In December 2024, Bilt hinted at plans to make changes to its credit card, and to start awarding points for mortgages. The Bilt Mastercard is an incredibly lucrative no annual fee card that lets you earn points for paying rent, though the sustainability of the business model is questionable, given how rewarding it is, with minimal effort.

Along those lines, today Bilt is sending out a survey to all cardholders, to get feedback on potential changes.

In this post:

Bilt surveys major credit card changes

Bilt is asking members for their feedback on three different Bilt Card 2.0 constructs. The company claims that these potential options have been designed based on member feedback. The company wants members to share which option is favored at each price point, and also what members would like to see that isn’t included.

The company emphasizes that these are not locked in options, and aren’t finalized or rigid. Quite to the contrary, the company expects there will be many more changes over the next several months. The idea seems to be to have a no annual fee card, a $95 annual fee card, and a $550 annual fee card.

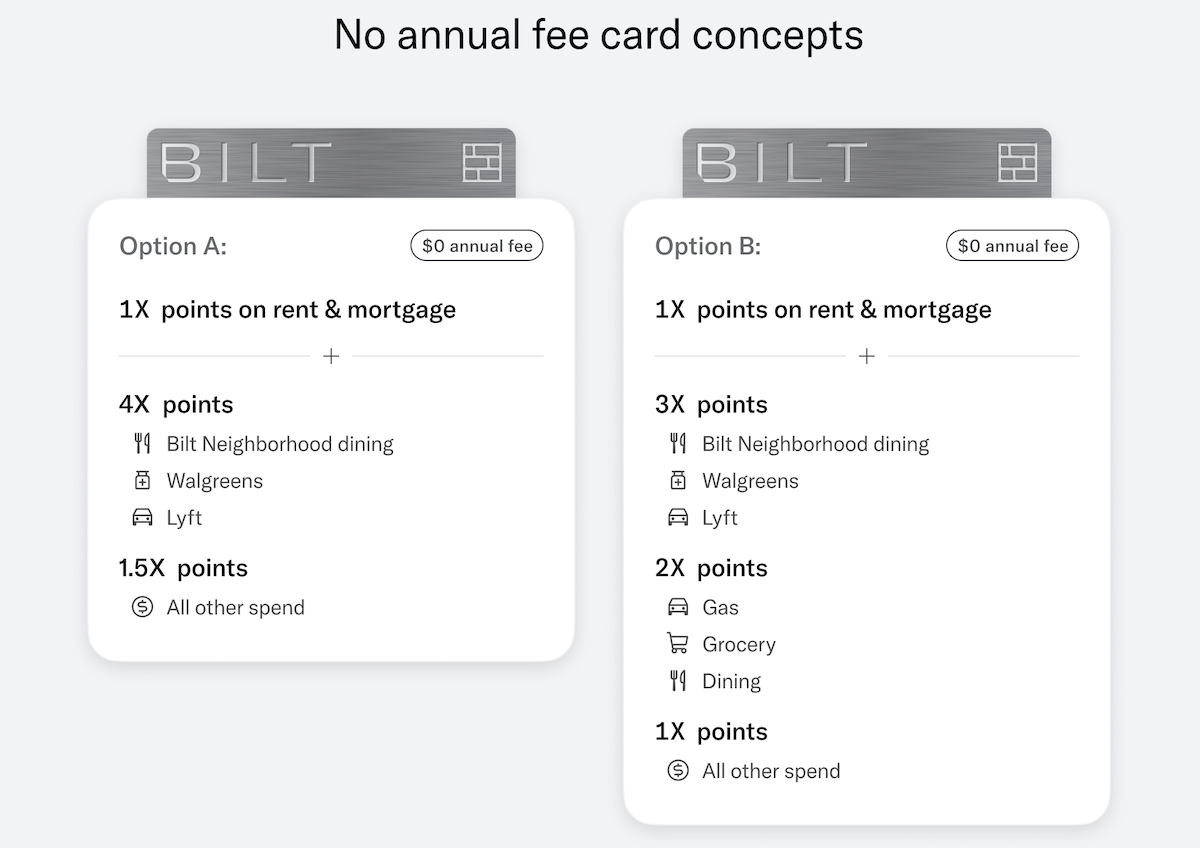

With that in mind, the company presents two versions of a no annual fee card:

