Ready to earn rewards for your business spend?

Brex Cash was recently introduced, and I wrote in a separate post about why this is so great. I signed up for an account a while back, and wanted to report back on my experience.

I’ve earned over 110,000 points (which can be transferred to airline partners) without a credit pull and without paying a dime in fees. This is quite literally an unprecedented opportunity.

These are probably the easiest points I’ve ever earned (easier than any credit card sign-up bonus), and best of all, I have a business cash management account that I actually like, and plan to keep long-term.

In this post, I wanted to break down the value of Brex Cash in basic terms, share my experience applying, and also share some tips for getting approved. For anything not answered in this post, see our Brex frequently asked questions.

Why you should get a Brex Cash account

Brex Cash is a cash management account that functions much like a business or corporate checking account (although it isn’t a bank account). In other words, you link your business checking account, and then you can transfer funds and then use your Brex account for everything from payroll to business purchases.

If you’re eligible you absolutely should apply, in my opinion:

- In order to qualify, your company must be a C-corp, S-corp, LLC, or LLP (sole proprietorships don’t qualify)

- If you have multiple businesses, you can apply for a Brex Cash account for each business (and each business would be eligible for the welcome bonus)

- Rewards earned through Brex Cash aren’t taxed

There are two reasons you should get a Brex Cash account — there’s a huge bonus when you sign up, and then there’s lots of value in keeping a Brex Cash account.

Earn 110,000 easy points with no fees or credit pull

One reason to get a Brex Cash account is because you can earn up to 110,000 bonus points. Points can be redeemed for one cent each cash back, or my preferred use would be to transfer them 1:1 to airline partners (these include Air France-KLM Flying Blue, Avianca LifeMiles, Emirates Skywards, JetBlue TrueBlue, Singapore KrisFlyer, and more). See this post for everything you need to know about redeeming Brex points.

Redeem your Brex points for travel in Emirates first class

Redeem your Brex points for travel in Emirates first class

That’s right, we’re talking about 110,000 points for a no fee account, and there’s not even a credit pull.

Here’s how that bonus is broken down:

- Earn 80,000 bonus points after spending $1,000 on your new Brex Card (this is an exclusive, limited time offer for OMAAT readers)

- Earn 10,000 additional bonus points after spending $3,000 on your next Brex Card within the first three months

- Earn 20,000 bonus points when you link payroll to your Brex Cash account

And yep, it’s really that easy — I have over 110,000 Brex points in my account already.

Earn 80K points as an OMAAT reader, plus up to 30k additional bonus points!

Why a Brex Cash account is worth keeping

The Brex Cash bonus for new accounts is obviously something to get excited about. However, beyond that, there’s value in keeping a Brex Cash account in the long run. Just to summarize a few highlights:

- Brex Cash is as no-fee as accounts and cards get — there are no account management fees, no foreign transaction fees, no ACH fees, no wire fees (even internationally), etc.

- Brex Cash offers some industry-leading bonus categories for spending on your Brex Card, like 8x points on rideshare, 4x points on restaurants and dining, and more

- Brex Cash offers perks with all kinds of partners, ranging from Amazon Web Services, to Dropbox, to Slack

- Brex Cash offers virtual card numbers for added security, which can be useful for online purchases, subscriptions that auto-renew, etc.

There are so many other reasons to hold onto a Brex Cash account, and it’s also worth noting that all deposits at program banks are FDIC-insured up to $250,000.

My experience applying for a Brex Cash account

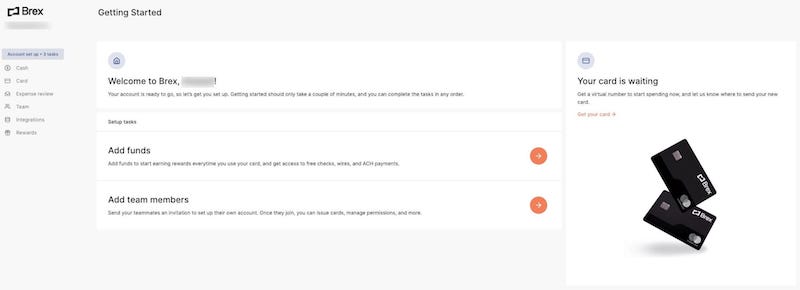

The process of applying for a Brex Cash account with an S-corp took me just over five minutes.

To briefly walk through the process, when applying you have to first provide some basic personal details, including a work email address. There’s no need to enter a referral code for the bonus of up to 110K points, as long as you use the OMAAT link.

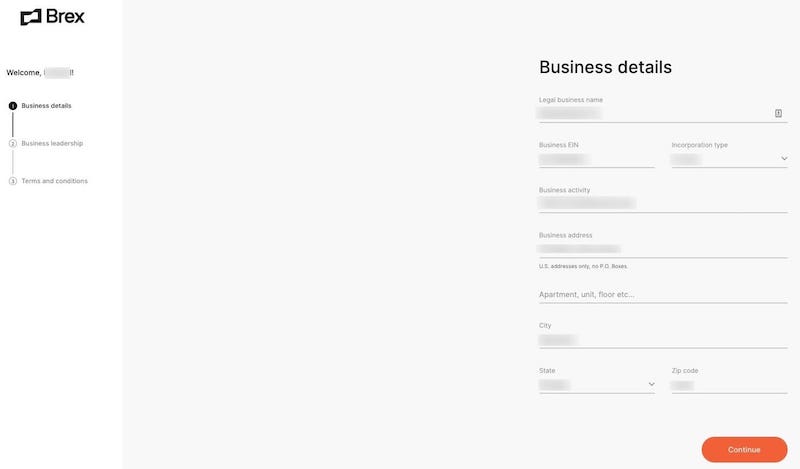

Then you’ll have to enter some information about your business.

