Reader Cole posted in the Ask Lucky forum about how Air Canada is selling some 787s, and then leasing them back. This is actually something that’s a lot more common than most people realize, which is why I think it’s an interesting topic to briefly cover.

Essentially Air Canada has sold two of their newest 787s for $351 million and then leased them back, allowing them to record a $19 million gain on the sale (which is perhaps more of an accounting exercise than anything). They plan on doing this for more 787s, and possibly other planes in the future as well.

Air Canada negotiated a deal with Boeing when they ordered the planes many years ago (as is standard when ordering in bulk), and the market price is now slightly higher than what they had negotiated at the time. So they’re planning on selling about 10 of their 787s over the coming years, and then leasing them back.

What’s the logic? Per the story in The Globe And Mail:

The goal is to maintain a fleet that is half owned and half leased. Leasing helps keep debt down. If the market for 787s stays healthy – driven in part by its popularity among airlines, which is demonstrated by a long waiting list – Air Canada could continue to book profits from selling some of the planes and leasing them back.

Now, I’m not sure the terms of their lease, and the degree to which they’re actually coming out ahead here.

However, the point is that most airlines prefer a mix of owning and leasing planes, as a way of mitigating risk.

The decision isn’t that different from trying to decide whether to buy or lease a car. If you’re not sure how long you want to keep the car, it could make sense to lease it rather than buy it. Meanwhile if you know you’ll keep the car for a long time, you’re generally better off buying it. The same applies to airlines, except it’s much more complicated, given that we’re talking about a fleet of hundreds of planes, rather than a single car.

Leasing some planes gives Air Canada more flexibility. If there’s an economic downturn or the plane no longer makes sense for Air Canada, they can just return the plane when the contract is up. Nonetheless long term they’re paying a premium for the privilege of leasing (the leasing company has to make money somehow as well), which is why they continue to own many of their planes.

But the logic for why they’re selling now makes sense. If they have an asset, they might as well sell it when its value is the highest, which is exactly what they’re doing.

Also keep in mind that we’re starting to see a more robust used market for widebodies. With some airlines returning 777s after only a decade or so in service, there’s a great opportunity for airlines to get a deal on those used planes.

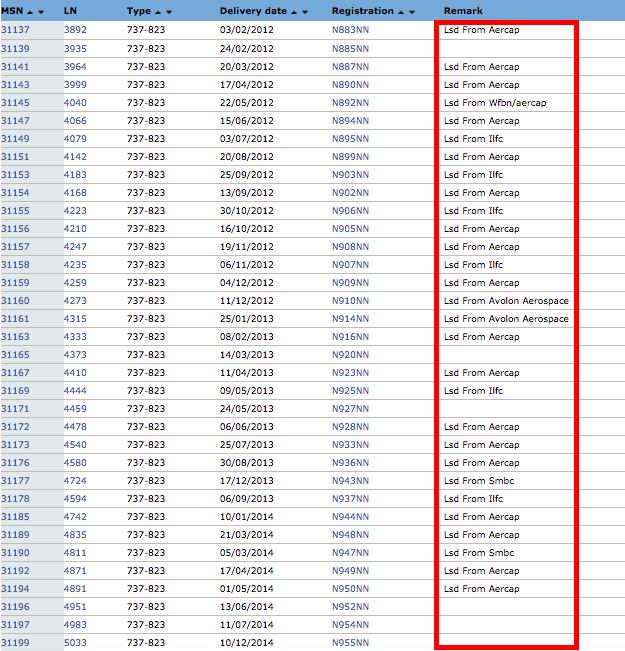

When you look at airlines’ fleets on airfleets.net, you’ll see all the planes they have leased listed under the “Remarks” section. You might just be surprised by how many planes airlines don’t actually own. For example, here’s a small part of American’s 737 fleet:

So while the Air Canada story is interesting, this is also a lot more common than most people realize.

(Tip of the hat to Cole)

@BucK T - You're exactly right - the guys like Udvar-Hazy and GECAS are getting huge discounts. Unlike airlines, they're taking 100+ aircraft on a single order, which especially at the onset of a new program like the A320NEO, 737MAX or 787 is a big deal for the OEMs. If you're a bit nerd like me, you could parse their purchase prices by diving into the purchase commitment disclosures in their financial statements, as that...

@BucK T - You're exactly right - the guys like Udvar-Hazy and GECAS are getting huge discounts. Unlike airlines, they're taking 100+ aircraft on a single order, which especially at the onset of a new program like the A320NEO, 737MAX or 787 is a big deal for the OEMs. If you're a bit nerd like me, you could parse their purchase prices by diving into the purchase commitment disclosures in their financial statements, as that would tell you their total cost for all aircraft on order.

Air Canada has now joined the auctions market:

http://www.cbc.ca/news/business/air-canada-upgrade-bid-flight-1.4019920

@Dan C - Aircraft lessors are some of the biggest direct customers for aircraft OEM. Pricing is never directly discussed in the open, but you can be certain that guys like Udvar-Hazy are getting significantly discounted purchase prices from Boeing and Airbus. In fact, I'd venture a guess that his acquisition costs on new metal are less than many major airlines out there.

Per @Dave, leasing is often cheaper for airlines. The large aircraft leasing companies would love to buy direct from manufacturers but don't get access to the deep discounts airlines are offered when buying new (for many structural reasons). Long story short, airline buys at a discount and then turns around and negotiates a sale-lease back on favorable terms; assuming aircraft type remains desirable, aircraft leasing earns a healthy spread on the back-end by leasing to...

