Earlier this year I experienced one of my worst travel nightmares — my laptop became totally unresponsive, halfway through a trip in a destination where there was zero chance of getting it repaired, during a ridiculously busy work week. Ugh.

Fortunately, my husband was on this trip, so I was able to commandeer his laptop and avoid a complete disaster (though he runs Linux on a machine that is not optimized for me/travel, so it still took me forever to get anything done), but the day we got home I headed right to the Apple Store to see what could be done.

My Macbook Air is only ~14 months old, but this particular machine has been a problem child fsrom the beginning. I don’t remember exactly why I didn’t purchase AppleCare when I bought the computer, but I’ve been dreading whatever post-warranty nonsense I was going to encounter since I realized the opportunity to purchase AppleCare had expired.

The guy at the Genius Bar looked like he wanted to cry when we went over the issues that were occurring (keyboard, trackpad, and SD card reader not functional).

“I hate to tell you, but you’re just outside the warranty period, and this is going to be a really expensive repair. It might not even be worth it…”

And while I probably will have to replace my laptop sooner than I would like, I knew that I’d purchased this one with my Chase Sapphire Reserve® Card, which offers an extended warranty benefit for just these circumstances.

Other premium cards, like American Express Platinum Card® and Citi Prestige Card offer a similar benefit, but Chase offers this perk on all their Visa Infinite and Visa Signature products, and since many of you have Chase Visa cards, I figured I’d go through the details of my experience.

Chase Visa Extended Warranty Protection Terms

Fundamentally, how this works is that you get an extra year on your manufacturer warranty if you “charge some portion of the item’s purchase price to your Account or use reward points earned on your Account toward the purchase.” If the repair or replacement would have been covered under the original warranty terms, and you purchased the item with a Chase Visa Infinite or Signature card, you basically get an extra year of warranty coverage under the same terms as the original agreement.

If it wouldn’t have been covered (for example, if you have a penchant for combining orange juice with your laptop, like some people around here have done multiple times), then Chase won’t cover it either.

There are some other limitations:

Extends the free repair period under the original manufacturers repair warranty up to one additional year on eligible warranties of three (3) years or less, up to a maximum of ten thousand ($10,000.00) dollars per claim, and a fifty thousand ($50,000.00) dollars maximum per Account.

And of course, some items are excluded entirely:

- Boats, automobiles, aircraft, and any other motorized vehicles and their motors, equipment, or accessories, including trailers and other items that can be towed by or attached to any motorized vehicle

- Any costs other than those specifically covered under the terms of the original manufacturer- written U.S. repair warranty, as supplied by the original manufacturer, or other eligible warranty

- Items purchased for resale, professional, or commercial use

- Rented or leased items or items purchased on an installment plan and for which the entire purchase price was not paid in full at the time of the occurrence

- Computer software• Medical equipment

- Used or pre-owned items

So you can’t use this benefit for buying a new car, but in a situation like mine, where you’re deciding whether or not to purchase extra coverage through AppleCare or similar, the automatic warranty through your credit card can be a great perk.

What Documentation Is Needed?

Like many things in life, the key to success here is in the preparation. If you have an item that you purchased with a Chase card and think is eligible for the warranty benefit, you’ll want to collect the following info:

- The original purchase receipt

- A copy of the credit card statement showing the original purchase on your Chase Visa Signature card

- The original manufacturer warranty

- Any repair or replacement estimates

It’s worth noting that for some products, you may be required to get a replacement quote from a designated repair specialist. For Apple products, however, the Genius Bar is the designated specialist, so it’s relatively easy.

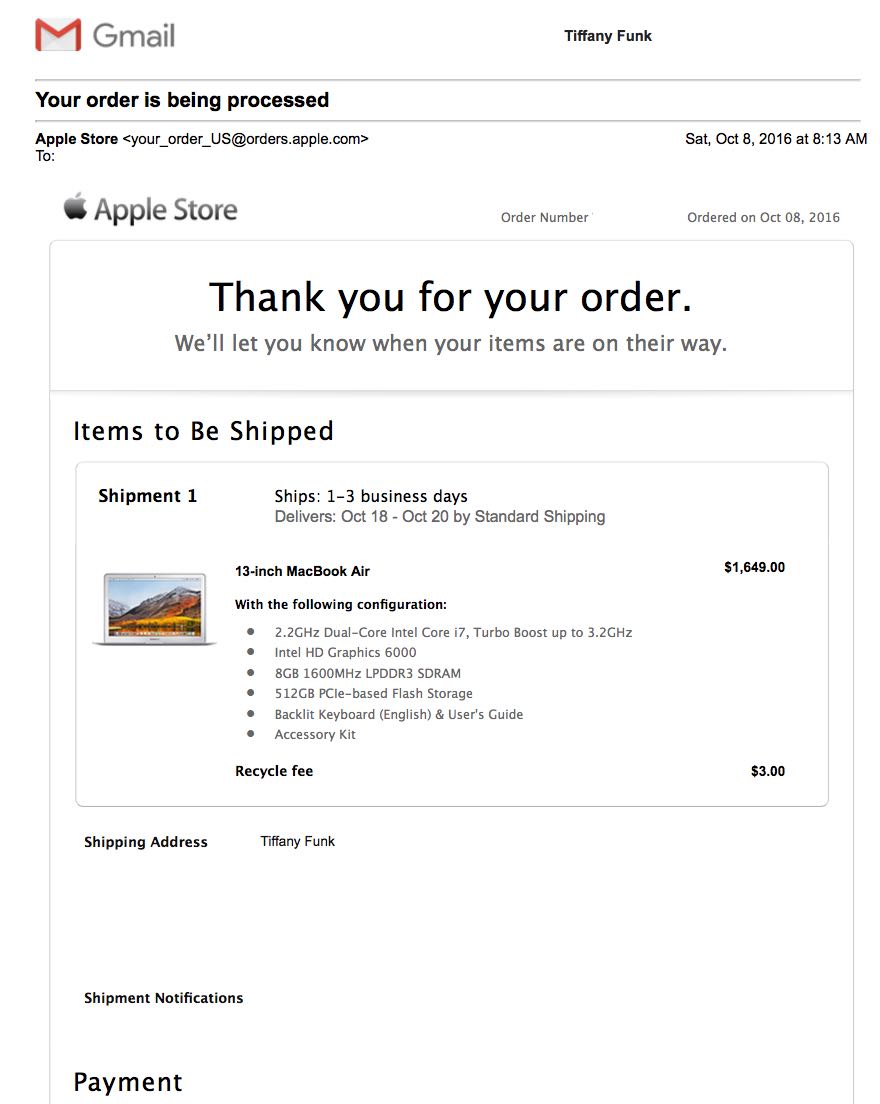

In my case, I didn’t have a paper receipt for the purchase, but a PDF from my email was fine:

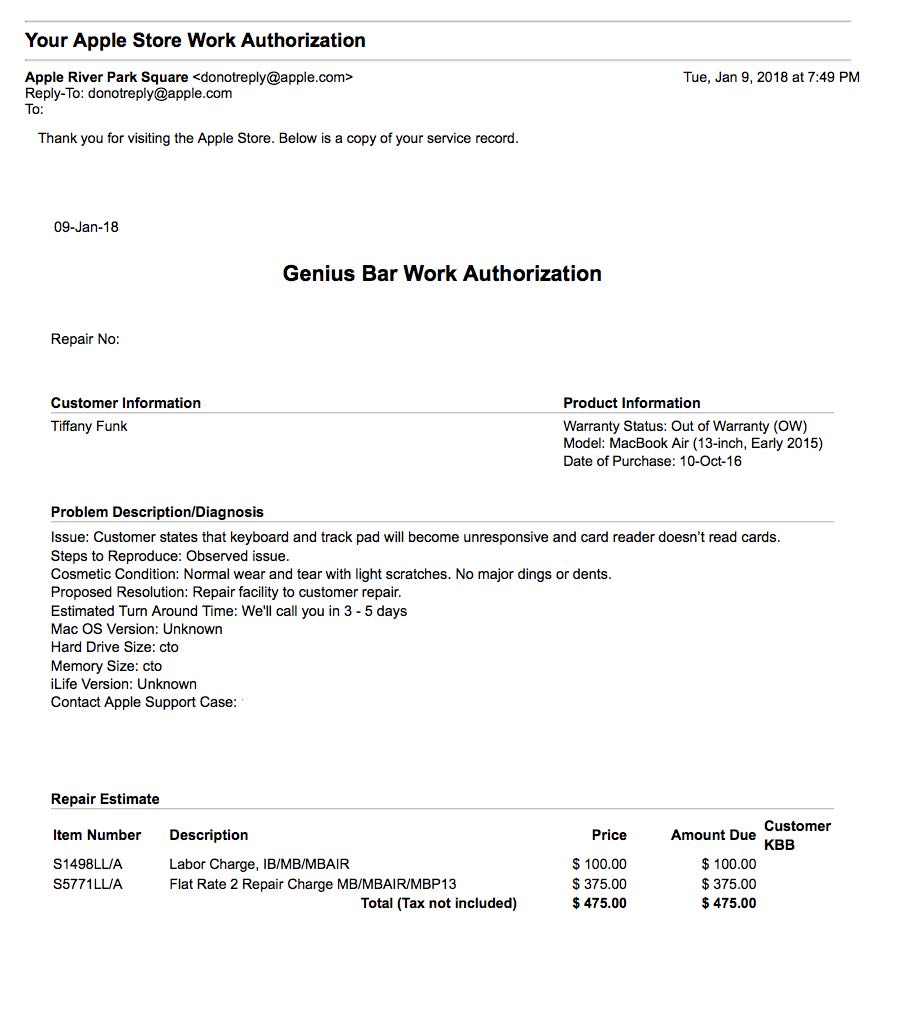

And while I could have scanned the printout from Apple for the as-expensive-as-promised estimated repair, a copy of the email was once again fine:

With everything I sent in, I made PDFs of each of the documents, with very specific and numbered file names. I don’t know if that helped or not, but my experience with insurance companies and banks is that if I appear super organized they give me less of a hassle. 😉

