Back in 2019, American Airlines launched SimplyMiles, which is an opportunity to earn bonus miles with select retailers when using a Mastercard. I didn’t write about SimplyMiles all that much at first, since frankly the program wasn’t that compelling.

However, I figure it’s time to write a guide about SimplyMiles for two reasons:

- As of 2022, miles earned through the SimplyMiles program will count as Loyalty Points, and therefore can help you earn AAdvantage elite status

- We recently saw an incredible SimplyMiles promotion that was perhaps the best mileage deal in the past decade, so of course a lot of people are interested now

In this post:

Basics of American AAdvantage SimplyMiles

The SimplyMiles program offers the opportunity to earn bonus AAdvantage miles for purchases with select retailers.

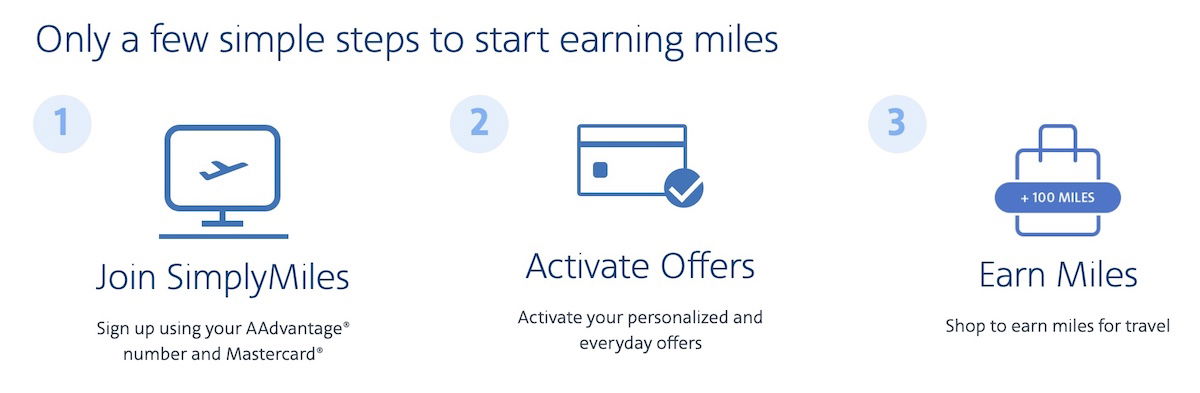

You need to register for the program, link an eligible credit card, activate offers, and then shop, and you’ll automatically be rewarded. Think of it like an online shopping portal (or even like Amex Offers or Chase Offers), except a little bit different, as even in-person purchases usually qualify.

How do you register for SimplyMiles?

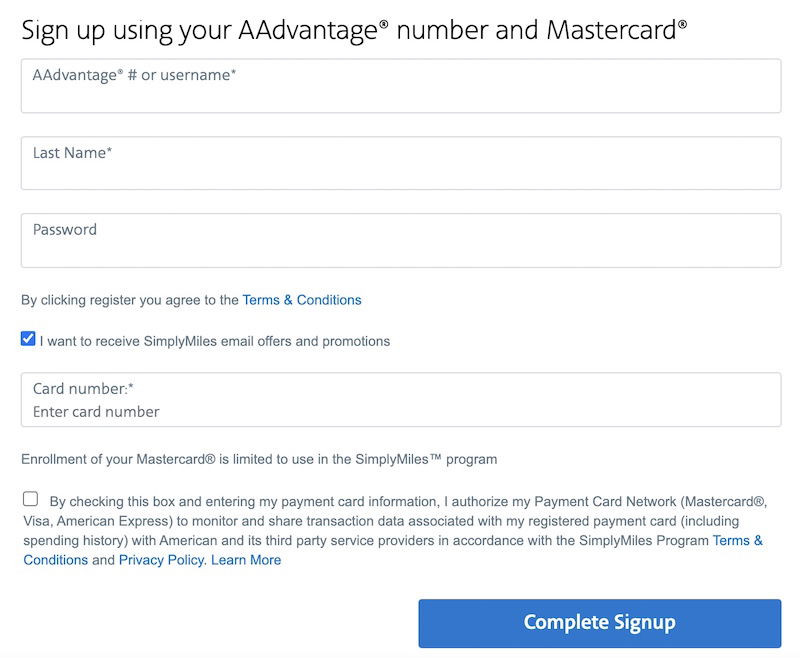

Joining SimplyMiles is super easy. Just follow this link, and then you’ll need to sign-in with your AAdvantage account details, and you can also enter a Mastercard credit card number. Note that registration for SimplyMiles is separate from registration for the AAdvantage program, so I’d highly recommend registering sooner rather than later, just so that you have an account in case an amazing offer comes along. There’s no cost to participate in SimplyMiles.

