Rakuten is my favorite online shopping portal, and it lets you earn bonus rewards for purchases you make online. Historically, Rakuten has offered the ability to earn cash back or Amex Membership Rewards points for online shopping, with the latter being a more compelling option (at least for those good at maximizing points).

However, several months ago we saw an exciting update, as Rakuten added a new rewards currency you can earn, and it might just be the best one yet… at least for some. In this post, I’d like to take a comprehensive look at how this partnership works, and whether it’s worth it.

In this post:

Bilt & Rakuten partner for shopping portal rewards

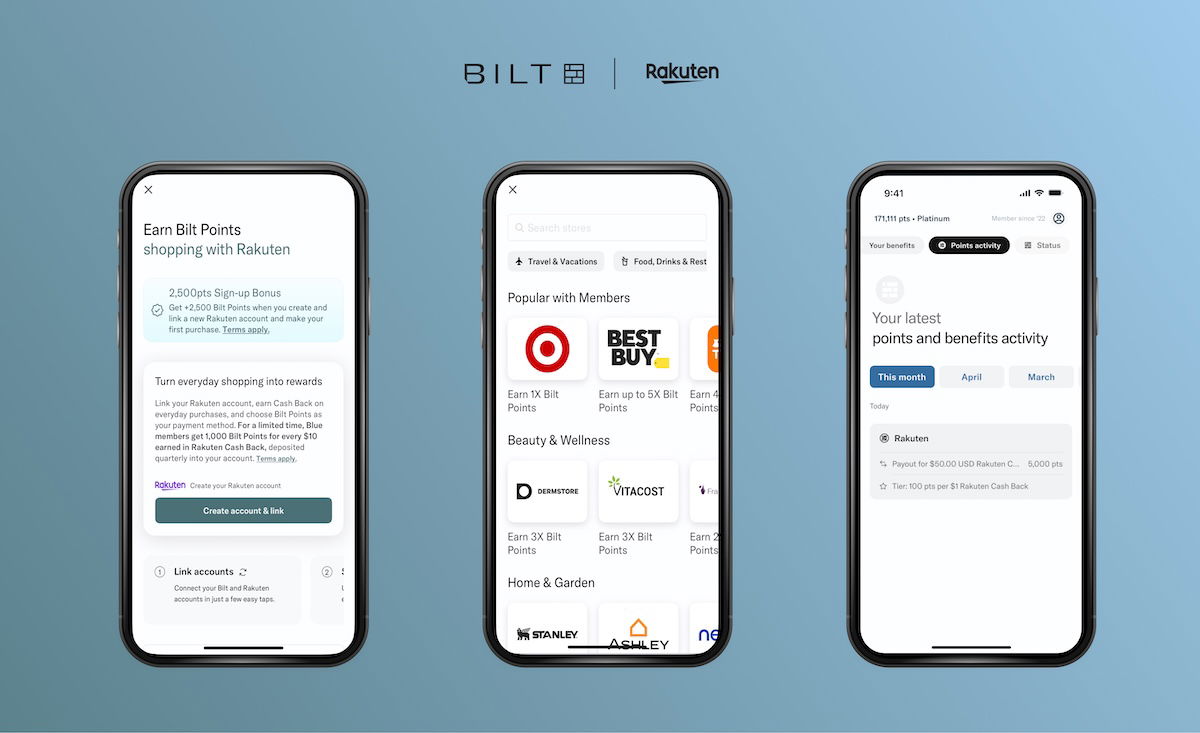

Nowadays it’s possible to earn Bilt points for online shopping with Rakuten:

- For payouts through May 15, 2026 (Rakuten pays out quarterly, so this would be for purchases through March 31, 2026), all Bilt members receive a 1:1 conversion rate, meaning every $10 in Rakuten cash back equals 1,000 Bilt points

- After that introductory period, Bilt Silver, Gold, and Platinum elite members, will maintain that transfer ratio, while non-elite Bilt members will receive 50 Bilt points per dollar in Rakuten cash back

- Those rates remain subject to change over time, and note that points earned through this partnership don’t count toward earning Bilt elite status

- Let me emphasize that the no annual fee Bilt Blue Card, $95 annual fee Bilt Obsidian Card, and $495 Bilt Palladium Card, all make it easier to earn elite status, and therefore, to maintain the better transfer ratio (read my Bilt credit card review & comparison)

How to earn Bilt points with Rakuten (step-by-step)

