Link: Learn more about the Ink Business Unlimited® Credit Card with 75K bonus points

I’ve been on a bit of a credit card application spree lately. A while back, I applied for the incredible Ink Business Unlimited® Credit Card, and shared my experience getting approved.

In this post:

Why the Chase Ink Unlimited Card is worth getting

The no annual fee Chase Ink Business Unlimited Card is an incredibly lucrative business card. There are many reasons to get this card, including:

- A welcome bonus of 75,000 Ultimate Rewards points after spending $6,000 within the first three months; those 75,000 points are worth at least $750, though based on my valuation of Ultimate Rewards points, the bonus is worth $1,275

- A great rewards structure, including the ability to earn 1.5x points on all business purchases, making it among the best Chase business cards for everyday spending

- If you have this card in conjunction with a product like the Chase Sapphire Preferred® Card (review) or Chase Sapphire Reserve® Card (review), then rewards can be transferred to Ultimate Rewards airline and hotel partners

- Several valuable perks, including rental car coverage, extended warranty protection, and more

Between the lack of an annual fee, the huge bonus, the great rewards structure, and the valuable purchase protection, this card is a no-brainer, in my opinion. For more details, see my review of the Chase Ink Unlimited Card.

Chase Ink Unlimited Card eligibility basics

Every credit card comes with its own eligibility terms, though fortunately the Chase Ink Business Unlimited Card has among the less restrictive terms. As you’ll see when you look at the offer terms for the card, there’s no 24-month or 48-month rule, as you’ll find on some other Chase cards.

So here are a few points to be aware of:

- Eligibility for the bonus on this card is unrelated to whether you have any other Chase card, including the other Chase Ink cards, like the Ink Business Preferred® Credit Card (review) and Ink Business Cash® Credit Card (review)

- As a matter of fact, you can get multiple multiple Chase Ink Unlimited cards for different businesses (and receive all the benefits, including the welcome offer, for each); so if you have one for a corporation, you could also apply for one for a sole proprietorship, and hold them concurrently

- This card may be subjected to Chase’s 5/24 rule, which is to say that you may not be approved if you’ve opened five or more new card accounts in the past 24 months (this excludes many business cards); however, there are increasingly data points that this rule is no longer consistently enforced

- It’s generally considered a best practice to not apply for more than one Chase business credit card every 30 days, so I’d recommend observing that limit when applying

My experience applying for the Chase Ink Unlimited Card

Given the incredible bonus currently available, I made the decision to apply for the Chase Ink Business Unlimited Card. For what it’s worth, I’ve had the card in the past, but didn’t otherwise have it right now. I decided to apply for the card for my corporation, though could’ve also applied for my sole proprietorship (maybe I’ll do that in the future).

