The Brex Card for Startups has been around for a while now. Its offer was unique: a corporate credit card, but tailored to newly launched startups and tech companies, without requiring a personal guarantee.

Bottom line up front? You can get up to 110,000 bonus points as a welcome bonus for opening a no-fee business cash management account.

Here’s how.

In this post:

What is Brex?

Brex is a startup for startups. At its core, it’s a financial technology company that offers corporate credit cards and a modern alternative to a bank account to tech, life sciences, and many other types of businesses.

Many startups have difficulty accessing credit without a corporate credit history. As banks don’t have anything to make lending decisions based on, startups and other growing companies would oftentimes find themselves locked out of credit markets. They might have loads of funding, but no credit.

That’s where Brex stepped in. Instead of approving accounts based on a corporate credit profile, Brex started making lending decisions based on a company’s funding. They would monitor your corporate checking account, and extend a line of credit. The line of credit would fluctuate based on your bank balance.

This worked great for new tech companies. Flush with cash, they could get a line of credit with Brex with a monthly payment cycle that offered a compelling rewards program.

The downside was that some traditional businesses have not been among the industries Brex targeted historically. Lots of companies tried signing up for the product but were unsuccessful due to not having sufficient capital to meet Brex’s underwriting requirements.

That’s all changing. Brex’s new products are now available to businesses in all industries, with a few standard exceptions.

