Usually my focus with credit cards is racking up rewards that can be redeemed for first & business class travel internationally, since that’s where I see the most value.

That being said, everyone is looking for different travel experiences with their points. In this post I thought it would be fun to review the Free Spirit® Travel More World Elite Mastercard®, which is a card I’ve never written about before.

While Spirit is the butt of many jokes, there’s a lot to like about the ultra low cost carrier. Spirit has the Big Front Seat, which I consider to be one of the best values in regional travel, and Spirit has also done an amazing job with rolling out Wi-Fi throughout most of its fleet.

Could there be merit to picking up the carrier’s co-branded credit card? Let’s take a closer look.

In this post:

How much are Free Spirit points worth?

Before we talk about Spirit Airlines’ credit card, it’s worth briefly covering how much Free Spirit points (Spirit Airlines’ points currency) are worth. After all, that’s the rewards structure offered by the card, so it’s important to have a sense of the value you can get with your points.

I pulled up some random flights and compared the cost when paying cash vs. redeeming points.

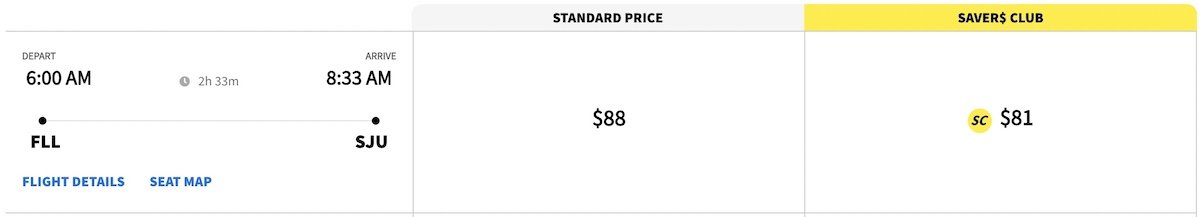

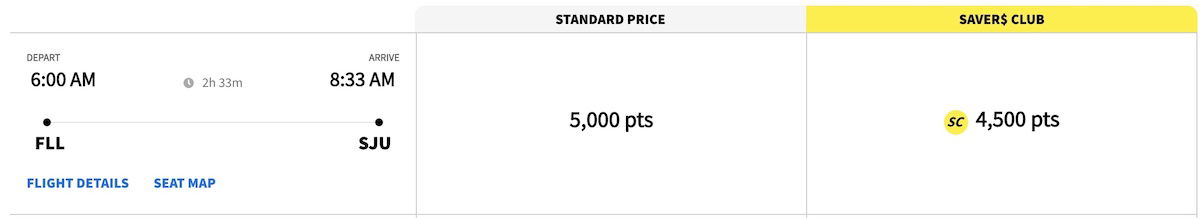

Between Fort Lauderdale and San Juan:

- You could pay $88 or you could pay 5,000 points plus $5.60 in taxes

- That means you’re getting 1.64 cents per point

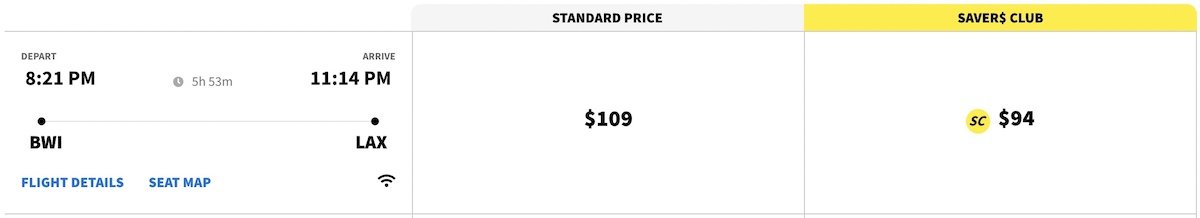

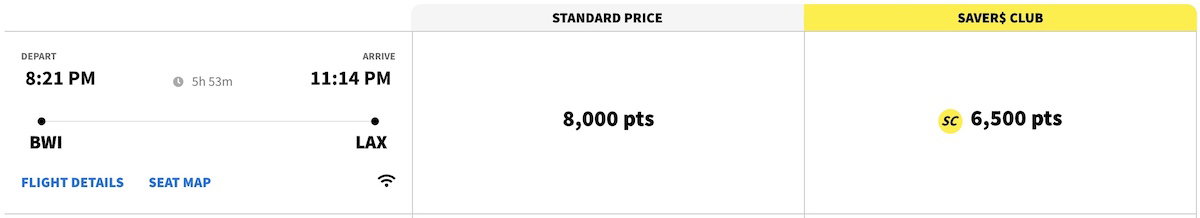

Between Baltimore and Los Angeles:

