Making Travel Less Taxing: Introduction

Your Tax Home (Away from Home)

Airfare and Transportation

Lodging and Meals

Entertaining Clients

Car Expenses

The Nitty Gritty: Required Receipts and Tax Forms

Ask Scott!

Greetings, taxpayers! This week, we continue our discussion of specific categories of deductible business travel expenses by reviewing the rules for lodging and meals. Both are deductible when unreimbursed and incurred while away from home on business. Please note the legal disclaimer at the end of this post.

Lodging

Recall from week two that you may deduct travel expenses only when you’re away from your tax home and that your tax home may not be the same place as your personal home. For employees, the employer will reimburse any lodging costs incurred and then take a deduction for the cost incurred. For self-employed business owners, the cost of the lodging is taken as an expense against business income.

The General Services Administration (“GSA”) publishes a per diem for lodging that is the maximum that government employees are entitled to receive as reimbursement, and the IRS has permitted that amount to be “deemed substantiated” by an employer who adheres to it in reimbursing its employees. This policy is designed to lessen the recordkeeping requirements of tracking actual expenses. Incidentally, for someone with a great deal of extra time, it would be interesting to track the federal government per diem lodging rates against actual hotel government rates; I wonder how well the market tracks the government maximums?

Hyatt House, Redmond, located in King County, Washington, where employers may deduct up to $137/night as a per diem for lodging for employees away from home.

The per diem amounts for lodging reduce the administrative recordkeeping burden on employers in tracking lodging expenses. But, note that it does not apply to employees or the self-employed. The policy of only permitting a deduction for actual lodging expenses is a tax revenue generator in that it prevents a taxpayer from deducting expenses not actually incurred. The classic example is a truck driver who sleeps in his rig; fair or not, tax law does not permit him a deduction for lodging unless he actually incurs such an expense.

Meals

Unreimbursed meals are deductible if business-related, but only 50% of the cost of the meals is deductible and a standard allowance in lieu of actual expenses may be used by all taxpayers. The term “meals” is defined to include not only food but also beverages, taxes, and tips.

Beverages such as those the InterContinental Frankfurt offers in its minibar are included in the definition of a “meal.”

Business-Related

For purposes of this week’s discussion, assume there is a legitimate business purpose to the meal; the taxpayer is either away from home on business or the main purpose of the client meal was to discuss business. In next week’s edition, I’ll delve into the specifics of what makes entertainment (including meals) business-related.

Flight attendants’ unreimbursed meals while away from home on business are deductible (assuming this LH crew is subject to U.S. tax).

Two (or Three) Martini Lunch

After meeting the business purpose test, the taxpayer may then deduct 50% of the unreimbursed cost of the meal; a bit of history is helpful to understand how this limit arose. During his presidency, Jimmy Carter emphasized the fact that a businessman and his client’s alcoholic drinks over lunch were fully deductible against income, while an average worker who consumed more pedestrian fare (Carter used “bologna” as his example) received no tax deduction. So, a compromise was reached: the government will “pay” for the client’s meal and drink in the form of a tax deduction, but the business owner must pay for his own meal. The one-half limitation applies regardless of how many people are at the meal and remains current law. Thus, while it’s simple to think of the rule as permitting a deduction for a client’s lunch and no deduction for your meal; in reality, the 50% limitation applies to the total cost regardless of who ordered the amuse bouche. More on the Carter backstory may be found here and here.

Only half of Lucky’s bottle of wine is deductible for business travel.

No discussion of tax law is complete without an exception, and this week is no exception. Meals served on business premises for the convenience of the employer are deductible in full; so for employers like Google or Apple that provide on-site cafeterias, the entire cost of those legendary offerings is deductible. Further, a restaurant or airline in the business of feeding its customers may deduct the entire cost of those meals.

Actual or Standard

For meals incurred while away from home on business, you can use the actual cost of the meals or the standard meal allowance set by the GSA for domestic cities and the State Department for foreign travel. The actual cost method may allow you to deduct more than the standard allowance but carries with it the administrative burden of having to keep receipts. The lowest per diem rate is $46 per day, and the rate increases in $5 increments to a top rate of $71. In addition to all three meals, the per diem is intended to cover incidental expenses like tips and transport to and from the place of business and hotel. Let’s look at a few cities to see how much is allowed:

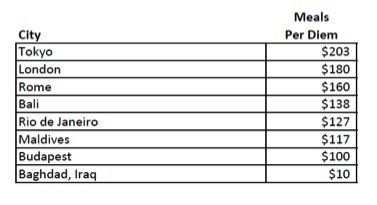

I am sure there is some magic methodology to these numbers, but as you can readily see, the allowance could be accurately described as either overly generous or too parsimonious to the taxpayer depending on the locale. Let’s examine some international cities from the State Department’s list:

Internationally, there is a much broader range from Antarctica at $1 (ice is free!) to $240. You may download the entire list of U.S. cities here and the international list here.

