American Express is rolling out a valuable feature for card applications, which I think will put many at ease when applying for cards. While this has been trialed for quite some time now, it’s official as of today.

In this post:

Know if you’re approved for Amex card without hard pull

American Express is piloting a new “Apply With Confidence” feature, whereby you’ll know if you’re approved for a card with no impact on your credit score. That said, your credit score may be impacted if you are approved and choose to accept the Card.

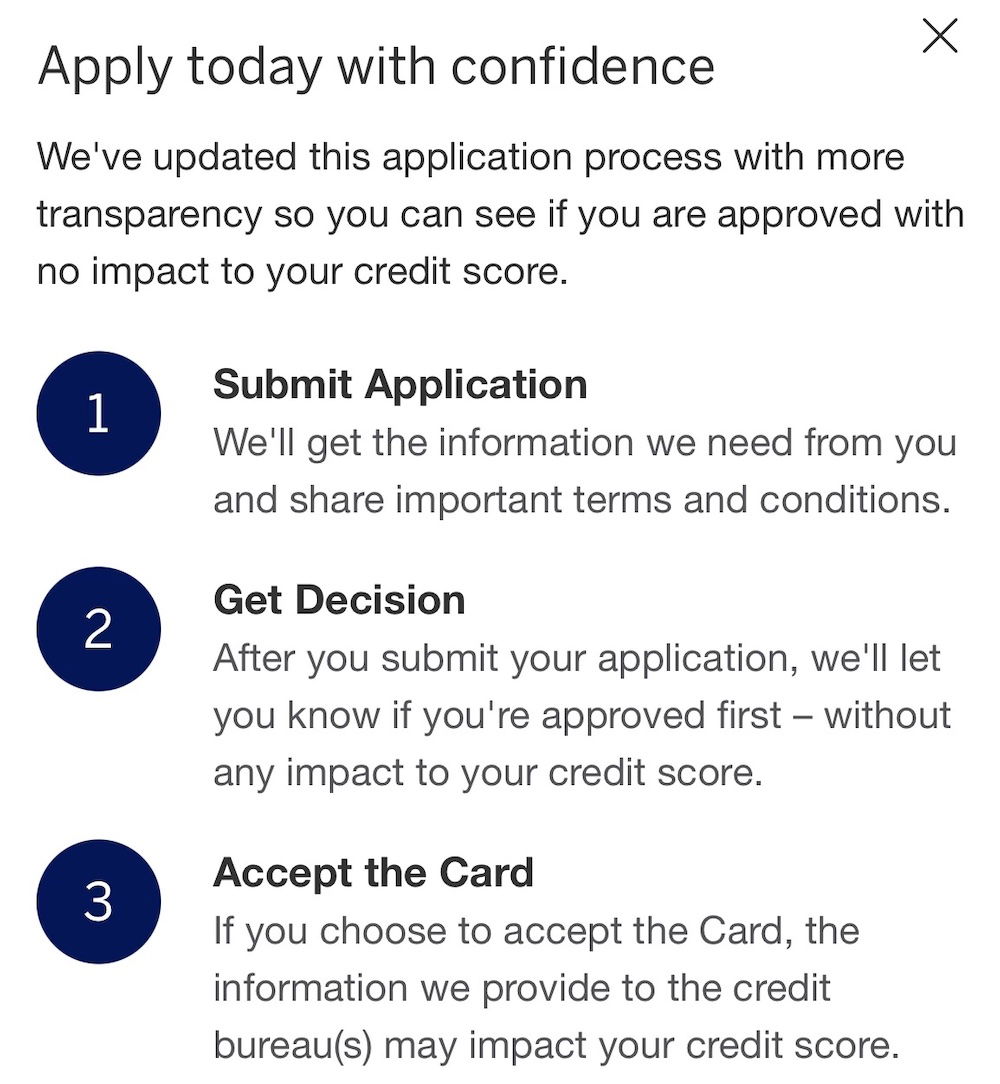

As it’s described, this is intended to create more transparency. Here’s how the process works:

- You’ll first submit your card application, including sharing your personal details, and agreeing to the terms & conditions of the application

- After submitting your application, you’ll get a decision with certainty, without a hard pull on your credit (rather there’s a soft pull)

- After you’re approved for your application, there may be a hard pull that could have an impact on your credit

The new application experience is currently available for individuals applying for a U.S. Personal Card via OMAAT, at AmericanExpress.com/us/credit-cards, or by calling American Express and is not available if you apply for a Card after you log into an existing Card Member Account.

Here’s how Amex’s EVP of U.S. Consumer Marketing, Sara Milsten, describes this feature:

“We know that consumers value transparency and certainty. With our new application experience, prospective Card Members can apply for a specific Card — and know if they are approved — without having to worry about whether their application will change their credit score until they accept the Card. We hope this new, more transparent application experience encourages anyone with an interest in American Express membership to apply.”

This is a smart and helpful initiative

The “Apply With Confidence” concept is a great idea that will put a lot of people at ease when applying for an American Express card. Interestingly this has been a consistent feature on the Apple Card since launch, as you’ve been able to know whether you’ll be approved without a hard pull.