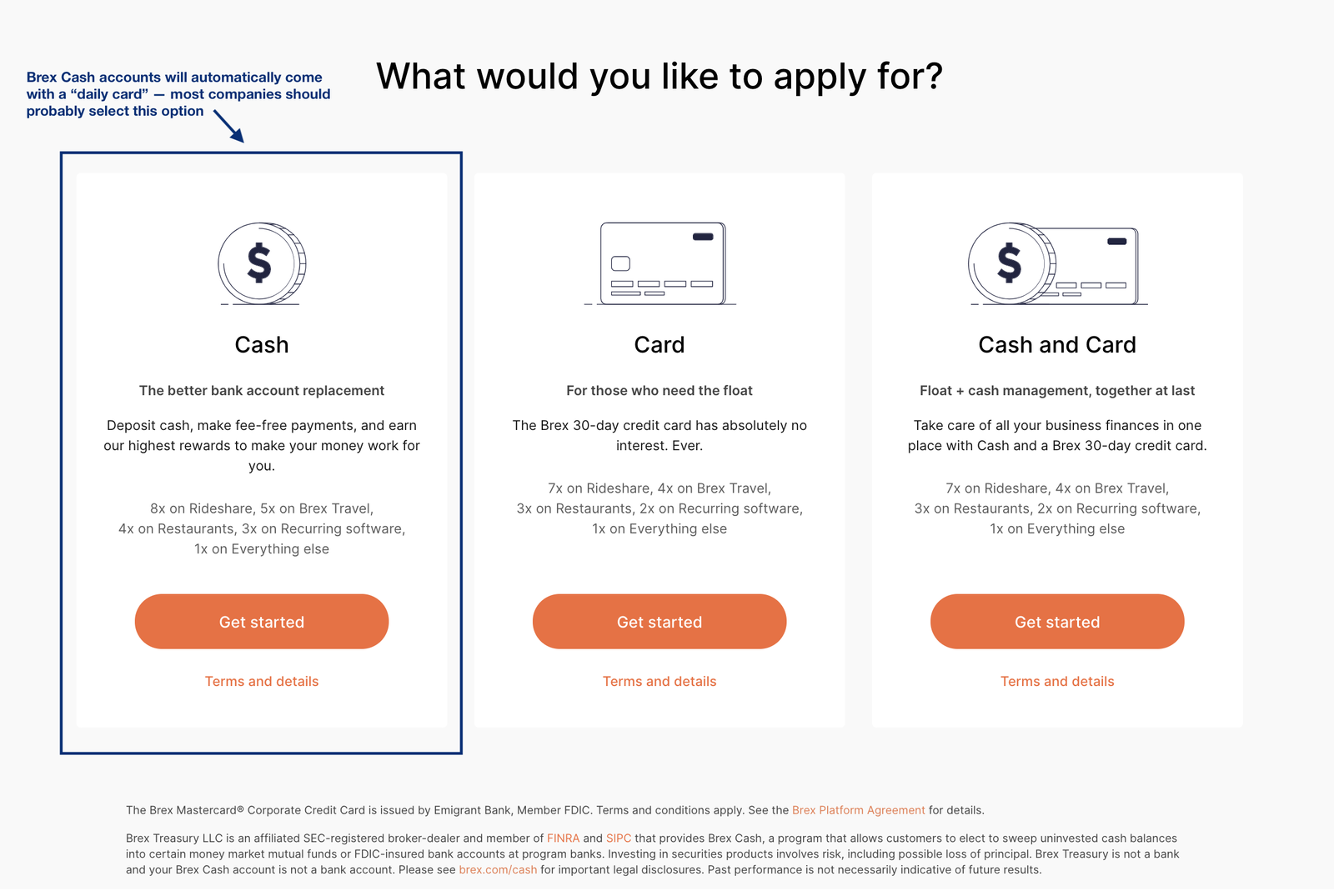

Depending on your type of business, you may then be presented with several account options. If you’re presented with this, you’ll want to select the “Cash” account option, since that’s what offers this great promotion.

If you don’t see this page, don’t worry. Generally businesses that are self-funded and/or are not tech companies will automatically be enrolled in Brex Cash, which is what you want anyway. This is intended to simplify the process.

Next, you’ll be asked to enter some more business details.

