Over the past several years we’ve seen the six US legacy airlines turn into three through a series of mergers. US airlines are experiencing record profitability, which is a result of a combination of capacity cuts, consolidation, low oil prices, and an improved economy.

The point at which I realize competition is dead

While the above has all contributed to higher airfare, I really came to terms with the state of the airline industry last week. We learned about the potential changes coming to the American AAdvantage program in 2016.

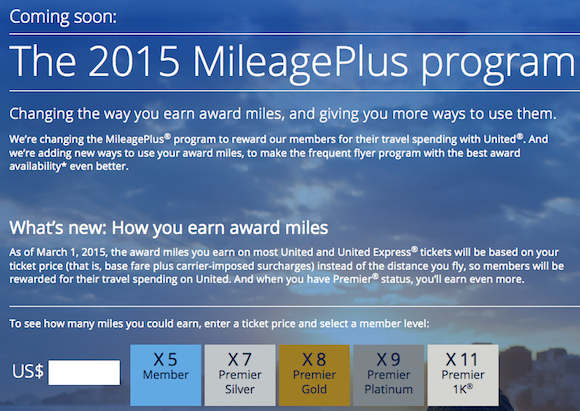

With these potential changes, we’re going from all six US legacy carriers issuing miles based on the number of miles flown, to seeing the three remaining ones issue an arbitrary number of miles based on how much you spend.

Now, there’s nothing wrong with that shift as such, though what I take issue with is that they all award exactly the same number of miles at all levels of status, despite the fact that the system is arbitrary.

To me that says they don’t feel the need to differentiate themselves in any way anymore, aside from the relative strengths of their route networks. In a way, competition is dead.

United pulled out of Kennedy

In June we learned about a drastic change United was making to their transcontinental routes out of JFK. Previously United operated Premium Service routes to Los Angeles and San Francisco out of Kennedy, while they decided to swap those flights to Newark as of October 25, 2015.

This would allow these flights to complement United’s existing network out of Newark, given that they had otherwise completely pulled out of Kennedy.

Given that United would be pulling out of Kennedy altogether, they had a plan for a slot swap with Delta. Delta could take over United’s Kennedy slots, while United could take over Delta’s Newark slots:

With its launch of p.s. services at Newark Liberty, United will cease operations at KennedyInternational Airport on Oct. 25. United has entered into two separate transactions: Delta Air Lines plans to acquire United’s JFK slots, and United plans to acquire slots from Delta in Newark. Each transaction is subject to regulatory approval.

That’s a win-win… for the airlines. And bad news for consumers, since it stifles competition even further.

The DOJ steps in… YAY!

It’s not often I’m for government regulation, though I do think the “big three” US carriers are getting to the point where a bit of intervention wouldn’t hurt. And that’s exactly what the Justice Department is doing, as they’re suing to block the slot swap between Delta and United.

Via USA Today:

The lawsuit argues that if United acquired 24 more takeoff and landing slots at Newark, it would so dominate the flight schedule that it would discourage other airlines from serving from the airport that sees 35 million travelers each year, enabling United to charge higher fares.

“We know that airfares at Newark are among the highest in the country while United’s service at Newark ranks among the worst,” Assistant Attorney General Bill Baer told reporters.

The lawsuit asks the U.S. District Court of New Jersey to prevent United from acquiring Delta’s slots at Newark and for United to warn the Justice Department about any other attempts to gain Newark slots for at least five years.

United already controls 73% of the slots at Newark, or 902 out of 1,233 allocated. That total is 10 times more than its closest competitor because no other airline has more than 70 slots at Newark, the lawsuit contends. United already grounds as many as 82 slots each day, which is more than any other competitor can even fly, the lawsuit contends.

“Yet United wants more,” the lawsuit said. “As a result, passengers at Newark would face even higher fares and fewer choices.”

Bottom line

The US airline industry sure feels like it’s turning into an oligopoly, so I’m all for the appropriate authorities stepping in and blocking moves which would even further stifle competition. We’d be much better off with those slots going to low cost carriers.

