A couple of weeks ago, I wrote about how United’s MileagePlus frequent flyer program rolled out a huge mileage devaluation. Initially this impacted transatlantic awards, but I wanted to post an update, as over the past couple of weeks this has progressively spread to just about all routes globally. It looks to me like the devaluation is now complete, because there’s not much left to devalue!

This might just be the worst devaluation we’ve seen in the history of the MileagePlus program. It’s not just the amount by which award costs have increased, but also how consistent these increases are across the board, for travel on both United and its partner airlines.

In this post:

United MileagePlus increases award costs by 30%+

United has made a no-notice mileage devaluation. It’s not surprising that the program didn’t provide notice, given that MileagePlus no longer publishes award charts, which greatly limits transparency.

It would appear that saver level award costs have increased by an average of over 30% for most routes, whether traveling on United or partner airlines. While the devaluation started with routes to Europe, it has now spread to routes to Asia, the South Pacific, Africa, the Middle East, South America, etc.

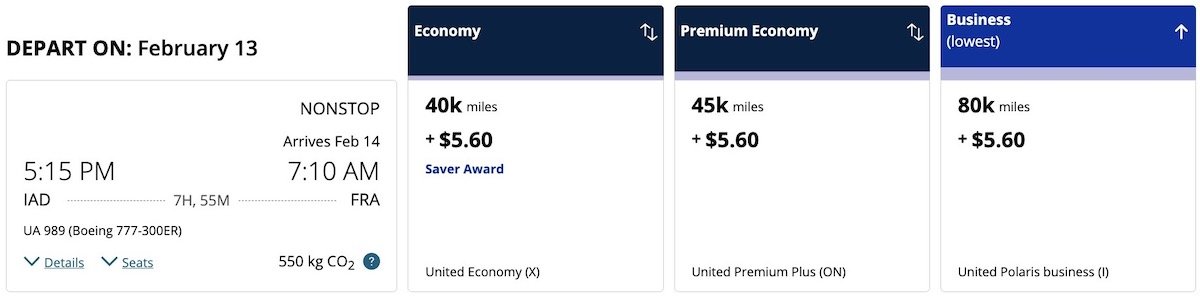

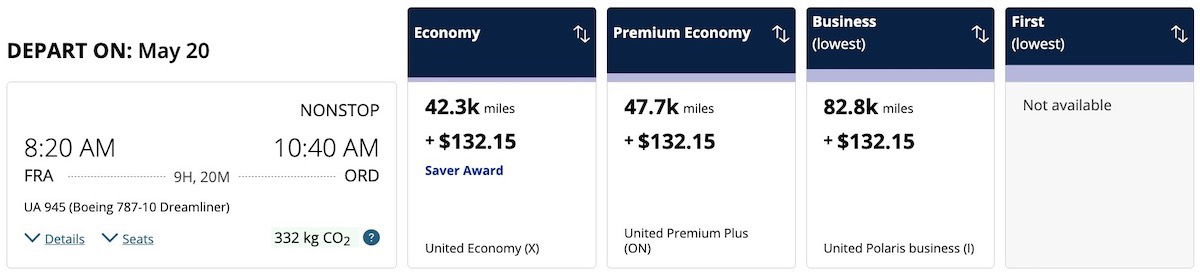

For example, one-way saver transatlantic awards for travel on United used to start at 30,000 miles in economy and 60,000 miles in business class. Those costs have increased by 33%, as these awards now start at 40,000 miles in economy and 80,000 miles in business class.

As before, MileagePlus has higher award costs when you’re booking within 30 days of departure, even when there’s saver award space. Those same types of awards will cost you an extra 2,300 miles in economy or 2,800 miles in business class.

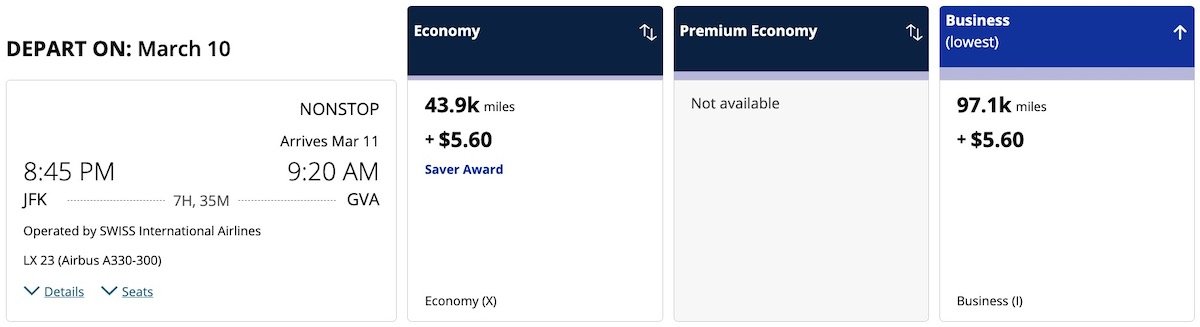

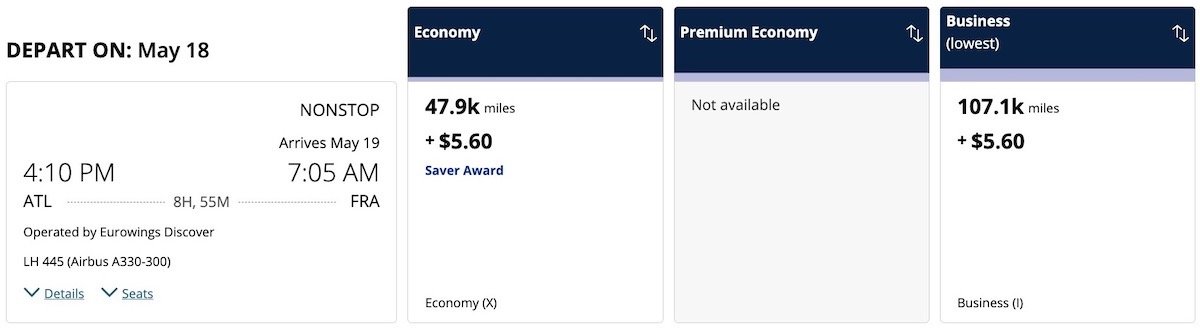

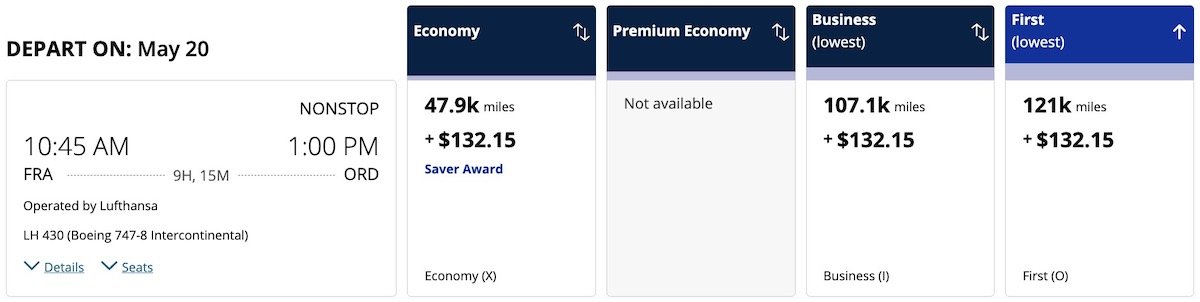

Partner awards have similarly been devalued. For example, one-way saver transatlantic awards for travel on partner airlines used to start at 30,000 miles in economy and 70,000 miles in business class. Those costs have increased by 39-47%, as these awards now start at 43,900 miles in economy and 97,100 miles in business class.

As before, MileagePlus has higher award costs when you’re booking within 30 days of departure. Those same types of partner awards will cost you an extra 4,000 miles in economy or 10,000 miles in business class.

Interestingly the cost of transatlantic first class awards has remained the same, as Lufthansa first class continues to cost 121,000 miles one-way.

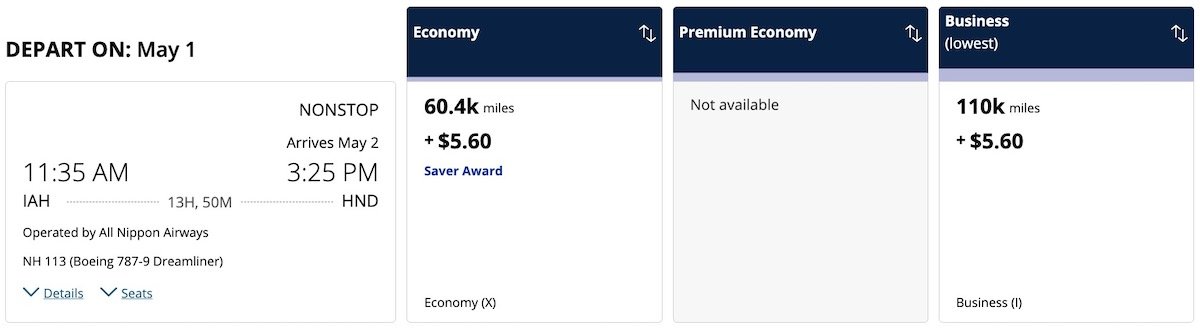

Looking at Asia, a one-way partner award between the United States and North Asia used to cost 38,500 miles in economy and 88,000 miles in business class, while it now starts at 60,400 miles in economy and 110,000 miles in business class. That’s a 57% cost increase in economy and a 25% cost increase in business class. Ouch.