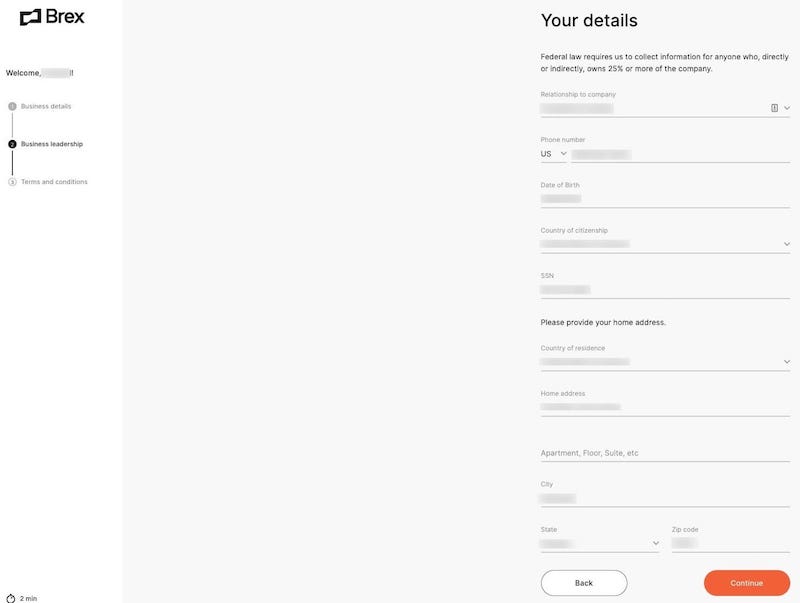

Depending on your business type, you will need to enter details on the various company owners, including their social security numbers due to federal data-collection requirements.

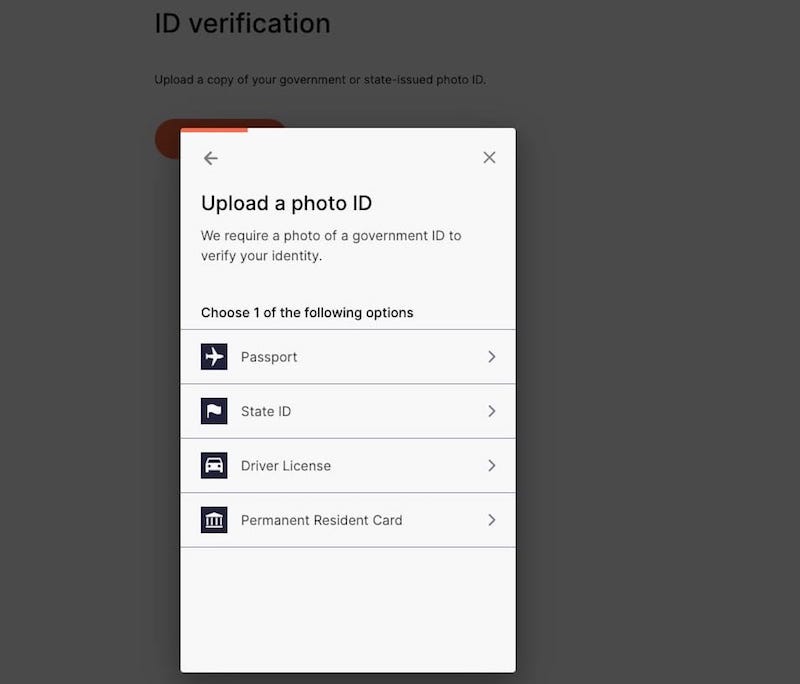

Once that’s complete, you’ll have to upload a copy of your photo ID, which could be your passport, state ID, permanent resident card, etc.

Once all that info is submitted and you’ve clicked a link in your email, you may be instantly approved (or in some cases further processing is required). If you are approved, you’ll instantly have access to your Brex Cash account, and can start using your account immediately. It’s that easy!

As you’d expect & hope (based on this ultimately being a quasi-tech company), the Brex online experience is much better than your typical online banking experience.

Tips: how to get Brex Cash instant approvals

People are overwhelmingly being instantly approved when applying for Brex Cash accounts, though that’s not the case for everyone.

While I can’t speak to every specific case, Brex has shared with us that the most common reason for not getting an instant approval is when Brex can’t collect the information needed to verify a business, which is most common for companies without much of an online presence.

To be clear, if you don’t get instantly approved, that doesn’t mean you’ll necessarily be denied. You definitely could still be approved, it’s just that some manual processing is required.

To maximize your odds of being approved instantly:

- Make sure you have a valid business (that isn’t a sole proprietorship)

- Make sure you select the Brex Cash option if you’re presented with it during the application process

- Ideally enter your actual business email address and business website, rather than using a personal email

Bottom line

Brex Cash is a phenomenal business cash management account. For starters, you can earn up to 110,000 bonus points when you apply and complete certain activities. That’s unheard of for a no-fee account that doesn’t even involve a credit pull.

It’s not just the great bonus that makes Brex Cash worth considering, but also the ongoing value that it can provide to your small business. This is an innovative product, and the Brex Cash concept doesn’t currently have any real competitors. Brex has developed a niche, and I can’t wait to see how the product evolves over time.

If you’re eligible, I’d highly recommend applying for a Brex Cash account with the current limited time bonus.

After following Lucky's advice I opened a BREX account... It was used every month.... They just notified me they are closing the account, but did give me notice.... I immediately transferred the points to an airline program and paid off an outstanding bill with the debit card.

Lets see if the points make it to the airline.....

Has anyone else had their accounts abruptly closed for inactivity? I find it astonishing that this company believes they can close our accounts and wipe out our accumulated rewards on a whim! Feels like an underhanded attempt to clear liabilities from their books. Close my account, fine. Tell me that I can't transfer or otherwise redeem my rewards? Girl, you've just poked the bear. Stay tuned for the class action (I'll gladly be the class...