Submitting a claim

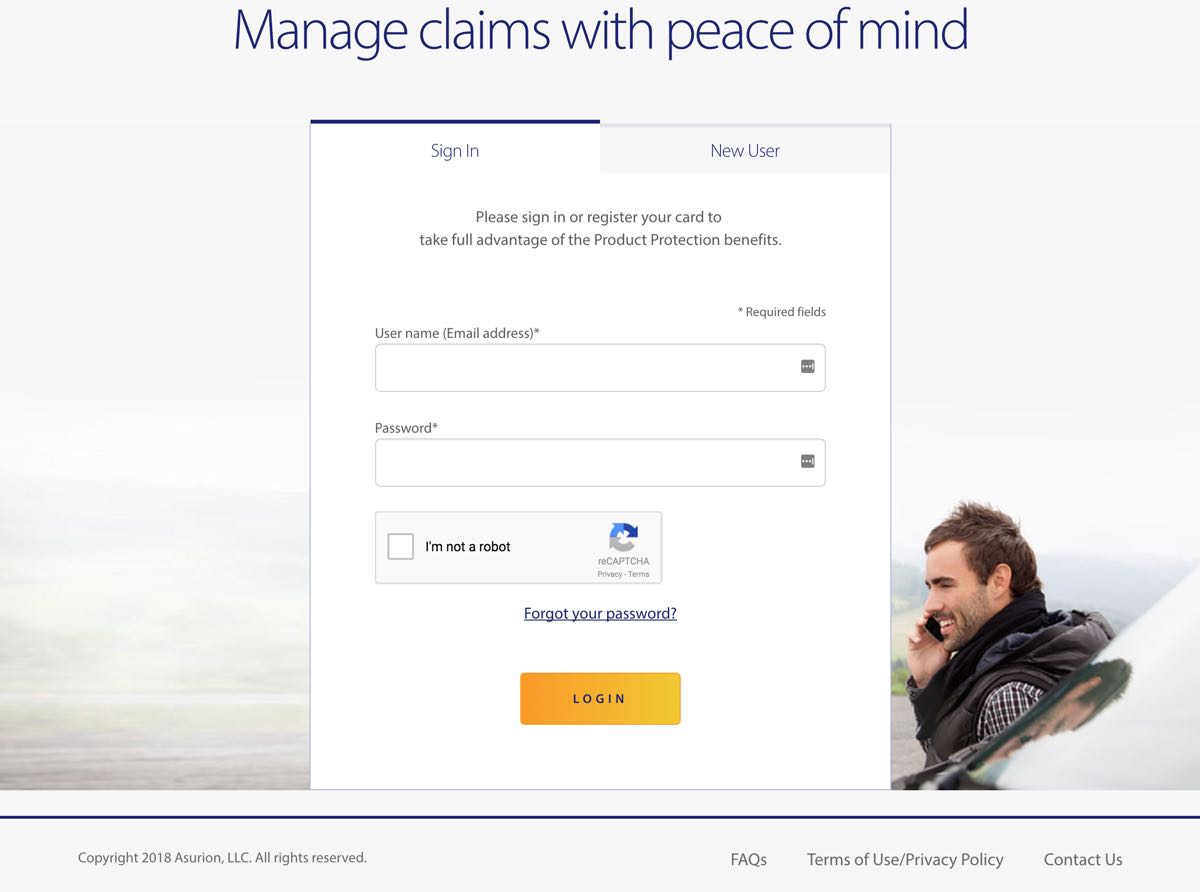

Regardless of which card you have, all the warranty benefits are managed by a company called Card Benefit Services. You can technically call them at 800-874-7702 to start a claim (or if you have questions about your coverage), but since you’re going to have to submit a bunch of documents anyway it’s easier to just do everything on their website of cardbenefitservices.com.

If it’s your first time using the service, you’ll be prompted to create an account, otherwise you can just log in. Again, this service supports all the Chase Visa Infinite and Signature cards, so you only need one account here regardless of how many cards you have.

From there, you have options to file a claim, register a product, manage products, or manage claims:

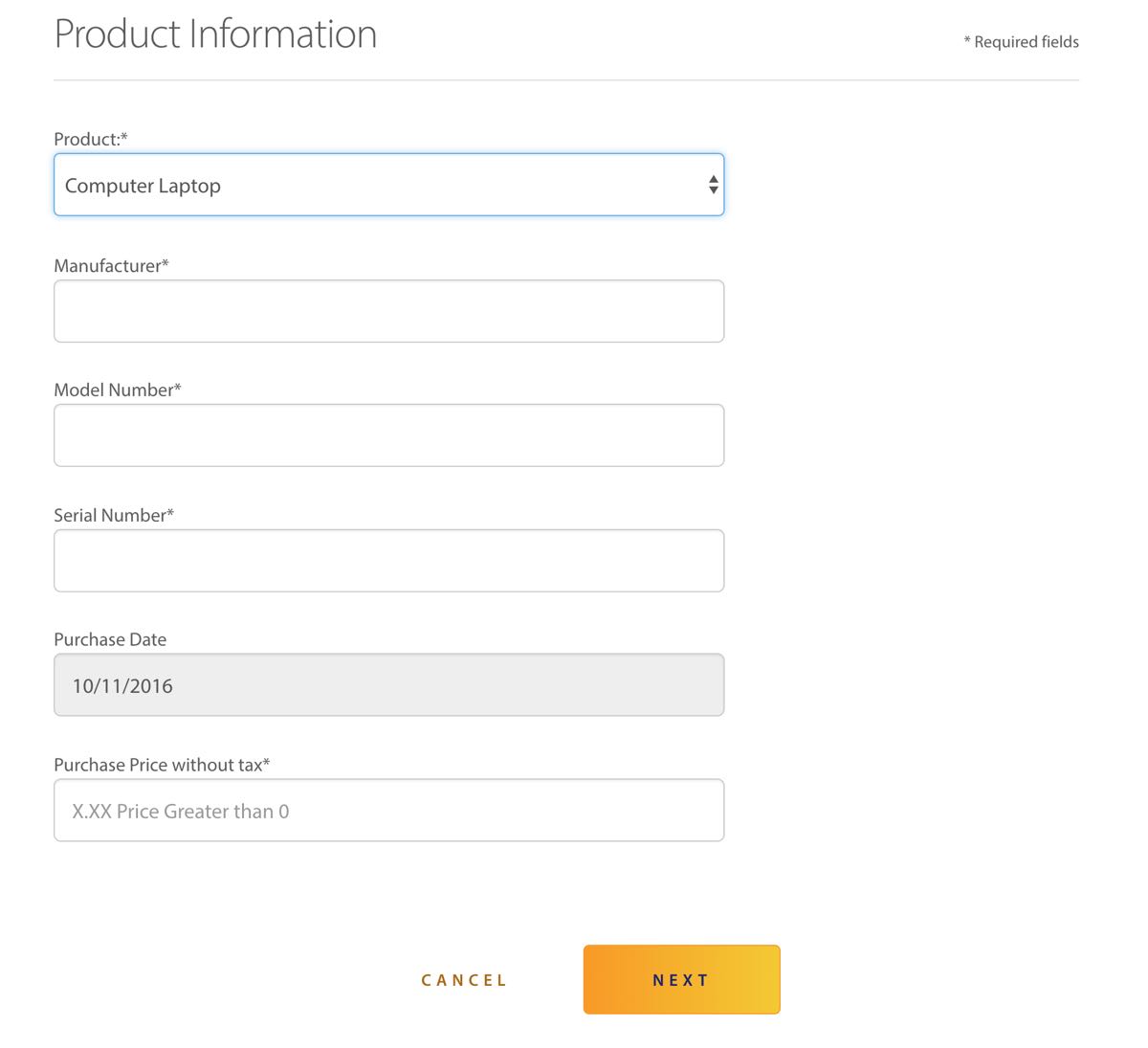

You can register a product as soon as you purchase it, which from an organization perspective is possibly even better than waiting until it breaks. Just enter some basic details about your new gadget, including any model numbers and serial numbers:

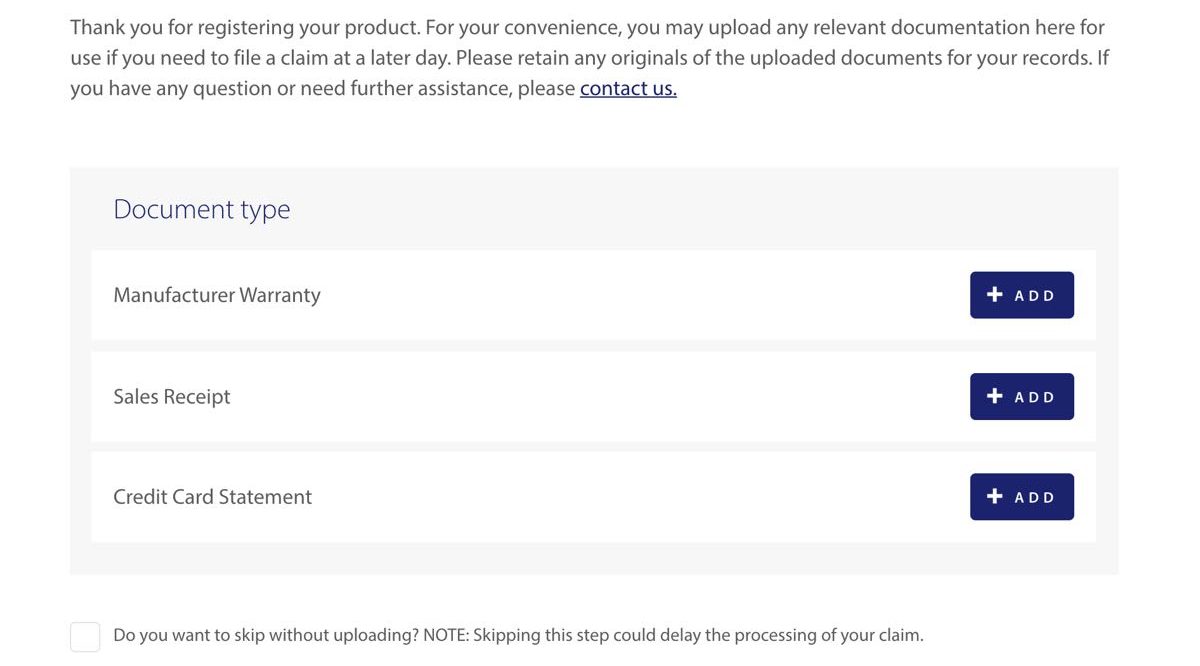

You can also go ahead and upload the warranty, receipt, and card statement so that everything is in the system for future use.

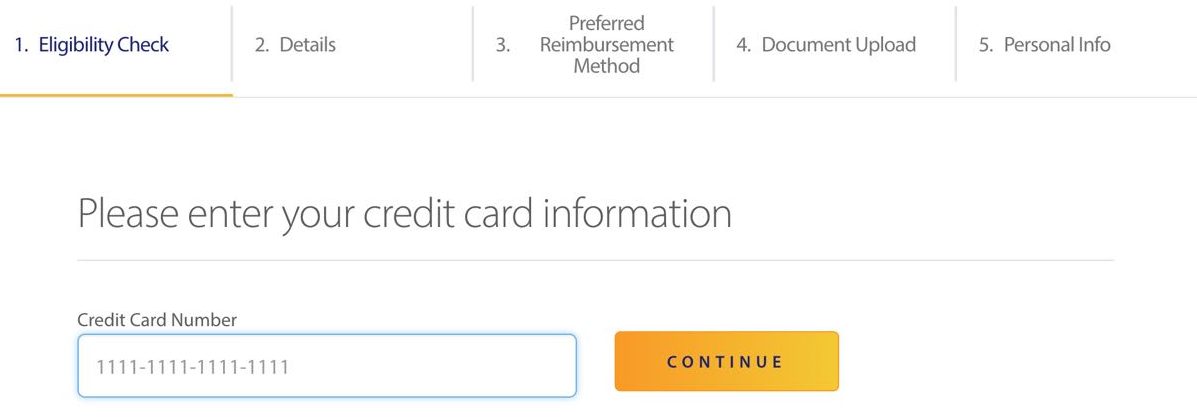

To file a claim, you’ll start by entering your full card number. I know it seems like they should have this information, but remember this is all handled by a third-party company.

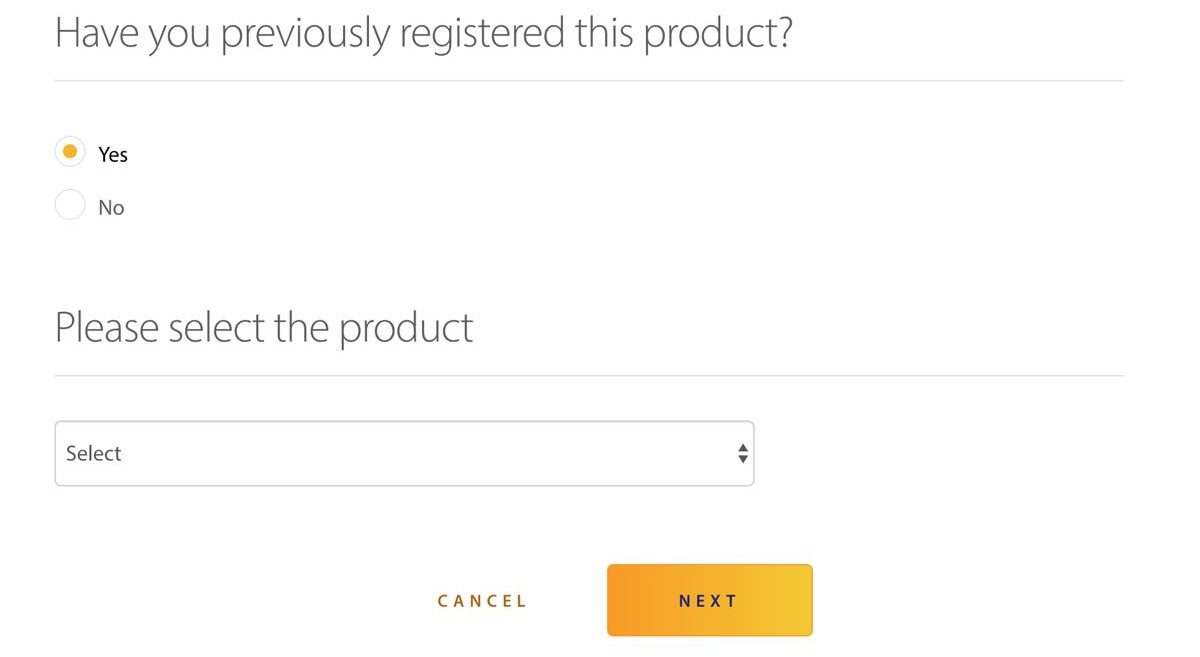

You’ll then be asked how organized you are if you previously registered this product with Card Benefit Services.

