As we’ve known since early last year, Costco is replacing American Express with Citi for their exclusive credit card agreement. With Citi taking over the contract, all Visa cards will eventually be accepted at Costco stores.

Citi was supposed to be taking over the Costco contract from American Express on April 1, though in early February we learned that would be delayed, and that American Express cards would continue to be accepted at Costco stores until at least June.

Then in early March we found out the reason for this — American Express is selling their portfolio of Costco cardmembers to Citi in a billion dollar deal, meaning those with the Costco Amex will have their card converted into a Costco Visa in the coming months. This will make the transition easier for cardmembers, since those who want to continue to have a Costco credit card won’t have to apply for a new one.

Over the weekend the details of the transition were laid out, including the following:

- American Express cards will be accepted at Costco stores through June 19, 2016

- Starting June 20, 2016, only Visa credit cards will be accepted at Costco stores

- Cardholders should receive account information from Citibank starting in April 2016, and will be mailed their new Citi Visa Costco cards in May or early June 2016

- Rewards earned through the Costco American Express will transfer to the Costco Citi Visa

- There will be no credit pull as part of the transfer process, and cardholders will maintain their credit line

Now Citi has a website with all the details of the new Costco Anywhere Visa Card by Citi, and it’s quite compelling. What I’m really surprised about is that they’re changing the rewards structure of the Costco Card.

The Costco American Express Card (being discontinued on June 19, 2016) offers the following return on spend:

- 3% cash back at US stand-alone gas stations and on gasoline at Costco (up to $4,000 per year), then 1%

- 2% cash back at US restaurants and on eligible travel purchases, including at Costco

- 1% cash back on other purchases, including at Costco

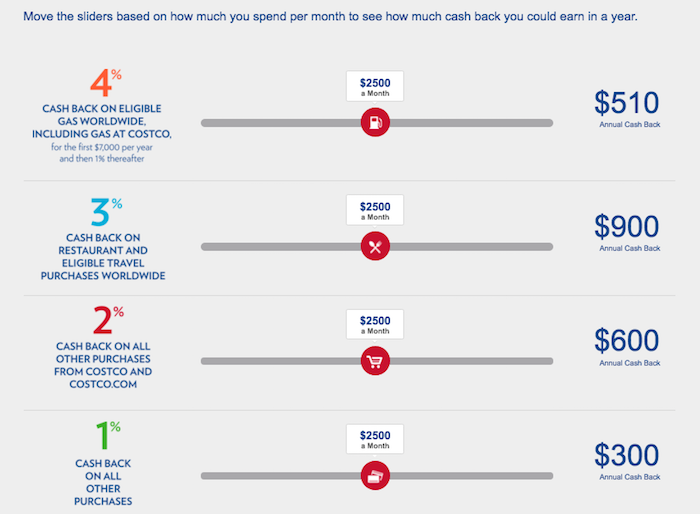

However, the new Citi Costco Visa Card (being introduced on June 20, 2016) will have different bonus categories:

- 4% cash back on eligible gas worldwide, including at Costco (up to $7,000 per year), then 1%

- 3% cash back on restaurant and eligible travel purchases worldwide

- 2% cash back on all other purchases from Costco and Costco.com

- 1% cash back on all other purchases

To recap the differences between the old American Express and the new Citi product:

- Cash back on Costco spend will be increasing from 1% to 2%

- Cash back on gas will be increasing from 3% to 4%, and the cap will be increased from $4,000 to $7,000

- Cash back on restaurants and travel purchases will be increasing from 2% to 3%

And the card still won’t have an annual fee! That’s really, really impressive, given Citi is increasing the cash back in all bonus categories by 1%, and isn’t actually taking anything away.

Bottom line

I’m really impressed by what Citi is doing with their new Costco Card. They’ve first worked out a deal with American Express to take over the portfolio so that people don’t have to apply again, and on top of that are significantly improving the rewards structure.

This isn’t the card I’d personally use for everyday spend, though part of the reason this portfolio is so profitable is because a bunch of people do use their Costco cards for everyday spend. If you’re one of those people, you should be thrilled by this improvement.

Are you also surprised to see Citi improve the bonus categories on the Costco Visa Card?

Links:

I don't think the Citi card is as good as it sounds for

1. The Forex transactions seem to be at an exchange rate which is advantageous to Citi (not an accepted Wall Street Exchange rate which is widely published in Wall Street Journal or some such publication). The Amex card was much more transparent in that respect. I called them out on it and they quietly decided to waive the forex fee on...