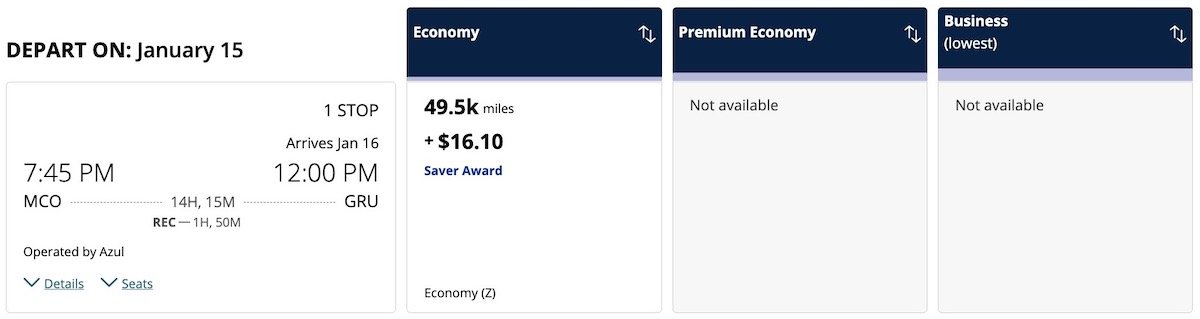

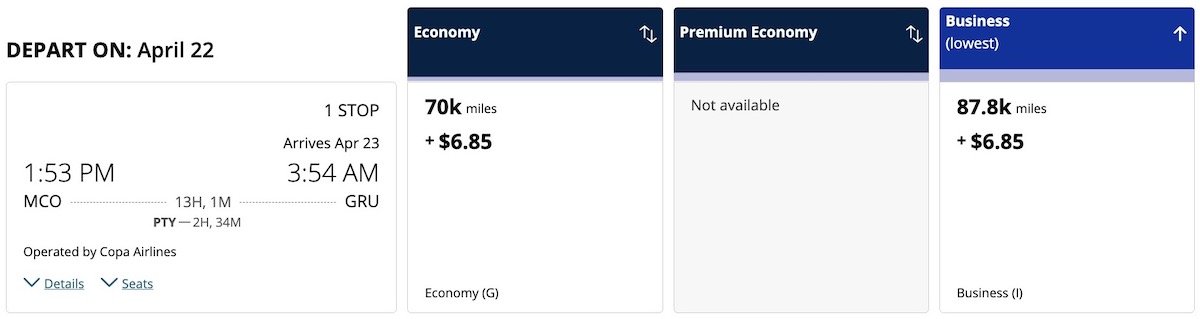

Looking at South America, a one-way partner award between the United States and Southern South America used to cost 33,000 miles in economy and 66,000 miles in business class, while it now starts at 49,500 miles in economy and 87,800 miles in business class. That’s a 50% cost increase in economy and a 33% cost increase in business class.

Suffice it to say that these changes are brutal.

United MileagePlus redemption rates are becoming awful

Unfortunately we’ve seen so many program devaluations in the past couple of years, that nothing really surprises me anymore. A few things to note about these latest changes:

- If you’re not earning MileagePlus miles directly from flying United, you should absolutely instead be using programs like Air Canada Aeroplan and Avianca LifeMiles, which offer much more attractive partner redemption rates; you shouldn’t be transferring your Chase Ultimate Rewards points to United MileagePlus

- I can understand why United would want to increase costs of awards for travel on its own flights, since there’s often an internal battle between folks working in loyalty and revenue management, but the huge partner award cost increases are downright punitive, since it’s not like those reimbursement rates have changed overnight

- It very much feels like United MileagePlus is trying to follow Delta SkyMiles’ lead here when it comes to the value of miles

It’s really quite sad how innovating and offering value to frequent flyers no longer seems to be the priority for many programs. Nowadays it’s all about cutting costs, despite how high margin these businesses are (the loyalty programs, not the airlines).

Bottom line

MileagePlus has significantly increased award costs, for travel on both United and partner airlines. These changes are rough, as the cost of many awards has increased by over 30% (and in some cases significantly more than that). This is the worst devaluation I recall seeing from MileagePlus.

This makes both Air Canada Aeroplan and Avianca LifeMiles even more lucrative.

What do you make of these United MileagePlus changes?

Given that United does not value customers that have been loyal to it for a long time and therefore have accumulated hundreds of thousands of miles, I now flying United only when its prices are not higher than competition, unlike earlier when I used to always fly United.

A business class one-way ticket from from US to India used to be 60,000 miles. Overnight it got devalued to 80,000 miles. Thereafter, United introduced on-demand...

Given that United does not value customers that have been loyal to it for a long time and therefore have accumulated hundreds of thousands of miles, I now flying United only when its prices are not higher than competition, unlike earlier when I used to always fly United.

A business class one-way ticket from from US to India used to be 60,000 miles. Overnight it got devalued to 80,000 miles. Thereafter, United introduced on-demand pricing for mileage tickets. Now, it costs anywhere between 83,000 miles to 440,000 miles per business class one-way ticket, with more often than not the lower price not being available.

Right now, United is not even allowing us to book online on miles beyond about a month in advance. So, the miles have become really useless. Therefore, I have decided to stop spending on the United Club Card too, and will cancel it as soon as I exhaust whatever miles I have collected.

I’m frustrating MileagePlus awarded ticket. No matter to search it can’t to find the business class for partner airlines. Please can you teach me how to do or where to complain it?

Did some quick math and at current rates one would pay almost twice the amount to use miles purchased at maximum holiday discount (45% off more than 50k or ~52mi/$) for a routine flight that I can get for $138 round trip or just $38 from a discount airline. Guess they figure customers can't do math. One would think miles would give better than market rates since its locked in $$. Been reading alot of...

Did some quick math and at current rates one would pay almost twice the amount to use miles purchased at maximum holiday discount (45% off more than 50k or ~52mi/$) for a routine flight that I can get for $138 round trip or just $38 from a discount airline. Guess they figure customers can't do math. One would think miles would give better than market rates since its locked in $$. Been reading alot of negatives about miles programs and awards stuff in general seem to be dying. Oh well, guess I'll cut up the cards like everyone else.

Just cancelled 4 Chase cards. I'm done.

This is the last straw unfortunately, after 22 years. Flying to Asia constantly from north America and Europe, had in the past no issue achieving 1K for about 15 years, no credit card miles/perks, since outside the US is not available, this year I will maybe reach platinum, not sure. in any case I m a million miler so gold is for life (till they renege on that as well). Switching to Air Canada, ANA...

This is the last straw unfortunately, after 22 years. Flying to Asia constantly from north America and Europe, had in the past no issue achieving 1K for about 15 years, no credit card miles/perks, since outside the US is not available, this year I will maybe reach platinum, not sure. in any case I m a million miler so gold is for life (till they renege on that as well). Switching to Air Canada, ANA or Singapore, just doing my homework now which one is best. I'll also avoid passing by the US, which is always a pain in the neck to say the least since you cannot just transfer but have to redo security, take your baggage, etc. Sad but all in all unavoidable and I suspect much better service overall (at least Singapore and ANA)

Your post is old now. The miles and examples that you have shown are 40% cheaper than what UA has now. UA has increased mile award ticket costs by over 70% for all routes. Minimum business class award miles to any 8+ hr flight is 170k to 200k *(with special pricing - Chase credit cards).

Just shows there's no point in saving miles. Spend them ASAP because you know United will devalue often. They've killed any loyalty I felt.

I used to travel from Durango, Co to Columbus, Oh for 12.5k miles one way, now that trip cost 32.5K miles. I figure that to be a 160% increase. I'm looking for a different card.

I am getting rid of my united credit card.

Without any courtesy of advanced notice, I see this devaluation as a direct reflection of how United devalues its customers.

This is why I got rid of my mileage plus credit card.

This is insane! I'm literally seeing one-way business class flights between US and Asia for 850K miles ?! The whole roundtrip costs 1.6+ million miles. This is insane, has to be a mistake.... right?

It doesn't seem that long ago when United's MileagePlus partner redemption cost in Business Class from the US-Southeast Asia was 70000 miles one way. Maybe in 2015 or 2016? Then point redemption costs went up to 80000 miles for partners. Then 99000 miles. Now 110000 miles. Ironically, economy saver point redemptions from the US to Southeast Asia are 60500 miles one way. Nearly the cost of what Business Class used to be. We've been down...

It doesn't seem that long ago when United's MileagePlus partner redemption cost in Business Class from the US-Southeast Asia was 70000 miles one way. Maybe in 2015 or 2016? Then point redemption costs went up to 80000 miles for partners. Then 99000 miles. Now 110000 miles. Ironically, economy saver point redemptions from the US to Southeast Asia are 60500 miles one way. Nearly the cost of what Business Class used to be. We've been down this road before (devaluations), but it doesn't mean we like it. Now more than ever it is important to have a Plan B to have miles or the ability to transfer miles to other FF programs

I called chase and downgraded to gateway

Sales Rep understood said she'll pass feedback on but that no one else had mentioned it or anything

If we vote they'll listen!

