Unrelated to my never-ending quest to earn miles & points, I was about to sign up for a subscription to Motley Fool… then I realized that some people may want to sign up even if they have no interest in what Motley Fool offers, just for the AAdvantage miles and Loyalty Points.

In this post:

Sign up for Motley Fool through AAdvantage eShopping

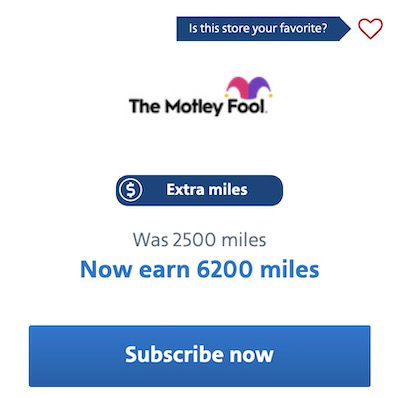

Most US airlines have shopping portal bonuses, allowing you to earn bonus miles for purchases you’d make anyway. At the moment, the AAdvantage eShopping Portal is offering 6,200 AAdvantage bonus miles when you sign up for a subscription to Motley Fool. Currently that subscription costs just $79.

So that means for $79 you could earn 6,200 AAdvantage miles, and those also qualify as Loyalty Points, helping you earn elite status. I’m not sure how much longer this offer will be available (both the $79 first year pricing, plus the current elevated bonus miles), though it seems like this has also been offered several times in the past.

Regardless, you’re earning AAdvantage miles that also qualify as Loyalty Points for 1.27 cents each, which is pretty good.

Note that subscriptions to Motley Fool renew at $199 per year (the $79 pricing is for the first year only), so if you don’t want to keep your membership, you’ll have to be sure to cancel (but only after your subscription is active for at least 60 days).

Furthermore, note the following terms:

Monthly subscriptions, Auto-renewals, Free products, trials, services, memberships, subscriptions, Purchases made with a gift card, Gift cards, Gift certificates, Cash equivalents and Purchases made with coupon or discount codes not found on this site. Limits: Eligible on one (1) subscription per loyalty account number per year. Special terms: Only eligible on paid 1 year subscription to The Motley Fool. Offers cannot be combined/stacked with any other offer. Subscription must be active for at least 60 days.

Why I’m interested in Motley Fool

For those not familiar, Motley Fool is essentially a company that provides expert stock tips that theoretically outperform the market. When you do research online, you’ll often see references to top Motley Fool picks, yet you have to subscribe to see what they are.

I’m trying to figure out some investment strategy that’s somewhere between just investing in an S&P 500 ETF, and randomly picking stocks that I think make sense, even though I know very little (though I’ve had good luck with that). So at a minimum, I’ll gladly spend $79 to see what Motley Fool recommends (whether or not I take the advice is a different story), and the 6,200 AAdvantage bonus miles and Loyalty Points are the icing on the cake.

If anyone has any thoughts on Motley Fool in general, I’d also love to hear them!

Bottom line

If you’re looking for an easy way to earn AAdvantage miles and Loyalty Points, sign up for a Motley Fool subscription, as you can earn 6,200 miles for $79. If you don’t get value out of it, just be sure you cancel within a year (but not earlier than 60 days), so that you’re not auto-renewed at $199.

Anyone plan on earning some AAdvantage miles with Motley Fool?

Has anyone actually gotten the 6200 LP and AAdvantage miles credited to their account after taking this offer?

When does the loyalty points gets credited to our account? Now sitting at 34 days since I subscribe and still nothing. Thanks!

Did you ever get your miles and LP? I've had similar problems with other eshopping sites. One time for Hilton it took numerous emails and 3 months to finally get any miles.

Subscribed to Motley Fool for $89 with the promise of 6,200 AA points. About a month later and numerous complaints to AA eshoppjng and still no resolution. They don’t even provide a phone number to inquire with and the email form inquiries they require largely go unanswered. Sorry I joined AA shopping.

Do we need to use the AA credit card for this? Thank you.

When it says "limit 1 per year" does this mean per calendar year or AA year? For example, I got the 6200 miles for getting a subscription to Motley Fool in Feb of 2023 for last year's AA cycle. Can I do it again now for this year's AA cycle or do I need to wait until after Jan 2024 and hope the promotion is still going?

Looks like the 6200 mile offer is back but for $89.99.

