| Want to learn more about policies of major transferable points currencies? See my series about Amex Membership Rewards, Capital One, Chase Ultimate Rewards, and Citi ThankYou. |

Chase Ultimate Rewards is one of the most popular transferable points currencies. There are several excellent cards earning Chase Ultimate Rewards points. The program also gives you lots of flexibility, whether you want to transfer points to airline and hotel partners, or want to redeem points toward the cost of a travel purchase through the Chase Travel℠ Portal.

The logistics of redeeming points can get confusing. In this post, I wanted to go over the basics of moving Chase Ultimate Rewards points around, including how you transfer them to airline and hotel partners, how you combine them between accounts, and how you share them with others.

In this post:

How to transfer Chase points to airline & hotel partners

Chase Ultimate Rewards points can be transferred to 14 travel partners, including 11 airline loyalty programs and three hotel loyalty programs. Personally I find World of Hyatt to be the most useful transfer partner, though there’s also lots of value to be had with some of Chase’s airline partners as well.

| Airline Partners |

|---|

| Aer Lingus AerClub |

| Air Canada Aeroplan |

| Air France-KLM Flying Blue |

| British Airways Executive Club |

| Emirates Skywards |

| Iberia Plus |

| JetBlue TrueBlue |

| Singapore Airlines KrisFlyer |

| Southwest Rapid Rewards |

| United MileagePlus |

| Virgin Atlantic Flying Club |

| Hotel Partners |

|---|

| IHG Rewards |

| Marriott Bonvoy |

| World of Hyatt |

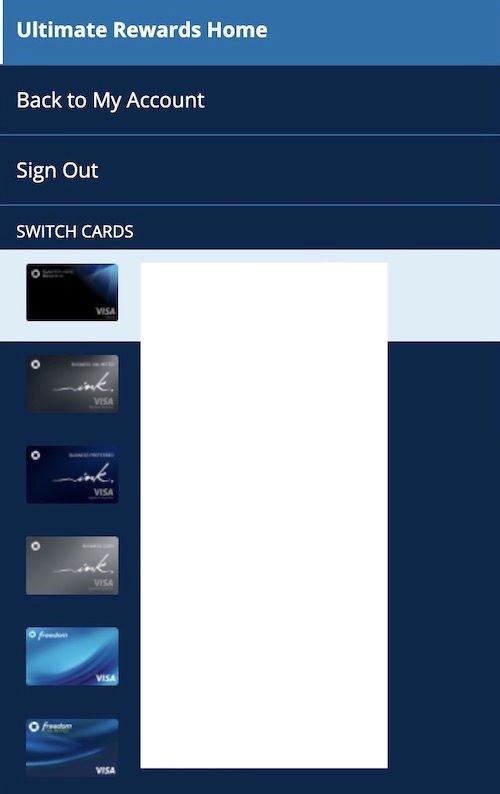

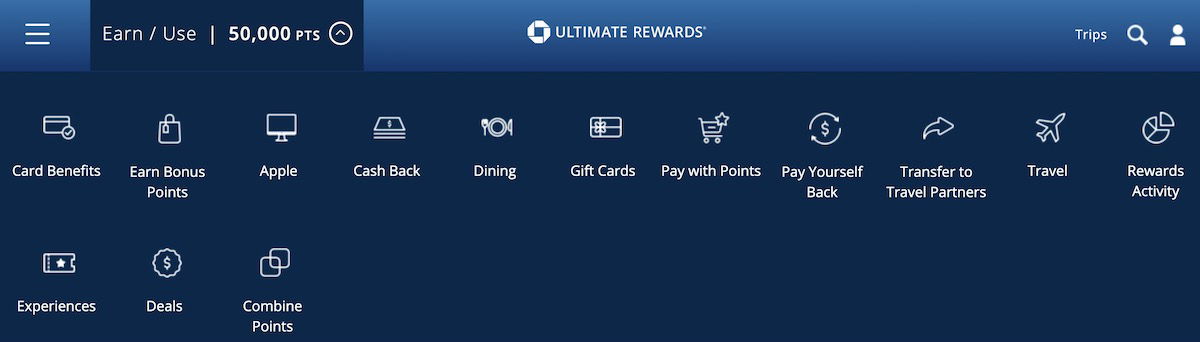

The process of transferring Chase Ultimate Rewards points to partner loyalty programs is easy. To start, just log into your Ultimate Rewards account. Once there, you’ll want to select the card you plan on transferring points from. You can select the card via the menu at the top left of the Ultimate Rewards homepage (it will show the points balance and last four digits of the card number for each account, but I removed them for the below screenshot).