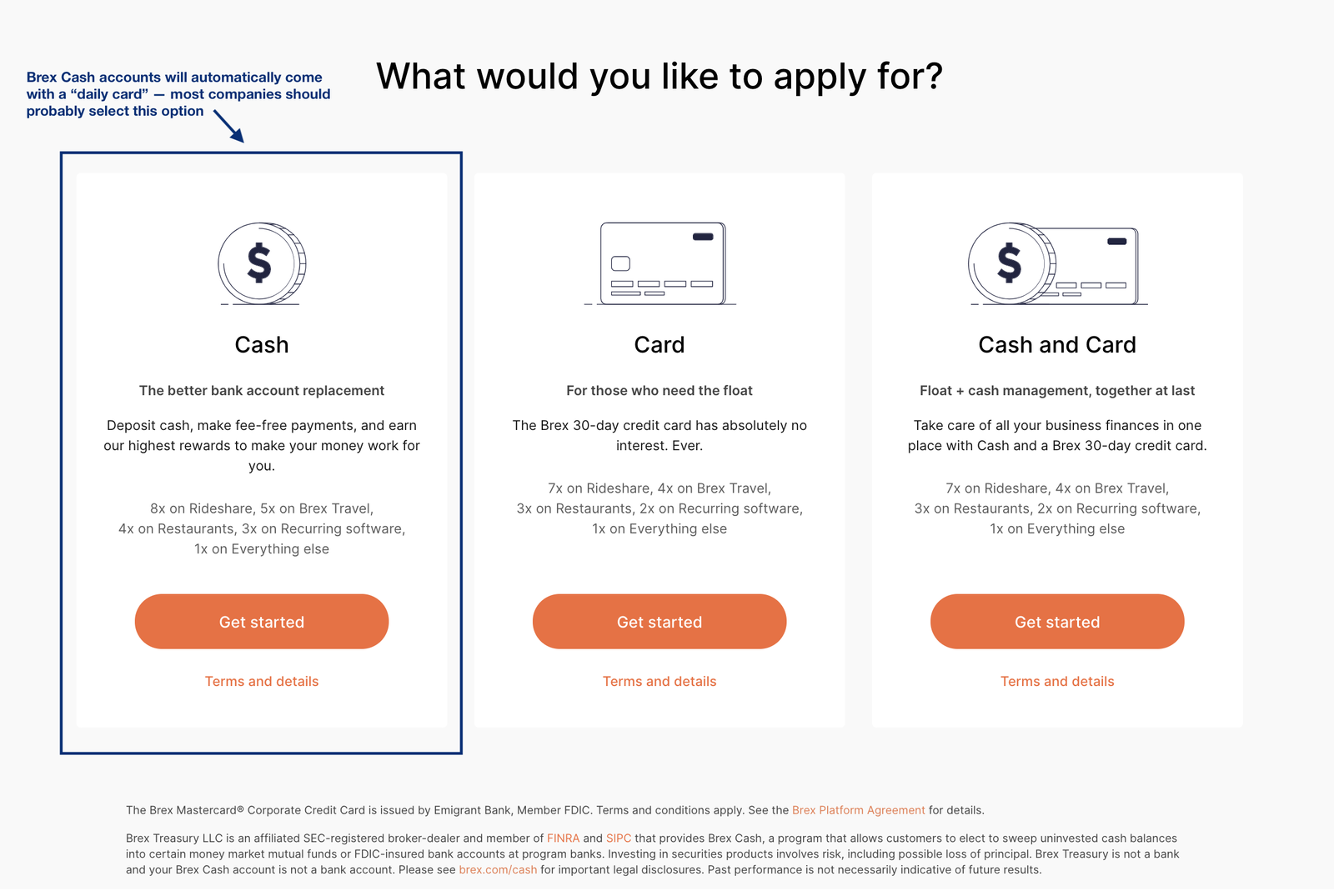

Brex is expanding its offerings to serve more businesses and launching some new products. There’s a Brex Cash account, which is a sleek update to a traditional cash management account, and then a new Brex Daily card complete with rewards. Brex’s lineup now consists of:

- Brex credit card with monthly statements (formerly Brex 30 Card or Brex for Startups)

- Brex credit card with daily statements (previously referred to as Brex Daily or Brex 1)

- Brex Cash (this is the one I’m excited about)

I’ll break down the new products in this post, but the key point to know is that some variant of Brex is now potentially available to most businesses in the U.S., without being limited to tech or life sciences companies (though Sole Proprietorships are not currently eligible), and there are some awesome welcome bonuses exclusively for OMAAT readers.

What is Brex Cash?

Brex Cash is a cash management account that functions much like a business or corporate checking account (although it isn’t a bank account), but is updated for the way businesses work in the modern world. You can use the account to deposit checks, send and receive ACH transfers, wire money internationally, and manage spending for different users.

There are no fees for the account, which is fantastic. International money wires are even free (though there may be a fee for the person sending or receiving the wire depending on their bank).

Brex Cash also includes a Brex credit card that can be used like a debit card that earns rewards. Instead of making a payment every month like a traditional credit card, with the Brex card your charges are paid daily against the balance of your Brex Cash account (or you can alternatively apply for a Brex credit card with monthly statements).

The Brex credit card with daily statements essentially serves like a debit card or a prepaid credit card. You can only spend what you have available in your Brex Cash account, and all charges are accounted for daily.

How does this fit in with the current Brex Card?

As mentioned, Brex is also keeping a version of the card with a monthly payment period. That is like a traditional credit card as you pay your statement every each month.

The Brex credit card with monthly statements will be available to qualified companies in more industries, and the rewards structure will differ a bit. Your credit limit will be determined by either your Brex Cash account or your external corporate checking account.

Category | Brex Cash + Brex Card, paid daily | Brex Cash + Brex Card, paid monthly | Brex Card only, paid monthly |

|---|---|---|---|

Earning Rates | • 8x on rideshare • 5x on Brex travel • 4x on restaurants/dining • 3x on Apple products • 3x on recurring software • 1x on everything else | • 7x on rideshare • 4x on Brex travel • 3x on restaurants/dining • 3x on Apple products • 2x on recurring software • 1x on everything else | • 7x on rideshare • 4x on Brex travel • 3x on restaurants/dining • 3x on Apple products • 2x on recurring software • 1x on everything else |

