Arguably the best way to earn points in the US is through credit cards, be it through sign-up bonuses or earning bonus points through everyday spend.

While the US and Australia are culturally similar in many ways, credit cards isn’t one of those ways. In the US, credit cards have become almost globally accepted, and in many cases credit card surcharges are even in violation of merchant contracts.

Australia is different, however. Not only are credit card surcharges commonplace, but they’re actually a profit center for many companies. Many companies don’t just pass on the cost of using credit cards, but actually profit off the use of them.

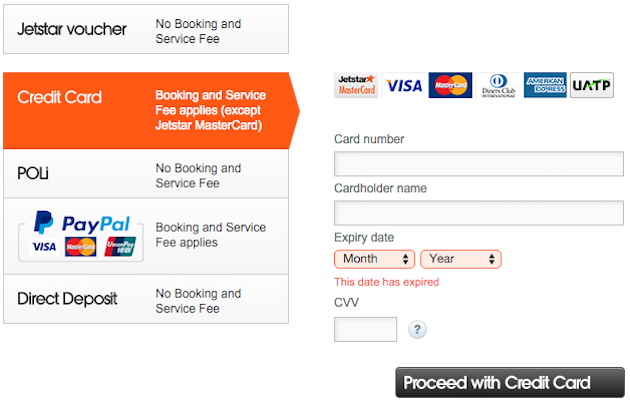

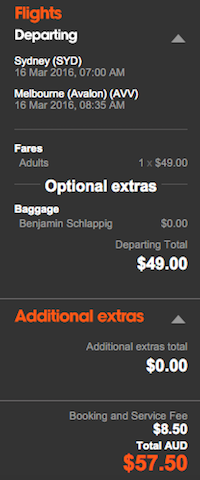

Perhaps the worst culprits are airlines, which in some cases charge insane fees. Take Jetstar, for example. They accept credit cards, but booking and service fees apply.

Just how bad are the fees? Even on a flight which costs $49, the online booking and service fees are $8.50. That’s a whopping 17% credit card surcharge.

Other businesses are a bit more reasonable. For example, Hilton charges a 1.5% fee for credit card payments, which seems more in line with their cost of accepting them.

![]()

Well, it seems like consumers in Australia have had enough, and laws will be changing. While Australia won’t quite match the US, to the point that there are virtually no credit card fees, Australian credit card fees will be regulated by the government.

Via The Sydney Morning Herald:

The Competition and Consumer Amendment (Payment Surcharges) Bill 2015, passed in the Senate on Monday, will instate tough new laws to end excessive surcharges on card payments.

The statement labelled card and other electronic payments as “critical for the efficient operation of the economy”.

The new laws will ensure customers are only charged according to the true amount of a merchant’s costs in accepting payment.

What hasn’t yet been determined is what’s considered “excessive,” though guidelines for that should be set soon:

Specific details on how much a merchant is permitted to charge per electronic transaction are yet to be determined, however the ban will work in tandem with Reserve Bank of Australia Payments System Board standards that will set the permitted surcharge.

Bottom line

This is fantastic news for those in Australia (or those who travel to Australia), because under the current system you get penalized for using credit cards. The new system will be a huge improvement, but you’ll still basically be paying for the “right” to use a credit card. In the US when I put a charge on a credit card, there’s no direct cost to doing so (other than the overall increase in costs caused by higher merchant fees, though those paying cash and those paying by credit card are subsidizing that equally), which won’t be true in Australia.

But this is still a huge step in the right direction for Australia.

So, who’s excited about this new legislation?

Just because the banks are forced not to charge these fees any longer does not mean they won't be passed onto the consumer somewhere. Flight Centre, one of Australia's biggest travel companies announced that they would be passing them on in some form as they won't allow their margins to be eroded.

More it changes the more it stays the same!

In the US, merchant agreements prevent surcharging: American Express won't let you charge more for their users than those of Visa, say, or even than people paying with cash. The Australian government previously regulated this away, to the disadvantage of almost everyone but especially of the higher-end buyers who can get approved for higher-end credit cards. Then, predictably, certain merchants (the airlines being the most obvious culprits) ran riot with this and took the liberty...

In the US, merchant agreements prevent surcharging: American Express won't let you charge more for their users than those of Visa, say, or even than people paying with cash. The Australian government previously regulated this away, to the disadvantage of almost everyone but especially of the higher-end buyers who can get approved for higher-end credit cards. Then, predictably, certain merchants (the airlines being the most obvious culprits) ran riot with this and took the liberty of padding their own profit margins while blaming the evil people at Visa/MasterCard/AmEx/Diners.

This change may be an improvement - it's hard to judge yet - but it's still inferior to just letting the market force merchants to manage their margins. You want the higher-spending customers who prefer their AmEx or Diners Club? Compete for them!

