Link: Learn more about the Citi Strata Elite℠ Card

The Citi Strata Elite℠ Card (review) is Citi’s new premium credit card. The card has a big welcome bonus that makes it worth picking up — many people should be eligible for the product, and it’s a card that I recently applied for. There’s likely a particular interest in this card since Citi ThankYou points can be transfered to American AAdvantage.

The card has a $595 annual fee, but offers a variety of perks that can help justify that. These benefits include a $200 annual “Splurge Credit,” a $200 annual Blacklane credit, four annual Admirals Club passes, a Priority Pass membership, and more. In this post, I’d like to take a look at the $300 annual hotel credit offered by the card.

What are the restrictions associated with this benefit, how complicated is it to use, and how much should we value this perk? Let’s go over all the details, because as I’ve played around with this benefit, I’ve made a couple of cool discoveries.

In this post:

Details of the Citi Strata Elite Card hotel credit

The Citi Strata Elite Card offers a $300 hotel credit annually, valid for hotel stays of two or more nights that are booked through Citi Travel. As you’d expect, there are some terms to be aware of:

- The $300 credit is offered per calendar year, though the calendar year is based on when you book, rather than based on when you stay; that means you could use a credit for a stay the following year

- The credit is only valid for hotel stays of two or more consecutive nights booked through Citi Travel via cititravel.com or by calling the Citi Travel service center

- To use the credit, you must pre-pay for your complete stay with the Citi Strata Elite Card, ThankYou points, or a combination thereof; note that pre-paying doesn’t necessarily mean the rate is non-refundable

- If you use this credit, the $300 will be applied to your reservation at the time of booking, so this is an immediate rebate, rather than an after the fact refund

- You can use this across one or more transactions, so if your reservation costs less than $300, the remaining amount of the annual benefit will be available with the next eligible booking

- If you cancel a booking, the credit will be returned to your account, and will retain the initial expiration date

- While the Citi Strata Elite Card offers 12x ThankYou points on hotels booked with the card through Citi Travel, you wouldn’t earn points for the portion of the stay covered with the credit

- The reservation must be made by the primary cardmember, but reservations can be made in the name of the primary cardmember or authorized users (at least that’s what the terms state — more on that below)

- If you also have the Citi Prestige Card, the $300 annual hotel benefit can’t be used in conjunction with the fourth night free benefit offered by the Citi Prestige Card

Logistics of the Citi Strata Elite Card hotel credit

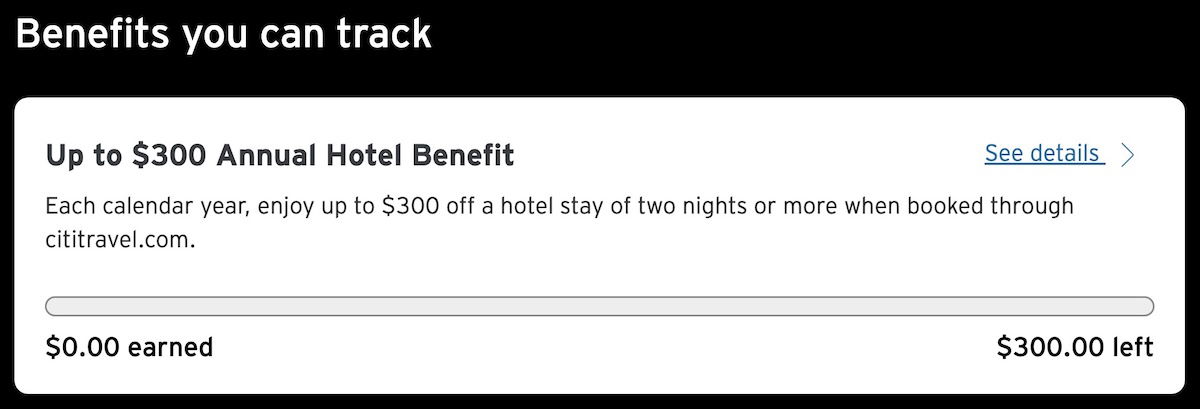

Since I recently picked up the Citi Strata Elite Card, let me share my experience with the logistics of the $300 annual hotel credit. On the benefits page of your account, you’ll see a tracker that shows how much of your annual hotel credit you’ve used so far.