I have used Motley Fool stock picks since June 2014 The original $100,000 I set aside in a Fidelity account to test them out grew to over $500,000 on just 10 stocks I bought from their "Best Buys Now" list. Even with the pandemic the ones I bought seemed to sail right through without an issue. I didn't follow the ones I didn't buy but the ones I did buy have done great. I have...

I have used Motley Fool stock picks since June 2014 The original $100,000 I set aside in a Fidelity account to test them out grew to over $500,000 on just 10 stocks I bought from their "Best Buys Now" list. Even with the pandemic the ones I bought seemed to sail right through without an issue. I didn't follow the ones I didn't buy but the ones I did buy have done great. I have since bought more from their list that have sometimes run hot & cold in the last couple of years but overall are ahead. I have also signed up for their MF Options. That has worked out well. Both have done much better than either of the 2 professional stock advisors I use at Schwab & Edward Jones. They invest in various mutual funds rather than individual stocks and have not done nearly as well as MF. I would have done 100% better to have ditched the pros and bought the DJIA funds . Either way, buy good stocks & hold is the way to go long term. I'm sticking with MF!

I thought 'Motley Fool' was named for the customers who pay for their advice?

Shoot - missed it. At 3700 LP, hard pass. Was a maybe at 6200.

As for the product, worked with those guys in the 90s when it was an AOL channel and I too worked there in content (adjacently). Love the humor - good focus on quality writing. But then and now, no one holds a crystal ball so I'm not looking to see any subscription gives insights otherwise unknown.

Do it for the miles and LP, but please… do not invest based on what Motley Fool says. Horrible.

It's difficult to do better than the S&P over the long run, but in a bull market you can do some picking.

Motley Fool has a sort of a retail investor stock picking information service, but I try to think about investing like I'm managing a pro-am hedge fund, so it doesn't really fit my approach.

I like dividend-paying corporate bond etfs at the moment, because if you're being fearful when everyone else is being...

It's difficult to do better than the S&P over the long run, but in a bull market you can do some picking.

Motley Fool has a sort of a retail investor stock picking information service, but I try to think about investing like I'm managing a pro-am hedge fund, so it doesn't really fit my approach.

I like dividend-paying corporate bond etfs at the moment, because if you're being fearful when everyone else is being greedy, you're hedged, and you'll have some money to spend when everyone else is being fearful again.

It's not a great time for buying and holding.

It is always a good time to buy and hold. DCA a S&P500 etf or a 5 star growth fund and never stop, you cant lose.

Why do most Americans only care about S&P500 ETFs?

If you make your living in the US, you do not really want to have your investments depend on the US economy as well. Diversify overseas and choose a broader ETF, MSCI World (either ACWI or do it on your own and take 2 ETFS, one for developed and one for emerging markets) or FTSE ETFs.

Then you still have a high proportion (likely 60-70%)...

Why do most Americans only care about S&P500 ETFs?

If you make your living in the US, you do not really want to have your investments depend on the US economy as well. Diversify overseas and choose a broader ETF, MSCI World (either ACWI or do it on your own and take 2 ETFS, one for developed and one for emerging markets) or FTSE ETFs.

Then you still have a high proportion (likely 60-70%) of US stocks in your protfolio.

Your desire to add some single stocks is understandable. Keep in mind that it is nothing more then a bet, with better odds than in a Casino given generally increasing a stock prices in the longterm.

I have a Masters Degree in Finance. But you don’t need it to understand what is a smart investments. Stay away from sites which are recommending stocks. Nothing mire then “financial p*graphy”.

I wonder what AA got from Motley Fool to post this offer.

I did motley fool for a similar offer a couple years ago. I tried to actually use their service to help inform my investing strategy, but I found them no better than what you read for free on cnbc or yahoo finance. There was a general dearth of in depth analysis, and just a lot of picks based on very little.

Take the miles, leave the investment advice.

Two comments here.

1. Motley Fool - it is a subscription newsletter like so many of them. You think their advice would be really good if many people follow it? There are probably strategies against their advice. You can find similar ideas of other celebrity type stock people such as Jim Cramer.

2. Regarding the bonus offer, you blow both ways. You are conflicted as to whether to collect 2500 Delta points although the policies...

Two comments here.

1. Motley Fool - it is a subscription newsletter like so many of them. You think their advice would be really good if many people follow it? There are probably strategies against their advice. You can find similar ideas of other celebrity type stock people such as Jim Cramer.

2. Regarding the bonus offer, you blow both ways. You are conflicted as to whether to collect 2500 Delta points although the policies say you can but you will go through this effort and spend $79 for around 6000 AA points. Such may be valued differently but the point is it is not a lot of money. As others correctly commented, Amex, Citi and others often have discounts for Motley Fool.