Sign-Up Bonus | 80,000 after spending $1,000 on your new Brex card | 80,000 after spending $1,000 on your new Brex card | 80,000 after spending $1,000 on your new Brex card |

Other Bonuses | • One-time 20,000 bonus points when you link payroll to your Brex Cash account • 10,000 additional points after spending $3,000 on your Brex Card in the first 3 months | • One-time 20,000 bonus points when you link payroll to your Brex Cash account • 10,000 additional points after spending $3,000 on your Brex Card in the first 3 months | N/A |

Points Redemption Options | • Cash Back: 1¢/pt • Gift Card: 1¢/pt • Travel Portal: 1¢/pt • Miles Transfer: 1:1 | • Cash Back: 1¢/pt • Gift Card: 1¢/pt • Travel Portal: 1¢/pt • Miles Transfer: 1:1 | • Statement Credit: 1¢/pt • Gift Card: 1¢/pt • Travel Portal: 1¢/pt • Miles Transfer: 1:1 |

Qualification Criteria | For all business types* with no minimum balances or funding requirements | $50,000 minimum balance in any bank account | $50,000 minimum balance in any bank account |

The above earnings rates are for the tech version of the Brex card with monthly statements. There is also a life sciences version of the Brex 30 card with monthly statements, which has different bonus categories. That card earns 7x points on conference tickets in lieu of rideshare, 2x points on lab supplies instead of software charges, and doesn’t have a bonus for dining/restaurant spend.

If you currently have a Brex card with monthly statements (called the Brex Card for Startups), you’ll have the option of switching to the daily payments schedule. If you do that, you’ll earn a 1x multiplier on your spend. This is similar to how the Brex Exclusive rewards worked previously.

Earning points with Brex Cash

The Brex Daily card with daily payments that automatically comes with a Brex Cash account earns up to 8x points in certain bonus categories. Here’s what you’ll earn*:

- 8x on rideshare (Uber, Lyft, taxis, scooters)

- 5x on travel booked through Brex Travel

- 4x on restaurants and dining

- 3x on recurring software charges, like Salesforce

- 3x on eligible Apple products through the Brex portal

- 1x on everything else

Basically, with a Brex Cash account, you earn more rewards when you opt for the daily payment schedule, which makes sense, as Brex isn’t having to float those balances all month. The 1x rewards multiplier boost for rewards on the daily payments cycle is more lucrative, though some businesses may find the monthly payment schedule more attractive at the cost of the extra point per dollar.

I’m also told that the Brex Cash and Brex card with daily statements combo will be easier to get approved for (which again makes sense, as it’s tied to your balance in a feature-rich cash management account).

*Multipliers are subject to change.

Brex Rewards points redemption

Brex is making a few additions to how you can redeem your points, including additional redemption options for those with a Brex Cash account:

- New! 100 points for $1 cash back deposited to your Brex Cash account

- New! 100 points for $1 in gift cards through the Brex dashboard

- 100 points for $1 in travel credits through Brex Travel (this hasn’t changed)

- Transfer points to airline frequent flyer programs (this hasn’t changed)

It’s worth noting that if you don’t have a Brex Cash account and only the traditional Brex credit card with monthly statements, you can no longer redeem points for statement credits at $1 per 100 points. Instead you’ll only get $0.70 per 100 points, which is a significant reduction. While most OMAAT readers won’t want to redeem for cash back, some may — and getting a 8%, 5%, or 3% discount on all of your purchases in those categories is very compelling.

You don’t have to wait for your statement to close in order to convert those points to frequent flyer miles for future travel — instead, you can convert your points to cash to be used immediately. That really makes this account standout.