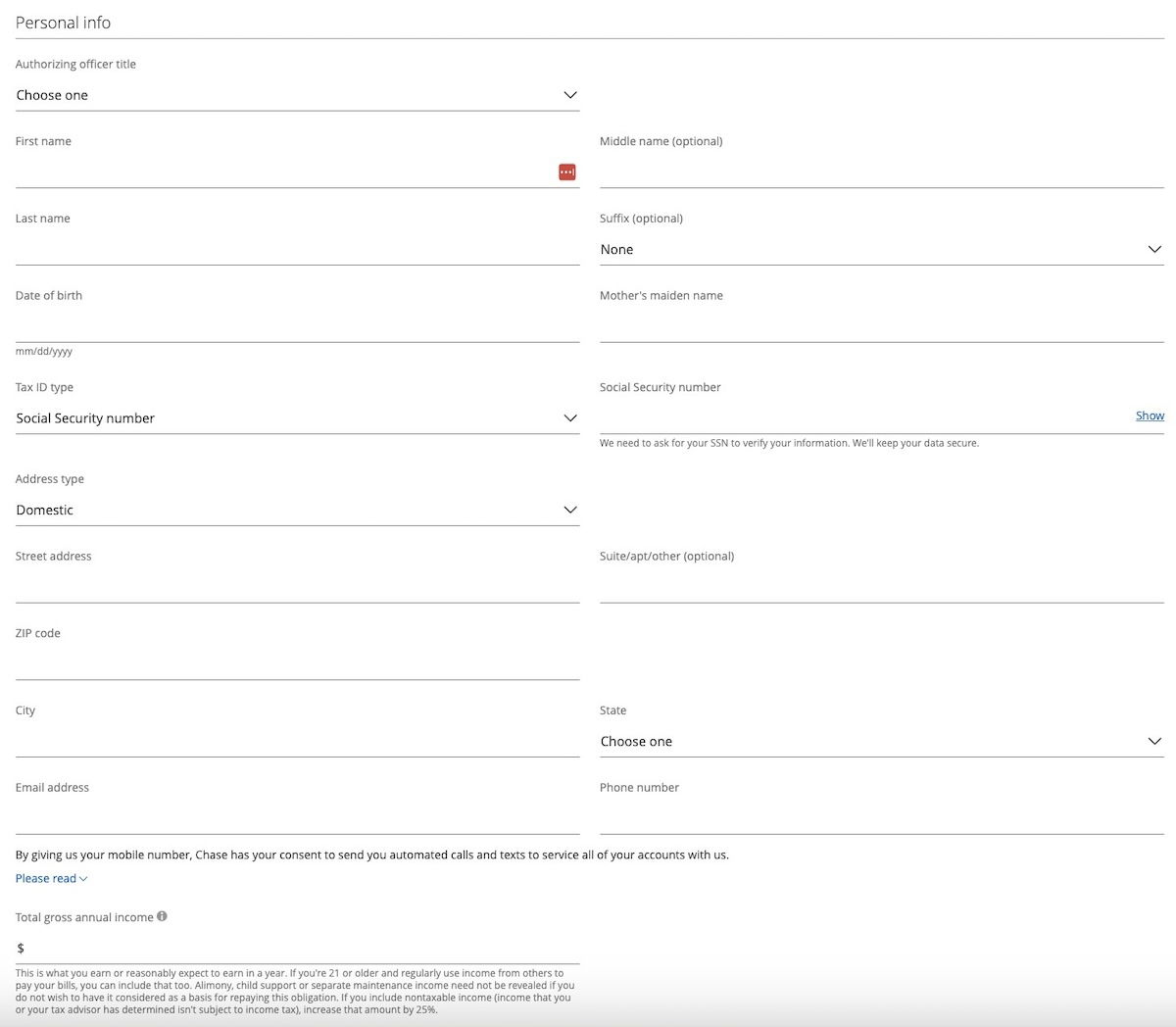

Chase’s business card applications are pretty straightforward. The first section just requires completing personal information, which is pretty standard for any credit card application.