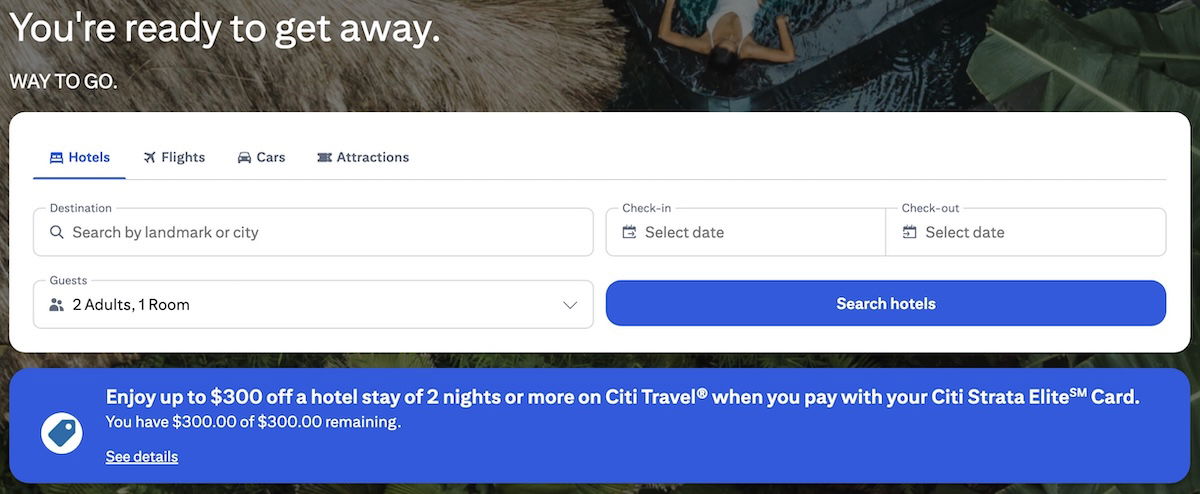

Then when you actually want to redeem your credit, just go to cititravel.com, log into your account, and select the Citi Strata Elite as the card for the transaction. The Citi Travel portal is in partnership with Rocket Travel by Agoda, so you have access to a huge number of properties around the globe.

You can enter your destination, dates, and number of guests, and then you can search hotels across a wide variety of metrics.

