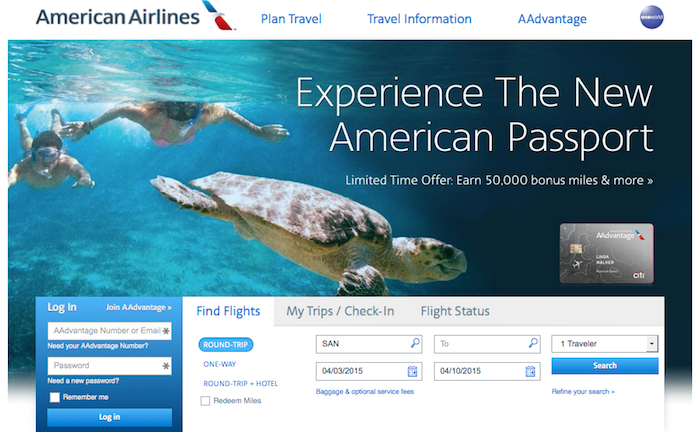

The Amex Gold card was launched in October 2018, and offers a compelling 3x Membership Rewards points on airfare purchases. It’s worth nothing though, that this card has a pretty strict interpretation of airfare purchases, defined as airfare purchased directly with an airline or through AmexTravel.com.

Only airfare purchased directly with an airline or through AmexTravel.com qualifies to earn 3x Membership Rewards

Barclaycard Arrival® Plus World Elite Mastercard®

This card doesn’t offer bonus points for money spent in the travel category, but instead points earned through the card can be redeemed towards travel purchases. This is arguably the most compelling travel cashback credit card, since you’re earning the equivalent of ~2.1% cashback towards the cost of travel. Here’s how the card defines “travel” redemptions, which you can use your points towards:

airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, travel agencies, discount travel sites, trains, buses, taxis, limousines, and ferries

Redeem your points for a cruise

Bottom line

These are some of the best travel cards out there, so I think it’s worth noting the subtle distinctions between the cards. Some of the most important distinctions include:

- Of the above, the Citi Premier® Card is the only card which includes gas purchases as travel

- The American Express® Gold Card only gives you bonus points when you purchase airfare directly with an airline or through AmexTravel.com, while both the Chase Sapphire Preferred® Card and Citi Premier® Card also give you bonus points for airfare purchased through online travel agencies

- I think a lot of people overlook just how broad the travel categories are on some of these cards — both the Chase Sapphire Preferred® Card and Citi Premier® Card give bonus points for tolls, taxis, parking, etc., which people might often not associate with travel

Be sure you understand all these categories so you’re maximizing your points as much as possible!

Hi Lucky,

I saw that you replied to another comment regarding Airbnb being a valid double points "travel purchase" for Chase Sapphire Preferred. I actually just called Chase and they replied that they don't know this information and it all depends on what category Airbnb bills under. I also saw on another blog comment that Airbnb bills under the code 4722 (not confirmed since I have not booked with Airbnb before), which Chase has...

Hi Lucky,

I saw that you replied to another comment regarding Airbnb being a valid double points "travel purchase" for Chase Sapphire Preferred. I actually just called Chase and they replied that they don't know this information and it all depends on what category Airbnb bills under. I also saw on another blog comment that Airbnb bills under the code 4722 (not confirmed since I have not booked with Airbnb before), which Chase has confirmed NOT to be a valid travel purchase, that means no double points. Do you know something more to what I have found so far? I'm very interested in the Chase Sapphire card since I have an upcoming trip that sums to more than 5k Airbnb purchase, but only if they offer double points on it. Any information is appreciated!

Thanks!

Would buying airline/hotel/rental car gift cards (for use later) count as travel purchases for redemption with Barclay Arrival Plus?

If so, must the gift cards be bought directly from the airline, etc? I can buy some at discount through giftcardgranny.com

@ Jerry Mandel -- If it's a purchase directly through the airline then it should be eligible. But not through a third party.

That's weird. My comment seems to have disappeared...? I was wondering if stays at airbnb and/or VRBO are categorized as "travel" with the Chase Sapphire Preferred. Does anyone know? Can someone help out? I have a large expense coming up ($1K) and wanted to know if it makes sense to use this card. Thanks!

@ Lara -- I'm pretty sure it does count as travel.

Awesome to hear! Thank you!!

@Lucky: And, both it is. Approved for both in my latest app-o-rama.

@ Tuan -- Congrats!

Ben,

i am weighing the City Thankyou Premier card. Now while get 3x points looks like a good deal all of the partners are non-US. which of these partners would you consider worth transfering points to rather than say collecting points in a US program and using those to pay (eg AA points to pay for Etihad)? Singapore I like. Cathay is that not better through AA? Others? Thanks. LF.

@ Levy Flight -- Indeed, the transfer partners are lacking somewhat. The two that interest me most are KrisFlyer and FlyingBlue. My long term hope is that they add American AAdvantage as a transfer partner, though that's far from set in stone.

is it possible to use thankyou points for award flight on ANA or korean air?

@ steven k -- Sure. Singapore and Air France are transfer partners of TYP, and they are part of Star Alliance and SkyTeam, respectively, so you could redeem those points on partners.

Ben,

You get quite creative in your drive to get people to click for referrals. I am not complaining as I realise why here is the need to do it. Just wish I was able to get the deals you guys in the US get on cards.

I've had some strange things count as travel on the CSP (not that I'm complaining!) For example, a dive shop in Australia... So they are awarding points on more broad things than just what their definition says.

The Amex PRG does give 2x on gas.

@ Sach -- Right, good point, that's a separate category bonus. My point was simply that they don't include it under the travel "umbrella."

@Tuan: Ultimate Reward points transfer to SQ & BA (to book CX) so that's a plus for the CSP. I'd get both since the spend requirements aren't a problem.

Lucky,

I'm currently comparing the CSP vs. the Citi ThankYou Premier card. Which one would be better for a person that's aspiring to take a trip to Asia on Singapore or Cathay?

I'm targeted for a 50k bonus offer for 3k spend on the Citi card, while just the 40k on the CSP. Minimums spend requirements aren't a problem.

@ Tuan -- How about both? :) They both have their merits. In general I value Ultimate Rewards points slightly more than ThankYou Rewards points, since I find their transfer partners to be more valuable. But they're both great cards.