Given the new offer that waives the annual fee for the first year, I figured it’s a good time to review what the Barclaycard Arrival® Plus World Elite Mastercard® has to offer and whether it’s worth a spot in your wallet.

Biggest bonus we’ve seen on the Arrival Plus

If you were to relaunch a card, I think offering the biggest welcome bonus ever is a great way to go about it. Currently, the Arrival Plus is offering 70,000 bonus miles if you spend $5,000 within the first 90 days. Recently, the card has offered bonuses of 40,000, 50,000, and even 60,000 miles so this is a solid increase.

Simple earning structure: 2X on all purchases

While American Express, Chase and Citi offer cards with a variety of bonus categories to fit just about anyone’s needs, Barclays has chosen to keep things very simple. With the Barclaycard Arrival Plus, you’ll earn 2X points per dollar on all purchases.

Redeem points for travel purchases after the fact

While you earn “miles” with the Arrival Plus, you won’t be earning miles that can be used to book award flights. Arrival miles are really points that can be redeemed for a statement credit when you pay for travel at a rate of 1 cent per mile.

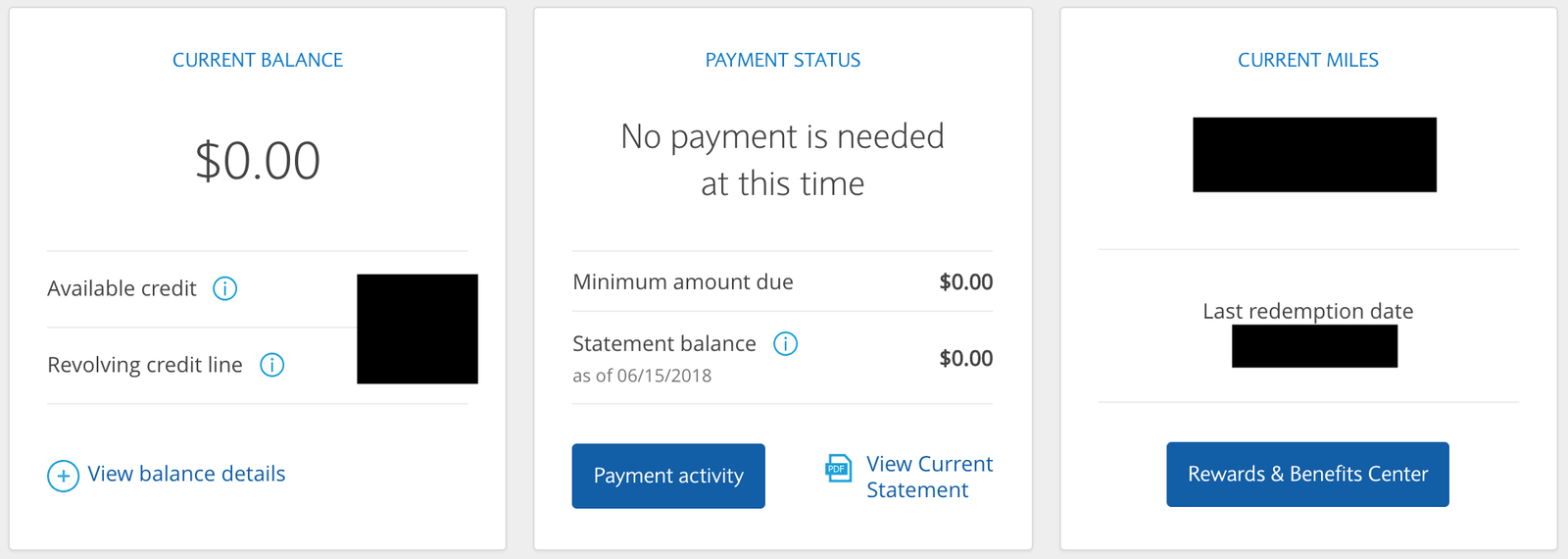

All you have to do is use your Arrival Plus card to pay for a travel purchase — it must code as travel — then go to the Rewards & Benefits Center when your purchase posts to redeem for a statement credit. Basically, it erases the purchase you have already made with the card.

