There are many benefits to making purchases with credit cards, ranging from the ability to earn rewards, to purchase protection. For those of us who are frequent travelers, having a credit card that offers travel coverage is essential.

Earlier this year I had a trip where I misconnected, forcing an overnight layover. Fortunately I paid with American Express Platinum Card® (review), which offers a fantastic trip delay insurance benefit. While I found the whole claims process to be a bit time consuming and cumbersome, it worked out in the end, and that’s what counts.

In this post I figured I’d outline my experience, because I know many people will likely go through the same process.

In this post:

Basics of Amex Platinum trip delay insurance

While the Amex Platinum offers a variety of coverage benefits, I’ll be focusing specifically on the trip delay insurance coverage, since that’s what I used, and where I can share my firsthand experience. While you’ll want to consult the Guide to Benefits to read all the fine print, let’s talk about the basics of the coverage.

With Amex Platinum trip delay insurance coverage, you can be reimbursed up to $500 per covered trip for necessary expenses when your trip is delayed for more than six hours. You can claim this benefit up to two times per eligible card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

Here are what I consider to be the most important terms to be aware of:

- You must have proof of roundtrip travel, which means you have to return to your starting point within 365 days; multi-city itineraries are fine, as are trips booked as two one-ways, as long as you can prove this

- This coverage applies for you and your family members and travel companions when the trip is purchased with your eligible card

- You need to pay for the airline ticket with your card, though it’s fine if only a portion of it is paid this way; in other words, if you redeem miles for a ticket, paying the taxes with your eligible card would be sufficient

- To be eligible for this coverage, you must be delayed by at least six hours; this doesn’t mean a single flight has to be delayed by that long, but rather if you misconnect and will end up at your destination six or more hours later, you’d be eligible

- It doesn’t matter if the delay is within the carrier’s control or not; eligible reasons include everything from bad weather, to aircraft mechanical issues

- The coverage applies for reasonable expenses, including meals, lodging, toiletries, medication, and other personal use items; as you can tell, this is pretty vague

- You can use this benefit up to twice per consecutive 12-month period

Let me emphasize that I’m just trying to hit on the key points here. You’ll want to read the full Guide to Benefits for all the details, because there’s obviously a lot of fine print (as there is with any insurance policy).

