Investment platform Robinhood is launching a credit card, and it almost sounds too good to be true.

In this post:

Details of the lucrative Robinhood Gold Card

The Robinhood Gold Card will soon be coming to market, issued as a Visa Signature Card. The card isn’t yet open for applications, but you can add yourself to the waitlist, with a launch expected later this year. The card has a very simple value proposition, as it will offer 3% cash back on all purchases with no caps. That’s quite literally unheard of, and obviously sounds too good to be true.

To cover some more of the details of the Robinhood Gold Card:

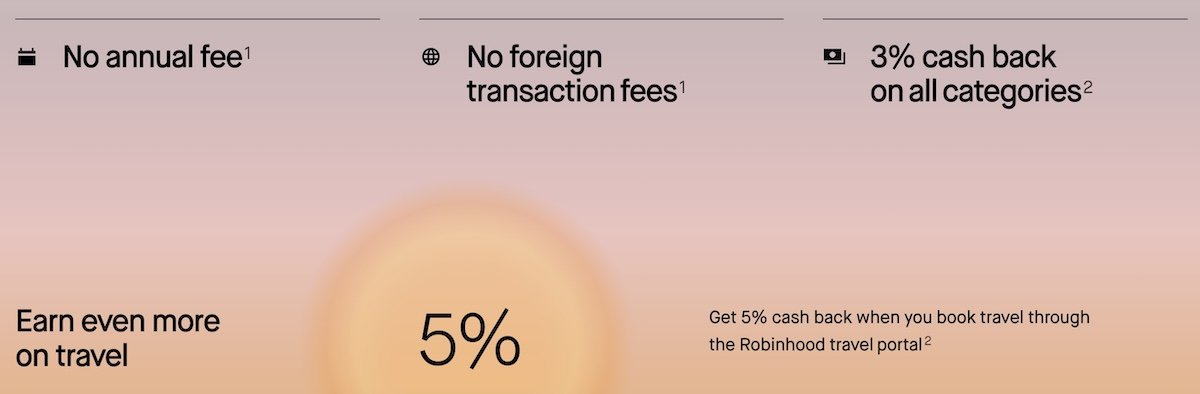

- The card will offer 3% cash back on all purchases, and 5% cash back on travel booked through Robinhood’s travel portal, all with no foreign transaction fees

- The card will let you redeem cash back in a variety of ways, including transferring the rewards to your Robinhood brokerage account, booking travel through Robinhood’s travel portal, shopping with partner merchants, and more

- The card won’t have an annual fee, but you’ll need to be a Robinhood Gold member to get the card, with a membership costing either $5 per month or $50 per year

- The card will weigh 17 grams and will be made of stainless steel; meanwhile if you refer 10 people to Robinhood Gold, you’ll receive a “limited edition Solid Gold Card”

- The card will offer a variety of Visa Signature perks, including trip interruption protection, auto rental collision damage waiver, extended warranty protection, travel and emergency assistance, and more

It’s interesting to note that last year, Robinhood acquired credit card startup X1 for $95 million, and it appears that this credit card launch is essentially based on that concept.

Is the Robinhood Gold Card too good to be true?

Over the years we’ve seen credit card rewards get richer and richer. While there are lots of ways to earn travel rewards with credit cards, at a minimum you should be earning the equivalent of 2% cash back on all purchases, or else you’re leaving money on the table.

However, the concept of a 3% cash back credit card with no caps is unheard of. That’s more than the merchant fees, meaning that Robinhood would be losing money on every single transaction, rather than making money. Is there any world in which a loss leading credit card like this is sustainable?

On the one hand, there’s potentially still quite a bit of upside for Robinhood:

- This will encourage people to become Robinhood Gold members, which costs at least $50 per year, so think of that as an indirect annual fee

- Many credit cards offer huge upfront sign-up bonuses, while I suppose one could argue that Robinhood is instead allocating that investment into ongoing rewards

- This would certainly help Robinhood build huge market share as an investment platform, since this is a card that many people would probably be interested in

- Some people will finance charges, which is another way that credit card companies ordinarily make money

- The average person isn’t spending hundreds of thousands of dollars per year on credit cards, so the company’s per-person loss on the card will be minimal for most customers

On the other hand, this really does sound too good to be true. I mean, you can pay your federal income taxes by credit card with a fee of under 2%, so you could profit more than 1% on your tax payments.

Then again, for those of us who are savvy with using credit cards, this card might not get us a higher overall return than we have by using a credit card portfolio that takes advantage of bonus categories. But for everyday, non-bonused spending, this level of return is unheard of.

Let’s wait and see when this card launches, as I can’t help but wonder if there might be some surprises.

Bottom line

Robinhood is planning on launching the Gold Card later in 2024, which will offer 3% cash back on all purchases with no caps. This is an unheard of return on everyday spending, and Robinhood would lose money on each transaction.

It’s interesting to see an investment platform essentially try to make a credit card a loss leader in order to get people on the platform. I’ll reserve final judgment until the card launches, but I sure am intrigued…

What do you make of the Robinhood Gold Card?

This looks good to me as my everyday purchase card is currently PayPal 2% on most things, 3% on PayPal. I do have other cards for Gas and Groceries, but I think this will be for everything else.

3% is a nice upgrade and helps me consolidate restaurant, travel (their travel portal 5%) and Costco spend onto this card as well as that was 2 or 3. Less cards to manage for different categories.

It...

This looks good to me as my everyday purchase card is currently PayPal 2% on most things, 3% on PayPal. I do have other cards for Gas and Groceries, but I think this will be for everything else.

3% is a nice upgrade and helps me consolidate restaurant, travel (their travel portal 5%) and Costco spend onto this card as well as that was 2 or 3. Less cards to manage for different categories.