Contacted United to advise them unless these 30% uncreases were moderaated we put United card awaay and no more Chase traansfers to United. Can they be pressured or do they just lose money? Their response "thanks for helping us improve" ?

Get upset and feel betrayed all you want, but United is in business to make money, not keep points collectors happy.

If MP members are redeeming at these increased levels, the Board will be overjoyed. If points start stacking up on the books creating a concerning liability, the Board will drop the hammer.

"Let's charge as little as possible" is something no successful business has ever said.

Costco.............................................................................................................

No sympathy.

Blogger shamelessly participates in a system which floods the market with credit card miles across multiple airlines. Then complains when the entirely predicable devaluation happens.

Welcome to the consequences of the system you so gleefully promote.

As an Australian based UA 1K and 1MMr this is the last straw. Loyalty has no rewards, so it is all about price and service going forward. I still fly 100K a year in Business and UA along with AA and Delta are not competitive on these criteria.

Agreed, same situation, flying to Asia constantly, had in the past no issue achieving 1K for about 10 years, no credit card miles/perks, since outside the US is not available. Switching to Air Canada, ANA or Singapore, just doing my homework now which one is best. I'll also avoid passing by the Us, which is always a pain in the neck to say the least since you cannot just transfer but have to redo security, take your baggage, etc.

Why is this in any way a surprise given the ludicrously generous sign up bonuses and ongoing earning rates offered on US credit cards? Sadly it's those based elsewhere that are hit much harder.

I would like to see all the major bloggers actually call a DECREASE IN VALUE in United miles, within the next two weeks.

And that would accomplish what, exactly?

And they don't know why people aren't signing up/using their credit cards... /facepalm.

Also there are reports that new chase UA credit card holders cannot see XN tix any more.

How new is new? The final changes appear to have gone live yesterday.

I have been a loyal United flyer / status person for years. 2 years ago the Chase card was paying 1.5 point per $1 spent. They changed that to $1 to $1. I stopped using my Chase card and went to a Logix card that gives me 3% back on everything. I also depleted almost all of my 2 million miles in the last 12 months. Very fortuitous timing. Now my Chase Visa is my back-up card to my back-up card.

I use miles mostly for business class awards to Europe. So I ask what is easier to find a J award to Europe at the saver 200k miles or a J fare for 2k. The answer is obviously a paid J fare for $2000 which is why I value United miles at < 1 cent per point.

What is a J fare? Curious how to efficiently $$ strategize going forward. Thanks.

May 3, 2024

JNB-EWR one way in business class

395k miles

WTF?!?! Race to the bottom with Delta SkyPesos

The key here is always keep your miles on cc than individual airlines. Sometimes I find Aeroplan needs more points for me get from A to B and sometimes United is more. Often times I find I can fly nonstop from X to Z on United while using Aeroplan, I have to go through YYZ with long layovers. Even though it’s nice to find saaver awards, I find most of the time it’s incompatible with...

The key here is always keep your miles on cc than individual airlines. Sometimes I find Aeroplan needs more points for me get from A to B and sometimes United is more. Often times I find I can fly nonstop from X to Z on United while using Aeroplan, I have to go through YYZ with long layovers. Even though it’s nice to find saaver awards, I find most of the time it’s incompatible with my schedule so instead of trying to find the least amount of points award tickets, I balance that with convenience and length of travel time. At the end of the day, time is money. I rather spend half more day in the Maldives/ Positano/ Bali than transferring/long layover in airports to save some miles. Devaluation is never good but this is not nearly as bad as Delta where I consistently find flying between US and Europe costs a whopping 400k and up one way.

If you’re not earning MileagePlus miles directly from flying United, you should absolutely instead be using programs like Air Canada Aeroplan and Avianca LifeMiles, which offer much more attractive partner redemption rates; you shouldn’t be transferring your Chase Ultimate Rewards points to United MileagePlus

That has always been wishful thinking. Here are real, head-to-head comparisons, done just a few minutes ago for itineraries I am actually interested in:

EWR -> NRT (12/01/2023)

AC business:...

If you’re not earning MileagePlus miles directly from flying United, you should absolutely instead be using programs like Air Canada Aeroplan and Avianca LifeMiles, which offer much more attractive partner redemption rates; you shouldn’t be transferring your Chase Ultimate Rewards points to United MileagePlus

That has always been wishful thinking. Here are real, head-to-head comparisons, done just a few minutes ago for itineraries I am actually interested in:

EWR -> NRT (12/01/2023)

AC business: 409.8K (16h:20min flight) - 1 stop YUL, all AC metal

UA Business: 200.0K (14h:30min flight) - Nonstop, all UA

YUL -> NRT (12/01/2023) for fairness...

AC business: 271.5K (13h:35min flight) - nonstop, AC metal

UA Business: 200.0K (17h:30min flight) - 1 stop IAD->HND, UA metal

MLE -> SIN (12/21/2023)

AC Economy: 35K (11h:55min flight) - 1 stop CMB, EK, SQ

UA Economy: 27.5K (4h:35min flight) - Nonstop, SQ

[I snatched a Business award ticket for SIN->MLE on SQ for 43K; MLE->SIN is waitlisted for Business and confirmed in SQ Economy for 37K]

HAN -> BKK (12/24/2023)

AC business: 45K (11h:50min flight) - 1 stop SQ/TG [Economy: 25K]

UA Business: 27.5K (9h:45min flight) - 1 stop, SQ/TG [Economy: 19.5K]

There are other itineraries of interest where the cost difference is +/-3-5K one way or the other, but the picture is consistent with what I wrote below when this post was first published:

Q.E.D.

LOL, I can't point out a thousand counterpoints and also LOL if you are redeeming 200K UA points for UA business trans-Pacific.

You got me stumped because I have no idea what your LOL'ing has to do with the substance of my comment, which I suggest you read first.

I said nothing about redeeming 200K on a TPAC UA biz award, although considering the recommended AC alternative, it would be a a steal...

Your examples are valid for comparing dynamic pricing between the 2 programs, but the article is specifically about saver level award pricing; clearly none of your examples are at the saver level, so that's like comparing apples to oranges. No one in their right mind would spend the amounts you're quoting in your examples unless they had millions and millions of points or unless they don't know any better. You should find examples when saver...

Your examples are valid for comparing dynamic pricing between the 2 programs, but the article is specifically about saver level award pricing; clearly none of your examples are at the saver level, so that's like comparing apples to oranges. No one in their right mind would spend the amounts you're quoting in your examples unless they had millions and millions of points or unless they don't know any better. You should find examples when saver level is available for the same itinerary on both programs.

My comparisons are about what happens in real life. I am in the process of booking flights for my upcoming Year-end Escapade and what I found is what I am reporting.

In fact, it is does not even matter whether the post was about saver awards. AC's awards would not be better than comparable UA saver awards because I did do that comparison. Look at awards costs where the carrier is neither UA nor AC...

My comparisons are about what happens in real life. I am in the process of booking flights for my upcoming Year-end Escapade and what I found is what I am reporting.

In fact, it is does not even matter whether the post was about saver awards. AC's awards would not be better than comparable UA saver awards because I did do that comparison. Look at awards costs where the carrier is neither UA nor AC but another *A airline. Those were comparisons of saver awards. Q.E.D.

I agree with all of this. As I have been looking for for flight to Japan at the end of June. In terms of cost Aeroplan was asking for 485K for a connecting flight in business class. United is asking for 200K direct flight. So clearly United is a way better deal but I still wouldn't pay that many points.

Ummm, Lucky specifically noted partner awards, not AC's flights. Do you have examples of those?

How can you miss it? SQ/TG are partner awards...but you do not have to take my word for it. Do the award searches yourself and come back to show us circumstances under which costs AC awards are significantly better than UA's, as self-anointed "travel gurus" constantly claim...

Dear DCS please do you have a blog where one can find accurate information? You often berate “self-annointed travel gurus” so I’m sincerely wondering if you could probably more accurate information about award travels both airlines and hotels (hilton)?

Dear Ken: Yes, I do have a blog titled, "TravelRealityCheck by DCS: Quantitative Travel Blogging", which is chock full of quantitative and accurate information on travel. I created it not for deriving income but to be able to express myself freely in a long format that would be censored or not be appropriate on someone else's blog.

The blog has been mostly dormant but I will reboot it in a big way to publish...

Dear Ken: Yes, I do have a blog titled, "TravelRealityCheck by DCS: Quantitative Travel Blogging", which is chock full of quantitative and accurate information on travel. I created it not for deriving income but to be able to express myself freely in a long format that would be censored or not be appropriate on someone else's blog.

The blog has been mostly dormant but I will reboot it in a big way to publish my opus magnun that will quantitatively and forever demystify the universally misunderstood "values" of hotel loyalty points currencies, especially by self-anointed "travel gurus", who publish them to great fanfare without having the foggiest idea of what they mean.

G'day.

Switch to ANA or Singapore, still star alliance and a class of service that is just not comparable. As an ex mileageplus I could not be happier. (but I never had the credit card to be honest)

I am seeing Lufthansa from CLT-MUC or beyond for example starting at 88k.

