Link: Learn more about the Chase Sapphire Reserve® Card or Sapphire Reserve for Business℠

The Chase Sapphire Reserve® Card (review) has just undergone a refresh. The card’s annual fee has increased to $795, but the card is also getting a slew of new benefits. On top of that, we’ve just seen the introduction of the Sapphire Reserve for Business℠ (review).

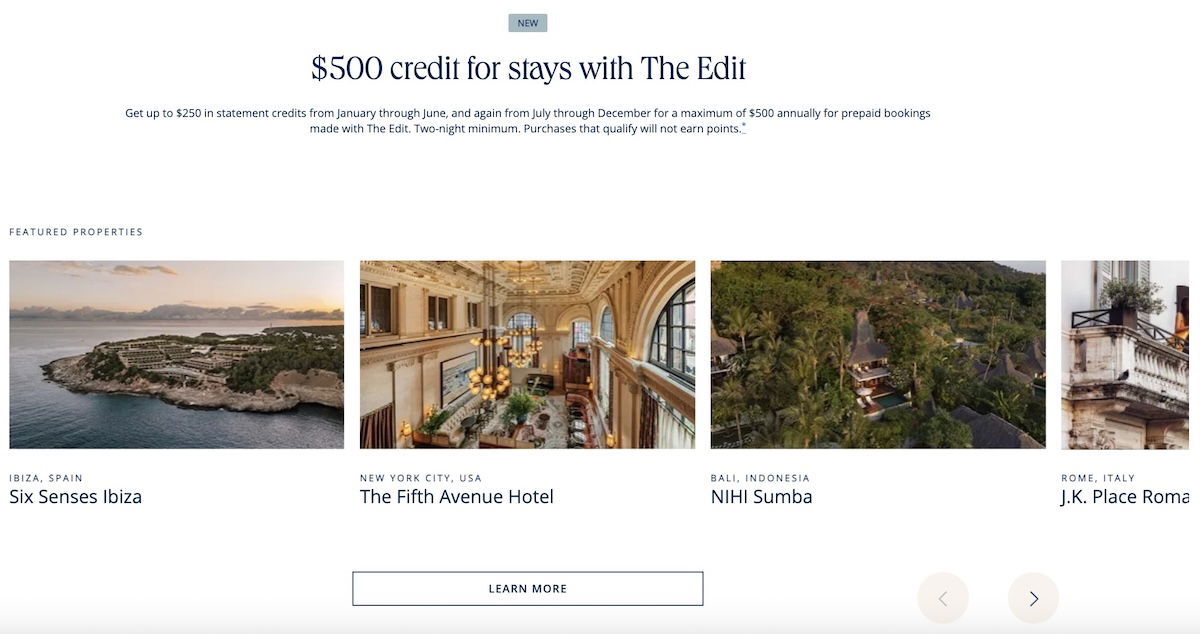

Among other things, both of these cards offer up to $500 in annual hotel credits, valid with The Edit by Chase Travel℠. In this post, I want to take a closer look at how that works, as there’s a bit of nuance to using these credits, and some hoops to jump through.

In this post:

What is the Chase Sapphire Reserve $500 hotel credit?

With its refresh, the Chase Sapphire Reserve offers up to $500 in hotel credits annually. Note that this benefit applies as of June 23, 2025, for new cardmembers, and as of October 26, 2025, for existing cardmembers. On top of that, this same benefit applies on the new Chase Sapphire Reserve Business.

So, how does this benefit work, exactly? In total, the card offers up to $500 in statement credits annually for prepaid bookings made via The Edit by Chase Travel:

- The card offers an up to $250 statement credit semi-annually, once in January through June, and once in July through December

- The credit can only be used on stays of two nights or more, when using the “Pay Now” feature

- The credit can be used by the primary cardmember or authorized users, though authorized users don’t get extra credits

- You don’t earn points for the portion of the stay covered with the credit

- It can take six to eight weeks for statement credits to appear on billing statements

What is The Edit by Chase Travel?

The Edit by Chase Travel is essentially Chase’s luxury hotel program, currently consisting of over 1,000 properties around the globe. Think of this as being Chase’s equivalent of Amex Fine Hotels + Resorts®. Why would you want to book through The Edit by Chase Travel?