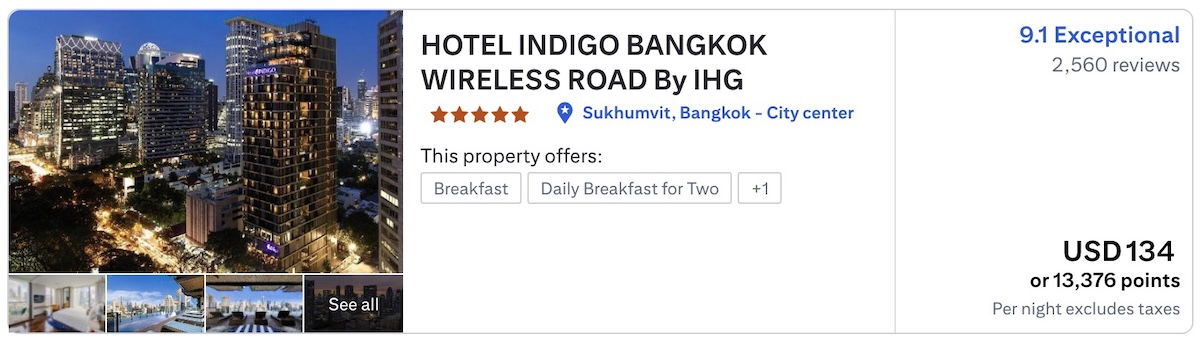

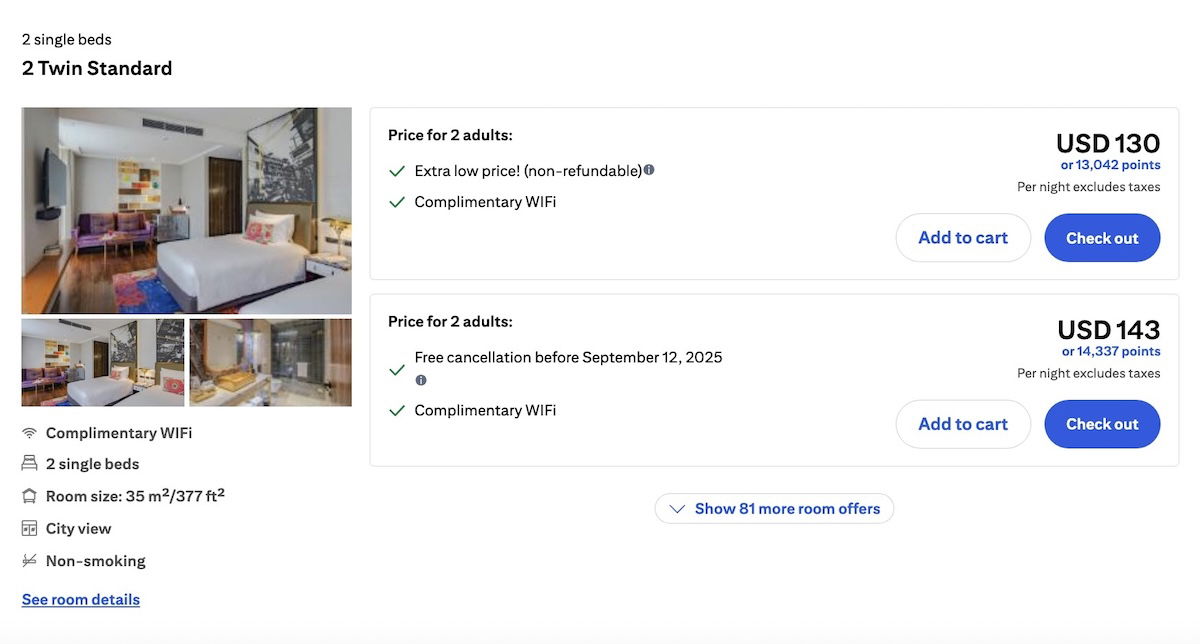

To pick a random example, let’s say you want to spend two nights at the Hotel Indigo Bangkok Wireless Road

You can select your preferred room type, and then proceed to the booking page.

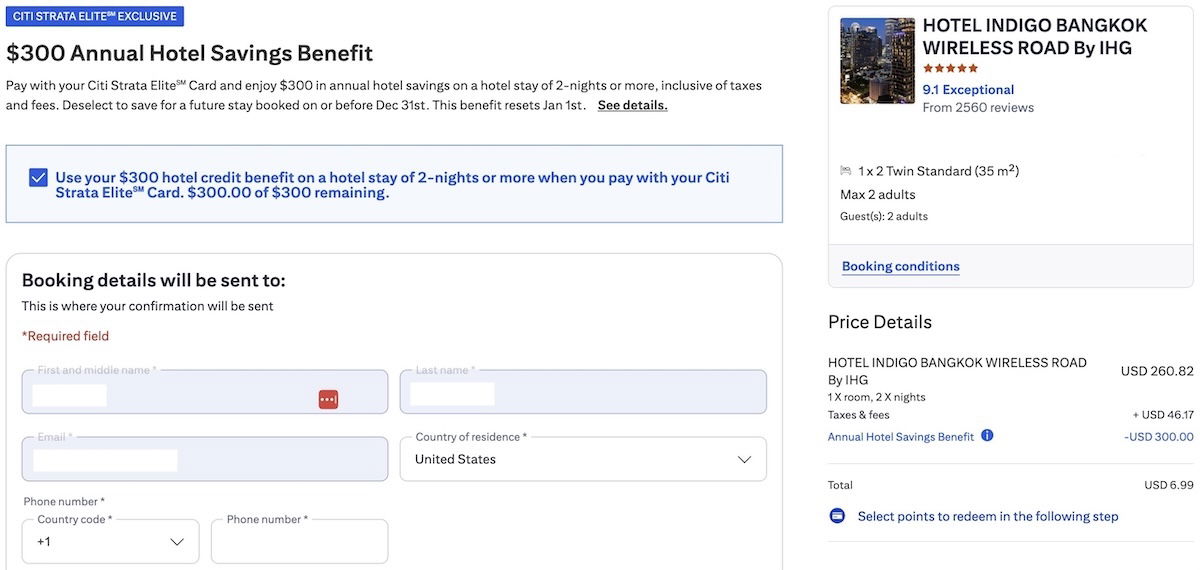

If you have an eligible $300 hotel credit, then on the booking page, you should see a box that you can check, allowing you to apply the credit toward the hotel stay. For example, in this case the hotel comes out to $306.17, so after the $300 credit is applied, the total due would be just $6.99. As you can see, the credit can even apply to the taxes and fees on a booking, which is great.