What do you make of the DOJ trying to block United getting more slots at Newark?

@Chuck (and Eric): The difference is that in the old days a flight from A to B got you x miles from all the carriers, an award flight from C to D cost y miles from all the carriers, BUT what you paid for that original flight was not the same across carriers. So, you shopped dates, times, sales, and airlines for the best deal. A savvy shopper got his x miles for a lot...

@Chuck (and Eric): The difference is that in the old days a flight from A to B got you x miles from all the carriers, an award flight from C to D cost y miles from all the carriers, BUT what you paid for that original flight was not the same across carriers. So, you shopped dates, times, sales, and airlines for the best deal. A savvy shopper got his x miles for a lot less money than the less savvy shopper, and took his award trip much sooner.

If they all go to revenue earning AND redeeming plans, there's not much left to this game but cc apps. : (

I think DOJ should auction off those slots, but only to the big 3 ME carriers. That would be fun. The political fireworks alone I think will make it worth reading!

What's the difference between 75% or 85% UA at EWR?

It's still UA and it's still EWR.

Anyone flying them loves to be tortured. So presumably paying more for the torture would be even better?

@farnorthtrader As the article says, United already sits on 82 slots a day at EWR. If they wanted to run more service they could. There is no indication that they do not view this simply as a way to enhance their already dominant market position at EWR, not by adding service but by forcing a competitor to cut service. The DOJ should force United to use more of its slots at EWR as well.

I notice no one ever brings up the Wright Amendment. Now that WN has been allowed to fly unrestricted out of DAL, they're smothering the market. I used to love WN. I hate them now. They can charge whatever they want. A WN employee friend actually alluded that VX might not be able to operate my most frequent route (DAL-AUS) anymore due to the saturation. It's not just legacies, folks.

"...issue an arbitrary number of miles based on what you spend.". NOT SO! UA's new system assigns an arbitrary $ value (fare) to each flight flown that comes nowhere near what I pay for the flight. A recent flight taken cost me $2,100+ fare plus taxes/fees in 'First'.......UA calculated the miles I received based on a "fare paid" of $342.00. Where does that figure come from? What they have done is cancel any mileage credit...

"...issue an arbitrary number of miles based on what you spend.". NOT SO! UA's new system assigns an arbitrary $ value (fare) to each flight flown that comes nowhere near what I pay for the flight. A recent flight taken cost me $2,100+ fare plus taxes/fees in 'First'.......UA calculated the miles I received based on a "fare paid" of $342.00. Where does that figure come from? What they have done is cancel any mileage credit difference between someone paying a discounted fare to sit in the back versus someone paying top dollars for a 'premium' cabin ticket.

How about we leave the mindless political axe grinding out of these TRAVEL comments. You can get a complete belly full of that just watching the GOP debates. Maybe Credit's bad day is just some poor decisions in the booming stock market/really? Maybe the SS check was late or you had to deal with the Medicare website and that took away time from Judge Judy. Nobody really cares just keep the comments on topic.

I think you have this wrong. The DOJ getting involved has nothing to do with the consumers. They want something from United or Delta. When they get it, they will stop opposing the sale. That is how crony capitalism works.

"With these potential changes, we’re going from all six US legacy carriers issuing miles based on the number of miles flown, to seeing the three remaining ones issue an arbitrary number of miles based on how much you spend.

Now, there’s nothing wrong with that shift as such, though what I take issue with is that they all award exactly the same number of miles at all levels of status, despite the fact that the...

"With these potential changes, we’re going from all six US legacy carriers issuing miles based on the number of miles flown, to seeing the three remaining ones issue an arbitrary number of miles based on how much you spend.

Now, there’s nothing wrong with that shift as such, though what I take issue with is that they all award exactly the same number of miles at all levels of status, despite the fact that the system is arbitrary."

