| Want to learn more about policies of major transferable points currencies? See my series about Amex Membership Rewards, Capital One, Chase Ultimate Rewards, and Citi ThankYou. |

Link: Learn more about the Capital One Venture X Rewards Credit Card or Capital One Venture X Business

Capital One’s mileage currency has becoming increasingly competitive in recent years, especially with the popularity of the Capital One Venture X Rewards Credit Card (review) and Capital One Venture X Business (review). These are Capital One’s premium cards, and both the personal card and business card have amazing perks.

In this post, I wanted to go over the basics of moving Capital One miles around, including how you transfer them to airline and hotel partners, how you combine them between accounts, and how you share them with others.

In this post:

How to transfer Capital One miles to airline & hotel partners

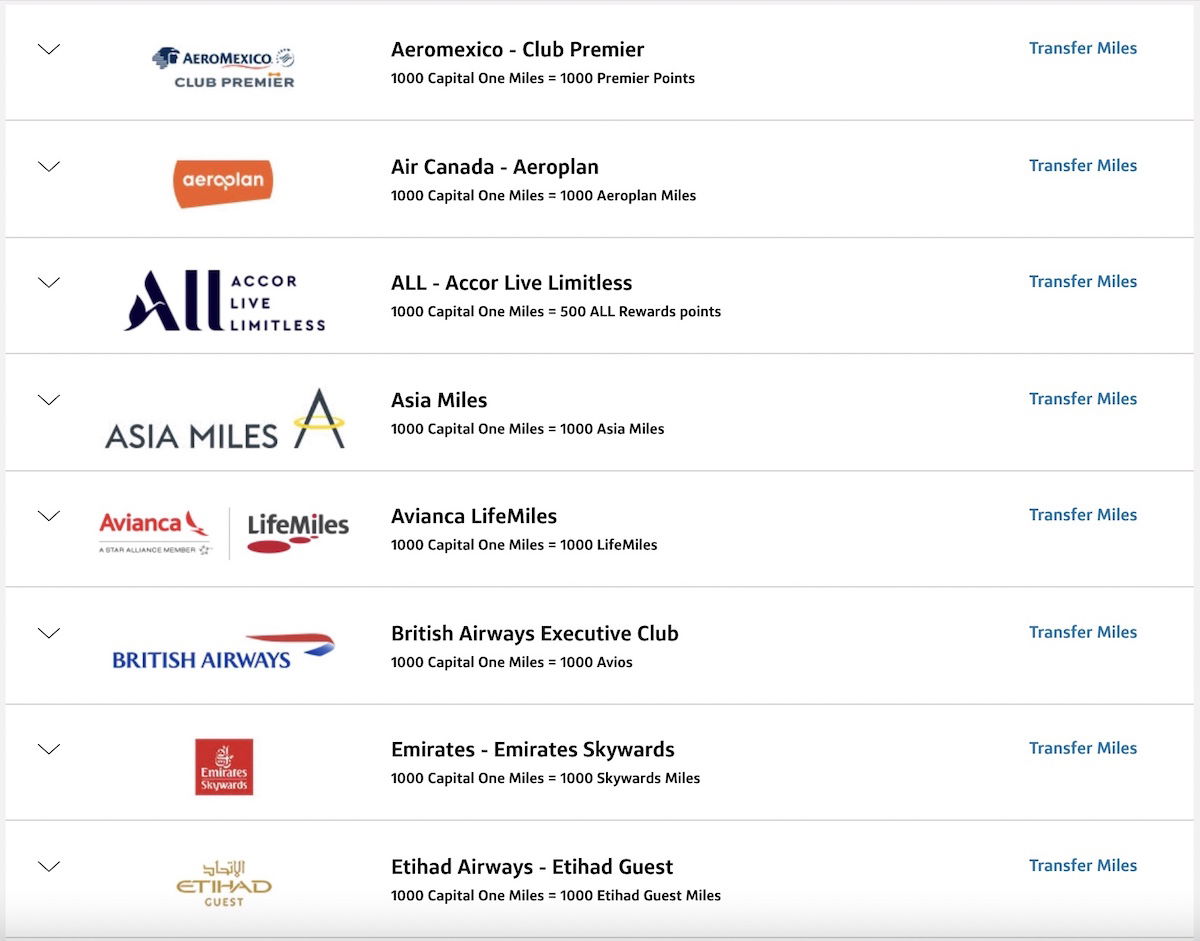

Capital One miles can be transferred to 20 travel partners, including 17 airline loyalty programs and three hotel loyalty programs. Personally, my favorite use of Capital One miles is transferring them to airline partners, given the huge value that can be had for first & business-class redemptions.