Has anyone else had their accounts abruptly closed for inactivity? I find it astonishing that this company believes they can close our accounts and wipe out our accumulated rewards on a whim! Feels like an underhanded attempt to clear liabilities from their books. Close my account, fine. Tell me that I can't transfer or otherwise redeem my rewards? Girl, you've just poked the bear. Stay tuned for the class action (I'll gladly be the class leader). If you've been screwed by these goons, don't go quietly. Post here (Ben: I know you have a business relationship with Brex, but you owe it to your readers to help make this right. We followed your recommendation to get involved with Brex in the first place).

I god denied for over 4 times

Part of the Group who got approved deposited money and then had account suspended. They have been holding my money hostage for over a month. I sent them the form 4 times as to where to return money and each time they said they would do it they have not. Ben I'm disappointed that you habe gotten your readers into a pump and dump scam. Doubt myself or anyone else where ever see that money...

Part of the Group who got approved deposited money and then had account suspended. They have been holding my money hostage for over a month. I sent them the form 4 times as to where to return money and each time they said they would do it they have not. Ben I'm disappointed that you habe gotten your readers into a pump and dump scam. Doubt myself or anyone else where ever see that money again. Did some more digging company only has $20 million bank deposits and is a very shaddy company. Notice there D- minus BBB rating. Wish i would have looked that up first. Hope the advertising money was worth burning your readers.

One more customer to add to the Account suspended list. Opened a new account using your link, was able to link bank and transfer funds. 2 days later, account was suspended and my funds are lost somewhere. I’ve sent Brex 2 emails with no response, been on hold now for an hour on the phone and chat, I’m at a loss on how to contact someone at Brex. Don’t care for the bonus points, just need my funds returned. Any ideas?

I hit the “cash and card” option by mistake instead of the Cash account as I should have. I got a message saying that it might take 15 days to approve the account. I sent them an email right away saying that I had applied for the wrong account and I wanted the Cash account that would earn the OMAAT bonus. Is there anything else that I can do?

Ben and Tiffany, thanks for publicizing this offer. I applied early on in the process and had no problems. I qualified fairly quickly for the 20k bonus and received it promptly. I just received the 80k bonus as I didn't rush into this. TProphet all throughout the month there was never anything under my account profile or rewards about or progress towards the 80k bonus. I passed the $1,000 spend on Sunday and this afternoon...

Ben and Tiffany, thanks for publicizing this offer. I applied early on in the process and had no problems. I qualified fairly quickly for the 20k bonus and received it promptly. I just received the 80k bonus as I didn't rush into this. TProphet all throughout the month there was never anything under my account profile or rewards about or progress towards the 80k bonus. I passed the $1,000 spend on Sunday and this afternoon the 80k points were in my rewards account. I believe Tiffany, Ben and others have all said there will be no visibility on your Brex account about the 80k bonus or where you stand. You just have to trust they will take care of it when you meet the spend which they did in my case.

I only got offered 30K when I logged in (20k for payroll, 10k for $3k in spend), there's no reference to the 80k anywhere. Can you provide any clarity on whether the bonus is being honored?

Thank you Gary

@Susan I did an online chat with Brex and you can get it back. Go into your Brex account and Click on Cash > Payments > then either make an ACH or Check payment back to yourself.

Same question as Gary from 2/15/21 ... how do i get my $750 back from the Brex cash account as 80% is the maximum that can be spent on the debit card ?

Do you know if spend has to be via debit or can it be ACH?

Any idea if to trigger the 80k bonus spend has to be on a debit card or can it be via ACH payment?

Just wanted to thank you again for posting and sharing this deal with us. I wasn't able to use the Gusto benefits (I have an existing account with them) but I was able to get approved with my S-Corp and open my account. I linked my PayPal account and the trial deposits triggered the payroll bonus. Unfortunately, after I spent $1,000 (paying taxes) and linked PayPal, Brex closed my account and said I'd only be...

Just wanted to thank you again for posting and sharing this deal with us. I wasn't able to use the Gusto benefits (I have an existing account with them) but I was able to get approved with my S-Corp and open my account. I linked my PayPal account and the trial deposits triggered the payroll bonus. Unfortunately, after I spent $1,000 (paying taxes) and linked PayPal, Brex closed my account and said I'd only be able to login in read-only mode. A day later, the payroll bonus points showed up, and a few days later the 80K points showed up. I'm not sure why my account was closed (my other business account wasn't linking so I instead linked a personal bank account and personal PayPal account, and I signed up with a gmail email - I recommend not doing any of those things!) but I was still able to redeem my points. I chose to redeem for a prepaid MCGC, just in case I had a problem transferring the money out. Sad I won't be able to use their products, but grateful they honored the points and that the system allowed me to redeem them. Thanks!

Applied on 2/1 and 16 days later, application is still pending. At this point I may just give up. Definitely can't depend on a cash management fintech company for my legit LLC (since 2002) if they can't even review an application in 16 days.

I applied about 10 days ago.. was approved and given my digital card number. Then was asked to upload my drivers license - no prob. Then was asked to upload proof of EIN - no prob. Now my account says it's under review and I'm unable to load any funds. I tried to chat and email and had zero luck with either. Anyone wait this long only to eventually get approved (again) ? Or should I anticipate a denial for some reason ?

Pretty telling that OMAAT still hasn't bothered to directly address the fact that you could get assets frozen without a clear path back out from nor bothered to warn in a direct fashion about the terrible customer service.

¯\_(ツ)_/¯

Disappointing.

Hope this is the last Brex "reminder," that gets thrown onto the top of the front page.

