As I first wrote about yesterday, Cathay Pacific is in the process of introducing a credit card in the U.S. market. They provided some hints suggesting this would be announced today, and sure enough the application page for the Cathay Pacific Visa Signature Card is now live.

The details are similar to what I wrote about yesterday, though there are a few things that make this card pretty cool.

Here are the basic things to know about this card:

Cathay Pacific Visa Signature Card welcome bonus

The card is offering a welcome bonus of 25,000 bonus Asia Miles after spending $2,500 or more in the first 90 days.

The card is issued by Synchrony Bank, which primarily issues credit cards for retailers. This is the first airline they’ve partnered with an airline, as far as I know. On the plus side, I believe it’s pretty easy to be approved for their cards, though they’re also notorious for giving small credit limits.

As far as the terms of the welcome bonus goes, the application states the following:

25,000 BONUS MILES: For new accounts only. Purchases must post to your account within 90 days of account opening to be eligible for this offer. Only one 25,000 bonus miles offer per cardholder account.

Cathay Pacific Visa Signature Card annual fee

The card has a $95 annual fee, which isn’t waived the first year. That’s pretty similar to the annual fees on many airline, hotel, and other mid-range credit cards.

Cathay Pacific Visa Signature Card return on spend

The card offers the following points for spend:

- 2x points for Cathay Pacific purchases

- 1.5x points on dining

- 1.5x points on purchases outside the U.S.

- 1x point per dollar dollar spent on everything else

The bonus being offered on airfare spend isn’t especially compelling, when American Express Platinum Card® offers 5x points on airfare (on up to $500,000 in flight purchases per calendar year and then 1x when booked directly with the airline or through Amex Travel), and cards like the Citi Prestige® Card offer 3x points on airfare.

1.5x points on dining also isn’t especially compelling. The Chase Sapphire Preferred® Card also has a $95 annual fee, and offers 3x points on dining.

Even a card like the Citi Strata Premier® Card (review) is a great alternative, offering 3x points on airfare, hotels, gas stations, dining and supermarkets.

The 1.5x points on international purchases is a unique bonus category. I think the concept behind this is smart. Cathay Pacific is an international airline, so the fact that the card is more rewarding outside the U.S. than in the U.S. is cool. Back in the day the British Airways Visa card didn’t even have waived foreign transaction fees, which seemed a bit backwards.

So the idea behind this is great, though personally I don’t think 1.5x points on international purchases is that compelling.

The Chase Sapphire Reserve® offers 3x points on dining, while the Chase Sapphire Preferred® Card offers 3x points on dining and 2x points on travel. If you’re anything like me, a vast majority of international spend falls into one of those bonus categories.

Your mileage may vary.

Cathay Pacific Visa Signature Card benefits

In terms of benefits, the card has a few pretty standard benefits, like no foreign transaction fees, chip-enabled technology, and standard Visa benefits.

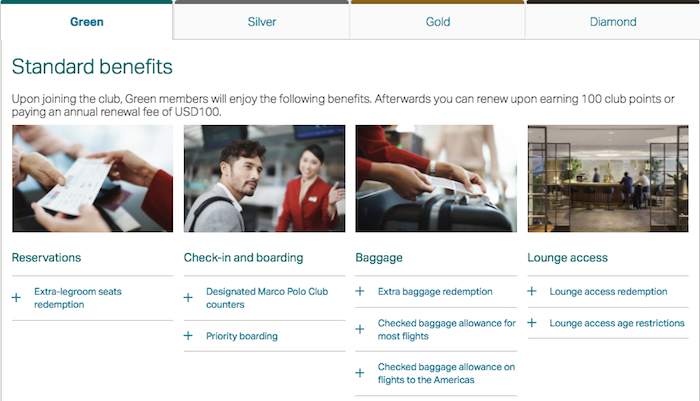

The one unique benefit of the card is that it offers complimentary Green membership in the Marco Polo Club. That’s the base level in the Marco Polo program, which doesn’t get you all that much in the way of benefits. The main benefit is that you can redeem points for things like extra legroom seats, extra baggage, lounge access, etc.

Nonetheless Cathay Pacific ordinarily charges $100 to renew Green membership, so some will find value in that.

Bottom line

I give Synchrony Bank and Cathay Pacific credit for trying to come up with something unique. We’ve certainly seen much more generic cards introduced.

While the welcome bonus isn’t especially compelling, at least they have a couple of unique benefits. The fact that the card offers more points for purchases outside the U.S. than in the U.S. isn’t something I’ve ever seen before, though it’s a cool way for them to differentiate themselves.

Personally I’ll be giving this card a pass. If you would otherwise pay for Marco Polo Green membership then you might as well get this card instead, but otherwise I think the welcome bonus is the extent of the usefulness of this card.

On average I do much better than earning 1.5x points per dollar spent internationally, though I’m sure that’s not the case for everyone.

What do you make of Cathay Pacific’s U.S. credit card?

Since I've always used AA for redeeming CX 1St, I'm unsure whether programs transfer to CX. Today, I got in mail offer from USBank for Korean SKYPASS visa w/ 50K signup bonus. I'll take advantage of this cause I know I can transfer points to KAL :-)

When I was based in HK, I simply loved the AMEX Cathay card. The downside is that AMEX is not all that widely accepted in HK, but I used it both online and offline at major chains wherever I could.

While I still have a large pool of Asia Miles and am tempted to sign up for this card for overseas use, the initlial up front annual fee of $95 is kind of a deal...

When I was based in HK, I simply loved the AMEX Cathay card. The downside is that AMEX is not all that widely accepted in HK, but I used it both online and offline at major chains wherever I could.

While I still have a large pool of Asia Miles and am tempted to sign up for this card for overseas use, the initlial up front annual fee of $95 is kind of a deal breaker. It certainly lessens the overall value if you simply want to grind out the 25k sign up bonus, even with the Marco Polo green level.

It's a shame that Cathay couldn't have partnered with a larger bank.

Lucky,

What about using the points for upgrades? $95 bucks in order to upgrade on a catahy flight or two sounds like a good deal, no?

Lucky, any idea of online purchases done on foreign country domains will count as int'l spend? Could see a lot of shopping moving to amazon.co.uk, for example, because of this.

@ Devious Schemer -- Interesting thought -- I wonder! Ultimately I'm earning 5x points on Amazon as it stands, so not sure I'd even find that worthwhile. But it very well may.

My Japan-issued Delta gold Amex card offers 1.25 Skymiles for international (non-yen) purchases, plus unlimited complimentary gold medallion status, so maybe its more common for non-US cards to have these sorts of benefits? I realize Skymiles are near-worthless, but just pointing out the similarities!

Seems like my amex Elite HK issued card or my Stan Chart AM card is far better than this crap. No thanks !!

It also seems worthwhile to note that the website specifically states that free green tier membership in the Marco Polo Club is for the first year only ("members will enjoy a complimentary first year green tier membership in the Marco Polo Club"), which is the same as the Cathay Pacific Elite American Express Card in Hong Kong.

LOL let me know when it offers comp diamond