I don't think the Citi card is as good as it sounds for

1. The Forex transactions seem to be at an exchange rate which is advantageous to Citi (not an accepted Wall Street Exchange rate which is widely published in Wall Street Journal or some such publication). The Amex card was much more transparent in that respect. I called them out on it and they quietly decided to waive the forex fee on top of their higher exchange rate.

2. Train travel is not counted in the travel bucket (eg the regional CalTrain in the SF-Bay Area) and eligible for a higher cash back.

I think the Fidelity 2% cash back - no exceptions no fee card may rival this

Does anyone knows if the Costco Anywhere Citi Card is a Visa Signature or Visa Signature Presferred card?

FYI... Capital One Visa Signature has no annual fee, no FTF (foreign transaction fees) and their miles program is fairly decent. 1.25 miles per $1.

Is Uber considered 'eligible travel'

Just got off the phone w/ Citi and confirmed that they charge 3% Foreign Transaction Fee on purchases made abroad. As the agent stated, the rule of thumb is if the credit card charges an annual membership fee then there's no Foreign Transaction Fee and the opposite is true. So I guess Costco Membership Fee that I pay does not qualify... I don't get it why would Citi put "worldwide" on their marketing material while...

Just got off the phone w/ Citi and confirmed that they charge 3% Foreign Transaction Fee on purchases made abroad. As the agent stated, the rule of thumb is if the credit card charges an annual membership fee then there's no Foreign Transaction Fee and the opposite is true. So I guess Costco Membership Fee that I pay does not qualify... I don't get it why would Citi put "worldwide" on their marketing material while they charge fees for foreign transactions. No one in their right mind would use this card for traveling abroad knowing there will be a 3% surcharge (unless that person has no other better alternatives.) It is totally misleading!! I was going to take this card with me to UK because I assumed like it's predecessor, AMEX, there's no FTF. Now thanks to that honest Agent who just happened to mention about the fee, I will not use this card anywhere outside of US. Moral of the story - Never assume, always ask and preferably get statement in writing.

Re: getting 4% back at gas stations that also have convenience stores... this is on the citi Costco website: Visa has separate codes for miscellaneous food stores/convenience stores (5499), service stations (5541) and automated fuel dispensers (5542). Supermarkets and warehouse clubs also have separate codes. Citi does not control how merchants are coded.

Citi confirmed to me that the Costco Anywhere Visa Card will give 4 percent at merchants classified as gas stations. In practice,...

Re: getting 4% back at gas stations that also have convenience stores... this is on the citi Costco website: Visa has separate codes for miscellaneous food stores/convenience stores (5499), service stations (5541) and automated fuel dispensers (5542). Supermarkets and warehouse clubs also have separate codes. Citi does not control how merchants are coded.

Citi confirmed to me that the Costco Anywhere Visa Card will give 4 percent at merchants classified as gas stations. In practice, most places where you pump gas are coded as gas stations, not as convenience stores – even if they are affiliated with a convenience store that offers the usual array of gum, lottery tickets, old-looking hot dogs and cold beer.

i live in the nyc area and use amtrak, the northeast corridor. the ny subway system, nj transit as well as all those wonderful bridges and tunnels. what qualifies as travel, if anything? any answers?

My executive membership gives me 2% back on Costco purchases. Will I get that 2% back, IN ADDITION TO the 2% back that the new visa card is giving (i.e. a total of 4% back?)

Holders of the Costco/Citi Visa card should be award of the mandatory Arbitration clause in the Credit Card Agreement. This takes away a great deal of your rights.

You have a right to opt-out of arbitration.

You need to decide in advance whether you want to:

1) opt-out in the given 30-day window, and:

1a) keep your right to class action

1b) keep your right to sue in a regular court with...

Holders of the Costco/Citi Visa card should be award of the mandatory Arbitration clause in the Credit Card Agreement. This takes away a great deal of your rights.

You have a right to opt-out of arbitration.

You need to decide in advance whether you want to:

1) opt-out in the given 30-day window, and:

1a) keep your right to class action

1b) keep your right to sue in a regular court with a proper judge

1c) keep your right to sue in small claims if the arbitration clause takes that right away

1d) keep your right to appeal to a higher court if you disagree with the first court's decision

1e) although this route will probably take longer to reach resolution

or:

2) do nothing, and:

2a) waive your right to class action

2b) take a chance with an arbitrator (who may not be a judge or even have much legal training, and is basically on the payroll of the credit card issuers and banks), with about a 10% chance of winning.