Airline Partners | Hotel Partners |

|---|---|

Aeromexico Club Premier | |

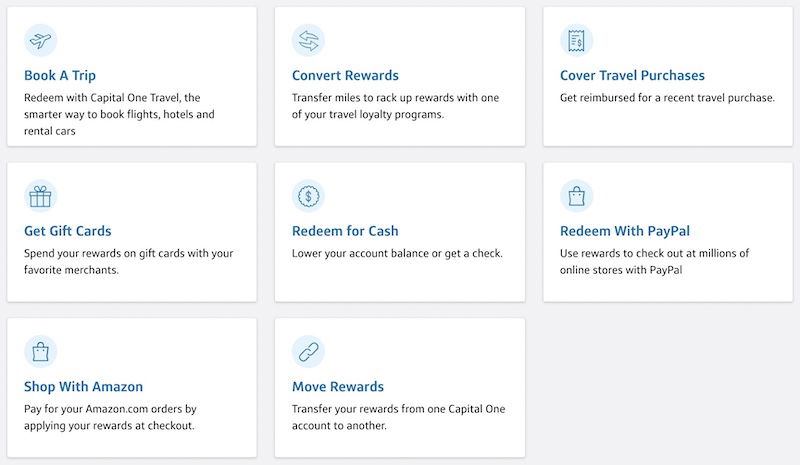

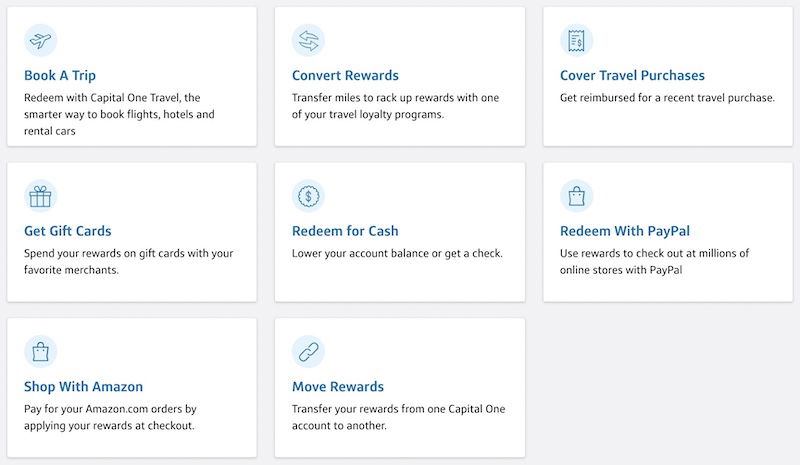

The process of transferring miles is easy. Just log into your Capital One account, which will bring you to your account dashboard. When you’re at your account dashboard, you just need to get to the “Rewards” page, which can be accessed by clicking the “Rewards Miles” button, displayed underneath your mileage balance.

On the rewards page, you’ll see the section for “Convert Rewards,” so you’ll want to click that.

That will list all of Capital One’s transfer partners, so select the program you want to transfer your Capital One miles to.

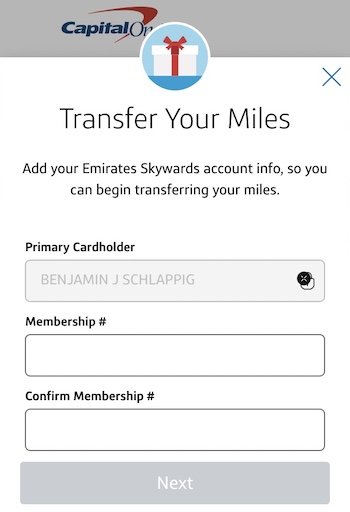

When you see the program you want to transfer miles to, click the “Transfer Miles” button. You’ll see that the cardholder’s name is already pre-populated, which is because you can only transfer miles to an account registered to the primary cardmember. You’ll then want to enter the membership number with the partner loyalty program.