Which credit cards can you use with SimplyMiles?

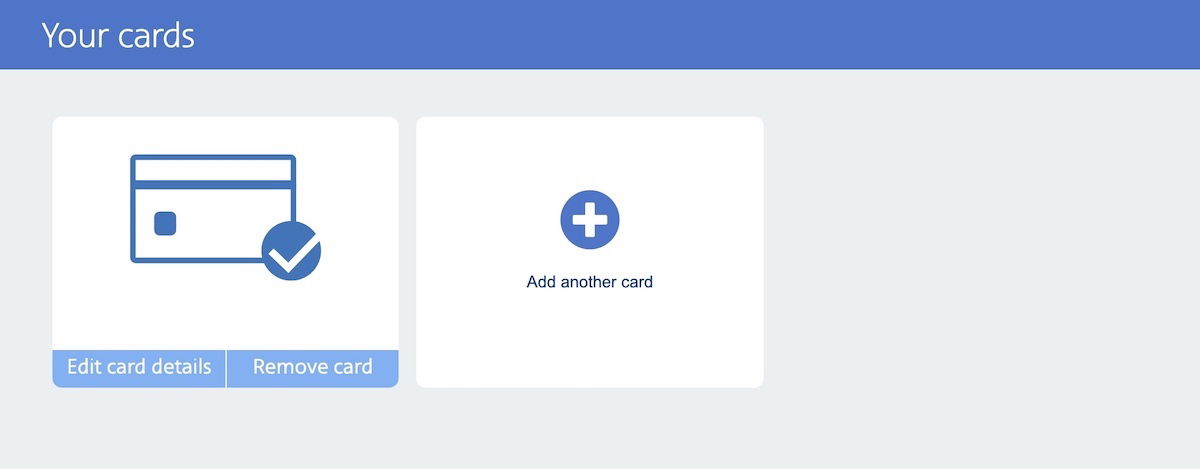

At any given point you can have up to three Mastercard credit cards linked to your SimplyMiles account (though over time you can change the cards that are linked).

You can link them simply by providing the full card number, with nothing else needed at that time. This can be done when you’re logged into your SimplyMiles account, in the “View Profile” section.

You’ll just want to be sure that you have an eligible card linked prior to making a purchase (though it’s fine if you activate an offer prior to adding your eligible card). Note that in some cases you may be required to use an American AAdvantage credit card to qualify for an offer, so always read the terms & conditions.

How do you activate SimplyMiles offers?

When you’re logged into your SimplyMiles account, you’ll see that the homepage lists how many offers are available to you.