So, wait... why is one of these more arbitrary than the other? When they were issuing miles based on the distance flown, they all issued the same number of miles, despite the fact that the system is arbitrary. You just happen to prefer the old way to the new way so now all of a sudden you "take issue" with them doing it all the same, even though you didn't before?

I think during cold war, capitalism was more benevolent as a foil to communism. You could not have poor Americans hating capitalism. With no adversarial ideology any more capitalism is becoming more Lassieze Faire. Until Obama care came along.

How is this in any way protecting consumers? Now Delta has these slots at both JFK and EWR. They don't want and won't use the EWR ones because they have the JFK ones that they really wanted and will use. So the DOJ will now cause less flights to come out of EWR and will not encourage any competition. So they are getting themselves involved in something that will not do anyone any good. Even...

How is this in any way protecting consumers? Now Delta has these slots at both JFK and EWR. They don't want and won't use the EWR ones because they have the JFK ones that they really wanted and will use. So the DOJ will now cause less flights to come out of EWR and will not encourage any competition. So they are getting themselves involved in something that will not do anyone any good. Even if they had dealt with this properly and blocked both halves of the transaction, is it really in the consumers best interest to force those consumers to connect via a shuttle between JFK and EWR?

The DOJ has had plenty of opportunities before this to step in and actually protect consumers, it is bizarre that this is the transaction that they decided to meddle in. I assume that it is to punish United for the shenanigans that have gone on previously in New Jersey.

"Perhaps you are predisposed to finding collusion like Joe McCarthy was predisposed to finding communists."

There were way more Communists working in US government posts than McCarthy even suspected. When the KGB files were opened decades later, it became clear that Washington had been crawling with both Soviet agents and sympathizers. That's how the Soviets got the bomb so quickly.

I suppose next you will be denying that Bernie Sanders is a Socialist. :)

..."Perhaps you are predisposed to finding collusion like Joe McCarthy was predisposed to finding communists."

There were way more Communists working in US government posts than McCarthy even suspected. When the KGB files were opened decades later, it became clear that Washington had been crawling with both Soviet agents and sympathizers. That's how the Soviets got the bomb so quickly.

I suppose next you will be denying that Bernie Sanders is a Socialist. :)

BTW, last week the Rasmussen polling organization asked registered Democrats: "Which system do you prefer, Capitalism or Socialism?" The results were about 50/50. Same as it ever was....

Lucky, if you don't like the way airlines are going, why don't you start your own airline? You can it Lucky Air. You can create the best FF program so you will be happy.

I get the antitrust concerns if you're viewing Newark as an isolated destination, but thats questionable at best given the alternative airports in nearby proximity. People flying to/from Newark for access to New York and Northern/Central New Jersey have access to both JFK, LGA, and HPN which collectively provide competition for both Domestic and International Routes.

Likewise for Southern NJ flyers with respect to PHL. Sure, EWR is more convenient for some than those airports,...

I get the antitrust concerns if you're viewing Newark as an isolated destination, but thats questionable at best given the alternative airports in nearby proximity. People flying to/from Newark for access to New York and Northern/Central New Jersey have access to both JFK, LGA, and HPN which collectively provide competition for both Domestic and International Routes.

Likewise for Southern NJ flyers with respect to PHL. Sure, EWR is more convenient for some than those airports, but the point is that they provide an alternative. If the fares (and service quality) are not competitive, people will vote with their wallets.

Obama must have woken up from his coma and realized he was elected as a Democrat.

@ScottC, you say:

"I would say there is a good deal of collusion going on in the airline industry. I see it with banks too. Just recently I got a slew of notices form banks changing the terms of my user agreement. Specifically they were raising the late fees. Surprise, surprise, every one of them (separate banks mind you) raised the late fee to the exact same number $37."

Sorry dude, similarities in pricing, including...

@ScottC, you say:

"I would say there is a good deal of collusion going on in the airline industry. I see it with banks too. Just recently I got a slew of notices form banks changing the terms of my user agreement. Specifically they were raising the late fees. Surprise, surprise, every one of them (separate banks mind you) raised the late fee to the exact same number $37."

