Alaska Airlines has announced plans to acquire Hawaiian Airlines, which is something that I didn’t see coming. This is a huge win for Hawaiian investors, though I’m not sure I understand Alaska’s logic here?

In this post:

Alaska to buy Hawaiian for $1.9 billion

Alaska Airlines has entered into a definitive agreement to acquire Hawaiian Airlines, with a transaction value of roughly $1.9 billion, including $900 million in debt. Alaska plans to buy Hawaiian for $18 per share in cash — goodness, that’s amazing for Hawaiian investors, as the carrier’s shares were recently trading for under $4.

The airlines expect that it will take 12-18 months for the merger to finalize, assuming there aren’t major regulatory challenges. Keep in mind that Alaska acquired Virgin America for around $4 billion back in 2016, so this would be Alaska’s second major acquisition in several years.

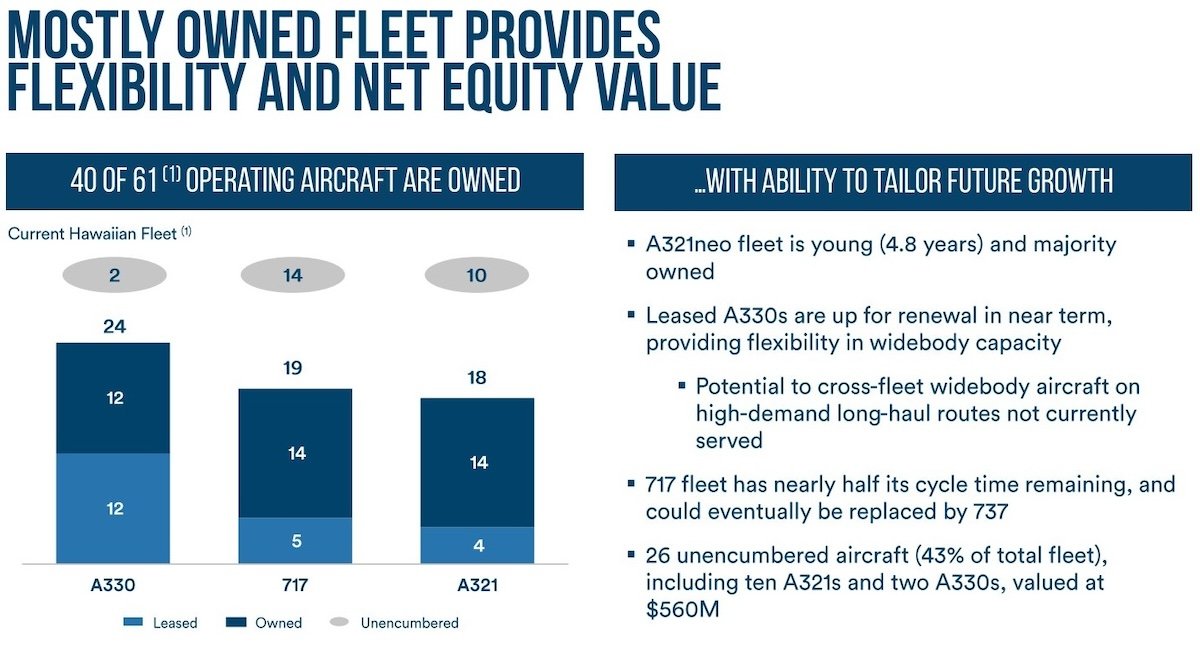

Funny enough, Alaska has historically been an all-Boeing airline, which was a point of pride, given that the carrier is based in Seattle. The airline just retired its last former Virgin America Airbus jet, only to announce an acquisition of Hawaiian, which largely flies Airbus jets. Hah.

Here’s how Alaska Airlines CEO Ben Minicucci describes plans for the acquisition:

“This combination is an exciting next step in our collective journey to provide a better travel experience

for our guests and expand options for West Coast and Hawai‘i travelers. We have a longstanding and deep respect for Hawaiian Airlines, for their role as a top employer in Hawai‘i, and for how their brand and people carry the warm culture of aloha around the globe. Our two airlines are powered by incredible employees, with 90+ year legacies and values grounded in caring for the special places and people that we serve.I am grateful to the more than 23,000 Alaska Airlines employees who are proud to have served Hawai‘i for over 16 years, and we are fully committed to investing in the communities of Hawai‘i and maintaining robust Neighbor Island service that Hawaiian Airlines travelers have come to expect. We look forward to deepening this stewardship as our airlines come together, while providing unmatched value to customers, employees, communities and owners.”

What the Alaska & Hawaiian merger would look like

Practically speaking, what would a merged Alaska Airlines and Hawaiian Airlines look like?

