When it comes to applying for American Express cards, the issuer’s five card limit is a restriction to be aware of. In this post I wanted to discuss that in more detail, and also share a data point about how perhaps this isn’t quite so strict anymore?

In this post:

How Amex’s limit of five credit cards works

All the major card issuers have different restrictions when it comes to approving people for new cards. One of the major restrictions for getting approved for American Express cards has been a limit on how many total Amex credit cards you can have (this doesn’t include cards you have with other issuers).

Specifically, Amex limits consumers to having at most five credit cards with the issuer at a given time. It doesn’t matter if those are personal or business cards, as both count toward the limit. However, the trick is that non-credit cards, often referred to as hybrid cards, don’t count toward that limit.

Which cards don’t count toward Amex’s card limit?

Not all Amex cards count toward the five credit card limit. Generally speaking, both personal and business cards count towards the limit, with the exception of the following:

- The Platinum Card® from American Express (review)

- The Business Platinum Card® from American Express (review)

- American Express® Gold Card (review)

- American Express® Business Gold Card (review)

- American Express® Green Card (review)

Why are these cards excluded? Historically these were known as charge cards, meaning there was no pre-set spending limit, and you couldn’t consistently finance charges. These are not credit cards. However, nowadays these are all hybrid cards, as the option to finance charges is now more consistently available.

Just as an example, looking at my Amex card strategy, I have a total of nine Amex cards — this includes five credit cards and four “hybrid” cards.

Is the Amex five card limit still being enforced?

Here’s an interesting update. A few days ago, a friend messaged me with a data point regarding Amex’s card limit. He had just been approved for two more credit cards from American Express, despite already being at the five credit card limit. He understands how to correctly “count” Amex cards, as he additionally has four Amex hybrid cards.

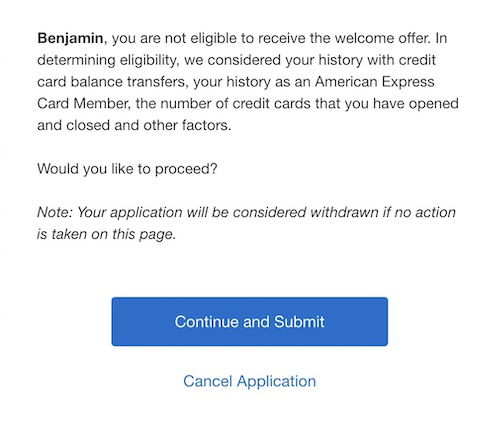

I found that to be an interesting data point. I’m currently at the five credit card limit, so I decided to apply for another Amex card. Now, when I did so, I got an application pop-up warning, informing me that I wouldn’t qualify for the bonus. However, that has nothing to do with the five credit card limit, but rather some algorithm that at times limits the ability to qualify for welcome offers on a card. I decided to not follow through on the application, since I wouldn’t earn the bonus.

I can’t say with certainty whether I would have been approved or not. However, given Amex’s “Apply With Confidence” feature (where you can in select situations learn if you’ll be approved for a card without a hard pull), I figured I’d throw this data point out there, as I’m curious if others are also having luck getting approved for more than five Amex credit cards.

At a minimum, it seems that some people aren’t subjected to this limit…

Bottom line

American Express has an unofficial policy of limiting customers to having five Amex credit cards at any given point. It doesn’t matter if these are personal or business cards, though hybrid cards don’t count toward that limit. This is always a restriction to be aware of if you’re considering applying for an Amex card.

However, a friend recently shared a data point about being approved for a sixth and seventh Amex credit card, and I don’t think I’ve seen many data points along those lines. So was he just really lucky, or has Amex had a change in policy?

What has your experience been with the Amex five credit card limit?

JW why the Business Green card (as opposed to personal) is not listed as one of the cards that is exempt from the 5 card limit?

July 31 - I was just denied for have 5 - 2 Hilton, 2 Marriott, + Blue Business (to maintain points). For some reason, I had thought the hotel cards didn't count. I only have 1 Business Platinum - no golds or greens of any kind.

Does anyone know if I can cancel a card to get Blue Cash as my new #5? If so, Hilton free, or Surpass, or Marriott Business or Bonvoy (was Starwood) might be my choices to ax.

When you're an authorized user on someone else's Amex cc account, does amex count that as one of your 5 max CCs? Is this the same for Biz and pers A/U accounts? Thanks!

I would like to know this too!

It does not count

I've had 7 for years now. I had 5, then when the Citi Hilton no-fee card switched to Amex I had 6 (and it meant I had 2 of the same no-fee Hilton cards). I then signed up for the Delta Plat Amex a couple of years later and assumed this rule would restrict it, but to my surprise I was approved instantly.

There haven't been any Amex cards I've needed to apply for in a few years, so I can't speak to any updates, but it certainly wasn't an issue for me ~3-4 years ago.

I should add that I do mean 7 non-charge cards. I also have the Gold and used to have the Plat until two years ago.

The 5-card limit for lending cards (non-charge cards) is definitely still in effect. Over the past years, I've applied for 4 cards while at the 5-card limit, then called and was told I had too many and was able to get approved only after canceling one.

You buried the lead! Ben’s in Amex pop-up jail? I’d be more concerned that you can’t get bonus offers at all than the credit card limit. Any idea what got you there?

It seems like a LOT of people are now in popup jail for personal (but not business) cards. Seems to include a lot of people who aren’t necessarily on Amex’s traditional bad list (ie closing a card less than one year after opening).