I agree with the other posts in that you need to hire a broker or an advisor. If he or she works with one of the major firms, then they will generally need to go within the firm's advice. It furthermore depends on your time horizon and what you buy in at. Some funds will not perform as well as individual stocks depending on how diversified it is. Hope this helps.

Nice try it’s 3700

Ben, I think most people's advice is pretty accurate. I subscribe to the Motley Fool basically to find new stocks to research. Over the years they have generally picked stocks that are high risk. This is by design. If you pick 10 stocks 7 are below market average 2 go out of business and 1 hits 100x you've just destroyed the market. You can just as easily not hit that 1 and lose. If you...

Ben, I think most people's advice is pretty accurate. I subscribe to the Motley Fool basically to find new stocks to research. Over the years they have generally picked stocks that are high risk. This is by design. If you pick 10 stocks 7 are below market average 2 go out of business and 1 hits 100x you've just destroyed the market. You can just as easily not hit that 1 and lose. If you want to be an active investor you A) need to do a lot of research B) you need to have conviction and intestinal fortitude and C) you need to hope you're right. The best thing to do is index and if you really want to invest in a few companies you really love (I'd recommend it NOT be an airline) a small percentage of your portfolio (1-10%) dollar cost averaged over time is a smart way to do it. Cheers

For what it's worth, I did it back in February when I needed the LPs to keep my status. Was the same $79, 6200 mile deal.

Just keep investing in index funds. Warren Buffett, one of the world's greatest stock pickers, recommends that pretty much every individual investor should do just that.

They're low cost, tax efficient, and have consistently out-performed actively managed mutual funds (which are just investment experts picking individual stocks) for decades. Best of all, they're easy. Just set your Vanguard (or Fidelity or whichever other low-fee index fund or ETF provider you like) to auto-invest and...

Just keep investing in index funds. Warren Buffett, one of the world's greatest stock pickers, recommends that pretty much every individual investor should do just that.

They're low cost, tax efficient, and have consistently out-performed actively managed mutual funds (which are just investment experts picking individual stocks) for decades. Best of all, they're easy. Just set your Vanguard (or Fidelity or whichever other low-fee index fund or ETF provider you like) to auto-invest and forget it. (Also, make sure to take advantage of tax advantaged accounts. As self-employed person, you can stick a ton of money in a Solo 401(k), which is a great deal.)

Motley Fool has given some seriously bad advice over the years. They wrote a whole book called "The Foolish Four: How to Crush Your Mutual Funds in 15 Minutes a Year" in the late 1990s about investing in certain dividend stocks in the Dow. It turns out that index mutual funds totally crushed their strategy, and they had to retract it.

They're really not a product worth endorsing.

@Ben, I hope you will seriously consider this advice and the advice of others... don't do this. You have three options:

1. Keep investing in index funds. But, you really should diversify to include fixed income including bonds and bond funds are problematic in a declining, market. So, you'd really want individual bonds.

2. Hire a broker from a reputable firm like Morgan Stanley, Fidelity or whichever one you feel good about -- it's about...

@Ben, I hope you will seriously consider this advice and the advice of others... don't do this. You have three options:

1. Keep investing in index funds. But, you really should diversify to include fixed income including bonds and bond funds are problematic in a declining, market. So, you'd really want individual bonds.

2. Hire a broker from a reputable firm like Morgan Stanley, Fidelity or whichever one you feel good about -- it's about the person, not the firm. The purpose is not because they can beat the market, but because they can build you a portfolio that meets your risk criteria and is appropriately diversified. Yes, they are expensive, but I firmly believe my broker keeps me from doing dumb things. He also doesn't always do as well as a rising market, but he always beats a declining market.

3. Spend 40 hours a week studying the market... and still probably make bad picks. I have a small amount of money I play with. I made one good pick - Apple in 2001 and a dozen terrible ones. Apple paid off handsomely, but it could just as easily been a loser too.

Please don't invest your money based on Motley Fool picks.

Also, as someone who is self-employed you can invest a TON of money tax-deferred. I hope you're doing that, as that's the best return of all!

Ben, I highly recommend the article "Not even God can beat dollar-cost averaging" on "Of Dollars and Data" (dot com). My cousin who used to work on Wall St sent that to me some years ago, and it was the best investment advice I ever got.