Sorry dude, similarities in pricing, including similarities in price increases/decreases is as much evidence of competition in a market as it is of collusion. Does it not occur to you that rather than colluding, banks are competitive, looking over the shoulder at the competition to determine what they will charge? Does it not occur to you that the move to a $37 figure is not a result of collusion but, instead, is the result of all banks reacting to a change in what the CFPB permits as a late fee? See https://s3.amazonaws.com/public-inspection.federalregister.gov/2015-22987.pdf. ("The adjusted dollar amount for the penalty fees safe harbor in 2016 is $27 for a first late payment and $37 for each

subsequent violation within the following six months.").

Perhaps you are predisposed to finding collusion like Joe McCarthy was predisposed to finding communists. People go to jail for collusion (when proven by sufficient evidence) - as such claims of collusion require much sterner evidence than the fact that competitors tend to charge the same amounts for like services.

Ben,

You say "[t]o me that says they don’t feel the need to differentiate themselves in any way anymore, aside from the relative strengths of their route networks. In a way, competition is dead."

You see lack of differentiation and infer a lack of competition. Or is American moving to a spend-based system EXPLICITY because it must do so to COMPETE for high dollar customers.

Twenty years ago, when airfares in any given city...

Ben,

You say "[t]o me that says they don’t feel the need to differentiate themselves in any way anymore, aside from the relative strengths of their route networks. In a way, competition is dead."

You see lack of differentiation and infer a lack of competition. Or is American moving to a spend-based system EXPLICITY because it must do so to COMPETE for high dollar customers.

Twenty years ago, when airfares in any given city pair tended to be approximately the same across 6 or so legacy carriers, the folks who wanted to draw an inference of collusion did so on the basis of the fact that carriers charged the same amounts even though there was no direct evidence of collusion. Those who were not predisposed to finding conspiracies were not so paranoid - they saw equal prices across carriers and inferred a highly competitive market.

Sorry, as much as they suck, the changes to Aadvantage, while they eliminate "differentiation" support an inference of there being healthy competition, not collusion.

"as they’re suing to block the slot swap between Delta and United."

This is not actually what they are doing. They are NOT blocking Delta's acquisition/lease of United's JFK slots. They're blocking United's acquisition of Delta's EWR slots. Delta made a point of saying they are separate transactions.

The thing here is JFK has multiple competitors (Delta, American, Jet Blue) hubbed there, so there's reasonable choice for domestic travel. EWR? Not so much. It's UA...

"as they’re suing to block the slot swap between Delta and United."

This is not actually what they are doing. They are NOT blocking Delta's acquisition/lease of United's JFK slots. They're blocking United's acquisition of Delta's EWR slots. Delta made a point of saying they are separate transactions.

The thing here is JFK has multiple competitors (Delta, American, Jet Blue) hubbed there, so there's reasonable choice for domestic travel. EWR? Not so much. It's UA and nobody (Delta's actually second). Thus the DOJ has an interest in anti-competitive behavior at EWR, but JFK, not so much.

These types of agreements are textbook anti trust cooties. Agreement between the two like this his program glad the department of justice stepped in

@Scott C, I completely agree and sadly this is the way American big business works. I have had many instances in my career where I questioned the path a client wanted to take, only to have the CEO tell me something along the lines of, "you don't know what I know." There is an old boy's network of communication amongst the major players and that keeps things aligned very closely.

I'm a bit confused as to how the new revenue-based systems are any more arbitrary than the old systems. The old systems were also, by and large, very very similar to one another.

I even remember when I was first getting into FFPs, back when there were 6 airlines and I was reading each of their websites trying to figure out how they compared, and I was struck by how despite lots of differences in...

I'm a bit confused as to how the new revenue-based systems are any more arbitrary than the old systems. The old systems were also, by and large, very very similar to one another.