Here’s one other interesting angle, and you can make of this what you will. When you go to the booking page, you’ll see that the primary cardmember’s information is pre-filled for where the booking details will be sent. However, underneath that, there’s a section that reads “Make this booking for someone else,” where you can enter the name of the actual guest, if it’s different than the cardmember.

The system lets you make a booking for anyone there, and still applies the discount. I don’t have any authorized users on my cards, for what it’s worth.

Beyond that, let me emphasize a few points:

- Online travel agency rates for hotels don’t always match the price you’ll find directly with hotels; often you’ll find a slightly lower rate directly with the hotel, and in rare instances, you may find that online travel agencies have lower rates

- If you’re staying at a hotel with a loyalty program, the catch is that you generally won’t earn points or receive elite benefits if you’re staying on an online travel agency booking

- I said it above, but I think it bears repeating — while you need to book a pre-paid stay to use the credit, that doesn’t mean it’s non-refundable, so these bookings often still have good flexibility

Is the Citi Strata Elite Card hotel credit worth it?

The value proposition of premium credit cards is pretty consistent, in the sense that the cards have steep annual fees, but then offer credits and other benefits that can help offset those fees. So, what’s my take on the $300 hotel credit offered by the Citi Strata Elite Card?

Would I rather have an annual fee that’s $300 lower instead of a $300 hotel credit? Of course. But I actually think this is a reasonably easy credit to use. The play here is to book the cheapest two night hotel stay that you’re planning during the year through Citi Travel, while getting as close to a $300 total as possible.

What I appreciate here is that the credit applies even if the stay costs less than $300 (though you only get credited as much as you’d spend). I’d also recommend making the booking with the lowest opportunity cost, ideally at a hotel that doesn’t belong to a major loyalty program, or where the rate difference between Citi Travel and other sources is minimal.

Even without much effort, I’d say that I conservatively value this credit at maybe half of face value, since I do with some frequency make stays of two nights at hotels in this price range. If nothing else, this could come in handy in a situation where I need a really early check-in time (due to an early flight arrival), and then I can just book a stay of two nights to use this credit and guarantee early check-in.

Then there’s the angle of being able to use this credit on someone else. You can add people as authorized users at no cost, though in practice, it seems you can actually make a reservation in anyone’s name, and the credit is still automatically applied. I can’t guarantee that will continue to be the case, but that’s currently what things look like.

There’s no denying that the Citi Strata Elite Card has an astonishingly good first year value, given how so many of the benefits are per calendar year rather than per cardmember year. That means you’ll do particularly well on the card with your first annual fee, especially when you consider the massive welcome bonus. Even on an ongoing basis, I’m not really struggling much with making the math work.

Bottom line

The Citi Strata Elite Card offers several valuable benefits, and among those is a $300 annual hotel credit. This is valid for pre-paid Citi Travel bookings of two or more nights. The good news is that it’s super easy to use, and the $300 credit is applied immediately at the time that you book. It can be used for the primary cardmember or authorized users (and possibly even others, anecdotally?).

While I wouldn’t consider this to be worth face value, I’d say it still fits in the category of adding value, rather than being in the “don’t even bother” category. It also particularly contributes to the card’s amazing first year value.

What’s your take on the Citi Strata Elite Card $300 hotel credit?

Are there certain countries that citi travel won't show any hotels?

In my case Nairobi Kenya won't return any results

Does anyone know if there is a way to change the settings in the Citi Travel Portal so that hotel prices show the full price and not the price exclusive of taxes?

Even the major hotel chains (and Airbnb) now show the full price. I thought the laws changed and now require them to do that so I would think the online travel agencies would do the same.

Does anyone know if you can stack the Citi Strata $300 credit with the Citi Reserve benefits on the same booking/stay?

Are you sure the $300 hotel credit can be spread across multiple stays? The reason I ask is: on the citi website for the Strate Elite, under the How does the annual hotel benefit work? section, it says "...$300 off a single hotel stay of 2 nights or more..."