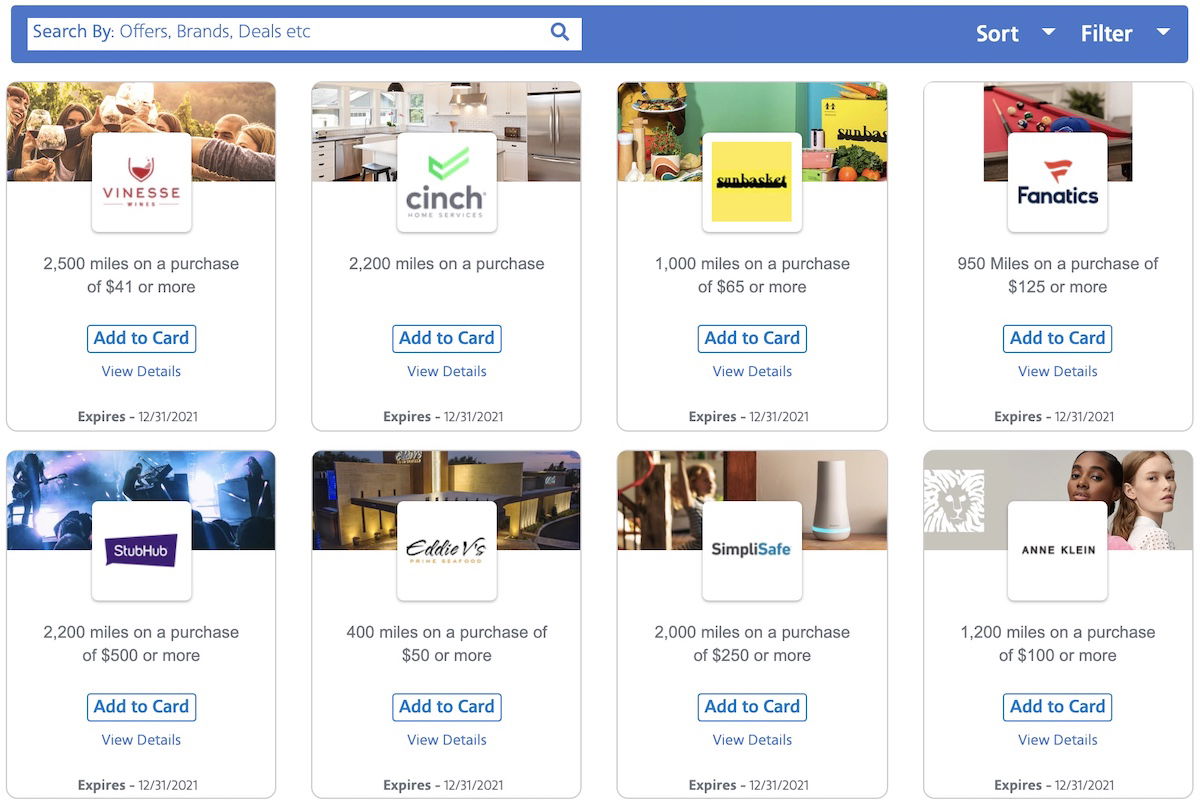

Along the top of the homepage you can click on “Browsers Offers,” which will bring you to all the deals that are available. You can activate as many of them as you’d like. Once they’re activated, you can typically immediately start using your credit card with those retailers, and then you’ll be rewarded.

The offers are in many case quite good, especially when you consider that you earn your typical credit cards rewards on top of that, and in many cases you can stack these deals with online shopping portal bonuses and more.

Note that:

- Offers are targeted, so not all members will be eligible for the same offers

- The available offers are constantly changing, so you’ll want to check back often to see what you’re eligible for

- Generally new members don’t immediately have access to all offers, which is why it’s worth registering for the program, in case there are good offers in the future

- You’ll want to read the terms & conditions of each offer carefully, as there are varying restrictions with these deals (I can’t emphasize this enough — read the offer terms carefully!)

When do SimplyMiles bonus AAdvantage miles post?

SimplyMiles claims that in most cases miles are awarded within three to five business days, but in some cases could take up to 15 business days to post. Data points suggest that it’s pretty common for it to take more than five business days for bonus miles to post.

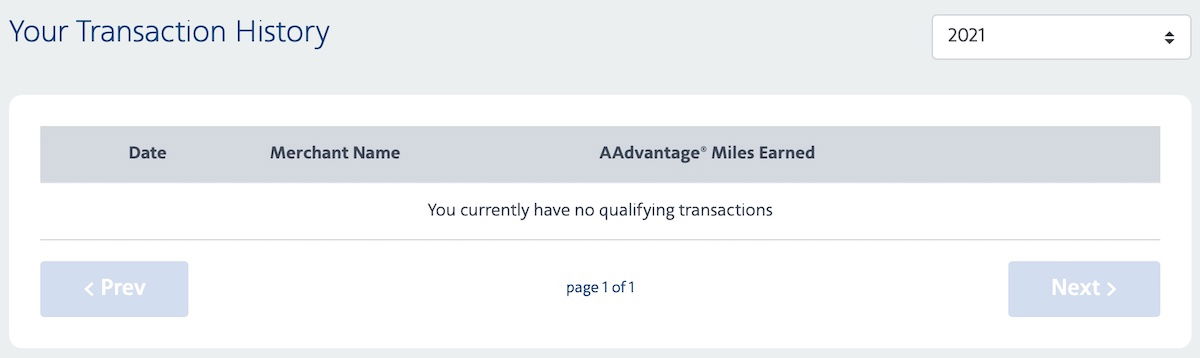

You can keep an eye on your American AAdvantage account to see when the miles post. There’s also a “Miles Earned” section on the SimplyMiles website, though don’t expect that this will reflect the activity before the miles post to your AAdvantage account.

Is American AAdvantage SimplyMiles worth it?

It goes without saying that many of us recently got the mileage deal of a lifetime, thanks to being able to earn 240x AAdvantage miles on a donation to a great cause. I don’t expect that deal to repeat itself. That said, the offer did remind me of the general value of the SimplyMiles program, which is about to get even more interesting.