On the next page, you’ll be asked to select how many Capital One miles you want to transfer to a partner program.

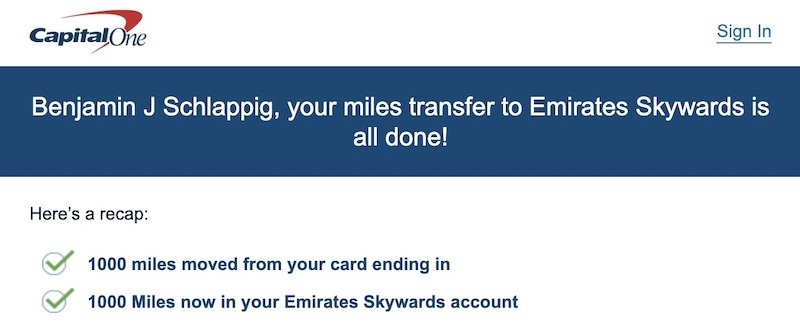

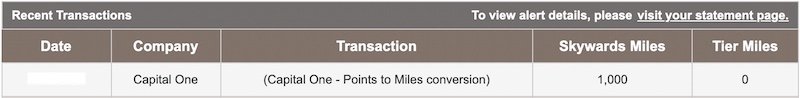

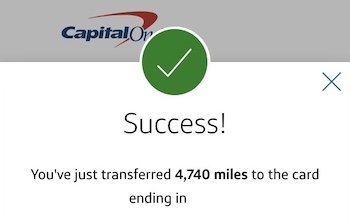

Once you transfer miles and they post in the partner account, you’ll receive an email confirmation stating that the transaction was completed.

Sure enough, when I checked my Emirates Skywards account, the miles had already posted.

See our guide to how long Capital One mileage transfers take — as you can see, most transfers are instant, but some take a few hours or even a couple of days. Also, check out our guide on the best ways to redeem Capital One miles.

How to combine Capital One miles between accounts

Miles earned on a Spark and Venture cards are worth the same, can be redeemed in the same way toward travel, whether transferring the miles to a partner program or redeeming through Capital One Business Travel.

The process of combining Capital One miles between your card accounts is easy. When you’re at your account dashboard, you just need to get to the “Rewards” page, which can be accessed by clicking the “Rewards Miles” button.

On the next page you’ll want to go to the “Move Rewards” section, which allows you to transfer miles between accounts.

Assuming you have multiple cards, you should then see the other cards listed that you can transfer points to.

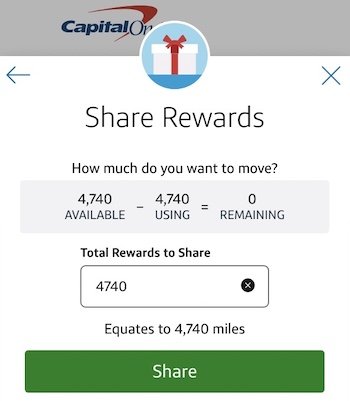

You’ll then be asked how many miles you want to transfer. You can transfer some or all of the miles in your account.

The miles will then appear in the account you transfer them to instantly.

You can keep moving miles back and forth as much as you want, and this doesn’t in any way impact the expiration of your miles. Assuming you have multiple Capital One cards earning miles, make sure you transfer out your miles before closing your account. For example, this could be useful if you’re closing the Venture Card and opening a Venture X Card.

One other cool angle is that if you have the Capital One Savor Cash Rewards Credit Card (review) or Capital One Spark Cash Plus (review), those rewards can be converted into miles using the same functionality. While these are cash back cards, each cent cash back can be converted into one Capital One mile.

This is potentially a fantastic opportunity, as both cards have a great rewards structure:

- The Savor Cash Rewards Card offers 3% cashback on dining, grocery stores (excluding superstores like Walmart® and Target®), entertainment, and popular streaming services

- The Spark Cash Plus offers 2% cashback on all purchases, with no pre-set spending limit

These are potentially some great credit card duos for maximizing your rewards.

