We’re slowly seeing credit card issuers make some changes to reflect the current environment. For example, Brex has adjusted rewards to reflect that most businesses are working remotely, and Chase is offering a $100 statement credit towards the annual fee for select Sapphire Reserve cardmembers.

Now we can add another card issuer to the list of those adapting to the current environment.

Amex extends welcome bonus spending period by three months

There can still be a lot of value in signing up for the right travel rewards credit card (assuming it doesn’t cause you to spend irresponsibly, or cause you to spend more than you otherwise might). However, a lot of people are struggling to meet the minimum spending requirements that are needed to earn the welcome bonuses on cards.

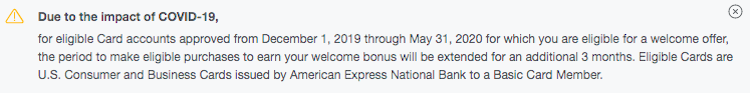

As a result, American Express is giving people three extra months to complete the minimum spending for welcome bonuses on card accounts:

- This is valid for cards approved between December 1, 2019, and May 31, 2020

- The period to make eligible purchases to earn your welcome bonus is being extended by three months over what it normally would be

- Eligible cards are US consumer and small business cards issued by American Express National Bank to a basic card member

If you’ve been considering an American Express card but were worried about completing the minimum spending, this could present a good opportunity.

Bottom line

It makes perfect sense for card issuers to give new members more time to complete minimum spending on credit cards.

Many individuals and small businesses are spending significantly less than in the past, and may no longer be able to complete minimum spending on a card as fast. Similarly, this could be a good incentive to get people to sign up for cards now.

I wouldn’t be surprised to see other card issuers introduce a similar policy.

Will you benefit from this new Amex grace period on completing minimum spending?

People really will complain about everything.

Let's hope Chase and BoA does the same thing.

@Lucky just to clarify, in your post it says cards approved through May 31 will get an additional three months. So, does this mean if I get it approved on May 31, I essentially have six months to complete the bonus spend requirement? Thank you for your explanation.

@Andrew R

+1. I deliberately avoided getting the Delta Platinum because I knew that I wouldn't have been able to hit the spending minimum in three months in the new normal. Had I known they would announce this change just two days after the expiration for signup on the 100k offer, I would have chosen a different path, one which would have been better for me and better for them. Surely they knew their plans...

@Andrew R

+1. I deliberately avoided getting the Delta Platinum because I knew that I wouldn't have been able to hit the spending minimum in three months in the new normal. Had I known they would announce this change just two days after the expiration for signup on the 100k offer, I would have chosen a different path, one which would have been better for me and better for them. Surely they knew their plans before April 1. Strange choice on their part. Perhaps they don't want more business?

@Colin...I have the Delta AX card and just checked with them...they confirmed they have extended the date by another 3 months...Its really a great gesture from AX and wish the other banks would follow

Just finished chat with Amex. They are extending to August the time I have to meet the spend on an upgrade offer they gave me last month.

side note - the 'color' of my Amex plat is now more black when I go online, I guess the new CC are are in the works?

@GoAmtrak:

So “wasting” spend on $500 is what, like maybe $3 compared to putting that spend on a 2% no annual fee cashback card that’s the typical fallback option for unbonused spend? Maybe more like $15-20 if it’s in some 5% category bonus (though I would be trying to find something else, personally)?

I mean, seems like a pretty modest priced security blanket from the RAT if you ask me.

(I chucked unbonused spending AMEX’s...

@GoAmtrak:

So “wasting” spend on $500 is what, like maybe $3 compared to putting that spend on a 2% no annual fee cashback card that’s the typical fallback option for unbonused spend? Maybe more like $15-20 if it’s in some 5% category bonus (though I would be trying to find something else, personally)?

I mean, seems like a pretty modest priced security blanket from the RAT if you ask me.

(I chucked unbonused spending AMEX’s way from a 2% card to knock it out early. Boo hoo, I only got 1.7% back...)

Would have been nice to announce BEFORE the bonuses on the delta cards went down. Thanks Amex.

Do you think Amex will extend the validity of the airline fee waivers?

Good, I hope Chase does the same. I have a United Business card with the 10K spending requirement that I'll have a hard time getting to by mid-May.

Does this apply to the DL Amex cards? I signed up for the DL Amex Platinum card last month and hopefully this will apply too.

Already nailed a Green Card bonus on natural spend, I can be choosier for a Hilton Amex bonus that I got for 2.5% back on groceries with no annual fee.

(I have reasons why I don’t want the Aspire yet- for one thing I should be able to upgrade this card and get a nice bonus offer, the other is why pay $95 for status I can’t use?)

Good, now AmEx needs to be more systematic about annual fee waivers/challenges.

Also, what if you already completed a signup minimum spend but then dipped back below the threshold due to refunds? I met the Green 45k bonus last month, which posted. But due to travel refunds, I'm now short $500. Does this mean I have an extra 3 months before the RAT team claws back the 45k? I could probably spend that much on...

Good, now AmEx needs to be more systematic about annual fee waivers/challenges.

Also, what if you already completed a signup minimum spend but then dipped back below the threshold due to refunds? I met the Green 45k bonus last month, which posted. But due to travel refunds, I'm now short $500. Does this mean I have an extra 3 months before the RAT team claws back the 45k? I could probably spend that much on dining in that time, but likely not on travel, and I don't want to "waste" the 3x for general spend. Or should I act as if, now that I got my bonus, there's no grace period at all and it could be rescinded at any time?

It looks like the offer pages still show 3 months but they do have a banner at the top showing the additional 3 month qualification period