2c) waive your right to sue in small claims if the arbitration clause says so

2d) be bound by the arbitrator's decision without a right to appeal unless you can prove gross misconduct by the arbitrator (or something like that)

2e) your case will probably be resolved quicker than in regular court (with about a 10% chance of winning)

I think that about summarizes it. To me the choice is very clear.

I have to admit the above is the work of someone whom I have long forgotten their name.

The US Constitution offer protections. Do give them away.

I got a letter from American Express telling me that "my account will not be transferred to Citibank, but will be converted to a new Blue Everyday American Express Account with the same number as the Costco Tru Earnings card." Although it cannot be used at Costco, it will pay a $100 bonus after $1000 in new charges, and 3% in cash points for groceries, 1% on everything else, and it will give insurance on...

I got a letter from American Express telling me that "my account will not be transferred to Citibank, but will be converted to a new Blue Everyday American Express Account with the same number as the Costco Tru Earnings card." Although it cannot be used at Costco, it will pay a $100 bonus after $1000 in new charges, and 3% in cash points for groceries, 1% on everything else, and it will give insurance on Rental vehicles.--something not in the new Citi Anywhere card. There was no information about acceptance or rejection of this decision. Did anyone else get this letter?

After calling Costco, American Express and Citibank, I determined that I do need to approve this decision, which continues my 16-year history with AMEXP, a credit perk, vs switching to Citi. However, if I cancel my card after a short time, this may be a credit ding. I am free to get a NEW Citi Anywhere card, after June 20th, to use at Costco, but I can't get both on the same 16-year history. If I reject the AMEXP offer, I will get a Citibank Card tied to the old AMEXP credit history.

Just got the terms and conditions and I can confirm that they are charging a 3% foreign transaction fee. I was hoping they wouldn't. The Costco "Anywhere" Visa Card is not good for travel. They can keep their travel benefits.

The deal breaker is that when you travel overseases, we will need to pay 3% penalty to Citi for using their card.

Just received the Costco packet from Citi outlining the benefits and fees. THEY ARE CHARGING a 3% foreign transaction fee! This is lame!

@ Frank Nasso:

"4% cash back on eligible gas worldwide,

If you read the fine print…. Any facility that sells gas that has “ANY convenience store associated with it is only eligible for a 1% rebate."

Can you tell me where you saw that? I'm interested in this card but if that's true it might change my mind.

What is considered "eligible" travel? I can't find a definition for it.

4% cash back on eligible gas worldwide,

If you read the fine print.... Any facility that sells gas that has "ANY convenience store associated with it is only eligible for a 1% rebate.

It makes no difference whether the store is connected to each other. What matters is the merchant code which was used to acquire the rights to use the VISA card system. If the merchant code is under a "food" category you...

4% cash back on eligible gas worldwide,

If you read the fine print.... Any facility that sells gas that has "ANY convenience store associated with it is only eligible for a 1% rebate.

It makes no difference whether the store is connected to each other. What matters is the merchant code which was used to acquire the rights to use the VISA card system. If the merchant code is under a "food" category you get the smaller percentage , period.

Don't know about your area, not many stand alone station around without a convenience store to support it.

How is this new costco visa card compare to the supposedly "best" card Chase Sapphire Preferred Card?

I have a Mastercard which I got through Upromise.com by SallieMae. I thought that card was the best for other stuff (mainly on line purchases) than costco credit card because it offers 5% cash back from the credit card and usually another 5% cash back through the merchants as long as you make the purchase by going through the upromise.com website.

I think this visa Costco card can really take place over the bofa cash cards and chase freedom cards.

The benefits seem so good to be true. Especially for people who go to Costco, travel through Costco, and gas through the Costco.

With the Amex card I have no foreign transaction fees and the rate of the currency is the best. Just like converting 1 million dollars into anothe foreign currency. I would advise to have both:

Amex for travel

Visa for everyday life in the states

I was just at CostCo and they have a huge banner talking about what CC they will take after the switch, no where on the banner does it say Citi Visa, just says any Visa card will be taken.

I have the same question about foreign transaction fees. My experience using Visa overseas is that they really gouge on this fee. With AmEx fees are usually under $20. With a visa card on my last trip I was charged more than $50 for one transaction.

As someone above said, this aspect can quickly cancel out many benefits if you travel much at all.