My American Airlines trip that got disrupted

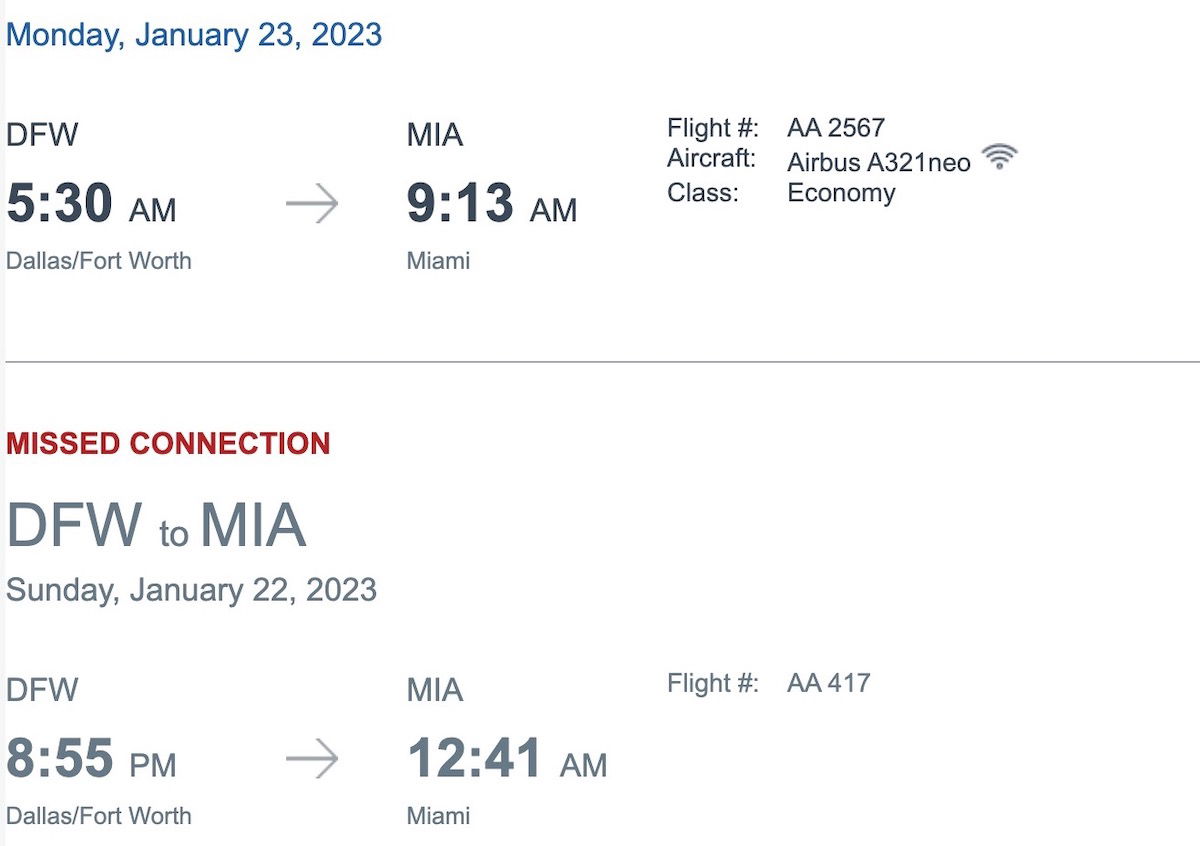

This claim actually dates all the way back to an itinerary I had on January 22, from Puerto Vallarta to Dallas to Miami. I was supposed to have a roughly two hour connection in Dallas, but due to a maintenance issue in Puerto Vallarta, the flight was delayed, and I ended up misconnecting.

The Dallas to Miami flight that I was booked on was the last flight of the evening, so I was rebooked on a 5:30AM flight the following morning.

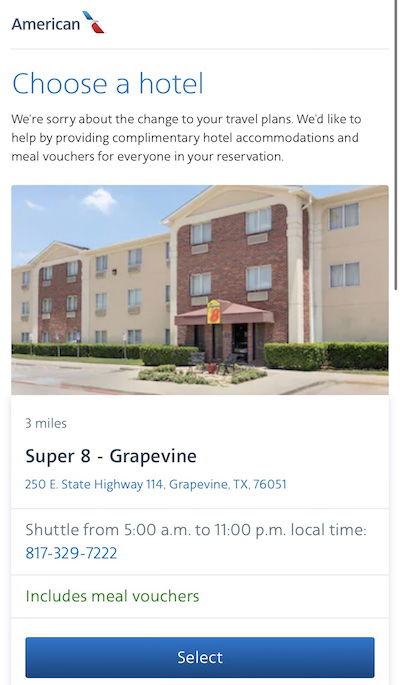

Now, since this delay was within American’s control, I was offered a hotel accommodation… at the Super 8 Grapevine. It’s pretty disappointing what American offers an Executive Platinum member traveling in paid first class, especially when you consider that some decent hotels near the airport weren’t unreasonably priced.

DFW happens to have one of my favorite airport hotels in the world, the Grand Hyatt DFW, which is connected to the terminal. I had pondered just redeeming points there, because it’s so much more convenient. I then wouldn’t have had to wait for a shuttle or use a rideshare to & from the hotel, not to mention I’d have a much more comfortable stay.

But I didn’t even need to do that. The beauty of credit card insurance is that I was covered in this case. There’s nothing in the terms stating that you have to accept the hotel an airline offers you, but rather you just can’t double dip, and request reimbursement from multiple sources.