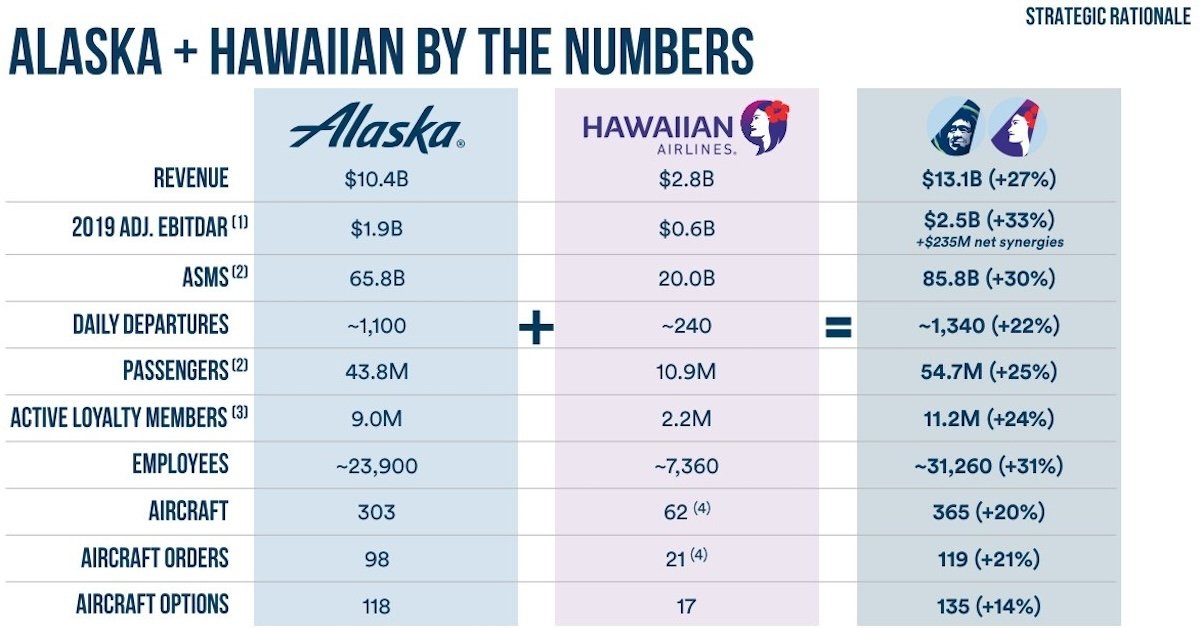

- Alaska and Hawaiian would continue to be branded separately, while integrating into a single operating platform; the airlines would operate a combined fleet of 365 aircraft, with no plans to materially change the current fleet strategy, though the company notes there’s flexibility

- The airlines would maintain their general business models, including Alaska’s “high-value, low fare options,” and Hawaiian’s “international and long-haul product on par with network carriers”

- Hawaiian Airlines would be integrated into Alaska’s Mileage Plan program, and both carriers would belong to the oneworld alliance

- The airlines describe their route networks as complementary, with passengers traveling throughout the continental United States, US West Coast, and across the Pacific, benefiting from more choices and increased connectivity, with service to 138 destinations

- Hawaiian would maintain its strong inter-island network, and Alaska would give people in Hawaii access to triple the number of destinations throughout North America with up to one stop

- Honolulu would become the combined carrier’s second biggest hub, and a strategic one that would allow West Coast travelers to get connectivity to the Asia Pacific region

- Alaska is expecting $235 million in run-rate synergies with the combined airline

There’s a website talking more about the value of the proposed merger, with the URL localcareglobalreach.com.

Below is a map showing the combined route network of the carriers.

Below is a chart showing some numbers behind the Alaska and Hawaiian merger.

My take on the Alaska & Hawaiian merger

I’m not sure what exactly to make of this merger, but it’s not one that I saw coming. I have a few different thoughts, so let me break them down…

Hawaiian Airlines has been having a tough time

Hawaiian Airlines has been struggling for quite some time, so this acquisition would be a great deal for Hawaiian investors. Personally I don’t think Hawaiian is just in a temporary rut, but rather I think the airline has some major long term challenges as an independent player:

- Hawaiian now faces brutal competition from Southwest on inter-island flights, while previously there wasn’t much competition

- US mainland carriers (including Alaska) have added a ton of capacity to Hawaii, and Hawaiian has been struggling to expand to the mainland in a profitable way

- Hawaiian has also been having a tough time in Asia, and with Japan’s currency having weakened so much, there’s not as much inbound tourist demand from Japan to Hawaii (which has historically been a huge market)

- Then you have all kinds of temporary issues, ranging from the pandemic, to the Maui wildfires, to leisure demand being stronger to Europe than Hawaii right now

I don’t understand what Alaska gets out of this?

While I understand Hawaiian is in a tough spot, I don’t really get how Alaska acquiring Hawaiian improves the situation all that much?

- There’s a lack of synergies from continuing to maintain two independent airline brands, and I wonder if that’s really the long term plan

- This isn’t like JetBlue’s acquisition of Spirit (which is questionable in a different way), where it’s just about trying to get employees and planes to grow operations and compete on a national level

- How will Alaska taking over Hawaiian improve the carrier’s challenges on inter-island flying, and on Asia Pacific flying?