Yes, some partners are starting at 97.1k but not all. Certainly 88k is not great but it's hardly, "The sky is falling".

I need to fly to Naples (Italy) at the end of September. United is the only nonstop option from NYC. I know prices are going to be higher because of that, and the crazy demand for Europe this summer (really through October), but even knowing that, they are still outrageous. 70k for economy, 180k for PE, and a whoping 295k for business - One way!!

Time to rename the program MileageMinus

Wow Saver Awards to Peru went up from 20k to 30k. 50% increase. I am so happy I booked my March 2024 trip in May. My United Card will now officially be removed from my wallet even when they offer me 2x points (if I spend $6000 in 3 months) like they did so recently. No thank you United. I've flown United and Alaska for years. Though Alaska has also devalued, the United devaluations across...

Wow Saver Awards to Peru went up from 20k to 30k. 50% increase. I am so happy I booked my March 2024 trip in May. My United Card will now officially be removed from my wallet even when they offer me 2x points (if I spend $6000 in 3 months) like they did so recently. No thank you United. I've flown United and Alaska for years. Though Alaska has also devalued, the United devaluations across the board have been MASSIVE. Going to prioritize my revenue fares to Alaska now.

I remember when I booked saver business for 35k in 2021. This is getting ridiculous

I go to South Africa often, and partner awards to South Africa (or Africa overall) appear not to have been impacted. It has been 88k each way for years, and it still appears to be the case.

what about UA's own EWR to CPT?

@Ben - Like all the bloggers, you have completely missed the worst part of this devaluation. Hint: It's not the price increase.

Yes, prices have gone up - A LOT! But that's not even the bad part. You have been misdirected and have not yet noticed an even bigger devaluation: the loss of nearly all nonstop awards and the forcing of 1, 2, 3 or more LONG layovers. Basically, you simply can not get a...

@Ben - Like all the bloggers, you have completely missed the worst part of this devaluation. Hint: It's not the price increase.

Yes, prices have gone up - A LOT! But that's not even the bad part. You have been misdirected and have not yet noticed an even bigger devaluation: the loss of nearly all nonstop awards and the forcing of 1, 2, 3 or more LONG layovers. Basically, you simply can not get a decent international business class award routing that includes partner legs anymore. At any price. It's not just the higher prices, now any longhaul award now requires multiple, long, miserable stops. And you can't avoid that even if you're willing to throw a million miles at it. It also appears that many (most?) partner award options are just gone altogether - you only can be on United metal. Options including partners are just no longer available.

Sounds like AA, where every redemption seemingly involves an overnight connection or a transfer from LGA to JFK, SNA to LAX, etc

I do t think Chase cares one lick about what United does. They certainly didn’t care about all the changes Marriott made to their, now, almost worthless program.

But, at least United has great food and service. :-)

This doesnt surprise me 1 bit. Back in 2/21 when I wanted to fly to Florida havent gotten over Covid. UA wanted $83 roundtrip from EWR or 29,500 miles Saver.

I called up and was told that Saver was soldout, I said not only does it say its Saver but the flight has less then a handful of passengers

I booked JetBlue for 5300 pts R/T it too was $83.

What I learnt...

This doesnt surprise me 1 bit. Back in 2/21 when I wanted to fly to Florida havent gotten over Covid. UA wanted $83 roundtrip from EWR or 29,500 miles Saver.

I called up and was told that Saver was soldout, I said not only does it say its Saver but the flight has less then a handful of passengers

I booked JetBlue for 5300 pts R/T it too was $83.

What I learnt was not only did UA get rid of its award charts but they still enforced a Peak time and when they said the amount of miles needed will be in accordance to the $$ fare, they meant ONLY if the fare goes up as they dont have a max they will charge, But indeed they do a min they will charge no matter how low the fare goes.

I havent spent a Dime for rev tkts since then and dont ever plan to unless UA is the cheapest fare out there = I probably will never be buying another UA tkt as a rev tkt

On a positive note, I'm seeing lots of Europe - NYC in August for ~25k in economy. Sad that this is the best deal now

After this round of devaluation, a UA mile is priced at less than a penny on many of the "saver awards" in economy (not that you should use your miles for these "awards").

#POINTSINFLATION

Hi Lucky. United Airlines has just implemented another round of massive devaluation, this time focused on US-Asia Pacific flights. US to Japan, Korea, Taiwan, Hong Kong, Southeast Asia, Australia, New Zealand have all increased to around 55k in Economy savers (from 35k, 42.5k, and 40k, respectively). No more <40k long haul flights to Asia as far as I can see.

There is a reason that United consistently rates as one of the worst airlines.

I don't know if this has been mentioned in the previous comments but United's devaluation begs the question of when and if Chase will increase their upfront mileage bonuses on their United branded credit cards. Their current level of upfront bonuses will look less attractive now.

I think the last seat awards increased in price too. I was looking at a flight to Africa for months, and it was always 250k (still much better than paying cash if you had to go).

That's now become 325k, also a 30% increase.

Helpful, thanks. I’m wondering how you concluded that airlines are high margin businesses. Airlines have some of the lowest margins of any industry.

The sale of miles to credit card companies like American Express is a big business for airlines, more profitable than selling tickets!

I had the same reaction as you David. Airlines run very low margins and have an extremely variable/vulnerable business--changes in demand occur frequently due to external forces (like weather, oil prices, or, more recently, pandemics) and can really hinder their business. Sure, I guess you could argue the loyalty program portion, in a silo, is high-margin, but companies don't really work like that so unless the loyalty program is entirely detached from the airline the...

I had the same reaction as you David. Airlines run very low margins and have an extremely variable/vulnerable business--changes in demand occur frequently due to external forces (like weather, oil prices, or, more recently, pandemics) and can really hinder their business. Sure, I guess you could argue the loyalty program portion, in a silo, is high-margin, but companies don't really work like that so unless the loyalty program is entirely detached from the airline the company is going to look at its overall margin, not the margin of the loyalty program. In many cases, the high margins of the loyalty program are necessary to prop up the low margins from actual air travel, and they can also act as a hedge against down years.

I think you may find this Wendover video helpful: https://www.youtube.com/watch?v=ggUduBmvQ_4

It explains that the airline rewards programs themselves have become dramatically more profitable than the airlines themselves. In some cases, the rewards programs are the main profit center for the larger airlines, which is part of the reason why certain programs like Aeroplan (Air Canada) and Lifemiles (Avianca) seemingly go out of their way to market themselves outside of their base of frequent flyers.

I think you may find this Wendover video helpful: https://www.youtube.com/watch?v=ggUduBmvQ_4

It explains that the airline rewards programs themselves have become dramatically more profitable than the airlines themselves. In some cases, the rewards programs are the main profit center for the larger airlines, which is part of the reason why certain programs like Aeroplan (Air Canada) and Lifemiles (Avianca) seemingly go out of their way to market themselves outside of their base of frequent flyers.

Jayceegee, I addressed this in the second half of my comment. It's not fair to evaluate MileagePlus in a vacuum, it's part of UAL as a whole and included in its financial statements (some airlines did spin off their loyalty programs, but not United). If you look at UAL's 2022 10-K, you'll see it had a profit margin of 1.6% in FY2022, and that includes profits from MileagePlus. Definitely not a high margin business.

Again,...

Jayceegee, I addressed this in the second half of my comment. It's not fair to evaluate MileagePlus in a vacuum, it's part of UAL as a whole and included in its financial statements (some airlines did spin off their loyalty programs, but not United). If you look at UAL's 2022 10-K, you'll see it had a profit margin of 1.6% in FY2022, and that includes profits from MileagePlus. Definitely not a high margin business.

Again, while it's true that MileagePlus by itself may be relatively high margin (their financials may go into this level of detail but I haven't gone through them thoroughly), it's fair to guess that without MileagePlus United might have been in the red last year. You could argue that United requires these high margins from MileagePlus to remain a profitable business without raising ticket prices. But in any case, UAL did not have high profit margins last year (and definitely not in 2020 or 2021, when it lost money). This devaluation is probably a way to help boost profit margins to a more comfortable level.

So why does it seem flights to LHR are cheaper then the 40k to the rest of European destiantions? I see prices as low as 31.8K

If the cash price of flights to Europe are going up, then why shouldn't the points needed increase? Many of you got points for free flying on the corporate dime, so stop complaining. Just switch to cash reward credit cards and opt out of Airline/Hotel ponze programs.

This is just a terrible move overall for two reasons

1) Unlike most other program devaluations, United did it overnight with no warning whatsoever to any of its customers. This sends a terrible message as far as not caring about its most loyal customers, and prioritizing corporate profits.

2) Higher airfare costs/prices is a common denominator to ALL airlines, yet while UA is charging 80k for a one-way business award to Europe, other Star Alliance...

This is just a terrible move overall for two reasons

1) Unlike most other program devaluations, United did it overnight with no warning whatsoever to any of its customers. This sends a terrible message as far as not caring about its most loyal customers, and prioritizing corporate profits.

