There are a lot of misconceptions about how credit scores are calculated. This causes a lot of people to believe that applying for or canceling credit cards is horrible for their credit score, when in reality that’s typically not the case.

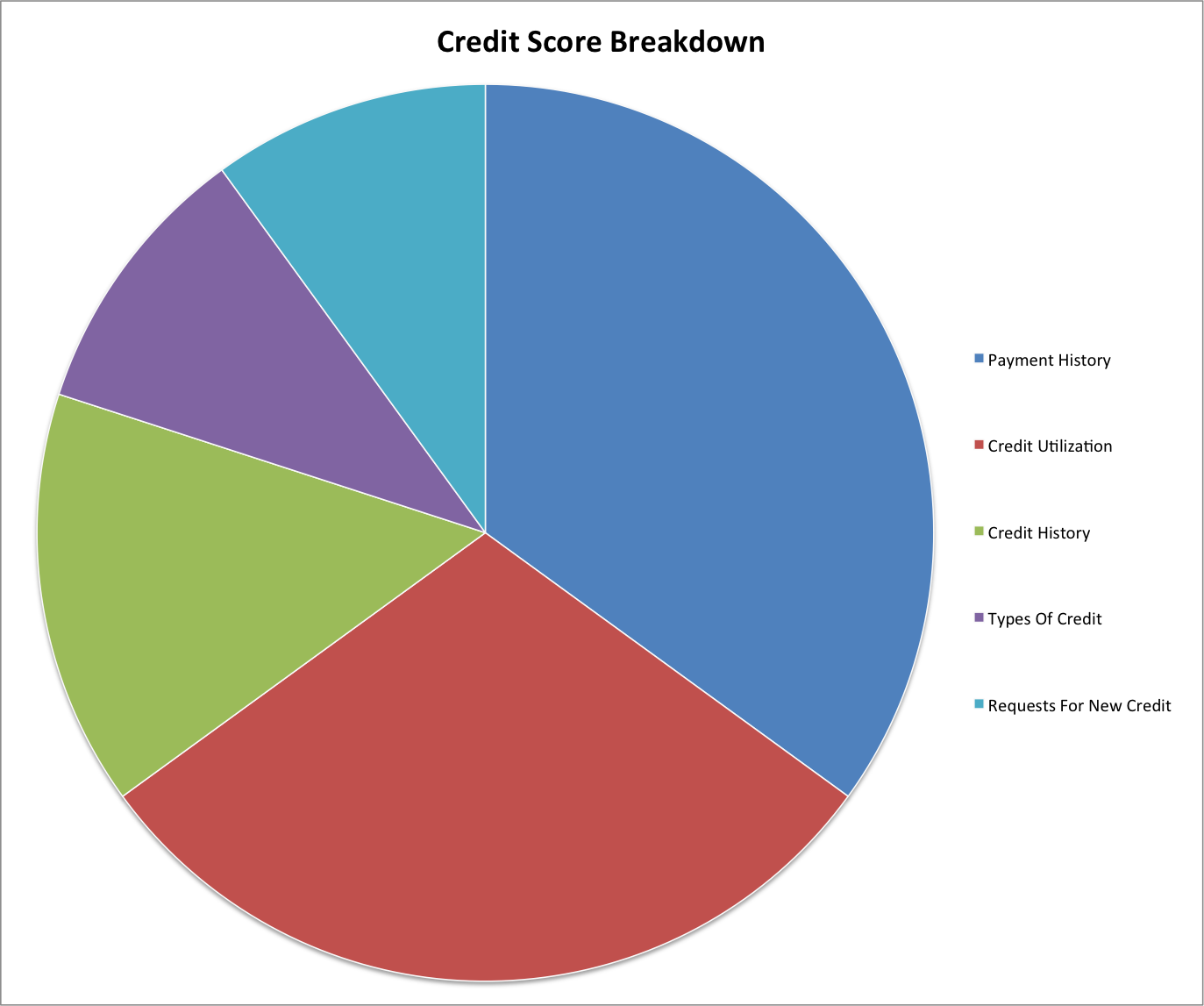

I’ve written about this in the past, so in this post I’ll simply mention that you should have a good credit score as long as you keep some cards open for a long time (to build a good credit history), make your payments on time, and also don’t utilize too much of your credit (since it looks risky if you’re using too much of your credit). Compared to the above factors, the impact of new applications is minimal, and in many ways, applying for new cards can help your score (since it can increase your total available credit, and improve your payment history and credit history).

The Associated Press is reporting that huge changes are going to be made to how credit scores are calculated, and they could impact all of us.

The changes will be implemented later this year by VantageScore, which is a company created by Experian, TransUnion, and Equifax, and which handled eight billion account applications in 2016. So this won’t impact all applications, but will impact many of them.

What’s changing about how credit scores are calculated?

There are three main areas of credit reporting that are changing:

If you carry a balance

First of all, your score will take into account trended date as it relates to you credit card debt:

Using what’s known as trended data is the biggest change. The phrase means credit scores will take into account the trajectory of a borrower’s debts on a month-to-month basis. So a person who is paying down debt is now likely to be scored better than a person who is making minimum monthly payments but has been slowly accumulating credit card debt.

Hopefully most readers aren’t impacted by the above change, since I never recommend carrying a balance on a rewards credit card (unless you have a 0% financing offer, or something), and the above applies primarily to people carrying a balance.

If you have a lot of available credit

If you’re someone who has a lot of available credit, the following will be changing:

But VantageScore will now mark a borrower negatively for having excessively large credit card limits, on the theory that the person could run up a high credit card debt quickly. Those who have prime credit scores may be hurt the most, since they are most likely to have multiple cards open. But those who like to play the credit card rewards program points game could be affected as well.

Up until now having a lot of available credit has been a good thing. When you don’t utilize much of your credit it shows that you’re a responsible consumer. For example, if I spend $5,000 per month but only have a card with a $5,000 credit line, I’m utilizing 100% of my credit, which looks risky to issuers. They think that if they raised my credit limit I might also increase my spending, and might go into debt.

Meanwhile if I spend $5,000 per month but have $100,000 in credit across all my cards (because I have a lot of credit cards), I’m only utilizing 5% of my credit, which shows I’m responsible. The flip side is that there’s also a lot more exposure for the card issuers, since I could much more easily get myself into debt.

So we’ll have to see how this is implemented, but this could potentially mean that we’ll want to ask for smaller credit lines, rather than bigger credit lines, which counters the trend so far.

If you have medical debt, tax liens, etc.

If you have civil judgments, medical debts, and tax liens, those will no longer impact your credit score:

Taking civil judgments, medical debts and tax liens out of the equation comes after a 2015 agreement between the three credit bureaus and 31 state attorneys general. The argument was that civil judgments and tax liens —which can significantly hurt a person’s credit score — were often full of errors. Medical debt was being reported on a person’s credit report before there was time for insurance to reimburse.

That seems pretty straightforward.

Bottom line

The changes to how credit scores are calculated have the potential to be a very big deal. We’ll have to wait and see how this is implemented before drawing too many conclusions, but this is definitely something to keep an eye on. Most of the changes seem logical enough, as it did in a way seem backwards to encourage people to have disproportionately large credit lines, which could cause them to built up credit card debt.

I’m not really worried as of now. The way I see it, worst case scenario I’ll ask for lower credit lines on some cards, which shouldn’t be much of an issue.

What are your initial thoughts about the potential change to how credit scores are calculated?

(Tip of the hat to Mike)

I was looking to repair my credit, but I have went through more than a few individuals whom stated that they could and have my funds without a result.I got a review from a forum about DarkWeb hacker and was wondering if this could be possible? I really need my credit to be temporarily increase because obviously it is updated every 31st by the bank, credit card company also reports and this make me worried...

I was looking to repair my credit, but I have went through more than a few individuals whom stated that they could and have my funds without a result.I got a review from a forum about DarkWeb hacker and was wondering if this could be possible? I really need my credit to be temporarily increase because obviously it is updated every 31st by the bank, credit card company also reports and this make me worried before its turn permanent score by this hacker and i was surprised. DarkWeb assisted me in getting approval for a loan after fixing my credit score to 810 which he called a golden score and all debts deleted.I need you guys to contact him for more: darkwebcyberservice At Gmail Dot CoM

My wife and I are pharmacists and we racked up 150k+ each in student loans. it’s a huge sum of money, but with our stable jobs and good income, we were on track to pay it off. Then tragedy struck when my wife got disabled and couldn't continue her job. I now had to pay off both our debts. I couldn't just meet up with the payment of both. loan default rates started to increase...

My wife and I are pharmacists and we racked up 150k+ each in student loans. it’s a huge sum of money, but with our stable jobs and good income, we were on track to pay it off. Then tragedy struck when my wife got disabled and couldn't continue her job. I now had to pay off both our debts. I couldn't just meet up with the payment of both. loan default rates started to increase and it got worse. We also incurred credit card debts and it affected our credit score. I went on the internet to look for solution and figured people were talking about how a hacker helped them settle their situation. I narrowed my search down to a hacker named blackbutcher because he had a lot of positive reviews and even belongs to a hacking community. His name was scary but I guess it explained how bad ass he is lol. This hacker successfully cleared our student loans and credit card debts also fixed our credit scores. This is incredible and I always thought there will be a down side to it but I'm writing this review after 3 months and nothing bad has happened. Now my life is really stable and I'm doing ok. His contact is blackbutcher.hacker AT outlook DOT com. It's best you contact him if you really need hel

This new system destroyed my credit score. No late payments EVER!, no judgements etc, etc, etc. A 30% income to debt ratio. But because I used my available credit while renovating up to 71% utilization I can't get a Home Equity Line to payoff my Renovation Debt. Credit Score fell over 200 points. I have never in my life been in this situation! Only found out due to being denied by my bank. Started falling in Jan 2017.

I have to assume that having a charge card with "No pre-set spending limit" will have no effect on the calculation. It doesn't seem to have an influence currently. Does anyone think otherwise?

I think factoring in the trajectory of someone's debt trend is excellent. You can't usually get out of a hole instantly, but getting a quicker boost on your credit score should allow more reasonable rates on loan or other debt consolidation options...

I have to assume that having a charge card with "No pre-set spending limit" will have no effect on the calculation. It doesn't seem to have an influence currently. Does anyone think otherwise?

I think factoring in the trajectory of someone's debt trend is excellent. You can't usually get out of a hole instantly, but getting a quicker boost on your credit score should allow more reasonable rates on loan or other debt consolidation options that can accelerate repayment.

Why don't we start throwing in jail anyone who owns a car? Some day they might feel under the weather and start running over pedestrians. Yeah, I know, till now they have been good citizens, they have been civilized, they've done everything they're supposed to do. But, what if one day they don't? Let's punish them just in case.

IDIOTIC!

Calm down, people. It will take some time for everyone to figure out that new system. Time will show us the right way. Everything will be OK. Don't forget to live your life! It's beautiful and so short. Life is what happens to us between the time when we plan it. :-)

@bart People retired abroad and get Social Security are not getting an handout. They paid into the system when they were working in expectation of the payments.

(How some people turn everything political never ceases to amaze me.)

This is an interesting development. Not as far reaching as it might seem but it may be reflection on where things are going.

Medical debt not counting is GREAT NEWS. Finally, the largest cartel of scam artists and hucksters lost their lobbying power. Good riddance.

This is a non-issue. The only scores that matter are FICO scores for Experian, Equifax and TransUnion. VantageScore is a fake (FAKO score as is known to anyone that understands credit scoring). CreditKarma is garbage. Only use it to verify your accounts and balances, inquiries, changes etc.. But disregard their scores.

I'll give you a credit score of 849. Feels awesome to know your score is that high, huh? But no one uses my scoring...

This is a non-issue. The only scores that matter are FICO scores for Experian, Equifax and TransUnion. VantageScore is a fake (FAKO score as is known to anyone that understands credit scoring). CreditKarma is garbage. Only use it to verify your accounts and balances, inquiries, changes etc.. But disregard their scores.

I'll give you a credit score of 849. Feels awesome to know your score is that high, huh? But no one uses my scoring model, so why would it matter if I change how much credit you have available or your medical or tax debts? Try telling Chase or Amex you have an 849 score by SparkinCA and they will laugh at you the same way if you tell them your score is from VantageScore. They don't use it. Never will. It's garbage...

This concludes credit scores 101. Carry on..

Here's one thing... yeah nobody cares for Politics... looking for Travel deals..... but here's one thing that Mr. T is going to cut off.... 100%...

People living in foreign markets receiving social security checks and having their families forward them.

Guaranteed.

That being said, I care not one bit for the "International" doctor example.

Situations like this convince bank officers that in the interest of protecting Americans in America such actions are justified.

If your insurance isn't accepted where you're working,

A) Don't work there.

B) Come home

C) Don't expect anybody else to pay for it or have any sympathy regarding your decision to 'HALF expatriate' .. GO ALL THE WAY .

Another attempt by a banking industry who received untold billions from HRC and Mr Obama to short arm American consumers.

This is bad for people who are neither bank officers or their employees.

It's not enough that they've rigged everything else?

America has become a socialist society.

You should not penalize somebody for 1) Having $ or 2) having access to $.

Regardless of whether or not you feel that $ will eventually wind up in your pocket.

There is a potential downside to the limitation of credit limits.

We had a friend who died in a foreign country because their insurance was not immediately accepted and they did not have a large enough credit limit on their credit card to pay for immediate treatment. By the time the treatment was authorized the patient could not recover.

For this reason I carry $100,000 total credit available over several cards to handle emergencies such...

There is a potential downside to the limitation of credit limits.

We had a friend who died in a foreign country because their insurance was not immediately accepted and they did not have a large enough credit limit on their credit card to pay for immediate treatment. By the time the treatment was authorized the patient could not recover.

For this reason I carry $100,000 total credit available over several cards to handle emergencies such as this but do not use it (or only rarely to buy a car if dealer will accept it).

Hope the new credit evaluation does not suffer for this - but if it does what the heck. Only comes into play if I want a new card or new mortgage and my current lenders know me.

I don't think this will be a huge impact. I've been watching my credit score regularly for years and use Credit Karma to do so. They use the VantageScore model and my credit was excellent under the old model and excellent under the new model, despite having a large, unused credit line. If I remember correctly, it actually went up a little under the VantageScore model... If you are financially responsible, it'll show one way...

I don't think this will be a huge impact. I've been watching my credit score regularly for years and use Credit Karma to do so. They use the VantageScore model and my credit was excellent under the old model and excellent under the new model, despite having a large, unused credit line. If I remember correctly, it actually went up a little under the VantageScore model... If you are financially responsible, it'll show one way or the other. And if you are not, it will, too!

oh, and CreditKarma is free - I think anybody interested in reward cards should have an account just to keep an eye on your score, be notified about new accounts (in case somebody else opened it in your name) or notice screw-ups (a large bank once did three hard pulls on my account for a mortgage! name starts with Citi...)

@Martin

1. Because.

2. What if, in this example, the same thing happens to the guy who actually does use his credit cards to the max? He wouldn't even have much available in credit cards to max out but he would still be a huge risk to his creditors at that point. I don't think he would be more credit worthy because he used more of the credit allocated to him. In your scenario,...

@Martin

1. Because.

2. What if, in this example, the same thing happens to the guy who actually does use his credit cards to the max? He wouldn't even have much available in credit cards to max out but he would still be a huge risk to his creditors at that point. I don't think he would be more credit worthy because he used more of the credit allocated to him. In your scenario, he should still get approved for credit cards if he acted before any missed payments

If a bank wants to lower somebody's credit limit due to inactivity, fine by me. But how can you penalize somebody for not closing credit cards they no longer use? Or for having an overdraft line of credit that has gone untouched? Or having a home equity line that you haven't touched? The banks are the ones that pushed that on you in the first place, you open one, you don't touch it, and now that's a problem too.

Umm, is it just me, or is anyone else absolutely floored that medical debt and civil judgments will no longer affect credit score negatively?

So I could essentially have a lawsuit filed against me for $50 mil, refuse to pay, and not suffer any consequences from a credit perspective? WOW.

Wait a second.

"VantageScore, which is a company created by Experian, TransUnion, and Equifax, and which handled eight billion account applications in 2016"

You're telling me that VantageScore handled the equivalent of slightly more than one account for every man, women, and child on the face of earth in 2016? Let me guess, Wells Fargo uses them.

For comparison, Chase opened 10.4 million new credit card accounts in 2016.

JJ, I think the reason is twofold:

1) Why do you have 200K in credit lines if you never owe more than 5K

2) What if something bad happens? You might be tempted to max out all your cards and vanish. It can make sense to mitigate the impact of that

I have had credit limits reduced when I didn't use a card - BofA did this in particular. So it's hardly a new concept

So it's more of a credit risk for those that have high limits and don't use them then those WITH high lights that use them?

Not super relevant to the topic of credit card limits (though I will be paying attention to this), but one of my favorite things about Lucky's writing is this line:

"That seems pretty straightforward."

Thank you for so consistently holding back from insulting your readers' intelligence like so many mediocre reporters/writers who feel this annoying need to go on and on explaining points and concepts that are completely self-explanatory.

David

Thanks !!!... " Their Here "

Make's a 790 FICOer just want to THROW UP but that's not PC.

Capital One uses VantageScore. Mine runs about 40 points lower than my FICOs.

Matt

I saw this a way back like 3 years ago they want to be PC like it's not ur fault u have a 550 Fico score its the people's fault who borrowed u it or rented to u.. I hope they don't do this BUT THEY WILL OVER TIME . So the banks can borrow more money and renters can get a place to rent ever if they don't deserve it . Look around Trump got in by people being tired of helping everyone out and them paying for it..

CHEERs

CaveLord

Medical debt not counting is absurd - fine if it's weighted lower and payment plans with physician practices and hospitals should be a favorable for individuals. But no provider I'm exposed to nor my company has ever reported debt not adjudicated by the insurance carrier - how does a provider get paid on a patient responsibility amount that is in network -reasonable and low - providers cannot be expected to write-off patients copays and deductibles...

Medical debt not counting is absurd - fine if it's weighted lower and payment plans with physician practices and hospitals should be a favorable for individuals. But no provider I'm exposed to nor my company has ever reported debt not adjudicated by the insurance carrier - how does a provider get paid on a patient responsibility amount that is in network -reasonable and low - providers cannot be expected to write-off patients copays and deductibles at the beginning of the year - reasonable amounts

Everyone needs to chill out about this. VantageScore is the FAKO method that creditkarma (and other similar websites) use to score you. They're essentially meaningless other than giving you a ballpark idea of your score. All banks use FICO scoring which, if i'm reading this correctly, will remain unchanged.

I have a feeling the credit card issuers are in for a world of hurt once people respond by cancelling accounts.

2 years ago I made a math error on my state tax return, owed the state $102.00, the state sent me a bill via snail mail while I was out of the country for 3 months -

state policy is --if the bill is over $100.00 and not paid in 30 or 60 days - they report to credit agency -- my score dropped 60 points . It was a good thing my score was 790 and the dropped did not kill me

takes 5 years for it to drop from your credit report

Will FICO be changed as well? I have gotten a number of letters from banks with my credit score when they approved me for a new card. Have never seen a VantageScore listed, it's always been FICO. Any knowledge of if banks actually use VantageScore for new card applications?

My personal secured line of credit is reported the same way as a credit card - a revolving line. Credit limit on it is >>$100k, and is almost unused since I keep it open for an emergency. With these changed, my credit score will take a huge hit because of that limit!

I can't understand why those with "prime credit scores may be hurt the most," given that they have a lot of available credit. It would seem that their scores are high because they are responsible handling high credit limits. It will be interesting to see how this plays out.

I have one credit card that has 100k limit and use it for business expenses about 140k a month. I let my card statement close with 2k balance but I pay in full each month. Is that going to impact me?

This is great news! It will finally be in my best interest to cancel most of my sock drawer cards and consolidate down to the accounts I actually want.