For the major transferable points currencies there are generally two best ways to redeem points. You can transfer them to an airline or hotel partner (largely to get outsized value for aspirational redemptions), or you could redeem them as cash towards the cost of a travel purchase.

Regarding that second way to redeem points, reader John asked me the following question by email:

My suggestion is to compare the following which I have been using for some time:

1. AMEX Business PLT and AMEX Everyday Preferred Card for Airline Pay with Point using 35% bonus and assuming 1.5 on Everyday Spend for travel when award travel is not available.

versus below which I have not been doing.

2. Chase Sapphire Reserve and Freedom Unlimited On all spend at 1.5, earning $2.25 for travel spend via Chase UR.

I have read your posts lately on the Chase Strategy and this seems to be much more advantageous than the AMEX option if I am reading this correctly.

I love both of these strategies especially when award space is not available.

The Amex strategy

John outlines the method he uses to redeem points as cash towards the cost of a travel purchase. Generally speaking, Amex only lets you redeem points for one cent each towards the cost of a travel purchase, though there’s a strategy you can use to do better than that.

If you have The Business Platinum Card® from American Express and use the Pay with Points feature, then you can get up to 35% of those points back. There are a couple of restrictions to be aware of:

- You can only get back 1,000,000 points per year

- The only types of tickets that are eligible for this are first and business class tickets on all airlines available through American Express Travel, as well as any fare class with your selected qualifying airline (you can choose one airline for that per year)

Keep in mind that the 35% points are refunded after the fact. That means a qualifying $1,000 ticket would cost you 100,000 points, but then you’d get 35,000 points back. Your cost in the end would be 65,000 points, which is the equivalent of 1.54 cents per point.

What John does is use The Amex EveryDay® Preferred Credit Card from American Express, which offers a 50% points bonus when you have at least 30 qualifying transactions per billing cycle.

That means with this card combo you can earn 1.5x points per dollar spent in non-bonused categories, and you can in the end get 1.54 cents of value per point, for a total return of up to ~2.3 cents per dollar spent in non-bonused categories.

The information and associated card details on this page for the Amex EveryDay Preferred Credit Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

The 35% rebate applies for all first and business class tickets bookable through Amex Travel

The Chase strategy

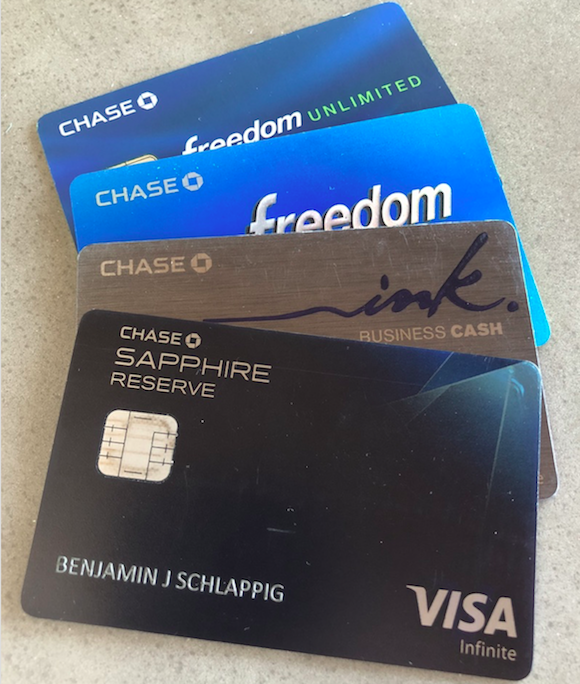

The strategy I often talk about is what I consider to be the best credit card duo for maximizing everyday spend. I’m talking about the Chase Sapphire Reserve® Card and Chase Freedom Unlimited®.

The Freedom Unlimited offers 1.5x points per dollar spent, and if you have the Sapphire Reserve then points can be redeemed for 1.5 cents each towards the cost of a travel purchase. That means if you have the two cards you’re looking at a return of 2.25 cents per dollar spent in non-bonused categories.

The other great thing is that thanks to the Chase Ultimate Rewards ecosystem, there are several other small business and personal cards you could use to maximize your return on spend.

Redeeming points towards the cost of a travel purchase can be a great deal for domestic travel

So, which strategy is better?

Obviously there’s no “one size fits all” strategy. On the most basic level, I think it’s important to consider the overall value proposition of the points currency to you. While I value Amex and Chase points roughly equally, different people value one points currency significantly more than another. Maybe you value Chase points more because you like that they have Hyatt and United as partners, or maybe you value Amex points more, because they have Aeroplan and Delta as partners.

Being able to redeem points as cash towards the cost of a travel purchase can be part of a larger overall strategy.

Other than that, I do think Chase has an overall advantage in terms of being able to redeem points towards the cost of a travel purchase. On the surface Amex may seem better, since I talked about getting 1.54 cents of value per point rather than 1.5 cents of value per point. However:

- With Amex you’re limited to redeeming on select airlines, while with Chase you can not only redeem for virtually any airline, but you can even redeem for hotels, car rentals, and more

- With Amex you get reimbursed 35% of the points after the fact (and it takes several weeks) with limits, while with Chase you just get the better price to start

- With the Amex EveryDay Preferred you need to make 30 transactions per billing cycle to activate the 50% bonus, while with the Chase Freedom Unlimited you get the same return no matter how many purchases you make

- With Chase you can potentially have the Chase Sapphire Reserve® Card (which offers triple points on dining and travel) and then add four no annual fee cards to maximize your points:

- The Chase Freedom Unlimited® offers 1.5x points per dollar spent

- The Chase Freedom FlexSM offers 5x points in rotating quarterly categories

- The Ink Business Unlimited® Credit Card offers 1.5x points per dollar spent

- The Ink Business Cash® Credit Card offers 5x points on the first $25,000 of combined purchases per cardmember year on office supply stores, internet, cable TV, mobile phones, and landlines, and 2x points on the first $25,000 of combined purchases per cardmember year on restaurants and gas stations

You can create quite a portfolio of Chase cards

Now, in fairness, I do think it’s worth pointing out that Amex lets you redeem points towards a ticket purchase as part of the International Airline Program. This offers discounts on first and business class tickets, so getting a discount on a ticket while also being able to redeem points can represent a very good value.

The information and associated card details on this page for the Amex EveryDay Preferred Credit Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

I got a big discount on a Qatar Airways ticket using the International Airline Program

Bottom line

Over the years, the major transferable points currencies have made it increasingly lucrative to redeem points as cash towards the cost of a travel purchase.

All things considered, this is an area where Chase still leads the way. If you have the Chase Sapphire Reserve® Card you can redeem points for 1.5 cents each towards the cost of a travel purchase (not just airfare, but also hotels, car rentals, and more), and being able to earn tons of Chase points with no annual fee card complements is quite easy. So I do think this is the best strategy given how few hoops you have to jump through to achieve a return that beats just about any cash back card.

What’s your preferred program for redeeming points towards a travel purchase — Amex or Chase?

@Daniel - I did some random itineraries that usually publish insider fares. When you select the flight and get to the check out screen, under "review your flight booking" you can pull up the fare rules. Under penalties, insider fares seem to have "CHANGES ANY TIME CHANGES PERMITTED FOR REISSUE" where as the normally priced fares mention the $200 fee. Not sure if that is going to be true 100% of the time, but it's...

@Daniel - I did some random itineraries that usually publish insider fares. When you select the flight and get to the check out screen, under "review your flight booking" you can pull up the fare rules. Under penalties, insider fares seem to have "CHANGES ANY TIME CHANGES PERMITTED FOR REISSUE" where as the normally priced fares mention the $200 fee. Not sure if that is going to be true 100% of the time, but it's worth checking the fare rules before checking out, you might be surprised.

Glad you mentioned the International Airline Program. Considering that the savings are anywhere from 15% to 50%, if using points, the redemption is closer to Chase’s 1.5. I guess the thing is to shop them both and see who scores the better price. On paper Chase will always be better, but factor in the International Airline Program and things can change, sometimes quite a bit.

It would be useful to see a post about why anyone would ever redeem for cash value versus transferring to a points currency. Certainly for any International biz or First redemption with availability, this method makes no sense, right? Is this just useful for domestic awards or in instances where there isn't sufficient award seating?

The annoying thing about Chase is the availability on their portal, esp. internationally. I can't find a bunch of fares available on Google Flights and the airlines' websites. Hopefully their move to Expedia will help?

@Andrew Merewitz: BINGO! And with winter fast approaching, using the CSR's trip/delay protection is no-brainer.

Isnt chase also better cause if you pay with UR you get all of the CSR's trip/delay protection benefits?

@Stephen How do you find out whether the insider fare on AA is refundable? Is this a case for ones purchased through Amex Travel, or only for ones purchased using points? Can one see this before making the purchase?

AMEX has been better for us as they increased our credit line rapidly to the point where it is now 10x our chase line. Helps when we have large invoices also in conjunction with the business blue card for 2x on the first 50K plus 3x on shipping and 2x for gas and other categories with the gold card and it's a winner for us. That's lots of annual fees but the amex offers with 15% off shipping with FedEx sometimes makes shipping FedEx cheaper than the post office!

Chase is also a COMPLETE MESS when the airlines issue full refunds for tickets. They accept the funds back to their ISS Travel Mastercard, then say you were already refunded so they also keep your points. Been working on a Hawaii Huricane refund for weeks now!

Chase is fine...until you have a problem. Buyer beware.

@Milenomics - I've also noted that the insider fares will sometimes book into AA fares that have no cancellation fee (value gets retained with Amex travel and you call in to use on another ticket), and only a $39 rebooking fee via Amex travel. I'm 2 for 2 on AA tickets with MR insider fares.

I'd say Amex MRs are better to use towards airfare than Chase URs because:

1) Amex Insider Fares can save you ~5% depending on the flights

2) If you choose to "pay" with the flight with a Amex Personal Platinum you'll earn 4x. You don't actually pay when redeeming MRs for a flight of course, but the way their accounting has been working you earn 5x then lose 1x when points are refunded.

3) URs have broader utility with uplift (cruises, hotels, etc)

alcwj, it's one sign up bonus per card. You can get a card more than once.

since you can only get one card per lifetime for Amex vs Chase 5/24 i'll pick Chase over Amex