2) Higher airfare costs/prices is a common denominator to ALL airlines, yet while UA is charging 80k for a one-way business award to Europe, other Star Alliance programs are charging much less (ANA 44k, Air Canada 60k, Avianca 63k, Turkish 45k, and etc.).

It cost 170k to get my son a coach RT from LAX to Geneva. Nuts.

Get lost, bozo!

Yet another example of lack of loyalty and respect for customers.

Points are worthless until redeemed. Point issuers are becoming more frustrated because interest rate increases force liability accruals to cost the issuer more.

When will some public company with a large loyalty program take the lead and create an option to convert loyalty points/miles into shares of stock of the issuing company (LoyaltyShares). Who's a more loyal customer an owner?

Grateful I’m moving back to Southwest Air territory!

80 k business class...shoot...I wish. You are way late to this. 1k for whatever that's worth anymore????

And to make things worse, United has removed most of Polaris award availability to London and Tokyo from partner programs (Aeroplan, Lifemiles, etc.). There was a ton of Polaris award availability last week, now it's all gone!

I guess United is trying to become the new Delta...

You're absolutely correct: United is following pathetic Delta in its treatment of their loyal customers.

Unfortunately, I don't this trend is ending any time soon unless we, as flying public will start punishing their chief sponsors: credit card companies: Chase, Amex, Citi, etc -by sharply curtailing the use of their credit cards. Those banks, which spend billions of dollars on buying miles from the airlines, are certainly in position to force the airlines to...

You're absolutely correct: United is following pathetic Delta in its treatment of their loyal customers.

Unfortunately, I don't this trend is ending any time soon unless we, as flying public will start punishing their chief sponsors: credit card companies: Chase, Amex, Citi, etc -by sharply curtailing the use of their credit cards. Those banks, which spend billions of dollars on buying miles from the airlines, are certainly in position to force the airlines to change this vile practice of endlessly devaluing our hard earned miles...

I think folks would resort to using the Money & Miles option since the value of $0.10 / mile is a better deal.

$.01

I just priced out a business class flight to Zurich using money and miles. When redeeming 77,000 miles it reduced the cash price by a little over $500...so that is not a great option either

I have found value with United on various awards for the past number of yrs. Had ot cancel some flights during covid as well. American just tightened the screws and raised levels. Delta is the worst all around. In the past I could find some sweet spots or things that made sense like Virgin awards in Upper Class. Those awards are now like 300K one way per person. Forget it.

Fun Mileage Plus story: Saw that we could upgrade an international flight..click "upgrade cabin". We could have paid for it, but we could pay less and use miles. We didn't have enough miles so we bought 80k. Clicked upgrade, paid the money and used the points.

Went to make sure we got first class seats together, "awaiting upgrade". Waited an hour to try again - same story. Called United, it's not an upgrade, it's...

Fun Mileage Plus story: Saw that we could upgrade an international flight..click "upgrade cabin". We could have paid for it, but we could pay less and use miles. We didn't have enough miles so we bought 80k. Clicked upgrade, paid the money and used the points.

Went to make sure we got first class seats together, "awaiting upgrade". Waited an hour to try again - same story. Called United, it's not an upgrade, it's a chance at an upgrade. Spent $5k on the tickets, spent another $3k to upgrade, but it's not one. You're waitlisted. It says "upgrade" - not try to upgrade.

Called them and mileage plus - both told me too bad.

It says "Waitlist" next to all options unless instant upgrades are available

Glad I hadn't yet pulled the trigger on the Mileage Plus Visa . . . and won't now (at least until the bonus goes up 30%).

I suspect that only a minority of FFs care about mileage anymore. I have the Explorer card not because of mileage accrual/redemption but because of its perks: free checked bag, free carry-on, priority boarding, and the occasional extra flight choices when booking on United. Any mileage perks are just a bonus.

Can we normalize not calling the perks free... You're paying for it in the annual fee. It's an included checked bag.

sure, if you only fly like once per year.

For any frequently flier below Silver, they can save quite a bit... and yeah, that'd then be free.

If you have a card that reimburses travel expenses on any airline you are in a better place than a UA/DL/AA card. Or just pay for the luggage, it’s cheaper in the long run.

$95 annual fee but my family of 3 travels 2-3 times a year with checked bags. At $35 per bag each way, it doesn't take long for these perks to be FREE. The fact that I also like UA is a nice bonus too.

This is what I'm telling myself to justify the annual fee. But it's misleading: no one really needs a suitcase per family member, and lately, I find it easier to travel light. It is not free, it is just a convenience. What's there to like at UA? If you travel internationally, one can see the difference.

Really the only way to speak is with your wallets. Unfortunately, airlines (and hotels) know that even dangling the measliest carrot will keep their frequent fliers in line. Flattering emails, upgrades on domestic narrow-body flights with no meals ... and concurrence from competing airlines. Anything to make the program passengers feel just one iota superior to the other passengers. Bottom line, the flying public will perpetuate this problem until the next pandemic or 9/11, when...

Really the only way to speak is with your wallets. Unfortunately, airlines (and hotels) know that even dangling the measliest carrot will keep their frequent fliers in line. Flattering emails, upgrades on domestic narrow-body flights with no meals ... and concurrence from competing airlines. Anything to make the program passengers feel just one iota superior to the other passengers. Bottom line, the flying public will perpetuate this problem until the next pandemic or 9/11, when the airlines (and hotels) will once again have hat-in-hand. Long story short, you're doing it to yourselves folks. There is absolutely to oversight or accountability for these programs.

So your solution is don't fly? Spend 3 days traversing the country by car?

Don't apply for new credit cards from Chase (or Amex to punish Delta --at least until they increase their bonus miles by 30-40 percent).

As I said before, ONLY the banks could force the airlines from never-ending practice of devaluing our hard-earned miles...

you're absolutely correct!

At this point, I’d be happier if the airlines would discount the cash price of my flights by one cent per mile owed me given my status and forget about miles and the inevitable redemption hassle.

Pretty sure all the airlines will let you do just that... Look for the cash+miles option which discounts your airfare one cent for each mile spent.

I am not really sure Aeoplan is a solution or a good alternative. My plans usually change once or twice, and their cancellation fees are brutal. Not having any change or cancellation fees on UA still makes them preferable in some cases.

Self-anointed "travel gurus" have always had a soft spot for Aeroplan, and trot it out every single time as a solution for anything that ails MileagePlus. I have an Aeroplan account into which I "parked" 100K Chase UR points based on the notion that the program would provide me better redemption opportunities, either on AC or some other *A metal (SQ...

Self-anointed "travel gurus" have always had a soft spot for Aeroplan, and trot it out every single time as a solution for anything that ails MileagePlus. I have an Aeroplan account into which I "parked" 100K Chase UR points based on the notion that the program would provide me better redemption opportunities, either on AC or some other *A metal (SQ specifically). Well, I have been checking regularly the past 3 months and so far Aeroplan has not offered better opportunities than MileagePlus. I doubt that things will improve even after this purportedly 'massive' devaluation of UA miles.

Am I a problem thinking 80K isn't really that bad given acquisition rates of miles?

Indeed - in order to get the same flexibility as you have with UA on cancellation / changes, you will spend many more Aeroplan points compared to UA miles. I've tried Aeroplan a few times and it just doesn't work for me, I wish Ben would be a bit more careful about recommending them.

On top of Aeroplan's cancellation fees, does anyone realize Aeroplan recently added a "U.S. tax recovery fee" even though there is no U.S, payable on tickets paid for with miles.

Aeroplan is definitely not a better option as on top of the awful change and cancellation fees , they seem to be playing dirty games by suddenly blocking several partner airlines availability or just removing them from the inventory to further frustrate customers. Never Buy Aeroplan is the lesson to be learned

If you travel to Asia a lot use ANA and second SQ, at least food service and comfort are waaaay better.

I was hesitant to sign up for that United credit card……NOW I know why!

And bloggers need to be honest about what credit cards they push.

If it’s trash, just tell the readers the truth. OK?

Somebody has to pay for the absurd, massively increased pilot salaries...

It saddens me to see the increase in mileage ticket costs, but have you seen the increase in revenue ticket costs? I'm seeing increases of 50-100% on some tickets, regardless of whether I'm looking in the "goldilocks window" (4-8 months out), or even even close to the 331 day limit.

In my opinion, the airlines have seen that folks really want to travel to reconnect to colleagues & customers, and to family & friends -...

It saddens me to see the increase in mileage ticket costs, but have you seen the increase in revenue ticket costs? I'm seeing increases of 50-100% on some tickets, regardless of whether I'm looking in the "goldilocks window" (4-8 months out), or even even close to the 331 day limit.

In my opinion, the airlines have seen that folks really want to travel to reconnect to colleagues & customers, and to family & friends - after a few years of Covid restrictions / travel banned by company policy. So they are simply increasing costs on all forms of payment.

It sucks, because I want to get my kids & grandkids all together for a family vacation, and it is simply not affordable.

The Genie has been let out of the bottle. Tiktok and Instagram reels have effectively killed (airline/ hotel) points. You are introducing thousands of people to "the points game" at once and oh by the way, the direct aisle access of Polaris (any refreshed business class cabin) doesn't help (less seats in premium cabins). Think of it this way: emirates only has 8 first class seats. If you start sending 1 million people after those...