I even remember when I was first getting into FFPs, back when there were 6 airlines and I was reading each of their websites trying to figure out how they compared, and I was struck by how despite lots of differences in framing, they were really very similar programs. For those of us who know this well enough to get obsessed with the tiny details like the difference between EQPs and EQMs or the finer pros and cons of each program's international upgrade offerings, it is easy to forget the more basic ways they don't differ.

I would say there is a good deal of collusion going on in the airline industry. I see it with banks too. Just recently I got a slew of notices form banks changing the terms of my user agreement. Specifically they were raising the late fees. Surprise, surprise, every one of them (separate banks mind you) raised the late fee to the exact same number $37. Not that I care about the late fee, I...

I would say there is a good deal of collusion going on in the airline industry. I see it with banks too. Just recently I got a slew of notices form banks changing the terms of my user agreement. Specifically they were raising the late fees. Surprise, surprise, every one of them (separate banks mind you) raised the late fee to the exact same number $37. Not that I care about the late fee, I am not late, but how do 3 separate supposedly competing banking institutions arrive at the exact same number to charge then all announce it at the same time? Collusion. I see a similar thing happening with the airline rewards programs. Some say that Delta is leading the charge to the bottom of the loyalty game, and others are copying, but I disagree. My belief is that these are coordinated actions between competitors. Shameful really.

Not sure if they would make United put back its JFK routes it would be more convenient for me if United kept flights at Kennedy

Completely agree with this action. But there are worse where they took no actions - fare from Philly have gone up significantly in the last year to everywhere except London (due to new DL/VS flight). Fares from PHX have gone up. I'm a fan of AA and still don't appreciate the exorbitant fares from their least competitive hubs.

Also, I think you miss the point on AA going revenue based. It's not about innovating, even...

Completely agree with this action. But there are worse where they took no actions - fare from Philly have gone up significantly in the last year to everywhere except London (due to new DL/VS flight). Fares from PHX have gone up. I'm a fan of AA and still don't appreciate the exorbitant fares from their least competitive hubs.

Also, I think you miss the point on AA going revenue based. It's not about innovating, even if their PR line says so. As the last carrier to make a move, it's about customer/market incentives - they lost the ability to innovate by being the last mover. When you are the last airline to move to revenue-based, you will indeed incentivize primarily low-spend customers to fly your airline because they have the most reason to. Some business travelers in fact have moved from AA/US to DL/UA ONLY BECAUSE many of them earn more miles with higher fares on DL/UA than AA. An airline miles guide was passed around my company (one of the higher spending companies in business travel) giving tips specifically about that. In the long run, the AAdvantage program would have suffered more by remaining distance-based unless they gave significant spend-based incentives on top.

This is closing the barn door after the horses have already fled. The extra EWR slots aren't going to make a substantive difference compared to *huge* impacts from the mega-mergers that have already taken place. DOJ is a paper tiger and this is all for show and politics. Besides, they'll end up caving/settling in the end as they did with the US buyout of AA.

And while I don't necessarily like the change to revenue...

This is closing the barn door after the horses have already fled. The extra EWR slots aren't going to make a substantive difference compared to *huge* impacts from the mega-mergers that have already taken place. DOJ is a paper tiger and this is all for show and politics. Besides, they'll end up caving/settling in the end as they did with the US buyout of AA.

And while I don't necessarily like the change to revenue based earnings, basing it on the ticket price isn't any more, or less, arbitrary than basing it on miles flown. It just feels that way because it's always been based on flown miles so you're used to that.

Earning could be based on other things as well. WN used to be one credit per flight. If the airlines hadn't decided to base it on spend, they could have just as well reduced the per-mile earning (which is already done on some airlines with lower buckets) in order to reduce how many miles they give out. Six of one, half a dozen of the other.

I agree with you but this is a small thing compared to what they are ding elsewhere. I don't fly for work thank god because it's not fun anymore. I really enjoy your blog Ben but I wouldn't trade places with you keep up the good work