- You could pay $109 or you could pay 8,000 points plus $5.60

- That means you’re getting 1.29 cents per point

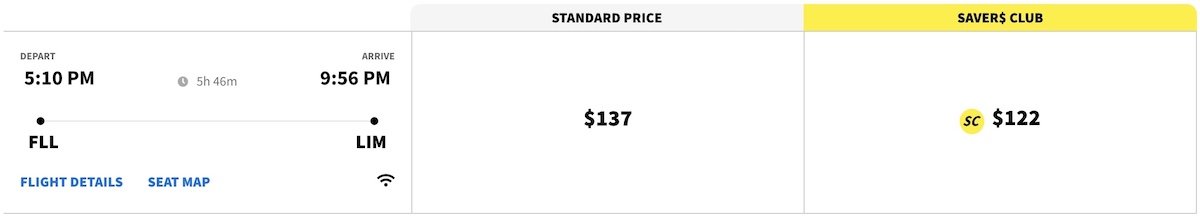

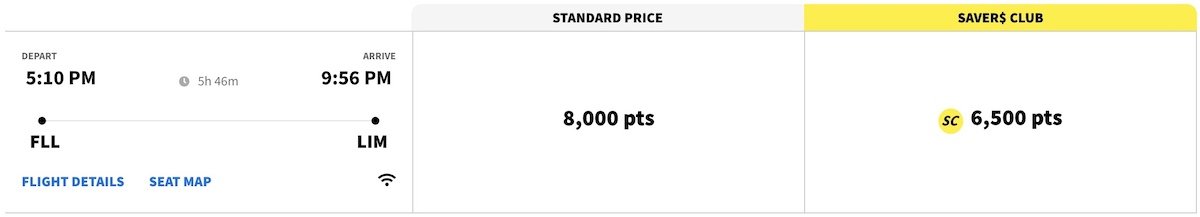

Between Fort Lauderdale and Lima:

- You could pay $137 or you could pay 8,000 points plus $20.60

- That means you’re getting 1.45 cents per point

As you can see, redemption rates aren’t consistent, but you’ll typically get over 1.2 cents of value per point, and you’ll pretty regularly get over 1.5 cents of value per point. That’s pretty solid.

Free Spirit Mastercard welcome bonus

The Spirit Airlines Mastercard is offering a two part welcome bonus, which you can unlock after spending $1,000 within the first 90 days of account opening:

- Earn 60,000 bonus Free Spirit points

- Earn a $100 companion voucher

60,000 bonus points could potentially get you a lot of airfare on Spirit Airlines. In some markets that translates to $900+ worth of Spirit Airlines tickets!

As far as the $100 companion voucher goes, this can be applied directly on Spirit Airlines’ website. You can use it for a companion traveling with you on the same itinerary, booked at the same time. The ticket must be purchased with the card to qualify.

The Spirit Airlines Mastercard is issued by Bank of America, so standard credit card application rules apply.

Earning points with the Free Spirit Mastercard

When it comes to earning points with the Spirit Airlines Mastercard, the card has the following rewards structure:

- Earn 3x points per dollar spent on Spirit purchases

- Earn 2x points per dollar spent on dining and grocery store purchases

- Earn 1x points per dollar spent on all other purchases

I would say that the rewards structure is pretty decent, but not amazing. There are better cards for dining spending, grocery store spending, and everyday spending. However, there are some further spending thresholds on the card, which I’ll talk about below, and which could change the math.

Note that the card has no foreign transaction fees, so it’s a good card to use abroad, and it also has a contactless pay feature, so you don’t even have to swipe your card.

Free Spirit Mastercard annual fee

The Spirit Airlines Mastercard has an introductory $0 annual fee for the first year, and it’s just $79 after that. It’s nice to be able to “try” the card before you have to “buy” it. Furthermore, at least on an ongoing basis the card has a lower annual fee than many other mid-range cards, as it’s common for cards to have fees of just under $100.

Free Spirit Mastercard perks

The area where the Spirit Airlines Mastercard shines is when it comes to perks, especially if you fly Spirit with any frequency. Let’s go over those perks, in no particular order.

25% savings on inflight food & beverage purchases

Those with the Spirit Airlines credit card can save 25% on inflight food& beverage purchases when paying with the card. Given that Spirit charges for all food & drinks, the value of that could add up quite a bit.

Zone 2 shortcut boarding

Those with the Sprit Airlines credit card receive Zone 2 shortcut boarding, meaning that they can board toward the beginning of the boarding process. This is also valid for companions traveling on the same reservation.

No redemption fees

Spirit Airlines loves fees (it’s how the airline makes money!), and the airline typically has award redemption fees. Specifically, when you book an award within 28 days of departure, there’s a $50 fee. This is waived for those who have the Spirit Airlines credit card, which represents huge savings.

This can be used when the primary cardmember is one of the passengers on an itinerary.

The ability to pool points

Those with the Spirit Airlines credit card can pool points with others. This is a free program allowing the primary cardmember to become a “Pool Pilot,” whereby they can create and manage a pool of up to eight additional Free Spirit members’ points. Points can still be redeemed for anyone.