- Both cards would earn 1x points on rent and mortgages

- One version of the card would earn 4x points on Bilt Neighborhood Dining, Walgreens, and Lyft, and 1.5x points on all other purchases

- The other version of the card would earn 3x points on Bilt Neighborhood Dining, Walgreens, and Lyft, 2x points on gas, groceries, and dining, and 1x points on all other purchases

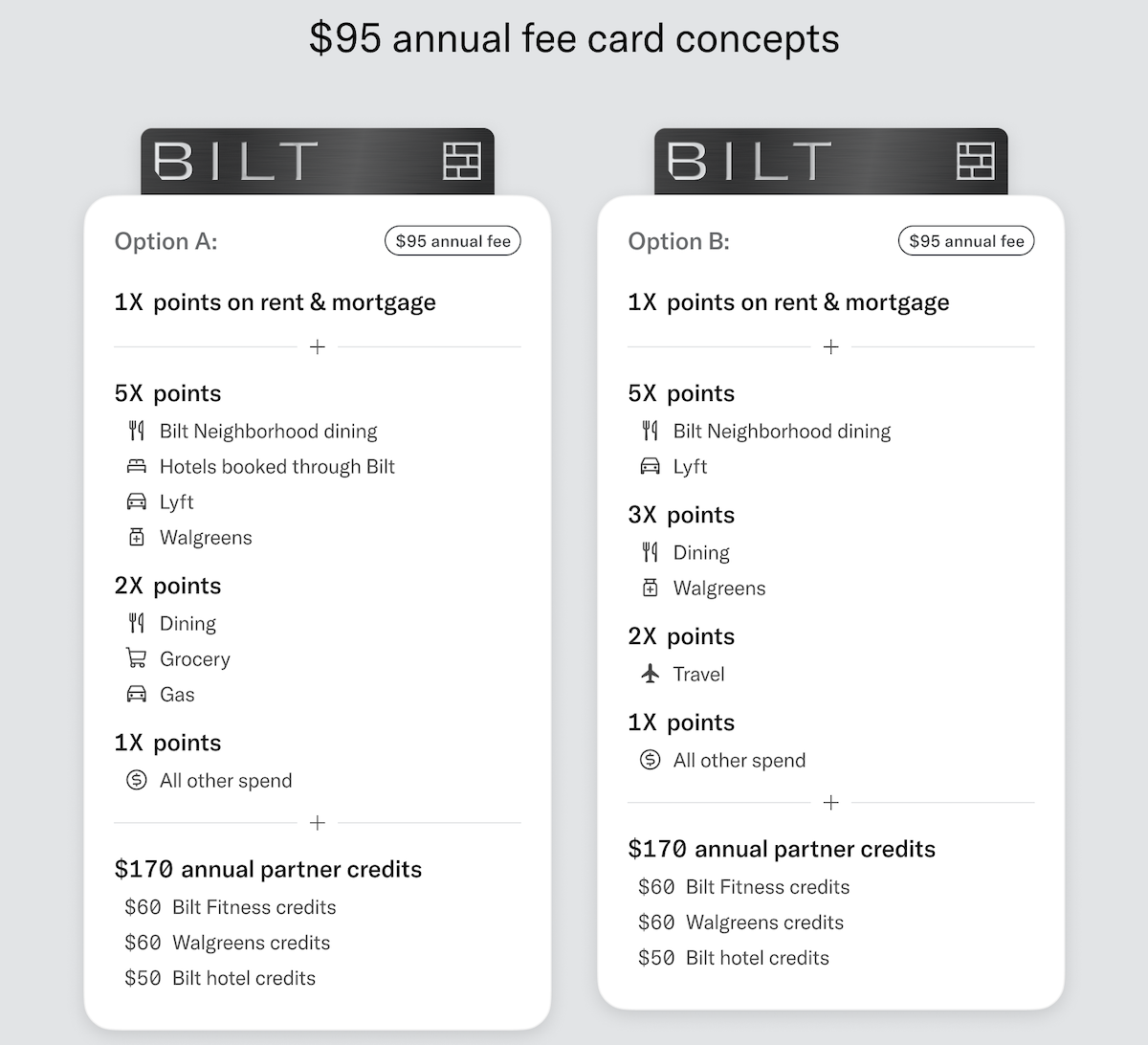

The company also presents concepts for two $95 annual fee cards:

- Both cards would earn 1x points on rent and mortgages, and would offer up to $170 in annual partner credits, including $60 Bilt Fitness credits, $60 Walgreens credits, and $50 Bilt hotel credits

- One version of the card would earn 5x points on Bilt Neighborhood Dining, hotels booked through Bilt, Lyft, and Walgreens, 2x points on dining, groceries, and gas, and 1x points on all other purchases

- The other version of the card would earn 5x points on Bilt Neighborhood Dining and Lyft, 3x points on dining and Walgreens, 2x points on travel, and 1x points on all other purchases

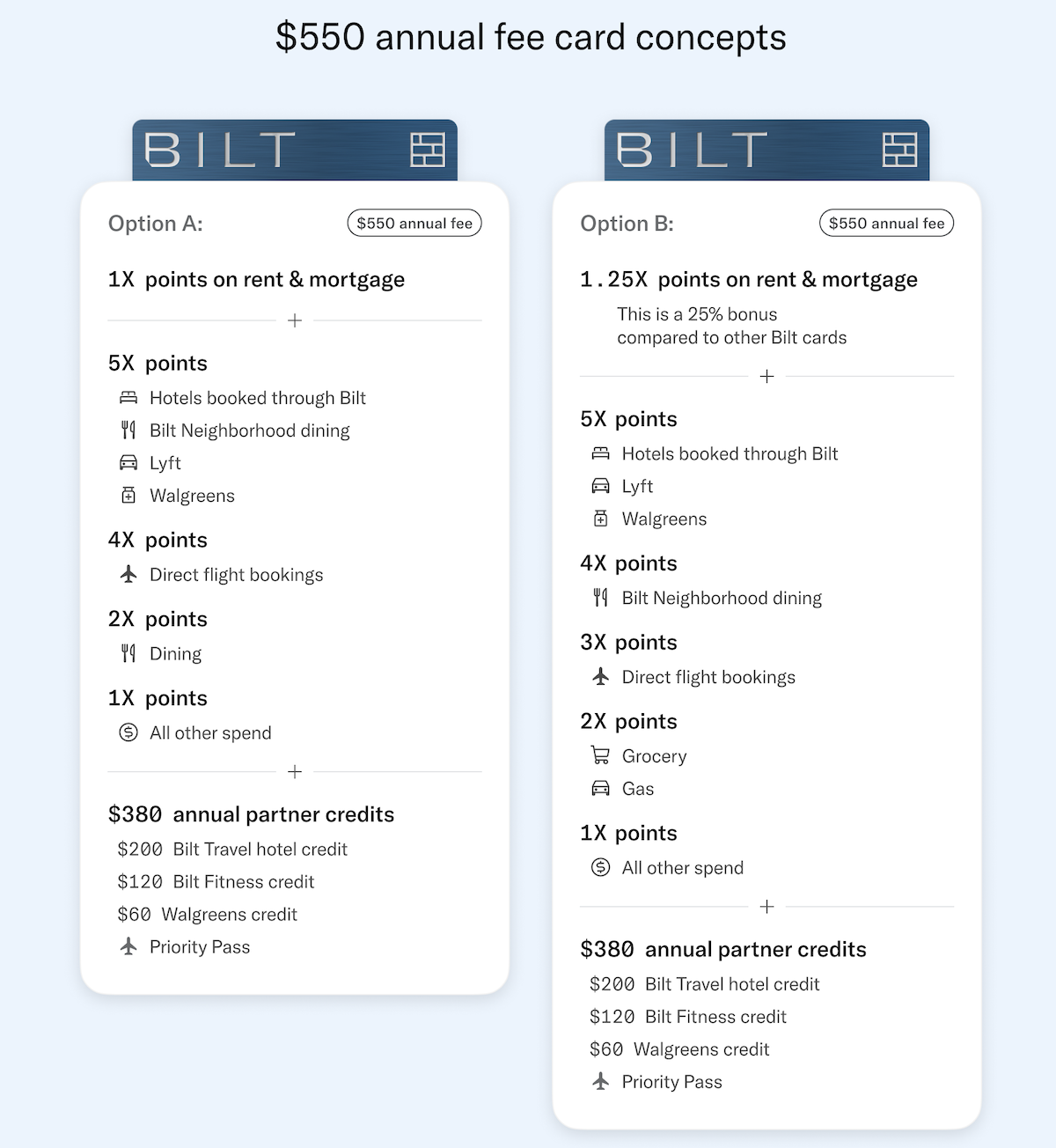

Lastly, the company presents concepts for two $550 annual fee cards:

- Both cards would offer up to $380 in annual partner credits, including $200 in Bilt Travel hotel credits, $120 in Bilt Fitness credits, $60 in Walgreens credits, and a Priority Pass™ Select membership

- One version of the card would earn 5x points on hotels booked through Bilt, Bilt Neighborhood Dining, Lyft, and Walgreens, 4x points on direct flight bookings, 2x points on dining, and 1x points on all other purchases, including rent and mortgages

- The other version of the card would earn 5x points on hotels booked through Bilt, Lyft, and Walgreens, 4x points on Bilt Neighborhood Dining, 3x points on direct flight bookings, 2x points on gas and groceries, 1.25x points on rent and mortgages, and 1x points on all other purchases

My take on these proposed Bilt card changes

I don’t necessarily have strong opinions on the above proposed concepts, and which of them is better.

My first reaction is that I’m happy to see that Bilt is committed to keeping around awarding points for paying rent, even on the no annual fee product, and even expanding points earning to mortgages. Now, we could see more restrictions in the future — currently you can earn points on rent as long as you make at least five transactions per billing cycle, and those could be purchases for a dollar each.

I’m more concerned about what the restrictions are for earning points on rent, rather than the exact rewards structure of the cards. But that also gets at the general issue with Bilt in the miles & points space. Bilt is incredibly rewarding and is loved by savvy consumers. Those of us into miles & points enjoy maximizing. Speaking only for myself, and not consumers at large:

- I’m not really interested in more cards with credits that are potentially difficult to use, as I have enough of those already

- None of the card rewards structures are really industry leading, for those of us who use a strategy where we have multiple cards; I earn 2x points on everyday spending, and 5x points on all dining and flights, while some of these bonus categories are very specific

The problem is, Bilt also needs to make money. Wells Fargo is reportedly losing large amounts of money on its agreement with Bilt, because a majority of the spending on the card is rent payments, with the rewards being subsidized by Wells Fargo.

Bilt promised free points for paying rent, as long as five transactions are made per billing cycle. Many people do exactly that, and make five transactions. But that’s also not a great long term business model.

With Wells Fargo reportedly not happy with its Bilt partnership, Bilt will eventually need a new partner to issue the card. I’m curious what that will look like, since I have to imagine any new card wouldn’t be issued with Wells Fargo, unless the company had a reason to believe that economics would be very different.

Yes, Bilt’s business model goes beyond credit card processing fees. I suppose annual fees could help a bit. The company also makes money through its partnerships with landlords, restaurants, etc. But is all of that enough? I don’t know, we don’t have access to that data…

Bottom line

Bilt is surveying some concepts for a Bilt Card 2.0, including cards at three different pricing tiers — one no annual fee card, one $95 annual fee card, and one $550 annual fee card. I don’t think there’s anything revolutionary with these concepts, and if anything, they look like a lot of other products in the market.

Ultimately there’s only so much that can be innovated, so I think any of these products would be fine. The question is how Bilt can actually get people to greatly increase spending on the card in a profitable way, to offset the cost of processing rent payments. I suppose charging an annual fee is a good start, though I’m also not sure the proposed cards are compelling enough, compared to what else is available in the market.

What do you make of these proposed Bilt Card 2.0 concepts?

Today's the day... January 14 is upon us... more details at noon EST, supposedly. 3 hours 45 minutes to go... https://www.bilt.com/card

And, they just emailed: “Welcome to a new era of Bilt, (name)” with a 2-minute video (with Ankur and a lot of bass) that says… absolutely nothing.

Looking good! /s

Anyone else receive the mailer from Wells Fargo today about the conversion to Autograph?

“Whether or not you obtain a new Bilt 2.0 Card, your card will convert to a Wells Fargo Autograph Visa Card. Your new Wells Fargo card can be activated and used beginning on February 6, 2026, but will not be associated with Bilt or earn Bilt Rewards.”