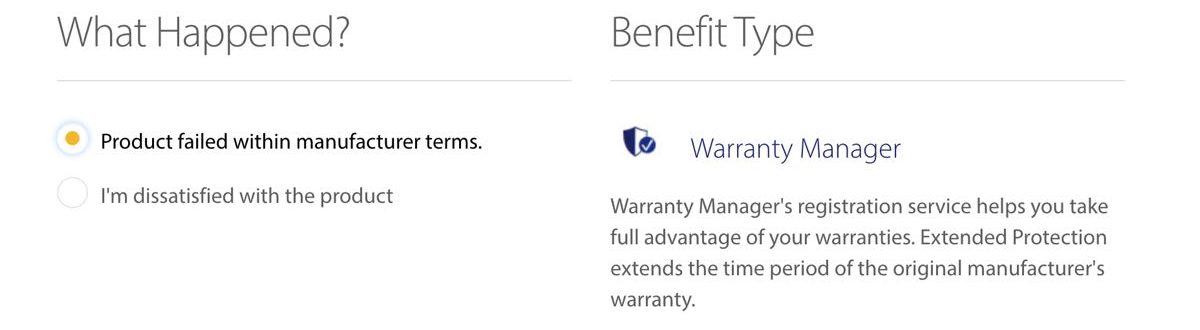

If you have, the product will show up in the dropdown menu. If you haven’t, you’ll be prompted to go through the steps above. From there, you’ll want to select that the “Product failed within manufacturer terms.”

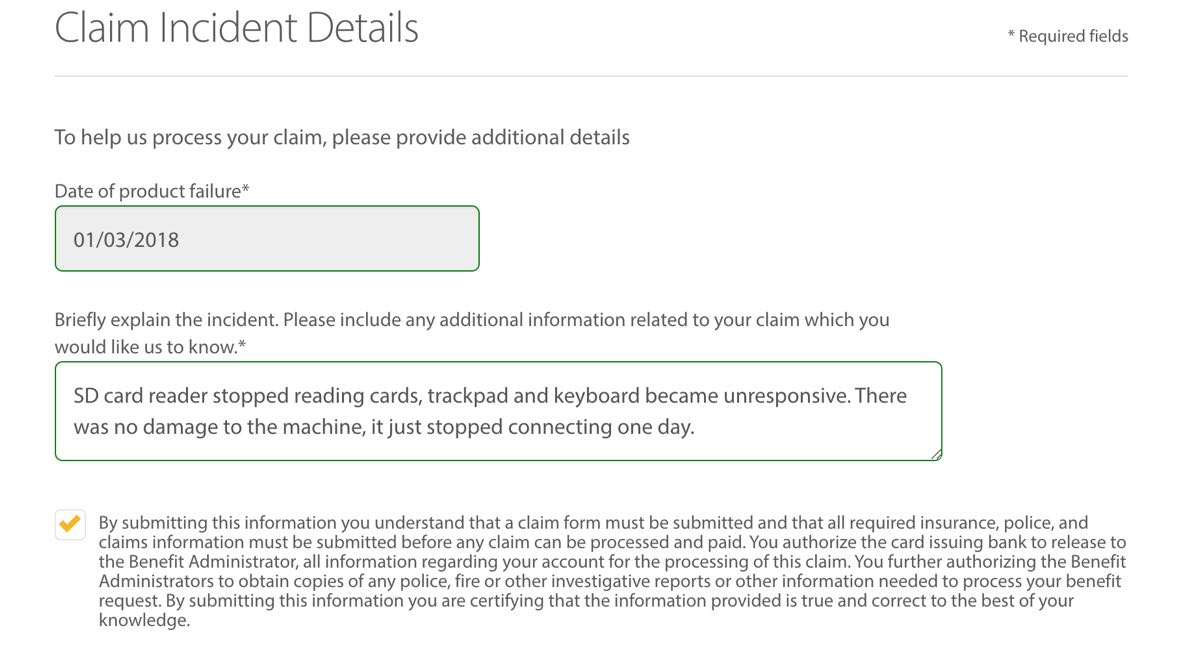

And then you just have to enter a few details, and agree to some terms:

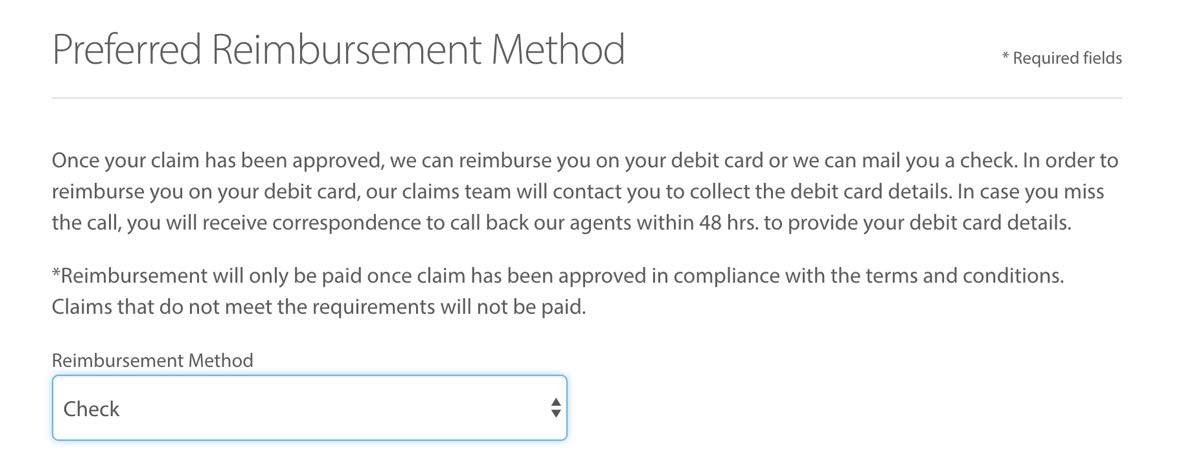

Then you choose how you want to be reimbursed, which is honestly confidence-inducing. I chose a check, but you can give them a debit card number as well.