Per @Dave, leasing is often cheaper for airlines. The large aircraft leasing companies would love to buy direct from manufacturers but don't get access to the deep discounts airlines are offered when buying new (for many structural reasons). Long story short, airline buys at a discount and then turns around and negotiates a sale-lease back on favorable terms; assuming aircraft type remains desirable, aircraft leasing earns a healthy spread on the back-end by leasing to tier 2/3 airlines. Great business model with +40% IRR. And many private equity funds (Terra Firma, Oaktree) have done well backing aircraft leasing platforms

I'm a Canadian accounting student and a reason I've learned as to why companies opt to engage in capital leases is that is affords off balance sheet financing. In essence they're able to have access to capital on assets that they own/need. It allows them to gain access to cash that normally they might have to go through a bank to get. And if a company already has a good amount of debt then it...

I'm a Canadian accounting student and a reason I've learned as to why companies opt to engage in capital leases is that is affords off balance sheet financing. In essence they're able to have access to capital on assets that they own/need. It allows them to gain access to cash that normally they might have to go through a bank to get. And if a company already has a good amount of debt then it makes sense for them to leverage assets that they have already paid for. I wouldn't call it "'accounting shenanigans' to pad bonuses" because it it allowing a company to get access to cash that they would have needed anyway. So instead of taking a loan from a bank that might restrict their business abilities through covenants etc. and recording a huge liability, they're able to move an asset on the balance sheet to another asset position (capital lease).

This is actually super super common in a lot of different businesses that require very expensive machinery. Construction companies do it with their large equipment, shipping companies with their equipment etc etc. It's actually very common with corporate planes as well.

@ Mike: correct; US GAAP ( the US accounting standards) have capital and operating leases (while the international IFRS refer to finance and operating leases). Capital (finance) leases are typically long-term (> 75% of useful life of the asset or > 90% of the asset value) and are therefore on the lessee's balance sheet (as you in substance aquired the asset).

Airlines typically lease under operating leases, however, in order to remove the asset...

@ Mike: correct; US GAAP ( the US accounting standards) have capital and operating leases (while the international IFRS refer to finance and operating leases). Capital (finance) leases are typically long-term (> 75% of useful life of the asset or > 90% of the asset value) and are therefore on the lessee's balance sheet (as you in substance aquired the asset).

Airlines typically lease under operating leases, however, in order to remove the asset (and lease liability) from the balance sheet on show a better debt/equity ratio.

This will change in a few years, as the revised leasing in US GAAP and IFRS will bring ALL leases on balance sheet, also operating leases (airline accounting was actually a trigger for this revison...).

@Lucky: leasing is not necessarily more expensive, as financing the airplane through bank loans or other vehicles doesn't come for free either. Keeping the planes off balance sheet is typically the driving factor.

About 50% of the world's commercial fleet is leased. It rose significantly until about 2015 and has leveled off. It's a numbers game. The big lessors get better interest rates because of their stability/scale. Even with the margin they earn on lease rates, it can still be cheaper for an airline to lease the plane, as their own questionable credit histories (i.e. Air Canada) make borrowing to purchase planes very expensive. It also adds flexibility....

About 50% of the world's commercial fleet is leased. It rose significantly until about 2015 and has leveled off. It's a numbers game. The big lessors get better interest rates because of their stability/scale. Even with the margin they earn on lease rates, it can still be cheaper for an airline to lease the plane, as their own questionable credit histories (i.e. Air Canada) make borrowing to purchase planes very expensive. It also adds flexibility. Planes have a usual lifespan of 25 years, and leases on brand new planes are typically 10-15 years, so it takes away the longer term risk for the airline.

As far as operating vs. capital goes, as someone stated earlier, that distinction will become irrelevant in 2018, as both IFRS and US GAAP will put all leases on balance sheet, so that basically eliminates any apparent benefit from accounting trickery.

N.B. I'm an accountant that has worked in aircraft leasing.

^^^^ that's one of the commenters you will want to ban Lucky, but anyways Ben I'm sure you knew this already but did you know that Asiana is getting A350s? I only know that they are getting some but I don't know anymore details. Could you make a post on it? Thanks!

United actually owns a bunch of Air Canada's A330s and AC leases them back from UA

http://www.airliners.net/forum/viewtopic.php?t=17031

Basically, accounting shenanigans to pad bonus in the short term.

Btw, leasing a car is better for picking up women. Women are shallow.

I am not an expert in aircraft leasing - but have looked at it a bit. As I understand it typically there are 2 types of leases - Operating vs. Capital. As I recall an operating lease is kind of similar to a car rental - in that you agree to operate the plane for a period of time, maintain it and then 'turn in the keys' when the lease period is over. A capital...

I am not an expert in aircraft leasing - but have looked at it a bit. As I understand it typically there are 2 types of leases - Operating vs. Capital. As I recall an operating lease is kind of similar to a car rental - in that you agree to operate the plane for a period of time, maintain it and then 'turn in the keys' when the lease period is over. A capital lease on the other hand is a bit more like 'lease to own' where you pay lease payments for set (longish term) like 10 or 15 years and then at the end there is either a 'buyout' price where you can purchase the plane for a set ballon amount. I believe the ballon amount is technically optional so the asset (the plane) doesn't sit on the books (techinical accounting stuff) but at the end of the day the airlines I think almost always exercise the ballon payment. As I understand it, it's a way for the airlines to nominally own the plane without having the long term debt appear on their balance sheet.

It would be interesting to know which Air Canada's are. I 'assume' these are Capital leases.