“You should receive your new Autograph Card by early February.”

“There is no application...

Anyone else receive the mailer from Wells Fargo today about the conversion to Autograph?

“Whether or not you obtain a new Bilt 2.0 Card, your card will convert to a Wells Fargo Autograph Visa Card. Your new Wells Fargo card can be activated and used beginning on February 6, 2026, but will not be associated with Bilt or earn Bilt Rewards.”

“You should receive your new Autograph Card by early February.”

“There is no application or credit bureau inquiry.”

“Your Autograph Card will have a new account number.”

“This change will not impact your Bilt Points balance or how you access Bilt Rewards, subject to Bilt’s Terms and Conditions.”

Some real ‘mommie and daddie are getting a divorce’ vibes.

Worthless card for the purposes of paying rent. Got my new card, set everything up properly, and waited for the first of the month to use it. In the evening, I went on my renter's portal, added my new Bilt card to it, and submitted the payment. Result?

Declined.

By issuer.

Twice.

Received an automated call from Wells Fargo's fraud department THE FOLLOWING MORNING asking me if the charge was legitimate or not....

Worthless card for the purposes of paying rent. Got my new card, set everything up properly, and waited for the first of the month to use it. In the evening, I went on my renter's portal, added my new Bilt card to it, and submitted the payment. Result?

Declined.

By issuer.

Twice.

Received an automated call from Wells Fargo's fraud department THE FOLLOWING MORNING asking me if the charge was legitimate or not. I verified the charge as legitimate and the call ended automatically after that. I then called the Bilt customer service line. They assured me that since I had verified the charge as legitimate, I would have no more issues.

Went back to the portal to pay my rent. Declined by issuer. Again. Pulled out a different card, added it it to the portal, and attempted to pay the rent. The charge was immediately successful. On the first try.

A horrible card. A horrible experience. At least for paying the rent, it does not work as advertised. If the reason you're getting the card is for paying the rent, then don't bother. Save yourself the time, headache, and hassle. If you're getting it for the traveling and dining, then knock yourself out. I wish you luck.

Why has no credit card to my knowledge offered 2-3 points for insurance payments. medical, dental and hospital payments?

Because these are non-discretionary and large payments for everyone and they don’t want to reward everyone.

Why are they asking current rent customers? They should be asking future mortgage customers. I would love the ultimate catch-all card. 2x on everything, 1x rent/mortgage, and that's it. They would kill CFU, Venture, Double Cash, and BBP. They would 5-10x their customer base and make tons of money in swipe fees. They would turn the card into a daily carry card, instead of gamers charging 5 bananas. I don't think people will give up...

Why are they asking current rent customers? They should be asking future mortgage customers. I would love the ultimate catch-all card. 2x on everything, 1x rent/mortgage, and that's it. They would kill CFU, Venture, Double Cash, and BBP. They would 5-10x their customer base and make tons of money in swipe fees. They would turn the card into a daily carry card, instead of gamers charging 5 bananas. I don't think people will give up their CFU for 1.5x match. Bilt if you are reading these comments, please give us a simple 2x card.

Yeah I will say I thought it was bizarre how the only presented card option with 1.5x was the $0 annual fee one.

2x would obviously be killer but likely not financially feasible for a $0 AF card that’s eating costs on rent transactions. Venture is $100 and DoubleCash is *essentially* $100 since it needs a big brother card to transfer…

I think a far more appealing option would be a $150 BILT card...

Yeah I will say I thought it was bizarre how the only presented card option with 1.5x was the $0 annual fee one.

2x would obviously be killer but likely not financially feasible for a $0 AF card that’s eating costs on rent transactions. Venture is $100 and DoubleCash is *essentially* $100 since it needs a big brother card to transfer…

I think a far more appealing option would be a $150 BILT card with 2x across the board, forget all the other silly bonuses/coupons, and eliminate the minimum purchase requirement.

That being said, the thought of using their garbage bloated app to check my general spend transactions sounds nightmarish. Thank goodness we can use WF’s app for everything short of transfers, right?

Very curious how this could pencil? You're asking them to give above-market general spend points PLUS subsidize 1% back on rent/mortgage (with zero interchange in most cases) for a $0 annual fee?