Note that you can transfer points between your various card accounts instantly and for free, though we’ll cover that a bit later. If you’re trying to transfer points to a partner loyalty program, you’ll have to do so from the Chase Sapphire Preferred® Card (review), Chase Sapphire Reserve® Card (review), or Ink Business Preferred® Credit Card (review).

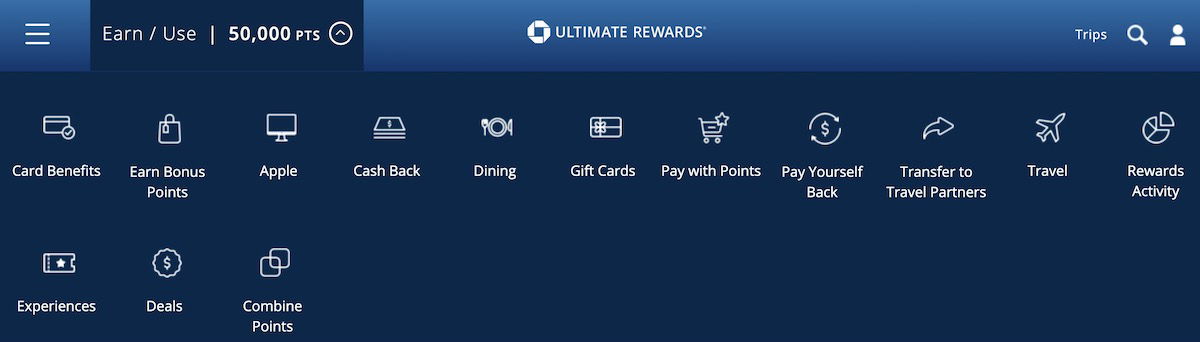

After selecting your card, expand the “Earn/Use” tab and then click on “Transfer to Travel Partners.”

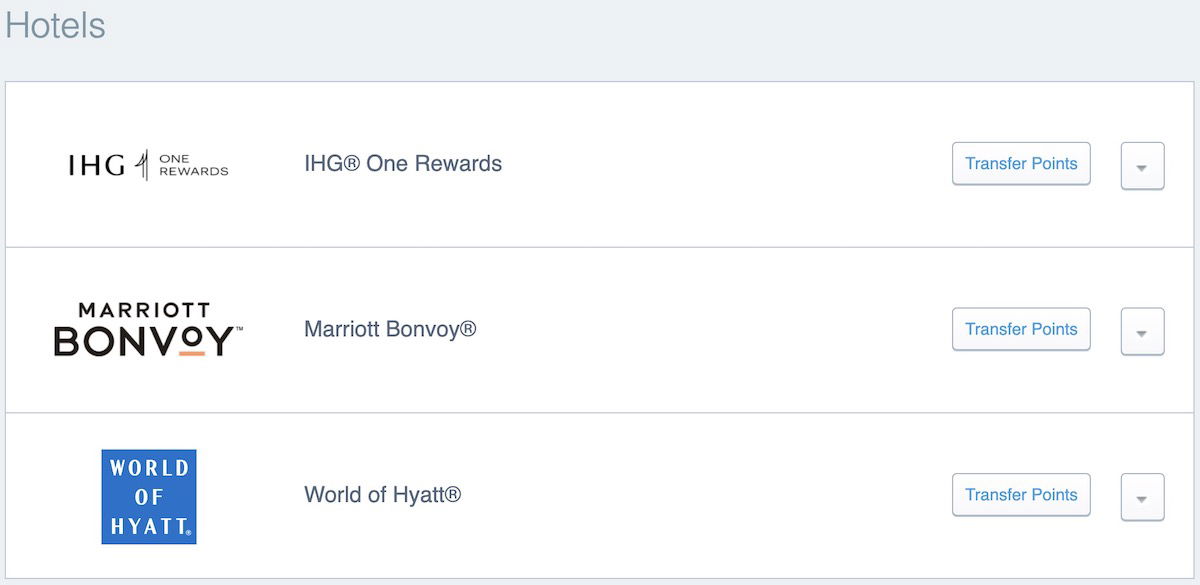

On the next page you’ll see all of the Chase transfer partners listed. Airlines will be listed first, and then hotels.