Are you able to transfer cash from Brex back to your external bank account? I ask because $3,000 is the minimum spend but I will need to transfer more than this amount to Brex because 80% of your Brex cash balance is the maximum amount that can be spent on the debit card. So If I transfer $3,750 but I only spend $3,000, how do I get the $750 back?

I applied for one and they never even got back to me with approval/denial lol. Totally ridiculous.

umm..... @Mike, who said anything about being 'cheated'? Not me.

I understand that credit cards and the carrots they dangle are the lifeblood of most OMAAT readers travels, and simply pointed out that they were of no interest to readers outside the US.

A 30 second skim of one days OMAAT content is not being cheated; on the contrary the saved time is of value to me.

@JC I know from one of my other large business groups that Brex is a mess. Not with this same product but inconsistencies and especially not being clear with their terms, changing them to suit them (such as the 20 yr business here turned down) My other group had "special offers" From Brex and the members found that there were phantom requirements that were not disclosed upfront among other things. I think as other customers...

@JC I know from one of my other large business groups that Brex is a mess. Not with this same product but inconsistencies and especially not being clear with their terms, changing them to suit them (such as the 20 yr business here turned down) My other group had "special offers" From Brex and the members found that there were phantom requirements that were not disclosed upfront among other things. I think as other customers comment, there will be many more customer issues that mirror that. The principals of its FIntech seem to be way over their heads. The skill they have is attracting VC money, not customer service in any way. Many of these Fintechs will be gone in a few years the way I see it.

Not super impressed with Brex so far. It took way to long for them to approve my application and then to add insult to injury they count the 90 days for the 10,000 in spend from date of application rather then the date they approved the account. So in my case I lost about 20 days of spending time since that is how long it took for them to approve the account. Plus, I have...

Not super impressed with Brex so far. It took way to long for them to approve my application and then to add insult to injury they count the 90 days for the 10,000 in spend from date of application rather then the date they approved the account. So in my case I lost about 20 days of spending time since that is how long it took for them to approve the account. Plus, I have not been able to link my business checking account with them from Bank of America even though Bank of America shows it has been linked through Plaid. The process says the account is setup and then the next screen asks me to choose a transfer from account with no options. It has been like that for over a week now. I had to deposit a check from the business checking account I was transferring from and that took about 2 business days to clear which isn't bad for a new account but other banks in my area make all business deposits available next business day so also not unusual as well. I then decided to try and push money to the account and the bank I deal with says that the routing number provided is not a bank I am able to push money to or pull money from and they can't set it up.

So while Brex sounds great initially, it leaves a lot to be desired overall with slow approval processes, broken account linkage, unable to push or pull money to other business checking accounts according to the several banks I have business checking accounts with, and then due to their own slowness approving accounts losing days or weeks to meet the minimum spend requirement. I'm not sure I will keep this account longterm unless these issues are addressed.

@Glen T, when Ben and Tiffany are doing the right thing and not traveling, what should we expect them to post about? Valid point that credit card deals are of no value to OUS readers, but given them some slack. We are all trying to get by and we are not paying for this content, therefore I don't understand how you are cheated.

@Santiago Speranza, allegedly it's every Tuesday.

How soon after spending the $1K do the 80K bonus points post? I have received the 20K bonus but still waiting on the 80K bonus with no updates from Brex Support.

@ Santiago Speranza -- @ Lukas is correct, they are doing sweeps every Tuesday for the special 80k bonus. Other points should just post automatically.

The apparent excitement this thread is seemingly generating aside, I notice that this weeks round-up of TIPS of 10 items has 7 out of 10 posts on credit cards.

Now I realise that this may be of some interest to the American OMAAT audience, it is of zero interest to anyone residing outside the US.

I feel a little cheated when I can skim through one day's posts in less than 30 seconds.

I signed up this morning using your link but selected cash and card figuring i had to have a card for the purchases. Will i not get the 80,000 points?

@ Troy -- If you were approved for the Cash+30-day product, you would still get the 80k points. Most businesses just can't get approved for that as easily, since it is designed for tech companies/startups and has additional underwriting requirements, but it still counts for the bonus.

Hey Ben - Opened my account and they requested my SOS letter of good standing. Any idea if they're fairly quick about finalizing the last portion? Everything is approved, but it won't allow me to transfer funds. Did you have the same issue? Any idea how long it'll take them to approve the documents?

I have to agree with several others Brex is a joke. I have had a company for 20 years and I applied and Brex has had no communication with me for the 2 weeks since application went it.Then I received an email that said "account suspended" with no other info. They are probably overwhelmed but I cannot recommend anyone apply for this right now

@Ben,

It's difficult to put into words my level of disappointment at how OMAAT has conducted itself in relation to Brex.

Simply put, many of your readers have had a very bad experience with this company. The "other" post is a litany of account delays (maybe not the most serious issue), but quite seriously, frozen accounts, frozen funds, and absolute absence of communication from Brex about any of this.

It seems the only way...

@Ben,

It's difficult to put into words my level of disappointment at how OMAAT has conducted itself in relation to Brex.

Simply put, many of your readers have had a very bad experience with this company. The "other" post is a litany of account delays (maybe not the most serious issue), but quite seriously, frozen accounts, frozen funds, and absolute absence of communication from Brex about any of this.

It seems the only way to get reasonable customer service from Brex is through Tiffany as a back channel.

As I said in the other thread, integrity in this situation would be an update such as: "Many readers report substantial customer service issues with Brex. Although potentially a lucrative offer, I recommend that readers only place with Brex funds that their company could comfortably operate without for a substantial amount of time.