For one, eligible bookings with The Edit by Chase Travel come with extra perks, including daily breakfast for two, a $100 property credit once per stay, a room upgrade subject to availability, and early check-in and late check-out subject to availability. Nowadays there are all kinds of luxury hotel programs out there, not just with credit card issuers, but also otherwise (like Virtuoso).

Generally speaking, hotel rates through The Edit by Chase Travel should be similar to the “best available” rates you’ll find directly with a hotel. To be clear, I put that in quotes because I’m talking about the flexible rate (often marketed as the “best available”), and that doesn’t include member rates, AAA rates, senior rates, etc. So in many situations, you may find cheaper rates elsewhere, but there are also valuable perks.

Note that if you’re booking a property that belongs to a major global hotel loyalty program through The Edit by Chase Travel, you’ll typically still earn points with that loyalty program.

There are a couple of other things that might make The Edit by Chase Travel interesting:

- With the Chase Sapphire Reserve changes, you can earn 8x points on eligible spending with The Edit by Chase Travel

- With the new Chase Sapphire Reserve Points Boost feature, you can redeem Ultimate Rewards points for 2.0 cents each toward hotel stays belonging to The Edit by Chase Travel

How useful is this Chase Sapphire Reserve hotel credit?

To start, I think it’s worth discussing the economics at play here. All the major credit card companies are trying to grow their volume of travel bookings, and essentially take on the traditional online travel agencies. There’s a lot of money to be made, given that these companies can get a commission on hotel bookings.

So the incentives here are clear. Chase will give a $250 credit twice per year, each valid toward a booking of at least two nights. Presumably Chase hopes this will influence behavior, and get people to book their luxury hotels this way. If you end up booking a stay that costs $500, Chase probably won’t come out ahead, while if you end up booking a stay that costs $10,000, Chase comes out way ahead. Makes sense, right?

With that in mind, is using The Edit by Chase Travel worth it, and is it worth using the $250 credit? As you’d expect, the answer is “it depends.” The pricing of the 1,000+ hotels belonging to the collection are all over the place, though generally, they’re priced at the high end of the market. That’s not to say that there aren’t deals to be had, though.

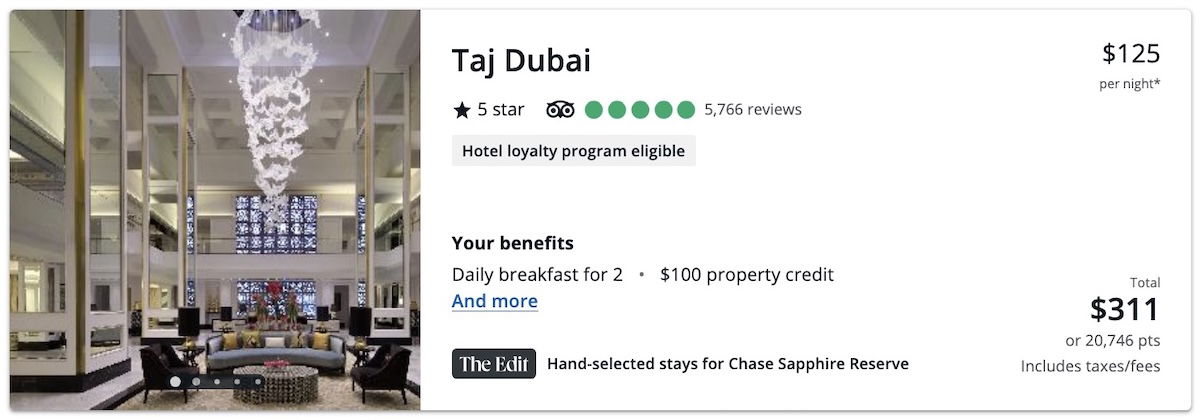

For example, want to spend two nights at the Taj Dubai in August? It’s bookable for just $125 per night plus taxes and fees, so comes out to a total of $311. You could then use the $250 credit, and end up spending just $61. Of course that’s a great deal, but that requires wanting to go to Dubai in August, and wanting to stay at this hotel.

