If you have a SoFi Money account, there’s a great opportunity to save 10% on some popular spending categories at the moment.

In this post:

SoFi offering 10% cash back on groceries and subscriptions

Between July 1 and September 30, you can receive 10% cash back with SoFi Money with select grocery and subscription services:

- Eligible groceries include Whole Foods, Trader Joe’s, and Instacart

- Eligible subscriptions include Netflix, Disney+, and Spotify

In order to take advantage of this:

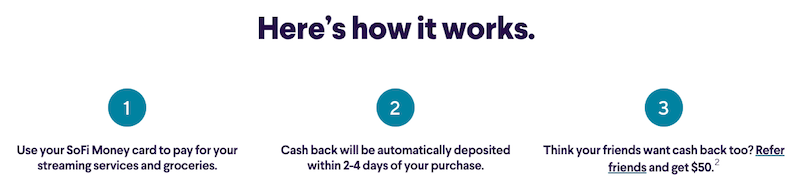

- Pay with your SoFi Money debit card

- You can save at most $50 in the grocery category and at most $50 in the subscription category, so each category can be maxed out with $500 in spending

- The 10% cash back will be deposited in your account within two to four days of your purchase

Is this SoFi Money cashback promotion worth it?

Obviously the answer to this will vary depending on what credit cards you have. I’d say that in general this is a really lucrative promotion. In my specific situation:

- Personally I won’t benefit from the 10% cash back on subscriptions, because the Amex Platinum is offering a $20 monthly streaming credit through the end of 2020, and that more than covers my subscription costs

- The best credit cards for grocery store spending offers a return of at most 8.5% (by my valuation), so a 10% return is superior

I do intend to use SoFi Money to save with Instacart (I don’t typically shop at Whole Foods or Trader Joe’s, so Instacart is what’s useful here to me).

What is SoFi, and why should you care?

With details of this promotion out of the way, let’s talk about what SoFi is in general. It’s essentially an online bank with an excellent app, which I’ve had positive experiences with. On the most basic level, if you open a SoFi Money account:

- There are no account fees

- ATM fees are reimbursed worldwide

- There are constantly rotating cash back opportunities

That’s pretty compelling to begin with (especially the ATM fees being reimbursed on a no fee account for those who travel with any frequency).

On top of that, SoFi has an excellent referral program that offers $25 to the person being referred after funding an account with at least $10 within five days.

You can read all about that process in this post, but it’s something that I’ve done, and it took just a few minutes, and it’s something I recommend others consider as well.

Tip: Get $25 with SoFi Invest account

In addition to the standard SoFi Money account, there’s also SoFi Invest, which is SoFi’s stock trading platform. SoFi Invest also has a great referral program. This offers $25 to the person being referred after funding an investment account with at least $100.

Bottom line

SoFi Money is offering 10% back on select groceries and streaming services. This is potentially valuable, though just keep in mind the limit of $50 cash back per category.

I’ll absolutely be maximizing the grocery category for Instacart, since it’s better than the return offered by any credit card.

I continue to be impressed by SoFi, especially in terms of the ongoing promotions they have for what’s ultimately a free checking account.

Do you plan on taking advantage of this SoFi Money 10% cash back promotion?

The article should be update to reflect that new accounts no longer have worldwide atm fee reimbursed. Only those that were grandfathered in. Considering most people signed up as alternative to Charles Schwab for ATM, don't want people signing up for the wrong reasons.

The privilege in these comments is astounding.

JWags - sorry to hear that. That's terrible sales. Same boat here for my wife's degree: top 20 school. Took them < 24 hours to reject with no meaningful explanation or appeal option.

We were fortunate to inherit some money, so we paid off the entire student loan in a lump sum.

As a result, SoFi missed out on 2 years of interest-heavy payments and complete principal return. Flawless indeed. ;-)

They recently changed their ATM reimbursement policy such that accounts opened after June 9 will only have free ATM access with the Allpoint network, not worldwide ATM reimbursement. It’s in the bottom fine print of the Sofi.com/money page.

@Andrew agreed. When I initially looked to refinance my Student Loan, they deemed that my graduate school wasnt on their "approved list" of schools. It wasnt Stanford or Harvard, but it was very well respected and highly ranked. And were incredibly rude about their reasoning and in conversation, there was an utmost arrogance. Then they had the nerve to routinely personally contact me for other personal loan and credit options.

A buddy of mine works...

@Andrew agreed. When I initially looked to refinance my Student Loan, they deemed that my graduate school wasnt on their "approved list" of schools. It wasnt Stanford or Harvard, but it was very well respected and highly ranked. And were incredibly rude about their reasoning and in conversation, there was an utmost arrogance. Then they had the nerve to routinely personally contact me for other personal loan and credit options.

A buddy of mine works for an ad agency that handles their media buying. The SoFi team was boasting in an early meeting about their criteria and how flawless their vetting was. He mentioned "a friend" that was looking to refinance and rattled off my stats, and they glowlingly responded that "its sounds like one of our ideal candidates, he should apply!"...then he hit them with the truth and they got quiet.

So many other companies that are more worthwhile IMO

I've been avoiding SoFi for a while. A long time ago my wife had a significant student loan and they constantly advertised how they were the 'good guys' of the student loan industry / disruptors and they would lower our interest rate, etc.

When they found out that her student loan > income, they decided that they weren't the good guys anymore. No loan even with cosigner. (That's really a microcosm of everything wrong with...

I've been avoiding SoFi for a while. A long time ago my wife had a significant student loan and they constantly advertised how they were the 'good guys' of the student loan industry / disruptors and they would lower our interest rate, etc.

When they found out that her student loan > income, they decided that they weren't the good guys anymore. No loan even with cosigner. (That's really a microcosm of everything wrong with America: you only get help if you have the means to help yourself.)

We've since paid her loan off, but it definitely left a distrust for the organization. I'll reconsider at some point... but it will have to be more compelling than a few percentage points better.

Do I have to process the transaction as a debit (use PIN) or credit to trigger the 10% cash back?

I love SoFi.

Customer service is great, too.

This promotion is awesome, thanks for the heads up!