Louis V,

I am aware that current AMEX TrueEarnings card holders will roll over to the new Citi Costco card. I do not have the AMEX Costco card since I have been using my 5% Blue Cash card or Starwood card at Costco. Thus, I would like to get the new Citibank Costco card. I have not seen anything yet as to how non-AMEX Costco card customers can accomplish this. Thank you for the response.

@Jim T

There is nothing to apply for with the new card. With the deal Citi just made with Amex, the your current Amex card will automatically move over to Citi and your new card will be mailed in the next month or two.

No app, no credit checks. All current rewards will roll right over.

Ben,

Any idea when Costco customers without the AMEX TrueEarnings card can apply for the new Citibank Costco Anywhere Visa card? Costco and Citibank seem unable to answer this question now.

Stop complaining people. A better deal is a better deal. I'm happy with the new plan.

@deelizzle You can get 4% cash back at gas stations, on up to $7,000 per year. Assuming a $4.95 fee for a $500 Visa gift card, that's $210 per year in cash back you can earn, which you can use to book flights.

Harsh - Amex car rental CDW is 2ndary, same as Visa Signature.

One difference - I recently did use some Amex Offers (though more are on Blue Cash and not on True Earnings). Similar to Discover Deals, Amex Offers do add value. I have no such benefits with my City cards (Dividend and Double Cash) and no such benefits with Capital One QuickSilver [Visa Signature]. Though Citi has some other items (I used price rewind once) and Capital One is bare-bones on benefits.

Awesome! I alternated between True Earnings and Chase Fredom, but I think I'm gonna use the new Citi card even more than Freedom! Sounds too good to be true, I wonder if they will reduce the cash back percentage after a while.

Amex had primary car rental insurance. The citi does not have it. It should get rectified to truly say it beats the old card on all parameters. Also foreign transaction fee is an issue. Still debating this vs chase sapphire

@Harsh - with the Costco Citi Card having no annual fee, there's very little reason not to get it and the Sapphire. Because of the value of Chase ultimate rewards points, The sapphire Will be the best card for dining out and travel as well as spending that is on bonus on either card. The Costco card will be better for gas and it's a tie between the two for shopping at Costco depending on...

@Harsh - with the Costco Citi Card having no annual fee, there's very little reason not to get it and the Sapphire. Because of the value of Chase ultimate rewards points, The sapphire Will be the best card for dining out and travel as well as spending that is on bonus on either card. The Costco card will be better for gas and it's a tie between the two for shopping at Costco depending on if you value Chase ultimate rewards points at more than two cents per point or not. The other card that is a more direct competitor is the new freedom unlimited combined with the Sapphire, since the freedom is also no annual fee, and offers the highest return on onbonused spend at 1.5x points/$. If you have that + the Sapphire, it would also be the preferred card for use at Costco, with the Citi card only offering a better return on gas vs the two Chase cards.

Pretty crazy deal, Visa has been cut out of the warehouse stores for a long time.

3% on restaurants is incredible. For people who are warehouse shoppers and just travel around town, you can get some great value out of the card.

Looks Sam's Club followed as well which is great. More opportunities for points!

@Lothar - 1% cashback is a pretty low return. There are plenty of cards that give 2% back on all spending, either as cash (citi double cash) or as flexible points currency (Barclay Arrival). There are also a lot of cards that give 1 mile/point per $ everywhere, and those are currencies like Chase ultimate rewards, American Express membership rewards, Citi thank you points, and Starwood starpoints that are all worth more than $.01/pt and...

@Lothar - 1% cashback is a pretty low return. There are plenty of cards that give 2% back on all spending, either as cash (citi double cash) or as flexible points currency (Barclay Arrival). There are also a lot of cards that give 1 mile/point per $ everywhere, and those are currencies like Chase ultimate rewards, American Express membership rewards, Citi thank you points, and Starwood starpoints that are all worth more than $.01/pt and therefore provide a greater return then a straight 1% cashback

At the end of your article you state " this isn't the card you would use for everyday spend". Could you please offer your perspective as to why? What other options for everyday spend would you recommend?

As a Costco Member I'm very excited. It's going to be hard to beat the 4% return on gas The 2% cash back at Costco is a nice touch too. It may not beat a Freedom Unlimited at 1.5x pts, but in my personal case, I may have to wait to get that card so this will do great in the meantime.

To those that are asking - you get your rebate check once...