So I booked the Grand Hyatt DFW (which was running around $300), and then ordered room service as well (which cost around $100), knowing that would be covered (for the record, Ford was with me, so the food wasn’t all for me). 😉

My Amex trip delay coverage claim experience

The process of being reimbursed as part of this coverage consists of three steps, all of which are handled by AIG, Amex’s benefits administrator:

- First you have to call to file a claim

- Then you have to submit the documents for your case

- Then you have to wait for reimbursement

Let me share my experience with each of these steps.

Filing a trip delay coverage claim

To kick off this process, you first need to file a claim within 60 days of your disruption. This has to be done by phone, by calling 844.933.0648. The phone call took around 15 minutes, and I was asked to provide some basic details about my trip, as well as the interruption I experienced, including how, why, and when I misconnected.

This is just intended to establish the basic details of the claim, and then you’ll be sent an email with a case number, and all the documents you have to complete.

Submitting trip delay coverage documents

Okay, to be honest, they don’t make it easy to file all the required documents, but then again, which insurance policy does? I’d say the process of gathering documents, filling out all the paperwork, and submitting them, took me around an hour, and I’m usually pretty fast.

What all is required?

- Filing out a claim form, which asks for your personal details, as well as the details of the itinerary

- Proof of the original flight itinerary, showing your roundtrip journey (if you have two one-ways, you’d want to submit both itineraries)

- Proof of payment of your itinerary, in the form of a credit card statement showing that the trip was charged to your eligible card

- Proof of your revised itinerary resulting from irregular operations; fortunately American sent me an updated itinerary when I was rebooked, so that was easy enough

- Proof of the reason for your claim, and if it’s due to an equipment failure, you need documentation from the airline about this; this was easy to do, as I could go to American’s customer relations form, click on the “trip insurance verification” tab, and then a day later I got an email from American customer relations outlining the reason for the delay

- Proof of the expenses incurred that you want reimbursed; this includes receipts for the purchases, as well as the billing statement showing proof of the card this was charged to

I was a little worried about that last point, as the form stated that I had to show “additional expenses purchased on your Eligible American Express Card,” though I used another card. Fortunately IAG confirmed that this was okay, and I just needed to submit proof of that billing statement.

Gathering all these documents and filling out these forms took a bit of time. On top of that, AIG has a 14MB limit on how big emails can be, so you may have to resize some files, or send multiple emails.

Waiting patiently for reimbursement

I found it odd that when I submitted my email, there wasn’t any sort of an automated email response confirming that my documents had been received. I only mention that because I was pretty close to the 14MB email limit, so I wanted to make sure I didn’t do anything incorrectly.

I also sent an email to confirm my initial had been received, but never received a response. However, when I called a couple of weeks later (and waited on hold for 20 minutes), an agent confirmed that my documents had been submitted, and were being reviewed.

In the end it took around six weeks for my claim to be approved, and then the check arrived around a week after that.

Bottom line

The Amex Platinum Card offers valuable trip delay insurance, whereby you can be covered for up to $500 in necessary expenses when your trip is delayed by at least six hours. When I misconnected at DFW earlier this year, it seemed like the perfect opportunity to give this coverage a try.

I’m happy to report that it worked exactly as planned, and I was reimbursed the full cost for my hotel room and dining at the hotel.

I’d say there are two major things to be aware of. First of all, the process of filing a claim is fairly time consuming, so expect that altogether you’ll likely spend a couple of hours on this. Furthermore, don’t expect the claim to be processed quickly, as it will likely take several weeks.

If you’ve used Amex’s trip delay insurance benefit, what was your experience like?

Hey thanks for this, a week later I had a huge delay and used this benefit and got a check for $700 in the mail. You know it was slightly clunky but they worked with me in a fair way I felt, I was able to go back and forth on email and figure out the proper amount.

AIG has one of the worst customer satisfaction rates of any insurance company. Shame on Amex for forcing their cardholders to endure those headaches. I cancelled my Amex Platinum as a result of their cutting the lounge guest benefit but I would have canceled had Amex required a round trip purchase to file a claim.

