I just submitted my latest credit card application, and want to report back on my experience (it’s good news!).

In this post:

Why I picked up Emirates’ premium credit card

I’m a big fan of Emirates first class, and Emirates Skywards recently implemented a new policy when it comes to redeeming the program’s miles for first class travel. Specifically, you now need Skywards elite status in order to be eligible to redeem for first class.

Admittedly there are some workarounds — you can still upgrade from business class to first class without status, select partner programs still have access to this first class award space, etc. That being said, there’s not that much of a barrier to actually getting Emirates status, so I figured I’d go for it.

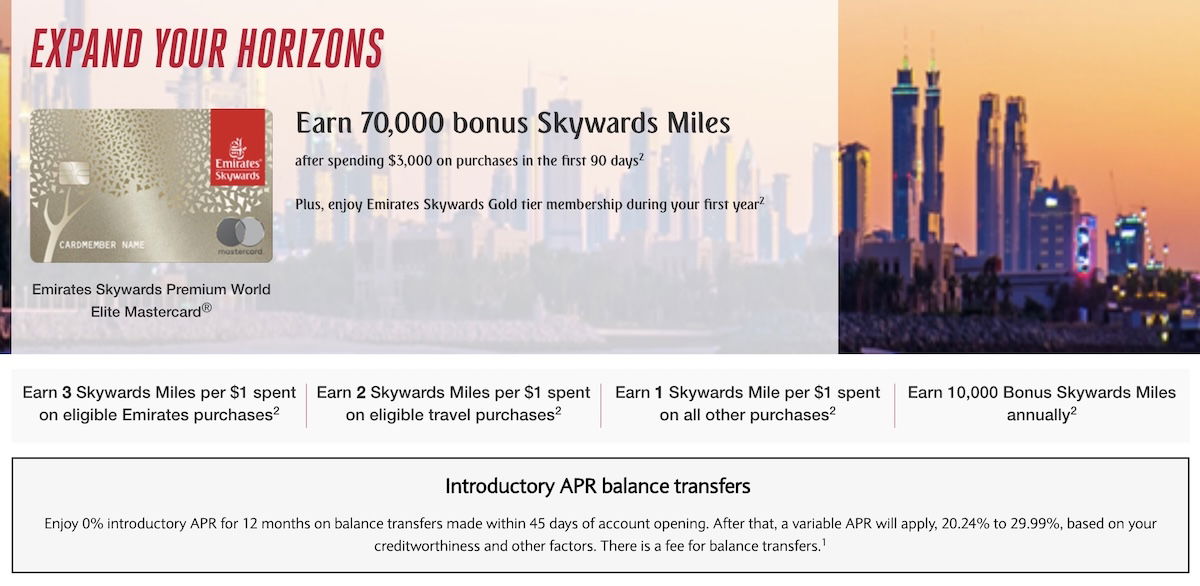

Specifically, Barclays issues two co-branded Emirates Skywards credit cards in the United States. I decided to apply for the $499 annual fee Emirates Skywards Premium World Elite Mastercard. Am I happy about picking up another card with such a high annual fee? Not really. But here’s how I went about justifying this:

- The card is currently offering an elevated welcome bonus of 70,000 Skywards miles upon completing minimum spending, so that’s a pretty good bonus

- The card offers Skywards Gold status for the first year, and Skywards Silver status in subsequent years with no spending requirement (alternatively, you can spend $40,000 per year to maintain Gold status)

- An often overlooked perk is that with the Marriott & Emirates Your World Rewards partnership, Emirates elite members earn one mile per dollar spent with Marriott; so having Emirates elite status will earn me bonus Emirates miles for my Marriott stays, which is worth something

- The card offers some other potentially valuable perks, like a Priority Pass™ Select membership, including for authorized users

Anyway, I’m not sure what my long term strategy is here. We’ll see if I pay the annual fee on an ongoing basis, downgrade to the more basic $99 annual fee card, or cancel it. Regardless, the card is worth applying for (in my situation), as I do value being able to redeem for Emirates first class.