It appears that the fee is $50 annual (of pay up front). That is totally justified for me with the current amounts we put on the PayPal monthly.

Additionally, if you are into it, it appears that the included free access to margin to make money on a low risk ETF.

Lastly, depositing the cash back back to their 5% sweep/brokerage account means it could just hang out there bearing interest as that is the same as my HYSA.

If anyone else wants to make the jump, please use my referral link below. It helps me get a bonus.

https://robinhood.com/creditcard?referral_code=7ba7271e

Get as many credit cards as you can. Use them to buy a whole bunch of things you don’t need. Feel good about getting 3% back and having “cheated the system”. Sounds like the American dream…

Since RH Gold comes with $1,000 of interest free margin, easy to offset 'annual fee' with BOXX

Amazingly compelling product

Not sure if trading options just to cover the annual fee is a good idea for most people.

BOXX is not an options trade

Long dated index options incorporate the 'risk-free-rate' (T bills) and a box is a complex options strategy that delivers the risk free rate

BOXX is just a tax efficient ETF wrapper around that strategy, that as the term 'risk free rate' captures, is pretty much risk free

Not sure that this card is any better than USBank’s Altitude Reserve. I actually think it’s worse. The reserve gets me 3% cash back on every tap-to-pay purchase (most stores and online shops will take Apple Pay these days). In Europe, everything is tap to pay so that’s every purchase on vacation for me. Plus, if I redeem for travel this ends up being 4.5% cash back on almost everything. 3% on everything sounds good...

Not sure that this card is any better than USBank’s Altitude Reserve. I actually think it’s worse. The reserve gets me 3% cash back on every tap-to-pay purchase (most stores and online shops will take Apple Pay these days). In Europe, everything is tap to pay so that’s every purchase on vacation for me. Plus, if I redeem for travel this ends up being 4.5% cash back on almost everything. 3% on everything sounds good but (1) I trust US Bank more (2) I already get the same or better from my cards and (3) I get really great insurance from a card the costs net $75 a year (after getting $300 back on dining or travel). I feel this is just advertising to people who react to flashy advertising without looking too closely at the fine print and actual benefits. For plain cash back even the 2% citi cash back may be better if you consider the fee.

Agreed. The US Bank Altitude Reserve is my primary card and it is effectively 4.5% cashback via Real Time Rewards.

Tap/Apple Pay acceptance has skyrocketed since COVID. Even at small businesses with non-customer facing card terminals, the terminals are typically tap-enabled. Asked about Apply Pay at my doctor's office once, and the staff had no problem just holding the card terminal up for me to tap.

My apologies. Her eis the actual link:

https://cdn.robinhood.com/assets/robinhood/legal/RHF%20Fee%20Schedule.pdf

Here is the link to Robinhood's fee schedule: chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://cdn.robinhood.com/assets/robinhood/legal/RHF%20Fee%20Schedule.pdf

The Gold subscription fee is $75/year or $6.99/30 days according to the fee schedule on Robinhood's website. Not sure how you got the $50/year number.

As a Visa Signature, its interchange fees will average about 2.2 percent. So, where are they getting the extra 0.8 percent? Moreover, the recent settlement will bring those interchange fees down to about 1.6-1.8 percent over the next five years.

Either, as some suggested, it's a short term bait and switch, or they think that $50 + whatever revenue they get from any other business from you will be worth it to them. ¯\_(ツ)_/¯

I'm waiting for the Ben post about the new interchange fee agreement. That has the potential to change his game a lot.

That 3% is a great deal if you’re paying your taxes with it, if you can get a big enough credit line.

The BofA VISA tops out at 2.62% for non-entertainment/travel. An extra 0.38% back would make a big difference.

I smell "Bait and Switch" in the future. Like many financial institutions, Robinhood will offer benefits that's "Too Good To Be True. But once they penetrate the market with mass adoption, they will scale back these offerings and start diluting benefits. Like the old saying goes "New $hit, same old pile".

This isn’t *that* unheard of, the Fidelity cashback card gets 3% as a member of rewards+, if you have over 2 million in assets at Fidelity.

If you’re ok paying Fidelity’s wealth management fees on your money.

Not unheard of. Many of us still have the AOD Federal Credit Union Visa Signature card with 3% uncapped and auto credited each month back to the statement. No annual fee and no FX fee. They closed the card to new signups after a year or two, and underwriting was manual on every application and very conservative, but it was a well publicized card. Membership was open to anyone who signed up for a local mountain biking association for a tiny one-time donation.

Wouldn't $5 per month equate to an annual fee of $60 per year instead of $50?

And to echo 305's comment, why would anyone want a card associated with a trading platform that just arbitrarily shut off the "sell" function during the whole Gamestop short event a few years ago? No amount of rewards would entice me to get within a mile of applying for this card.

@ Euro -- There's a discount if you pay the annual membership fee rather than paying month-by-month.

No chance I’d sign up for anything coming from this shady company. They illegally suspended retail trading of certain stocks to allow hedge funds to cover their shorts. No one should trust them

They did nothing illegal according to the government.

But people should know better. Their name says it all, Robin from the hood.

What does it matter in this case, if they’re lending money to you?

I wonder if you refer 10 people that they'd let you get a plastic version of the card? There are people that don't like the weight of a metal card in their wallet.

Exactly! It's gotten so bad that I'm excited now when a new card arrives and is plastic.

Get the card, sign up 10 people, get the gold card, cancel the account, and sell the gold. If it's 17 g like the steel card, and it's really "solid gold", it's worth $1200.

Of course, like everything else with Robin Hood, I'm sure every part of "solid gold card" is misleading.