I’ve explained many times in the past how you’re best off accruing transferrable points currencies. They give you a lot more flexibility than “fixed” points currencies, as you can transfer them to any of a number of airline or hotel transfer partners.

The benefit is that you’re basically hedged against devaluations. If you collect points in a specific mileage program and they’re devalued, the value of your miles could decrease significantly overnight. However, with transferrable points currencies you aren’t really tied down to one transfer partner, so you’re more protected in the event of a devaluation.

But flexible points currencies don’t just have airline and hotel transfer partners, but in many cases you can redeem the points directly towards the cost of a paid airline ticket on any airline.

With that in mind, I figured I’d compare the rates at which you can redeem points with the three “big” bank-issued transferrable points currencies — American Express Membership Rewards, Chase Ultimate Rewards, and Citi ThankYou Rewards.

Here’s a quick rundown of the current situation:

- Citi Strata Premier℠ Card — each point can be redeemed for 1.0 cents towards the cost of an airline ticket

- Citi Prestige® Card — each point can be redeemed for 1.0 cents towards the cost of an airline ticket

- Chase Sapphire Preferred® Card — each point can be redeemed for 1.25 cents towards the cost of an airline ticket

- The Business Platinum Card® from American Express — each point can be redeemed for 1.54 cents towards the cost of a ticket on a designated airline (see below for further explanation, as it’s not that straightforward)

- The Platinum Card® from American Express — each point can be redeemed for 1.0 cent towards the cost of an airline ticket

American Express Membership Rewards

While I value American Express Membership Rewards points at ~1.8 cents each, there’s no way to redeem those points for anywhere close to that amount for paid air travel.

If you have The Platinum Card® from American Express or The Business Platinum Card® from American Express then you can redeem Membership Rewards points for a penny each towards the cost of air travel.

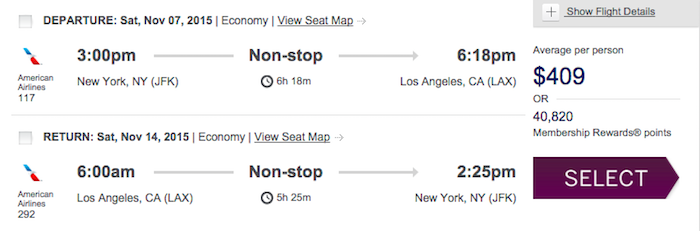

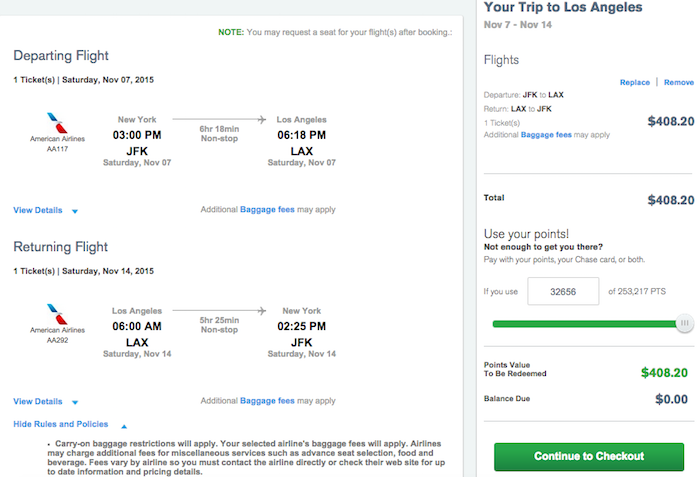

For example, the below ~$410 roundtrip flight between New York and Los Angeles would cost you ~41,000 Membership Rewards points.

When you factor in a 35% refund on redeemed points with The Business Platinum Card® from American Express, you’re really getting about 1.54 cents per Membership Rewards point. In the above example you’d be refunded ~14,000 Membership Rewards points, bringing the cost of the ~$410 redemption down to ~27,000 Membership Rewards points.

Redeeming Membership Rewards points through the business card for paid travel on a designated airline isn’t a terrible value when you factor in the 35% refund, but it’s still not how I’d choose to redeem points most of the time.

Chase Ultimate Rewards

Chase Ultimate Rewards, the currency issued by the Chase Sapphire Preferred® Card, is a bit more straightforward. Each point gets you 1.25 cents towards the cost of a travel purchase. So that same ~$410 ticket would cost you ~33,000 Ultimate Rewards points.

Personally, I value Ultimate Rewards points at ~1.8 cents each, so it’s not how I’d choose to redeem them. However, it’s certainly better than the “standard” redemption rate offered when paying with Membership Rewards points.

Citi ThankYou Rewards

I value Citi ThankYou points at ~1.7 cents each. Historically, it used to be possible to redeem ThankYou points for upwards of 1.6 cents per point. However, that benefit is no longer available and points can now be redeemed for 1.0 cents each. Therefore, this is no longer a method I’d recommend.

If you really want to redeem points towards paid airline travel…

In general if your goal is simply to accrue a points currency which can be used towards the cost of paid airline travel, then you might seriously want to consider the Citi Double Cash® Card. It’s a straight cash back card, which offers 1% cash back when you make a purchase, plus 1% cash back when you pay for that purchase (in the form of ThankYou points).

That’s basically the equivalent of 2% cash back, which is tough to beat for a no annual fee card. And that’s cash, so you can redeem it however you’d like.

Bottom line

Overall, I do think American Express Membership Rewards points and Chase Ultimate Rewards points are slightly more valuable than Citi ThankYou points (thanks to the more useful transfer partners).

While I’m typically a pretty “aspirational” traveler when it comes to earning miles, there are certainly times where it can make a lot of sense to use transferable points to pay for a flight directly.

Are there any transferrable points currencies that you redeem for paid travel? If so, which ones?

@DCS I know you accrue in one program only, that wasn't my point. My point was that much of this blog is geared towards accruing points through spend. It's great that you are in a position where you can earn points through traveling.

That being said, I'm surprised you earn points through co-branded United credit cards rather than the Chase Sapphire preferred. You'd earn the same number of United miles for travel on United, plus...

@DCS I know you accrue in one program only, that wasn't my point. My point was that much of this blog is geared towards accruing points through spend. It's great that you are in a position where you can earn points through traveling.

That being said, I'm surprised you earn points through co-branded United credit cards rather than the Chase Sapphire preferred. You'd earn the same number of United miles for travel on United, plus more points on other spend (i.e. non-United travel and meals). Plus, you'd have the option to transfer to other programs if needed. Maybe I'm missing something here? Unless you have the United Club card and really value access to United Club.

I recently used some TY points to book a "mileage run" on AA. I'm chasing Platinum status, so getting a "free" flight that will earn me 15,000 EQMs is a great deal!

How much do you value TY points transferred to Singapore Airlines and used on Star Alliance flights?

@ Tom -- Of course it depends on the specific redemption, but in general I value KrisFlyer miles at ~1.5 cents each.

@Lucky -- Fair point...

*nice typos... Really have to stop making comments from my phone with swype.

@Lucky

Continuing along:

The EDP+Plat method beats the return rate of the venture, arrival, and double cash at its worst return rate of 2.14cents/pts when redeemed at cash on the Amex travel site.

I admit there is airline lock in - but it can be changed every year.

Furthermore it allows for a max return on groceries of over 6 cents/point, still gives the option to use multiple airline FF programs, use FHR...

@Lucky

Continuing along:

The EDP+Plat method beats the return rate of the venture, arrival, and double cash at its worst return rate of 2.14cents/pts when redeemed at cash on the Amex travel site.

I admit there is airline lock in - but it can be changed every year.

Furthermore it allows for a max return on groceries of over 6 cents/point, still gives the option to use multiple airline FF programs, use FHR and still get lounge access which a single card solution of the venture, arrival or double cash can't offer.

Doing the math the annual fee is covered and a profit over the other cars is started at 16k in spending without using any bonus category spending which would do that number by a factor of 3 to <6k out what can be archived in just the grocery bonus alone.

Note I realize this does not work for your spending as someone living in a hotel. However the PRG+Plat gives the same type of earning to someone who is a heavy airfare, and restaurant person. The break even point though is a bit higher at 20k annual spend. But it still covers the fee, gives the option of points as cash or point to FF programs plus FHR and Lounge access.

So the question is, if spend more than 20k per year do you want a return of 2.1cents/$ as a flat rate, or do you want 2.14 cents/$ up to 6 cents/$ with centurion lounge access, FHR perks, and the option to use aware tickets if they are available? I think it's worth the hassle.

In all honesty you really are not doing the Member Rewards system justice. The real combination for this type of redemption b is to use:

Everyday Preferred for at worse 1.5pts/$

Platinum Business for 30% point rebate.

This means 1.5*1.43 for about 2.14 cents per dollar beating the arrival and the Venture cards as well as all other competitors in this space.

@ Vinhsynd -- Good point. I agree that's not bad, though the Citi Double Cash Card gives you 2% cash back, and doesn't require you to go through the hoops of having two cards with annual fees, doesn't limit you to one airline, and doesn't achieve that rate with a refund which posts retroactively. Otherwise totally agree.

@Brad -- I diversify primarily on hotel points because there are places -- mostly overseas -- that have no Hilton presence (e.g., Ho Chi Minh City or Taipei or Manila) but have Hyatt or Marriott hotels. So, I tend to accrue Hyatt GP points through revenue stays, especially when there is a nice promo, or I would transfer some UA miles to Marriott through the RewardsPlus program (very poor transfer rates but I usually have...

@Brad -- I diversify primarily on hotel points because there are places -- mostly overseas -- that have no Hilton presence (e.g., Ho Chi Minh City or Taipei or Manila) but have Hyatt or Marriott hotels. So, I tend to accrue Hyatt GP points through revenue stays, especially when there is a nice promo, or I would transfer some UA miles to Marriott through the RewardsPlus program (very poor transfer rates but I usually have had more miles than I've needed so I could afford it) to enable me to redeem stays at Hyatt or Marriott hotels in those rare cities without a Hilton property...

For miles, I earn everything exclusively in United miles, both through paid travel and co-branded credit card spend.

@DCS Good point, but a large portion of this blog is geared towards earning points on spend. Not to mention, it's always nice to have some flexibility. I focus my earn in a few select programs, but I still like to earn occasionally in other areas. It can come in handy in a pinch if you can't find availability in your preferred program.

Aren't Citi TY points redeemable at 1.6 cents on ANY airline that AA/US codeshare switch?

@ Pete -- Correct, but it would actually need to be booked as a codeshare. In other words, American codeshares with plenty of airlines, but not on all routes. That means you couldn't necessarily redeem at 1.6 cents per point for every flight on British Airways, Qatar, etc.

@Lucky sez dogmatic: "I’ve explained many times in the past how you’re best off accruing transferrable points currencies. They give you a lot more flexibility than “fixed” points currencies, as you can transfer them to any of a number of airline or hotel transfer partners."

I have little use for this strategy nor do many others who earn most of their hotel points/air miles through revenue stays/flying. Such folks just pick a hotel loyalty program...

@Lucky sez dogmatic: "I’ve explained many times in the past how you’re best off accruing transferrable points currencies. They give you a lot more flexibility than “fixed” points currencies, as you can transfer them to any of a number of airline or hotel transfer partners."

I have little use for this strategy nor do many others who earn most of their hotel points/air miles through revenue stays/flying. Such folks just pick a hotel loyalty program and FF program and accrue points and miles in those programs' "fixed" currencies. I have no need to transfer points/miles to any other program because I earn plenty of either within my preferred hotel and airline loyalty programs. It is barely July and I have already accumulated ~600K HH points on my way to 1M+ points for the year, after depleting the bank last year, and I will end up with some 500K UA miles for the year, which I will be able to use for award travel to anywhere by redeeming on any of the 27 Star Alliance carriers without transferring a single mile.

So, rather than pushing your usual dogma, maybe you should include the caveat that one is "best off accruing transferrable points currencies" IF ONE EARNS MOST OF THEIR POINTS THROUGH CREDIT CARD SPEND... ;-)

@ DCS -- Sorry, I think that sort of goes without saying, no? You can't accrue a transferrable points currency for flights or hotel stays...

But are there rules about expiration when you combine?

@ Kate -- Indeed, under certain circumstances. See here:

https://onemileatatime.com/can-you-transfer-citi-thankyou-points-to-others/

Having had (and still do) a massive amount of airline cards, as well as the UR line of cards, I actually see the best value in buying tickets (usually domestic economy on AA/US) with the Prestige card. Getting the in-branch version for $350 p/y makes keeping the card after the first year a no brainier. Couldn't say that for the Amex Plat card, simply not worth the fee anymore.

That was a great opening statement for the article. It almost sounds like you're scolding us! LOL

So tangentially reassured question. Hotels booked using Citi TY (eg premier) points- do they count as qualifying for elite / points at all chains?

Additionally, are the rates displayed on citi thank you rewards website as good as you can get? Looking at some future options, I see they have the same standard, refundable rate as the chain itself. However, the chain has a 25% off rate for prepaid that citi doesn't show. Anyone ever...

So tangentially reassured question. Hotels booked using Citi TY (eg premier) points- do they count as qualifying for elite / points at all chains?

Additionally, are the rates displayed on citi thank you rewards website as good as you can get? Looking at some future options, I see they have the same standard, refundable rate as the chain itself. However, the chain has a 25% off rate for prepaid that citi doesn't show. Anyone ever had any luck getting citi to match by calling?

@ Bluehorseshoe -- Generally speaking Citi will just show the best "daily" or "published" rate, and not any promotional rates, unfortunately. The stays should qualify for points and stay credits, though.