Link: Learn more about the Chase Sapphire Reserve® Card or Sapphire Reserve for Business℠

The Chase Sapphire Reserve® Card (review) and Sapphire Reserve for Business℠ (review) are lucrative premium travel cards. There are lots of reasons to consider picking up these cards, including great rewards structures, lounge access, and more.

While both cards offer quite a few credits, there’s one credit that’s easiest to use, and which I consider to basically be good as cash. Specifically, I’m talking about the $300 annual travel credit. In this post, I want to take a closer look at how this benefit works, as it helps greatly with offsetting the $795 annual fee.

In this post:

What is the Chase Sapphire Reserve $300 travel credit?

Every cardmember year, the Chase Sapphire Reserve and Sapphire Reserve Business offer a $300 travel credit.

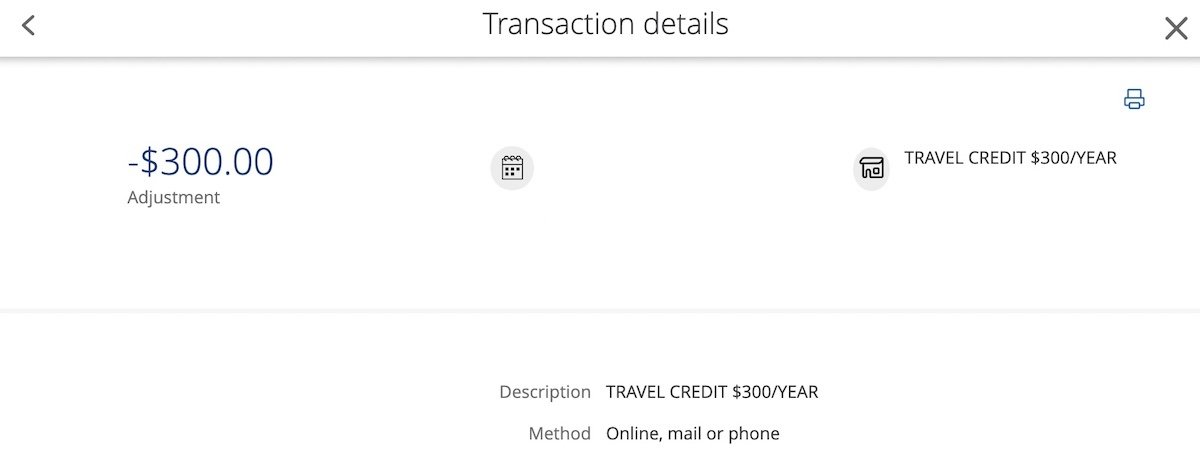

This credit is applied to purchases automatically — there’s no need to register — and you can use it over as many purchases as needed until the credit is completely used up. So that can be a single $300 purchase, 10 purchases of $30 each, etc. This comes in the form of a statement credit that posts shortly after you make your purchase.

What qualifies as travel for the $300 travel credit?

What purchases will automatically be credited as travel? Chase defines travel as including the following purchases:

Merchants in the travel category include airlines, hotels, motels, timeshares, car rental agencies, cruise lines, travel agencies, discount travel sites, campgrounds and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages.

As you can see, it’s not just traditional travel purchases that get reimbursed, but also things like rideshare, parking, trains, buses, and more. You can easily use the $300 credit in your day-to-day life.

When do you get the $300 Chase Sapphire Reserve travel credit?

As soon as you activate the Chase Sapphire Reserve or Sapphire Reserve Business, you can immediately start using the travel credit. There’s no waiting period required.