I have communicated with Brex and they have been overwhelmed by the volume of interest in their product, and their customer service response times..."

Instead, the banner update is, "sIGn uP Now, oFFER WoNt LAsT!!!"

Also, quite interesting that you've chosen to elevate this post rather than the one with dozens of reader complaints about their direct experience with the company.

I can't say I'm all too impressed with Brex. I applied for a Brex Cash account on 1/29 and it went into a pending status. Sent them an email three days ago as to status and there's still no update.

What is the deadline for this limited time offer?

@ Kevin Szarka -- I don't have an official end date, but I would highly recommend applying in the next week if possible. If I have a formal end date I'll be sure to pass it on (though it's also possible notice may not be given).

I also have the same issue - applied through the link via OMAAT, and then don't see 80k bonus on my account. Contacting support, said I have to re -apply. I've read some comments of some people having the same issue and we could email you guys to get some clearer answers? I appreciate your help

@ Trang Hoang -- When did you complete the spending requirement for the 80,000 points? Unlike the other points offered by Brex, the 80,000 points typically don't post instantly, but rather "sweep" the Tuesday after the spending is complete (or sometimes the Tuesday after that).

In the article above, it says: "Earn 20,000 bonus points when you link payroll to your Brex Cash account"

Is "payroll" supposed to be "PayPal?" I keep seeing people mention PayPal, but nothing about "payroll" ... and if it IS "payroll," how does that work if you're the only owner/employee?

@ Eileen Kerrigan -- You can link a payroll provider (such as Gusto, etc., which many single employee businesses still use as it automates federal tax filings and such), or a payment services provider that you use to generate business income (PayPal, Stripe, Square, etc.). Either option works for earning that bonus.

Finally got Paypal connected, it took too long for them to help me because it is not straight forward. So do I have to transfer money from paypal to brex cash to qualify for the 20k bonus, or is connecting the two enough? thanks

@ Scott -- The terms say you need to have business income hit your PayPal account, and then swept to Brex.

I can't add funds. It says I have to upload "certificate of good standing".

@ dizzy -- I replied to this on the other post, but just in case you didn't see this, you should be able to get that fairly easily from your state licensing bureau. In Florida you can do it instantly on a website with a small (<$10 I think) processing fee, and you get a document that says your Corporation is current in the eyes of the state, has been filing annual reports, etc. Because Brex doesn't do a personal credit check, they rely on other ways of getting information about businesses, so it sounds like they just might not have been able to get everything they need through the automated methods.

Anybody know if there is a minimum funding or average balance requirement to receive the bonuses (or maintain the account)?

@ Runs Pretty Good for a Fat Guy -- Nope, there isn't.

Does single member LLC qualify? Thanks.

@ yy -- Yep!

Thank you so much @Ben for clarifying, I will be applying using your link, and I'm looking forward to those 80,000 or more points! And thank you for these very detailed points about Brex.

This looks amazing, and thank you for this great post! I think I'd like to sign up, as I have an established LLC. One question I have though, what did you mean by this line?

"Earn 10,000 additional bonus points after spending $3,000 on your next Brex Card within the first three months"

I'm a bit confused by this, do you have to get more than one Brex card?

@ Dan Nainan -- When you are approved for Brex Cash you receive a card (which can be virtual) that you can use for expenses, and it's automatic. So spending $3,000 on that would earn you an extra 10,000 points. Let me know if you have any other questions!

Tough times at OMAAT, eh? Sure pushing this thing. At least it's a refreshing break from articles about face masks.

@Ben - Is there a timeframe in which you have to spend the $1k to receive the 80K signup bonus? After the $1k spend has been met, how long until the 80k points are posted? Thanks.

@ Jeff -- I would do it in the first 3 months, so that it helps stack with the additional 10k for spending $3k in that time period.

If there's a bonus for connecting payroll, does that mean you're able to connect via ACH for payroll pulls? I don't pay payroll on credit card because of the fees, so even with the bonus it would only make sense if I can set up the ACH with my payroll provider (ADP in this case).

Also, just curious... if it's FDIC insured up to $250k how is this not just a bank account with a good web interface?

@ Cate -- Yep! The Brex Cash account has ACH functionality, and then theres a credit Card "with daily statements" that comes with it.

And to your second question...I think it's a business type/regulation/lawyers involved/careful vocabulary situation. But that's basically what it is in practice.

Quick heads up regarding a couple of common questions (which I've updated the post to reflect):

-- If you have multiple businesses then you could get a Brex Cash account for each business, and you'd be eligible for the bonus

-- Rewards earned through Brex aren't taxed

I'm not impressed at all in regards to redemption. If you redeem for cash back or gift cards $1/100 points. Only transfers to certain airlines isn't good either. If there's a 1:1 transfer then the transfer partners become more important.

@Tiffany sure - how can I forward the email to you? I do not have a nefarious business type :)

Ben - You said "That’s correct, there’s no need to enter anything in the referral code field. As long as you follow the OMAAT link, you’ll automatically be eligible for this amazing bonus."

I applied - followed up with Chat - and the rep said he didn't see anything. I went through your link and all. My account is approved - but no bonus offer attached supposedly. You might want to chat with him - because your reputation unfortunately gets tarnished.

