Marriott Bonvoy and American Express seem to have just launched a new spending offer on their co-branded business credit card in the United States, and I imagine this could interest some.

In this post:

Marriott Business Card spend bonus with Amex Offers

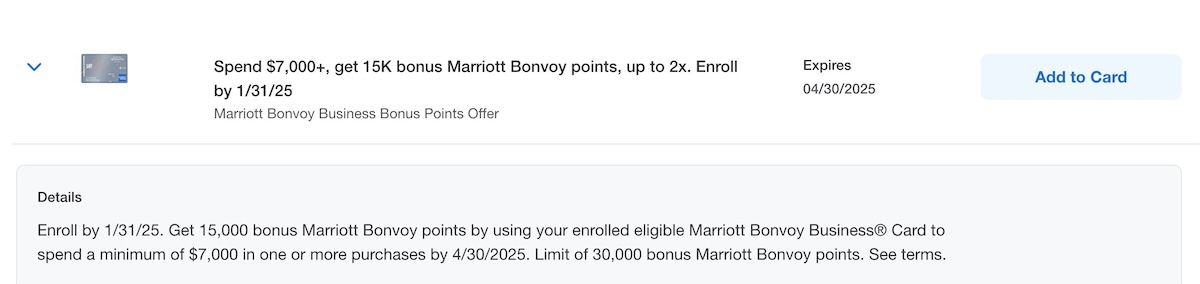

Many people with the Marriott Bonvoy Business® American Express® Card (review) seem to be eligible for a spending bonus through the Amex Offers program, as flagged by Frequent Miler. To see if you’re eligible, log into your Amex account (though the website or app) and go to the Amex Offers section, where you might see this offer listed.

There seem to be at least a couple versions of this promotion:

- Spend $7,000+ and earn 15,000 Bonvoy bonus points, up to two times (for up to 30,000 points)

- Spend $2,000+ and earn 5,000 Bonvoy bonus points, up to two times (for up to 10,000 points)

Enrollment in this offer is required by January 31, 2025, and eligible spending needs to be completed by April 30, 2025. We see spending offers on co-branded Marriott cards with some frequency, and at least this seems to be pretty widely targeted. I might even go so far as to say that this is likely available to all existing cardmembers, based on there being a specific registration deadline (unlike typical Amex Offers deal)

Is this Marriott Business Card spending offer worth it?

If you have the Marriott Bonvoy Business Amex and are eligible for one of these offers, is it worth taking advantage of? For context on deciding on the value of this offer, personally I value Marriott Bonvoy® points at 0.7 cents each.

With this offer, you’re potentially earning the following incremental return, in the right increments:

- If you’re eligible for the 15,000 bonus points offer, you’re earning 2.14 bonus Bonvoy points per dollar spent

- If you’re eligible for the 5,000 bonus points offer, you’re earning 2.5 bonus Bonvoy points per dollar spent

This card ordinarily earns 2x Bonvoy points per dollar spent in non-bonused categories. So to put it differently, in the right increments, you’re earning 4.14-4.5 Bonvoy points per dollar spent in non-bonused categories. At a valuation of 0.7 cents per point, that’s like a 2.9-3.15% return on spending.

By my valuation, the best cards for everyday spending offer a 3.4% return on spending, in the form of 2x transferable points per dollar spent. This would be on cards like the Capital One Venture Rewards Credit Card (review) and Citi Double Cash® Card (review).

So based on such a valuation, this offer probably wouldn’t be worth it. However, this doesn’t consider two factors:

- It’s otherwise hard to efficiently earn Marriott Bonvoy® points outside of hotel stays, so this could be valuable for those looking to boost their Marriott points balance

- If you can spend in a category that qualifies for bonus points, you can come out ahead; for example, the card also offers 6x Bonvoy points on hotel spending, in which case it’s nice to stack that elevated return with this promotion

Since I have a fair number of Marriott stays planned in the coming months, I do plan on taking advantage of this offer. Between the 6x Bonvoy points on Marriott spending, plus the 15,000 to 30,000 bonus Bonvoy points with this offer, I think it’ll be worthwhile.

Bottom line

The Marriott Bonvoy Business Amex seems to have a targeted spending bonus, whereby registered cardmembers can earn bonus points for completing a certain amount of spending in the coming months. If you value Marriott Bonvoy® points, then I’d say this offer could be worth considering, especially if you’d spend some money at Marriott properties anyway (where the 6x points multiplier adds up).

If you’re a cardmember, do you plan on taking advantage of this Marriott Bonvoy spending offer?

I have the 15k spend. It was first offered 11.22.24, & I recently received my first set of bonus points. Absolutely worth it since nowhere else to get a bump on Marriott points (& I am running low after a Marriott timeshare bundle promo years ago).

Offer absent in my account, which listed 100 offers. I loaded 15 offers, logged out, logged in, found 100 offers but this wasn't among them. I happen to also be in Popup Prison atm. If only there was an expert who wrote about this stuff, so I could understand what's happening to me.

I have the offer but it’s the $7,000 spend. I was hoping the card offer would allow me to choose which spend I wanted to complete but I have no option for the lower spend, which I could have made organically on hotel spend by 4/30. But I won’t come close to $7K and the lost opportunity of using this card for everything else to meet the !7K isn’t worth it.