Now that you have a bit of background information, let’s talk about how to leverage the relationships between the banks and airlines into fantastic travel opportunities.

The secret, which probably seems apparent by now, is in getting the most out of credit card rewards. I earn about a million miles and points a year through taking advantage of the best credit card offers, and allocating my spend accordingly.

This is something that anyone can do.

Before we talk about specific cards, I first want to talk about a couple of the most common questions I get whenever credit cards come into discussion: credit scores.

How Credit Scores are Calculated

There are a lot of misconceptions about how credit scores work, as most people believe that applying for a credit card will negatively impact their credit score.

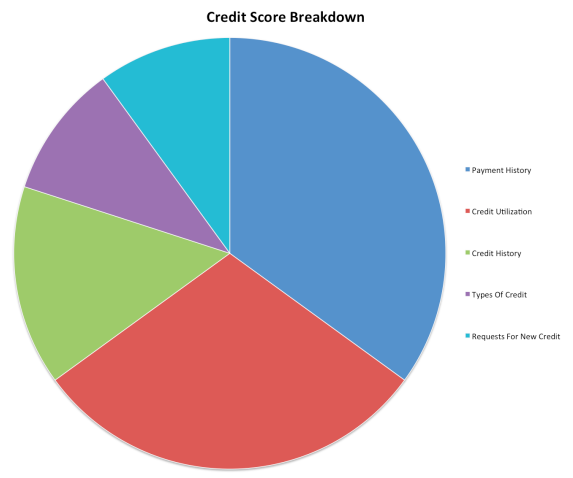

In reality, credit scores are made up of the following components:

- 35% of your score is made up of your payment history

- 30% of your score is your credit utilization

- 15% of your score is your credit history

- 10% of your score is made up of the types of credit you use

- 10% of your score is your request for new credit

When you apply for credit cards you get hit with an inquiry, which falls in the category of requests for new credit. You’ll temporarily be dinged 2-3 points on your credit score, though that falls off within two years.

Meanwhile virtually all the other components of your credit score can improve as a result of applying for a credit card, meaning your credit score can actually go up as a result of applying for more cards.

As long as you keep your credit utilization low and make your payments on time, you shouldn’t see a negative impact on your credit score from applying for cards.

If you haven’t done so recently, you’ll want to look over a copy of your free annual credit report and check for inaccuracies.

To determine your credit score, my best suggestion is to use a free service like Credit Sesame. There are several others as well, and it doesn’t really matter which you use. You could also enroll in a professional credit monitoring service, but I’ve never really found that necessary – the free service should work just fine.

You’ll need to enter your social security number, and will then receive a report with your credit score, credit utilization ratio, and debt to income ratio.

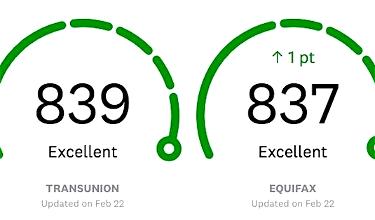

If your credit score is above 720 or so, you should have no problems getting approved for any of the credit cards that we’ll discuss.

How to Use Your Credit Card

Before we go any further we need to have a serious conversation about credit. If used wisely, credit cards can provide some fantastic opportunities, but the math only works if used strategically.

If you do not, or cannot, pay your credit cards in full, each and every month, stop.

You should not be looking at funding travel with credit card points.

To be clear, I am not judging anyone’s financial situation – it just doesn’t make sense to pay a 15.4% interest rate in order to get 1%-5% back on travel.

If you are a student, or don’t have a strong credit profile, that’s okay. You’ll just want to start small, with less rewarding cards that help you to build your credit.

Thankfully, I am in a position to pay my cards in full, each and every month. Believe it or not, my credit score is actually much better now than it was before I started applying for lots of credit cards, and I apply for about a dozen a year.

A dozen a year?!? You can’t expect everyone to do that!

Nope, I don’t.

Nor do I expect anyone else to fly hundreds of thousands of miles per year in international first and business class, fantastic though it may be.

For most people, a handful of credit cards will be enough to have a significant impact on the way they travel, or the frequency with which they can afford to travel.

But I want to show you what is possible, and when it comes to miles and points, nearly anything is possible.

There are currently no responses to this story.

Be the first to respond.