But what’s really the plan beyond that?

- Is this just about essentially eliminating a competitor between the mainland and Hawaii? If so, that seems like it could lead to some regulatory scrutiny, since that’s not great for consumers

- How will Alaska harmonize products between the fleets? Will A330s maintain flat beds?

- Could Alaska end up using Hawaiian’s upcoming 787s to operate other long haul routes out of Seattle, rather than out of Hawaii? The presentation hints at the possibility of cross-fleeting long haul aircraft…

In terms of loyalty perks, this would be great

As a consumer, I probably wouldn’t mind this merger. Alaska Mileage Plan is a way better program than HawaiianMiles, and I’m happy to see that Hawaiian could join oneworld. This could be a great new option for earning and redeeming points. But then again, my perspectives are often skewed by caring about loyalty programs more than the average consumer, as the downside here would be the elimination of a competitor between the mainland and Hawaii.

I would assume that Hawaiian miles will convert into Alaska miles at a 1:1 ratio. I’ve seen some people ask whether it makes sense to move transferable points currencies to HawaiianMiles, with the hopes of eventually earning Mileage Plan miles?

Personally I wouldn’t do that just yet, especially since we’re potentially well over a year from when the airlines merge, if the deal happens at all.

Bottom line

Alaska Airlines intends to acquire Hawaiian Airlines in a $1.9 billion deal. If this happens, the two airlines would maintain their separate brands, though Hawaiian would join the Mileage Plan program and the oneworld alliance.

As far as airline mergers go, this one isn’t that expensive in terms of total purchase price. It’s less than half the cost of Alaska’s takeover of Virgin America. But still, I’m struggling to see the upside here?

As an aviation geek, I do kind of love the thought of Alaska returning to Asia and introducing flat beds, though it would be indirect, given that the airlines will maintain their separate brands.

What do you make of Alaska acquiring Hawaiian?

Doesn't Alska compete successfully with Southwest in plenty of places? Won't they do better than Hawaiian vs. SWA inter-island?

The Airbus fleet seems doomed. Perhaps Hawaiian 1st class will survive on international flights.

Regardless of what Alaska says now, .Market realities will help them debrand Hawaiian cut by cut over time. Alaska excels at minimalism while pretending otherwise because that's air travel reality.

I think this merger makes plenty of sense for both parties. Alaska indirectly gains a bigger presence in the Pacific including the Asia/Oceania market while Hawaiian gets greater access to the mainland and a global alliance in Oneworld. This is an expansion that both carriers could find helpful for their future. I’ve also heard that Hawaiian has struggled financially and might not be viable long term without a merger. Also Alaska is a much better...

I think this merger makes plenty of sense for both parties. Alaska indirectly gains a bigger presence in the Pacific including the Asia/Oceania market while Hawaiian gets greater access to the mainland and a global alliance in Oneworld. This is an expansion that both carriers could find helpful for their future. I’ve also heard that Hawaiian has struggled financially and might not be viable long term without a merger. Also Alaska is a much better takeover candidate for Hawaiian than the US3. Now for the More to Love plane they should do the Eskimo and Pulaski kissing on the tail.

I'm wondering if this means they will offer some sort of "Fly to Japan from the US through Hawaii and stay in Hawaii for a bit" like Iceland Air.

Ultimately the brands will be combined because that's where the cost savings come from. I think this is nothing more than to get the unions to go along but at some point this deal doesn't make a whole lot of sense if there are 2 separate brands.

Ironically Alaska got rid of a lot of the VS Airbuses to now getting a bunch of airbuses back.

Air France and KLM operate separate brands, as do Lufthansa and Swiss, BA and Iberia.

In this case there is also a cultural issue as Hawaiian is very much a separate identity and it would be in their best interest to keep it that way. Everything from design to uniforms, meal service, language etc

Locals and many others will see Alaska as just a typical mainland carrier. Should Alaska decide to fully integrate...

Air France and KLM operate separate brands, as do Lufthansa and Swiss, BA and Iberia.

In this case there is also a cultural issue as Hawaiian is very much a separate identity and it would be in their best interest to keep it that way. Everything from design to uniforms, meal service, language etc

Locals and many others will see Alaska as just a typical mainland carrier. Should Alaska decide to fully integrate it, then ideally they should change the name entirely. Hopefully they won’t end getting rid of the airbus and 787 with have what is essentially a long haul product, and customers the end up on smaller 737s

Yeah my comments were assuming Alaska preserves the Hawaiian brand. You’re right that this is more like Air France-KLM, IAG, and Lufthansa than Virgin America because Hawaii is geographically and culturally almost like a separate country from the perspective of the continental US and there’d be too much cultural backlash. I wouldn’t be surprised if they call the combined parent company Alaska Hawaiian Air Group/Holdings.