You can still transfer points to a frequent flyer program like before. Those partners aren’t changing. You can transfer points at a 1:1 ratio to the following programs:

Aeromexico Club Premier | Emirates Skywards |

Air France/KLM Flying Blue | |

Avianca Lifemiles | Qantas Frequent Flyer |

Cathay Pacific Asia Miles | Singapore Airlines KrisFlyer |

Brex has added new rewards options that make the card even more appealing for businesses. Being able to redeem points for cash is a nice option to have while still being able to transfer points to frequent flyer programs. The flexibility of Brex points makes this a compelling card, especially considering there’s no annual fee.

Sign up bonus for the new Brex Cash

As a special bonus to OMAAT readers, Brex is offering an 80,000 point sign-up bonus to those who sign up for and are approved for Brex Cash accounts through OMAAT. The account just needs to be funded, and you’ll get the bonus points once you’ve spent $1,000 on your new Brex card.

On top of that, you can earn up to 30,000 additional bonus points:

- You’ll earn 20,000 bonus points when you link payroll to your Brex Cash account

- You’ll earn an additional 10,000 points after spending $3,000 on your Brex Card in the first 3 months

That’s potentially 110,000 points, which can be redeemed as cash back, towards travel, or transferred to airline partners. That’s an incredible offer for a no-fee card in general, and really unheard of for a secured/debit card product.

Transfer Brex points to Asia Miles to redeem for Cathay Pacific first class

If you’re approved, your new account can be available instantly. You can deposit money right away, and are even given a virtual card number to use instantly. It really couldn’t be much simpler. I opened a Brex Cash account a few months ago, and was pleasantly surprised to see that rewards points posted on a daily basis as well.

With Brex Cash and the Brex card with daily payments, you’ll be able to spend as much money as you have available in your account and your credit limit will be 80% of your Brex Cash account balance. If you are approved for the Brex card with the monthly payment cycle, credit limits will be based off of your corporate checking account balance.

With that in mind, if you are eligible for Brex it’s well worth signing up for. Earning 8x points for rideshare and 4x points for restaurants and dining worldwide for an account with no fees is industry-leading.

Other Brex benefits

Brex account holders get a slew of other benefits, on top of earning rewards. Brex advertises up to $150,000 in value with a card (up from $50,000). Most companies won’t take advantage of the full $150,000, but it’s worth pointing a few things out:

If you use Amazon Web Services, it’s definitely worth getting this card as it comes with a $5,000 AWS credit and up to $100,000 in AWS Activate, depending on eligibility.

It comes with a $150 Google Ads credit, and between 20% and 50% discounts on other software products including Gusto, Slack, Zoom, Carta, QuickBooks, and Dropbox. Of those, I only use Gusto and Slack for my business, but those discounts would still put cash back in my pocket (especially as there isn’t even an annual fee to offset).

Who’s eligible for a Brex Cash account?

Most types of businesses are now eligible for Brex Cash accounts, with the following restrictions:

- Your company must be organized and registered in the United States, and have a valid EIN

- Your company must be a C-corp, S-corp, LLC, or LLP — because of the way Brex handles underwriting, Sole Proprietorships (even if registered in their locality and in possession of a valid EIN) are not eligible at this time

- Your company must not be in an industry where there are additional Federally-imposed financial regulations (gambling, marijuana, guns/ammunition, prostitution, etc.)

Because Brex is for businesses, it was important to apply for the older version of the card using a business email address, so I would recommend doing that this time around as well. Brex doesn’t make mention of it, but I don’t think it’d hurt.

Signing up for Brex accounts is generally fast and straightforward. They don’t underwrite based on your personal credit score, so there’s no inquiry on your personal credit report, and you won’t see a hard inquiry on your personal credit report for opening this account.

Keep in mind that the payment cycle for the Brex card with daily statements works a bit differently than a traditional credit card. Instead of receiving a statement every month and paying once monthly, payments are required daily. If cash flow is an issue, Brex Daily isn’t for you.

Note, if you are currently a Brex for Startups cardholder, you’ll need to open a Brex Cash account through your member portal (and unfortunately aren’t eligible for this 80K welcome bonus). The good news is that with Brex Cash + Card you will be collecting more points than under the Card only program.