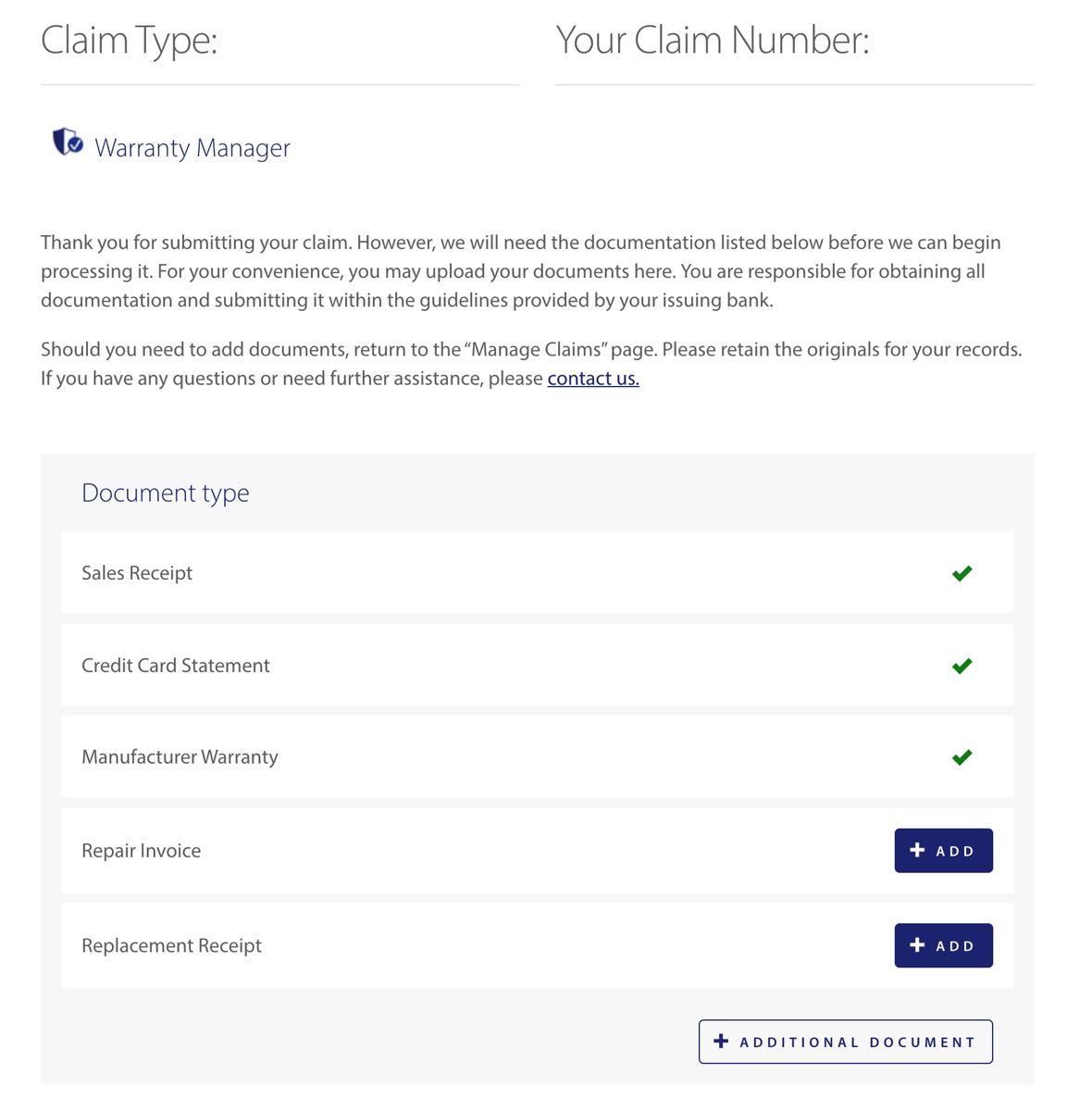

At this point you’ll be prompted to enter any information you haven’t already uploaded. In my case the product was already registered, so I just had to add the repair details.

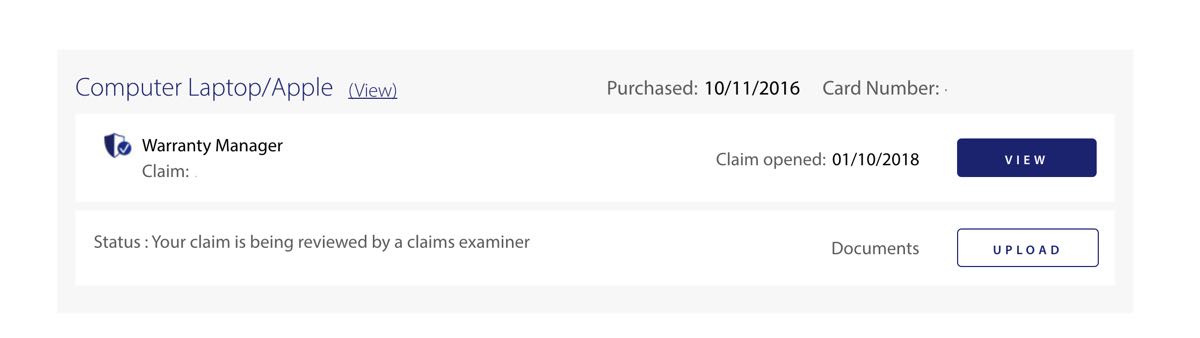

With that done, I was given a claim number, and the claim appeared in my account under “Manage Claims”:

How long does it take for a claim to be processed?

I submitted my claim just before a holiday weekend started, so I think mine took a bit longer than normal. Card Benefit Services says they’ll respond to claims within five business days of the documentation being reviewed, but getting to the point of anything actually being reviewed took a few weeks. For about ten days the status was this:

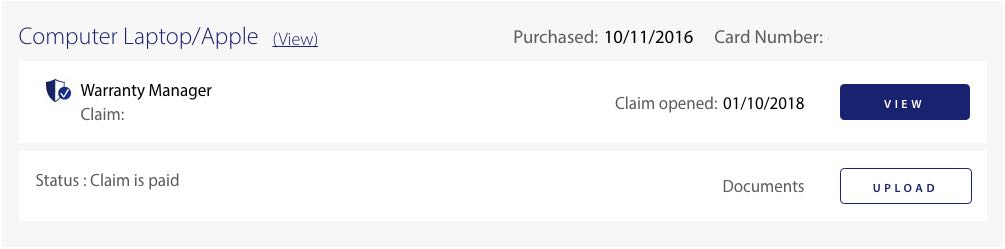

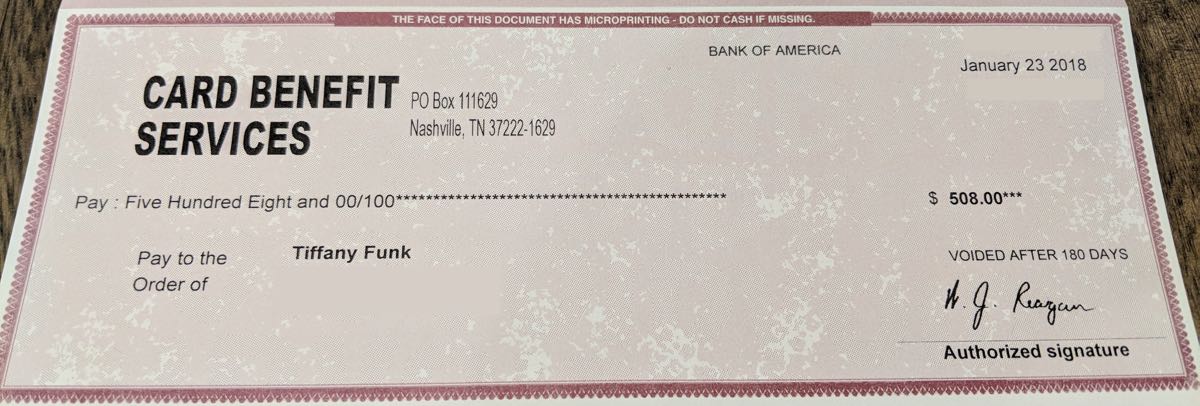

And then on January 22nd (12 days after I submitted the claim), I received a voicemail saying the claim had been approved and payment was being sent.

Sure enough, a check arrived in the mail a few days later:

Super easy, and I especially appreciated that they added a bit more for sales tax without my having to say anything!

Bottom line

This is the first time I’ve had a product fail outside of the standard manufacturer warranty, and I’m so glad I’d made this purchase with my Chase Sapphire Reserve® Card so I could take advantage of the extended warranty benefit. The process was straightforward, and I appreciated that there weren’t lengthy negotiations about what exactly was or was not covered.

And while I used a super-premium card for this purchase, I think it’s especially impressive that this same benefit is available on other Chase products as well, including those with no annual fee!

Have you used Chase’s Extended Warranty? What was your experience?

This warranty is worthless! They will request impossible to obtain information. They do this just so they can refuse to pay claims. Very questionable business practices. No morals or ethics at all. Customer service reps have no common sense when you explain to them how impossible their "required' information is to obtain. Standard responses that are read from a script. I do not recommend doing business with Chase credit cards.

It pains me badly how people buy MacBook Air in 2014, let alone 2016.

The screen is just abhorrent.

Citi offers an extra 2 years of warranty, which is why my Citi cards get used when I buy dodgy appliances or things which I don't think will last the manufacturer's warranty + 2 years. Haven't needed to file a claim yet, but we'll see how it goes.

And I agree with the others -- Amex does this much easier than Citi does.

A super useful, super neat article... As always from you!

And with all due respect, soulmate!: "With everything I sent in, I made PDFs of each of the documents, with very specific and numbered file names. I don’t know if that helped or not, but my experience with insurance companies and banks is that if I appear super organized they give me less of a hassle. "

Reality check- many cards have offered extended warranty for YEARS so this isn't some new benefit of only "premium" or Chase cards. My BofA Cash Rewards and Citi Diamond Preferred have always included this- way before I jumped on the Chase bandwagon.

@Tiffany

Thanks for the guide but I am as still confused here so please help me out:

Did you go ahead and have your laptop repaired at Apple store before submitting a claim? If so, wasn't it a gamble and risky move because what about if the claim is denied by Chase 3rd party warranty processor?

Or did you submit a claim and request first and then go to Apple store to have it repaired?

@ Avidtravel -- Well, either way I was going to get the laptop repaired, so when I went to the Apple Store to get a quote for the repair I just had them keep it. But you could get a quote, submit the claim, then take it back to Apple to be repaired. It just would have taken longer, and I was short on time.

The info you gave regarding "charging some portion" may be wrong:

Fundamentally, how this works is that you get an extra year on your manufacturer warranty if you “charge some portion of the item’s purchase price to your Account or use reward points earned on your Account toward the purchase.”

The warranty will only cover the portion paid by the credit card and not the full amount. I have had to use it for...

The info you gave regarding "charging some portion" may be wrong:

Fundamentally, how this works is that you get an extra year on your manufacturer warranty if you “charge some portion of the item’s purchase price to your Account or use reward points earned on your Account toward the purchase.”

The warranty will only cover the portion paid by the credit card and not the full amount. I have had to use it for a laptop I bought from Dell using Amex and gift cards. Amex reimbursed the amount charged on the card only and not the full amount. I would assume they would do a similar thing for repairs.

Tiffany—small world. Guessing Chase contracted this out to Asurion in Nashville since my old friend and former co-worker Jack Reagan signed your check.

Great story and I'll remember this for the US.

I have Apple everything - phone, mackbook pro, ipad and so do both my kids. I'm frequently getting stuff fixed - and always for free. Luckily in Australia warranties are a notional issue because our consumer laws are expected performance over time so you can argue that the product should never have broken in 15 months. Apple isn't perfect and has a habit of doing quiet...

Great story and I'll remember this for the US.

I have Apple everything - phone, mackbook pro, ipad and so do both my kids. I'm frequently getting stuff fixed - and always for free. Luckily in Australia warranties are a notional issue because our consumer laws are expected performance over time so you can argue that the product should never have broken in 15 months. Apple isn't perfect and has a habit of doing quiet recalls or customer goodwill fixes (remember the white macbooks from 2006 anyone that would crack the case when shutting and after 3 years apple came clean and replaced for free? I had one machine fixed three times over 4 years.) Last year they replaced my iphone 6 battery after having told me to go away twice because batteries wear out. I went back a third time and said the iphone4s battery in my old phone being used by my son is 4 years older and still perfect with more cycles on it. The lady just smiled and said come back in an hour and we will have replaced your battery. But what strikes me as nasty is that in the US one minute over the warranty period and you get screwed. Maybe that's why the same laptop retails for $200 more in Australia?