The other implication of this reform that you fail to mention is that they are capping interchange fees at cost except for directly issued Amexs. It's basically going to spell the end of the 1 FF point per dollar Visa/MC in Australia because it no longer makes them enough money to give the benefit (Most of the banks give less than a point a dollar anyway).

@AdamH

Having consumer pricing whereby every business costs in merchant fees to their pricing is akin to a tax. Do your economics 101 again.

How many businesses do you run? With what turnover? Do business in multiple contries? Understand

the variance in fees in different countries?

Yee haw theoretic economics out of the Heritage Foundation doesn't work in the real world.

But back to the credit cards. The points and benefits don't exists...

@AdamH

Having consumer pricing whereby every business costs in merchant fees to their pricing is akin to a tax. Do your economics 101 again.

How many businesses do you run? With what turnover? Do business in multiple contries? Understand

the variance in fees in different countries?

Yee haw theoretic economics out of the Heritage Foundation doesn't work in the real world.

But back to the credit cards. The points and benefits don't exists anywhere else I've found near the level they do in the US. My business friends, overseas, marvel at what we get in the US and yet are horrified at the merchant fees.

Ticketmaster is by far the worst offender in these types of fees

Since the EU are introducing similar legislation does it follow that Europe is also only just entering the 21st Century?

Nice to know that when your current gig finishes the Daily Mail will offer you a job...

This is probably the end of big sign up bonuses on cards and lower mileage earning rates. In the long run a good thing as high transaction costs are terrible for the economy as a whole.

I find credit card surcharges in Australia annoying too but airlines/hotels etc normally have to offer a free payment option. For example Qantas offers BPAY, Jetstar offers bank deposit and Tiger offers payment by debit MasterCard for free. For hotels you can pay with a debit card without fee via EFTPOS. So there is usually a free option but these are only really an option for Australians or those with an Australian bank account.

@Wizard

I'd like to know where you obtained that information about the ANZ because there's nothing on the Bank's website &, as an ANZ Qantas Visa / AMEX cardholder, I've not received any advice from the Bank about changes to the Program

@wowwee I think its part of the mentality that is drummed into Americans from an early age, that they live in the best country in the world.

I fully agree with Ben on this one. There are more competion US. On the other hand Australia is quite protected market.

Which one is better? Depends, we all remember there financial institutions closed down during GFC, Australian financial institutions were much better positioned.

For this particular case, I agree with Ben the businesses should not charge fees on credit card transactions.

yes Lucky is often very condencending to countries besides the US

@AdamH banks in Australia (and NZ) also make a lot of money from fees (including credit card merchant fees). However the financial system is less competitive with a small number of large banks dominating the market.

The current situation is a result of a previous legal ruling that businesses may pass on the costs of credit cards. (Which was then copied in NZ.)

Before you rejoice on the latest law change, consider what the result may be for airlines in Australia. A flat % fee added for all credit card bookings. Sure it reduces the fee for a cheap domestic flight by a few dollars (but high percentage) but increases the...

The current situation is a result of a previous legal ruling that businesses may pass on the costs of credit cards. (Which was then copied in NZ.)

Before you rejoice on the latest law change, consider what the result may be for airlines in Australia. A flat % fee added for all credit card bookings. Sure it reduces the fee for a cheap domestic flight by a few dollars (but high percentage) but increases the fee for expensive flights (e.g. international premium cabin) by lots of dollars.

@Paul

*have to pass on part of that revenue to us as consumers **to stay competitive among their competitors.**

@Paul

Comparing credit card fees to VAT is pure idiocy. Doing so on a miles and points blog is even more so. The reason we can have cards that have 1, 2, 5 x or % in either points or cash back is because the banks are making a killing on these fees and have to pass on a part of that revenue to us as consumers. Debit cards used to have some great rewards...

@Paul

Comparing credit card fees to VAT is pure idiocy. Doing so on a miles and points blog is even more so. The reason we can have cards that have 1, 2, 5 x or % in either points or cash back is because the banks are making a killing on these fees and have to pass on a part of that revenue to us as consumers. Debit cards used to have some great rewards programs in the days before the financial crisis. The government put caps on the debit card interchange fees and those program almost immediately ceased to exist.

The lack of regulation over these fees and generally looser lending laws is a reason the miles and points games are so US-centric.

@bert says:

Government intervention in a free market is always a good thing.

LOL bert. Yep, it was too much government intervention in the free market that caused the economic collapse of 2008...

Also the CC companies are cutting back on how many FF points one can get and as of this month banks like ANZ no points paying any financials like tax.

This regulation is in favor of the banks. Pure and simple. What most of you don't know is that the merchant fees in the US are twice as high as most other western countries. That is down to lack of regulation and monopolistic practices. Practices that VI/MC get sued over frequently, lose multi billion dollars as its just a cost of business. The real benefactors are the banks. I haven't delved into it more deeply...