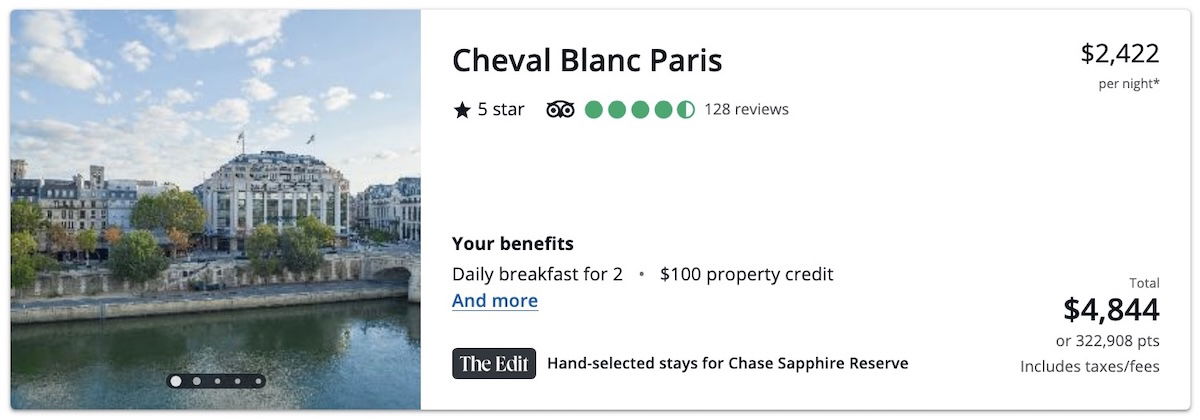

Conversely, if you were to book a two night stay at Cheval Blanc Paris, that would cost $2,422 per night, or $4,844 for two nights. So while $250 in savings is nice, we’re talking about a return of under 5%, which isn’t exactly massive. For that matter, you could get better benefits booking the same hotel through Virtuoso. In addition to The Edit by Chase Travel perks, you’d also receive roundtrip transfers to the airport, with a meet & greet service. To many people, that’s worth way more than the savings.

Personally, I’d put this benefit in the category of “worth being aware of,” though I wouldn’t really add this perk to my math on deciding whether or not this card makes sense. Instead, I view this more as a creative way for Chase to increase its market share in the luxury travel space, and this is a smart incentive for encouraging that.

Of course you should always compare rates across booking platforms, and not assume that you’re getting the best overall deal just because you’re getting a $250 statement credit.

Bottom line

The Chase Sapphire Reserve has a new $500 annual hotel credit, which is also available on the Chase Sapphire Reserve Business. This comes in the form of a semi-annual $250 credit for prepaid bookings with The Edit by Chase Travel. This perk is obviously intended to increase interest in Chase’s luxury hotel collection, which is a smart thing for Chase to incentivize.

I think this benefit is worth being aware of, though personally, I wouldn’t necessarily place a large dollar amount value on this. Overall, I’m sure The Edit by Chase Travel will be getting a lot more attention, between the 8x points on cash bookings, and the ability to redeem points for 2.0 cents each toward hotel stays.

Just keep in mind that The Edit by Chase Travel currently only has a little over 1,000 hotels, so it’s primarily going to be pricey luxury hotels (with some good deals to be had as well).

What do you make of the Sapphire Reserve $500 hotel credit?

Hey Ben,

Just an FYI that you might want to mention concerning the Edit breakfast benefit. I go to Vegas often and booked Edit properties several times throughout this year. Benefits were great such as breakfast and special amenity. Well it turns out that most properties in Vegas have already slashed the breakfast benefit. I called Chase to confirm and they indeed did, stating that the Edit benefits “MAY” include the free breakfast for two....

Hey Ben,

Just an FYI that you might want to mention concerning the Edit breakfast benefit. I go to Vegas often and booked Edit properties several times throughout this year. Benefits were great such as breakfast and special amenity. Well it turns out that most properties in Vegas have already slashed the breakfast benefit. I called Chase to confirm and they indeed did, stating that the Edit benefits “MAY” include the free breakfast for two. I’d imagine many other Edit properties already have or will soon follow suit. Just thought I’d bring this to your attention as the slashing game begins quicker then anyone anticipated with CSR card

Thank you for your well-reasoned, common sense analysis of this new feature of the Sapphire program!

If you pay points and cash do you get the 250 credit?

I came to the comments section to ask the exact same question! Hope we get an answer.

What about Cash + Points bookings for 2+ nts at The Edit hotel? so if I book 2 nights at St. Regis Bangkok paying $250 with my CSR and the rest on points, will I be eligible got the $250 credit? Or do I need to pay the entire booking in cash on the CSR?

If you book and pay for one June 28th but the stay is in August, would it count towards the $250 Jan-June credit or would it credit towards July-Dec $250 credit?