I signed up for the MF offer purely for the LPs/RDMs. Even then, I'm pretty annoyed with them. They *immediately* and aggressively started trying to get me to pay...

Ben, I highly recommend the article "Not even God can beat dollar-cost averaging" on "Of Dollars and Data" (dot com). My cousin who used to work on Wall St sent that to me some years ago, and it was the best investment advice I ever got.

I signed up for the MF offer purely for the LPs/RDMs. Even then, I'm pretty annoyed with them. They *immediately* and aggressively started trying to get me to pay *even more* for their "tHiS iS tHe ReAL oNe PrOmIsE" bundle. And then above that bundle, there's an even more expensive one! They just keep relentlessly trying to suck more money out of you, and FOMO is a real force that makes people pay up.

I can't speak for their stock picks (I haven't bothered to read any) but their business practices are shady AF. I can't recommend enough that you steer clear of their investment advice.

motley fool is junk.

Citi Merchant offers has a 20% deal for The Motley Fool on at least one of my cards.

Just make like 10% of your investable money 'play' money to go on your hunches. The rest keep diversified in low cost funds.

Motley Fool has almost zero serious value add for investors.

I'm sure some of your readers are also good financial advisors / planners.

Yes , but the “play money” is not for everyone as it can be time consuming and a waste of energy.

“Not even looking at it “ is good long term investment advice.

I got a late start in investing ; my early 40s. I have one large cap equity and one digital asset. That is all. My long term outlook is 15 yrs. I do swing trade a small percentage of my position buying dips and selling rips on a small percentage of the stock.

Just pick a couple total stock market index funds like an 80/20 mix of VTI and VXUS. The problem with just using an S&P 500 index fund is you are only getting exposure to the largest companies. What about years when small cap or international outperforms? For 95% of people in their 20s/30s/40s and probably even well into 50s it can be as simple as that. Layer in a little bit of BND for bond exposure later in life, but being too conservative is a risk itself.

The Motley Fool is worthless.

I made the mistake of subscribing to them years ago - it basically was free after an AMEX offer....and I still got ripped off! LOL

Their stock picks are hot garbage, and they try to cover their ass by saying "you need to hold it for 5 years before you can evaluate it."

The price/LP isn't bad....just don't compound the the price by buying the crappy stocks they recommend.

Sorry - just saw it is down to 3700 LP

Now a SOLID "no thanks" from me!

95% of people should not be actively investing. Use a low cost etf structure and dca your investments every time you get a paycheck. The only thing I change is how much I contribute based on how I think the market is overvalued / undervalued at the time. I pile in consistently. If most money managers can’t beat the index, we have no chance.

If you do decide to invest despite the odds, Motley fool...

95% of people should not be actively investing. Use a low cost etf structure and dca your investments every time you get a paycheck. The only thing I change is how much I contribute based on how I think the market is overvalued / undervalued at the time. I pile in consistently. If most money managers can’t beat the index, we have no chance.

If you do decide to invest despite the odds, Motley fool is not where I would do any research. Use an established broker with research embedded into the platform. (Schwab, etrade, MS of JPM if you can afford it)

Offer no longer available, down to 3,700

Stick with the S&P 500 ETF.

Your business is points & miles writing / referral harvesting.

Trying to beat the market long term as a regular Joe is a fool’s game.

If you want to take a chance and wait, last summer it was 7400-7500 miles. I'm not sure if the price was only $79. Maybe $99?

I got 7500 miles for $79 Back in Sept 2022, I am interested in using this promo again but as it says one loyalty acct per year i'm taking the chance waiting.

Hi Ben, I highly recommend just putting your money in a few ETFs and not thinking about it.

Don't be an active investor. You won't "win" and you'll waste a lot of time, and add a lot of stress to your life.

You and Ford have a kid now; you have much better ways to spend your time.

Ben just wants the LPs. No need to bullshit and make pretend you are interested in investing.

I think the deal expired . . . Can't seem to find it anymore. It was a great deal.

Presuming you have a Schwab or similar account, you can do a lot of research there. I'm not a big fan of index funds, I figure with the amount of time I spend on planes I can do sufficient research to figure stuff out for myself. So far so good. But only by a couple of percent or so.

Even better if you are already at 100k LPs and can get a 30% bonus!

Motley Fool mostly provided me good advice. I didn't use it as they recommend, buying 15 equities, holding for years. I made short term plays and sold most at a profit. My experience was modestly profitable and the advice was invaluable. I hate paying attention to my real investments, when instead I could be focusing on points and miles LOL.

Never ending question? I'm guessing you meant never ending quest.

I did it for the miles a few months back, and it was sort of a mistake. You can unsubscribe from most of their emails but their "Stock Picks" are literally un-unsubscribable. Whenever you go to the manage emails page, it keeps saying those emails are "Included with your membership!" with no way to cancel

I am a financial advisor and will gladly help!

Motley Fool is to finance what TPG is to travel.

Friends don't let friends rely on Motley Fool for investment advice.

Vanguard is your friend. Index funds are your friends (VTSAX, VFIAX).

Motley Fool is useful for 6200 miles, that's about it.

@ ACKER -- LOL, well when you put it into terms that simple/relatable, I guess I should steer clear. ;-)

Motley fool advice is right, slightly more than half the time. I've had success short-term with some companies they recommended long-term. Comparing them to TPG is silly. On the merits, many of their recommendations are good and cautiously dipping in one's toe, then wading in to mid-calf, the advice is useful. I find points/miles endlessly engaging and "the market" mind-numbingly tedious, so having this crutch is worth a small expense. I'd certainly do worse without...

Motley fool advice is right, slightly more than half the time. I've had success short-term with some companies they recommended long-term. Comparing them to TPG is silly. On the merits, many of their recommendations are good and cautiously dipping in one's toe, then wading in to mid-calf, the advice is useful. I find points/miles endlessly engaging and "the market" mind-numbingly tedious, so having this crutch is worth a small expense. I'd certainly do worse without them.

@Ben - this is the best comment on the thread. I cosign completely.

I believe there was a higher bonus (via Rakuten?) earlier this year, so it isn't the "all time highest SUB", so to speak

Amex also frequently has offers for Motley Fool, so I'd check there for a stacking opportunity.

Buyer beware with Motley Fool... "Expert" advice is a loose term. Yes, they pick sticks for a living, but their research always seems to be pretty superficial and they've picked some serious stinkers (i.e. SKLZ was one of their "must buys" at ~$35 - you can Google the price history there).

You are much better off with...

Amex also frequently has offers for Motley Fool, so I'd check there for a stacking opportunity.

Buyer beware with Motley Fool... "Expert" advice is a loose term. Yes, they pick sticks for a living, but their research always seems to be pretty superficial and they've picked some serious stinkers (i.e. SKLZ was one of their "must buys" at ~$35 - you can Google the price history there).

You are much better off with index funds and other similar ETFs or Mutual Funds. If you want to rely on motley fool, just give yourself some cash that you delegate for "playing" around with.

@ pstm91 -- Thanks for the feedback. Obviously they're not always going to get everything right, and you shouldn't go all-in on one stock (and ugh, the SKLZ situation is ROUGH). Motley Fool claims to have a 3x better return over the past 20 years than the S&P 500 (492% vs. 129%). I'm curious, is there some major "gotcha" I'm missing there?

You’re young. Play around with thinking you can pick stocks and motley fool. Then graduate to bogleheads and wish you had earlier. Nobody knows nothing, Ben.

There's no "gotcha" with them, and they seem like decent enough guys. Of course not every pick will hit, but ACKER's comparison to TPG is spot on. I subscribed a few years ago just because there was a big Amex offer on it and I got it reimbursed through my job at the time. I was really turned off by the overall approach, the cheesy videos and blogs, constantly touting their hits while barely acknowledging...

There's no "gotcha" with them, and they seem like decent enough guys. Of course not every pick will hit, but ACKER's comparison to TPG is spot on. I subscribed a few years ago just because there was a big Amex offer on it and I got it reimbursed through my job at the time. I was really turned off by the overall approach, the cheesy videos and blogs, constantly touting their hits while barely acknowledging their misses. Stick to funds and you'll be much better off long term and won't have to worry about it on a day to day basis. Long-term, passive investing out earns day trading by a huge margin (obviously there are outliers).

https://www.bizjournals.com/washington/news/2019/05/02/the-motley-fool-is-putting-together-a-hedge-fund.html

Lucky, the Motley Fool is a hedge fund, they recommend stocks that benefit their own investments

Is this a once in a lifetime benefit? Can one subscribe if they previously had the service but canceled 4 years ago?

@ Robert -- The terms suggest you can only get one subscription offer per loyalty account per year, so based on that, it seems to me like this should be repeatable? The $79 offer seems to be for new users, though if you use a different email address I don't think they'd have any way of tracking that? For that matter, I'm not sure they'd even care.