Tragically Capital One is just as bad and Chase is much worse. Fortunately, they arent the only card issuers offering...

AIG has one of the worst customer satisfaction rates of any insurance company. Shame on Amex for forcing their cardholders to endure those headaches. I cancelled my Amex Platinum as a result of their cutting the lounge guest benefit but I would have canceled had Amex required a round trip purchase to file a claim.

Tragically Capital One is just as bad and Chase is much worse. Fortunately, they arent the only card issuers offering travel protection. I have never had any trouble from the US Bank Altitude Reserve.

Round trip travel only nixes the idea of me ever using the Amex card to purchase airline tickets.

I had a flight diverted from Cincinnati to Houston and missed my connection. It was simple to submit a claim to Chase for the hotel and dinner. Apart from waiting for United to send me a statement, the process was simple.

Years ago I had a bad accident in Nicaragua where I totaled a rental...

Round trip travel only nixes the idea of me ever using the Amex card to purchase airline tickets.

I had a flight diverted from Cincinnati to Houston and missed my connection. It was simple to submit a claim to Chase for the hotel and dinner. Apart from waiting for United to send me a statement, the process was simple.

Years ago I had a bad accident in Nicaragua where I totaled a rental car. Chase paid the value of the car; it took awhile because they kept asking for an estimate as to the junk value of the vehicle but eventually I was able to settle the claim.

Last year I also filed a claim for the cost to repair a flat tire; that too was a paid.

Overall my experience with Chase has been good; I will not say excellent because they often ask for too much documentation.

My only experience of using trip interruption insurance was several years ago when my family & I were stranded at a foreign airport for 3 days due to weather. Knowing I had insurance through the Chase Sapphire Reserve put my mind at ease. I simply called the closest airport hotel, got two hotel SUVs with drivers and porters to transport our considerable luggage, got nice (but not extravagant) meals and CSR reimbursed everything including tips....

My only experience of using trip interruption insurance was several years ago when my family & I were stranded at a foreign airport for 3 days due to weather. Knowing I had insurance through the Chase Sapphire Reserve put my mind at ease. I simply called the closest airport hotel, got two hotel SUVs with drivers and porters to transport our considerable luggage, got nice (but not extravagant) meals and CSR reimbursed everything including tips. It was so nice not having to wait in long lines at the airport for accommodation through the airline.

Ben, it would be super helpful if you could do a trip insurance article detailing the differences between coverages of Chase, Amex, Cap One etc. I usually book one ways - 330 days / 366 days out and I want to be the first to snag a space when it opens up - so can't wait for the return leg to be available before booking an RT especially if the trip is say 2 months long during the summer. Which card(s) would you recommend for one way points-booked trip insurance?

Ben, not sure if you have ever used CSR trip delay insurance, but it is much superior. Almost all done online, no waiting on hold and prompt response in my experience. Additionally it is a more generous amount.

Even more valuable than the article (not that it isn’t) are the comments from real readers who filed claims with Amex and Chase.

Their terms and conditions vary and there seems to be a portion of luck how strictly the claims agent interprets the rules (such as payment with miles being permitted or prove use of Amex converted points, to the required documentation).

Flies first class on short haul flights, A 3 hour flight, despite not being overweight or very tall and would easily fit in economy.

Is too "high status" to be seen staying at a super 8 for free.

Spoiled much?

I hope you teach your child some humility.

@ staradmiral -- Thanks for your analysis, but I see things a bit differently.

First of all, first class for the entire journey from PVR to MIA cost an extra $200 over economy. I work nonstop when I fly, from the moment I board until the moment I land. I'm sure you can appreciate that one can reasonably comfortably work in a first class seat, while it can be harder to work in an...

@ staradmiral -- Thanks for your analysis, but I see things a bit differently.