Does it have to be 2 separate reservations? Can you book June 30th - July 1st and get the full $500 credit?

I was at chase bank the other day closing my checking and savings account and overheard someone talking about the new card price and benefits. There were four other people waiting to cancel their card. I don’t get it, just close out your account and chase will be forced to be more competitive. It worked with Delta when they changed their plan and reverted back. Service is so poor these days because we the customer...

I was at chase bank the other day closing my checking and savings account and overheard someone talking about the new card price and benefits. There were four other people waiting to cancel their card. I don’t get it, just close out your account and chase will be forced to be more competitive. It worked with Delta when they changed their plan and reverted back. Service is so poor these days because we the customer allows it. I don’t blame the businesses, I blame us, the customer.

Among the major problems with this "perk" is that you must book non-refundable rates ("PayNow" means non-refundable). At least with FHR you can cancel a few days in advance of arrival in case your plans change.

There are many refundable if you pay cash but none with points and cash

Will downgrade as soon as renewal time

This benefit, just like the card is overpriced and weak sauce.

The problem with this benefit is that you need to spend 2 nights and the hotel rates tend to be higher than you can get directly. $250 per six months with two night stay and only luxury hotels are on the list. Not a good deal.

Do you need to already have the CSR to view which hotels are part of The Edit in Chase travel?

Disappointed, price is too high! Hotel credit not worth the trouble, the price of hotels on Edit are high., not booking to save $250

Disappointed, price is too high! Hotel credit not worth the trouble, the price of hotels on Edit are high.

@Ben or anyone else that may know - Can you stack a $250 Edit credit with the $300 annual travel credit? So effectively take $550 off an Edit booking all in one reservation?

Not worth the rise in card price. Very disappointing.

I’d hate it, but might have to cancel my card all together if the annual fee rises that high. I don’t use luxury hotels to stretch my vacation dollars. Not worth it.

This CSR card is really for those who spend a lot on travel and use points for things like business class flights on all these trips. No doubt about it, I had to apply some careful consideration and utilize my analytical skills to determine if I wanted to continue to keep this card with the $795 spend (Gasp!!!). Since I'm retired and able to travel a lot, I've been able to justify the spend by...

This CSR card is really for those who spend a lot on travel and use points for things like business class flights on all these trips. No doubt about it, I had to apply some careful consideration and utilize my analytical skills to determine if I wanted to continue to keep this card with the $795 spend (Gasp!!!). Since I'm retired and able to travel a lot, I've been able to justify the spend by adding the original $300 credit and $500 Edit credit to my repertoire. I've logged into the Edit site and found it has an amazing amount of hotel choices which was my original concern. I actually found the hotel I want to book in London and Singapore with a lower rate than Hotels.com with added perks of free breakfast and/or $100 hotel credit. So by the time I use both of these credits I've recouped my $795 spend AND still have Priority Plus entrance to lounges, door dash credits, the awesome insurance for canceled trips (I've had to use it and gotten 10K back on canceled trip) etc. etc. All these perks drive my willingness to even consider the new amount. The only real downside is the elimination of cruises. My plan to mitigate that is to apply for the Preferred card (which you can now do with the $795 upgrade.) Net loss to me is additional annual fee of $95 and 1 point per dollar per cruise as preferred pays 2 points per dollar spent on cruises as opposed to 3.

You sound like a paid reviewer or someone from Chase's marketing department.

It will take some careful math to see if this is worth keeping, which in and of itself is annoying. Chase is trying to slough off some card members but wants to retain the more affluent city folk with a coupon book they have to track. It seems to be flogged on the hobby pages as the most amazing upgrade, but alas those authors have an incentive to stump for signups. It's cool to make...

It will take some careful math to see if this is worth keeping, which in and of itself is annoying. Chase is trying to slough off some card members but wants to retain the more affluent city folk with a coupon book they have to track. It seems to be flogged on the hobby pages as the most amazing upgrade, but alas those authors have an incentive to stump for signups. It's cool to make a living as a travel/points blogger but that lifestyle is not reflective of the masses with regular jobs/families/schedules who are probably not hanging at Edit properties and noshing at the Chase exclusive tables...I have a few months before my AF and can decide if my relationship with Chase becomes more casual..