My Emirates credit card approval experience

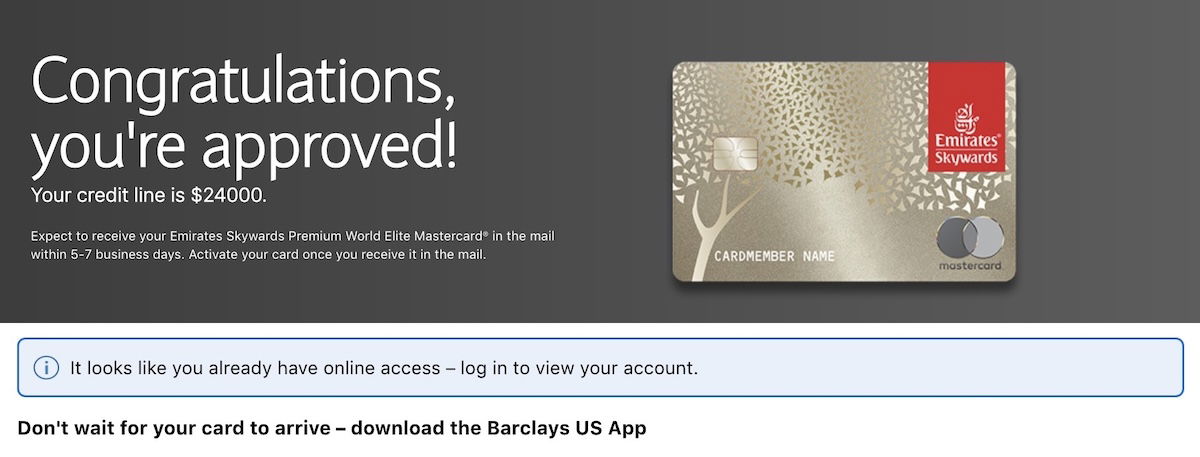

It has been some time since I’ve applied for a Barclays credit card, so I submitted my application this morning. The application was straightforward, and I was delighted to find that I was instantly approved, and I even had the option of getting the new card number right away.

I was curious to see how long after approval it would take before my Emirates Skywards status is updated. To my surprise, my status was upgraded within hours, and my Skywards account already reflects my Gold status — score!

For those curious about the rules surrounding eligibility for the welcome bonus, the application terms state that “you may not be eligible for this offer if you currently have or previously had an account with us in this program.”

Obviously that’s not very specific. Beyond that, Barclays generally has pretty inconsistent rules surrounding approval. For example, there’s often the 24-month rule, whereby you’re not eligible for a welcome bonus on a card, if you’ve received a bonus on that card within the past 24 months. I can’t speak as to whether or not that applies here (if anyone knows, please let me know!).

Bottom line

I decided to apply for Emirates’ premium credit card, and was instantly approved. Not only that, but my Emirates elite status was upgraded within hours of approval, so that’s pretty awesome. I’m not sure what my long term strategy will be, but I’ll take the 70,000 bonus miles and Emirates Skywards Gold status for a year, and we’ll go from there.

Hey, I get Emirates’ new restrictions on award travel are working in some way to increase engagement, as it’s what it took for me to apply for the credit card!

Has anyone else picked up an Emirates credit card in recent times? If so, what was your experience like?

I’m wondering if you have silver or gold status, do you have more first-class award availability in advance?

It must be amazing to be part of the US credit card market. Here in the UAE, Emirates' home country, we have to jump through hoops and spend a lot on Emirates to obtain even Silver status through co-branded credit cards.

Has been a gold member at Emirates for more than 20 + years.

I also had a Citibank skywards card which used to help me rack up lot of miles and maintain my gold status easyily.

Then 7-8 years ago first Emirates the value their miles after their partnership with Qantas and they didn't even announce or give us members a chance to keep the miles value at least for the older earned...

Has been a gold member at Emirates for more than 20 + years.

I also had a Citibank skywards card which used to help me rack up lot of miles and maintain my gold status easyily.

Then 7-8 years ago first Emirates the value their miles after their partnership with Qantas and they didn't even announce or give us members a chance to keep the miles value at least for the older earned miles.

Then few years back they started to be value the credit card works for the mileage earning here in their home country. They saw that members like me were milking away the miles benefits on the cards.

They almost forced me to cancel my card asking me questions like what is source your income and how you are able to spend so much when your states salary is so and so.

At the end I just got fed up and cancelled thinking I'll change to another bank.

I was so wrong.

First bank I got the 2nd card from....they didn't give any tier miles nor skywards miles so membership tier level became an issue.

