I’m a big fan of American Express business cards. I find that for those with excellent credit, Amex business cards are among the easiest to be approved for. Amex likes to work with small businesses from early on, so even if you have a small business that’s in its early stages, it’s typically not too tough to be approved for their cards. It looks like a new restriction has been added to Amex business card applications this year, which I’ve received quite a few questions about.

The basics of applying for an Amex business card

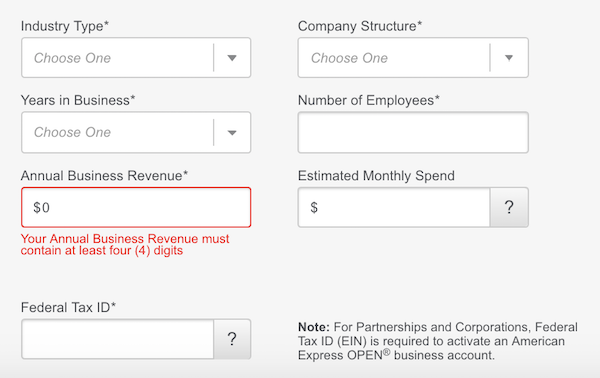

It can be intimidating to apply for your first business credit card, though even if you’re a small business or sole proprietorship, you should be eligible. When applying for an Amex business card, you’ll be asked the following questions:

- Legal Business Name

- Business Address & Phone Number

- Industry Type

- Company Structure

- Years In Business

- Number Of Employees

- Annual Business Revenue

- Estimated Monthly Spend

- Federal Tax ID

If you’re a sole proprietorship, how should you approach this? First of all, and most importantly, answer everything truthfully. I think the concern that a lot of people have is that they think they need an incorporated business, a separate office, etc., in order to be considered for a business card. That’s not the case:

- You can use your name as your legal business name

- The business address and phone number can be the same as your personal address and phone number

- You can select “other” as your industry type, if that’s the case

- If you’re a sole proprietorship, you can select that as your company structure

- In terms of years in business, there’s no shame in saying it has been less than a year, 1-2 years, etc.

- In terms of the number of employees, saying just ons is perfectly fine

- For the federal tax ID you can put your social security number

The new restriction on Amex business card applications

There’s one new requirement that Amex seems to have instituted on business card applications recently, which is noteworthy. In the past it used to be possible to get approved for an Amex business card while stating $0 as the “Annual Business Revenue.” That’s no longer the case — now if you try to enter $0, you get a message saying that “Your Annual Business Revenue must contain at least four (4) digits.” Unfortunately $10.01 doesn’t count as four digits for these purposes.

This means that to be approved for an Amex business card, you need to have a minimum business revenue of $1,000.

I’ve received several reader questions regarding this, mostly from people asking what they should do. As I always say, you should answer every aspect of the application truthfully. Logically it doesn’t make sense that Amex wouldn’t approve someone for a card with $0 past business revenue, given that a start-up business that’s ramping up may not have any revenue yet, but may have big potential. After all, getting a good credit card should be one of the things you do while setting up your business.

That’s why it’s worth pointing out one interesting distinction I’ve heard from readers. Some report that Amex reps over the phone say that it’s acceptable to provide projected business revenue. In the case of the online application, I don’t see anything indicating whether the revenue stated has to be actual revenue from the past year, or projected revenue over the next year.

Personally I think it’s logical that you could state projected business revenue over the next year, as that matches what phone agents are reported to be saying, and they’re going through the same process. At least that’s how I interpret the application.

Amex business card bonuses

American Express has quite a few business cards and several of them have welcome bonuses right now, including:

- American Express® Business Gold Card

- The Business Platinum Card® from American Express

- The Blue Business® Plus Credit Card from American Express

- The American Express Blue Business Cash™ Card

- Marriott Bonvoy Business® American Express® Card

- Delta SkyMiles® Gold Business American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- The Hilton Honors American Express Business Card

- Access to Amex Offers

- Redeem Amex Points Towards Airfare

- $375

- Earn 2x on purchases of $5,000 or more in a single transaction on up to $2MM per calendar year

- Redeem Points For Over 1.5 Cents Each Towards Airfare

- Amex Centurion Lounge Access

- $895

- 2x points on purchases up to $50k then 1x

- Access to Amex Offers

- No annual fee

- 2% cash back on the first $50k then 1% thereafter

- Access to Amex Offers

- No annual fee

- Earn 6x points at Marriott

- Free Night Award Annually

- 15 Elite Nights Towards Status Annually

- $125

- Earn 2x SkyMiles on purchases directly with Delta

- First Checked Bag Free

- Priority Boarding

- $0 introductory annual fee for the first year, then $150

- Earn 3x SkyMiles for purchases directly with Delta

- First Checked Bag Free

- Annual Companion Certificate

- $350

- Annual Companion Certificate

- Upgrade Priority

- First Checked Bag Free

- $650

- Earn 12x points on eligible Hilton purchases

- Hilton Honors™ Gold Status

- Hilton Honors™ Diamond Status With Spending

- $195

Bottom line

Amex’s business applications now require you to state at least $1,000 as your business revenue. For a vast majority of businesses that shouldn’t be an issue. However, if you have a start-up small business and don’t have any business revenue yet, there seem to be inconsistent reports as to whether that’s intended to be revenue in the past year, or projected revenue. Amex phone reps seem to be saying that it’s acceptable to provide projected revenue, so personally I’d feel pretty comfortable applying and stating the projected revenue.

