For years, we haven’t seen any major US airlines introduce co-branded debit cards, due to lack of ability to make money there. Fortunately that’s a trend that’s now changing, and Southwest Airlines is the first carrier to roll out such a product.

In this post:

Details of the new Southwest Rapid Rewards Debit Card

The new Southwest Airlines Rapid Rewards Debit Card has just launched, powered by Galileo. The card is issued by Sunrise Banks N.A., member FDIC, with Visa as the payment network. Customers can now sign up for this product at southwestdebit.com, and there’s no credit check when applying.

To cover the basics of Southwest’s new debit card:

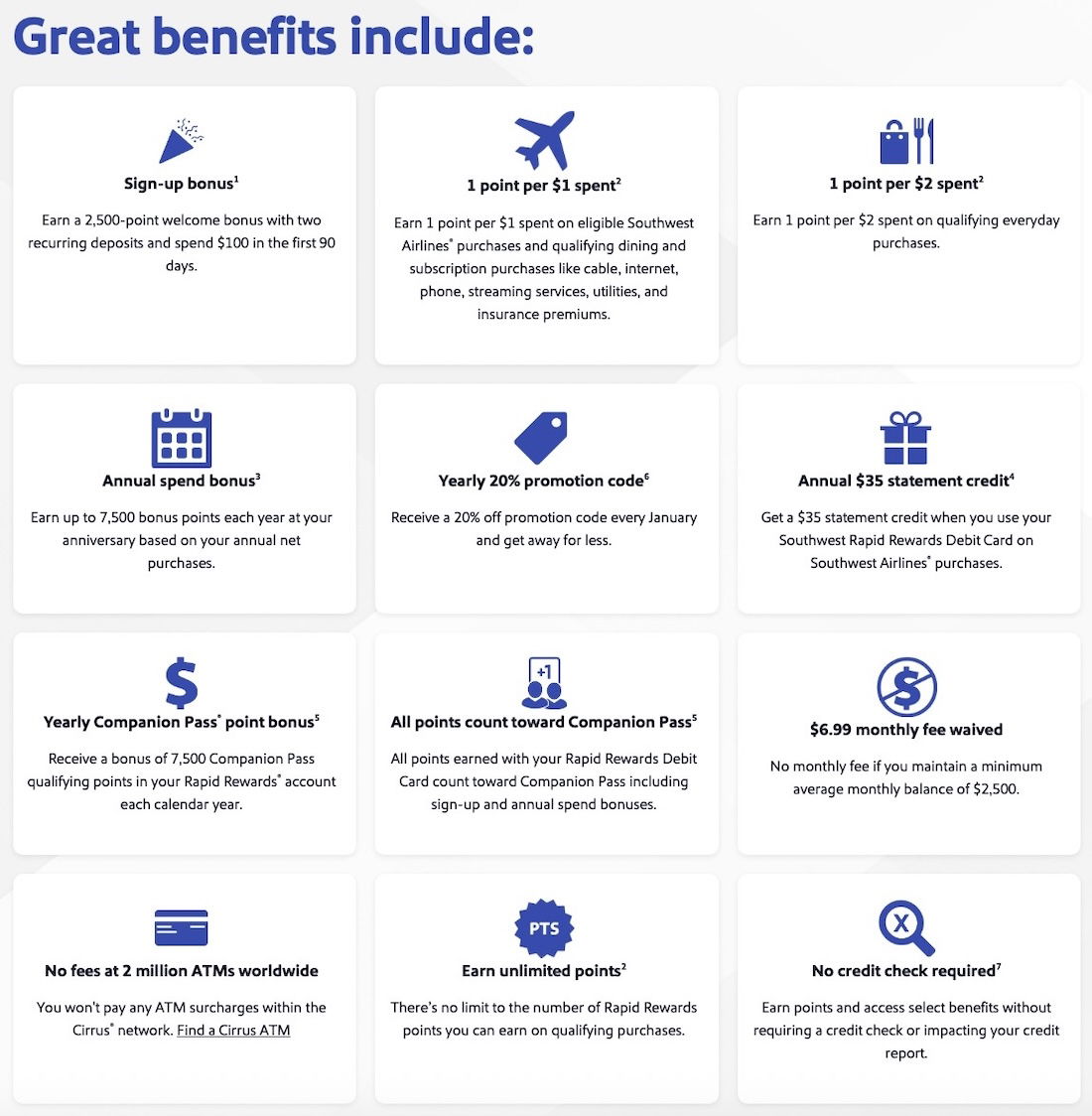

- The card has a welcome bonus of 2,500 points after making two recurring deposits and spending $100 within the first 90 days

- The card offers one point per two dollars spent on everyday purchases, plus one point per dollar spent on Southwest purchases, dining, and subscriptions (including internet, phone, streaming services, and utilities)

- The card can help you earn Companion Pass — the card offers a 7,500-point bonus toward Companion Pass every year, plus all points earned on the card count toward Companion Pass

- The card offers up to 7,500 bonus points on the cardmember anniversary ever year (if you make at least $15,000 in qualifying purchases), an annual 20% off promotion code, and an annual $35 Southwest credit

With the card, there are no fees to withdraw money from ATMs within the Cirrus network, and the monthly fee is waived if you keep a monthly balance of at least $2,500.

Here’s how Tony Roach, Southwest’s Chief Customer and Brand Officer, describes this:

“At Southwest Airlines, we are continually exploring new ways for our Customers to experience the benefits of our Rapid Rewards program. With more than 90% of Americans using debit cards, expanding our award-winning Rapid Rewards loyalty program to include a debit card was a natural next step. Whether it’s a college student looking to book a flight to watch their favorite team, a parent setting up an account for a recent graduate, or a cash-savvy Customer looking for another way to earn rewards, the Rapid Rewards Debit Card offers unlimited options to turn everyday spending into that next Southwest flight.”

Wait, how do the economics of debit cards suddenly work?

Back in the day, there were plenty of debit cards offering half decent rewards. However, in 2011, debit card fees in the United States were capped by the Federal Reserve, following the passage of the Durbin Amendment to the Dodd-Frank Act. With that, the maximum interchange fee for debit card transactions was set at $0.21 plus 0.05%.

It goes without saying that this doesn’t leave much upside for debit card issuers, or for any co-brand partners. That’s why we saw lucrative debit cards largely eliminated.

Credit cards have become increasingly big businesses year after year, and for airlines, we’ve also seen a large percentage of profits generated from these co-brand agreements. But in recent years, there hasn’t been upside with debit cards.

So, why are airlines suddenly once again looking at debit cards? It seems they’re getting more creative, and there are a few main considerations:

- There’s a small issuer exemption, whereby banks with less than $10 billion in assets can still earn higher interchange fees, so that’s a loophole that’s presumably being used

- There’s potentially money to be made by a bank having someone in their “ecosystem,” in terms of holding a balance with the bank, being able to sell them more banking products, collecting fees, etc.

- Airlines are of course obsessed with getting people to apply for their credit cards, so the goal might be to first get someone to apply for a debit card, and use that to eventually get them to apply for a credit card, if/when their credit improves

To state the obvious, if you qualify for credit cards (based on having a decent credit score) and can use credit cards responsibly, you absolutely should use them. They offer much better rewards (in terms of the welcome bonuses, return on spending, and benefits), and they also offer better consumer protection.

But if you don’t qualify for credit cards, you’re still better off earning some rewards with a decent debit card, rather than no rewards.

Bottom line

Southwest Airlines is getting back into the debit card business, with the introduction of a new debit card. We haven’t seen much action on this front in the past 15 years, given the lack of upside. However, thanks to creative partnerships between airlines, issuers, and banks, I suspect that’s a trend that will now reverse, and that it won’t just be Southwest introducing something like this.

What do you make of Southwest launching a debit card product?

This isn’t so much a debit card as a bank account. The money isn’t in the interchange but the monthly fee or high (interest-free) balance that waives it.

A debit rewards card might be worth looking into for those rent/mortgage/hoa payments depending on what happens with Bilt 2.0

Any rumors of other carriers going for this? I remember Continental did big business with their debit cards. United has to have that data somewhere, so wouldn't be shocked to see them jump on the bandwagon.

Delta seems screwed, due to exclusivity with American Express. I don't remember them ever having a debit option, back then.

The entire fintech industry is based on exploiting the small banks loophole

I wonder if the annual 7500 companion pass bonus will stack with the annual 10,000 credit card companion pass bonus? Need to dig through the terms and see some data points next year