Chase decided to lost existing Reserve customers

It will take some careful math to see if this is worth keeping, which in and of itself is annoying. Chase is trying to slough off some card members but wants to retain the more affluent city folk with a coupon book they have to track. It seems to be flogged on the hobby pages as the most amazing upgrade, but alas those authors have an incentive to stump for signups. It's cool to make...

It will take some careful math to see if this is worth keeping, which in and of itself is annoying. Chase is trying to slough off some card members but wants to retain the more affluent city folk with a coupon book they have to track. It seems to be flogged on the hobby pages as the most amazing upgrade, but alas those authors have an incentive to stump for signups. It's cool to make a living as a travel/points blogger but that lifestyle is not reflective of the masses with regular jobs/families/schedules who are probably not hanging at Edit properties and noshing at the Chase exclusive tables...I have a few months before my AF and can decide if my relationship with Chase becomes more casual..

I value this benefit at 0.

Even at high end hotels, you can usually find much better pricing on priceline

Make it complicated and low value call it a benefit

Then raise the annual fee through the roof

Sure ok

Hard pass

Have spent some time seeing if would use this perk on various dates through end of year in NY, Miami, London and Rome. Couldn't find a single instance where would actually book with Edit. Obviously, this is not a comprehensive analysis of this perk, but at this time I would attribute no value in terms of justifying the card - if you can make it work, then congrats on a win.

How would you get loyalty points and benefits, especially on a prepaid booking, as this is a third-party booking? Assuming no elite benefits, this is generally a non-starter for me, especially on a two night stay.

So what's the best way to compare all the available portals?

Frequent Miler has articles on good hotel tools.

Is the accrual rate of UR for bookings through The Edit the same as bookings through Chase Travel in general? I seem to remember it being lower which was a deal breaker for me in the past. Also, do you earn those points on the non credit component of the booking or is the whole booking ineligible for points if you receive the credit?

Everytime goes to 8x. New cardholders on now. Existing cardholders in late October.

Im staying at 5 different hotels this summer and compared the pricing on Expedia being a gold member, to the Chase Travel portal pricing. 4k worth of hotels cost around $600 more if I were to book through the Chase Portal instead. It appears that the 8x point bonus you get booking through the Chase Portal is why this package costs $600 more.

Chase has priced it in a way that your essentially buying...

Im staying at 5 different hotels this summer and compared the pricing on Expedia being a gold member, to the Chase Travel portal pricing. 4k worth of hotels cost around $600 more if I were to book through the Chase Portal instead. It appears that the 8x point bonus you get booking through the Chase Portal is why this package costs $600 more.

Chase has priced it in a way that your essentially buying UR points. I've only looked at a few comparisons through Edit but it appears to be the same type of pricing model as well. In any event, Chase has definitely tightened the loop on outsized travel deals with this new card refresh. A $500 annual Edit credit is really just going to be a discount to the premium they charge booking on the portal.

More like The Delete, amirite?

Are points + cash bookings eligible?

I believe Greg at FM said the credit can be used with a redemption booking. You might want to check the comments section on the FM article.

Does the credit apply only on non-refundable rates or just prepaid? I’ve purchased hotels through the chase portal and had to pay immediately, but could get a refund up to a few days before arrival. Does the credit apply to those purchases?

It applies to refundable prepaid bookings as well. Recommendation: never do a non-refundable booking. Good luck

Agreed, I don’t do nonrefundable bookings. Thanks!

Went to the Chase Travel portal to see what's available for the 2+ day stays in Kyoto and Istanbul. Both cities appear to have just one Edit hotel each that is not in the $1500+/night range: ACE in Kyoto, Bank Hotel (Marriott) in Istanbul. ACE may be a viable option for a 2-3 day stay if you are looking for an upscale international style hotel in Kyoto. In Istanbul, you can still get a much better deal booking a member rate at the Grand Hyatt.

It will always be a booking by booking thing. Sometimes a direct Hyatt booking will absolutely be the better route. Other times FHR. Other times the Edit. And, Nick over at FM has found that certain offer stacks using OTAs are better. Also, you might be surprised, see if a non-US hotel has a AAA rate.

There are too many reports of problems with Chase and other such travel portals for me to be comfortable with them. For luxury hotels, Virtuoso TAs or the like provide better perks than Chase, FHR, etc. offer and are more likely to be able to fix problems.

I'd rather get 5% back with the WF Autograph Journey and book through my TA than deal with Chase for hotels.

Ah, but Richard_, this is OMAAT. The Autograph Journey does not exist. Only cards that offer sign up link commissions exist.

