Link: Apply or upgrade your existing card to the no annual fee Bilt Blue Card, $95 annual fee Bilt Obsidian Card, or $495 Bilt Palladium Card

A few weeks ago, we learned how major changes are coming to Bilt, the platform that’s known for letting people earn points for paying rent, without racking up any fees. We’ve known that Bilt is discontinuing its one Wells Fargo credit card, and transitioning to having three Cardless credit cards. Not only that, but the way that members are rewarded for paying rent is changing as well.

I’d like to provide an update, as today is a big day, as the transition to the new Bilt Card 2.0 platform is underway. Just about everything is changing, from how housing payments are rewarded, to the rewards structures and perks of the credit card(s). Let’s cover everything we know.

In this post:

Bilt’s new system for awarding points for rent & mortgages

Before we even talk about the details of the new credit cards, let’s discuss how rewards for rent are changing. I don’t want to bury the lede, so to put this as simply as possible, regardless of which credit card you have, you’ll need to spend an average of 75% of your rent or mortgage amount on the card (give or take) in order to earn 1x points.

To discuss that in a bit more detail, historically, those with the Bilt Card have been able to pay their rent with no fee while earning 1x points on that spending, for up to $50,000 in rent spending per year. The only requirement was that you had to make five transactions per billing cycle on the Bilt Card in order to unlock that.

The hope was that people would shift a lot of their spending to the Bilt Card. However, as you might have guessed, that wasn’t always the case. Instead, many people would make five small transactions per billing cycle while earning points for rent, which wasn’t really a sustainable model.

With that in mind, this system has completely changed. Here’s the good news:

- Members are now able to earn points for paying both rent and mortgages (mortgage rewards are new)

- Members are now able to pay for multiple properties and earn points (compared to being limited to one property)

- There is no longer a cap on the amount that members can be rewarded annually (previously there was a $50,000 annual cap)

As you’d expect, there’s a major catch — you now need to “earn” the ability to earn rewards for your housing payments. Specifically, this comes in the form of using Bilt Cash:

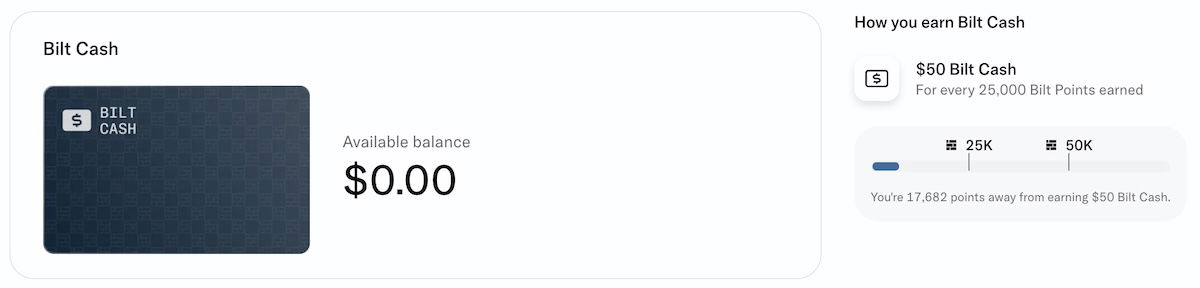

- All three Bilt credit cards offer 4% in Bilt Cash on spending, in addition to the standard rewards structure (Bilt Cash is a Bilt specific rewards currency)

- $3 in Bilt Cash is worth 100 Bilt points on your total rent and mortgage payment, at the rate of 1x points

- Bilt Cash expires on December 31 of the year in which it’s earned, though $100 in Bilt Cash can be rolled over to the next year

- You need to have the Bilt Cash in your account at the time that you try to make your rent or mortgage payment, so you can’t pay after the fact, or anything like that

- While earning rewards on housing payments is one of the best uses of Bilt Cash, there are other ways to use these rewards as well, like for a spending accelerator, for improved Rent Day promotions, and more

Okay, the way this is structured strikes me as unnecessarily complicated, as it seems like the amounts should’ve been adjusted a bit, to be simpler. But the idea is that you earn 4% back in Bilt Cash toward those payments on your spending, and then you can earn rewards on your housing payments at a 4:3 ratio between your rent or mortgage cost and your credit card spending.

