Typically when we consider the value of using a credit card to pay for a purchase, we think of it in terms of the rewards that we can earn. However, there’s another major benefit to paying by credit card, and that’s the ability to dispute a charge, or to flag purchases as fraud (this is in addition to any other purchase protection offered by a card).

In this post I wanted to talk a bit more about disputing credit card purchases. Under what circumstances can you dispute charges, how do you go about doing so, and is there a difference between card issuers when it comes to this? Let’s cover the basics…

In this post:

When you can dispute a credit card charge

Under what circumstances can you dispute a credit card charge? There are a few general things to keep in mind:

- There’s a difference between a purchase you should mark as fraud, and one you should dispute; fraudulent purchases include completely unauthorized ones, with companies you don’t do business with, rather than maybe a recurring payment with a company you do business with (which you would dispute)

- You’re only supposed to dispute a charge after you’ve reached out to the merchant to resolve the issue, and after you’ve come to a dead-end there

- You often have only 60 days from when the purchase was made to dispute a charge; this can be tricky, especially if you’re paying for a service well in advance (like a flight or a pre-paid hotel)

- Think of a credit card company more as a common sense court, rather than an assistant manager at an Olive Garden; in other words, you don’t dispute a charge because the pasta wasn’t very good, or because the service could have been friendlier, but rather because you didn’t get what you explicitly paid for

To give some examples of when a credit card dispute is appropriate:

- If you didn’t receive what you paid for

- If the item you received is defective

- If you didn’t authorize a purchase

- If you were double charged

- If you were charged a recurring fee after cancelling

- If you were charged the wrong amount

Now, there are definitely some grey areas when it comes to whether something should be disputed or not. For example, say you book a business class ticket on a long haul flight, but the seat is broken and doesn’t recline. Say the airline is only willing to give you a small number of miles as compensation.

Is it appropriate to dispute the charge in that situation or not? While the airline isn’t violating its contract of carriage (which is entirely one-sided), the airline is no doubt not living up to what was advertised, if you were promised a flat bed.

How you can dispute a credit card charge

While each credit card issuer has its own exact procedure for disputing a charge, the general concept is the same:

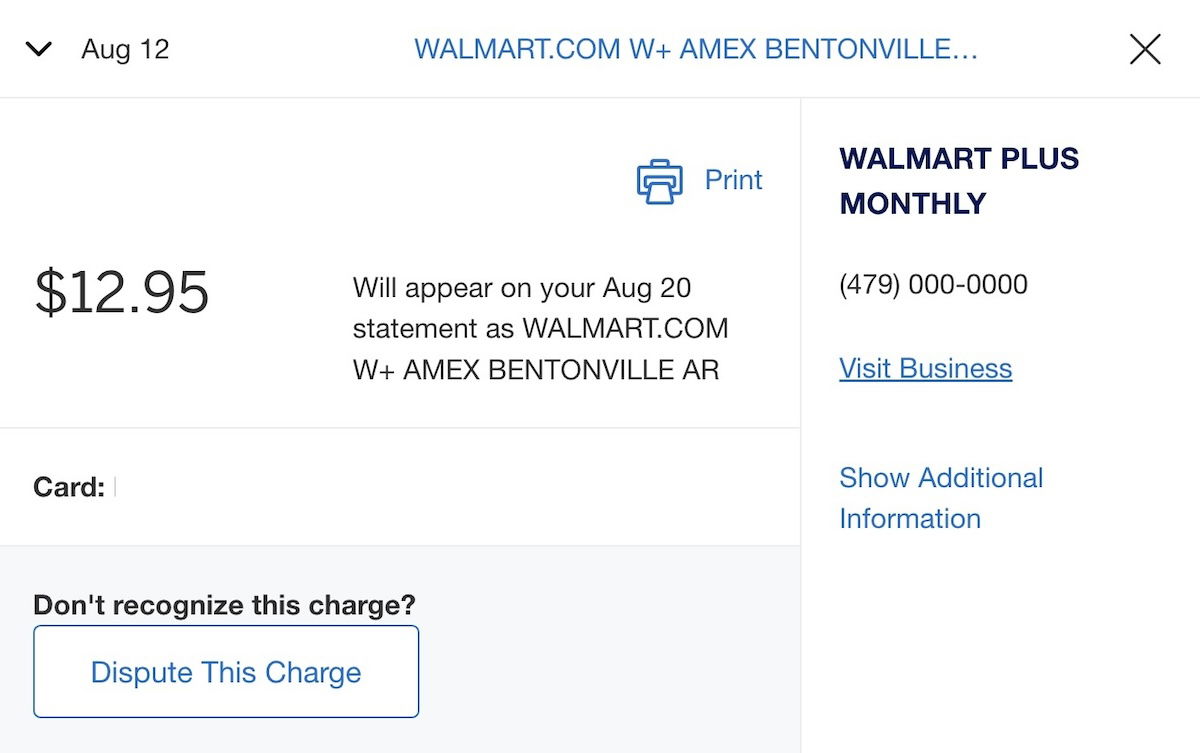

- When reviewing your charges online through your credit card company, you should see some sort of “dispute” button near any eligble purchase, that allows you to dispute the charge

- Alternatively, you can just call the credit card company, and they can help you file a dispute

Typically when you dispute a charge, you’ll be asked to provide some basic details, including confirming that you contacted the merchant first, sharing what went wrong, and more.

When you dispute a charge, you’ll be given a temporary credit for the amount of the purchase, until the dispute is resolved (at which point you’ll either be credited the amount permanently, or will be charged it once again).

The investigation into a charge can take up to a couple of months. This is because the card issuer gives the merchant the chance to respond to the dispute, and that can take some time. So you’ll want to dispute the charge within 60 days, and then you can expect it could take a similar amount of time for a final decision to be made.

Be responsible with credit card disputes

I know many people will dispute credit card charges as their first course of action when they’re not happy, rather than as a last resort. You should always try to first reach out to the company, and only dispute a charge either if you don’t get a satisfactory response, or if you’re approaching the 60-day deadline for disputing a charge.

Just to expand on that a bit:

- If you dispute a charge despite not having first reached out to the company, you might actually be making things take longer, since a dispute takes an extended period of time, while a company can often resolve your issues much more quickly

- While we probably don’t have much sympathy for mega-retailers, for small businesses, credit card disputes can be challenging, since the company isn’t paid until the dispute is resolved

Not all credit card issuers are created equal

On the topic of credit card disputes, here’s what I consider to be an interesting topic. If you’ve disputed credit card purchases with any frequency, you might have noticed that not all issuers handle them equally well. Some issuers are definitely a bit “friendlier” to disputes than others.

For example, in my experience, American Express is the best card issuer when it comes to resolving disputes in a consumer-friendly way. I’ve found Chase to be very good as well. However, I haven’t necessarily had equally positive experiences with other issuers.

Admittedly this is all anecdotal, and in some situations a dispute is pretty cut and dry, and one party is right, while the other is wrong. However, all else being equal, I find Amex’s excellent handling of credit card disputes to be a reason to use those cards for purchases.

Bottom line

Credit card disputes are a useful tool for situations where a merchant charges you for something you don’t think you should have to pay. While I think it’s important to use this ethically (after reaching out to a company first), this has saved me many times in situations where I got charged for a service that I didn’t receive.

I think it’s also worth emphasizing that different issuers seem to handle disputes a bit differently, and they’re not all equally consumer-friendly.

What has your experience been with credit card disputes, and which issuer have you found to be best?

It's 60 days from the statement closing date, not purchase date. Trying to resolve a dispute with the merchant first is faster, they may give you compensation, and it gives you two bites at the apple. On the other hand, merchants are penalized with a chargeback fee even if they win the dispute. I've found Chase to be the most consumer friendly. Usually they just give you an immediate permanent credit. I've actually found Amex...

It's 60 days from the statement closing date, not purchase date. Trying to resolve a dispute with the merchant first is faster, they may give you compensation, and it gives you two bites at the apple. On the other hand, merchants are penalized with a chargeback fee even if they win the dispute. I've found Chase to be the most consumer friendly. Usually they just give you an immediate permanent credit. I've actually found Amex to be the worst, with 2 of 3 disputes with them being reversed when the merchant responded, then I finally won after reopening the dispute and rebutting the merchant's response with additional documentation and screenshots as support. I don't believe for one second that Amex is "consumer friendly" when it comes to disputes, so now I put any purchases for products or services where there might be a problem on non-Amex cards (like CSR).

Chase seems to have changed their dispute process. When I recently tried to put in a hotel dispute online I got a message saying to call the dispute phone number. Upon calling, the agent (in Philippines and difficult to understand) said they no longer allow any disputes for in person transactions. Basically said that if you were there in person you need to dispute in person. In my cased I attempted that, but the hotel...

Chase seems to have changed their dispute process. When I recently tried to put in a hotel dispute online I got a message saying to call the dispute phone number. Upon calling, the agent (in Philippines and difficult to understand) said they no longer allow any disputes for in person transactions. Basically said that if you were there in person you need to dispute in person. In my cased I attempted that, but the hotel manager would not answer or return my phone calls. Been a Chase Sapphire customer for over 20 years so a big downhill step in service.

All my disputes have been resolved in my favor, though they've been small amounts (under $125). Most credits have been issued immediately, without the merchants' being contacted (nice, though sometimes I want the merchants to get an earful). Some resolutions have been obvious (prepaid lodging that turned out not to exist, forced or unauthorized DCC, Aer Lingus's refusing a seat-fee refund after an aircraft swap put me in a dissimilar seat, Megabus's refusing a refund...

All my disputes have been resolved in my favor, though they've been small amounts (under $125). Most credits have been issued immediately, without the merchants' being contacted (nice, though sometimes I want the merchants to get an earful). Some resolutions have been obvious (prepaid lodging that turned out not to exist, forced or unauthorized DCC, Aer Lingus's refusing a seat-fee refund after an aircraft swap put me in a dissimilar seat, Megabus's refusing a refund when they canceled the route); some less so (resort fee assessed at check-in that I didn't think I should have been subject to).

Amex has been great; Citi and Chase have also been very good.

I had to resort to a credit card dispute when a flight was cancelled during the pandemic era due to a strike. I had asked for a refund, but by the time the dispute window was about to run out, I still had not received a refund. After disputing, Vueling tried to claim that I'd taken the cancelled flight. Fortunately Chase agreed with me. I can only imagine how long it would have taken to pry the money out of Vueling.

I’ve had excellent experience with Elon Financial Services which issues Fidelity Visa cards. Have had several disputes over travel services resolved entirely in my favor. The disputes were all in good faith, but there’s usually some gray area.

I think the ones that don't handle disputes in a customer-friendly way are worth calling out:

1. Capital One still uses snail-mail and a 6-8 week resolution time for CC disputes. It's truly stuck in the 1980s.

2. Citibank has a more modern system, but it frequently falls apart (they forget to apply conditional credits and then give merchants 4-5 months to respond. Basically they invite you to not pay it and will...

I think the ones that don't handle disputes in a customer-friendly way are worth calling out:

1. Capital One still uses snail-mail and a 6-8 week resolution time for CC disputes. It's truly stuck in the 1980s.

2. Citibank has a more modern system, but it frequently falls apart (they forget to apply conditional credits and then give merchants 4-5 months to respond. Basically they invite you to not pay it and will refund you fees, but I don't roll that way given how shoddy their IT systems are... so basically I have to loan the issuer / merchant money for free.

Credit cards companies are not merchant friendly, especially AMEX. I do not accept their cards. However, I heard other small business owners and self employed people often complain about their dispute resolution. I find only Americans are perpetrators of cc fraud. Europeans do not engage in it simply because all their bank cards require a PIN, not signature. If their PIN is compromised, they will eat the loss. I wish all US ccs require PIN...

Credit cards companies are not merchant friendly, especially AMEX. I do not accept their cards. However, I heard other small business owners and self employed people often complain about their dispute resolution. I find only Americans are perpetrators of cc fraud. Europeans do not engage in it simply because all their bank cards require a PIN, not signature. If their PIN is compromised, they will eat the loss. I wish all US ccs require PIN to eliminate more than 85% of fraud cases, But I also know US banks and corporations do not invest in better ways to improve efficiency and effectiveness. They only focus on quarterly profit earnings. Over decades, I watch some astute cc holders engage in outright fraud, especially in CA, and won. Many businesses do not accept orders on the phone. But even verifying bank card with photo ID is not iron clad. When banks provide assurance that cc holders are not responsible for fraud transactions, it means that they force the merchants to eat the loss when merchants fail to prove to banks guidelines and satisfaction. Different bank staff can interpret guidelines different ways. Even different levels of courts disagree with each other's interpretations of the laws.

"I find only Americans are perpetrators of cc fraud. Europeans do not engage in it simply because all their bank cards require a PIN."

What a load of horse sh--. MOST financial fraud comes from eastern Europe, Russia, and Nigeria (so called 419 scams). Having to enter a pin won't prevent the type of disputes that this article focuses on, which are the "not satisfied with the quality of goods or services" disputes. Also, Visa...

"I find only Americans are perpetrators of cc fraud. Europeans do not engage in it simply because all their bank cards require a PIN."

What a load of horse sh--. MOST financial fraud comes from eastern Europe, Russia, and Nigeria (so called 419 scams). Having to enter a pin won't prevent the type of disputes that this article focuses on, which are the "not satisfied with the quality of goods or services" disputes. Also, Visa and MC merchant regulations prohibit merchants from requiring customers to show ID to complete a transaction. That's because merchants and their employees have been caught secretly copying or video recording the ID details to later use in identity theft! You're probably just a crummy small-business merchant that doesn't have any customer service skills and is just looking to get rich quick off a crappy product, resulting in a lot of chargebacks. Your kind is a dime a dozen.

"For example, in my experience, American Express is the best card issuer when it comes to resolving disputes in a consumer-friendly way."

Hear hear!!!!!

In September of '23 I had paid for some Aircalin flights I needed in June this year. Due to the civil unrest, the airport in Noumea was closed when I had planned on travelling. There was no way to get a refund via the Aircalin website, or via phone when I...

"For example, in my experience, American Express is the best card issuer when it comes to resolving disputes in a consumer-friendly way."

Hear hear!!!!!

In September of '23 I had paid for some Aircalin flights I needed in June this year. Due to the civil unrest, the airport in Noumea was closed when I had planned on travelling. There was no way to get a refund via the Aircalin website, or via phone when I called their US agent as well as Aircalin in Sydney, so I called Amex. They explained the 60-day rule, and I said that I understood, but that it was a bummer to be out >$2K for flights that were cancelled by the airline.

The Amex agent said that he'd open a case for me to see what they could do, and voila! Within a week Aircalin credited my account for the cancelled flights.

My rule of thumb is that for any expensive travel, I *always* use Amex - they have not let me down, ever.

I pay online shopping exclusively via paypal as an extra layer between my card and the merchant. I have excelent results with claiming disputes through them. Only in one case I received some threatening legal letters after winning a dispute to pay the merchant for items I didn't receive. This might also happen with creditcards as winning a dispute through them doesn't nessecerally mean you don't owe the merchant. (mine was stopped after I reached...

I pay online shopping exclusively via paypal as an extra layer between my card and the merchant. I have excelent results with claiming disputes through them. Only in one case I received some threatening legal letters after winning a dispute to pay the merchant for items I didn't receive. This might also happen with creditcards as winning a dispute through them doesn't nessecerally mean you don't owe the merchant. (mine was stopped after I reached out to the merchants public relations team)

I recently had a hotel stay that was prepaid and on our third day, our floor lost power and they couldn't fix it so we were walked to a nearby hotel that costs less than half of what I had paid. I talked to the manager on site asking for a refund for one of the nights, he said it was not possible because I had prepaid and payment went to corporate (Riu hotels) and...

I recently had a hotel stay that was prepaid and on our third day, our floor lost power and they couldn't fix it so we were walked to a nearby hotel that costs less than half of what I had paid. I talked to the manager on site asking for a refund for one of the nights, he said it was not possible because I had prepaid and payment went to corporate (Riu hotels) and for me to reach out to corporate customer support via email. So I did, it's now been over two weeks and no response. Should I now dispute it with my credit card company?

Yes, you should dispute it with your credit card company.

A gray area in which I often dispute is when I pay for expedited shipping, but don’t get something in time. Merchants often refund only the cost of expedited shipping. No, I want a full refund because I paid for expedited to get the item by a certain time. If it doesn’t arrive on time, the whole thing is useless, and don’t make me tape it back up for a return shipment. YOU screwed up...

A gray area in which I often dispute is when I pay for expedited shipping, but don’t get something in time. Merchants often refund only the cost of expedited shipping. No, I want a full refund because I paid for expedited to get the item by a certain time. If it doesn’t arrive on time, the whole thing is useless, and don’t make me tape it back up for a return shipment. YOU screwed up and I’m not going to be doing any work. Give me my money back.

I have a 100% rate of success on winning credit card disputes.

You also have a 100% success rate at being insufferable. So there's that, too.