The Genie has been let out of the bottle. Tiktok and Instagram reels have effectively killed (airline/ hotel) points. You are introducing thousands of people to "the points game" at once and oh by the way, the direct aisle access of Polaris (any refreshed business class cabin) doesn't help (less seats in premium cabins). Think of it this way: emirates only has 8 first class seats. If you start sending 1 million people after those seats (let's say that prior to IG/ TT it was 200k), that means that it will be harder to find award seats. Emirates only has 2 options: either increase award prices or do nothing. The biggest benefactors of this (for the moment) are transferable points; as mentioned in another comment, cash back cards might be the move long term. Eventually ALL loopholes will be closed (Avianca/ Air canada/ Singapore will also raise award prices) so even the transfer cards will become useless. I am surprised chase didn't put up any protest to this (or maybe they did and we just don't know); unless chase increases the sign up bonuses (unlikely), the co-branded credit cards with UAL have become effectively useless. I hope it hits chase in their bottom line. Let the cancelations begin!

Chase doesn't care if United devalues their miles, just pushes people towards Chase's non-United cards.

Funny how I've been reading for the last 20 years (literally) that one thing or the other "killed" the points game. Yet here we are, accumulating and redeeming points that have somehow already died a thousand deaths.

Very respectfully, I would like to borrow your time machine considering tiktok was founded 7 years ago and Instagram was founded in 2010 (still not 20 years). I can't speak to what others have said in the past, but with the influx of people that social media influencers bring; there will definitely be some people who drop out of collecting points and those that remain will have higher costs and higher fees. Until, ofc, Avianca,...

Very respectfully, I would like to borrow your time machine considering tiktok was founded 7 years ago and Instagram was founded in 2010 (still not 20 years). I can't speak to what others have said in the past, but with the influx of people that social media influencers bring; there will definitely be some people who drop out of collecting points and those that remain will have higher costs and higher fees. Until, ofc, Avianca, sia, and ac catch up and devalue there rewards as well.

Airlines have been giving out more miles than ever via ever increasing reward rates on cards, signup bonuses, category bonuses etc. It doesn't take a genius to figure out that eventually they are going to have to devalue the miles to avoid losing money. Don't worry, the next skyfraud card will have 5x points on dining, and then points will be worth even less once again. The airlines don't car because they don't care about...

Airlines have been giving out more miles than ever via ever increasing reward rates on cards, signup bonuses, category bonuses etc. It doesn't take a genius to figure out that eventually they are going to have to devalue the miles to avoid losing money. Don't worry, the next skyfraud card will have 5x points on dining, and then points will be worth even less once again. The airlines don't car because they don't care about what you spent on the miles you have with them, just that you are going to keep spending to get more.

Someone should pass this info on to Jerome Powell.

Honestly no surprise...you inject too much money into the system and you get inflation. No different with FF miles. If people want cheaper redemption rates, the airlines need to reduce the amount of miles being doled out. You can't hype every credit card sign up bonus and also be indignant about mileage devaluations.

AND THEY WONDER WHY America is the way it is today

The heck does THAT have to do with anything? Man, the stupidity in some of these comments, lol.

The last airline I was loyal to due to the mileage program was Northwest Airlines. Fortunately I was able to use my accumulated miles on Delta when they were bought out before the awards charts got too ridiculous. The actual flight across the Pacific was on Korean Air. I still have accumulated miles in several programs but they are low totals. I prefer getting cash back on my credit cards because the programs for it...

The last airline I was loyal to due to the mileage program was Northwest Airlines. Fortunately I was able to use my accumulated miles on Delta when they were bought out before the awards charts got too ridiculous. The actual flight across the Pacific was on Korean Air. I still have accumulated miles in several programs but they are low totals. I prefer getting cash back on my credit cards because the programs for it don't devalue the same way as airline mileage miles do.

It's so interesting reading the comments. It seems there are endless defenses of this action. With little mention of the fact that they gave absolutely no warning to the changes.

I agree, this is a product of credit cards. However, at what point to those of us who actually fly for a significant portion of our miles actually get fed up. Remember when airlines actually flew people and fought to win your loyalty? That...

It's so interesting reading the comments. It seems there are endless defenses of this action. With little mention of the fact that they gave absolutely no warning to the changes.

I agree, this is a product of credit cards. However, at what point to those of us who actually fly for a significant portion of our miles actually get fed up. Remember when airlines actually flew people and fought to win your loyalty? That is what I find so troublesome. It's reached the point sitting on planes every couple of days that I wonder, am I actually flying a credit card? That is, am I just subsidizing the insanity of credit card miles?

Oh Stuart, UA is the cheating spouse that empties the bank account after feeding you a gas station burger for dinner. Break ups are difficult but sometimes you gotta move on. Position yourself to survive the economic upheaval and do whatever is best for you

Haven't flown UA in 10 years (and it wasn't the best experience then either), another reason not to bother despite having just got at least low level status via Marriott Titanium. I'll soon loose Silver medallion and then it'll just be a case of booking whichever is most convenient and best value, rather than bother with any loyalty to any airline. Was BA Silver for quite some time but slowly burning through BA miles based...

Haven't flown UA in 10 years (and it wasn't the best experience then either), another reason not to bother despite having just got at least low level status via Marriott Titanium. I'll soon loose Silver medallion and then it'll just be a case of booking whichever is most convenient and best value, rather than bother with any loyalty to any airline. Was BA Silver for quite some time but slowly burning through BA miles based on the fact that's probably the next airline to devalue by moving from zone based pricing to dynamic, you can see that coming in the pipeline soon I'm sure - I hear they're investing in upgrading their IT, which I bet will also include a shift in how they price their tickets and awards...

So strange, because I just booked three economy tickets from Detroit to Rio with miles on United - for only 60,000 miles round trip each (reduced from 140,000 each).

The cowards. It’s wrong to take away rights from existing customers & they know it !!! :(. Very disappointed in this fine airline — those responsible for this should rightfully lose their jobs. Signed: Dr JP Cody, a loyal member of UAL.

I'm with you, Doc!

I'm not sure this should come as a great shock given the insane bonus and earnings rates on US credit cards - if the supply keeps on getting pumped up that much then sadly redemption increases seem an inevitable consequence. It's a little less of an issue for US airlines given most of those members can earn in the US but has knock on consequences for those based elsewhere trying to redeem.

So noone seems to point out that premium economy somehow has remained at 45k? That's only 5 k more than economy, makes no sense

Having lived in NJ for 47 years, most frequent travelers like me stuck to United despite their inferior service for the loyalty program and somewhat convenient Newark hub. I sometimes flew to Singapore via United for the rewards although I knew Singapore Air was 10 times a better airline. Now the decision not to fly United is easier.

Living now in Florida I find myself flying JetBlue more often because their superior service and more legroom space.

Chase is undoubtedly complicit in this move by United. Chase has never been trustworthy, and it continues to prove it. United's program has been one of the positives of flying United for years, but they have now shot themselves in the foot.

Was AMEX complicit when awards on Delta tripled? If past history is any indication, I remember the bloggers who had connections like Ben many yrs ago talk to AMEX on some major change and AMEX said they didnt know until everyone did. I think it was the change to variable awards or something. This is a while back.

I could not agree more!

This will really make me think twice about building my UR stash, as at least half my redemptions are through UA. I wonder if Chase has a leverage here.

Only 30% increase? That is just on some saver awards. When you look at regular international Business Class awards that used to be less than 100,000 miles RT, they are now often more than 500,000 miles RT.

Not to undermine the devaluation, but the thing that caught my eye was the (very low) fee attached to these award flights.

As a Qantas FF (sadly not a lot of attractive options down under), the program has become absolutely useless. Availability our of AU is basically non existent, and fees and charges are through the roof. My last priced trip to Europe was over $4,000 in fees, which makes the whole thing a...

Not to undermine the devaluation, but the thing that caught my eye was the (very low) fee attached to these award flights.

As a Qantas FF (sadly not a lot of attractive options down under), the program has become absolutely useless. Availability our of AU is basically non existent, and fees and charges are through the roof. My last priced trip to Europe was over $4,000 in fees, which makes the whole thing a joke.

I almost miss the days where earning points was more difficult (basically you'd just earn points through flying only) but award availability made the program attractive to loyal customers. With the explosion in point earning options, I am not surprised to see that airlines use the scarcity of awards to increase award pricing. To quote an ex president "Sad. Very Sad."

Qantas and BA are notorious for their shockingly high fees. AA is a better choice for OneWorld accumulation. Just preCovid I wanted to book 5 tickets from the AU east coast (CBR, MEL, SYD) to Perth for a family holiday. If I used my QF miles it would have cost me well over $1,000 in fees. Using my AA miles (on the same QF flights) it cost less than $200. I only fly QF when I have no choice these days.

These aren’t high margin businesses…

So glad I spent almost all my UA miles in 2022 for a last minute biz class from BKK-ZRH-ORD-SAN for just 63k + $63. TG on first leg followed by UA's (re)inaugural flight ZRH-ORD with a memento, 3 hrs in Polaris lounge at ORD before donestic 1st class. A really long flight but well worth it.

I’m jealous!!