@ Guest -- Ugh. We are chatting with them, however (as ever), we would generally caution readers against relying on single data points from front-line customer service employees, who are unfortunately rarely as informed as would be optimal. The Brex product and marketing teams are aware that people are getting conflicting information, but assure us that the link tracking is in place, and everyone who applies through the OMAAT links will receive the 80k bonus...

@ Guest -- Ugh. We are chatting with them, however (as ever), we would generally caution readers against relying on single data points from front-line customer service employees, who are unfortunately rarely as informed as would be optimal. The Brex product and marketing teams are aware that people are getting conflicting information, but assure us that the link tracking is in place, and everyone who applies through the OMAAT links will receive the 80k bonus after meeting the spending requirement.

If it would make you feel more confident, feel free to send Ben or I your business details over email, and we'll make sure someone there takes a look at it.

Another data point: I signed up and, while I received a virtual card and an email stating that, "you and your team can start using Brex right away to move and manage your company’s money," my account has been unusable and has shown "Processing information" in the header since.

An online chat with them today had them hedging their commitments, letting me know that they would "get back to me with a decision in 3...

Another data point: I signed up and, while I received a virtual card and an email stating that, "you and your team can start using Brex right away to move and manage your company’s money," my account has been unusable and has shown "Processing information" in the header since.

An online chat with them today had them hedging their commitments, letting me know that they would "get back to me with a decision in 3 to 7 business days," so I have the same feeling as @Robin that they got overwhelmed, pulled the plug and are now in CYA mode.

My LLC is very well-established (more than 20 years in business) and my credit rating is excellent, so this development is frustrating to say the least. I do not provide my financial information easily, and the only reason I gave this one a shot was Ben's "easiest 110K points I ever earned" headline and the goodwill he had banked with sound advice and recommendations over the years.

To that end and FWIW: Ben, trust is hard-won and easily lost. I know that you are not responsible for the companies you work with or how they operate, but I have to agree with Robin here. Whether or not the account and points come through, Brex's conduct does not reflect well on your advice or your judgment. Blogging has always been a business, but I will certainly filter future information and advice from OMAAT through the lens of this experience.

Hi Ben

- Not impressed with this at all. Apparently I failed their "internal screening process". Surprising as they asked for almost no information on the application. Since my company is an LLC I had to provide my SSN but, if anything, my credit rating should have helped with the "internal screening process". I hope I did not waste a credit pull on this.

I assume they got flooded with apps for the...

Hi Ben

- Not impressed with this at all. Apparently I failed their "internal screening process". Surprising as they asked for almost no information on the application. Since my company is an LLC I had to provide my SSN but, if anything, my credit rating should have helped with the "internal screening process". I hope I did not waste a credit pull on this.

I assume they got flooded with apps for the 80k bonus and pulled the plug...

Might want to chat with them about that as it doesn't look good on OMAAT after pumping the deal...

Here is email I got...

Thank you for your interest in Brex. We've reviewed your application, and unfortunately, we’re unable to approve XXXXXXXX LLC for an account at this time for the following reason:

Your application did not pass our internal screening process

We’re working hard to build more solutions to support all businesses.

The Brex Team

@ Robin -- I'm sorry to hear that you weren't approved for an account. Many other businesses have been, so I don't think it's related to any throttling of this offer (which they are well aware of, and specifically promoting here based on the readership). If it helps, they won't have pulled your credit, given that they only collect SSNs due to Federal reporting requirements, and purposefully don't use that information for account approval.

Applied using the link - Brex is saying they don't see the offer on the account.......

@ Guest -- What makes you think it's not attached to the account? Just to be clear, the dashboard after registration will only show the bonus of up to 30K. The additional bonus will post automatically upon qualifying activity, since it's exclusive to those who applied through this link. This confused me as well when I signed up, but I can assure you it should be tracked if you used the OMAAT link.

I clicked on the link from this article to open an account, but the referral code field (which is optional) is blank. Just want to make sure its correct as I assume there might be another way to track and link back to your referral?

@ David -- That's correct, there's no need to enter anything in the referral code field. As long as you follow the OMAAT link, you'll automatically be eligible for this amazing bonus.

I was approved earlier today, but then got this just the below with zero explanation via email:

"Unfortunately, we’re unable to continue offering your company an account with Brex. As a result, your Brex account has been closed.

You will continue to have read-only access to your account.

This decision is final. If you have any questions, please consult Brex’s Platform Agreement.

The Brex Team

@ George -- Do you want to forward that to me? I should at least be able to get you a better answer, if not a resolution. Unless you have a "prohibited" business type (like a weed dispensary, etc.) we haven't heard of that happening to anyone else.

Note. This is not a credit card. This is like a bank account or a pre-paid card.

"In other words, you link your business checking account, and then you can transfer funds and then use your Brex account for everything from payroll to business purchases."

That means that you need to transfer the cash in order to use this account.

The account would better if it offered hotel point transfers, as well as...

Note. This is not a credit card. This is like a bank account or a pre-paid card.

"In other words, you link your business checking account, and then you can transfer funds and then use your Brex account for everything from payroll to business purchases."

That means that you need to transfer the cash in order to use this account.

The account would better if it offered hotel point transfers, as well as cash back.

Airline points don't really have much value since many airlines are charging so many points for their redemptions.

Another question - What if the owner of the LLC or company in the US is a foreign national? Can they still apply for this card?

Of course, sole proprietors don't count since there is not a registered business entity...

