Link: Learn more about the Ink Business Preferred® Credit Card with 100K bonus points

The Ink Business Preferred® Credit Card is an awesome card that I just applied for, and I wanted to share my experience getting approved.

In this post:

Why the Chase Ink Preferred Card is worth getting

The $95 annual fee Chase Ink Business Preferred Card is one of the most compelling business cards out there. There are many reasons to get this card, including:

- A welcome bonus of 100,000 Ultimate Rewards points after spending $8,000 within the first three months; this gets you at least $1,000 toward travel, though based on my valuation of Ultimate Rewards points, the bonus is worth $1,700

- A great rewards structure, including several categories in which you can earn 3x points, making it an ideal card for racking up Ultimate Rewards points

- Lots of valuable perks, including cell phone protection, rental car coverage, extended warranty protection, and more

Between the low annual fee, huge bonus, great rewards structure, and valuable purchase protection, this card is a no-brainer, in my opinion.

For more details, see my review of the Chase Ink Preferred Card.

Chase Ink Preferred Card eligibility basics

Every credit card comes with its own eligibility terms, though fortunately the Chase Ink Business Preferred Card has among the less restrictive terms. As you’ll see when you look at the offer terms for the card, there’s no 24-month or 48-month rule, as you’ll find on some other Chase cards.

For example, I’ve had a Chase Ink Business Preferred Card for years for my corporation, which is one of my primary cards for business spending. However, if you have multiple businesses, there are no issues with picking up cards for multiple businesses.

In my case, I decided to apply for a second Chase Ink Business Preferred Card for a sole proprietorship. With Chase Ink products, you can expect that you’re eligible for the bonus if you get approved for the card, assuming there’s no mention to the contrary. So the welcome offers on these cards aren’t “once in a lifetime.”

For more details, see my guide to Chase Ink Preferred Card eligibility.

My experience applying for the Chase Ink Preferred Card

As mentioned above, I hadn’t applied for the Chase Ink Business Preferred Card for years, since I’ve had my existing card basically since the product launched. This time I applied as a sole proprietorship, though, so figured I’d report back on that experience.