At this point, nearly all of these programs are becoming almost useless. I'm seriously thinking of just going to straight up cash back everywhere. Hotels and airlines have lost nearly all value with these programs. Seeing really stupid things like 720,000 skypesos on delta for one person r/t transatlantic. Seeing similar things on AA. It's just pointless to even bother most of the time.

Nah. It's not much different than it's always been. You have to study miles and points like it's an academic discipline, have a lot of flexibility, and book far in advance.

Honestly I'm pretty happy with the marriott program...as for united Im switching to ANA which has waaaay better service with the occasional SQ. Yes costs more but at least you get what you pay for, I feel it's not the case anymore with United.

Not surprised by this sorry sack of an airline. awful food, surly staff and a mediocre Business product.

So glad I cancelled the mileage plus chase card 6 months ago!

i

You could be referring to any US airline or FF program.

It's whatever one can tolerate...really.

I went to a straight 2.5% cash back. Stashing miles is a fools game.

I am seeing late January LAX-LHR roundtrip economy saver awards for 54,000 roundtrip:

33,400 outbound AND 20,600 return... maybe because I am a cobranded cardholder and Silver?

All the airlines suck. It's a race to the bottom. Once everyone is at the bottom someone will decide there's money in having customers not hate you and it will start to get better.

It's been years since I've had a booking and trip go well on an airline and I hate them all.

Um, there is no "bottom"...they're racing downward, but there is no limit where it's going to start getting better.

Define the bottom? Greyhound?

yes this is happening with low end transport too - need to book months ahead (bought in April for August travel) when tickets are released as it always has been but Megabus now only sells one seat per bus for $1 (plus taxes and fees) so my husband and I have to travel on two different buses for our budget DC to NYC weekend trip, unlike years ago when I snagged four seats for $4...

yes this is happening with low end transport too - need to book months ahead (bought in April for August travel) when tickets are released as it always has been but Megabus now only sells one seat per bus for $1 (plus taxes and fees) so my husband and I have to travel on two different buses for our budget DC to NYC weekend trip, unlike years ago when I snagged four seats for $4 plus taxes/fees. He is retiring the end of the year from USAF so going Space-A to Guam and Japan before we drop off active duty to lowest priority (I hope, but you never know when hitchhiking a C-17)

What do you expect when Delta gets away with charging 1 million miles for business to Europe and New Zealand?

Do they (Delta) really sell any meaningful number of awards at those rates? I think it's really another (scamy) way of saying "sorry, no awards available. Try again later"

I've been talking about now vile and corrupt Delta for years (and I live in Atlanta). I remember about 15-20 years ago (before Bastian become CEO of Delta) it was a decent airline with reasonable redemption rate on its international flights. I also had many AMEX cards linked to Delta. However, since their shameful devaluation begun about 5-7 years ago, I canceled all my Amex cards, or fyling on Delta. That has been my way to show how disgusted I'm with Delta.

I have flown delta for 30 years and have enjoyed Diamond status for years until I actually got covid and just missed. I can tell you United has treated me much better since joining and reaching 1K status.

Anecdotal evidence. I was 1K for United the last two years and failed to get an upgrade to first on 57 of 58 domestic flights.

It's been a few years already that loyalty programs stopped serving airline passengers and instead focused on big spenders. For 30+ years they did succeed at making many of us loyal to specific airlines or alliances. No longer.

Good things go bad and bad things go bust.

I spent 20 years flying UA (after 20 years flying AA and DL) and am almost at the 3M mile mark. I was unflaggingly loyal and ended up putting my sales team and family on UA both domestically and internationally literally hundreds of times, but primarily in coach. It started going down hill when they moved to revenue based mileage almost 10 years ago now. I can count on one hand the number of UA...

I spent 20 years flying UA (after 20 years flying AA and DL) and am almost at the 3M mile mark. I was unflaggingly loyal and ended up putting my sales team and family on UA both domestically and internationally literally hundreds of times, but primarily in coach. It started going down hill when they moved to revenue based mileage almost 10 years ago now. I can count on one hand the number of UA flights I've booked in the last 5 years - all domestic short haul. My SA Gold works just as well on SQ, LH, NZ, OS, TK, NH AC, CA and the rest - all of which I've used in that same period since UA no longer cares about loyalty in coach.

You make a good point: "car[ing] about loyalty in coach".

This used to be a key element of frequent flyer programs. Many of us who mostly could get coach tickets (from their employers) were very loyal to their alliance, their FPP, and their airline. In return we got priority services, lounge access, extra baggage allowance, and the occasional upgrade and free ticket.

This changed. Now many of us tend to stick to a specific alliance,...

You make a good point: "car[ing] about loyalty in coach".

This used to be a key element of frequent flyer programs. Many of us who mostly could get coach tickets (from their employers) were very loyal to their alliance, their FPP, and their airline. In return we got priority services, lounge access, extra baggage allowance, and the occasional upgrade and free ticket.

This changed. Now many of us tend to stick to a specific alliance, let alone airline, only when flying coach and if we have status and associated benefits. Otherwise, in particular when flying premium, we are free agents.

I’m done. Sure I’ll sign up for the random 100k credit card offer. But im all cash back and pay for flights now. When almost all flights are 60-100!k.

Not fun.

Been in this game since late 90’s

Not really fun anymore.

Peace out

The only astonishing thing here is that there are people who actually seem surprised by this.

What the heck did you THINK would happen, in the era of "get 100K miles for spending $X000 on our card!" or "dine here 10x and get 10,000mi!"...??

Precisely.

100% agree

Instead of making the minimum points 40k one way across the board, it seems like they could have targeted more popular routes & dates. Very disappointing.

the only useful part of United miles were for eco saver awards on international travel where the flight were in the day time and you don't need to sleep.

no one should be redeeming non-saver awards anyway, unless they get united miles for free

I noticed about a month ago transcon business/first rates jumped from a 60K floor to an 80K floor (barring unicorn Saver tickets, which are like, oh, six dates per year). Now I see it's part of a bigger picture. I suppose the only good thing that can be said is that at least award tickets now earn PQP's, but who wants to earn loyalty status when the airline shows none? What are you really getting...

I noticed about a month ago transcon business/first rates jumped from a 60K floor to an 80K floor (barring unicorn Saver tickets, which are like, oh, six dates per year). Now I see it's part of a bigger picture. I suppose the only good thing that can be said is that at least award tickets now earn PQP's, but who wants to earn loyalty status when the airline shows none? What are you really getting for it? The quality of Premier Desk agents for non-1K Premier members has dropped dramatically in the last year, so once-in-a-while upgrades are about all that's truly on offer.

I do need to fly transcon all the time, and UA is the only airline that offers connections from SBA through LAX and SFO (meaning much nicer planes with Polaris and Premium Plus cabins), so I'm stuck with them.

I'll still be transferring my Chase points to UA when a mile is worth more than 1.5 cents versus the refundable cash price, but I need to weigh earning with Chase at 1.5x+3x with a minimum 1.5 cent per point redemption for $250/year, against earning with Amex at 2x+4x with a minimum 1.54 cent per point redemption for $325/year (if I exploit every benefit).

Yawn...

Glad I got in on a saver economy award from HNL to LHR this summer for 27.5k one way a few months ago!

I’m seeing some LHR- EWR flights for 17.3K miles in economy and 65k miles in business class on UA metal — for example UA 147 on September 8. Is this another fare bucket?

@Lucky - your previous valuation was 1.3 cents. What is your new valuation?

Blogger pushes credit cards and credit card miles incessantly.

Blogger complains about the completely predictable devaluation of miles that follows.

You can have one thing (good redemption value or easy to earn credit card miles). You can't have both.

Nothing to see here folks, move along.

@Bob

Based on this news ; following up with a post recommending the Chase Sapphire Preferred card is a solid suggestion.

The saver SFO/LAX – SYD jumped from 175k to 200k like six months ago and no one in the blogosphere seemed to comment on it. ¯\_(ツ)_/¯ Though I will say on my next flight out there in June I saw an award labeled "for 1k members only" for 80k in J via Auckland and I jumped on it.

No matter how you slice it, the airline is going to avoid giving away things they...

The saver SFO/LAX – SYD jumped from 175k to 200k like six months ago and no one in the blogosphere seemed to comment on it. ¯\_(ツ)_/¯ Though I will say on my next flight out there in June I saw an award labeled "for 1k members only" for 80k in J via Auckland and I jumped on it.

No matter how you slice it, the airline is going to avoid giving away things they can charge a lot of money for, and discount the stuff they can't. I've been trying to stay flexible with my travel timing to jump on good deals when I can. But when I can't, I suck it up and fly in Y or pay the $$$ and fly J.

Saver LAX-SYD/AKL/MEL is still 80K each way... I can see some now and I'm not 1K

I have long given up on MileagePlus and, for that matter, AAdvantage.

The only points I value at all are my Ultimate Rewards, which to be honest you risk trip disaster to get the value out of (booking with their portal basically guarantees you are boned if anything goes wrong.)

Besides point devalution, the product is crap anyway. On AA I find myself paying cash for F and J fares, and can't even expect a pre-departure drink or anything but those vending machine cookies. The lounge often...