Sure there would be some cost savings from axing one of the brands but it's not the only cost saving. It's possible that cost savings will come from combining the airlines in all except brands and uniforms. One set of contracts, one central ops centre etc.

But if Alaska were to go for one brand it would come with cost risks too, like its reputation and customer appeal in Hawaii. Why be loyal to a company that ditched your local brand? Just fly someone else instead.

The cost savings come from a single operating certificate, labor agreement and technology platform. Branding is a pretty small part of the equation and I expect there will be a lot of "Alaska Hawaiian" style branding after the merger closes.

Lucky, this isn't as much about eliminating a competitor as it is about Alaska ensuring its continued independent existence. "Buy or be bought" was the mentality here. AS couldn't grow much without buying someone, and HA was cheap and made the most sense of the available options.

Does anyone know why the combined route map shows 2 routes to Fukuoka?

If you look at the map provided and and thinking out of the box:

- Hawaiian has the Pacific rim and the islands covered.

- Alaska has the west coast and some of the mid west covered.

- JetBlue has all of the east coast and Caribbean covered with a developing Euro footprint.

- Have JetBlue drop the silly idea of acquiring Spirit, and have B6 join to form B6-HA-AS airlines...

If you look at the map provided and and thinking out of the box:

- Hawaiian has the Pacific rim and the islands covered.

- Alaska has the west coast and some of the mid west covered.

- JetBlue has all of the east coast and Caribbean covered with a developing Euro footprint.

- Have JetBlue drop the silly idea of acquiring Spirit, and have B6 join to form B6-HA-AS airlines (code name: Aurora Blue Airlines).

- This would result in the 5th largest "nation wide" airline in the US with a developing Euro footprint

One potential benefit for AS:

Midterm, all flights to and through Hawaii operated by HA branded aircraft freeing up AS aircraft for mainland expansion.

So what will happen all boeing fleet policy?

If they truly do maintain two brands, operating Hawaiian as basically a subsidiary airline like Horizon Air (which flies all Embraer), then Alaska can still claim to operate "All Boeing", at least under the Alaska livery.

Why does everyone of your posts start with WOW or AMAZING? This will be the last time I click on anything you write

Buh bye!

Ben also uses "Splendid". So there.

Jet Blue next?

Don't understand the scepticism. The two networks look perfectly aligned with minimal overlap, giving both airlines access to new routes and destinations. This expands Alaska's reach from the west coast and midwest into the mid- and western Pacific with the potential to expand its Asia-pacific network.

What's often not understood outside the aviation industry is the importance of slots and landing rights, which are a very scarce, valuable and highly contested resource, with all...

Don't understand the scepticism. The two networks look perfectly aligned with minimal overlap, giving both airlines access to new routes and destinations. This expands Alaska's reach from the west coast and midwest into the mid- and western Pacific with the potential to expand its Asia-pacific network.

What's often not understood outside the aviation industry is the importance of slots and landing rights, which are a very scarce, valuable and highly contested resource, with all manner of regulatory, national and other barriers to overcome. Airlines can wait years, even decades to get access to some routes and slots. It's very expensive and time-consuming, An acquisition can solve that problem in one go and give them leverage with other airlines to share routes, develop new codeshares or even trade slots.

Alaska is obviously an airline on the rise that wants to get a jump on the competition and grab a bigger share of the lucrative and growing west-coast/midwest and western Pacific rim markets and this move makes perfect sense. I would expect more announcements of tie-ups/codeshares to follow as a result.

Great news for oneworld members like me with additional options connecting with BA/AA on transatlantic routes like LHR-SEA. I was in SEA last week flying with BA which shares the same check-in counter as Hawaiian. So for me the link-up of Alaskan-Hawaiian and oneworld opens up a whole new range of connections and frequent flyer options. SEA becomes another major oneworld hub alongside DFW, JFK and MIA.

Does anyone know why they announced such a major corporate decision on a Sunday?

Because they had to tell the unions on Sat. And you can't tell incredibly non-public info before the markets open. So had to tell the unions Saturday and and publicly announce on sunday so it would all be open before trading on Monday. -- Otherwise, if you'd tried to tell outsiders on Friday you're opened to massive SEC problems. -- It was well managed by the both to avoid leaks of such critical market information, actually.

Halaska Airlines!

(sarcastic) Great, so with Alaska finally done destroying one superior-for-customers airline, now they can do another. I can't wait for the run-rate synergies of all-737max service from the West Coast to Hawai'i.

I knew Alaska was going to do something in reaction to the Jetblue-Spirit deal but didn't expect this. I expect them to do something unimaginative like buying Sun Country.

This will be a terrible deal for West coast resident, if approved.

Alaska already has very expensive fares to Hawaii from Seattle to Portland. After merging with Hawaiian, the competition will be reduced, resulting in higher pricing power.

Seattle to Maui or Big Island airports are quite often $800+ on one way trips- More than what you'd pay to go to Asia. These fares will go even higher with the merger.