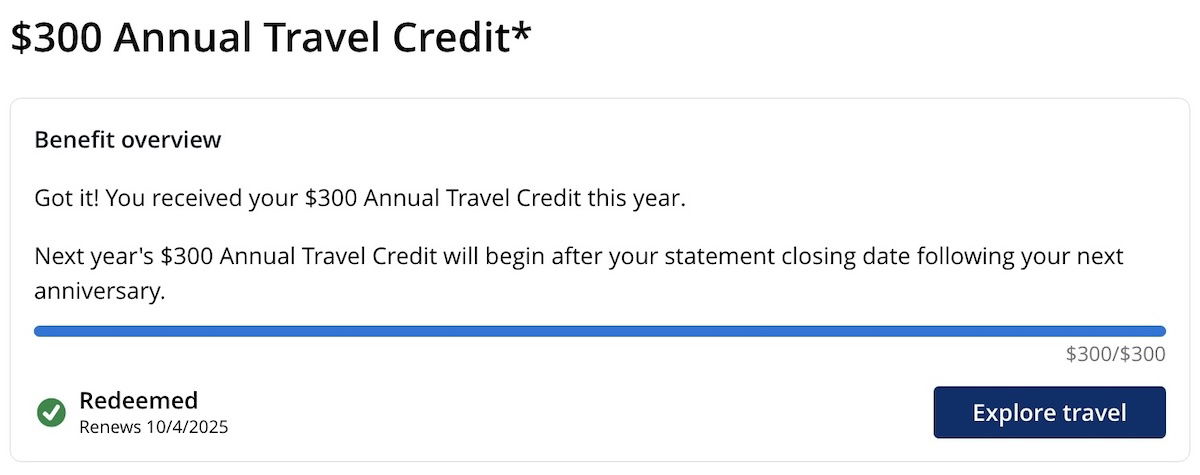

In subsequent years, your $300 travel credit is valid starting on your anniversary account date, which would be 12 monthly billing cycles after you opened the card.

How quickly does the Sapphire Reserve $300 travel credit post?

The travel credit should post almost instantly after a purchase posts to your statement. So if you’re an existing cardmember, just wait for your new anniversary year, and then you should start to see the credits posting. Unlike some other credits, you typically don’t have to wait weeks for this to post, or anything like that.

Does the $300 credit impact the minimum spending requirement?

When many people get the Chase Sapphire Reserve or Sapphire Reserve Business, they’re trying to reach the minimum spending requirement in order to earn the welcome bonus. How does the $300 you get reimbursed for travel play into that?

Well, the total amount you spend (minus the annual fee) counts toward the minimum spending requirement. So even if you get reimbursed $300 through the travel credit, that $300 in spending would still count toward the minimum spending requirement.

Do you earn points for reimbursed transactions?

Note that if a purchase on the Chase Sapphire Reserve or Sapphire Reserve Business qualifies toward the credit, then you don’t earn points for that portion of the credit. In other words, if you spent $1,000 on travel and had $300 reimbursed, you’d only earn points on $700 worth of that purchase.

What happens if you refund a transaction that’s reimbursed?

If you refund a purchase that was reimbursed, then the statement credit should similarly be reversed, and the amount should automatically be applied toward a future travel transaction. However, some report that the statement credit doesn’t get reversed, so this seems like a case of “your mileage may vary.”

How can you track how much of the $300 credit you’ve used?

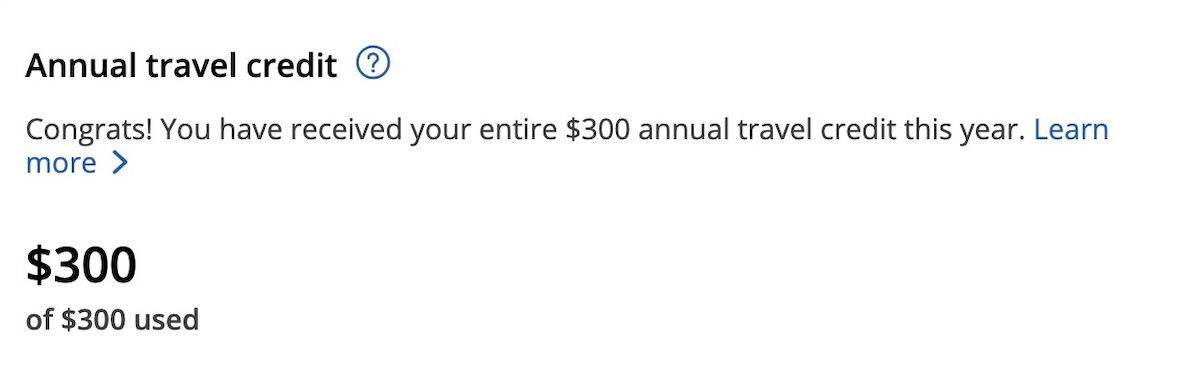

When you go to the Ultimate Rewards homepage, log into your account, and select your eligible card, you should see the card’s dashboard, with all kinds of details. If you scroll down, you should see the “Annual travel credit” section, showing how much of your credit has been used.

If you click the “Learn more” button, you’ll be brought to a page that also shows your renewal date, so that you can see when you’ll next receive a credit.

Do most people use the full $300 credit?

There is no published data on this, though I’d have to assume that a vast majority of people with the Chase Sapphire Reserve and Sapphire Reserve Business are fully utilizing the travel credit. That’s why I feel comfortable suggesting that for most users, it lowers the real annual “out of pocket” on the card by roughly $300.

Let me take it a step further — if you don’t use the full $300 travel credit then this card simply isn’t for you. There are better cards out there for someone who doesn’t spend at least $300 per year on taxis, rideshare, subways, trains, hotels, airlines, etc.