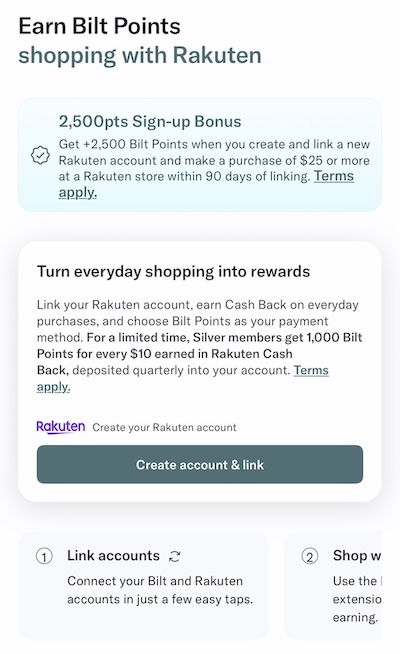

How can you start earning Bilt points with Rakuten? If you’re not yet a member of Rakuten, I’d recommend signing up through a refer a friend link before you set up your account for this partnership. That’s because the current refer a friend bonus gets you $50 in rewards (5,000 Bilt points) upon completing eligible activity, while Bilt’s offer only gets you 2,500 Bilt points in rewards.

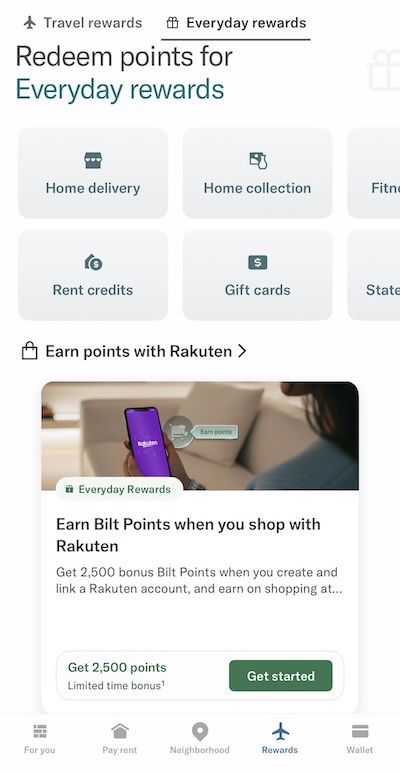

So once you have a Rakuten account, you’ll want to either visit the partnership page on Bilt’s website, or go to the Bilt app. Once in the Bilt app, navigate to the “Rewards” section, and then select the “Everyday rewards” section. There you’ll see the “Earn points with Rakuten” heading, so click on “Get started.”

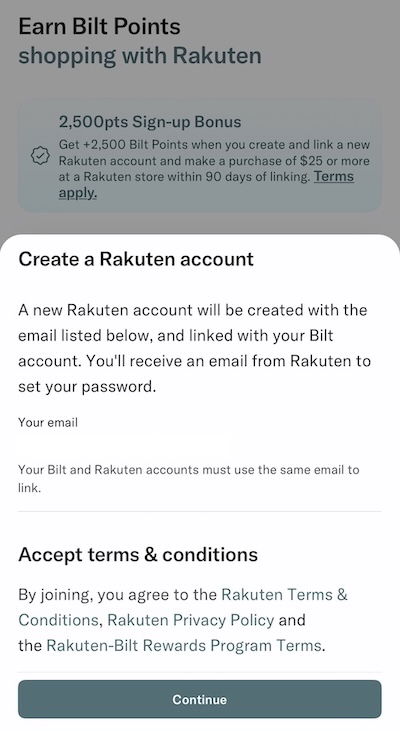

If you have an existing account (or even if you don’t), click on the “Create account & link” button. Make sure that the emails associated with your Bilt and Rakuten accounts match.

You’ll just have to click “Continue” on the next page, and then you should see that your account linking is successful.

