There are a lot of misconceptions about how credit scores work. When I tell people I have dozens of open credit cards, they look at me like I’m from a different planet.

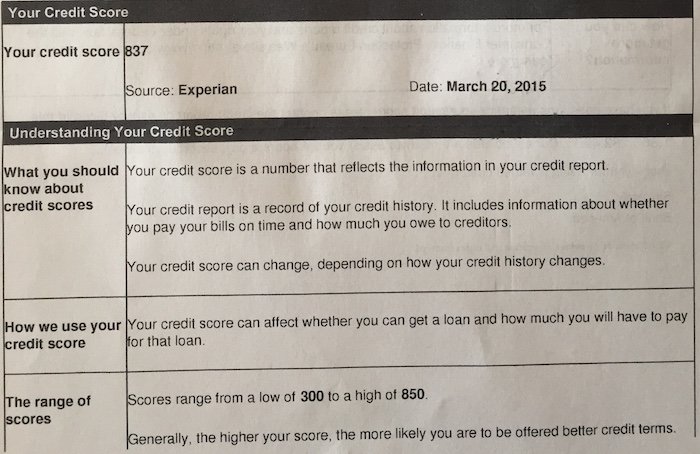

The response is almost always “your credit score must be horrible.” Nope, it’s not. My credit score is way over 800, better than 98% of the US population.

As I’ve explained before, credit scores don’t work how people think they do. Applying for a credit card won’t ruin your credit score long term. Instead, it could actually help it.

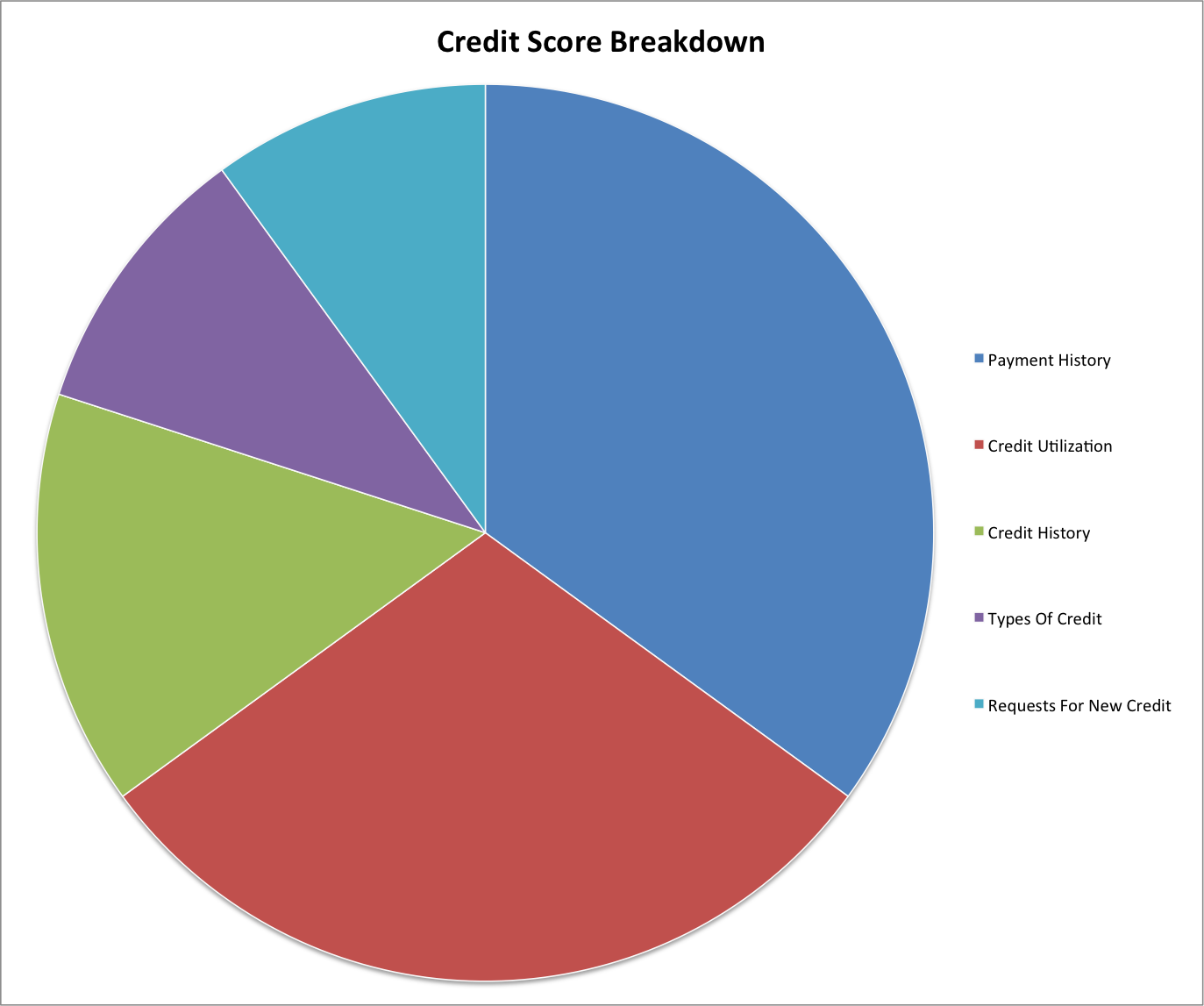

Here’s what goes into your credit score:

- 35% of your score is made up of your payment history

- 30% of your score is your credit utilization

- 15% of your score is your credit history

- 10% of your score is made up of the types of credit you use

- 10% of your score is your request for new credit

What’s most important is that you make your payments on-time, don’t have any bad marks on your credit, and keep your credit utilization low. That alone constitutes 80% of your credit score. While your score may be temporarily dinged a couple of points for your credit inquiry, the long term impact of lowering your overall credit utilization and having a positive payment history can more than offset it.

While people might think the number of cards I have is insane, my situation pales in comparison to the guy who holds the Guinness Book of World Records title for having the most credit cards. He has 1,497 credit cards, including $1.7 million in available credit.

So, how did this all happen? Via ABC News, he got started collecting credit cards based on a bet, which caused him to get 143 credit cards in a year:

“I got started in the late 1960s” Cavanagh said. “Me and a buddy in Santa Clara, Calif., made a silly bet: the guy who could collect the most credit cards by the end of the year would win dinner. I was fresh from the Peace Corps and I got 143 cards by the end of the year. My friend gathered 138. He’s still a pharmacist — like I was back then — if only he had worked a little harder maybe he could have been the one here today.”

And you’ll be happy to know that his credit score is nearly perfect:

With $1.7 million available to him at any moment, Cavanagh says his credit score is great. “It’s nearly perfect. I have a nearly perfect credit score. I only use one card and I pay it off at the end of the month. But you should see the length of my credit report — wow!”

Bottom line

If this doesn’t prove that having a lot of credit cards can actually help your credit score (in conjunction with good habits and using them responsibly), then I don’t know what does.

Now I’m just hoping he actually bothered to collect and redeem all the points associated with these cards!

I disagree with the people above, loved the post and forwarded it to a bunch of people that laugh when I page through my wallet when buying something to get the best spend bonus. It was a fun interruption to my day and theirs.

Haters are gonna hate.

If the headline made you want to read the story..... you click on it.

If it didn't appeal to your buzzfeed senses...... don't click on it.

Whatever happened to free will??

This wasn't even remotely close to Gary's misleading clickbait.

My first question about folks who have a large number of "points" cards is how do they manage the annual fees? I know that many banks will waive the the fee first year and some will waive it in following years but I expect they want to see sufficient activity on the card -- literally money in the bank for them. And I know that as Ben has pointed out several of the cards give...

My first question about folks who have a large number of "points" cards is how do they manage the annual fees? I know that many banks will waive the the fee first year and some will waive it in following years but I expect they want to see sufficient activity on the card -- literally money in the bank for them. And I know that as Ben has pointed out several of the cards give you enough bennies to pay for the annual fee. But to hold 10's or 100's of such cards doesn't seem to make sense to me once you have obtained the bonus.

Can someone enlighten me on this.

Seems like it would be tough to find that many different products from enough different banks that they would allow that many cards.

All u complainers don't have to read. Some of us enjoy these articles and aren't always trying to hack the system like u guys are. Nice article Lucky, keep doing these.

Agreed. Please don't use clickbait titles

What about annual fees? Gotta be $10k a year for him.

Your score is 837? You must not have been applying for any cards recently.

You don't have a mortgage payment, car payment.

I agree with the posters above, do not turn into Gary, I don't even visit his blog anymore.

Arrrrrghhhh - whatever you do, don't start using clickbait headlines! What's next, "one woman's weird old trick" for getting upgrades? Gimme a break.

YOU'LL NEVER BELIEVE WHAT HAPPENS NEXT!

"if only he had worked a little harder maybe he could have been the one here today.”

Where is he? What does he gain from this??

I mean, are there that many different credit card account's that you can have ?

@ complainers - "You’ll Never Believe How Many Credit Cards One Man Has" is a pretty obvious headline. Not interested? Don't click then clutter the comments with how you think the post is inappropriate. Readers can decide for themselves.

^ Agree 100% with keith (first post).

This guy must need a massive mailbox. Even with paperless I still get lots of crap in the mail. Plus the expected new cards when the old ones are expiring. Wow. I have 15 cards I think, it's too much, but my credit score is very high and I'm planning to take out a mortgage later this year, so I'm not wanting to close any accounts.

^^ Agreed with the above. Please don't turn into Buzzfeed - you're better than that, Ben.

Applying like a moron doesnt help. Use some sense and the gauge the types of cards etc you are allying for over time.

Hey Ben,

I am based in Europe and would love if you also gave tips on great credit cards for those in the European market!

^ Agree with the hating Buzzfeed headlines. Also, doesn't applying for so many new accounts really damage your AAoA?

Ben, please don't turn into Gary Leff with the Buzzfeed baitclick headers like this one. Your readers deserve better.