Why doesn’t Chase cut the $300 credit and lower the fee?

If the credit is so easy to use, many people probably wonder why Chase bothers having such a credit, rather than just outright lowering the annual fee but that much. I suspect there are two reasons for this:

- Chase wants more wallet share — Chase wants you to use your card as much as possible, and card issuers know that if they’re reimbursing you for certain purchases, you’re more likely to actually use your card and have it at the front of your wallet

- Chase doesn’t want to cannibalize its portfolio — Chase also has the Chase Sapphire Preferred® Card (review) and Ink Business Preferred® Credit Card (review), which have much lower annual fees; Chase doesn’t want to completely cannibalize those cards, and by having more of a difference in terms of the fees, it’s one way to segment the market a bit

How does this compare to the Amex Platinum credit?

Both American Express Platinum Card® (review) and The Business Platinum Card® from American Express (review) offer a variety of credits as well. One of the credits they both offer is an annual up to $200 airline fee credit (Enrollment required). There are a few things that make this credit not as good, though:

- The credit is for up to $200, rather than $300

- The credit only applies to airline fees, rather than all travel purchases (and airline fees has a very specific definition)

- Registration is required, and you have to designate an airline for which you want to use the credit

While the $200 airline fee credit is only a small part of the Amex Platinum suite of benefits, that aspect of the card is in no way competitive, in my opinion.

How does this compare to the Capital One Venture X credit?

The Capital One Venture X Rewards Credit Card (review) and Capital One Venture X Business (review) are also lucrative premium cards, which are quite easy to justify. The cards have $395 annual fees, and offer a $300 annual travel credit. How does that credit compare?

- The credit is the same amount as on the Chase Sapphire Reserve

- The major catch is that the credit can only be used through the Capital One Travel portal, toward flights, hotels, and rental cars

- The credit is also applied at the time that you make the travel purchase, so it’s not an after the fact reimbursement, like with Chase

- So this credit isn’t quite as valuable or flexible, but then again, the Capital One Venture X also has a significantly lower annual fee, with fewer hoops to jump through in order to maximize value

Bottom line

Many people are deterred by the $795 annual fee on the Chase Sapphire Reserve and Sapphire Reserve Business. While the cards offer lots of credits that can help offset those fees, the single easiest perk to maximize is the $300 annual travel credit.

Every cardmember year, your first $300 in spending in the travel category will automatically be reimbursed. Unlike some of the other credits and benefits on these cards, this credit is super straightforward. By my math, this really lowers the “out of pocket” on the cards by $300.

What has your experience been with the Chase Sapphire Reserve and Sapphire Reserve Business $300 travel credit?

"...are lucrative premium travel cards" - used to be. About the only value with the Reserve card going forward is the travel credit, but that is not enough to keep the card. Surprising with the refresh they did not edit the details of this benefit. As for why they have the credit, I suspect most people use their card for travel purchases and do not spend exactly $300 so they have the credit.

If you want to encourage people to use a card every day, the $300 credit was brilliant. It said to people in major cities "Hi, here's a card that earns 3x on all travel, it's premium, all of your friends are going to have this card, start charging everything on it and we'll give you your first $300 a year back on all of the rideshares, transit, etc." Pretty brilliant.

Is there still a $300...

If you want to encourage people to use a card every day, the $300 credit was brilliant. It said to people in major cities "Hi, here's a card that earns 3x on all travel, it's premium, all of your friends are going to have this card, start charging everything on it and we'll give you your first $300 a year back on all of the rideshares, transit, etc." Pretty brilliant.

Is there still a $300 credit? Yes. But now that most travel is not included (Lyft is still 5x points I guess), only "special travel" like air/hotel, the card quickly does not become the daily driver that it once was.

This card, and its credits, have simply lost the plot. No idea what they are trying to be. When you are scraping the bottom of the barrel to offer wealthy folks a $500 credit on Southwest if they keep spending money on the card, it's not about the new $990 fee for a married couple. It's about a premium identity that they are destroying.

Is there a method on either the Chase website or the statement where one can see if the credit has been fully used?

@ Pauls98 -- Absolutely! See this section in the post: "How can you track how much of the $300 credit you’ve used?"

Thank you, Ben. How the actual heck did I miss that? YIKES! Congratulations on your new addition! I'm sure your mother is THRILLED to meet Jet!

This has always coded generously and been used up before I can hardly blink. I'd have to go back and look at my statements but they have some very loose interpretations of "Travel". It's always gone in a flash but a decent surprise when it's time to pay my balance off.