Alaska and a whole lot of people here want to believe the world has forgotten about how badly Alaska gutted Virgin America.

HA is a far more complicated merger with a whole lot more fleet integration.

The notion that AS will save hundreds of millions of dollars by keeping two separate operations is more than wishful.

and let's not forget that the only route between the two that are competitively protected is Hawaii-Tokyo....

Alaska and a whole lot of people here want to believe the world has forgotten about how badly Alaska gutted Virgin America.

HA is a far more complicated merger with a whole lot more fleet integration.

The notion that AS will save hundreds of millions of dollars by keeping two separate operations is more than wishful.

and let's not forget that the only route between the two that are competitively protected is Hawaii-Tokyo. If any one of the big 4 wants to sit on either of them, this could all fall apart real fast.

Let's not forget that part of the reason HA is in bad shape is because WN decided it was not only going to fly TO Hawaii but within it.

Different time, different strategy.

“If any one of the big 4 wants to sit on either of them, this could all fall apart real fast.”

Funny you’d mention that. Delta tried to do that in Seattle and is left with an unprofitable hub.

Keep dreaming, Timmy

Tim, Where's your proof? You have absolutely no idea how this will work out. And neither does anyone else.

I think it has real potential. HNL serves various cities in Asia like Sapporo, Osaka, and Fukuoka that have little or no other service from the mainland US. Alaska can add more feed to HNL and turn it into a hub for Asia.

Fares to Asia are usually pretty low and not sure Alaska would rather fly a low yield passenger all the way to Asia via Hawaii vs having a high yield passenger to Hawaii. And I don’t think anyone paying business would want 6 hours of the travel in a recliner vs connecting somewhere else in Asia to get to the States with a lie flat all the way across the Pacific

Fares to Asia are usually pretty low and not sure Alaska would rather fly a low yield passenger all the way to Asia via Hawaii vs having a high yield passenger to Hawaii. And I don’t think anyone paying business would want 6 hours of the travel in a recliner vs connecting somewhere else in Asia to get to the States with a lie flat all the way across the Pacific

The Alaska investor presentation on the merger lists Alaska’s hubs as SEA, PDX, an ANC only. Have SFO and LAX officially dropped as AS hubs?

LAX is considered a hub as AS confirms this on their own website, however not SFO not although both they serve around 35-40 destinations from both.

Interesting. The 2022 Investor Presentation included SFO and LAX as 2 of their 5 hubs (and both were listed as being bigger than ANC by daily departures), but their investor presentation yesterday listed exactly 3 hubs (SEA, PDX, ANC).

If what they shared yesterday is accurate, it doesn't speak well to how they handled they handled VX hubs after the acquisition.

It was such a lost opportunity for AS to not buyout B6. JetBlue's purchase of Spirit and Alaska's purchase of Hawaiian makes for a inferior airline compared to what could have been. Neither of these mergers will apply substantial pressure to the big 4 US airlines.

As a oneworld loyalist I’m very pleased.

I assume they’ll co-locate terminals at LAX at T6. They would need to, as well as other relevant airports in order to achieve efficiencies.

HA has immense brand equity, so AS would be foolish to touch the brand.

Finally, HA mainland service to HNL connects poorly to their Asia/SoPac network - forced overnights one or both ways - so perhaps the additional AS frequencies can improve connectivity. That...

As a oneworld loyalist I’m very pleased.

I assume they’ll co-locate terminals at LAX at T6. They would need to, as well as other relevant airports in order to achieve efficiencies.

HA has immense brand equity, so AS would be foolish to touch the brand.

Finally, HA mainland service to HNL connects poorly to their Asia/SoPac network - forced overnights one or both ways - so perhaps the additional AS frequencies can improve connectivity. That said, it’s always been a source of friction for the HA revenue management team - maximizing yield with HNL O/D versus connecting traffic. We’ll see.

Would there be any chance that Alaska could use those Asian slots and down the line add long haul ouf of SEA? In any merger they say all the same stuff yeah we'll operate the brands independantly yada yada - just like those airbus planes from Virgin were phased out, likely outcome here again (which is fine), my point is 5 years post merger things could look a lot differently.

I don't see how Alaska could be competitive in the SEA-Asia market, Alaska's brand is nothing in Asia, also they have to compete with all those asian airlines.

I was wondering the same thing. The one thing AS has going for it is their line employees are smart and empowered so when you need help you tend to get it. I'd welcome the option to fly them to Asia instead of UA (and I'm a lifetime UA 1MM flyer).

Bet they wish they kept the Virgin brand now. Such a silly move.

Nothing like a brand name that identifies with two isolated small regional areas of America. I really don't get Alaska's strategy at times. It's like, I dunno, they are living in Alaska.

Southwest Airlines carries more paxs in the US than any other airline. No one cares that they are named for a region where they started service. The original name created by Herb and Rollin was Air Southwest.

The prospect is exciting, but why is the hair on the back of my neck standing up? . . . Is that another devaluation of my elite Alaska status headed my way? The unpredictability of change!

Kind of. I think this is great news for investors, as there will be no competition on the Hawaii routes for the most part.

Alaska has made a point to not offer lie flat business class, so I’d be shocked if they didn’t standardize the fleet like they did with Virgin Atlantic.

This is a very minor and not particularly material observation. Both names of the existing airlines reflect states. I'll conjecture that neither name is relevant in the East/South Asia market interest in which there has been some discussion. The name Northern Pacific might work much better and maybe that name can acquired from some outfit that thinks it can fly their imaginary routes.

And before some yells at me, yes I'm aware that Northern...

This is a very minor and not particularly material observation. Both names of the existing airlines reflect states. I'll conjecture that neither name is relevant in the East/South Asia market interest in which there has been some discussion. The name Northern Pacific might work much better and maybe that name can acquired from some outfit that thinks it can fly their imaginary routes.

And before some yells at me, yes I'm aware that Northern Pacific is a hallowed railroad name strenuously and rightfully protected by the BNSF railroad

I believe at least in the Japanese market the Hawaiian name is relevant. Changing to Alaska or Northern Pacific will pretty much mean exiting the Japanese market, which I assume is a huge part of the airlines' business.

does this mean Hawaiian Airlines will allow me to get points on American? and be on Oneworld? if so another option to shop for flights!

I think this may pass muster because, sadly, HA isn't viable over the long term. The pushback I see is going to come from pols in AK & HI who knows that air transport is a lifeline to small communities in their respective states. It's how goods reach the hinterlands and how inhabitants get advanced medical care. They won't let this happen without covenants guaranteeing continuous connectivity no matter what the economic circumstances.

Both...

I think this may pass muster because, sadly, HA isn't viable over the long term. The pushback I see is going to come from pols in AK & HI who knows that air transport is a lifeline to small communities in their respective states. It's how goods reach the hinterlands and how inhabitants get advanced medical care. They won't let this happen without covenants guaranteeing continuous connectivity no matter what the economic circumstances.

Both states are going to have to be willing to poney up $$$$ to keep island and north slope villages connected no matter what.

That's not really true in Hawaii, though. Hawaii as a whole is obviously quite isolated, but internally air travel is more than self-sufficient as a business. Aside from Honolulu, Kahului, Kona, and Lihue all serve millions of passengers annually, and Hilo serves just under a million. That's easily enough to maintain profitable operations. Hawaii is a much more densely populated state than Alaska, and that's before considering the 10+ million tourists who arrive exclusively by...

That's not really true in Hawaii, though. Hawaii as a whole is obviously quite isolated, but internally air travel is more than self-sufficient as a business. Aside from Honolulu, Kahului, Kona, and Lihue all serve millions of passengers annually, and Hilo serves just under a million. That's easily enough to maintain profitable operations. Hawaii is a much more densely populated state than Alaska, and that's before considering the 10+ million tourists who arrive exclusively by plane annually (more than half of Alaska's tourists arrive by ship).

The only islands with very low passenger counts are Molokai and Lanai, but Hawaiian doesn't serve these airports anyway so the merger doesn't impact them. Inter-island traffic is otherwise competitive enough that Southwest got in on that market, which is not something that happens when service is being maintained solely due to contractual obligation.

Ben, This has been a merger years in the making. Long time ago when Stevens and Inouye were alive this is something they wanted to accomplish, thats a fact.

Fast forward to the announcement I got from Peter Ingram CEO of Hawaiian he states at the end of his letter " All of this will be delivered under the Hawaiian Airlines brand with the livery ." Yet posting seem to contradict this.

Globally...

Ben, This has been a merger years in the making. Long time ago when Stevens and Inouye were alive this is something they wanted to accomplish, thats a fact.

Fast forward to the announcement I got from Peter Ingram CEO of Hawaiian he states at the end of his letter " All of this will be delivered under the Hawaiian Airlines brand with the livery ." Yet posting seem to contradict this.

Globally this is a defensive move by both carriers with very similar loyal customer base. Interesting enough they will have long range metal to each Europe.

Could someone please translate "run-rate synergies" into English for me? (As in, Alaska is expecting "$235 million in run-rate synergies with the combined airline".)

Synergies estimated to be on-going vs one time.

It’s something Ben copied and pasted.

Going from narrow body flying only to widebody international is a huge leap for any carrier. AS has aspired to fly long-haul out of SEA as the final fortification against DL. Acquiring HA is a smart way to gain widebody infrastructure and experience fast, rather than starting from scratch. Cheap valuation and beefing up the west coast portfolio makes this a smart gamble for AS. Curious to see what lessons AS will learn from VX...

Going from narrow body flying only to widebody international is a huge leap for any carrier. AS has aspired to fly long-haul out of SEA as the final fortification against DL. Acquiring HA is a smart way to gain widebody infrastructure and experience fast, rather than starting from scratch. Cheap valuation and beefing up the west coast portfolio makes this a smart gamble for AS. Curious to see what lessons AS will learn from VX acquisition, and what they plan to do with a321 fleet.

AS eliminated LAx-LIH/OGG/KOA non stop ostensibly due to pilot shortage. Maybe the pilots they get a worth it?

Perhaps they can make a deal with IAG to send them some 321s in exchange for a mix of older 737 and similar aged 787?

IAG don't have any 737s, and need more longhaul aircraft, not fewer...

Welcome to OneWorld! This is best news ever!

As long as they keep their operations separate I believe the Merger would be complementary and Successful. Two great Airlines bringing theirvery best! to the table... GODSPEED

How current Pualani Gold and Platinum member would be converted to Alaska MVP?

Pualani gold = Alaska MVP and Pualani Platinum = MVP Gold?

I am not sure separate Hawaiian and Alaska names will survive in the long term. Hawaiian has a slightly better name but Alaska is bigger and also the buyer.

It is possible that eventually the Hawaiian name will be used only for inter-island flights or that the Hawaiian name will die except for some Hawaiian themed livery on the Boeing 717 and its successor, if it is not the 737.

Eventually, Air Wisconsin will buy both of them and that will be the surviving name.

I'm pretty sure Alaska saw the backlash from the go! debacle, and they'd be smart not to retire the name.

Hawaii locals are extremely protective of local brands against mainland companies, and there's still a lot of folks that blame Mesa Air Group for pushing Aloha Airlines into bankruptcy. There was enough backlash to force a court order against Mesa trying to take over the Aloha name in bankruptcy proceedings, even though they were willing...

I'm pretty sure Alaska saw the backlash from the go! debacle, and they'd be smart not to retire the name.

Hawaii locals are extremely protective of local brands against mainland companies, and there's still a lot of folks that blame Mesa Air Group for pushing Aloha Airlines into bankruptcy. There was enough backlash to force a court order against Mesa trying to take over the Aloha name in bankruptcy proceedings, even though they were willing to buy the assets.

If Alaska decides to retire the name, they'll get stuck with the same stigma. It's just not a great move in a competitive environment, and the primary beneficiaries would be every other carrier with mainland service. Other mainland companies (such as CVS) have kept the local branding to serve Hawaii, and Alaska would be wise to do the same.

Alaska residents feel similarly protective so I think it’s a good pairing culturally. Would have to imagine the vast majority of Hawaii flying is done under the Hawaiian brand (with the exception of ANC and SEA perhaps) with state of Alaska and L48 flying under the Alaska name.

With AA abandoning their Seattle international plans, can Alaska redeploy some of the HA wide-bodies or acquire some new ones, and integrate SEA/ANC with their oneworld partners in Asia and Europe?

This is what I think, too, and maybe AA knew about this merger.

Just as Alaska operates a lot of flights not to/from Alaska, Hawaian can also fly between Asia and Seattle without stopping at HNL.

AA can just codeshare and interline with them on TPAC market.

A seasonal HNL-ANC-LHR, even with a change of gauge at ANC since one has to clear immigration anyway westbound, might be very attractive.

I presume Companion Fares wouldn't be usable on Hawaiian flights? Would be INSANE value if they were usable though.

Why is it any better value than currently using them for AS flights to Hawaii?? I'm sure the companion fares will be available considering the frequent flyer programs will be merged & presumably the Hawaiian cards at Barclays will be eliminated or shifted to BOA where the AS card lives & has lived for years.

@Sam Hawaiian flies some much longer routes than Alaska. For example, could you get a Companion routing from New York City to Honolulu to Sydney? While you can use the Alaska companion certs on international routes, the farthest you can currently go is Costa Rica, Hawaii, Alaska, etc.

Very interesting. Never would've thought HA may join oneworld, in spite of the JL partnership, though now that I look at their route network it actually seems pretty complementary with AA and QF

Will we see ha fly sea-HKG or tyo? With no award seats ever open…maybe they can fly direct now.

It always seemed odd for Alaska Airlines to have their HQ in Seattle. And now there will be a combined Alaska/Hawaiian Airlines, still with the HQ in Seattle.

I think if I were the Alaska CEO, I'd use the merger as an excuse to move the HQ to Honolulu.

This is aad to me. Alaska again taking over the 'nicer' airline and converting them to alaska planes. I really hope alaska keeps Hawaiians first class hard product and perhaps starts offering some nicer first class options on Alaskan flights as well.

The brands will continue to operate separately under one AOC so no planes will be converted at the moment as far as I can tell

No one else seems to have noted that Hawaiian and JAL were denied ability to partner by the Feds somewhat recently. Hawaiian is desperate for the synergies for that partnership and that will help Alaska as well. However, from several indicators, I was betting Hawaiian was for sale and that someone would be making an offer.

I suspect Alaska is also sizing up to avoid a hostile takeover. They prefer super incremental growth and so...