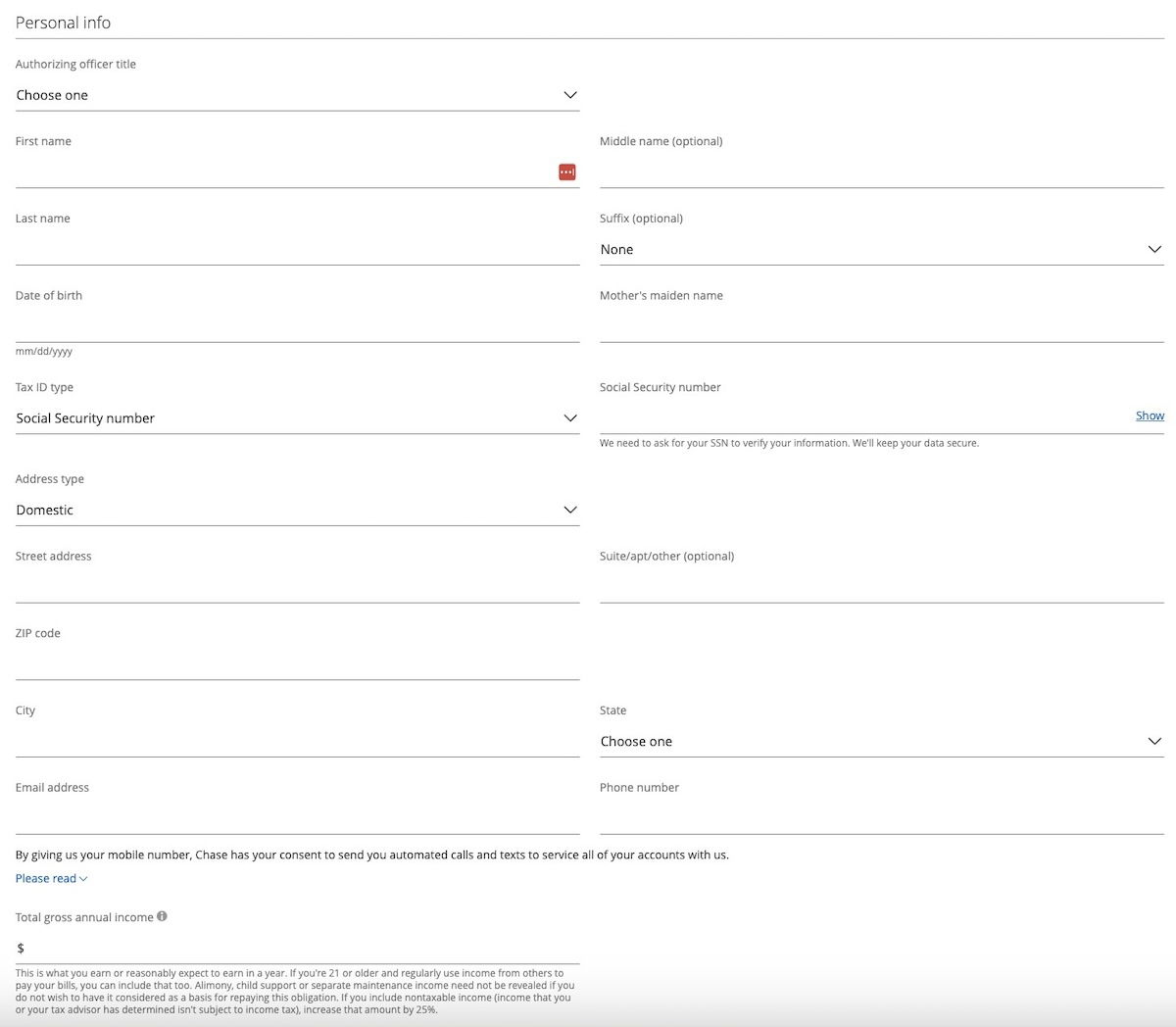

Chase’s business card applications are pretty straightforward. The first section just requires completing personal information, which is pretty standard for any credit card application.

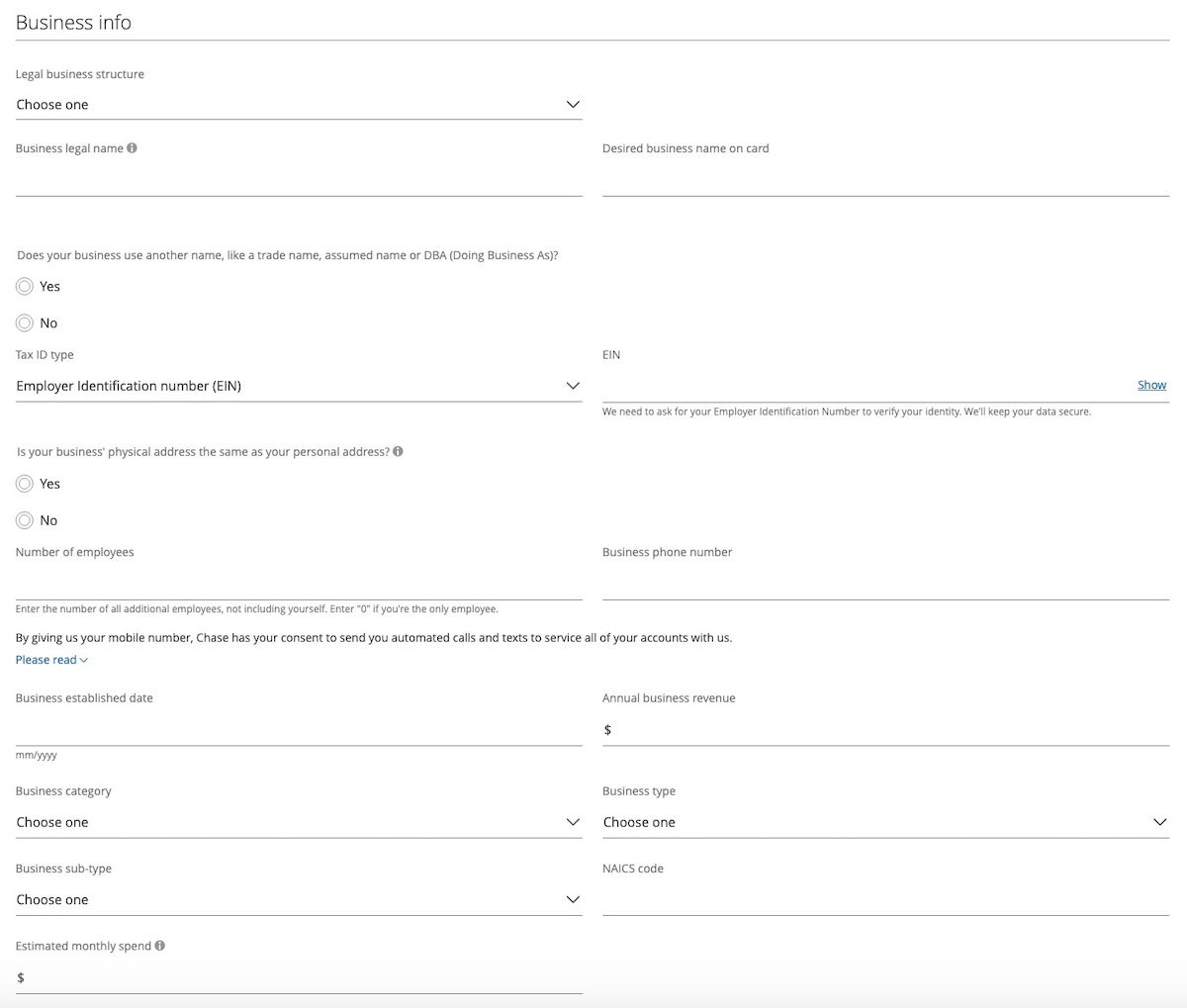

The next section asked for business information. You should always answer credit card applications truthfully. Here’s how I went about that, applying for my sole proprietorship:

- For legal business structure, I selected “sole proprietorship”

- For the legal business name, you can just use your name

- For the tax ID type, I selected social security number, and entered that

- Then I entered the information about number of employees (one), business phone number (same as my personal number), business establishment date, and business revenue

- For the business category, I selected “professional, scientific, tech services,” and then for the business type I selected “other prof, scientific, & technical svcs,” and then for the business sub-type I selected “other professional/sci/tech services”

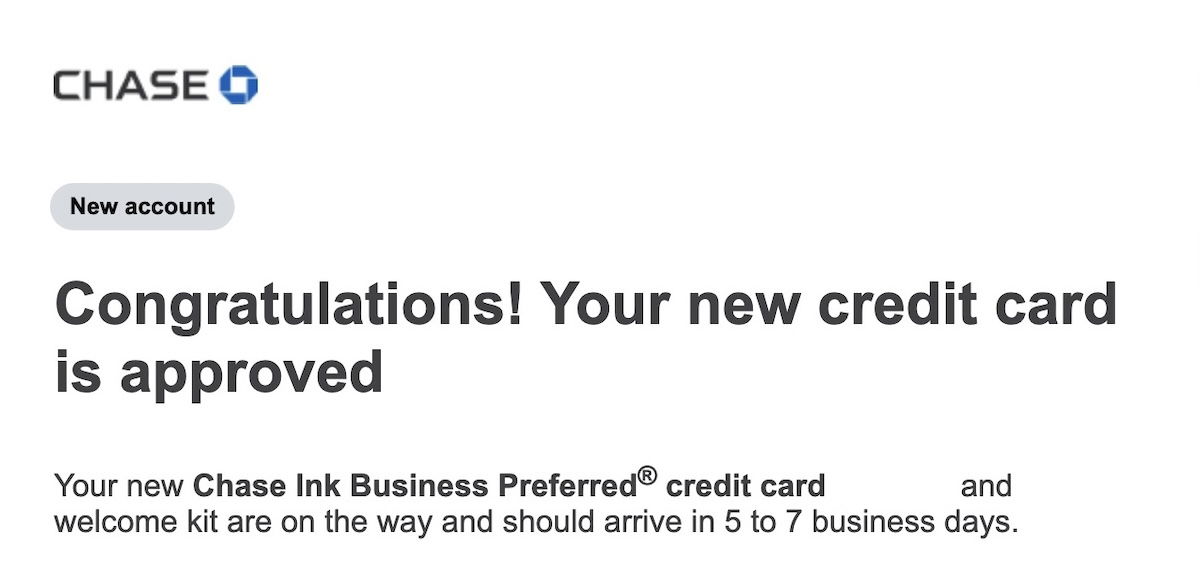

I submitted my application, and found that I was instantly approved. In my experience, instant approvals on Chase cards (particularly business cards) are pretty rare, so I was really happy to see that!

Bottom line

The Chase Ink Business Preferred Card is an awesome business card. I recently picked up the card, and got an instant approval. Hopefully this data point is useful for anyone else who may be considering picking up the card, especially as a sole proprietorship.

If you’ve recently applied for the Chase Ink Business Preferred Card, what was your experience like?

I’d like to use my sister’s referral link so she can get 40K, but that link is still showing a 100K SUB, not 120K. Has anyone had success with calling Chase and asking for an adjustment after the fact? Thanks!

Off topic:

According to Doctor of Credit, it is rumored that AMEX will refresh the AMEX gold card with very unappealing credits and the AF will go up to $375.

https://www.doctorofcredit.com/rumor-full-american-express-gold-refresh-details/

Also, according to Doctor of Credit, Capital 1 is not accepting any more applications for its Capital One Savor Card.

https://www.doctorofcredit.com/capital-one-not-accepting-applications-for-capital-one-savor-card/

Did you use P2 to gain an additional 40,000 points?

@ Paul B -- The refer a friend offer is for 100K points, as far as I know, so I didn't.

Yes, just got approved for the 100k submit bonus via P2's 40k referral link. 140k>120k

It is easier approval now. I got 2X Ink Cash and Ink Unlimited and 1 Preffered last year in their app-o-rama of increased Ink subs. But when i tried for a 2nd Ink Preferred early this year i was told by the csr that i had had 8 new Chase biz cards in 18 months and she could not approve. Last Sunday i applied again and did not phone when i got an "under review"....

It is easier approval now. I got 2X Ink Cash and Ink Unlimited and 1 Preffered last year in their app-o-rama of increased Ink subs. But when i tried for a 2nd Ink Preferred early this year i was told by the csr that i had had 8 new Chase biz cards in 18 months and she could not approve. Last Sunday i applied again and did not phone when i got an "under review". Tuesday i got the Approved email, i phoned and got the card in my hands wednesday. There's also a 40K referral offer in my offers. IDK for sure but i think the Preferred is easier and i think it's best to let the computer decide first to get 2 an extra shot at approval. I think the computer decisions may be easier sometimes in tough approvals.

In February, similar thing. In spite of being under 5/24, too many business card approvals in too little time.