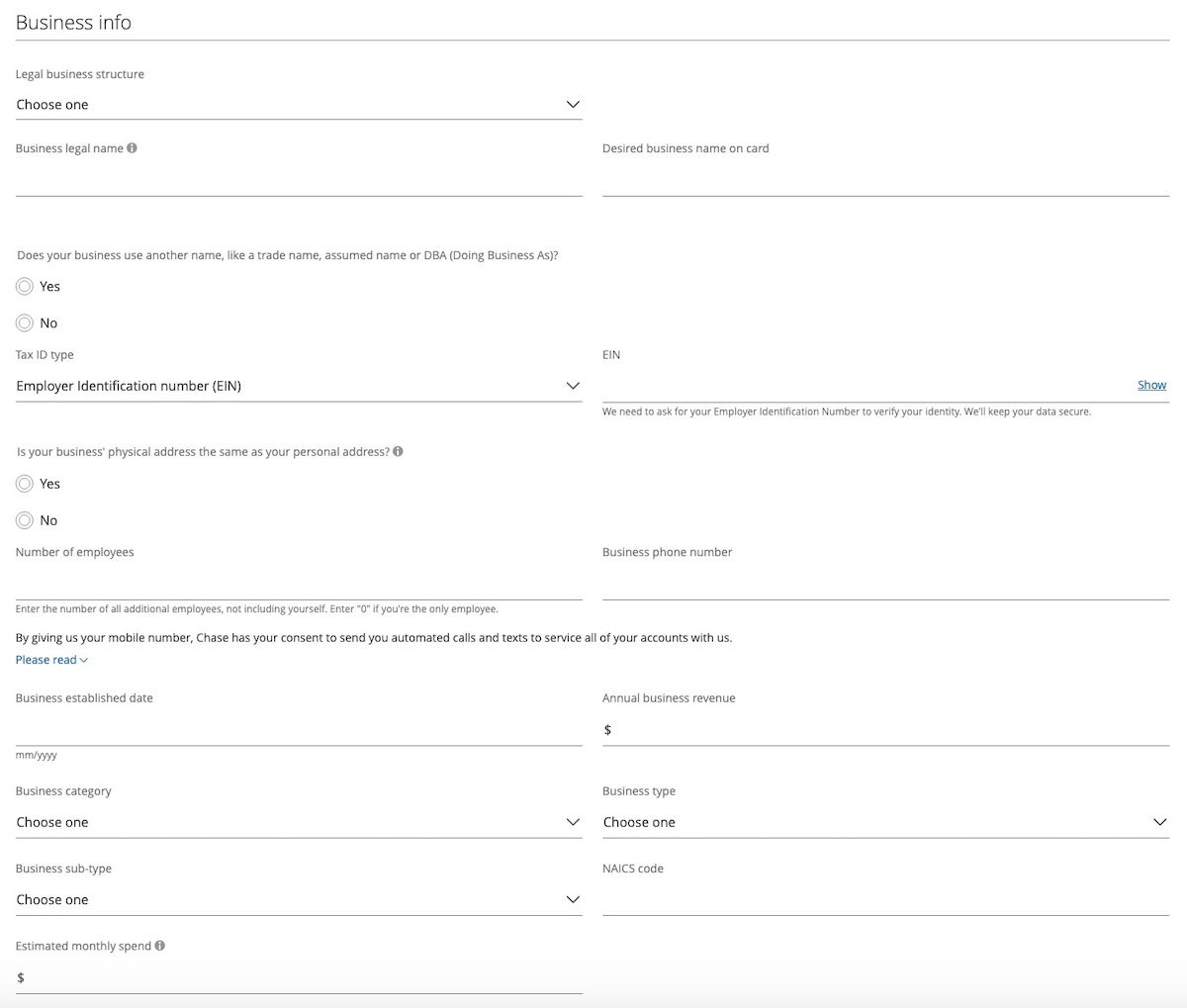

The next section asked for business information. You should always answer credit card applications truthfully. If you decide to apply for the card as a sole proprietorship, here are some tips:

- For legal business structure, you can select “sole proprietorship”

- For the legal business name, you can just use your name

- For the tax ID type, you can select social security number, and enter that

- You can then enter the information about the number of employees (there’s no shame in having just one), business phone number (it can be the same as your personal number), business establishment date, and business revenue

- For the business category, you can select whatever best describes your sole proprietorship