Bottom line

I’m excited to see Brex expand its product and offer it to traditional businesses. Their cards have no annual fee and their cash management product comes with a number of benefits for which banks would charge a hefty monthly account maintenance fee. We haven’t seen much innovation with business checking accounts, so I’m interested to see where this cash management account goes.

On top of that, you can earn rewards for your business spend that can be transferred to frequent flyer programs or converted to cash, and getting anywhere from 80,000 to 110,000 bonus points to start off with is incredible.

Hi, I was wondering if this offer was still live? Thanks!

Has anyone else found their points did NOT post? Support even confirmed that I was on the onemileatatime promotion, but I've yet to see the light of the 80,000 points.

Lucky - I have an EIN (sole proprietorship) but recently applied for an LLC (application pending, not yet accepted) Do you think I could still apply for the Brex deal? I'm worried the offer will be gone by the time my LLC is approved.

Anyone have a recommendation on where to get "certificate of good standing" for my "S corp" ;)

It's requiring this now

@ dizzy -- Depending on what state you are in, you may be able to easily get one from your Secretary of State / Corporations Commission website. In Florida it was like $8 or something when we had to do it last.

Can anyone confirm if the $5K AWS credit is valid for existing AWS accounts or new accounts only?

@ Jonathan -- We've been told existing accounts qualify! It looks like you register/link accounts, and then statement credits are applied to your account when you pay with your Brex account. A bit like Amex offers.

Thanks for the heads up. Got approved and will be funding over next few days. I linked my paypal to my cash account, is that enough to get the 20k bonus? In the description it says paypal is one of the accepted platforms. Thanks!

@ scott -- It should be, if you have business income hit PayPal and then get deposited to your Brex account. We did the same thing but with Stripe.

Hi! I signed up using your link and was approved, thanks! I see there's a 50% off Gusto link for the first 12 months, but that's only if you're a new user and signup through their link. I already use Gusto -- could you revise the post to clarify that the discounts on those services are only if you're a new user and signup through the Brex links? Thanks!

@jpayne731 I just contacted support about this. It doesn't show up anywhere but they said they can see it on their end and the bonus is applied.

Signed up and approved, but on the rewards tab it says "Track your progress towards 30,000 bonus points". That's not 80,000!

@ jpayne731 -- That is expected! The 30k points are available to everyone, and are in addition to the 80k points from being an OMAAT reader. As long as you applied through our links, the 80k offer will be attached to your account once you've met the minimum spend.

Applied this morning and received this email 4 hours later. Don’t ever remember putting in my spending or gross receipts.

Thank you for your interest in Brex. We’ve reviewed your application, and unfortunately, we’re unable to approve XXXXXXXXX, PLLC for an account at this time for the following reason:

Your company does not meet the minimum cash requirement

We’re working hard to build more solutions to support all businesses.

@ Garrett -- It sounds like you may have applied for Brex Card rather than Brex Cash, since the former has a $50K minimum in the linked account. Many have reported being approved with smaller balances. If that's the case, I'd recommend applying again for Brex Cash.

What is the time limit to spend $1000 for the 80k bonus?

denied "Your application did not pass our internal screening process" Legit LLC started in 2016 with 4 employees. Also denied recently for cap one checking account. Opened about 5 bank and/or savings accounts last year. Only opened 2 credit cards in the last year.

I'm also unclear how the linking payroll would work too. My husband does have employees but he processes the payroll himself (he's a CPA) not through a service. More information on how to work the payroll part of it would be appreciated!

@ John @ Kari -- I believe you'd need to link through one of their payroll providers to get the bonus, which may not be worth the hassle in your situations.

However, the same bonus is available if you have business income deposited into the account from a payment processor. We linked our Stripe account, for example, but PayPal, Amazon, Square (they list several) should work if you use any of those for processing invoices or payments.