No one else seems to have noted that Hawaiian and JAL were denied ability to partner by the Feds somewhat recently. Hawaiian is desperate for the synergies for that partnership and that will help Alaska as well. However, from several indicators, I was betting Hawaiian was for sale and that someone would be making an offer.

I suspect Alaska is also sizing up to avoid a hostile takeover. They prefer super incremental growth and so really this seems like Virgin America all over again. The difference between Alaska and JetBlue is that Alaska absolutely dominates it's main hubs and does that partially through a large regional feeder network. Hawaiian is not a strange addition for their model.

I think it’s super likely that in the long run, we’re stuck with Alaska metal, despite what the announcement states.

(Citation: have airline loyalty programs and marketing arms lied to us before? Only on days that end in ‘Y’)

Has it been explained why Hawaiian has not taken delivery of their 787-9s yet? Hasn't it been like two years since the first one rolled out of the factory?

Probably won't go through.

The overpayment is quite puzzling, as is announcing this in the middle of the weekend.

Announcing on Sundays is common, it keeps the stock prices from being influenced by news or leaks. The Fed does a lot of their bank takeovers on the weekends too. So too was the Credit Suise sale anniunced on a Sunday to UBS.

"Will Alaska increase Asia Pacific flying out of Honolulu?"

I hope so. Before the pandemic HNL was the biggest destination from HKG not served by a direct flight. The demand may have diminished somewhat but the numbers were big enough having to transfer in Japan that it may still be justifiable, especially with Alaska's partnership with Cathay...

*and by biggest I meant most passengers

Oh no… the two outer states are forming an Air Force to attack the continental 48!

LOL!!!!

IMO a lot of this is about WN, CA and strengthening AS’s competitive position vis a vis both. Combining with HA gives AS a lot more CA-HI traffic and HA’s operationally strong but financially weaker competitive position interisland.

Idk why Alaska is paying almost 4x the share price of Hawaiian. Def a defensive move to "try" and stay competitive with the big 4. Hawaii has some opportunity to offer flights to Asia and Australia but it's such a small market.

There are possibly a bunch of shareholders that paid $20-30/share that Hawaiian Airlines used to sell for.

The details of this scream (to me) that this was a defensive move - announced on a Sunday afternoon, with a 4:1 premium on the share price? That's not normal and definitely wasn't planned. My speculation is that one of the majors - like DL [lots of fleet similarity & DL isn't super strong in that direction] was preparing a tender and AS felt that would've been a threat.

(To be clear, the above is purely contextual speculation; I have no inside information.)

I think a takeover attempt by one of the Big Four would have been doomed by regulators from the start. Alaska is the right size and type that they can argue that the new combined route network of the two could actually increase competition on some routes and be beneficial for consumers.

I agree that it's very, VERY odd the way it was announced. I've literally heard NO ONE speak of this, or even of Hawaiian being taken over/bought. As an AA/OneWorld loyalist, I'm so happy to welcome them into the fold!

This is plausible - perhaps a step further - DL duplicated AS regional footprint out of SEA but provided more transcon connectivity. AS running that playbook out of HNL wouldn’t be unreasonable - consolidate traffic and provide better west coast frequency / connectivity. Either way a smart defensive move or a good “R & D” (rip off and duplicate) strategy.

I wonder what Hawaiian would have offered one of the legacy carriers, though. Unless they absolutely needed those planes so urgently they couldn't wait for their huge existing orders to be delivered, Hawaiian doesn't have much of value to a much larger player. If Asia-Pacific is that much of a growth opportunity, it seems that the major carriers could capitalize on that market more quickly by deploying their own metal to those routes, even if...

I wonder what Hawaiian would have offered one of the legacy carriers, though. Unless they absolutely needed those planes so urgently they couldn't wait for their huge existing orders to be delivered, Hawaiian doesn't have much of value to a much larger player. If Asia-Pacific is that much of a growth opportunity, it seems that the major carriers could capitalize on that market more quickly by deploying their own metal to those routes, even if it means accelerating their aircraft orders, going out for more leases, or buying second-hand.

Unless Hawaiian's two Haneda slots are really that valuable, but given the slow return of Japan travel, that doesn't seem likely. And I expect DOT would require those slots to be reassessed post-merger (if not pre-merger) for competitive reasons. I don't know of any other valuable slots that Hawaiian holds that would factor into a purchasing decision.

Any word on what would happen to our Hawaiian miles? Converted to AS? At what ratio?

That was my second thought after grabbing a couple Barclays Hawaiian cards.

Time to transfer some Amex miles to Hawaiian for future arbitrage to Alaska miles?

Virgin America Elevate miles resulted in a 1.3 mile conversion to Alaska Mileage Plan miles and a 10,000 mile bonus. On the other hand, the Biden Administration might put its foot down and prevent the acquisition.

I once flew on Virgin America and thought that my miles were orphan miles and wasted but it turned out that 1000 orphan miles morphed into about 11,000+ miles.