Sure, 5-10x customers, but as the old saying goes, "compensate for negative gross margin with volume" tends to not work

Perhaps Lifemiles' devaluation today has something to do with the Bilt rent day transfer bonus...

I agree with many of the responses. But what if Bilt offered 1 pt per $1 spent on rent (or mortgages), but instead of requiring 5 purchases per month the rent points “vested” based on the amount of non-rent spending on the card in the month (regardless of other category). For example, if I pay $1,000 in rent, I'd have to spend at least $1000 in non-rent spending on the card during the month to...

I agree with many of the responses. But what if Bilt offered 1 pt per $1 spent on rent (or mortgages), but instead of requiring 5 purchases per month the rent points “vested” based on the amount of non-rent spending on the card in the month (regardless of other category). For example, if I pay $1,000 in rent, I'd have to spend at least $1000 in non-rent spending on the card during the month to get the full 1,000 points for my rent to vest. Essentially, they’d be offering 2 pts/$1 on general spending up to the member’s rent, which is as good as any other transferable points currencies offer. Would that be enough to get those of you doing the 5 transaction minimum to spend more? Or drop it. Either way, it push you to do one or the other, I imagine.

One of Bilt's selling point to landlords is Bilt renters are more likely to go for premium apartment offerings. It's easier for a landlord to sell a 1 bed instead of a studio when they can "remind" the consumer the difference will be given back to them in more points.

Bilt's b2b sales team, if not the executive leadership team, would reject any proposal to incentivize consumers to minimize rent spend.

Interesting…I hadn’t thought about how this is sold to landlords. I don’t think the proposal would cause anyone to minimize rent spend, but it would remove some of the incentive. Maybe they could change the vesting schedule….make it total spend over a full year, or you’re fully vested after non-rent spending equal to 50% of your rent…I don’t know. The goal is to incentivize people to move spending to this card that they’d otherwise put...

Interesting…I hadn’t thought about how this is sold to landlords. I don’t think the proposal would cause anyone to minimize rent spend, but it would remove some of the incentive. Maybe they could change the vesting schedule….make it total spend over a full year, or you’re fully vested after non-rent spending equal to 50% of your rent…I don’t know. The goal is to incentivize people to move spending to this card that they’d otherwise put elsewhere. And they have the infrastructure now…great transfer partners, good bonuses that increase based on your Bilt status…all else equal…if you plan to transfer points to airlines and hotels, would you rather have 2 Bilt points/$1 than 2 Amex, Chase, Citi, or Capital One points? I would. If they tried it, I’d be curious to see how it impacted their mix of customers.

Wow, so another coupon book card with a Priority Pass membership. How original.

I’m riding the current offering as long as it lasts!

I bet we’ve got at least 6 months until they make any changes

Interesting that when I took the survey, I answered "Yes" to whether I use this card for everyday spend (which is only partially true, I just use it for restaurants), and it never bothered to even show me the above options for different potential cards options. Basically, if they think you already use it for everyday spend, they don't care what you think. LOL.

Ha, that is odd. For me the survey just kept going in a loop (“submitting” took me back to question one, prefilled).

Goodbye to the MoviePass of credit cards. Was nice to get free perks from Wells Fargo while it lasted. I'll probably start evacuating my points to United every month, because at some point we'll see the last helicopter out of Saigon.

At the end of the day, they spend money paying for points on ACH transaction rent, so any card model will be comparable to cards at that price-point, minus a provision for paying for...

Goodbye to the MoviePass of credit cards. Was nice to get free perks from Wells Fargo while it lasted. I'll probably start evacuating my points to United every month, because at some point we'll see the last helicopter out of Saigon.

At the end of the day, they spend money paying for points on ACH transaction rent, so any card model will be comparable to cards at that price-point, minus a provision for paying for rent points, plus some sort of enforcement to make sure you don't just use it on rent. Not sure a card like that can survive in the open market. The exception would be if they can negotiate deals to be a payment processor to landlords / banks and take some margin, but I doubt it.

Well said, Will.

I detest the coupon model. No don't want to give you money on return for credits at a shop I have no interest in.

Hidden in the details of all this is the travel category, where I make a large amount of points on this card currently. They want to eliminate it entirely on the no annual fee version and move it to one of the paid options. That would be suicide from a marketing perspective IMO, as the card’s rewards and overall proposition is issuing…travel rewards. Bilt is also far more restrictive than Chase Sapphire when it comes...