This regulation is in favor of the banks. Pure and simple. What most of you don't know is that the merchant fees in the US are twice as high as most other western countries. That is down to lack of regulation and monopolistic practices. Practices that VI/MC get sued over frequently, lose multi billion dollars as its just a cost of business. The real benefactors are the banks. I haven't delved into it more deeply but of a merchant fee of 2-2,5%, the banks(ie your Chase, Citi or BofA) make 75% of the fee and the VI/MC network makes the rest along with the merchant processor who will make 0.1-0.5%. Somewhere along those lines. We always hear of a VAT in this country as a solution to our debt. We already have a VAT but all the money goes to the banks.

This regulation looks to be a step backwards. The EU is trying to cap the fees that the credit cards charge, as they have constantly increased fees with greater, ie monopolistic, penetration of use.The merchants have no choice but to accept it. Who can't take a credit card?

So don't cheer too much. Having a true transparent cost would be the best way. Cahs discounts should always be allowed or a surcharge for cc use.

The rapid rise in profitability of the airlines can also be partially traced back to credit cards as well. Back in the good (bad old) days when startup airlines seem to be born quicker than a Duggar, the simple business model was to lease a couple of old planes, plan on flying in 3 months, start taking bookings with a call center and finance it all through the positive cash flow use of prepaid fares. Then the credit card companies used to pass the ticket cost over to the airline at the time of the ticket being purchased. That is no longer the case. If you start a business like that, the credit card companies will hold back those charges until after the customer travels. Hence there is huge finance issue with startup flying. That barrier to entry has allowed the existing airlines to increase fares.

There is also a lot of concern that credit card providers are going to reduce points earnings as they are making less revenue on the surcharges.

The credit card industry has expanded incredibly since the 1950s, now taking a cut the Mafia would envy of almost every financial transaction we make.

It has done a lot of harm, especially to the "Now" generation. Three cheers for indebtedness and high interest rates! We all realize deep down why they're trying to hook us with mega-point signup bonuses, free hotel nights, or cash back.

I'll mildly celebrate Australia's new laws if and when...

The credit card industry has expanded incredibly since the 1950s, now taking a cut the Mafia would envy of almost every financial transaction we make.

It has done a lot of harm, especially to the "Now" generation. Three cheers for indebtedness and high interest rates! We all realize deep down why they're trying to hook us with mega-point signup bonuses, free hotel nights, or cash back.

I'll mildly celebrate Australia's new laws if and when American merchants are no longer forbidden to offer a discount for cash on the barrel head, a sadly archaic expression.

When credit cards first appeared in Australia, it was illegal to have any difference at all in the price between cash and card. Charging card fees, etc. only became a thing some years back. However, I'll bet they still have some sort of booking fee that won't be a credit card fee. The government has been getting upset over those too. For example, there are ticket companies where the only way to buy a ticket...

When credit cards first appeared in Australia, it was illegal to have any difference at all in the price between cash and card. Charging card fees, etc. only became a thing some years back. However, I'll bet they still have some sort of booking fee that won't be a credit card fee. The government has been getting upset over those too. For example, there are ticket companies where the only way to buy a ticket is via a website and using a card, yet they charge you for both. That's ridiculous. They are being told they can't show a lower price without fees if the fees aren't actually optional.

... And Qantas just announced free wifi

Australia joins the 21st century? Coming from the country that rejects pay wave and chip cards for years I don't think you are in a position to piss and moan.

I can beat your 17% surcharge. For international bookings the credit card surcharge (oh sorry, "Booking and Service Fee") tends to be a much higher flat rate. I made an international redemption with Virgin Australia...approx $70 in taxes were due...and they added a $30 fee! Scandalous.

Personally I do not care if they simple roll this into the base fare, after all this is what they are trying to avoid in the first place...

I can beat your 17% surcharge. For international bookings the credit card surcharge (oh sorry, "Booking and Service Fee") tends to be a much higher flat rate. I made an international redemption with Virgin Australia...approx $70 in taxes were due...and they added a $30 fee! Scandalous.

Personally I do not care if they simple roll this into the base fare, after all this is what they are trying to avoid in the first place in order to market the fare more attractively (but deceptively). And of course the same goes for fuel surcharges which Qantas charges in the $100s of dollars per international redemption.

Government intervention in a free market is always a good thing.

Lucky you don't realise that all airlines in Australia will now simply raise their base fares by the amount they are no longer able to charge for CC surcharges. The credit card surcharge has about as much to do with the cost of providing the service as fuel surcharges do.

I don't know all the history of this, but wasn't it an Australian law that permitted these fees in the first place?