Do points owned by a business count as non-cash compensation when transferred to a personal account? I can see the IRS easily making the argument that if you get points from a business that you use on a personal 1st class ticket that costs $20k then it's the same as receiving $20k in compensation that should be taxed.

@ JDawG -- You'll want to consult your tax professional (which I'm not, obviously), but I can't imagine that would be the case. In my experience business credit card rewards can also be redeemed for personal travel with no tax implications. I don't see why this would be different. Even in situations where points are taxed, it's never based on the retail cost of a $20K first class ticket, for example.

What’s Bonvoy for TPG is Brex for OMAAT

Also, is there a problem using Brex to pay bills such as credit cards?

@ Christian -- There shouldn't be any issue using the Cash/ACH functions to pay bills. Using the Brex Card would depend on whether the payee excepts credit card payments.

What if I try it, get the bonus, then decide that it's not for me. I like to understand exit terms before entering in on a deal.

I used your link just now. It did require my social security number. When my account was approved, it said that I would earn 30K points (20K when link payroll and 10K when spend $3K in 3 months). It did not say that I would get 80K points just for opening the account using your link. Help please!

@ Darlene -- You will get the 80k points. The 30k points are for all Brex members, and are in addition to the OMAAT-exclusive offer.

How long do you need to keep the account opened for? Seems worthwhile for the bonus but not sure if I would want to keep using it. Trying to make sure they are not clawed back or there is some other negative impact?

Ben, do you know when the 80,000 OMAAT bonus points will post? Are there any activities that need to be fulfilled in order to receive the bonus?

@ entrada -- They should post very quickly after you've spent the $1k. With a few days, in our experience.

Thanks for the reply, it was pretty easy! +1 on the multiple LLC's questions, additionally to see if we try to stack the $250/ea referral code from our own accounts if that'll nullify yours (and I guess more importantly to us, the heightened sign up bonus through you). Can we double stack?

I applied today with 1 of my 2 LLCs and was instantly approved, but the one from Friday is still on hold.

Do you know how long they plan to offer this elevated signup bonus? Additionally, can I sign up as a sole-proprietorship?

@ AM -- I don't know how long the offer will be around, other than that this isn't the standard offer. Sole proprietorships don't qualify, unfortunately.

Will the Brex account report to personal credit reports as a new account?

Will this Brex account report to personal credit reports as a new account?

@ Bob Sanchez -- No it won't, your social security number is only required for Federally-required ownership information purposes.

I have no idea about a credit pull, but they DID want my SSN.

WIll you get a 1099 from Brex for the 80K bonus points?

@ Evan -- This is purely a guess on my part, but I would assume there wouldn't be a 1099 because the rewards are primarily offered as an incentive for spending, much like with a credit card (this is different than a checking account bonus, where it's offered for funding).

I certainly could be wrong, and heck, I'd even plan on getting a 1099, but to me it doesn't matter much, because I'm coming out way ahead either way.

Thanks Ben -

+1 on the question of whether these bonuses can be earned on multiple business accounts.

I have three businesses where this could come in handy

@ Erik -- I'm working on getting an answer. You can always start with one business, and then go from there. I believe the bonus is business-specific, but I'm working on verifying.

I’m seeing 80K not 110K points offered to OMAAT readers. Am I missing something here?

@ Sam J -- The 80K bonus is exclusively for OMAAT readers, and then the 30K bonus is on top of that and is the standard offer. When you sign-up through the OMAAT link you'll qualify for all three. You'll see the additional 30K bonus once you've created your account. Hope that helps.

@Ben,

Does the bonus point opportunities you discuss - apply to multiple corporations under some similar/same common ownership?

I saw this in a Forbes write-up of the Brex points redemption terms:

“ You may also transfer at a 1:1 ratio to one of seven airline partners, as long as you exclusively use the Brex card for your business expenses”

Does this mean if we use any other credit cards for our business we would not be eligible for this transfer? How would this even be monitored?

Also note that Brex will ask you...

I saw this in a Forbes write-up of the Brex points redemption terms:

“ You may also transfer at a 1:1 ratio to one of seven airline partners, as long as you exclusively use the Brex card for your business expenses”

Does this mean if we use any other credit cards for our business we would not be eligible for this transfer? How would this even be monitored?

Also note that Brex will ask you for a personal guarantee if your business spending flows are deemed insufficient. Not sure what their threshholds are.

@ Erik -- Brex has a few different products, and it's my understanding that this applies to a different product, which I had written about here:

https://onemileatatime.com/brex-business-card-review/

I am able to transfer points to airline partners out of my Brex Cash account without issue.

Doubt you saved screenshots of the payroll enrollment for the 20k bonus, but if you have, please amend the post with them! Or just explain the process.

@ Throwaway -- Sorry, I don't have screenshots, but it was really easy. We've tried it with both Stripe and Gusto, and it was as easy as changing the ACH info in Stripe and Gusto, and Brex recognized the transaction. Otherwise, there's a button that lets you link accounts.

Can you transfer the miles from the business checking account to any person? Or must the person you're transferring to match the name the business checking account is under.

In addition, if one person owns multiple LLCs, can you sign up for multiple accounts via the different LLCs and get the points for all?

@ Michelle -- You need to transfer the Brex points to someone who is an account holder on your Brex account, but it's also quite easy to add account holders. I'm not sure about the second question, let me try to find out. I believe you could apply for an account for multiple businesses since this is about the businesses rather than the individuals, but I could be mistaken.