Starting in 2022, all miles earned through SimplyMiles will qualify as Loyalty Points, and therefore can help you earn AAdvantage elite status.

Is it worth making a purchase through SimplyMiles that you wouldn’t otherwise make just for the miles? Well, no, usually not (unless there’s an amazing promotion). That being said, I absolutely think it’s worth it for AAdvantage loyalists to check the SimplyMiles website every couple of weeks to see what’s available. Not only can you earn bonus miles, but SimplyMiles will also help you towards earning status.

Bottom line

American Airlines’ SimplyMiles program offers bonus miles for purchases with select retailers. You just have to sign up for the program, link a Mastercard, activate offers, and then shop. The quality of the deals varies, but in many cases you might be pleasantly surprised by the retailers on the list.

I’d argue the SimplyMiles program is becoming significantly more lucrative as of 2022, as miles earned through SimplyMiles will qualify towards AAdvantage elite status thanks to the new Loyalty Points system.

Do you plan on using the American Airlines SimplyMiles program to (partly) help you earn AAdvantage elite status?

Ben,

Is double dipping with SimplyMiles and AAdvantageeshopping allowed? I've noticed that some of the vendors are present on both.

Can I use a master card debit card? I do not have m/c credit

Has anyone received their miles from Simply Miles for purchases made prior to 10a CT on Dec-14? I made a Best Buy purchase prior to that time that didn't post 'til 15th; will that count for the bonus? I haven't even received base miles.

Am I the only one who doesn't see terms and conditions on many of the offers?

Will Simplymiles show up on CashBackMonitor when searching for the best earning portal?

No, SimplyMiles is card-linked activation, not a portal site. It may be possible to stack both SimplyMiles and portal for some retailers (e.g. BestBuy)

I spent $1000 on the Forest Conservation donation to receveiv 240,000 miles... When do I receive the 1st 40,000 and when do I receive the other 200,000 miles???? Seems like no-one answers this???

The 40K will take up to 15 days to post and the additional 200K will take 6-8 weeks to post

I'm a member, never got the CI offer, all the offers I get are pretty worthless (250 miles, 1 mile per $ etc...). Not sure why.

I registerd. Activated an offer from Best Buy. Made the purchase. And a day later I looked and the offer wasn't in activated and was nowhere to be found. I sent an email and received a typical "48 hours to respond", but 4 business days later, still nothing. Has anyone had any issues with this or does anyone know if there's a waiting period from when you activate a card until you can use it as I did it all on the same day?

I registered and made a purchase from Best Buy early morning December 14. As of January 10, it has yet to show up as "miles earned". I have submitted two support tickets. The first response was to call 800-882-8880 which is the reservations number for AA. The second support ticket has gone unanswered for two weeks. No miles posted. I have been an Advantage member since 1984.

So by registering your credit card, you signed away your purchasing history and consent to constant monitoring by a whole list of companies that you no longer have control over.

And strange how the only people tipped off to this “sale of the decade “ were bloggers who write about miles, then were rewarded with millions of miles/points and only now decide to promote the product after this limited time available offer has expired???...

So by registering your credit card, you signed away your purchasing history and consent to constant monitoring by a whole list of companies that you no longer have control over.

And strange how the only people tipped off to this “sale of the decade “ were bloggers who write about miles, then were rewarded with millions of miles/points and only now decide to promote the product after this limited time available offer has expired??? Well Lucky, good for you and all the other insiders who were “selected” for this offer. But why not call out what is really happening when people click the permission box, who is getting this information and how is it being sold/traded..?

@ D4Queen -- Conspiracy theory much?

-- I've never been in communication with anyone from SimplyMiles; I learned about the offer on Frequent Miler, and tipped the hat accordingly

-- I wrote about the offer while it was live

-- SimplyMiles is facilitated by Mastercard, and I'm pretty sure Mastercard already has access to your transaction history

When it comes to conspiracy theorists, I learned the best way to deal with them is to completely ignore them :)

Lucky, I think it goes without saying that we’ll all be leaning on you next year to help point out the opportunities for easy SimplyMiles. The first thing that stands out to me are the promotions for IHG hotels that can be used on stays purchased with an IHG Mastercard.

The big question is will the base 40 miles earned from CI could as Loyalty Points since the terms and conditions said it would take up to five weeks to post putting us in January.