First of all, first class for the entire journey from PVR to MIA cost an extra $200 over economy. I work nonstop when I fly, from the moment I board until the moment I land. I'm sure you can appreciate that one can reasonably comfortably work in a first class seat, while it can be harder to work in an economy seat. There's not room to put your arms in a comfortable position when typing, etc. I respect if you don't think it's worth it, but I do think it's worth it.

Second, even if I had accepted the Super 8, I would have still had to submit documents to request reimbursement for my rideshare to the airport, and for any meals I had. So while I'm at it, why wouldn't I just stay at the hotel I actually wanted to stay at?

This confirms my experience. Since your business is selling credit cards, I applaud you for showing how convoluted a process this is. How many hours did this take you, how many weeks did you wait, and this is with an airline that actually makes it convenient to request a flight delay insurance statement! Just for the record, filing an rx claim took me about 5 minutes, car accident claim took me about 30 minutes, and...

This confirms my experience. Since your business is selling credit cards, I applaud you for showing how convoluted a process this is. How many hours did this take you, how many weeks did you wait, and this is with an airline that actually makes it convenient to request a flight delay insurance statement! Just for the record, filing an rx claim took me about 5 minutes, car accident claim took me about 30 minutes, and eye glasses took maybe 10 minutes because I forgot my password. Real insurance companies don't make it deliberately difficult to file a claim.

PS you guys really need some sort of EU261 equivalent! If you have the same issue when covered by that then you just book your own accommodation and claim it back from the airline, no insurer required.

Sounds quite an antiquated process! Amex UK insurance is via AXA and in fairness the claim process is all online and (in my experience claiming) pretty painless. Certainly a much quicker payout too.

Interesting they agreed to pay for the hotel without asking for some sort of attestation that accommodation was not provided by airline.

I wonder if it was an option to book a walk-up fare on some other airline and claim that?

From experience they do ask if you were offered and accepted accommodations, hence no double dipping. But if you decline, they will pay you

Mine did not work, even when AA sent me an email confirming it was a mechanical issue on my flight from AUS-PHX.

I sent them all of the documentation required and they still denied me.

We booked the JW Marriott in Austin for around 200, paid around 60 for a road-trip Uber, and only spent about 80 on food for our overnight delay.

To clarify, was this experience using the American Express insurance or was it another card issuer ?

I have only filed a rental car damage claim and that was with Chase. Creates claim through their website and uploaded documents on Monday. Got an email saying claim approved on Wednesday. Money deposited to my checking account on Wednesday. The best part? Earning 3 points on the $8,000 damage charged to my card by Avis and getting to keep the points because I was refunded to my checking account.

I carried the Chase Sapphire Reserve for many years because reviews claimed the travel insurance was so good. I have never seen Chase approve a legitimate claim

Chase Sapphire Reserve insurance covered a stolen rental car in SF, overnight expenses due to a TAP airline missed Lisbon connection, and a rental car side-scrape (this was my fault), over a three-year period. I am a huge CSR fan as a result. AMeX Platinum insurance refused my one missed connection claim.

Whoa....I carry both cards and Chase insurance is much superior to Amex. I have filed probably 10 claims with them and only had an issue once. Most of my claims are for trip delay insurance and they have literally never given me any pushback. The one they didn't pay was for bag delay insurance...they have a very limited amount of "essential" items they will pay for.

I seem to recall reading on the Amex site that the flight must originate in the US. Could be mistaken, however.

I used AmEx platinum insurance when my flight from Lisbon to the U.S. was canceled due to weather. Had to stay an extra day and AmEx covered the hotel, food, and cab fares

Two questions:

1. Did you book the Hyatt with points, as you mentioned you considered? If so, were you reimbursed for the hotel room and on what basis?

2. Is the Amex platinum business having the same coverage?

@ DCBanker -- No, I paid cash, since I knew I could get that reimbursed. Yes, the Amex Business Platinum also offers coverage, and you can find the Guide to Benefits for that here:

https://www.americanexpress.com/content/dam/amex/us/credit-cards/features-benefits/policies/pdf/Trip_Delay-Insurance-500_6hours.pdf

Ben, please clarify whether it’s good on award tickets.