(sarcasm aside, you're 100% correct, and that is also why I was so annoyed the other day when Ben referred to the new Sapphire hotel benefits as industry leading lol)

No thanks

what a waste, hard pass

This is basically useless.

For you.

Why are you personally offended and commenting towards people who don't like this card or perk. Get the card if you love it lol. Yes for me it is useless. I will stick with my Venture X.

I'm not personally offended. Comments have been unqualified. That is, not stating "for me." Which gives unseasoned readers the impression that the benefit is not good for anyone. In either case, the hobby doesn't want to hear that yet another person can't use the benefit. The hobby does want to hear "this is how I got this benefit to work." That's how we move the ball forward for everyone. Improvise, adapt, and overcome.

The two-night minimum sucks. At least with the Amex FHR credit I can do it on a one-night stay and get basically 50% off a $400 rate

So, you're saying that in a six-month period, you're only going to do one-night stays . . . that you'll never do a single two-night stay . . . and, thus, you can never use the credit. Sounds like your amount/type of travel is not a fit for this card. Sounds like Amex is a better fit.

I do plenty of two night stays but how often does one need a two night stay at a luxury hotel that happens to be part of a certain group of curated properties? And doesn’t want to redeem points?

Also, it shouldn’t take a genius to see that $200 off $400 is a better value than $250 off $800.

@Fred, I think you misunderstand James's point. With these benefits, it's often best (financially speaking) to just do one night stays, because the added benefit for each additional night (say, a free breakfast or $40 food credit) is marginal compared with the *overall stay benefit*.

Heck, there are many times when I'll intentionally book night #1 via Amex FHR, then use the hotel's own website to book the remaining nights (at an often-better rate, using...

@Fred, I think you misunderstand James's point. With these benefits, it's often best (financially speaking) to just do one night stays, because the added benefit for each additional night (say, a free breakfast or $40 food credit) is marginal compared with the *overall stay benefit*.

Heck, there are many times when I'll intentionally book night #1 via Amex FHR, then use the hotel's own website to book the remaining nights (at an often-better rate, using WF Autograph to get 5x points).... then merge reservations at the front desk.

And by "merge reservations" I'm simply talking keeping the same room, nothing fancy on the back-end.

There seems to be an assumption that the Edit always has a higher price. The Edit has LOWER prices on a couple of hotels I use. When that happens, I'll use the Edit. When it doesn't, I won't. I'm not certain what the problem is. So many of the comments about the CSR seem to be coming those who have been cheated out of their zero-net-cost lounge access card.

Well I'm pretty sure you're a stealth marketer for Chase or just wish you were, considering you have argued every single person who criticized your beloved card

Is the Edit Collection the same as the "Renowned Hotels and Resorts" offered through Chase's United Club Card?

@ Phil -- It's branded differently, but I think it's more or less the same.

Guarantee this credit will be nearly impossible to use unless you're using it to save $250 on your $2,000+ stay.

The Edit is a luxury hotel platform. So, yeah. And, the problem is?

There are opportunities to get $250 of an $800 or $1,000 stay, but the bigger news, I think, is that you can get 2 CPP or a little better on hotels other than Hyatt-- so, Hyatt-like value across other chains and independents (assuming they're in Chase's relatively small portfolio).

This ☝!

Worthless

For you.

Ben, are you aware of any up-to-date list of The Edit properties? If not, such a post might be highly appreciated.

@ Jim F. -- I don't see a publicly available list, as you have to log-in to see eligible properties. I would publish a post with a list, but the catch is that I imagine it will be updated constantly, so it will be hard to keep active.

While they're not identical, there's definitely a lot of overlap with Virtuoso properties, which you can look up at this link:

https://www.virtuoso.com/travel/luxury-hotels

@Ben do we know if the credit is applied to at time of booking time of stay, say we book the hotel in June and stay in July does the credtit count for the first half or the second half

@ Steve V -- Great question, let me ask a contact. My reading of the terms is that it's based on when you pay rather than when you stay, given that it's pre-paid. But I'll report back when I have an official answer.

For existing cardmembers, if I pay for now for a stay in November, will I get the $250 credit? Have a planned stay in November and rate through Chase Edit is the same as direct through Marriott because I have no status.

When it posts as opposed to when you pay is what we read

Ever get an answer?

Bookings are prepaid. It would seem logical that it would be at the time of booking.