It’s an exciting day for the Citi ThankYou program, as a new transfer partner has just been added!

In this post:

Transfer Citi ThankYou points to American AAdvantage

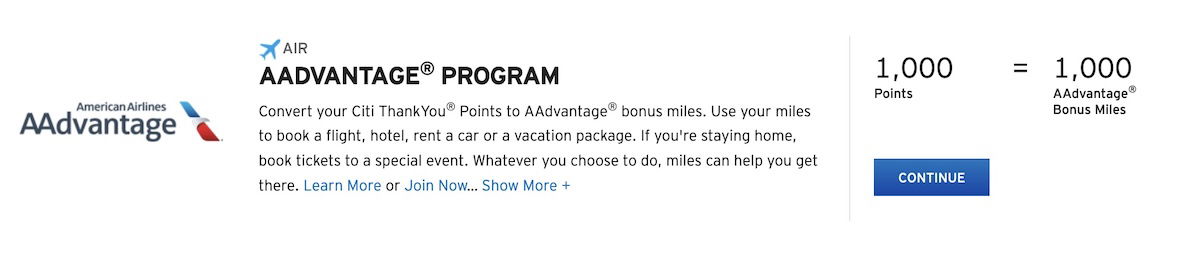

Effective immediately, the American AAdvantage program has been added as a Citi ThankYou transfer partner.

If you go to Citi’s website for points transfers, you’ll now see this functionality live, with transfers being possible at a 1:1 ratio. I just made a transfer, and points moved over instantly.

We had reason to believe that this was coming. In late 2024, American and Citi announced an expansion of their partnership, whereby Citi will become the exclusive issuer of AAdvantage co-branded credit cards in the United States, meaning that American is dumping Barclays.

This development goes beyond just American’s co-branded credit cards, as we’re also increasingly seeing American integrated into Citi’s own ThankYou portfolio. This is a major update, since Citi not having American AAdvantage as a ThankYou transfer partner up until now has been a weak point of the program. Looking at the US airline industry:

- Delta has a longstanding partnership with American Express, and SkyMiles has been a Membership Rewards transfer partner

- United has a longstanding partnership with Chase, and MileagePlus has been an Ultimate Rewards transfer partner

We know that the agreement between Citi and American is becoming closer, so clearly integrating AAdvantage into the ThankYou ecosystem was a big part of that. This is super exciting for cards earning Citi ThankYou points, like the Citi Strata Premier® Card (review), plus the newly launched Citi Strata Elite Card.

This is a huge boost to the Citi ThankYou ecosystem

If you ask me, among the “big three” US airlines, American AAdvantage miles are by far the most valuable. American has excellent premium cabin redemption rates on partner airlines, and often also has reasonably priced awards on its own metal.

Now, admittedly AAdvantage miles aren’t as useful as they used to be:

- American now has dynamic award pricing for travel on its own flights, and we’ve seen the cost of many award types creep up over time (for example, one-way transatlantic business class awards on American metal now generally start at 75,000 miles, rather than the previous 57,500 miles)

- While American continues to have excellent award costs on partner airlines, the catch is that partner airlines are increasingly restricting their award space to members of their own programs, which is sort of an unofficial devaluation

Still, there are all kinds of situations where there’s big value to be had when redeeming AAdvantage miles, so I’d consider this to be phenomenal news, and I think it’s a big reason to get involved in the Citi ThankYou ecosystem.

To play devil’s advocate, one certainly wonders what impact this development will have on the value of AAdvantage miles. With American having another revenue stream for monetizing its AAdvantage program, will that make American likely to devalue its mileage currency more?

After all, Delta and United have allowed points to be moved from partners, and neither program is exactly known for great redemption rates, so…

Bottom line

It’s now possible to transfer Citi ThankYou points to American AAdvantage, which is an exciting development. We had reason to believe that this was going to happen, given that Citi and American announced a closer partnership late last year, and this is a logical aspect of that.