I have an engineering business and signed up today and used a gmail account that I use with my business and was approved. Moved some money into the account. Not sure how to work the payroll angle since I am the only person in my business.

I have 2 LLC's where I am the managing member. I wonder if I can apply for both...

After clicking through, I assume we click on Open an account. need to put anything into Referral Code (optional) field?

@ z o -- Nope, it's tracked via the link.

Awesome deal. I was approved as an S-Corp with 1-4 employees. Thanks Ben!

Lucky, thanks for the easy 80k points. I have a small side business that has a tax ID. I applied when you first posted about it. 1 year in biz, 10k annual and got approved. Spent just over $1000 on the card and got my 80k bonus within a few days.

Now, which program to transfer to....

@Lucky - I absolutely appreciate the details you provided. My feeling comes from a simpler interpretation of how many details need to be managed to optimize rewards. Unless the goal is to use this card for "most things", is not worth the additional hassle. Again, just my perspective. Not suggesting others (you) dont see value in it.

If you link payroll and pay it through ACH, do you get reward points for that?

@ Nathan -- Only for the "linking payroll" activity bonus. Broadly, you otherwise get points for using the Brex Card, not the ACH/banking functionality.

For what is worth, I applied and was denied. 12 employees and revenue in the 2M. Computer tech startup working for silicon valley startups(Airbnb, Turo, Google).

@ Srinivas Damle -- Thanks for the data point, hmmm. If you don't mind me asking, when did you apply, and were you instantly rejected, or did you get a rejection email after applying?

@ Adam3438 -- As Tiffany quotes above, your account is insured up to certain limits, so I really don't view that as a risk.

Too complicated for a startup to consider and too limited for a fast growing firm. They might be in death valley with their positioning but .... not my jam anyways so I may not be seeing the full picture.

@ Chatter -- I tried to be thorough in this post, so maybe I made it seem more complicated than it actually is. But I'm curious, what makes you think it's complicated? I'll write a separate post with my experience signing up. It took all of five minutes, online management of my account couldn't be easier, and the rewards post as expected. The process was significantly easier than some checking accounts I've signed up for in the past.

It depends a bit on what you choose as to whether the FDIC or SIPC coverage applies, but ultimately the accounts are insured.

I can imagine how for someone running a business with significant payables and a single owner (like Ben!) this mechanism offers a superb way to rack up hundreds of thousands of miles a year at little cost. As a CFO, I’d like to use this too, but I have partners who could potentially see it as self-dealing even if there’s no cost to them, even potential savings and benefits for the corporation. I have to...

I can imagine how for someone running a business with significant payables and a single owner (like Ben!) this mechanism offers a superb way to rack up hundreds of thousands of miles a year at little cost. As a CFO, I’d like to use this too, but I have partners who could potentially see it as self-dealing even if there’s no cost to them, even potential savings and benefits for the corporation. I have to pass, as my love of free travel is limited by insisting that I handle our collective money in a manner above reproach.

@ SST -- Hah, fair enough, though if you use the rewards for your business, it seems like that would be a win-win for your partners as well?

Benefits way too complicated for the average business owner to pay attention to. Most business value services not earning points on rideshare... but that’s just my opinion

Can someone interpret the disclosure at the bottom of the blog post into English? Is an individual account insured by the federal government up to $250,000 or not? I wouldn't trust these people.

@ Gene -- Yeah, their disclosures are oof, but I think that's because they are not technically a bank, and account holders have a variety of options as to what they do with their funds. So it depends a bit on what you choose as to whether the FDIC or SIPC coverage applies, but ultimately the accounts are insured.

From their FAQ's:

@ Gene -- Yeah, their disclosures are oof, but I think that's because they are not technically a bank, and account holders have a variety of options as to what they do with their funds. So it depends a bit on what you choose as to whether the FDIC or SIPC coverage applies, but ultimately the accounts are insured.

From their FAQ's: