Link: Learn more about the Citi Strata Elite℠ Card

The Citi Strata Elite℠ Card (review) is Citi’s new premium credit card. The card has a big welcome bonus that makes it worth applying for — many people should be eligible for the product, and it’s a card that I recently applied for. There’s likely a particular interest in this card since Citi ThankYou points can be transferred to American AAdvantage.

The card has a $595 annual fee, but offers a variety of perks that can help justify that. These benefits include a $300 annual hotel credit, a $200 annual Blacklane credit, four annual Admirals Club passes, a Priority Pass membership, and more. In this post, I’d like to take a look at the $200 annual “Splurge Credit” offered by the card. I’d argue that this benefit is basically good as cash, so let’s cover the details…

In this post:

Details of the Citi Strata Elite Card Splurge Credit

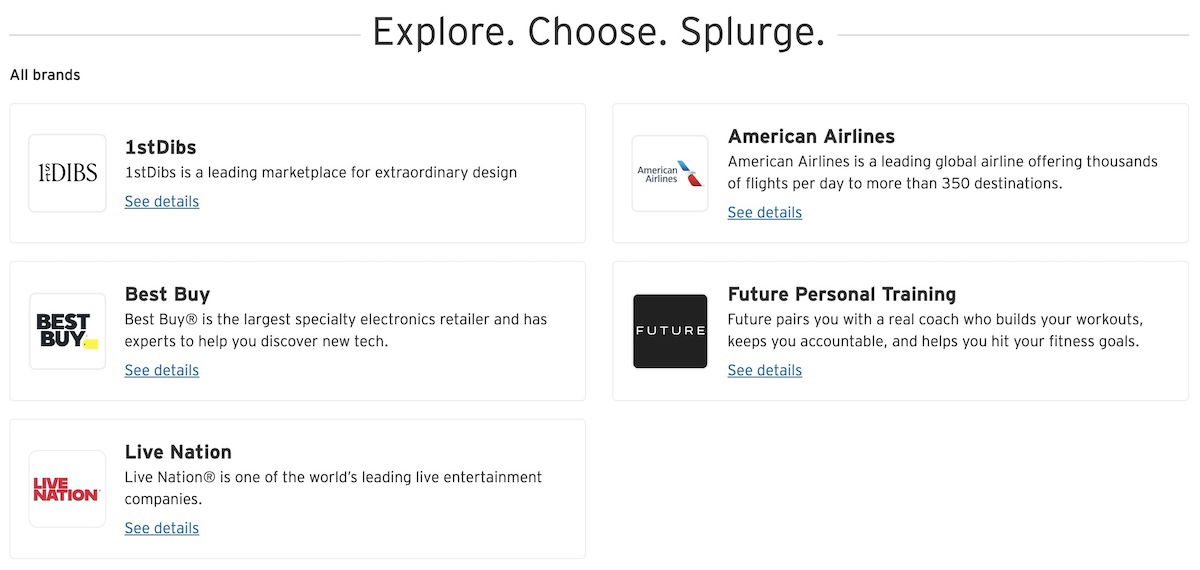

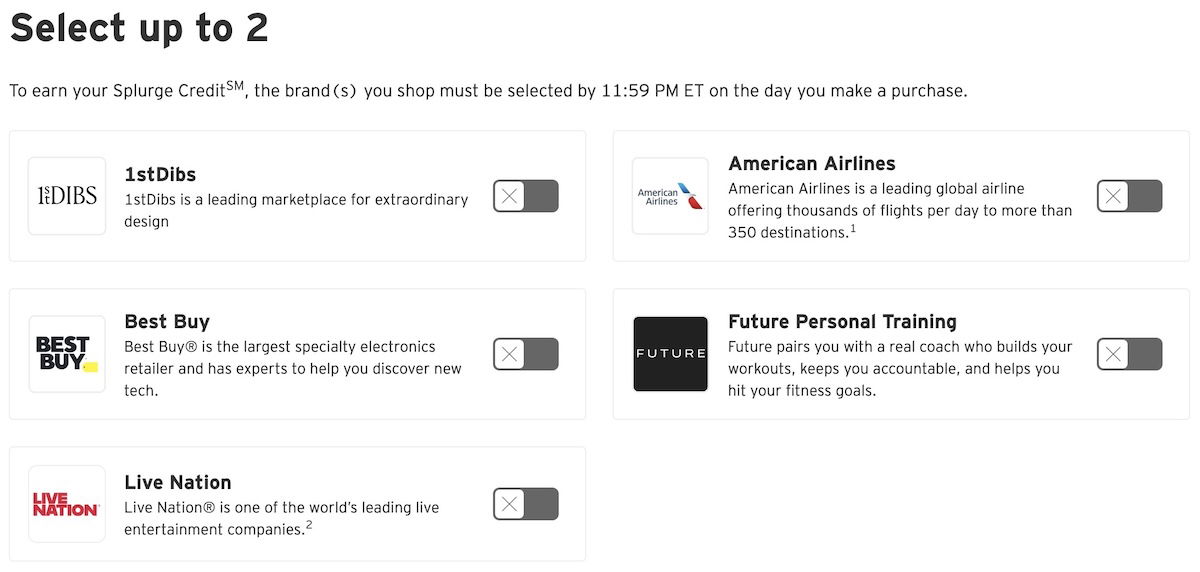

The Citi Strata Elite Card offers a $200 Splurge Credit annually. The way this works, you receive a credit of up to $200 that you can use with a variety of retailers, including 1stDibs, American Airlines, Best Buy, Future Personal Training, and Live Nation. As you’d expect, there are some terms to be aware of:

- The Splurge Credit is offered per calendar year rather than per cardmember year, so you’ll receive the $200 credit to use between January 1 and December 31 of each year

- The Splurge Credit can be redeemed across one or more transactions, until it’s fully used

- Prior to using your Splurge Credit, you need to register at this link, and during that process, you can select up to two merchants at a time that you want to use this credit for

- When you select the merchants you want to choose the Splurge Credit for, that selection applies as of 12AM ET on the day the merchant is selected; in other words, this could even apply slightly retroactively, because if you made a purchase at 1AM and only registered at 8AM the same day, that purchase would be eligible

- Purchases made by the primary cardmember or authorized users can count toward the Splurge Credit, though the credit is a maximum of $200 per primary cardmember account

- It can take one to two billing cycles for the Splurge Credit to appear on your statement

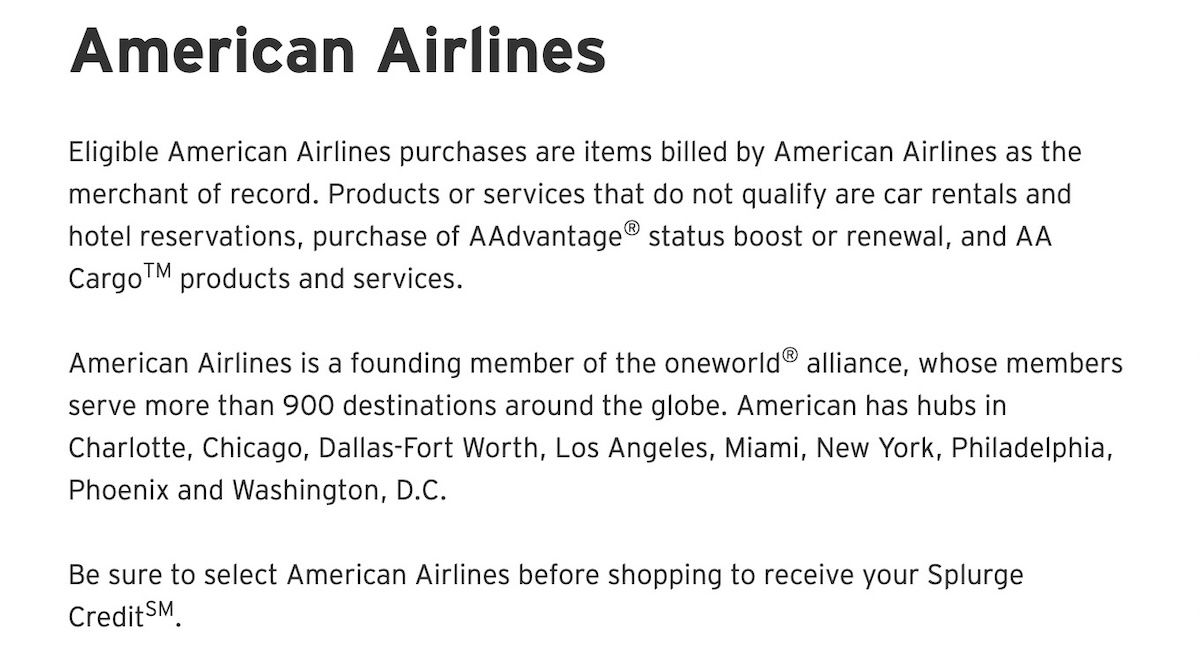

- To qualify for the American Airlines Splurge Credit, the purchase must be billed by American or American Airlines Vacations; car rentals, hotel reservations, purchases of AAdvantage status boost or renewal, and AA Cargo products and services, don’t qualify

- To qualify for the Live Nation Splurge Credit, a purchase must be made directly on livenation.com or ticketmaster.com for events or venues within the United States; the purchase must be fulfilled by Live Nation or Ticketmaster, and not by a third party service

Logistics of the Citi Strata Elite Card Splurge Credit

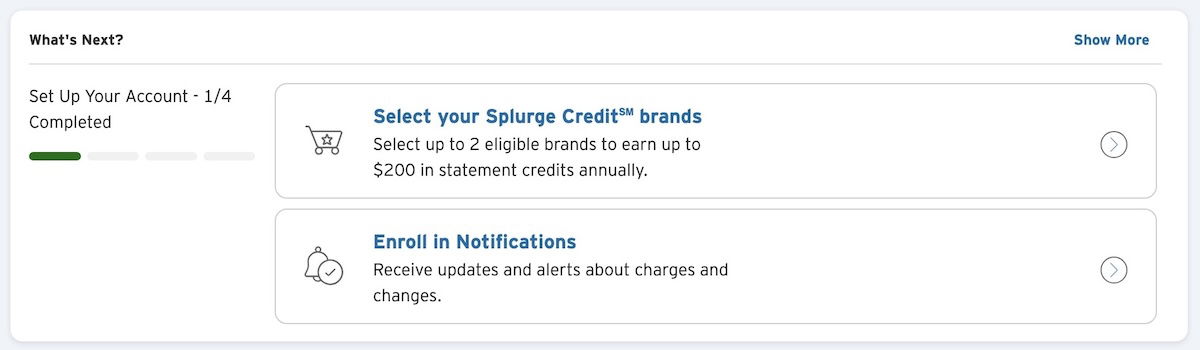

Since I recently applied for the Citi Strata Elite Card, let me share my experience with the logistics of this perk. Once you set up your account, you can either visit this link, or simply go to your main account management page, where you’ll see the option to select your Splurge Credit brands.

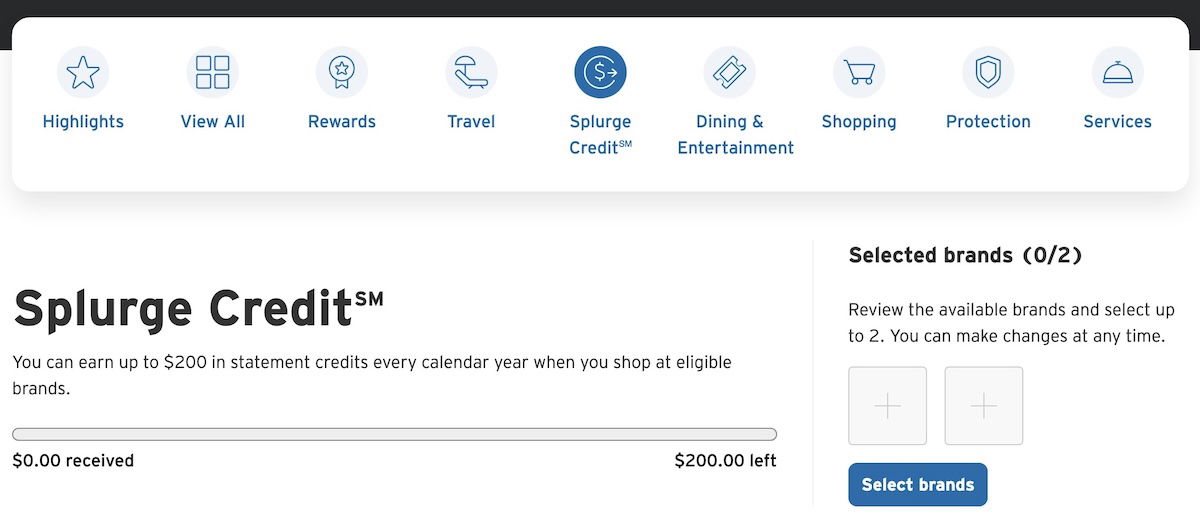

When you follow that link, you’ll see the option to select brands, and you’ll also see how much of your Splurge Credit you’ve used so far.

The page also lists all the brands you can choose from, and if you click on the “See details” buttons, you’ll see the terms associated with each merchant.

For example, below is the page about using your Splurge Credit for American purchases.

Then if you click the “Select brands” button, you’ll be brought to the page where you can select which merchant you want to activate.

The Citi Strata Elite Card Splurge Credit is easy to use

The value proposition of premium credit cards is pretty consistent, in the sense that the cards have steep annual fees, but then offer credits and other benefits that can help offset those fees. Among the benefits offered by the Citi Strata Elite Card, I’d argue that the Splurge Credit is the single perk that’s closest to being “good as cash.”

The first thing worth mentioning is that this offers disproportionate value in your first year of card membership, since you can receive two of those credits with your first annual fee. That’s because the Splurge Credit is based on the calendar year, while the annual fee is based on the cardmember year.

For me, the value of the Splurge Credit is pretty straightforward — I’ll spend at least $200 per year on American with this card in order to maximize the Splurge Credit. That’s super easy. A couple of important points:

- To use this credit, you’ll want to book directly with American, rather than through Citi Travel

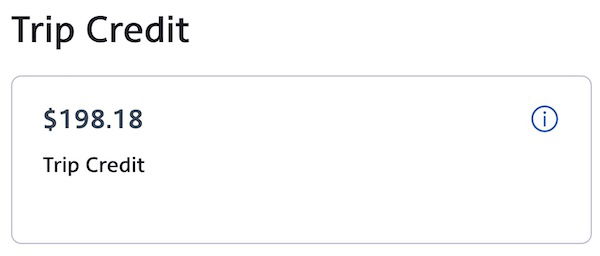

- Keep in mind that most non-basic economy fares don’t have change fees, so you can always book a ticket and then cancel it and bank the credit for a future itinerary

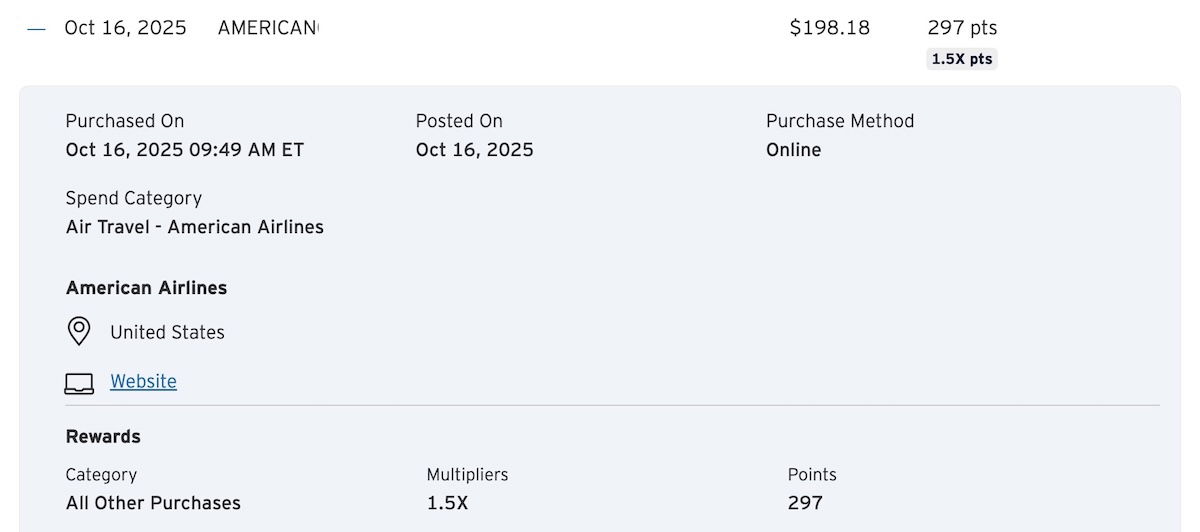

Just as an example, I recently purchased a $198.18 American flight with the card.

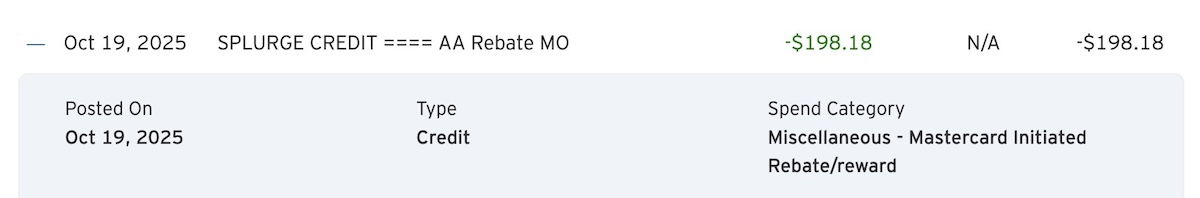

Three days later, the credit posted to my account.