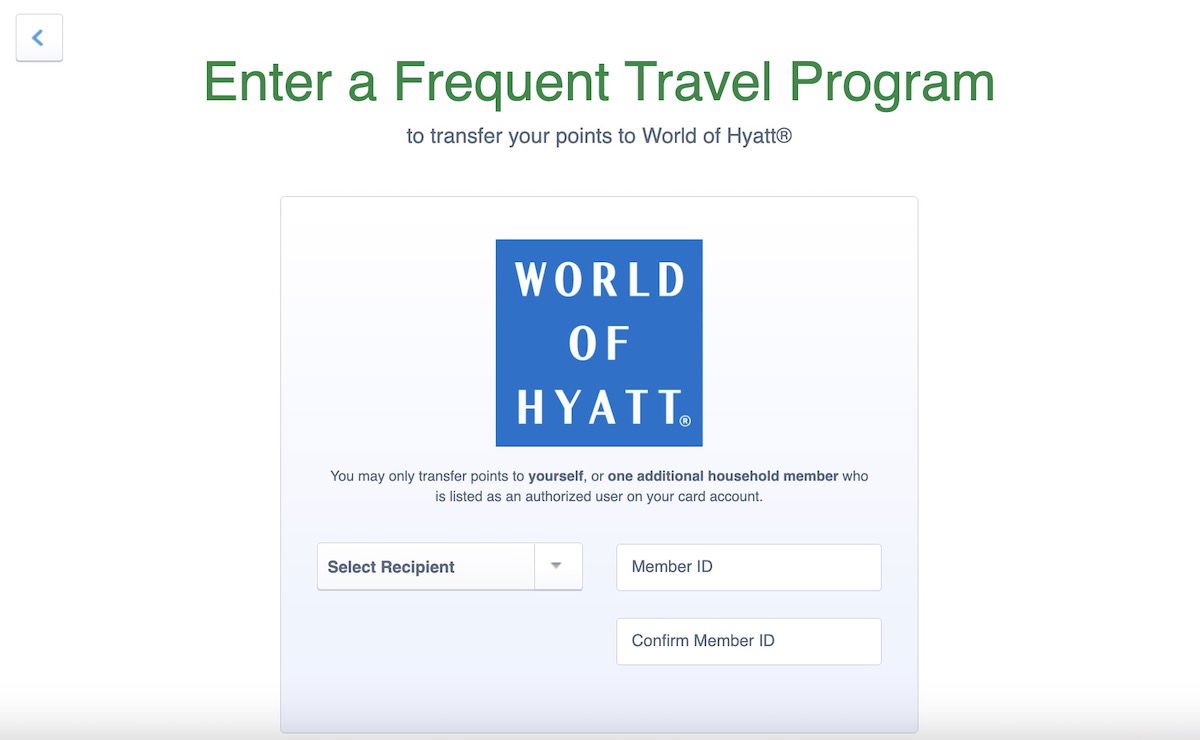

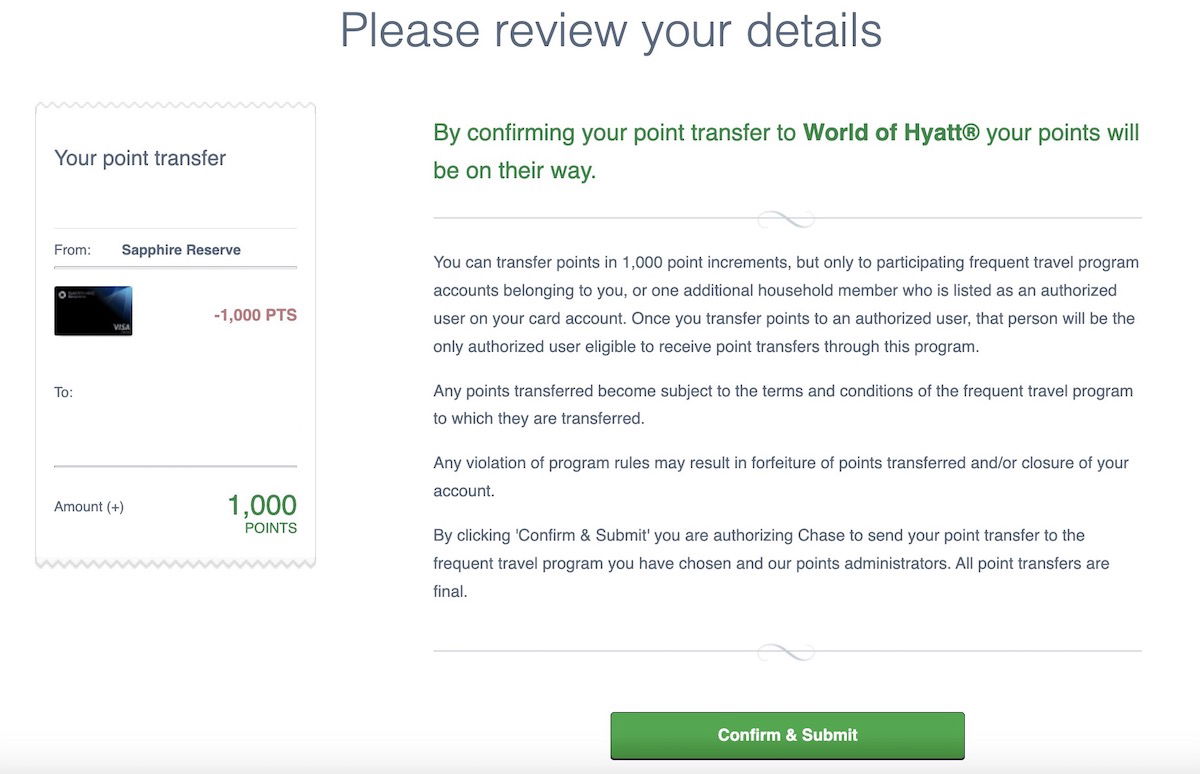

After you select the partner program you want to transfer to, you’ll be brought to a page where you have to enter the loyalty account number you want to transfer points to. You can only transfer points to an account in your own name or the name of one additional household member who is listed as an authorized user on one of your accounts. So you’ll have to specify who the account belongs to.

You can also save your account info, so that in the future you don’t have to provide those details again.