Awashima Island, Japan. Per the U.S. State Department, this is the most expensive place in the world to eat three meals.

For those travelers whose actual expenses are less than the allowance, the excess is a “free” tax deduction since the permitted deduction is greater than the cash spent. The allowance method also does not require keeping a record of actual costs; instead, the taxpayer must maintain a list of travel locations and dates. Remember that the 50% limitation applies, as well, regardless of what method the taxpayer uses, which mitigates the impact of any “free” deductions.

Mixing Business and Personal

Last week, I discussed allocating unreimbursed airfare expenses when a trip has a mixed purpose. For lodging and meals, the rules are applied on a per-day basis so that a business traveler on a seven day trip with five days of work and two personal days could deduct lodging and meals for the five days business is done. Days in transit and standby days that fall between business days may count as business days, as well as days in which your presence is required for a specific business purpose (e.g. an evening meeting) even if you spent most of the day on personal activities. These situations get fact specific rather quickly, so feel free to ask questions in the comments.

Convention organizers have long recognized the value of an exotic locale as a method of increasing attendance. Unfortunately, so has the IRS. For continuing education courses offered in far flung confines, only the direct registration fees of the courses are generally deductible due to a presumption that the primary purpose of the trip was personal and the course offering available elsewhere. I have yet to find a legal or CPA continuing education course offered abroad that I cannot obtain in a more convenient location, but I will keep trying to translate the course names at the UAE University. Daily. Just to be sure. 🙂

Conclusion and Next Time

Hence, an employer may reimburse employees and deduct travel costs for lodging using an actual cost or allowance method, while employees and the self-employed must use actual costs. All meals are subject to a 50% limitation, and all taxpayers may use either actual expenses or a per diem rate based on locality. Next week, I’ll discuss deducting entertainment costs, including luxury boxes and client gifts. Please leave any questions you have in the comments! Also, you may follow me on Twitter @ScottTaxLaw or learn more about my legal and CPA practice.

Disclaimer: While I hope the information I provide will be helpful (and hopefully even humorous at times), none of this information should be construed as offering legal advice or creating an attorney-client relationship between the reader and my law firm. You should not act or refrain from acting based on this advice and should consult your own attorney or CPA regarding your specific tax matters. IRS Circular 230 Notice: Nothing in these communication is intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law.

I travel for a living and am self employed. My clients reimburse me for my meals as well as my crew's meals. Since this is reported as income to me, I deduct 100% of this. My question..... since my reimbursement is for actual dollars spent, I write off actual dollars spent. Am I allowed to write off the standard per diem instead? I would think this would not be allowed. And second question is can...

I travel for a living and am self employed. My clients reimburse me for my meals as well as my crew's meals. Since this is reported as income to me, I deduct 100% of this. My question..... since my reimbursement is for actual dollars spent, I write off actual dollars spent. Am I allowed to write off the standard per diem instead? I would think this would not be allowed. And second question is can I write off standard per diem for my crew (I pay for their meals and my client reimburses me for actual expenses).

Please explain in more details

For those travelers whose actual expenses are less than the allowance, the excess is a “free” tax deduction since the permitted deduction is greater than the cash spent.

How can this be done?

Clarification! It is clear from the article that the full per diem rate can be expensed when you are away from home.

If I am at a Starbucks for clear business purposes in my own town… Can I take the full Per diem rate?

I frequently travel to the same place for business. For the first year I did this, I would stay in hotels. However due to the expense, I decided to simply purchase a home there. My primary residence is in another state. I only use the second home when conducting business there. Are the costs associated with that second home deductible?

I am self-employed. For a per diem in a given city/state, do I understand it correctly that the meal per diem can be taken even without actual receipts, or an actual costs which is less than the per diem, but the lodging per diem rate offered for that locality must have all receipts attached?

@jmd001, neither company was per se wrong in how they reported it, but obviously on your end, you will report it differently. You are correct that for (2), you should show the expenses against the income reported to you, and that you won't "lose" the 50% deduction in this instance, so report your meals at 100% since you were reimbursed under an accountable plan.

I am a sole proprietor. Recently, I was under contract to two separate companies. Both would reimburse me for travel using the same rules and limitations that apply to Government employees. (I had to file travel vouchers with receipts with each.) One company included the total reimbursement for all my trips in my Form 1099-Misc. The other included none of the reimbursements on their 1099 to me.

Two questions: (1) Which company did it correctly...

I am a sole proprietor. Recently, I was under contract to two separate companies. Both would reimburse me for travel using the same rules and limitations that apply to Government employees. (I had to file travel vouchers with receipts with each.) One company included the total reimbursement for all my trips in my Form 1099-Misc. The other included none of the reimbursements on their 1099 to me.

Two questions: (1) Which company did it correctly from the IRS view? (2) For the company who included my reimbursement in my 1099, I can deduct the full amount that I was reimbursed, correct? (Specifically, since I was reimbursed, the meal deduction is NOT limited to 50% of what I was reimbursed for meals, correct?)