Then I ended up canceling the flight, so I now have a Trip Credit with American worth that amount, which is valid for a year.

Using the Citi Strata Elite Card Splurge Credit for gift cards

If you’re looking to get as much flexibility as possible with your Citi Strata Elite Card Splurge Credit, the good news is that you have plenty of options.

Anecdotal reports suggest that outright purchasing American Airlines gift cards also triggers the Splurge Credit, meaning you can get a credit with the airline that never expires. For even more flexibility, Best Buy sells retail gift cards for a bunch of companies, ranging from Amazon, to Apple, to CVS, to Delta, to Ebay, to Home Depot, to Southwest.

So yeah, this credit could get you $200 per year on American, Delta, or Southwest, along with all kinds of other retailers. Simply put, everyone who gets this card should be able to get (near) full value out of this perk.

And since the credit is per calendar year rather than per cardmember year, the first year value is particularly impressive. Before you pay your second annual fee, you can take advantage of two years worth of Splurge Credits.

Bottom line

The Citi Strata Elite Card offers several valuable benefits, and among those is a $200 annual Splurge Credit. This is quite straightforward, as you just have to register with your choice of five retailers, and then any eligible spending counts toward that credit.

I think that American and Best Buy are probably the two most straightforward partners here — with American you can just buy tickets, while with Best Buy you can purchase all kinds of products, including gift cards. Since this credit is issued per calendar year rather than per cardmember year, you can do especially well with this for your first annual fee.

What’s your take on the Citi Strata Elite Card $200 Splurge Credit?

Will try LiveNation or Ticketmaster soon to get either a NBA game or concert in the US.

I like that taxes on AA reward flights count towards the splurge. And no claw back if you cancel the flight.

I bought disney gift cards from best buy for the splurge credit.

Selected AA, got a $200 AA gift card (from AA directly), waiting for my 'Splurge' credit.

For those who are resistant to couponization, Citi is reasonably mild. As odd as the dining earn rate is, a skilled hobbyist should be able to take advantage of it. The card's real strength is 12X on Citi Travel bookings. Yes, there can be a pricing issue . . . but it's been competitive of late. Certainly, not all properties. As bank travel portals seem to be adopting NDC, the question is whether Citi Travel bookings will receive loyalty credit.

Fred, let's be real, it's a great SUB at 100K, and yes, we'll use the coupon credits, but, they are a bit of a chore. Not sure I'm gonna keep this beyond the first year; probably will seek retention offers, downgrade to no-fee Strata. We'll see. I much prefer the original Prestige card with, of course, the 4th night free, and the standard 5x dining/airfare (no nonsense with 6x on Fridays and Saturdays, but time-limited.)...

Fred, let's be real, it's a great SUB at 100K, and yes, we'll use the coupon credits, but, they are a bit of a chore. Not sure I'm gonna keep this beyond the first year; probably will seek retention offers, downgrade to no-fee Strata. We'll see. I much prefer the original Prestige card with, of course, the 4th night free, and the standard 5x dining/airfare (no nonsense with 6x on Fridays and Saturdays, but time-limited.) Alas, Citi lost too much money on us back then, so less 'fun' this time, but we'll take 'em for another ride, anyway, you betcha!

You can get 10x MR points with Rakuten through Agoda very frequently (today it happens to be 8x, but it was at 10x for the past 10 days or so). Pair that with a card that earns 3x on travel (like the Strata Premier) and you've basically replicated the 12x (today it would be 11x, but a few days ago it would be 13x - YMMV but circling the same square). Other than through Rove,...

You can get 10x MR points with Rakuten through Agoda very frequently (today it happens to be 8x, but it was at 10x for the past 10 days or so). Pair that with a card that earns 3x on travel (like the Strata Premier) and you've basically replicated the 12x (today it would be 11x, but a few days ago it would be 13x - YMMV but circling the same square). Other than through Rove, I have not heard anything about portal bookings receiving hotel loyalty credit.

I'll insert my usual plug for AA Hotels here as a portal booking that may provide outsized value beyond 12x points (especially if you have any AA status and the AA Exec card) but YMMV on that one as well.

I am splurging over the splurge credit…

Why did they have to call it splurge… it sounds so vial.

What is *vile* about the word "splurge?" "I'm going to splurge today and get two doughnuts instead of only one."

Courtney must've been thinking of 'splooge'... naughty girlie.

So that you can alliteratively splurge with your Strata I suppose, which is an equally bad name for a credit card series?