Hidden in the details of all this is the travel category, where I make a large amount of points on this card currently. They want to eliminate it entirely on the no annual fee version and move it to one of the paid options. That would be suicide from a marketing perspective IMO, as the card’s rewards and overall proposition is issuing…travel rewards. Bilt is also far more restrictive than Chase Sapphire when it comes to what’s defined in the ‘travel’ category. I get that they need to rework their ecosystem, but they need to work on the engagement end of the equation rather than elimination of benefits.

These updates are hilarious. Ankur Jain is clearly annoyed that most of us are doing four tiny purchases per month plus rent. But the solution to that is making an appealing every day spend, not imposing more restrictions.

In regards to possible restrictions, Ankur's email from yesterday stated the following:

"Ensuring this benefit goes to members who genuinely engage with our broader program -- rather than those taking advantage of loopholes"

I'm assuming "loopholes" mean the 4 tiny purchases per month? Time will tell.

I don’t think 5 purchases a month is a “loophole” in any sense. It’s a basic term of the program that they’ve set on their own.

Not sure you can outrun bad unit economics on the rent part of the card by matching Chase Freedom Unlimited on the unit economics of the general spend category, or something

Making this card a 2x catch-all would kill the gaming loophole.

I think if they want to make the CC attractive, they should offer, at least, 3-4x for groceries for the mid-tier card. at least 5-6x for the high-end card.

Bilt has a marketing problem. You can't tell people your card is great for rent without expecting people to get your card exclusively to pay rent

Agreed, this is a failure for every card with a hugely desirable feature. US Bank Altitude reserve was supposed to be 3x for mobile purchases only (and redeemable for 1.5x), but they didn't predict it would be used exclusively for that.

It's been cancelled to new applications, naturally.

Exactly this. I've had the card since the first/beta came out, and that was because my building switched their payment system over to them. It was either get Bilt or pay by check/ACH. No brainier in my eyes. However, no matter how many perks and other earning bonuses they add, I've only ever used it for rent because I'm too used to my other cards.

I disagree. I think using the card exclusively for rent is symptomatic of the value proposition, not marketing. They've done a half-hearted job of enhancing the points value via statuses, but there is little value provided via extra points earning like other cards offer via large SUBs and best in class point earning categories. If they can fix the statuses and points earning then this card becomes the no-brainer top of wallet card. The problem...

I disagree. I think using the card exclusively for rent is symptomatic of the value proposition, not marketing. They've done a half-hearted job of enhancing the points value via statuses, but there is little value provided via extra points earning like other cards offer via large SUBs and best in class point earning categories. If they can fix the statuses and points earning then this card becomes the no-brainer top of wallet card. The problem is that this survey shows that they fundamentally misunderstand what the savvy consumer values.

@Super I dunno. Don't banks make more money off people who don't know the good side of credit cards? The randos that will apply for anything they get marketing material in the mail for.

As mentioned in the post, these proposed changes seem targeted toward people that use this card for every day spend already... i'd be curious how many of those people there actually are. I don't think any of these changes would encourage savvy CC users to upgrade to a paid version of this card.

Well judging by some of the comments on this blog, there's actually quite a few who do just that... including some who seemingly skew their monthly spending habits so that they intentionally eat out on the first of the month.

(unless I'm just doing a terrible job picking up sarcasm, of course...)

I don't think either version of the $550 card is going to get any traction. $200 Bilt travel credit is on hotel stays booked via Bilt, so it's probably worth a lot less than its face value. The version of the $95 card with 3x on dining and 2x on travel is basically the same card as the current no-fee card, with Walgreens and hotel credits to potentially offset some of the annual fee.

Welp, get ready for a comment section full of self-important morons who think their personal spending and lifestyle situations are worth sharing as an anecdote. Get ready for all the morons who will pompously say they don't have any use for the fitness credits. Imagine thinking it's a flex to say you don't go to fitness classes lmao

Wow! You're the first self-important moron to respond!

Who taught you such rude language? Your mustache is also ugly.

god i love the internet so much. calls people "self-important morons", gets called one in response. "who taught you such rude language"

10/10 unreal