In general, I tend to think applying for Amex cards is probably the best process you’ll find with any issuer:

- I appreciate Amex’s application pop-up feature, that tells you if you’re not eligible for the bonus on a card based on Amex’s rules, including the lifetime rule

- Anecdotally I find Amex cards easiest to be approved for, whether a personal or business card, assuming you follow the standard application restrictions

- If you’re an existing cardmember, I find that Amex often doesn’t even do a hard pull when you’re applying for a card, since the issuer often makes decisions based on existing info on file

While I’d say this is a great development, personally I’ve never considered a hard pull from a credit card application (whether I get approved or denied) to be a huge deal. I know some people are worried that applying for a card will hurt their credit score — while you may be dinged a few points, that shouldn’t be a big issue in the scheme of how credit scores are calculated, at least assuming you have a great score. Furthermore, getting approved for cards can greatly help your credit score in the long run.

For those wondering why Amex even bothers doing a hard pull after approving people, it’s because it’s a regulatory requirement to do so when someone opens a new credit card.

Bottom line

Amex has officially rolled out an “Apply With Confidence” feature, whereby you’ll get a decision on your card approval before there’s a hard pull to your credit. This is a cool feature that will make many people more comfortable with applying for new cards. Between this and Amex’s pop-up feature, plus Amex’s generally easy card approval, Amex is my favorite issuer when it comes to the application process.

What do you make of this new Amex application feature?

Here's what you don't discuss and it is important as to being approved, the assets you need, hard or soft credit score pull, etc. The difference between types of Amex cards. If you hold the Platinum or Gold card for example that is very different than a Marriott or Delta card for example. In the partner cards, Amex is acting like both the credit card processor (e.g. visa equivalent) and the bank (e.g. Chase). If...

Here's what you don't discuss and it is important as to being approved, the assets you need, hard or soft credit score pull, etc. The difference between types of Amex cards. If you hold the Platinum or Gold card for example that is very different than a Marriott or Delta card for example. In the partner cards, Amex is acting like both the credit card processor (e.g. visa equivalent) and the bank (e.g. Chase). If you hold a lower end Amex branded card which is not partnered that is similar to holding a generic visa or mastercard with a credit limit issued by a bank (e.g. Chase Unlimited). In this case Amex acts as both the bank and the processor, too. If you hold a platinum or gold card for example, those are charge cards. You generally are not able to finance your charges over time and are required to pay the bill in full when due. In this case Amex also acts in both. Generally the maximum limit for a charge card transaction is much higher. Amex used to be for charge cards only, but as they moved in to having credit cards and partnered credit cards, this made it so they issue both. Most people don't know or realize the difference.

You are WAY overthinking.

To most people, it doesn't matter.

You charge, you get a bill, you pay your bill.

If your credit profile gives you a limit of $1000 I doubt being a charge card would allow you to charge a lot higher than that.

At the end of the day, Amex being the bank or not, any bank would have calculated the exposure they are comfortable to extend you credit.

But for you, you charge, you get a bill, you pay your bill. Difference doesn't matter.

Amex does credit check spending routinely every 5-7 months . They pre approve you based on your assets , if you have friends needing higher credits core , use the person with the best credit who has a new house and new car under 7 years, also use their house address and cellphone number when applying with a minimum salary amount $94,862 Canada and $81900us. Amex will not call.

you'll get instant approval and...

Amex does credit check spending routinely every 5-7 months . They pre approve you based on your assets , if you have friends needing higher credits core , use the person with the best credit who has a new house and new car under 7 years, also use their house address and cellphone number when applying with a minimum salary amount $94,862 Canada and $81900us. Amex will not call.

you'll get instant approval and let your friend know they might receive mail under your name because the system kept denying you to use your postal code or zip code. Tell them you applied for a Marriott Outlet discount count.

Amex is probably the worse card for lowering your credit purchase while away with best credit repayment on time . The best Amex is Marriott Bon Voyage

your best to have second cc Airline travel Visa like TD Aeroplan Visa

avoid flying Air Canada at any cost !!!

you're a sketchy "friend"

Meth is a hell of a drug.

Then a surprise FR with confidence.

While the credit scoring system is a good thing.

The credit bureaus are a scam. They extort you money for your profile just to lose that info to hackers and selling you credit monitoring service.

How about you give me access to my credit for free and I'll do the monitoring myself.

To answer your last question - the hard pull is a regulatory requirement, not an information-driven one. Soft pulls provide the exact same information as hard pulls, but in order to legally extend credit in the US you must do a hard pull if you check the customer's credit at all.

Then how can AMEX explain 3 cards that they have approved for me (and I am not alone in this category) in 2022 alone without a single hard pull? All were business cards (one of them my first business card ever).

Simple - they didn't pull your credit at all when approving those cards. Amex routinely approves new accounts based purely on their own internal data on their relationship with you. If you're already a customer in good standing it's typically no problem on their end.