The most inconvenient part of this benefit is that you can only redeem Arrival miles for purchases of at least $100 (10,000 miles).

It reminds me of the unnecessary complexity of the airline fee credits that come with The Platinum Card from American Express. I’d like to see Barclays change the redemption requirements to something more like the Chase Sapphire Reserve travel credit which reimburses all travel expenses of any amount up to $300 per cardmember year.

If the Barclaycard Arrival Plus still allowed us to redeem Arrival miles for all travel purchases including those less than $100, I think that would be a big improvement. Just think of all those one-night hotel stays that could be covered.

On the flip side, however, you don’t have to have enough Arrival miles to cover the full cost of your purchase. So you can take $100 off a more expensive travel purchase rather than trying to get the exact amounts.

Get 5% of your Arrival miles back when you redeem for travel

One aspect I really do like about redeeming Arrival miles is that you get 5% of your miles back when you redeem for travel. Let’s say you earn the welcome bonus of 70,000 Arrival miles. You’d also have an additional 10,000 miles from hitting the minimum spend so you really have 80,000 miles.

If you book a $800 flight or spend $800 on a hotel stay (or a few stays), you could redeem your Arrival miles for these purchases. Once you do so, you would then receive 4,000 miles back into your account. Now, I realize 4,000 miles probably isn’t that exciting but, if you’re shooting for a $100 redemption, you’re already 40% of the way there.

With this rebate, you might have noticed that you’re really earning about 2.1X Arrival miles per dollar. I’m not over the moon about this, but it’s a solid return, particularly for everyday spend.

What counts as travel when redeeming Barclaycard Arrival Plus miles?

Obviously, with a 5% rebate on travel rewards, that’s where you’re going to want to use these miles. Fortunately, the definition of “travel” on the Barclaycard Arrival® Plus World Elite Mastercard® includes quite a few categories:

- Airlines

- Hotels/Motels

- Timeshares

- Campgrounds

- Car Rental Agencies

- Cruise Lines

- Travel Agencies

- Discount Travel Sites

- Trains

- Buses

- Taxis

- Limousines

- Ferries

In practice, you likely won’t be using your Arrival Plus miles for many bus trips, given the $100 minimum, but the range of options here is quite nice otherwise.

International chip and pin capability

Besides the welcome bonus, I think the Arrival Plus‘ chip and pin capability is my favorite part of this card. While the vast majority of American credit cards are chip and signature, the Arrival Plus at least provides the option for chip and pin when a point of sale requires it — think train stations in Europe.

Personally, I really enjoyed being able to use my Arrival Plus on train tickets in Munich during Oktoberfest last year. In fact, I was able to help friends who didn’t have a chip and pin card and needed train tickets as well — don’t worry, they reimbursed me.

Free shipping with ShopRunner

I think most people are used to getting a free ShopRunner membership with an American Express card. However, as a World Elite Mastercard, the Arrival Plus also provides this benefit which provides free 2-day shipping from 100+ merchants.

Free TransUnion FICO Credit Score

It’s always a good idea to keep an eye on your credit score — and credit report for that matter. With the Arrival Plus, you’ll have access to your TransUnion FICO credit score and it will update monthly so you can track it easily.

This is similar to the benefit provided by many American Express cards which provide your Experian FICO score and many Citi cards which provide your Equifax score.

When you consider last year’s Equifax data breach issues and the chance for other similar issues, I won’t complain about having access to any of my FICO credit scores.

Is the Barclaycard Arrival Plus right for you?

If I had to answer this simply I’d say it’s definitely a maybe. How’s that for clarity?

But, seriously. If you’re newer to the miles and points world, I’d say ignore this offer and focus on earning Ultimate Rewards points before you max out with the Chase 5/24 rule. Beyond 5/24 is where things aren’t quite as clear.