Obviously this is a major departure from the old system. To explain it in the form of an example:

- If you spent $15,000 on a Bilt card, you’d earn $600 in Bilt Cash (since you earn 4% back in Bilt Cash on all spending on all cards)

- $600 in Bilt Cash would allow you to earn $20,000 in fee free rent or mortgage payments, while earning 1x points

There’s one other major change that’s quietly being made here. Under the new system, rent and mortgage amounts are no longer charged to your card, but instead, are immediately deducted from your account via ACH, and then you’re awarded points. So you no longer basically get an interest free advance on your payments for a billing cycle. For that matter, it’s less than ideal for those who just don’t like having things directly debited from their bank account.

Details of the three new Bilt Cardless credit cards

Bilt is transitioning from having a single Wells Fargo credit card, to having three Cardless credit cards. The products are at very different price points, so let’s cover the details of those, as they’re launching as of today (February 7, 2026). Separately, I’ve reviewed the three cards, and have compared them.

Before I do, let me note that the sign-up bonuses mentioned below are available for a limited time, and are available for both new and transitioning customers. Furthermore, you can only be the primary cardmember on one Bilt credit card, so you couldn’t apply for multiple of these cards.

No annual fee Bilt Blue Card details

The no annual fee Bilt Blue Card is the most basic card in the portfolio, and the least exciting. It essentially gives you access to the ability to earn rewards for rent and mortgage payments with Bilt, without many frills. It has the following perks and rewards structure:

- A welcome bonus of $100 in Bilt Cash upon approval

- 1x points + 4% back in Bilt Cash on everyday purchases, with no foreign transaction fees

- Unlimited 1x points on rent and mortgage payments (funded with Bilt Cash)

- World Elite Mastercard benefits

$95 annual fee Bilt Obsidian Card details

The $95 annual fee Bilt Obsidian Card is the mid-range card in the portfolio, and it offers expanded spending multipliers, and a travel portal credit that can potentially offset the annual fee. It has the following perks and rewards structure:

- A welcome bonus of $200 in Bilt Cash upon approval

- 3x points on your choice of dining or groceries (dining is uncapped, groceries is capped at $25K of spending per year), 2x points on travel, 1x points on all other purchases, and 4% back in Bilt Cash on all purchases, with no foreign transaction fees

- A $100 Bilt travel portal hotel credit every calendar year ($50 semi-annually, two-night minimum stay)

- Unlimited 1x points on rent and mortgage payments (funded with Bilt Cash)

- World Elite Mastercard benefits

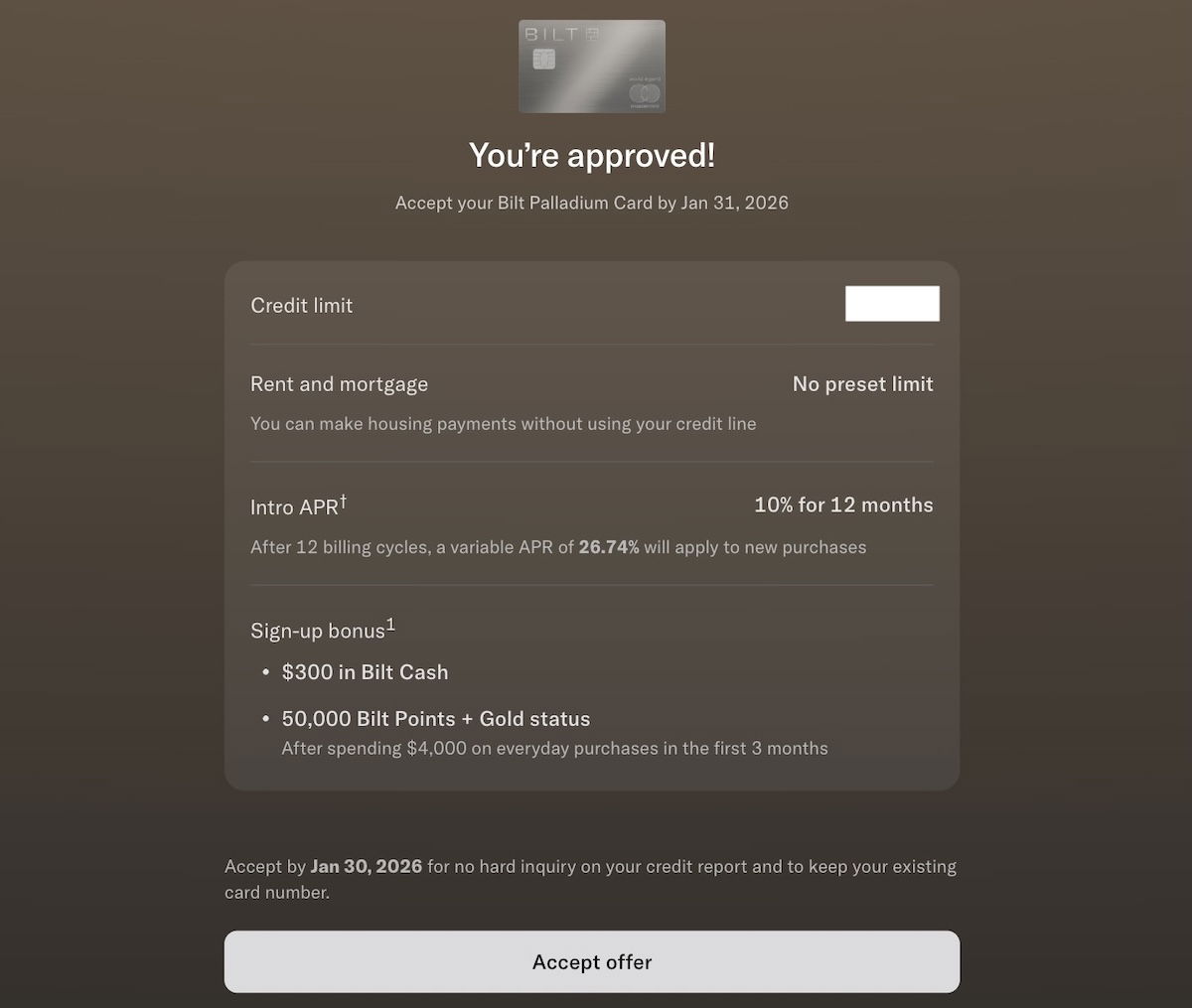

$495 annual fee Bilt Palladium Card details

The $495 annual fee Bilt Palladium Card is the most premium card in the portfolio, and it offers what might just be an unrivaled return on everyday spending. It has the following perks and rewards structure:

- A welcome bonus of 50,000 bonus points and Bilt Gold status after spending $4,000 within three first three months (on non-housing purchases), plus $300 Bilt Cash upon approval

- 2x points + 4% back in Bilt Cash on everyday purchases, with no foreign transaction fees

- A $400 Bilt travel portal hotel credit every calendar year ($200 semi-annually, two-night minimum stay)

- $200 in Bilt Cash annually, deposited at the beginning of each year, including with account opening

- Unlimited 1x points on rent and mortgage payments (funded with Bilt Cash)

- A Priority Pass membership, with up to two guests allowed (authorized users can be added for $95 each, and also receive a membership); this membership doesn’t offer credits at Priority Pass restaurants, unsurprisingly

- World Legend Mastercard benefits

How the Wells Fargo to Cardless transition works

Over the past few weeks, Bilt opened “pre-order” for the new card portfolio, whereby cardmembers could choose to transition to the new cards, to make the process seamless. Now we’re seeing the new card portfolio launch as of today, February 7, 2026:

- Bilt is transitioning from Wells Fargo to Cardless, and existing cardmembers are being moved to the new platform, with the card numbers staying the same, digital wallets auto-updating, and no hard credit inquiries

- Those who choose to transition to a new Bilt credit card are able to transfer any balance from their old account, with a soft credit pull; note that when you move from Wells Fargo to Cardless, your credit limit may change

- During the transition process, you can decide whether you want to keep your Wells Fargo account open, in which case the card become sthe Autograph Visa card with a different card number; you can keep this even if you decide to open a Bilt product with Cardless

- There are some reports of existing Wells Fargo cardmembers being denied for a Cardless product, which is… kind of not ideal

In a separate post, I shared my experience transitioning to the Bilt Palladium Card.

My take on these Bilt credit card & rewards changes

It goes without saying that these Bilt changes are massive, and it’s now a completely different ballgame. In the past, one could have the Bilt Card, make five tiny transactions each billing cycle on the card, and then earn thousands of points in monthly rent payments. Obviously that model simply wasn’t sustainable, from a profitability perspective.

For the average consumer, especially for those who aren’t huge credit card spenders (particularly in non-bonused categories) these changes are negative. The new no annual fee card isn’t nearly as rewarding as the old no annual fee card. Furthermore, you now need to spend an average of at least 75% as much as your rent payment in order to earn rewards for that amount. These changes aren’t surprising, but they’re rough.

That being said, I feel like the real sweet spot here is the $495 annual fee Bilt Palladium Card, and it’s the card that I’ve decided to apply for. It might just be the new best premium card for everyday spending:

- The card actually has a welcome bonus, which the old Bilt Card never officially had, which means it’s at least worth giving the card a try

- Earning 2x points on everyday spending is awesome, especially given Bilt’s transfer partners, like Alaska Atmos Rewards and World of Hyatt; however, frustratingly, the terms suggest you can’t earn points on things like tax payments, which totally counters the industry norm

- If you do spend a significant amount on credit cards, then there’s a ton of upside in being able to earn points for paying your rent, mortgage, etc., including on multiple properties (if applicable), with no caps

Of course the issue is the annual fee, and the general credit card fatigue that many of us have. I think most of us already have a Priority Pass membership, so don’t value an incremental membership that much. The $400 Bilt travel credit helps with offsetting the $495 annual fee, but either way, this isn’t a card where you’re likely to come out ahead exclusively based on the benefits and credits, and there’s a very real cost to holding onto the product.

As I see it, the sweet spot with maximizing value with Bilt has basically reversed. Bilt used to be great for those who weren’t big spenders and who had a no annual fee card, since the rent rewards were disproportionate. Meanwhile under the new system, Bilt is great for those who are big spenders, and who have huge rent or mortgage payments (the fact that there are now also rewards for mortgages is exciting for many!).

I would guess that with these changes, the number of people paying their rent through Bilt will be decreasing significantly. However, perhaps the amount that people are charging to Bilt cards will increase, since there’s finally an incentive to spend on one of the cards… if you’re willing to pay $495 per year. Unfortunately the rewards structures on the two more basic cards are significantly less interesting, if you ask me.

I think there’s one other potentially interesting angle here. Bilt and Alaska Atmos Rewards also have a partnership. This allows people to earn 3x points on rent payments on the Atmos™ Rewards Ascent Visa Signature® credit card (review) and Atmos™ Rewards Summit Visa Infinite® Credit Card (review), in exchange for a 3% fee, which can’t be paid with Bilt Cash.

Some people might still find that to be worthwhile, especially since you can then redeem Bilt Cash for other things, like an additional points accelerator on spending.

Bottom line

As of today (February 7, 2026), Bilt is transitioning its credit card portfolio from Wells Fargo to Cardless. Just about everything is changing, from the card details, to how housing payments are rewarded.

Long story short, cardmembers are able to earn points for rent and mortgage payments, with no caps. The catch is that they’ll essentially have to spend 75% of their rent or mortgage amount on the card in order to earn rewards.

Bilt has three credit cards, incuding a basic no annual fee card, a $95 annual fee card with a couple of bonus categories and a hotel credit, and a $495 annual fee card that offers 2x points on all purchases, plus a hotel credit.

These all represent massive changes, and there’s no denying that Bilt no longer has the mass appeal it once had, where you could basically earn rewards on rent for next to nothing. Bilt is still worthwhile for some, and in particular, the Bilt Palladium Card is pretty compelling.

But this is certainly a completely new concept that is going to have a lot of people rethinking their strategy. And seriously, how many $400-900 annual fee cards can we all reasonably have before we say “enough already?”

What do you make of these Bilt changes? How will they impact your strategy?

Regarding your statement "Under the new system, rent and mortgage amounts are no longer charged to your card, but instead, are immediately deducted from your account via ACH, and then you’re awarded points." - can you cite where this is mentioned? I don't see any reference to this on Bilt's website and its kind of a big deal.

Is anyone else questioning the value of the $200 Bilt cash point accelerator? I believe it’s one extra point for every $5000 spent, which means a maximum of 5000 Bilt points for the cost of $200 Bilt cash. However, I’m not sure if I value Bilt points quite that highly.

Yes, I think this is a crucial question. However, given the coupon book uses for Bilt Cash ($100 off Bilt hotel booking, $50 off Bilt dining, etc.), it's important to recognize that a dollar of Bilt Cash is really not worth 1 dollar -- so you're not really paying 4 cents a point for the accelerator. That said, there are some easy uses of Bilt cash where you can get close to a dollar of...

Yes, I think this is a crucial question. However, given the coupon book uses for Bilt Cash ($100 off Bilt hotel booking, $50 off Bilt dining, etc.), it's important to recognize that a dollar of Bilt Cash is really not worth 1 dollar -- so you're not really paying 4 cents a point for the accelerator. That said, there are some easy uses of Bilt cash where you can get close to a dollar of real value -- having just gotten into the app now, the functionality to get the $10 in Lyft coupon per month seems quite easy. You swipe on the reward and it appears that it will just automatically apply to your next $10 Lyft transaction. So there, yeah, $10 in Bilt cash is worth like $9.25 (forgoing points earning on Lyft) if you use Lyft at least once a month.

I don't have an option to turn on the points multiplier. Is this only available after meeting spend or something? I have the $500 in Bilt cash, but I've been through all the options to spend it and no multiplier. Under the 'Bonus Points' tab where I would expect it to be there are no options available. Anyone able to activate it?

Ah, ok, it's only missing in their horrible app. It's available on the website, although doesn't seem to work yet. Hopefully the kinks will get ironed out over the next day or two

DP: I redeemed it and I've already received accelerated point.

Ben’s question: And seriously, how many $400-900 annual fee cards can we all reasonably have before we say “enough already?”

Ben, isn’t this a question you should ask yourself? Based on your previous posts before your Bilt Palladium, Emirates card and the increased in AF with AMEX and Chase you are packing with HIGH annual fee cards along with other middle priced AFs. When do you think it’s enough?

5X/4X/3X travel and dining - Wells Fargo Autograph Journey - $95.

2X all other spending - Bilt Palladium - $495

Rakuten feeds into Bilt. Throw in Rove Miles.

Maybe not for everyone but it works for me.

Question: does TAX pmt count toward the $4000 in 3 month spend for 50K points on Palladium? I've asked BILT and haven't received a reply. I know that TAX doesn't count for credit toward rent. Their T&Cs state TAX does "not qualify as “Eligible Purchases” and do not earn Bilt Points or Bilt Cash." Appreciate clarification.

The best use of Bilt Cash is at restaurants. $25 is worth...$25 whereas using BC to offset rent you're giving up $30 for $10 in value ($30 buys 1,000 in rent payment yielding 1,000 points worth a penny each).

For anyone heavily into the Alaska ecosystem and in need of points to make status then using the Atmos card to pay rent at a penny a mile for RDMs in order to get EQMs is...

The best use of Bilt Cash is at restaurants. $25 is worth...$25 whereas using BC to offset rent you're giving up $30 for $10 in value ($30 buys 1,000 in rent payment yielding 1,000 points worth a penny each).

For anyone heavily into the Alaska ecosystem and in need of points to make status then using the Atmos card to pay rent at a penny a mile for RDMs in order to get EQMs is a decent deal since one can get at least that much value out of an Alaska mile.

Hence my conclusion that the the main value of Bilt isn't the ability to use Bilt Cash to earn miles for paying rent fee free or to goose daily spend to 3x from 2x (at a cost of 4 cents/point). Those are represent terrible value and should only be last resorts for excess Bilt Cash that can't otherwise be used dollar for dollar.

I meant to add that since daily spend earns 2x plus Bilt Cash at 4x then a cardholder who is able to use all their Bilt Cash dollar for dollar at hotels, restaurants, etc will be getting a 7% return.

Steve gets it. Alaska Summit for rent (until $50K). Palladium for 3x (with accelerator, 5x, up to 25,000), re-evaluate after 1 year.

The SUB is in the form of points and Bilt Cash. So, if you had three guesses -- between "yes" and "no" -- what would they be?

A ton of people, including myself, haven't gotten the card yet

I just went with the Blue card and the 4% cash back option since my apartment complex isn't part of the consortium and charges an unconscionable amount for using my Bilt card for rent, but my pharmacy is part of the consortium and I use my Bilt card for prescription drugs.

What if you experience ‘loss of consortium’? (Bad tort law joke).

Activated the Palladium card, then activated a points boost. Tried to make an online payment on my Palladium card and it was declined. Not a great start.

That is annoying. You are probably better off using 180$ bilt cash to unlock 6k rent/mortgage points than the gimmicky points boost which gives 5k points after 200$. Ask for a refund? (:

I’m planning to do both the points boost and points on my mortgage (+ the SUB). I just want to actually be able to use the card.

You have to use the virtual card number available in the BILT Wallet in the BILT app for all online purchase. The physical card number will not work. It would have been nice if BILT had informed its customers of this !

Tried that and it didn’t work either. Eventually was able to make the payment using PayPal as the middleman. Mildly annoying but at least I was able to quickly clear the SUB spend.

Just used it for uber eats and worked just fine.

yup. activated my card yesterday, waited a whole day to actually use it for something, and got a declined transaction for a pizza.

I'm glad that I moved BILT out of my critical path.

I really think people are sleeping on the points booster (the extra 1x) for $200 Bilt Cash. By my math I spend enough to get points on rent and keep the points booster mostly active, which makes the Palladium a 4x+ card for everyday spend… at least until you run out of boosters for the year. I got the Bilt Cash welcome bonus right away and activated it immediately.

Plus, if you don't want to...

I really think people are sleeping on the points booster (the extra 1x) for $200 Bilt Cash. By my math I spend enough to get points on rent and keep the points booster mostly active, which makes the Palladium a 4x+ card for everyday spend… at least until you run out of boosters for the year. I got the Bilt Cash welcome bonus right away and activated it immediately.

Plus, if you don't want to deal with rent at all (or want to charge it to the Atmos card, say,) the booster is a pretty good substitute for the rent points in a lot of situations. Not quite as many points, but close.

Yep all cardtubers didn't think it thru before rage uploading hate videos. A 3x catch all was the holy grail. I remember when the Robinhood Gold launched with 3% and everybody was going nuts over it. Now you can easily get 3x Bilt points and people are upset...

There is a reason why USA Today is written at the sixth grade level. The same applies here and other blogs. From comments, it's clear that people lack reading comprehension skills. They don't read terms and conditions. They lack the reasoning skills to figure stuff out. They want to be spoon fed and their butts wiped. And, when they are confronted with the natural results of their limitations, they lambaste whatever it is.

A short version of my comment: You and UnitedEF are 100 percent right. But, they won't get it.

Woah, The Other Jack and UnitedEF, that's a lot of sucking-up to BILT right there.

I respect Peter's analysis, because, he's an optimizer in this space/hobby; however, no one can or should call the loss of 1.0 and this disastrous BILT 2.0 transition 'good' for most.

Yes, we're each gonna try to maximize what we can, but, the simplicity of the old model is dead, and the new model only really works for high-spenders, like most things.

Before spending a dime, Palladium cardholders start with $500 in Bilt Cash. Immediately activate the bonus 1X with $200 of Bilt Cash. You're earning 3X on the next $5k. As spending progresses, you activate the next bonus 1X. You're still earning 3X. At the beginning of the next calendar year, you start with $200 in Bilt Cash. Immediately activate the bonus 1X with that $200 of Bilt Cash. If one does nothing else, what's so complex about just earning 3X?

Wouldn't you rather spend $35 BC on "Priority Pass 3rd & 4th guest passes"?? /s

just got my stupid Wells Fargo Autograph card and now I have to waste time on the phone figuring out how to cancel it

Perhaps it is you that is stupid rather than the card considering how long you had to decline keeping the WF account around.