I thought it was limited to the amount spent in the card (I.e taxes and fees on an award). Another poster said no coverage. Your readers use mileage awards a lot.

@ Beachfan -- It's my understanding that it is good on award tickets, and that taxes should be sufficient. Here's the relevant part from the Guide to Benefits:

"You must charge the full amount of a Covered Trip to your Eligible Card or in combination with your Eligible Card and accumulated points on your Eligible Card or redeemable certificates, vouchers, coupons, or discounts awarded from a frequent flyer program or similar program."

Last year my claim was denied. Delta's letter said "Reason for Flight Irregularity: Flight cancelled due to crew". Amex said this was not a covered event.

@ Sportsguy -- That is... really weird. I see that covered reasons include inclement weather, terrorist action, equipment failure, and lost or stolen travel documents. It's interesting that crew doesn't qualify. I guess Amex just assumes that's the carrier's responsibility to cover? Very strange, given that maintenance is included (which should also be the carrier's problem).

I had the same issue. My flight was canceled due to a sick flight attendant at an outstation and my claim was also denied.

I had a similarly frustrating experience. I had a Jetblue flight cancelled last year and the stated reason from Jetblue was "maintenance." Amex/AIG denied the claim because "maintenance" did not mean the same thing as "equipment failure;" as if Jetblue would have chosen to voluntarily cancel a flight to do some routine tune-ups to the plane.

Fighting with AIG is on my to-do list, but I haven't quite gotten there yet, which has to be part of their strategy!

Most of my travel (I"m part of the laptop class) is personal. Maybe 2x a year I get stuck somewhere due to weather. This seems like a total hassle to go through. I typically get on PriceLine, get a great deal at an airport hotel (I will never do under 3 stars and rating under 7) usually with an airport shuttle and just eat the cost. If I'm at an airport with an AA Admirals Club (often the case) I just eat there.

If an hour or two of work is not worth $500 to you, that’s your decision. For me, being able to book a nice hotel and a nice meal while I’m delayed is worth the effort.

The Grand Hyatt DFW plus room service, courtesy of Amex: well played, very well played! It looks like there is a Hyatt Regency there too, have you stayed in that one?

@ Regis -- I have. The Hyatt Regency is totally fine, but you can't beat the convenience of the Grand Hyatt, and I also find the service at the hotel to be excellent.

LOL at the hotel that AA offered you. When AA diverted me to OKC a year or so ago, AA offered me a choice of 3 hotels. I selected Home2 Suites through the link provided by AA. When I got to the hotel, they refused to accept the voucher and made me pay for the room myself, stating that they don’t work with AA. Funny, because that’s one of the three hotels that AA offered...

LOL at the hotel that AA offered you. When AA diverted me to OKC a year or so ago, AA offered me a choice of 3 hotels. I selected Home2 Suites through the link provided by AA. When I got to the hotel, they refused to accept the voucher and made me pay for the room myself, stating that they don’t work with AA. Funny, because that’s one of the three hotels that AA offered and I booked through the AA voucher “system”. Never even thought to make a claim with Amex, I do book all my flights with my plat.

No coverage if used miles to book, doesn't matter if taxes are paid on the card or not. Exception is only if you prove that ticket was booked directly with miles earned with the card - which is impossible to prove if any mileage transfers are involved.

"You must charge the full amount of a Covered Trip to your Eligible Card or in combination with your Eligible Card and accumulated points on your Eligible Card or redeemable certificates, vouchers, coupons, or discounts awarded from a frequent flyer program or similar program."

This is from the term and conditions. It is not precisely clear whether frequent flyer "points" would be covered.

@ echino -- That's not my understanding. I'm curious, were you denied for that reason, or do you just have a different read on the T&Cs than I do?