If you’re exclusively focused on earning miles and points for business and first class awards, perhaps Amex Membership Rewards points and Citi ThankYou points are more of a priority. However, I know many people — myself included — often book cash fares for domestic flights or hotel stays when the price is right. This is where the Barclaycard Arrival Plus can really come through big for us.

Additionally, I’ve seen tons of people use Arrival miles to cover the cost of park tickets when visiting Disneyland or Disney World by using the card to purchase with Undercover Tourist, Expedia, and Orbitz. If you have kids or are just a Disney fanatic, this could help save you a nice chunk of change.

You can also use Arrival miles to pay for stays outside of chain hotels, like Airbnb and boutique properties — or anything that codes in one of Barclays’ travel categories.

Even swanky Aman hotels are more accessible with Arrival Plus miles

Similarly, if you have constraints on your travel schedule that make finding award seats challenging, the Barclaycard Arrival Plus can help you purchase some flexibility. Making the tradeoff between a less-direct routing or paying fuel surcharges is a bit easier if you can use Arrival miles to pay the taxes and fees on award tickets!

Bottom line

Even with the great bonus of 70,000 Arrival miles, I just can’t bring myself to call this card a first-tier priority if your goal is international premium cabin flights. However, this isn’t a big knock on the card, I just think you can get more value by starting with Chase Ultimate Rewards — and then possibly Amex Membership Rewards.

I also think it’s a solid second-tier card for any style of traveler once you’ve taken advantage of Ultimate Rewards opportunities. The welcome bonus alone can easily help you take care of some economy flights and possibly a few hotels or stays in an Airbnb.

If you’re looking to redeem for economy flights, however, this is a great card, particularly for domestic flights with limited award availability.

And as I mentioned earlier, the Arrival Plus can really help with the additional costs that you might incur while traveling, such as ground transportation, park tickets, and even those pesky fuel surcharges.

Who has the Barclaycard Arrival® Plus World Elite Mastercard® already? How have you used your Arrival miles?

Hi. Can we use this card for hotel restaurants? Lots of hotels have restaurants inside. Can we redeem those points towards that? Thanks

id alsio like to know the hotel featured at the top of this post!

@ Julian @ ma'am -- That's Aman Sveti Stefan: https://onemileatatime.com/aman-sveti-stefan-review/

Actually the fact that the travel reimbursements are NOT limited is the key value to me compared to other cards. Put on any limit and it becomes harder, if not impossible, to justify the annual fee. Remember these "miles" are not transferrable, so the only way this card works mathematically (after the first year with its enrollment bonus) is to offset an important value of travel expenses. I'll probably offset more than $1,500 this year....

Actually the fact that the travel reimbursements are NOT limited is the key value to me compared to other cards. Put on any limit and it becomes harder, if not impossible, to justify the annual fee. Remember these "miles" are not transferrable, so the only way this card works mathematically (after the first year with its enrollment bonus) is to offset an important value of travel expenses. I'll probably offset more than $1,500 this year. What is the point of 2.05x if that cash back is good for only $300 a year, and there's a $95 fee? That statement reads like it was made by a person who has researched the card but doesn't really understand where its value lies.

Does anyone know what hotel/resort's pool is featured as the Title Photo in this post?

$5K. that's a lot to spend for a bonus. And with the annual fee-did you forget to mention that-this card is not better than the no-annual fee Citi Double Cash, assuming you have a backup for no foreign transaction fees.

Hello FFRIENDS!!!!!!!! why no reaction or Acknowledgement ?????

How are you today???? I was AI Japan fOR a few days. I tried the Lounge First from Japan Airlines I. Haneda . Andn the food was DELICIOUS ¡!!!!! I RECOMMEND ¡!

Just got it - decided to go for this with $600 in travel instead of the JetBlue card. The great thing is you don't have to wait a long time to redeem, pretty much on your next trip there's opportunity to get all or part of the $600!