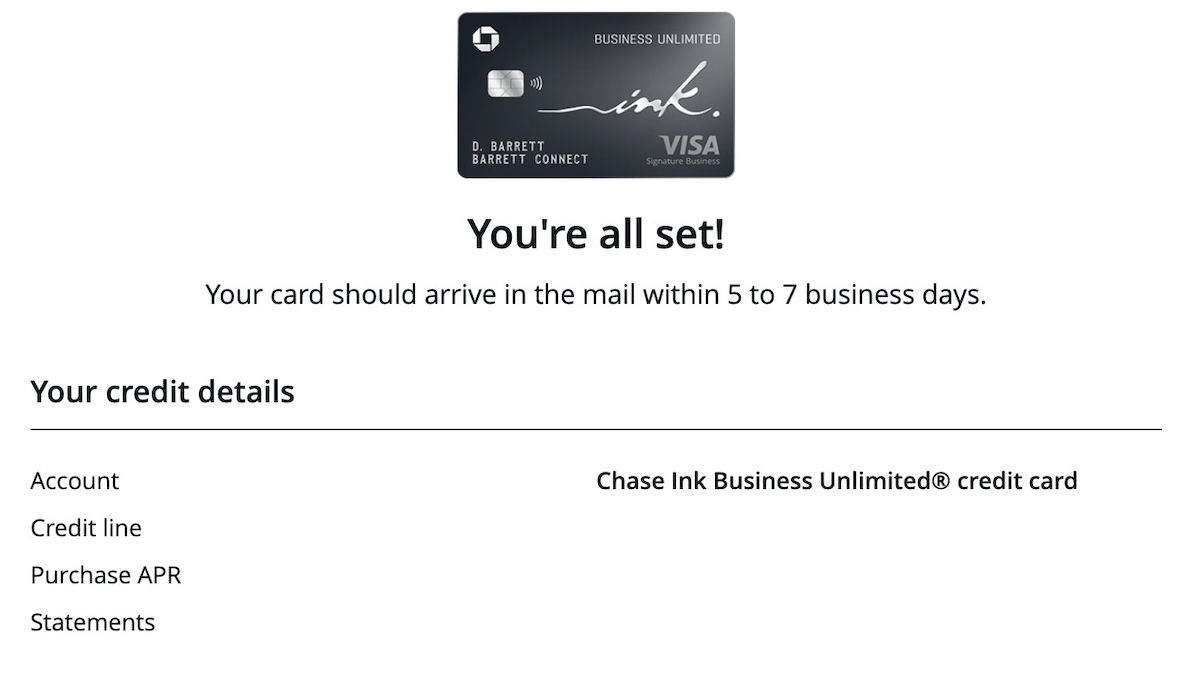

I submitted my application, and found that I was instantly approved. I can’t help but think that many Chase business cards are easier to get instant approvals for nowadays. I also recently applied for the Ink Business Preferred, and received an instant approval, which I’ve previously almost never gotten on a Chase business card.

Bottom line

The Chase Ink Business Unlimited Card is an awesome business card. I recently picked up the card, and got an instant approval. Hopefully this data point is useful for anyone else who may be considering picking up the card.

People are often surprised by the lack of restrictive eligibility requirements, and may also be pleasantly surprised by the results of applying as a sole proprietorship.

If you’ve recently applied for the Chase Ink Business Unlimited Card, what was your experience like?

When I went to apply offer changed to $900 cash back instead of points.

It's not $900 cash back. If you read the fine print, it says "90,000 Ultimate Rewards points, which can be redeemed for $900 cash back."

We’re interested in using this card for my wife’s business. She applied under the LLC’s name (and used the LLC’s tax ID). Do I understand that this card doesn’t technically earn Ultimate Rewards, but if you have another card that does, you can convert the cash-back rewards to ultimate Rewards and transfer to your other card? That’s super confusing. Wondering if my wife can transfer the Ultimate Rewards from her business Ink to her personal...

We’re interested in using this card for my wife’s business. She applied under the LLC’s name (and used the LLC’s tax ID). Do I understand that this card doesn’t technically earn Ultimate Rewards, but if you have another card that does, you can convert the cash-back rewards to ultimate Rewards and transfer to your other card? That’s super confusing. Wondering if my wife can transfer the Ultimate Rewards from her business Ink to her personal Sapphire, given they each are tied to a separate SSN/tax ID. Thanks.

Each card has its own points bucket. This is common among card issuers. When you click on rewards, you'll be asked which bucket you want to view. When you get to the rewards page for that bucket, you'll see a few drop-down menus, one of which offers the ability to move points to another bucket. And, there you go.

@Ben - Would you recommend using a friend's referral link if one is already pre-approved for this Chase Ink card? Would or should it make a difference in one's chances of being approved?

It should not make a difference. But, just make certain that the referral offer's sign-up bonus is at least the same number of points as the online/in-branch offer. They're not always the same.

I can’t get approval for this card no matter what I try despite following everything in your post. Ben, think your comments about what they check and don’t check work this time. (And no…it’s not a credit score or 5/24 issue at all).

Was not approved instantly, which was shocking given my high business income and credit score. Both the email and the automated phone message say 7-10 days until a decision.

Decline or approval coming?

Update: Got approved via email about two hours later.

Lucky, since Monday a new ad was added that is a pop up taking over the whole screen after about 5 seconds. This is truly truly too much. I've seen an increase in ads over the past years but you've reached a point that is unacceptable.

Ben does not have control over this issue (or any of the ads). The ads on his site and sister sites are administered commonly and it's the adminstrator who is responsible.

I understand but than Ben needs to take it up with the administrator or leave Boardingarea and host himself.

I agree. I spend the first 15 seconds just closing down video ad after video ad. BoardingArea is bad about that. Some articles I just close bc I get so tired of getting rid of moving, flashing ads.