I declined it during the transition (there was a specific question) - still got it nonetheless...

Then, WF sent out a letter to all cardholders stating that you had to confirm cancellation directly with it.

I would have gotten an Obsidian card if it was offering category bonus for both dining and grocery but it only offers either one. That minor detail pursuaded me not to get a bilt 2.0 card.

Meh it earns 2x less than Amex Gold but it's also $230 cheaper which at $.02 translates to about $11.5k of spending before you will be losing out. Plus you will get a 2x catchall which you don't have with the gold and 3x on all travel when you activate points accelerator

Do you have to first redeem Bilt cash for mortgage payment amount needed? I have to do a manual check setup but didn’t want to process it until I know if I must first redeem part or all of the Bilt cash or will Bilt now I have 500 Bilt cash and deduct the amount themselves? Thanks

I setup a manual check and it AutoPay. When I did AutoPay it gave the option to earn rewards via Bilt cash. Seems like doing it one time check did not give the option to redeem Bilt cash for the payment to earn rewards

Activation offer... countdown clock... 3 days... up to five hundred. For those expecting 5x for 5 days, is that all you see?

i got email this morning confirming my offer: 50k after $4k spend in 97 days, plus also, 5x points on up to $10k spend in first 5 days (technically the t's and c's say feb 12th at 11:59pm which is 6 days but whatever lol)

The bilt app still shows these charges going to the credit card. Are we sure it does an ach directly from your checking account?

Now that Biltpay for rent/mortgage is default. I really don't get the reason why they have their own random ACH details to mandate payment with to earn points (after having to use your biltcash anyway.... or the points ponzi scheme). I already have my own ACH set up as of now and it is super annoying to do this with my mortgage provider. I have written to bilt asking to let me just use my...

Now that Biltpay for rent/mortgage is default. I really don't get the reason why they have their own random ACH details to mandate payment with to earn points (after having to use your biltcash anyway.... or the points ponzi scheme). I already have my own ACH set up as of now and it is super annoying to do this with my mortgage provider. I have written to bilt asking to let me just use my own ACH or provide a voided check to let my mortgage bank do that. Would appreciate data points! Should really be able to your own ACH deets to get the points as opposed to their's...

They want your transaction data… without that that they would literally be handing out points for a small fee. There is always a bigger picture

This is true! But the points are no longer just a small fee. Bilt cash is no different than 3% fee. So it’s just as inconvenient as using Bilt than any other credit card

This is true! But the points are no longer just a small fee. Bilt cash is no different than 3% fee. So it’s just as inconvenient as using Bilt than any other credit card

Actually it is different because you are not paying a 3% fee it is just a way to track that you have spent enough to for them to waive the 3% fee. You aren't paying 3% extra for any of your other charges or to pay your housing payment. It's just a counter. People need to stop thinking that they are paying a 3% fee. There's no where in your statement where you will see a 3% fee tacked on.

Credit card fatigue is real. I have too many to keep up with.

The $495 card could have been good, but not for me.

You could just run the Palladium, turn on the 1x accelerator as well as housing spend for another 1.33x and stop spending on other cards? Then you only have to worry about the hotel credit and that's it. I'm really thinking about doing that as it would simplify my life.

Tried to make a hotel booking to use the $200 palladium credit. Didn’t see anything to toggle which the T/C say you need to do. Wonder if they’re behind on that or whether it’ll just be applied automatically later

The terms and conditions expressly state that the credit will automatically credit.

But, as with credits seen on other cards, the credit might take X weeks to be applied.

The Bilt Cash credit must be selected prior to booking.

Ugh, what a mess. Also, separate from the $200 Palladium semi-annual statement credit, the BILT Cash maximum is like just $50/month, and also requires 2-night minimum prepaid. Yikes.

It's $100 per month and can be combined with the semi-annual $200 for a total of $300 on a single booking. At any property bookable via Bilt Travel. For some, in spite of the 2-night requirement, $300 off is nice. (Chase and Citi have their own 2-night requirements.) For others, there is an expectation of not spending a penny over $300. C'est la vie

I am confused how you pay your mortgage. I have my lender now connected in the Bilt account but do I have to each month go pay manually and then turn off auto pay from my actual lender?