Another super great post Tiffany, thank you. Your posts are so useful and well written that I always click when I see you’ve written something.

I haven’t used this benefit before and figured it’d be a hassle but I have used the delayed baggage benefit and it was super easy so maybe I need to stop doubting the value of these extra benefits.

I’m glad it worked out for you. Love your posts BTW. We use MacBook airs at our job and I have found them to be junky. They always seem to go bad sooner than other Apple products. Not sure why? Maybe because they’re only roughly double an iPhone.

As always, AMEX is so much easier. A quick call and the credit appears.

Perfect timing since my MacBook Pro touchbar just stopped working. And my warranty ended last December. Except I bought mine on a Amex plat.

Looking forward to same results. Thanks for the tips on organization to make the process go smooth.

What rich said. You use the laptop for professional/commercial use. Then you blog about how you commit insurance fraud. Against Chase. What an egregious case of 'biting the hand that feeds you'.

@ rich @ Chuck -- No, apparently what's meant by "professional" is more "customer facing/utilized." The Ink cards (which are designed for small business owners who would ostensibly be using those cards for business purchases) have the exact same terms. When I called to ask about the process of getting a repair approved I said that I wanted to get it done ASAP as I use this laptop for work, and was told it was...

@ rich @ Chuck -- No, apparently what's meant by "professional" is more "customer facing/utilized." The Ink cards (which are designed for small business owners who would ostensibly be using those cards for business purchases) have the exact same terms. When I called to ask about the process of getting a repair approved I said that I wanted to get it done ASAP as I use this laptop for work, and was told it was fine. A hair dryer used in a salon or a TV in an office waiting room would likely be excluded, but they had no problem with this.

But thanks for your concern!

Great post! Thanks! Does anyone know if Chase would cover the repair during an international trip?

Awesome post Tiffany! I've also done the same thing with my CSR for an iphone that died, and chase handled it really well.

I used the extended warranty on my Platinum Delta Amex last month. The freezer compartment in my fridge was getting too warm again (I'd already had it repaired 6 months earlier under Maytag's warranty) and I lost all of my food again. I filed the claim online and went through the hassle of getting an authorized repair quote before I could submit my paperwork. About 2 weeks later, I had a credit on my Amex...

I used the extended warranty on my Platinum Delta Amex last month. The freezer compartment in my fridge was getting too warm again (I'd already had it repaired 6 months earlier under Maytag's warranty) and I lost all of my food again. I filed the claim online and went through the hassle of getting an authorized repair quote before I could submit my paperwork. About 2 weeks later, I had a credit on my Amex of $400 for the repair and $89 for the repair estimate service call fee. (The repair shop didn't take Amex, which wasn't ideal...) All in all, it was a really helpful benefit!

HI, Glad it worked out for you!

I have a few signature cards but not Chase signature--you said they even have a few cards with such benefits on NON-annual fees, but the ones you listed all have annual fees...?

thanks in advance for feedback

@ drew -- The Freedom, Freedom Unlimited, and Ink Cash don't have annual fees, and depending on the credit limit you're approved for are issued as Visa Signature cards.

Just curious but aren't you in dangerous territory with:

"Items purchased for resale, professional, or commercial use"

Aren't you using the laptop for professional/commercial use ?

I’ve been using both Amex and Chase extended warranties and return and purchase protection for some time now, and have to say that in most cases Amex is easier to use. One reason may be because a third party processor is not involved. In most cases, Chase would require to send the item to them when repair cost is higher than the cost of the item or when purchase /return protection claim is filed. This is a major headache.

Excellent step-by-step info! Thank you! I'm going to bookmark this and hope I never need it :)

Awesome! I really feel like this service and the Price Protection benefit from the Chase Sapphire Reserve are the most under advertised benefits that these cards offer! So far this year, I have gotten back ~$50 from things I bought around Christmas (that were not Christmas specific), that subsequently dropped in price as the deals got better. And last year, when we bought a dryer because ours died, of course the price dropped $50 a...

Awesome! I really feel like this service and the Price Protection benefit from the Chase Sapphire Reserve are the most under advertised benefits that these cards offer! So far this year, I have gotten back ~$50 from things I bought around Christmas (that were not Christmas specific), that subsequently dropped in price as the deals got better. And last year, when we bought a dryer because ours died, of course the price dropped $50 a few weeks later. But I submitted the documents and in 10 days, had a check for $50. I see this benefit as another great way to basically eat into the annual fee ($150 after $300 travel credit)!

Also, I have learned that if you use WalMart, Amazon or a few other sites that are integrated with the "Honey" browser extension, if you buy a product, you can add it to a "drop list". What this does is has Honey monitor the price daily on that site for 30, 60 or 90 days - and it will send you an e-mail if the price drops below what you paid. At that point, take screen shots and start the Price Protection process and get back the difference - with basically no effort.

Wait, $1650 for a 13 inch laptop? I had no idea, but I guess with their new $1,000 iPhone that isn't surprising. This is the main reason I avoid Apple products.

My kid's Microsoft Surface recently died just a couple of months outside the 1 year warranty period (bad SSD). MS was completely unwilling to offer anything beyond a replacement for something like $500. Fortunately, I used an Amex Everyday card to buy it, and that card also has an extended warranty benefit. The reimbursement for the replacement was so fast that it showed up on the same statement as the charge. The process was quite...

My kid's Microsoft Surface recently died just a couple of months outside the 1 year warranty period (bad SSD). MS was completely unwilling to offer anything beyond a replacement for something like $500. Fortunately, I used an Amex Everyday card to buy it, and that card also has an extended warranty benefit. The reimbursement for the replacement was so fast that it showed up on the same statement as the charge. The process was quite similar to what Tiffany describes for the Chase card.

This can be a very useful benefit, and it's great that the credit cards' insurance companies are not using every excuse they can think of to deny payment or obstruct the process. To the contrary, it's quick and easy. Now I pretty much always double check the extended warranty terms of the card I want to use before making a major purchase.

Kinda hilarious that the third party processing company uses Bank of America rather than chase itself lol

Me too, when my brand new iPhone got stolen in ZA. Got a police report and they processed a purchase protection claim within 6 days.

Fake news. Nothing can go wrong with Apple. Nothing!

Great step-by-step report. Thanks!

Great post!

Thank you for the detailed review! Very useful info - will definitely have to keep in mind!