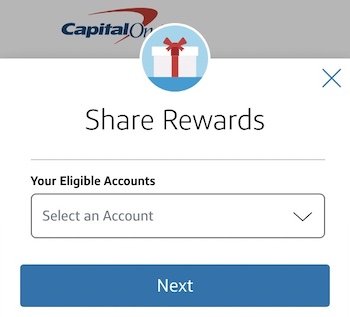

How to share Capital One miles with others

One of the awesome things about Capital One miles is that you can share them with other Capital One cardmembers at no cost:

- You can share an unlimited number of Capital One miles with Venture or Spark cardmembers

- There’s no requirement for the person you’re sharing miles with to live at the same address, be a family member, etc.

- When you transfer miles to others, there are no additional expiration policies, or other major restrictions

- This option applies to credit cards that earn Capital One miles

The easiest way to transfer Capital One miles to someone else’s account is by calling up Capital One. The best I can tell, this transfer option isn’t currently available online.

I can’t understate how valuable this is, as Amex, Chase, and Citi, all don’t offer this much flexibility when it comes to transferring your rewards to other cardmembers. Why is this so useful?

- This can be valuable if you want to transfer your miles to someone else’s loyalty account, since you could transfer your Capital One miles to their Capital one account, and then they could transfer to a loyalty account in their own name

- This can be useful if you don’t quite have enough miles in your account for a reward, but by transferring to someone else’s account you’ll have enough miles

- This can be useful if you’re thinking of closing down your Capital One card, so you can transfer the miles to someone else before doing so

Bottom line

Capital One’s mileage currency is getting even more mainstream, with the popularity of the Venture X Card and Venture X Business. I know a lot of people aren’t yet familiar with the ins and outs of Capital One miles, so hopefully the above is a useful rundown of what you need to know about transferring, combining, and sharing Capital One miles.

The process of transferring miles to airline and hotel partners is easy, as it is with most transferable points currencies. The same is true when combining points between Capital One accounts. What really sets Capital One miles apart, though, is the ability to transfer an unlimited number of miles at no cost to anyone else with a Capital One card.

To Capital One cardmembers, what has your experience been with transferring, combining, and sharing miles?

I wish there had been a response to "it can't be done" comments. My spouse and I (mostly me) spent an hour trying to combine points from his VX (I'm an AU and Acct Manager on that) to my Venture (he's NOT and AU but am trying that). They only said my card isn't eligible. I even asked if I made him an AU on my card, would it make the card eligible. I did...

I wish there had been a response to "it can't be done" comments. My spouse and I (mostly me) spent an hour trying to combine points from his VX (I'm an AU and Acct Manager on that) to my Venture (he's NOT and AU but am trying that). They only said my card isn't eligible. I even asked if I made him an AU on my card, would it make the card eligible. I did not get an answer at all on that. I have read on a forum that being an AU is required. I'll find out in about 10 days when his card arrive. Of course, I need to xfer miles to transfer partner. Aeroplan states that he can book for me and our son using aeroplan miles, but I can't determine if that would be an issue with ANA due to this disclaimer on Air Canada: ""Eligibility for Flight Rewards on partner airlines is subject to partner airline restrictions."

My sister has miles in Venture, and she called to transfer all her miles to me, a Venture X account holder. The representative said these are "incompatible" miles and can't be combined. Have you heard of this? Or was this a lame rep that doesn't know what she's doing?

BTW, I've successfully combined my other friends' miles (all Venture X) to mine. So the key seems to be "Venture" (without the "X")

How long did the transfer take from the time you called? Was it instant? Thank you.

I just called Capital One to transfer my Venture miles to my wife's Venture X. I am also an authorized user on her account. The agent tells me it can't be done but can offer no specific reason why it can't be done.

I am an authorized user on my husband and I’s capital one account. Tried to transfer some points to Flying Blue tonight and it won’t let me because the names on our C1 account and my Flying Blue account don’t match. How do I fix this?! Should we make me an account manager?

Miles can only transfer to the main account holder airline loyalty program. You will not be able to transfer to authorized users.

I have been waiting 14 hours for 270K to post to Air France.

Miles are shown as debited, but have not been deposited.

I also transferred 18k from Chase to Air France and it was instant

Still waiting ......