Heh, I think I may have found the answer to my question - on what looks like the official terms for the card, it says "If your reservation is less than $300, the remaining amount of the annual hotel benefit will be available for your next qualifying purchase in that same calendar year."

@Ben, I haven't seen much on Citi's "The Reserve" hotel collection, made to compete against Amex FHR and Chase's The Edit. Do you know if bookings of The Reserve hotels give you elite benefits and elite night credits the way FHR and The Edit do?

Neither applied for my stay at Hyatt recently

While the comments say Citi's portal is more expensive, I just booked a hotel for $474.51 (really $174.51 w/ the $300 credit) and the same room on Expedia or Booking is $493. Chase's portal was also $493, but had a points boost offer of 30,000 points.

The only difference is that while all adversed free cancellation until 10-29, the actual time did vary, with Citi and Chase being the earliest requiring cancelation before 11:59pm on...

While the comments say Citi's portal is more expensive, I just booked a hotel for $474.51 (really $174.51 w/ the $300 credit) and the same room on Expedia or Booking is $493. Chase's portal was also $493, but had a points boost offer of 30,000 points.

The only difference is that while all adversed free cancellation until 10-29, the actual time did vary, with Citi and Chase being the earliest requiring cancelation before 11:59pm on 10-28 (which is technically the day before the advertised last day to cancel).

So Citi was the cheapest, but Chase points boost also offered great value.

How does this credit relate to early check-in?

> If nothing else, this could come in handy in a situation where I need a really early check-in time (due to an early flight arrival), and then I can just book a stay of two nights to use this credit and guarantee early check-in.

If you have an early morning arrival you'd typically have to wait until mid-afternoon to be able to check in at a hotel but if you booked a room for the night before it would be ready for you when you arrive and you'd just be considered to be checking in very late.

It’s consistently higher than other OTAs (even reputable ones like Expedia, agoda, booking etc.). Some times it’s just by few dollars and those are rare. More often it’s by 50-100 dollars per night. I have a hard time justifying even if I come out a few dollar ahead .. but not really due to the annual fee. Good luck.

The price difference was $187 on Agoda vs $243 through Citi; same room, same dates. But I almost always stay at chains where I have status so I booked it. The $300 credit was really a little less than $299

I meant a little less than $200.

Less than $200

Sounds like much more useful than luxury hotel credits on the other cards. Easy to use as well.

These coupon credits are somewhat tedious but I’d rather use ‘em than lose ‘em.

I do prefer that it is a discount ‘at the time of booking, so this is an immediate rebate, rather than an after the fact refund’ unlike Amex’s FHR credits, which sometimes take a little while to post, and can be confusing if you change or cancel thereafter.

Admittedly, these ‘programs’ often raise their prices relative to other platforms or booking...

These coupon credits are somewhat tedious but I’d rather use ‘em than lose ‘em.

I do prefer that it is a discount ‘at the time of booking, so this is an immediate rebate, rather than an after the fact refund’ unlike Amex’s FHR credits, which sometimes take a little while to post, and can be confusing if you change or cancel thereafter.

Admittedly, these ‘programs’ often raise their prices relative to other platforms or booking directly, so it’s a slight opportunity cost, but, you still end up ahead when using the credit. I suppose their strategy is to ‘get you hooked’ on using their platform, but, in reality, unless the 12x TY points outweighs the savings via booking directly, most will probably just revert to their original methods (like, booking Hilton through Hilton Honors, etc.)

Where this gets interesting is for those who seek out the status multipliers from sources like AA Hotels for the extra LPs. Eh, to each their own. I’ll use my $300 credit either way.

I love AA hotels, but cash is king. I think the problem becomes when you have so many hotel credits to use, it is not always easy to use them all, especially ones like this one which require a 2 night minimum stay. I think it's a perfectly fine credit if this is the only premium card that you have in your wallet, but the reality is I would think many folks that are getting...

I love AA hotels, but cash is king. I think the problem becomes when you have so many hotel credits to use, it is not always easy to use them all, especially ones like this one which require a 2 night minimum stay. I think it's a perfectly fine credit if this is the only premium card that you have in your wallet, but the reality is I would think many folks that are getting the Elite already have an Amex Plat (or 4...) or a CSR or a C1VX (to live, perchance to dream...). So using this credit kind of becomes further down on the depth chart and a bit less useful.

A two-night stay at a Choice property is an easy candidate.

Your choice is Choice!