Then I cancelled and went to another bank and same thing they don't give tier mileage only skywards miles.

So I thought maybe I should have kept the Citibank card after all somehow.

Wrong!

Recently they just announced the devaluation of miles earning system on Citibank card holders.

It's like they make a system and once people start to understand the system and use it they will change it because it's not good for them.

I'm very disappointed. So much so that fir travelling this year I'm taking a one way flight out and I'll buy a separate airline return ticket from Europe to come back home and then go.

I like Emirates a lot. Been a loyal customer since they started flying and I stuck with them once I started flying for work . I guess all this investment didn't do much for me at the end. Like a lifetime platinum membership at Marriott or anything remotely close to that.

So in the home country for Emirates we don't have any credit cards giving us what the Barclays Card gives as above.

Plus whatever miles I have left.....it's like upgrade seats are RARELY available for days and days when I'm flying and then the taxes and fees are so high. It's just so irritating. Even with what miles they let us earn they make it so difficult to use.

I'm really disappointed in Emirates after being a life long customer

Nice to gear what Emirates Gold card offers. Where can I find what silver stays of te less costly card offers?

I am feeling “ steered” by you or did I miss that?

Emirates limited their first class because they wanted people to take up this card (and related cards in other countries).

This isn’t some sort of backdoor route, Emirates themselves said this:

“ Emirates Skywards Blue Tier members can still redeem Miles for upgrades prior to flight departure (from Business Class to First Class) and use Cash+Miles to save on First Class tickets. Members based in the UAE, KSA, India and US can also sign...

Emirates limited their first class because they wanted people to take up this card (and related cards in other countries).

This isn’t some sort of backdoor route, Emirates themselves said this:

“ Emirates Skywards Blue Tier members can still redeem Miles for upgrades prior to flight departure (from Business Class to First Class) and use Cash+Miles to save on First Class tickets. Members based in the UAE, KSA, India and US can also sign up and enjoy immediate Silver Tier membership status with the loyalty programme’s cobranded credit cards including Emirates NBD, Emirates Islamic Bank, Dubai Islamic Bank, Abu Dhabi Islamic Bank, SAB, ICICI Bank, Barclays, and HSBC”

Those are some pretty big markets they’re selling these cards in even outside the US.

Also would explain why they’re fairly relaxed about Qantas still having access given there’s no branded credit card in Aus. Sure American Amex can transfer to Qantas but plenty won’t do this.

I applied for the 99$ card for the silver status and was approved immediately and a few minutes later I refreshed my emirates account and my silver status was already there.

Applied and approved for barclays aviator red card on 4/8

Applied and approved for emirates barclays card on 5/13

Hey Ben, Thanks for sharing this great info. But as a Canadian is there a EMIRATES CARD OPTION for Canadians to apply in Canada ?? Kindly please advise. Also In Canada Master Card is not very popular & very well accepted and American Express Card is NOT accepted by most businesses in Canada so is there a EMIRATES CARD VISA option ? Your kind reply will be appreciated very much.

Is this avail to Australians?

Card isn’t open to Australians.

But if this is about booking Emirates First Class this can still be done with Qantas Frequent Flyer points.

With an ITIN

If the US govt allowed it, Middle Eastern airlines would dominate the US market. America is supposed to be about freedom and open commerce, except where you are inferior. Our airline staff are way better looking too.

Shame all that extra money can't buy class though!

But sadly you must live in the USA... or is that not correct?

What for those of us in the UK?

Unrelated story but interesting:

https://www.theguardian.com/business/2025/may/23/boeing-justice-department-deal-737-crashes

@Ben - It would be very interesting to read an article about all of the annual fee cards you currently have (as well as a total of how much you spend annually on annual fees)!

I'm also curious about which cards you carry everyday in your wallet.

That would be a pointless article because I'm sure Ben maxes out or exceeds the annual fee using various benefits and offers each card gives him access to.

search the website. he's already written one of these.

Maybe an update of that post would be good?

One also gets three miles per US $ spent on Emirates flights, though it may make more sense to buy Emirates flights with the Amex. Plat. or the Citi Prestige (if one still has it; I do) for 5x airfare points that may be transferable to Emirates (though I know that a couple of the transferable points currencies put a hold on these).

I was wondering about how long it would take to get the status reflected. Officially it was up to 8 weeks. Good to know that reality is different.