This is a pretty awesome feature, since it’s much easier to rack up points toward an award ticket if you have several people accruing points.

Receive a $100 anniversary companion voucher with spending

If you spend at least $5,000 on your Spirit Airlines credit card per anniversary year you’ll receive a $100 anniversary companion voucher. Much like the voucher that’s part of the welcome bonus, this can be used for a companion traveling on the same reservation to take $100 off airfare.

Spend your way to Free Spirit elite status

Having the Spirit Airlines credit card can help you earn Free Spirit elite status. Specifically, you earn one Status Qualifying Point (SQP) for every $10 in purchases on the card each calendar year.

For context:

- Free Spirit Silver status requires 2,000 SQPs, which would require $20,000 in credit card spending

- Free Spirit Gold status requires 5,000 SQPs, which would require $50,000 in credit card spending

The perks of Spirit Airlines elite status are surprisingly robust, so this could be worth it for some, at least at the margins. For example, Spirit Airlines Gold status offers a free carry-on bag, free checked bag, priority boarding, free standard seat selection, free inflight beverages and snacks, and more.

Is the Free Spirit Mastercard worth it?

Is the Spirit Airlines Mastercard a slam dunk card that everyone should apply for? Probably not, especially in the miles & points world, since it’s not all that aspirational. No matter how much you spend on this card, you won’t get a flight in Emirates’ A380 first class, and you won’t get a hotel stay at the Park Hyatt Paris. 😉

That being said, I think the overall value proposition of the card is surprisingly good, especially for an ultra low cost carrier:

- The card has an excellent welcome bonus that will get you a lot of travel on Spirit, between the 60,000 points and the $100 companion voucher

- It could be worth spending at least $5,000 on the card per year to earn the $100 companion certificate, especially if you spend in categories that also earn bonus points

- While the annual fee is waived the first year, some of the card’s perks will more than justify the ongoing annual fee; between savings on inflight purchases, boarding early, points pooling, and especially the waived redemption fees, there are lots of reasons for Spirit Airlines travelers to have this card

If you never fly Spirit Airlines, it’s probably not worth picking up this card. However, if you fly Spirit at least a couple of times per year, I think this card is a no-brainer.

Bottom line

The Spirit Airlines Mastercard is a surprisingly lucrative card for an ultra low cost carrier. The card has a huge welcome bonus, an annual fee that’s waived for the first year, and perks that justify the ongoing annual fee, assuming you fly the airline with any frequency.

What’s your take on the Free Spirit Travel More World Elite Mastercard?

If only the credit card would come with a free carry-on or luggage benefit...

I have had my spirit credit card for one year I have 70000 points on it it's time to renew it for $75 for the next year.. Do I have to have my card renewed for the following year to use my points in 2023 or can I cancel my card and still use my points

It's a lie I applied for the card and they didn't send it to me until three months and when I spent a lot they did!!!! supposedly you have to spend they don't give you any points it's a hoax they put me in an investigation and they never called me I'm finishing paying to deliver it

I would not recommend the Spirit Mastercard!!! I have spent over 30K on my Spirit card. I was given a $100 voucher, that I have yet to be able to actually use!!! I have 5 flights built for October and November for myself. My voucher is a companion voucher. I have tried to use this for my niece and her boyfriend to come and visit me, and they will not let me, unless I am...

I would not recommend the Spirit Mastercard!!! I have spent over 30K on my Spirit card. I was given a $100 voucher, that I have yet to be able to actually use!!! I have 5 flights built for October and November for myself. My voucher is a companion voucher. I have tried to use this for my niece and her boyfriend to come and visit me, and they will not let me, unless I am on the flight with them. I need to take a different flight, and have 4 other flights for myself, and they still will not le me use it!! This is absolute FRAUD!!!!! Do not get there credit card!!!!!!!!

It's kinda tough to recommend anything about them as the company's management has decided to sell itself for spare parts and just give up on running the place. All the great things (and yes there are some great things about Spirit) may all go away. The card is a good example, their wifi, and the big front seats are all things that are great. I hope they remain as they are today.

I don't want to get beat up mid air, so I don't fly Spirit.

The Spirit Gate Agents will gladly give you a beat down before boarding so the FA's can focus on the other passengers (your bruised up face will give you a pass. . . sometimes).

I've had this card for years and it's not bad. The worst part is that it can be tough to find award space. The card also unlocks additional award space much like UA cards. One trick is to use an Amex Platinum airline credit to buy the saver club for 2 years.

Seems sort-of logical if one flies Spirit a lot. But usually, with these add-ons they have, the price of a Spirit can be the same or exceed the fare of an economy ticket for a traditional carrier at least based on my experience.

But then you don’t get big front seat, which is the best part of spirit.

It's the ONLY credit card to come with a "get out of jail free card" and fighting points.