The only points I value at all are my Ultimate Rewards, which to be honest you risk trip disaster to get the value out of (booking with their portal basically guarantees you are boned if anything goes wrong.)

Besides point devalution, the product is crap anyway. On AA I find myself paying cash for F and J fares, and can't even expect a pre-departure drink or anything but those vending machine cookies. The lounge often doesn't even have cream cheese for the stale bagels.

I wish Spirit had more direct flights from here

When you consider how many ways people can earn miles what else would you expect? I'm sure other airlines are going to do same. When you understand what really drives profits at US domestic airlines today you understand how the game is quickly changing. The biggest factor you can have is flexibility when you want to travel but many people don't when they're looking to use miles. So they burn what they have to burn if they want certain dates.

As with most corporate decision-making, this just seems like a very shortsighted approach focused on reaping immediate benefits. Loyalty programs are massive profit centers, but that's only true as long as consumers continue to see value in earning miles.

Yes your right I always thought united gave miles for flying not everything else we do in life. Get miles flying give customers flights simple as that.

Booked in the nick of time!

Family member just booked Poland to San Francisco 1 stops in Business class for 75k two days ago. the same ticket is now 102k.

I'm still amazed at the fascination people have with airline miles, even as airlines continually devalue the value of each mile. I'm especially amazed as the number of people who buy into the co-branded credit cards (most with high annual fees).

People need to break the mile addiction. My bet is most people with an airline credit card aren't regular flyers and spend years "earning" a free ticket, all while paying a high annual fee,...

I'm still amazed at the fascination people have with airline miles, even as airlines continually devalue the value of each mile. I'm especially amazed as the number of people who buy into the co-branded credit cards (most with high annual fees).

People need to break the mile addiction. My bet is most people with an airline credit card aren't regular flyers and spend years "earning" a free ticket, all while paying a high annual fee, high interest rate, etc.

IMO, skip all of it and get a good cash-back credit card. That way, you can be a free agent and book tickets with who has the best price / schedule.

I would say that someone earning 100k with a few credit cards could easily get a couple of round trip tickets a year across the Atlantic, sometimes even in Business Class. All while not paying any interest and a few hundred in fees that are not offset.

I think the two caveats you mentioned eliminates a majority of cardholders.

IF someone spends the amount of money to earn 100K per year and IF they pay off the credit card every month and incur no finance charges, then it could be more valuable.

However, I'm not sure the average consumer fits that bucket. Even if someone does, an airline card may be valuable. However, when you earn cash back, you know the...

I think the two caveats you mentioned eliminates a majority of cardholders.

IF someone spends the amount of money to earn 100K per year and IF they pay off the credit card every month and incur no finance charges, then it could be more valuable.

However, I'm not sure the average consumer fits that bucket. Even if someone does, an airline card may be valuable. However, when you earn cash back, you know the value and it can be spent anywhere, whereas a mile is just funny money with the value dictated by the airline. Therefore, what may be "valuable" today may not be tomorrow.

The real question is why anyone spends money on co-branded cards. It's easy enough for an infrequent flier (with no status) to save money with a $95 co-brand card that waives checked bag fees for everyone in your travel party. One round-trip for two people with checked bags results in a net savings.

I saw this happen in real-time yesterday. I was searching for award seats for next April in business class to Europe (have been watching them for a couple weeks so I know the prices and options). When I refreshed my browser, all the numbers had gone up by 1/3 - and all the options offering reasonable connections were gone. Now everything costs 1/3 more, and even at the higher prices, now the connections are horrible.

...I saw this happen in real-time yesterday. I was searching for award seats for next April in business class to Europe (have been watching them for a couple weeks so I know the prices and options). When I refreshed my browser, all the numbers had gone up by 1/3 - and all the options offering reasonable connections were gone. Now everything costs 1/3 more, and even at the higher prices, now the connections are horrible.

This is a massive devaluation, perhaps the biggest ever. Gutted.

Glad I burnt all my miles last year ! Though I wouldn’t fly United even if they created value.

I think award availability and miles fluctuate based on the United status: 1K, gold, silver. Etc

It’s getting pointless than ever to collect points or getting those airline credit cards. Dynamic award sucks other than random award discount sales. Probably will burn up my MR and UR points or cash them out and walk away from point & miles game.

I'm doing the same thing!! I'm canceling cards and not even looking into redemption options. The greed has gotten out of control and I'm choosing not to be a part of it. My favorite is APR continues to go up on credit cards (Excellent credit), almost matching what a cash advance/penalty APR was: 29.99%. Bye!!

If you have a balance so that you need to pay the APR you're doing it wrong.

Ugh. Of course I found an award option yesterday for 77K that's now 102K today. The worst. United has been so reliable for at least something if you play the long game.

It's no surprise. When we can collect miles so freely these days from credit card offers, shopping and dining, something has got to give.

One of the things I love about OMAAT is that unlike some other blogs in this space that will remain namesless, I don't feel like you're trying to always put a spin on something or mislead your readers to make money. But I'd love to read an article on your thoughts about what the future of points and miles travel is for everyday users at this point. Most people are not savvy enough to always...

One of the things I love about OMAAT is that unlike some other blogs in this space that will remain namesless, I don't feel like you're trying to always put a spin on something or mislead your readers to make money. But I'd love to read an article on your thoughts about what the future of points and miles travel is for everyday users at this point. Most people are not savvy enough to always find award sweet spots and certainly aren't booking last minute travel to snag a business class seat 3 days out. We've seen hiked rates, closed loopholes, randomly increased fuel surcharges, and a total lack of award availability. I'll always be someone who tries to leverage points and miles, but at this point being totally honest with ourselves, what does the future look like now?

I mean - 80K points to Europe in J, in the grand scheme of things, isn't terrible. It is more than it was before. But that is $1,000 one way if you assume United points are worth 1.25 cents. $1,000 in business class to Europe is more than fair.

It is terrible when you realize 5 year ago it was 50k.

A lot of things were cheaper five years ago. It truly is what it is.

Points devalue - but so does the US$

The Genie has been let out of the bottle. Tiktok and Instagram reels have effectively killed (airline/ hotel) points. You are introducing thousands of people to "the points game" at once and oh by the way, the direct aisle access of Polaris (any refreshed business class cabin) doesn't help (less seats in premium cabins). Think of it this way: emirates only has 8 first class seats. If you start sending 1 million people after those...

The Genie has been let out of the bottle. Tiktok and Instagram reels have effectively killed (airline/ hotel) points. You are introducing thousands of people to "the points game" at once and oh by the way, the direct aisle access of Polaris (any refreshed business class cabin) doesn't help (less seats in premium cabins). Think of it this way: emirates only has 8 first class seats. If you start sending 1 million people after those seats (let's say that prior to IG/ TT it was 200k), that means that it will be harder to find award seats. Emirates only has 2 options: either increase award prices or do nothing. The biggest benefactors of this (for the moment) are transferable points; as mentioned in another comment, cash back cards might be the move long term. Eventually ALL loopholes will be closed (Avianca/ Air canada/ Singapore will also raise award prices) so even the transfer cards will become useless. I am surprised chase didn't put up any protest to this (or maybe they did and we just don't know); unless chase increases the sign up bonuses (unlikely), the co-branded credit cards with UAL have become effectively useless. Only if we could get the bud light movement and shift it over to airlines.

I agree it's not just the devaluation, but the total lack of J award availability that has really gutted these programmes. I'm questionning whether they are worth the effort.

I'd consider myself pretty savvy with miles and points, but have increasingly found myself prefering simple cashback credit cards. A straight 2% cashback on all you spend in the ultimate transferrable currency - it can buy me any seat on any airline, and no effort to...

I agree it's not just the devaluation, but the total lack of J award availability that has really gutted these programmes. I'm questionning whether they are worth the effort.

I'd consider myself pretty savvy with miles and points, but have increasingly found myself prefering simple cashback credit cards. A straight 2% cashback on all you spend in the ultimate transferrable currency - it can buy me any seat on any airline, and no effort to work out which card is best for which category of spend.

I just booked a Star Alliance trip on Friday on Life Miles. Those flights were already expensive by 28K miles at United and today they are even higher. Aeroplan and Hyatt are the only worthwhile partners of UR left.

Recently used about 85k miles to book my family on a domestic family vacation r/t (paid for my own). And I'm glad I did! I only wish we'd have booked business class (which seemed unnecessary for a sub-3 hour flight). Unbelievable how these airlines bite the hand that feeds them. And with no notice either, which is really sh!tty.

What a crap change by United.

Oscar Munoz should have remained in charge.

Still not nearly as ridiculous as Delta’s Skymiles. How about 630K miles for a round trip from east coast to Europe in the amazing Delta One onboard 767-400? Lol

Ditch loyalty & miles. Fly airlines that compete for your business, and allow you to add on services you need like lounge access and upgrade to J.

Lol yah… however skymiles still have some uses in the domestic Y space. Having flexibility allows my parents to visit me across the country at dirt cheap cost (9000 miles one way) and with 15% Amex award discount, even cheaper.

Other than that, not much, you find the rare partner award … but you’d be crazy to use skymiles for premium travel.

Phew.. good thing I booked our Spring Break trip to LIS 2 days ago, it's gone from 77K to 102K.. Yikes!