Chase has just announced that it’s improving travel and purchase protection benefits for cardmembers. This should be generally positive news, though I’ll wait until this is implemented before drawing any final conclusions…

In this post:

Chase makes changes to travel & purchase protection

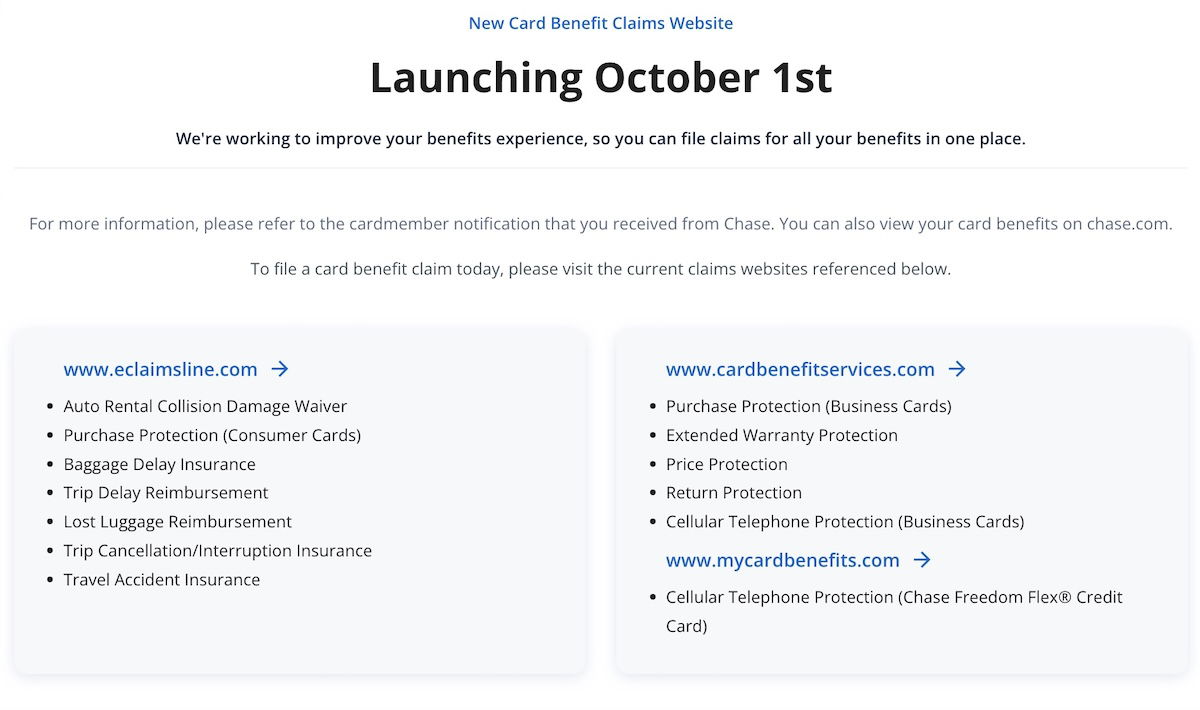

As of October 1, 2024, Chase will be introducing a new branded website (chasecardbenefits.com) where cardmembers can access their complimentary benefits, and file new travel and purchase protection claims all in one place.

To coincide with this, Chase is changing the Benefits Administrator and Underwriter for its card products to Assurant. Chase cardmembers should be notified of this change between late July and the middle of August 2024, via email or direct mail.

Chase highlights how several types of coverage will be improving with this transition. For example:

- Auto rental coverage will include more vehicles, as cardmembers will receive up to $60,000 in coverage for eligible vehicles with an MSRP of $125,000 or less, and the notification period will be extended from 60 days to 100 days

- Emergency evacuation and transportation will be arranged and provided by the service provider, so cardmembers will no longer need to pay upfront and then file a claim

- Travel and emergency assistance will be added to select products, whereby if a cardmember runs into a problem while traveling away from home, this benefit will provide legal and medical referrals and access to other travel and emergency assistance services

- Travel accident insurance coverage will be increased from $250,000 to $500,000 for select products

- Lost luggage reimbursement will be added to select products, providing reimbursement for the cost to repair or replace checked or carry-on bags that are lost or damaged

- Extended warranty protection will be updated for select products, with coverage being upgraded from $10,000 per claim and $50,000 for the life of the account, to $10,000 per claim and $50,000 per year

- Trip cancellation and interruption insurance will be updated for the United Gateway Card to cover additional family members and covered reasons

These changes mostly sound positive

Chase has among the best travel and purchase protection of any card issuer, especially on its premium cards. So while I’ll reserve final judgment until I can do a detailed, side-by-side comparison of the old and new policies, I am happy to see some positive changes.

However, I’d never expect any changes to be purely positive. Just to give an example of something that stands out, it’s stated that with the new policy, cardmembers can receive up to $60,000 in coverage for eligible vehicles with an MSRP of $125,000 or less.

As a point of comparison, currently some cards offer up to $75,000 in coverage, but coverage excludes many luxury cars. So it sounds like for some products, the maximum coverage amount may go down, while the maximum value of the car for which coverage applies may go up.

Bottom line

As of October 2024, Chase is updating its travel and purchase protection, as the issuer is switching to Assurant. We’ll see quite a few updates to the coverage provided by cards. Chase is marketing this as an improvement. As you’d expect, I imagine there will be some positive changes, but also some things that will be worse than before.

With this transition in October, it’s definitely worth reviewing coverage details, to understand what’s changing.

What do you make of Chase updating its travel and purchase protection?

***Big negative change for New York residents with CSP/CSR*** – no more primary rental coverage in the US if you have personal auto insurance:

From the Guide to Benefits – Auto Rental Coverage:

New York Residents, inside the United States coverage is primary unless You have personal automobile insurance in which case it is excess.

From the original email Chase sent in August:

New York residents should review the New York specific coverage...

***Big negative change for New York residents with CSP/CSR*** – no more primary rental coverage in the US if you have personal auto insurance:

From the Guide to Benefits – Auto Rental Coverage:

New York Residents, inside the United States coverage is primary unless You have personal automobile insurance in which case it is excess.

From the original email Chase sent in August:

New York residents should review the New York specific coverage terms and limitations for Purchase Protection and if applicable: Lost Luggage Reimbursement and Auto Rental Coverage.

Capital One Venture X still does not have this specific exclusion so I’ll be using that for rental cars going forward.

I filed a claim last year for a cancelled river cruise due to health issues. Once Chase received the documents and my doctor’s letter, they paid the balance after the tour company paid a 40% reimbursement.

This year, I had another health issue and had to go through Chase to get reimbursements for airline tickets. The airlines wanted to give me vouchers, but Chase got reimbursements instead. I personally think Chase does a good...

I filed a claim last year for a cancelled river cruise due to health issues. Once Chase received the documents and my doctor’s letter, they paid the balance after the tour company paid a 40% reimbursement.

This year, I had another health issue and had to go through Chase to get reimbursements for airline tickets. The airlines wanted to give me vouchers, but Chase got reimbursements instead. I personally think Chase does a good job of covering travel insurance issues.

No travel insurance is perfect, but Chase has come through for me.

Unless the Chase car rental coverage is primary, not secondary, I think the AMEX $19.95 (per rental, not per day) premium coverage is a better choice as it's primary...

Chase is primary. To my knowledge the only primary CC insurance

The car rental insurance benefit carrier is terrible!!

I’ve had two claims, chips to the windshield in New Zealand, and a hut and run sideswipe in San Diego, diver and passenger door damage, about $ 4000.

Both claims to forever to finally be reimbursed. I had to send so much paperwork and photos that I was to the point of just putting up with the terrible customer service.

My advice is to call,...

The car rental insurance benefit carrier is terrible!!

I’ve had two claims, chips to the windshield in New Zealand, and a hut and run sideswipe in San Diego, diver and passenger door damage, about $ 4000.

Both claims to forever to finally be reimbursed. I had to send so much paperwork and photos that I was to the point of just putting up with the terrible customer service.

My advice is to call, ask the name of your representative, and keep calling, and be very very patient to finally be reimbursed. 6-10 months is my estimate.

I just filed 2 claims for medical when on a trip/cruise in Europe. Once I had clarification on what data they needed, approval came within days. Payments to my checking account have started. So compared to Medicare, they are super fast.

Not sure what to make with it. As the current one is a nightmare, I am not sure if the new one will be any better.

I would have liked to be able to have more travel insurance coverage limits for the CSR.

The devil is in the fine print. I received the new benefits guide starting 10/4/24 for my Chase Aeroplan card and the trip cancellation/interruption insurance has now a benefit maximum of $1500 per person. Previously on this card it was $5000 per trip.

The $60K auto car rental limit is also a new limit. Previously some expensive cars were excluded, however BMW 5-series and Mercedes E-Class were covered. These can now easily be more expensive than $60K when totaled.

I have filed CDW claims with both Chase and AMEX in the past. I often will pay the $19.95 fee for Amex's primary CDW coverage due to them processing claims in-house and the ease of working with them. Part of being a premium card is offering a better experience when claims need to be made.

I never understood how Chase expected me to get auto utilization info from a rental car location to get...

I have filed CDW claims with both Chase and AMEX in the past. I often will pay the $19.95 fee for Amex's primary CDW coverage due to them processing claims in-house and the ease of working with them. Part of being a premium card is offering a better experience when claims need to be made.

I never understood how Chase expected me to get auto utilization info from a rental car location to get a claim processed. I can barely find a phone number to talk to a human at a rental car location.

The current claims administrator, Eclaims, is a complete fraud, and I know that Chase has been getting raked over the coals because of them, so I am not surprised to see this change, and I can't imagine any new administrator will be worse. I know that some of the commenters have not had the best of luck with Assurant, but there is a difference between claims that Assurant is paying and claims Assurant is administering....

The current claims administrator, Eclaims, is a complete fraud, and I know that Chase has been getting raked over the coals because of them, so I am not surprised to see this change, and I can't imagine any new administrator will be worse. I know that some of the commenters have not had the best of luck with Assurant, but there is a difference between claims that Assurant is paying and claims Assurant is administering. They are just administering Chase claims, the payouts don't come out of Assurant's pocket, so they don't care what it costs (in much the same way that there is a difference between fully-funded and self-funded health insurance plans and how easily they pay out is completely different).

I just went through a Chase claim with Eclaims and it was an absolute disaster, to the point that it was clearly just fraud, they want you to give up so they don't have to pay anything, but I held them to account, even if it meant being a total jerk. I submitted all of the required documents, got the "we'll respond within 10 days" auto response, and of course they didn't, but when they did finally respond they asked me for several documents, all of which I had already submitted with the initial claim. I said to them "Online forums are filled with story after story of you asking for the same paperwork over and over even though you already have it, in order to delay simple claims for 7-10 months in hopes that people just give up, I have no tolerance for that crap and according to my cardholder agreement I have to wait 60 days from the date of filing before I pursue legal action, which I will be doing if you do not process this in a timely manner. Every document you just asked me for I have already submitted, please review your files and process the claim". Of course they waited another few weeks and sent me the same letter asking me for the same stuff again, so I sent them the same response, then it happened again. This time I called them, and on the phone I walked the guy through the claim and the documents I submitted, the conversation was literally "You have asked for the final rental agreement, it is the document titled "final rental agreement" so let's not pretend that you even looked at this claim because every document I submitted is titled with exactly how you titled it in the request so there was no confusion." At that point he could no longer pretend they didn't have everything already and suddenly the list of required documents was satisfied and my claim was paid, it took about 75 days from submission to payment. And this was all for a $550 claim, that's now stupidly ridiculous this entire thing is.

So yes, I am very excited to be getting a new claims administrator.

The current administrator isn't easy to work with, but I'm very concerned about the switch to Assurant.

When I've had to deal with them in the past for my own private insurance, they've consistently been a nightmare. They've been really awful even when considering that every insurance company is focused on making the claims process cumbersome in order to save costs.

Assurant offers lower policy prices up front, but then makes up the difference through...

The current administrator isn't easy to work with, but I'm very concerned about the switch to Assurant.

When I've had to deal with them in the past for my own private insurance, they've consistently been a nightmare. They've been really awful even when considering that every insurance company is focused on making the claims process cumbersome in order to save costs.

Assurant offers lower policy prices up front, but then makes up the difference through their claims process.

I expect Chase is saving money by switching to Assurant at the expense of customers who will have their claims denied more frequently, or simply give up because of how difficult it is to work with Assurant. The increased benefit limits don't matter if it's such a PITA to file a claim that it's not worth the trouble.

I can't say I'm thrilled at the administrator swap, but that's because right now I know exactly what to hand in and what to say to make sure I don't muff a claim and I don't know if the new guys will reinterpret the rules somehow (e.g. in how to deal with an airline that won't give you a written excuse for TDEL).

I'd rather they have kicked the current guys to improve the website than switch providers.

Sound like a net positive. It will be nice to have an online portal to submit claims & (likely) upload docs & receipts.

Thank GOD they are changing administrators. The current one is a complete nightmare set up only to make claims more difficult.