Not true of my trip last year booked with Skymiles on Delta metal. Award roundtrip ticket with taxes and fees paid on Amex Platinum. Trip delayed multiple days due to the hurricane that hit Florida. Received the $500 max payout (submitted over $500 in expenses, just in case they’d payout more).

In my case facing a similar delay as yours at DFW I opted to Priceline a hotel and endured the inconvenience of waiting to take a crowded shuttle bus there and back as I was unsure if the Grand Hyatt would be considered "reasonable" at four times the price as what a decently rated 3 star hotel on Priceline provides for 10 hours. But apparently AMEX does consider this "reasonable". Not sure I can justify...

In my case facing a similar delay as yours at DFW I opted to Priceline a hotel and endured the inconvenience of waiting to take a crowded shuttle bus there and back as I was unsure if the Grand Hyatt would be considered "reasonable" at four times the price as what a decently rated 3 star hotel on Priceline provides for 10 hours. But apparently AMEX does consider this "reasonable". Not sure I can justify that in my mind however. AMEX did reimburse in a similar time frame but for a fraction of the amount. I found the process pretty quick and estimate that total time spent was 30-45 minutes.

I think the RT travel as well as the fact that travel has to be booked before departure needs to be emphasized more clearly here. I booked a return flight while traveling when LH space opened last minute. Subsequently denied because my trip was in flux.

Agree with the poster here. The full round trip travel must be purchased with the Card for claim to be accepted. It can be different tickets on different airlines, but a one way trip or an outbound trip with inbound on another card will not be accepted. Eric

I've found the AIG team that Amex works with to be unprofessional (takes weeks to respond to your point) and unhelpful. Always a pain to get this reimbursed to the point where I don't care anymore.

I've been hesitant to book with AMEX due to the "round trip" requirement. Using the Chase Sapphire and Chase Ink Preferred (Eclaimsline) has been relatively easy and quick.

Just 2 weeks ago, I had an award flight (I paid $5.60 plus points) cancel on a Friday, causing an overnight stay. I submitted the required information on Saturday morning and received confirmation of reimbursement on Thursday. The money hit my bank account on Friday via...

I've been hesitant to book with AMEX due to the "round trip" requirement. Using the Chase Sapphire and Chase Ink Preferred (Eclaimsline) has been relatively easy and quick.

Just 2 weeks ago, I had an award flight (I paid $5.60 plus points) cancel on a Friday, causing an overnight stay. I submitted the required information on Saturday morning and received confirmation of reimbursement on Thursday. The money hit my bank account on Friday via direct deposit.

Eclaimsline has been more picky when submitting a claim with foreign currency - they usually want the card statement showing the currency conversion. They have also been picky when it comes to the common carrier statement for the reason for the delay/cancellation. This past trip, I just screenshot the cancelation and had no problems. In the past, I've had to reach out to customer service like Ben did for his trip.

@Ben - Does the business platinum have the same insurance?

Experience exactly the same. Even stayed at the same hotel!

Cell phone screen insurance only required a single form and was approved very quickly.

Based on a friend's experience who was denied compensation, I want to point out that you have to book your entire trip before you depart. Some people book (or voluntarily cancel and rebook) their return ticket after their outbound trip has started. (e.g. waiting for an award space to open up) This will not be considered as a valid round-trip itinerary.

It's interesting to see how Amex USA and their underwriters handle this. In the UK Amex insurance is through AXA so obviously things are going to be slightly different but seem to be significantly better. We've had several claims. It's 100% online through the AXA Amex portal, and takes maybe 2-4 weeks to get paid directly into your bank.

Last year for a lost (then stolen) phone they even paid (slightly) more than we...

It's interesting to see how Amex USA and their underwriters handle this. In the UK Amex insurance is through AXA so obviously things are going to be slightly different but seem to be significantly better. We've had several claims. It's 100% online through the AXA Amex portal, and takes maybe 2-4 weeks to get paid directly into your bank.