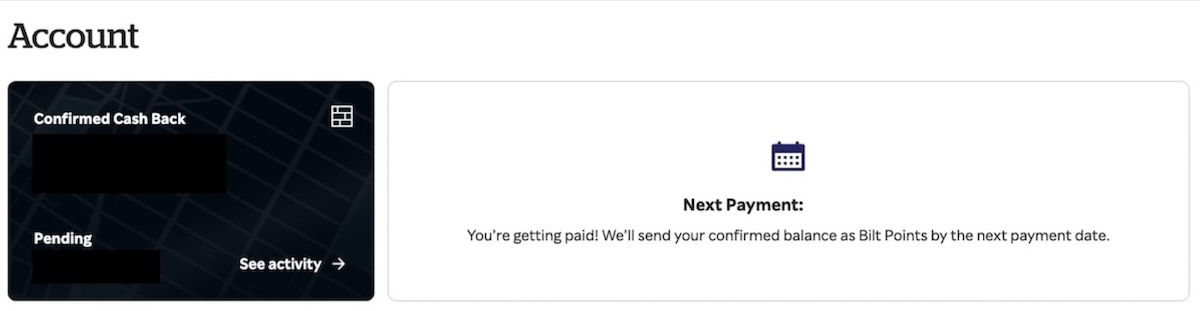

Once you’ve successfully linked your accounts, you can log into your Rakuten account and go to the “Account” section, and you’ll see that the account shows that you’ll be earning Bilt points as your reward. All rewards amounts show in cash, but are then converted into Bilt points at the above rate.

What’s interesting is that all your rewards earned within a particular “rewards cycle” (Rakuten pays out every three months) are eligible to earn Bilt points, even if you were previously supposed to earn Amex Membership Rewards points. So it’s awesome that you can retroactively switch that.

This is also why it’s great to use a refer a friend link if you’re not yet a member, to earn $50 upon completing qualifying activity, since that can then be converted into Bilt points.

As a reminder, these are the payout periods with Rakuten:

- For activity between January 1 and March 31, get paid on May 15

- For activity between April 1 and June 30, get paid on August 15

- For activity between July 1 and September 30, get paid on November 15

- For activity between October 1 and December 31, get paid on February 15

Is earning Bilt points with Rakuten worth it?

As mentioned above, I’m a big fan of using Rakuten for my online shopping. I’ve historically always chosen to earn Amex Membership Rewards points, given that you can essentially earn one Membership Rewards point in lieu of one cent cash back. Since I value Amex points at well over one cent each, that’s an advantageous rate of return.

Now that it’s possible to earn Bilt points with Rakuten in the same way you can earn Amex points, I think this option is also seriously worth considering. During the introductory period (for purchases through March 31, and payouts through May 15), everyone can earn one Bilt point in lieu of one cent cash back, so that’s a no-brainer. In the long run, only elite members can maintain that rate, while others earn one Bilt point in lieu of two cents cash back.

So, what’s my take on the value here? I’d rather earn one Bilt point than one Amex point, since Bilt points are generally harder to earn, Bilt has some unique transfer partners, and Bilt Rent Day promotions can stretch your points even further.

However, if the choice is between earning one Amex point or 0.5 Bilt points, I’d absolutely prefer to earn one Amex point. Fortunately with the new Bilt credit card portfolio, I should have an easier time maintaining elite status. Specifically, I have the Bilt Palladium Card, and I think I can make the math on this card work.

Bottom line

Bilt and Rakuten have a partnership, letting Rakuten members earn Bilt points for their online shopping. Initially, all Bilt members can earn one Bilt point in lieu of one cent cash back, which is a great rate of return. Meanwhile beyond the introductory period (for purchases through March 31, and payouts through May 15), only Bilt elite members will earn that rate of return, while others will earn one Bilt point for every two cents cash back.

I’m happy to see Rakuten partnering with two points currencies, as this is a nice alternative to earning Amex points with Bilt. And if you’re yet a Rakuten member, make sure you sign-up through a refer a friend link, given the current best-ever bonus. That can earn you $50, or 5,000 Bilt points.

What do you make of Bilt being a Rakuten partner? Do you prefer to earn Amex or Bilt points?

I would rather just have the cash back from Rakuten than points for Bilt or AmEx. And somehow Rakuten/Bilt slammed me into getting Bilt points from my usual cash, made the transfer three days earlier then they stated, and have left me with Bilt points I do not want that are worth less than the cash I would have gotten.

Ben asks …. “And Is It Worth It?” …. Meanwhile, I conclude that reading the article is not “Worth it”. Sorry Ben, at least you get my click, yes?

And Rakuten changed it so that you can switch back-and-forth between AMEX and BILT, right? I remember previously that once you selected AMEX as an option if you ever switched off it, you couldn’t switch back. I’ve read in a few places that you can go back-and-forth between either as many times as you want now.

Yes, you can.