Amex’s “Pay Over Time” feature is something that I recommend not using, but which could still be worth signing up for. Let me explain.

In this post:

What is Amex Pay Over Time?

Generally speaking, one of the ways that credit card companies make money is through people financing charges. I recommend avoiding financing charges whenever possible, because you’ll usually pay a pretty high interest rate.

One interesting thing about American Express is that not all cards in the issuer’s portfolio are credit cards — some are in fact hybrid cards (they used to be referred to as charge cards). With these cards, you generally have to pay off your balance in full each month.

That is, unless you enroll in Amex’s Pay Over Time feature. With this, you’re given the option of taking more time to pay for your purchases. Purchases can be placed into a Pay Over Time balance, and then you can pay them off over an extended period, meaning that you don’t have to pay your balance in full at the end of a billing cycle. The catch is that you’ll pay interest.

Which Amex cards are eligible for Pay Over Time?

Purchases on American Express credit cards are automatically eligible for financing, so there’s no need for this Pay Over Time feature. Pay Over Time is available on select hybrid American Express cards, including the following:

- The Amex Personal Platinum Card

- The Amex Personal Gold Card

- The Amex Personal Green Card

- The Amex Business Platinum Card

- The Amex Business Gold Card

Why you shouldn’t use Amex Pay Over Time

If you can avoid it, I’d recommend not using Amex’s Pay Over Time feature:

- You’ll get the most value from rewards cards if you pay your balance in full each billing period, so you’re not financing any charges; the interest rate you pay will typically more than offset any of the rewards you earn

- If you absolutely do need to finance charges on a card, there are some cards offering 0% intro APR, so I’d look into one of those instead

Why you should (maybe) enroll in Amex Pay Over Time

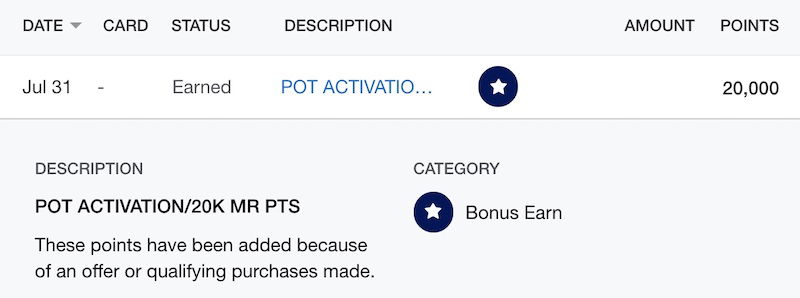

The reason you should consider enrolling in the Pay Over Time feature is because American Express often provides an incentive to do so. Keep on eye on your email and mail from American Express, and you may see an offer giving you an incentive to sign up for Pay Over Time. For example, I received one of these in the mail yesterday, offering 20,000 bonus Membership Rewards points for enrolling (I value Amex points at 1.7 cents each, so to me that’s like $340 in value).

Suffice to say that this is an awesome deal — there’s no fee to activate Pay Over Time, and you don’t actually have to use it to earn the 20,000 points. In my case, the points posted within 24 hours.

If you continue paying off your bill with each billing cycle (as you presumably did before), nothing will change.

It’s always worth keeping an eye on these offers. And while they might sound too good to be true, they’re not… this is exactly how it works, and who doesn’t want 20,000 “free” points?

While you’ll typically be contacted about these offers directly, you can also check this link to see if you’re eligible. If you have multiple hybrid Amex cards, you’ll want to switch to the profile of each card to see if you are eligible for a bonus for enrollment.

Bottom line

Amex’s Pay Over Time feature allows you to finance charges over an extended period on hybrid cards, which haven’t historically been eligible for financing. In general I recommend avoiding financing charges on cards, since the interest rates can be quite high (aside from some 0% intro APR offers).

That being said, it could be worth enrolling in Amex Pay Over Time if you’re targeted for a promotion. It’s not unusual to see enrollment offers of 20,000 Membership Rewards points, which is a lot of points to get for nothing. There’s no need to actually use Pay Over Time, and if you continue to pay off your charges in full, you won’t be charged anything.

Have you ever signed up for Amex’s Pay Over Time with a targeted offer?

The trick is "average" vs "median". Probably the median is much much lower. But a few billionaires and mega millionaires would skew the average....

No, pay over time does not charge you from day one. That is literally illegal. I did sign up for the exact reason listed in the article. Bonus points for something I'll never use.

If you don't have pay over time, you're paying your card in full monthly so this is literally a no change thing for me.

I just purchased a $2699 Qatar air ticket to TBS. Amex offered the plan it pay over time feature for 12 months with absolutely zero fees. I'll take that deal any day!

There is no good reason to use pay over time(POT), unless you don’t need it. The interest rates are very high and Amex will put all of your purchases automatically on POT if you start using your line. Yes that means interest on day one and no float. This feature is as close as you can get to a payday loan store.

I would think having a strong credit score interest rate should be pretty low.

It depends on the interest rate though to pay over time. You are only looking at it from a points and miles prospective which is a very linear view. If I can earn a greater return on my investments with the same money, I may consider to use the pay over time feature, especially for a card like the Platinum card where there is no credit limit so I do not need to worry about having more credit for more purchases.

Why would you pay interest on a high interest rewards card even if you could “earn a greater return on my investments” (clown talk for financial guru wannabes).

If that was the case you’d just purchase with a low interest credit card?

If, as was asserted, the interest made on (Bernie Madoff scheme) were higher than the pay over time interest rate, then it could make sense to do so.

HOWEVER, no such thing. A few points is as good as you're gonna get. Nowhere in the range of 10%. And let's keep in mind a CD requires a specific time frame for your money to be locked away. Not convenient for paying a monthly bill.

There is no such thing as no credit limit for Amex Platinum. It seems many people never get this part, but no preset limit doesn't equal unlimited.

I don't think you are in a position to call others linear view. You sound just like someone who just finished Finance 102 and think that you can conquer the world. (but have no clue what an unsecured loan is)

Playing with Robinhood might earn you money...

There is no such thing as no credit limit for Amex Platinum. It seems many people never get this part, but no preset limit doesn't equal unlimited.

I don't think you are in a position to call others linear view. You sound just like someone who just finished Finance 102 and think that you can conquer the world. (but have no clue what an unsecured loan is)

Playing with Robinhood might earn you money but doesn't mean you know much about finances.

There are a lot of very smart people playing the credit card game. Believe me, if it's as simple as "I can earn a greater return on my investments with the same money, I may consider to use the pay over time feature", these people will abuse the 0% APR cards to the last drop.

I saw the 20k MR offer show up about a month ago. Points posted instantly.

Thanks. Mrs. Doubt gets those emails. Will have to see if she got the offer.

Perfect timing. I received the 20k offer as well, and have been looking it up and down to find a catch.

Nice to have this confirmation, thanks.

Great if you get a 20k MR offer, otherwise I'd pass. Easiest points ever.

I have it on my Hilton card. I didn’t sign up for it it just occurred. But a couple of times AMEX has offered a zero fee pay over time. So, when it was free, and I had a big charge, I took advantage and paid it over four months. There was no interest or fee.

It’s nice to have the option to pay a fee on one big charge instead of carrying a balance and having your average daily balance subject to interest rate charges. But it’s not something I’ve had to do.

Easiest 20k MR points I’ve ever earned. No brainer.