Last year for a lost (then stolen) phone they even paid (slightly) more than we believed it was worth, and had even stated in the police report. On the whole, outstanding service. There is generally a £50 excesss for such things.

Also of note is the UK Amex doesn't require it to be paid on the Platinum, and rather just any Amex card held.

I'd say we get the better insurance, but you get better points per $, SUBs etc.

I would say, that non Amex insurance is even better in UK. No requirement to pay by particular card, no issue with roundtrip tickets bought during the trip, works for air miles booking and higher amount of reimbursement.

I also got stuck in DFW and wanted to stay at Hyatt but it was sold out. Some rooms were showing up at £500 but were disappearing quickly and I had to stay somewhere else. My...

I would say, that non Amex insurance is even better in UK. No requirement to pay by particular card, no issue with roundtrip tickets bought during the trip, works for air miles booking and higher amount of reimbursement.

I also got stuck in DFW and wanted to stay at Hyatt but it was sold out. Some rooms were showing up at £500 but were disappearing quickly and I had to stay somewhere else. My insurance has limit of £1000 for delay. Except hotel cost, insurance also paid for rebooking separate reservation for another trip, which was beginning next day from London.

Forgot to add, they also "sponsored" my weekend in Frankfurt in 5* hotel, at the beginning of pandemics.

I had to leave Poland before all flights were grounded and cheapest option was to fly to Frankfurt, stay overnight and fly back to London next day. That was paid for disrupted travel.

Since it is you and Ford does that mean you are eligible for $1000 in expenses because it is 2 tickets or is it capped at $500?

I can’t confirm how this is how it works for Amex, but when I made a similar claim on my Citi Prestige a few years back, it was $500 per covered ticket. That was important because I was delayed several days in NYC due to a snowstorm and having tickets on Southwest. We got back close to $1,000.

@Ben (guesT) Not sure if Chase Sapphire is better for travel delay/cancellation.

My flight SQ25 JFK-FRA was cancelled last month, opened a claim 4 weeks ago with Chase/eclaimsline and I still have not heard back.

My claim with Chase took forever, and I had to do multiple followup calls and emails. I eventually got the money back but I think my time ended up working out to minimum wage in the final tally of money vs. effort.

I am still waiting for TAP Portugal to send me the reason of the delay from last September. The travel insurance business is broken.

Not at all. The more claims that they can avoid paying through a cumbersome and inefficient claims process, the better things are.

@grichard

Nailed it.

It's a pretty bad model when the model only works by inconveniencing the "customers" to the point the customers give up. It's a great model for the insurance companies, but it seems like a borderline scam for the ones paying for the "service" - the service that will never provide any promised benefit by wearing people down.

Exactly, my travel insurance will not pay without this last piece of document (confirmation from airline the reason for delay) and since TAP is horrible with their customer service, I paid for nothing. Even bigger joke is when Lufthansa, Swiss and Austrian are working with the jokesters for their damaged luggage. That is another scam

Exactly, my travel insurance will not pay without this last piece of document (confirmation from airline the reason for delay) and since TAP is horrible with their customer service, I paid for nothing. Even bigger joke is when Lufthansa, Swiss and Austrian are working with the jokesters for their damaged luggage. That is another scam

Well done Ben!

Many thanks for the info, as I use that card as my go-to for airline purchases for the 5x points, and I assume many around here also do the same.

Amex (AIG) is the worst.. DO NOT use them for travel expenses and expect reimbursement. My AF flight broke and Amex won’t reimburse me bc the 6 hour delay was a “technical” issue,. Even though the engine broke and I missed my flights. USE CHASE OR CAP1

I don't recommend Capital One, when I looked at VentureX, they had one of the worst trip cancellation and insurance coverages I've seen. They'll cover exactly 2 situations.

Similar experience here! my flight was canceled and Amex's policy wouldn't cover it as "operational reasons" are not covered. only weather or equipment failure are covered. terrible insurance coverage!