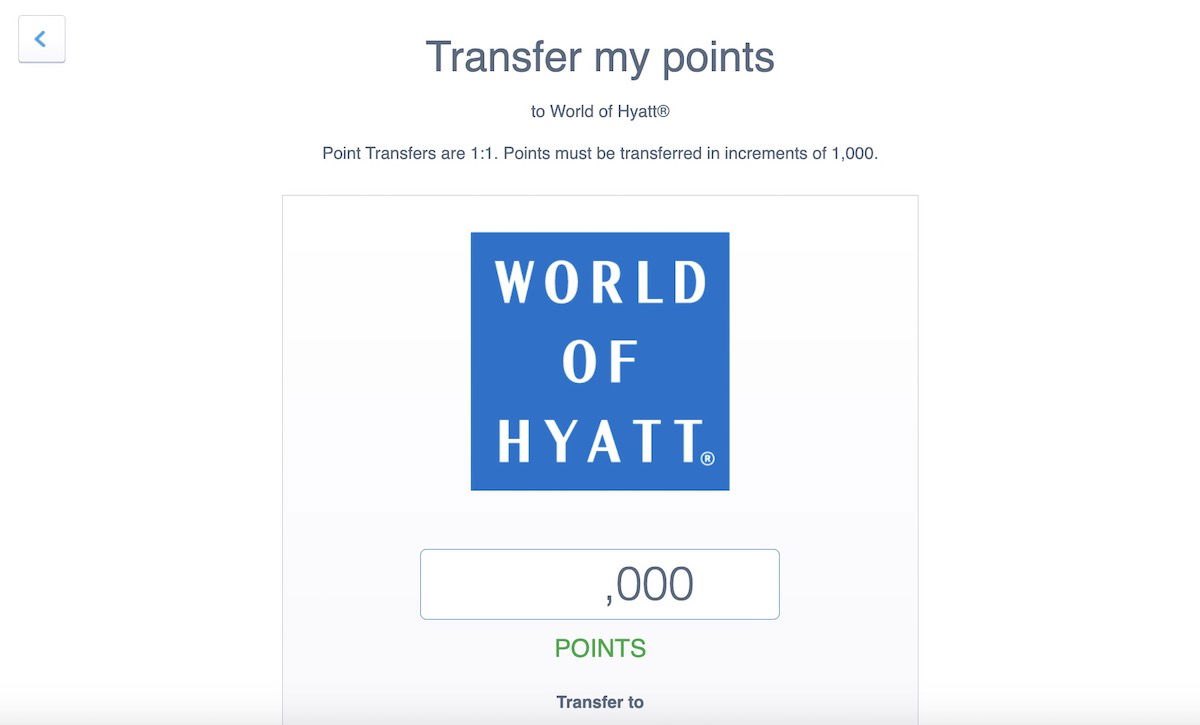

You’ll then be asked how many points you want to transfer.

You’ll then have one last page where you need to verify details, before submitting your request.

You’ll immediately receive an email stating that your points transfer is in progress, and then you’ll receive a second email once the points transfer is complete. Once you receive that second email, you can expect that the points will be in your account. Just keep in mind that you may have to log out and then log back in for your partner loyalty account.

See our guide to how long Chase Ultimate Rewards points transfers take. Transfers to all but two partners are generally instant.

How to combine Chase points between accounts

Unlike with Amex Membership Rewards, points between accounts don’t automatically pool just based on having the same online log-in. Rather you have to manually combine points between accounts.

Perhaps it’s first worth briefly talking about why combining points matters to begin with:

- There are seven cards that potentially earn Ultimate Rewards points, but you need one of three cards in order to be able to transfer these rewards to airline and hotel partners; note that while Chase Ink and Chase Freedom cards are marketed as earning cash back, in reality they earn points that can be combined with other Chase points to increase their value

- If you’re using the Chase Travel℠ Portal to redeem your points to offset the cost of a travel purchase, the value you get depends on the most premium card you have (you could get up to 1.5 cents of value per point)

- In general if you earn points across a variety of cards, it’s worth first transferring them to a single card, and then transferring them to an airline or hotel loyalty program partner, just to keep things easy, so that you don’t have to make multiple transfers to a partner program

Below is a chart showing each of the seven cards, along with the rate at which you can redeem points toward a travel purchase, and also whether or not the card independently lets you transfer points to partners.

Ink Business Cash® Credit Card

Ink Business Cash® Credit Card

Ink Business Unlimited® Credit Card

Ink Business Unlimited® Credit Card

Chase Freedom Unlimited®

Chase Freedom Unlimited®

So, how do you combine points between accounts? First you’ll want to make sure that all of your cards are listed under the same online log-in, as that makes things easiest. Once you’re logged into your Ultimate Rewards account, expand the “Earn/Use” tab and then click on “Combine Points.”

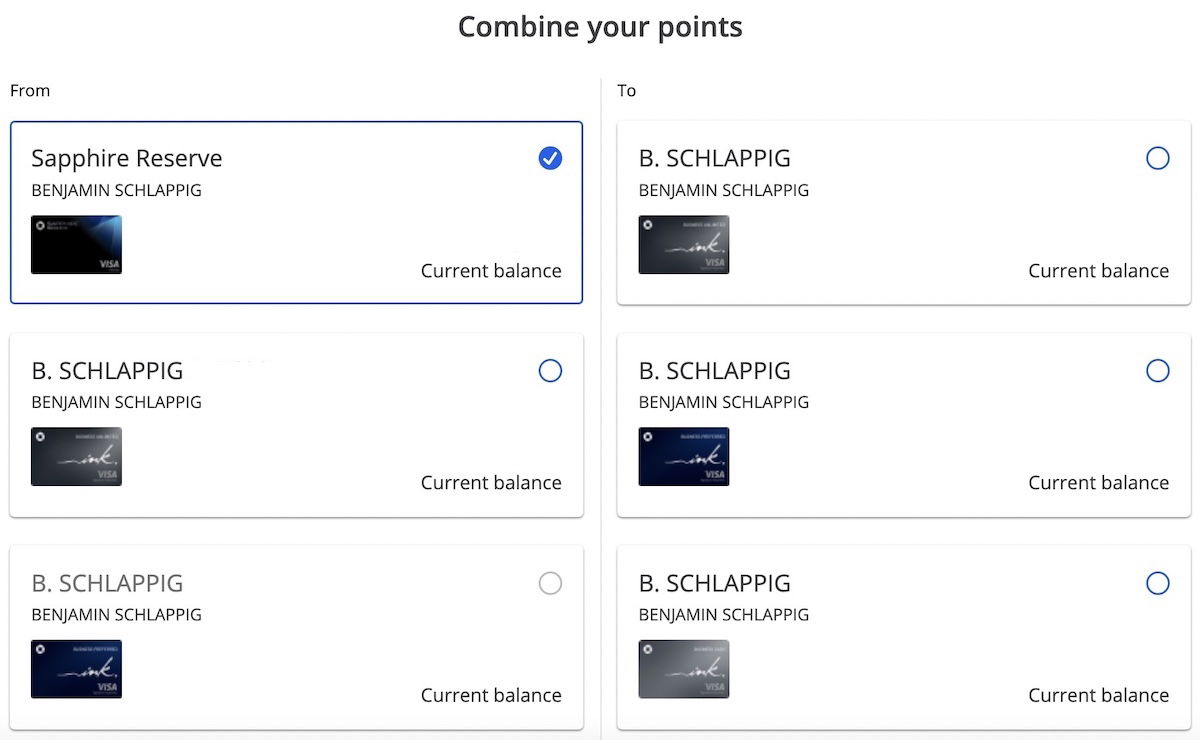

On the next page you’ll see all your accounts listed, and you can decide which accounts you want to transfer points from and to.

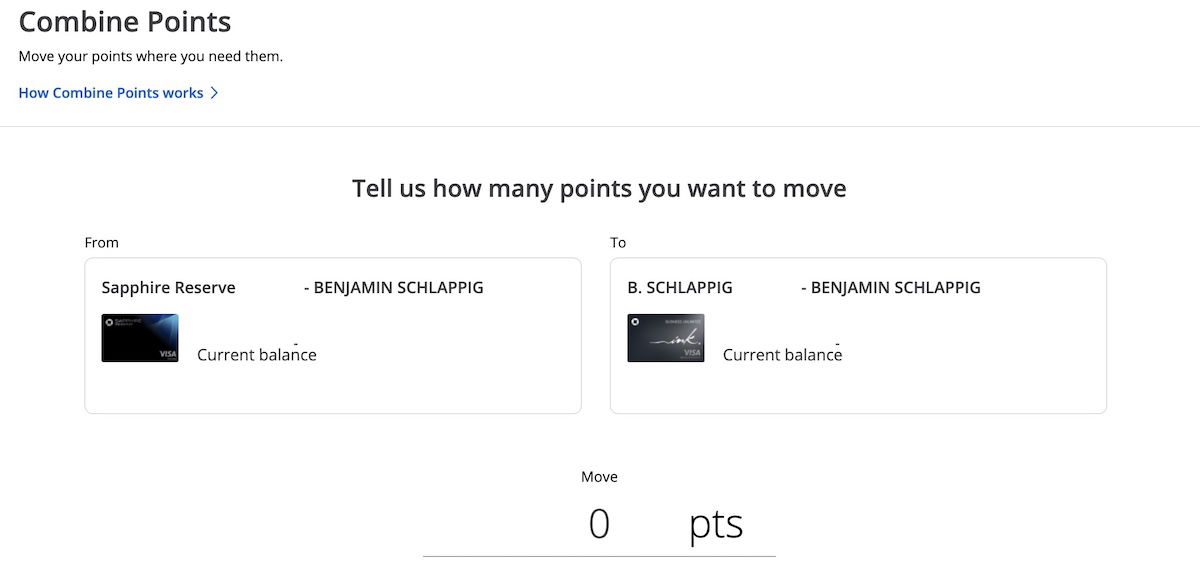

After you select accounts, you can decide how many points you want to transfer. There’s no minimum or maximum, and transfers can be done in any increments (unlike when transferring to partners, it doesn’t have to be in increments of 1,000 points).

You can transfer points back and forth between your own card accounts as often as you’d like and it’s instant, so there’s not much planning required here. You can just make a transfer when you’re ready to redeem.

How to share Chase points with others

Chase has some restrictions when it comes to sharing Ultimate Rewards points with others:

- You can move your Chase Ultimate Rewards points to the Chase Ultimate Rewards account of one member of your household

- You can move your Chase Ultimate Rewards points to the airline or hotel loyalty program of one member of your household who is also an authorized user on one of your accounts; once you designate this authorized user for points transfers, they’ll be the only person where you can transfer points to their loyalty account

It’s important to note Chase’s strong language about abusing this benefit:

If we suspect that you’ve engaged in fraudulent activity related to your credit card account or Ultimate Rewards, or that you’ve misused Ultimate Rewards in any way (for example by buying or selling points, moving or transferring points with or to an ineligible third party or account, or repeatedly opening or otherwise maintaining credit card accounts for the sole purpose of generating rewards or manufacturing spend, repeatedly opening or otherwise maintaining credit card accounts for the sole purpose of generating rewards) we may temporarily prohibit you from earning points or using points you’ve already earned. If we believe you’ve engaged in any of these acts, we’ll close your credit card account.

You’ll definitely want to play by the rules here. Absolutely designate one person in your household to transfer points to (if you’d like), but don’t try to switch the designated person around, and don’t try to game this and designate someone outside of your household.

How does this work logistically, though?

- The first time you want to transfer your Chase points to someone else’s Ultimate Rewards account, you’ll have to call Chase to have that done; subsequently it should be possible online, using the same method outlined above

- Transferring points to the airline or hotel loyalty account of an authorized user should be easy, as you should be able to enter their information directly online when trying to transfer points

Bottom line

Chase Ultimate Rewards is an incredibly valuable points currency, given the transfer partners the program has, as well as the ability to redeem rewards for up to 1.5 cents each toward the cost of a travel purchase. Hopefully the above is a useful rundown of how you can transfer, combine, and share Chase points with others.

The process of transferring points to airline and hotel partners is easy, as it is with most transferable points currencies. The same is true when combining points between Chase accounts, which can easily be done online at any point. You can also share points with one other person in your household, which can come in handy.

To Chase cardmembers, what has your experience been with transferring, combining, and sharing points?

i wonder how they determine whether a cardholder used the card for the sole purpose of generating rewards? i have read a growing # of cardholders have had their accounts closed without reason, but seems like this may be why. i use each of my chase cards for the sole purposes of generating rewards. dont we all?

I use it for 100% of my spending. Nothing else comes close. And Hyatt gets 75% of that activity.

Any reason you didn't include the Freedom Flex on the list of cards?

Also, minor note, but Chase recently updated the navigation bar at the top of the Ultimate Rewards page, so it's a bit harder to find the Combine Points and Transfer to Travel Partners than it used to be. For Combine Points, it's under the "Rewards details" dropdown. For Transfer Points to Partners it's under the "..." dropdown and then the "Travel" dropdown....

Any reason you didn't include the Freedom Flex on the list of cards?

Also, minor note, but Chase recently updated the navigation bar at the top of the Ultimate Rewards page, so it's a bit harder to find the Combine Points and Transfer to Travel Partners than it used to be. For Combine Points, it's under the "Rewards details" dropdown. For Transfer Points to Partners it's under the "..." dropdown and then the "Travel" dropdown. If you have a chance to update the screenshots that might be helpful for people who haven't used the new interface before!

One thing to remember is that some people have the legacy Chase Sapphire no-annual fee card (no longer publicly offered and you cannot redeem points with partners) which, if you also have, collects Ultimate Rewards points. By way of an example, my wife has that card and also has the Freedom card. She spends on the Freedom card and then transfers points to me so that I can redeem them with travel partners