Levi -

For a sole proprietor, you can use the per diem rate for meals, but you cannot use it for lodging, regardless of domestic or international travel.

if you start a corporation and are more than 10% owner, then you are also limited to the actual lodging costs and cannot take the per diem for lodging. The IRS apparently anticipated someone doing exactly what you are contemplating to maximize their lodging deductions!

Hi Scott, just to check i understand: so being sole proprietor I can't use a per diem rate over seas (or US) but have to keep receipts for all meals and lodgings. But, meals overseas are fully recompensed? If I start an S or C corp i can reimburse myself at per diem rates? Thanks!

PH -

In that instance, I do think the employer could deduct the per diem allowance even if the actual was less than that amount, similar to how a self-employed person can deduct the per diem for meals even if the actual were less than that.

I don't think employees would be pleased at all if they found out about such a practice, but as long as the employee has all of their expenses...

PH -

In that instance, I do think the employer could deduct the per diem allowance even if the actual was less than that amount, similar to how a self-employed person can deduct the per diem for meals even if the actual were less than that.

I don't think employees would be pleased at all if they found out about such a practice, but as long as the employee has all of their expenses reimbursed, I'm not sure they would know or complain about what the employer deducts. The employer in the "actual expense" scenario also takes the risk that the employee will exceed the maximum, too, I suppose.

My former employee requires actual receipts for reimbursements of employee meals while on business travel. I would be annoyed as a taxpayer if my former employee could take the per diem deduction such as $180 for London while requiring receipts and reimbursing for actual expenses with a travel policy recommendation to keep meal expenses far lower than that example $180. Is the employer in this example required to only deduct the actual expense it realizes,...

My former employee requires actual receipts for reimbursements of employee meals while on business travel. I would be annoyed as a taxpayer if my former employee could take the per diem deduction such as $180 for London while requiring receipts and reimbursing for actual expenses with a travel policy recommendation to keep meal expenses far lower than that example $180. Is the employer in this example required to only deduct the actual expense it realizes, namely the actual expenses it reimbursed me?

@Mark - Yes, I'd count that under the category of "reimbursed" business expenses, and I was highlighting the rules for unreimbursed expenses.

@Ron - Thanks for the UK info. Interesting how tax drives behavior sometimes, huh? I'm not sure if any country uses tax to try to influence behavior more than the US, but maybe HMRC gives the IRS a run for its, er, money.

UK tax law is somewhat different: when I worked there, my employer had a rule that whenever we entertained a guest, the host was only allowed to bring along one fellow employee. At some point I learned that this was due to a rule by Her Majesty's Revenue and Customs, whereby any meal paid for by the employer where the ratio of employees to guests exceeded 2:1 was considered to be taxable income to the employees.

I would add that self-employed taxpayers who adequately account for meal expenses to and subsequently receive reimbursement from a client are not subject to the 50% limit on deductions.

Thanks, jfhscott, for the clarification.

Thanks, too, Matt S, for highlighting the 80% rule for those subject to DOT hours of service limits. Here's the full list of occupations that the lists who are eligible for that higher limit:

*Certain air transportation workers (such as pilots, crew, dispatchers, mechanics, and control tower operators) who are under Federal Aviation Administration regulations.

*Interstate truck operators and bus drivers who are under Department of Transportation...

Thanks, jfhscott, for the clarification.

Thanks, too, Matt S, for highlighting the 80% rule for those subject to DOT hours of service limits. Here's the full list of occupations that the lists who are eligible for that higher limit:

*Certain air transportation workers (such as pilots, crew, dispatchers, mechanics, and control tower operators) who are under Federal Aviation Administration regulations.

*Interstate truck operators and bus drivers who are under Department of Transportation regulations.

*Certain railroad employees (such as engineers, conductors, train crews, dispatchers, and control operations personnel) who are under Federal Railroad Administration regulations.

*Certain merchant mariners who are under Coast Guard regulations.

This may not apply to a lot of people on this particular board, but if you hold a CDL and spend time over the road away from your home terminal, you can deduct 80% of $59/day ($47.20/day) per diem with no receipts as long as you keep a log book as proof (opposed to the standard 50%).

This does not only apply to truck drivers in the traditional sense - if you drive promotional vehicles...

This may not apply to a lot of people on this particular board, but if you hold a CDL and spend time over the road away from your home terminal, you can deduct 80% of $59/day ($47.20/day) per diem with no receipts as long as you keep a log book as proof (opposed to the standard 50%).

This does not only apply to truck drivers in the traditional sense - if you drive promotional vehicles for marketing companies etc etc etc you can use this as long as you identify yourself as a driver come tax time, which is fine if you hold the proper CDL and keep log books.

Its a small point, but DOD establishes per diem for Alaska and Hawaii.