While AAdvantage miles aren’t quite as valuable as they used to be, this is still positive, as there are lots of solid uses for these miles. I hope this doesn’t lead to further devaluations of the currency, but…

What do you make of American AAdvantage being added as a Citi ThankYou partner?

Transfer and burn burn burn. Devaluation incoming

Glad I used up all the miles bought years ago during a promotion that gave 240 aadvantage miles per dollar donated to some charity. Bought over a million miles for something like 5k

And goodbye beloved redemption for qatar or etihad for one way us/india business class awards at 70k miles (110 for first if unicorn available)

nooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooo. Why why why why why???

We see now a split in the transfer ratio for cards like custom/double cash versus the Strata cards (with a fee). This sounds strange compared to the ability to convert cashback from custom/double cash to Thank You Points with a Strata card and then transfer with the better ratio?!

Please check/explain.

As a long-time Citi Prestige cardholder with a bunch o' Thank You points, I welcome this transfer option as AAdvantage points have been by far my most valuable redemptions this year. But if everybody is somebody, nobody is anybody, and I fear our goose is cooked.

AA was due for an inevitable devaluation. This will only accelerate it

Bye bye saaver tpac JL awards, I never got to know ye.

Oneworld is my preferred alliance, but I shifted from AAdvantage to QR Privilege Club when AA modified their loyalty program. The path to PP had become too costly. I was fortunate to burn those miles on a few JL J flights, and an F flight from JFK. There has been a dearth of JL award flights with AA since. The transferability within the Avios sub-alliance has me thinking I made the right move.

I hope the devaluation won't be too bad. None of my friends who are into cc points have significant citi ty balances. We all have way more amex and chase points due to spend and sub churn.

It would be interesting to see the total outstanding points in each program. I think your intuition that Citi is way less than the other two is correct, but who knows.

Rest In Peace

AAdvantage

1981-2025

It's interesting how Ben basically whispers the message in the room, devaluation, which we know is now coming. In fact, it confirms the viability of this to AA. So AA will become a program like any other and with a subpar product offering to boot.

If the prices which Citi purchases miles from AA is high enough, there is no reason for AA to kill the cash cow by devaluing AAdvantage, especially AA desperate for cash now.

i love the cries of "deval!!!!!" so that ordinary people can transfer 100k points or whatever but when gary leff psychotically bought 30M AA miles there was no devaluation? make it make sense please

I love the folks who think these gigantic corporations just have no savvy or foresight when it comes to their own loyalty programs. Y'all think AA is going to get blindsided by a flurry of JL F cabin redemptions and decide to deval? They know exactly what they're doing and they've had a long-term strategy since before you gave it a second thought. It's not 2007 anymore. Earn and burn. Be flexible. Adapt or die....

I love the folks who think these gigantic corporations just have no savvy or foresight when it comes to their own loyalty programs. Y'all think AA is going to get blindsided by a flurry of JL F cabin redemptions and decide to deval? They know exactly what they're doing and they've had a long-term strategy since before you gave it a second thought. It's not 2007 anymore. Earn and burn. Be flexible. Adapt or die. If the hobby doesn't work for you like it used to, well that's life, kids.

Totally understood now why the .10 Rewards+ transfer bonus was nerfed

And that is the end of the AA partner chart.

This is not a good day. The end of the walled garden has made me completely rethink whether or not to keep the Citi Exec card and play in the AA loyalty system. This is a very big devaluation.

The cheapest I see for this year JFK-LHR in business is 70k in August, then generally 100k and up until February, when you start to see 65k dates. Pretty brutal. I suppose there are still a...

This is not a good day. The end of the walled garden has made me completely rethink whether or not to keep the Citi Exec card and play in the AA loyalty system. This is a very big devaluation.

The cheapest I see for this year JFK-LHR in business is 70k in August, then generally 100k and up until February, when you start to see 65k dates. Pretty brutal. I suppose there are still a number of BA 57.5k if you are willing to pay the even more brutal surcharges. LHR-JFK one way pricing out at $846! OMG.

I built a small bank (~300k) of TY points in anticipation of this, but I guess I didn't build enough of one based on the values I'm seeing.

For those of us who a) read your blog and b) saw this coming over the last few months, we knew where this was going. But the values that I was able to book with AA even earlier this year have now completely evaporated. Hopefully this lands at something that looks more like United's program versus Delta's, but the value is gone, and AA is certainly not "premium enough" yet to justify the loss in value.

You don't make sense.

If you already see "Pretty brutal" or "even earlier this year have now completely evaporated" before this transfer opportunity then the devaluation has nothing to do with Citi.

Sure and firing Colbert had nothing to do with a merger getting approved one week later. It’s not that hard to link two things that happen at slightly different times.

If you do a flight to mainland Europe through LHR, a lot of them are 57.5k. I think it’s because there is an added BA flight so it codes as a partner award. It doesn’t have the crazy taxes and fees though.

It has some taxes and fees (just did this exact thing for a flight I took last week - $70 or so in fees versus $5.60) but much more reasonable. You may have to transfer airports over to LCY (although I think this is a feature not a bug if you can build in a 24 hour stopover in London). But agree still value to be had there versus to and from LHR. Doesn’t help, however, when you actually want to go to London.

I mean… if you just have carry on, you can get off. Just don’t do it frequently.

Not my style. Especially not traveling with the family.

That said I actually enjoy the BA city flyer business service. The food is hot and good, there is champagne, and if you sit in the first row on the right side (row 2) you get unlimited legroom.

Big changes for Citi Double cash too- Qantas, Cathy, Eva, etc all transfer partners. not AA though.

Hi Ben - Does this only apply to Citi in the US, or will it likely roll out to other countries where Citi has a retail credit card offering?

@ RA -- So far it only applies to the US market, and frankly, I'd be surprised if extends to other markets.

Selfishly, it is not good news for us who have sizable AA miles from having a Bask AA mile earning account. Now we have to compete with a lot more people for the same number of award seats.

Some people said the same thing about you.

Selfishly, it is not good news for us who have sizable AA miles from flying. Now we have to compete with a lot more people with Bask AA mile earning account for the same number of award seats.

Devaluation incoming.

Be ready to have your 57,500 miles to Europe be starting at 97,500 now.

I used to consider Citi ThankYou points less valuable than either Chase or AmEx points. This changes everything. I now consider ThankYou points to be the most valuable, at least for the time being. Until AA devalues its program, that is.

With the increased fees for Chase Sapphire Reserve (new numbers just don't work for me anymore) planned to move a great deal of my credit card activity from Chase to Citi and Wells Fargo (3X on cruise fare). This change - CITI Thank You to AAdvantage makes the path much more clear!

I fly economy when the Premium Econ and Business awards are dynamically not worth it. American regularly has solid availability from US east...

With the increased fees for Chase Sapphire Reserve (new numbers just don't work for me anymore) planned to move a great deal of my credit card activity from Chase to Citi and Wells Fargo (3X on cruise fare). This change - CITI Thank You to AAdvantage makes the path much more clear!

I fly economy when the Premium Econ and Business awards are dynamically not worth it. American regularly has solid availability from US east coast to Europe in Economy under 30K with fees often less than $10.

Thanks for reporting on this Ben.

Is it possible to transfer Aadvantage miles to Citi thank you points ?

@ D3SWI33 -- Unfortunately not, transfers only work in one direction.

I just tried but got an error message.

@ CDKing -- Since this appears to be brand new, maybe give it a few hours or a day, and it will likely work. Like I said, I had luck just making a transfer, but it's possible that some maintenance is still being performed.

Bummer they aren't keeping Accor @ 1:1 !

@ vic -- Heh, yep, sadly I think that would be too good to be true.