Has anything changed in regards to the $1,000 Business Revenue Minimum requirement?

Seven years after closing a card Ian usually when it drops off your credit report, which is why “lifetime” is really seven years. Also, I applied for the Blue for Business a month ago and got the 4 digit requirement for income. I actually didn’t think this was “news” and was normal. Of course I claimed the minimum $1000 and was instantly approved. As long as you’re racking up merchant fees I can’t see them...

Seven years after closing a card Ian usually when it drops off your credit report, which is why “lifetime” is really seven years. Also, I applied for the Blue for Business a month ago and got the 4 digit requirement for income. I actually didn’t think this was “news” and was normal. Of course I claimed the minimum $1000 and was instantly approved. As long as you’re racking up merchant fees I can’t see them ever investigating whether or not folks with these cards have legit businesses.

@Max

No, they don’t show up on your personal credit report. I have both the Amex Gold Rewards card and the Amex Business Gold card. Only the personal card is reflected on my credit report — on all 3 credit reporting agencies.

I confirm, for new application online, there is validation on Annual Business Revenue to be 4 digits means $1000 or more. Tried all different combination to hack it, doesn't work online application form. Applying over phone with annual business revenue less $1000 is accepted.

If you apply over the phone, there is no min requirement. I got SPG Buz.

I did receive a bonus on a Amex Delta card last year on a card I had around 7 yrs ago

Thanks for info Robert!

@Tom Sorry, but having gotten a bonus is irrelevant. Even someone who got an AMEX card years ago when it didn't even come with a bonus cannot get a bonus on the same card type.

There is one loophole though: @7 years after having gotten an AMEX card, the AMEX computer seems to "forget" that you had it, and word is you then qualify for a bonus on the new card. Haven't tried this...

@Tom Sorry, but having gotten a bonus is irrelevant. Even someone who got an AMEX card years ago when it didn't even come with a bonus cannot get a bonus on the same card type.

There is one loophole though: @7 years after having gotten an AMEX card, the AMEX computer seems to "forget" that you had it, and word is you then qualify for a bonus on the new card. Haven't tried this myself, as I don't have any AMEX cards that go back that far, but it comes from pretty reliable sources.

What lousy timing! My blog is not OMaaT so $1,000 in revenue would cause me a dance a jig! I was getting ready to close out one of my SPG cards and apply for another Amex Business card. I did tweak my site earlier this year and I am VERY optimistic about the results! *wink wink nudge nudge*

@ Lucky - Thanks!

My projected business revenue has been $5000 for the last five years or so. I keep falling well short of my target ;-) Maybe 2018 will be a better year!

Good to know. I've been looking at getting my first AMEX card and one of the business cards might be the way to go. I'm 5/24 right now but I think these business cards listed above won't show on my personal credit report, right? My Citi AA business card doesn't so I assume these won't as well.

@ Max -- That's correct. :)

If I had the SPG Business card but did not spend enough to earn the points bonus can I reapply and earn the bonus if I meet the spend this time? Or is it only one try?

"Social media and banks not really similar at all when it comes to your personal information."

So true - social media to date has never been caught illegally opening customer accounts without customer permission. That being said, social media companies probably guard your personal data using the classy River City Data standard for personal data protection.

@Donna - Social media and banks not really similar at all when it comes to your personal information. Banks have many legitimate business needs for the personal info of their customers and cannot even legally open accounts without it. There are also many specific laws governing how banks can use the information provided, which are largely restricted to these legitimate business purposes for handling your account. That said, any business can be hacked, although you...

@Donna - Social media and banks not really similar at all when it comes to your personal information. Banks have many legitimate business needs for the personal info of their customers and cannot even legally open accounts without it. There are also many specific laws governing how banks can use the information provided, which are largely restricted to these legitimate business purposes for handling your account. That said, any business can be hacked, although you can bet that financial institutions are among the most likely companies to invest highly in anti-hacking measures given their massive potential liability in the event of a data breach.

Social media companies have little real need for your personal information, and their collection and use of this information is governed largely by their own user agreements, along with a patchwork of state laws that are nowhere near as restrictive as the laws applicable to banks.

Have you tried to put in 0001? 4 digits. Or 1000 in binary.

In light of the recent Facebook breach of user information, I am left to wonder if any of this information will be sold, stolen, or used for their own marketing efforts. I am always reluctant to release more information than is necessary to social media and banks.

I applied online for the Chase Ink Cash yesterday, it had the same field on the application. My revenue is higher than $1000 and I answered honestly so I don't know if there's the same $0 restriction there.

Applied for the Delta Plat Bus and Hilton Bus card yesterday and received 2 instant approvals! I know have 4 AMEX Bus Cards- trying to get down below 5/24.

That makes sense, not hard to meet that goal if you have a business