As a Costco Member I'm very excited. It's going to be hard to beat the 4% return on gas The 2% cash back at Costco is a nice touch too. It may not beat a Freedom Unlimited at 1.5x pts, but in my personal case, I may have to wait to get that card so this will do great in the meantime.

To those that are asking - you get your rebate check once a year. It's a check you can cash at Costco for straight cash in your pocket or put it towards your purchases.

As others have said, a lot of Costco Amex members were not points enthusiasts and liked having one no annual fee card that gave them a little extra on everyday expenses like gas and eating out, and so they use the card for everything (that was my parents before I explained points/miles to them and my grandfather today). While Citi may not make much $ at Costco with the card, if previous spending trends continue and card holders use this everywhere (and being a Visa, it will be Accepted more places than the old Amex), they probably figure they'll make it up there.

Honest question: what does this have to do with miles and points?

how do I use this card to get better travel?

Curious if there is a foreign transaction fee. If so, that would quickly negate any rewards earned worldwide.

@Jay

You get your check twice (once for Exec member benefits and the other for the card cashback) a year. Both times it will come as a check on your statement. You can either:

1) Redemn the check for purchases at Costco

2) Go to a cashier and ask to cash the check (i do this all the time, pay for my purchases with my card and at the end pass the check for cash)

@Eric

You need to have a valid Costco membership, so that's your annual fee in a way

SAMS Club is 5% gas up to $6,000 then 1%, 3% dinning and travel, 1% everday with a cap of $5,000 cashback per year.

I currently have the Executive membership at Costco. It costs me $110 per year but I get 2% reward (up to $750 per year) in most of my Costco purchases. I usually spend enough at Costco to pay for the cost of the membership and get me cash back. BTW, the Costco check I get at the end of the year with my rewards can be exchanged to cash at any Costco store. I need to learn more about this Citi card to see if it makes sense to apply for it vs using my Chase Sapphire.

Two things with this card:

Can you use the Cashback for anything? If so, that's amazing. If only at Costco, this is meh.

Second, are there any Foreign Transaction fees? If not, WOW. This card gets a lot better. I could see using this card for a lot of everyday spend/travel spending.

Thank goodness we still have companies like Costco that know how to attract and reward their loyal customers. Cash back is still king in my book, especially after the way points have been devalued in the last few years.

Does this mean holders of this card have free costco memberships?

Wooow this is nice! Guess they sort of had to, seeing that almost everybody has a Visa and has many options to put the Costco spend on. Good job Citi!

So I wonder if you can transfer a existing citi CC to this new Costco Card??

I wonder how much Citi is losing on this deal. No way that with 0% discount rate at Costco, no annual fee, and ridiculously generous rewards scheme they are making money.

@Daniel

It's a check that's only good at Costco but it can be converted into cash at Costco.

This is almost as good as Citi Thank you Premier if anybody still redeems points at 1c.

Unrelated issue @lucky: it seems that AA charges you the post-devaluation price when you change the airlines on an award, even if the award type stays the same (so switching from Cathay to JAL would trigger the higher price). In addition, they charge a $150 change fee for this. See https://www.aa.com/i18n/AAdvantage/redeemMiles/award-travel.jsp : "For awards involving travel on other airlines, origin or destination changes or changes to the airline(s) in the itinerary will incur a change...

Unrelated issue @lucky: it seems that AA charges you the post-devaluation price when you change the airlines on an award, even if the award type stays the same (so switching from Cathay to JAL would trigger the higher price). In addition, they charge a $150 change fee for this. See https://www.aa.com/i18n/AAdvantage/redeemMiles/award-travel.jsp : "For awards involving travel on other airlines, origin or destination changes or changes to the airline(s) in the itinerary will incur a change fee of $150, even when retaining the same award type". This is new, right, and different from what you wrote before?

I would LOVE it if these 'cash back' earned can be transferrable as Thank You points.. similar to how Chase allows their Ink Cash and Freedom 'cash back' be transfer to UR earning account and be used as UR points. If they would do that, I would sign back up with Costo, leaving Sams Club and get this card on June 20th 12:01AM!! :)

I always thought the Amex card had a dumb rewards scheme, with just 1% at Costco, their co-brand partner. If I want to settle for 1%, I can pick almost any Amex. Glad Citi saw the light. I'm not sure they need to offer 3-4% on other categories, but that 2% at Costco is key.

How is the cashback given? is it a "real" check or Costco credit?

Surprising that it's all better - I thought I remember Citi announcing all the categories and bonus amounts were staying the same. Did I misremember that?