There’s no denying that premium credit cards are all the rage nowadays, and annual fees are reaching new heights. The Chase Sapphire Reserve is undergoing a refresh, a new Chase Sapphire Business is launching, and the Amex Platinum is undergoing some updates later this year.

So here’s another fun credit card topic. Could Delta soon issue (by far) the highest annual fee co-branded credit card in the United States? It would appear so.

In this post:

New premium Delta credit card on the way?

View from the Wing flags how a Reddit user shares that there’s a new Delta Amex card in the works, above the current Delta Reserve Card (which is Delta’s most premium credit card). The user shares no other details, but points out how they also shared the Medallion program overhaul days before the official announcement, and before details leaked anywhere else. So there’s definitely some credibility there.

For what it’s worth, this isn’t the first time that we’ve heard of this general concept. During Delta’s November 2024 Investor Day presentation, Delta President Glenn Hauenstein hinted at the possibility of a more premium card. He acknowledged that “we’ve got the Reserve Card out there,” but asked “is there even a better card?” He finished by saying “we’ll put on our thinking caps on that.”

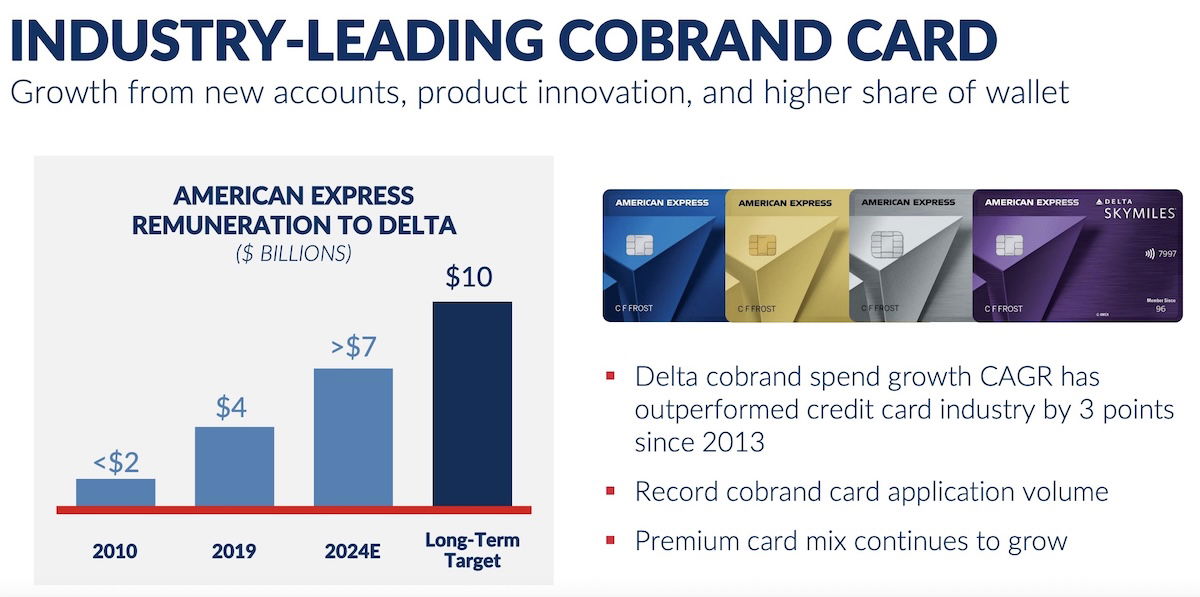

We know that for US airlines, loyalty programs, and in particular co-brand credit cards, are one of the biggest sources of profit. Delta’s remuneration from its co-brand Amex portfolio is currently around $7 billion annually, though the airline is hoping to increase that to $10 billion.

However, the timeline with which that happens keeping being pushed back. Given how competitive the credit card space has become, including the increased popularity of transferable points cards, I imagine that poses a challenge for Delta. So I suppose a super premium card might be part of that strategy.

Is there a limit to how “premium” cards can get?

The popularity of premium credit cards has exploded in recent years. I’d say this largely comes down to several factors, including the following:

- The cards largely actually have good value propositions, and are easy to justify, at least for savvy consumers

- Demand for premium travel continues to be through the roof, and it’s clear younger generations are happy spending their disposable income on travel experiences more than ever before

- We live in an era where people feel the need to “keep up” (made worse by social media), and I think the travel experience is a large part of that

We’ve gotten to the point where $600-800 annual fees are normalized. So could we see annual fees of $1,000+? What about $5,000+? In theory, I can see how this could be a very appealing segment to card issuers — not only could those annual fees generate significant revenue, but people spending that much on an annual fee are also likely to spend a lot on their cards, which is another way card issuers make money.

The issue is, what kind of a value proposition could Delta come up with that would make the card worthwhile? Elite status isn’t worth as much as it used to be. Lounge crowding is a major issue. First class upgrades are rare. So would a premium card just be about giving people even more priority beyond existing card members? After all, so many “benefits” nowadays are just about rearranging priority for experiences. Or could we see something else like, Delta One Lounge access, automatic elite status, etc.?

It’s anyone’s guess how this plays out, but I’m inclined to believe that something is in the works here. Delta already has four tiers of credit cards, so what’s a fifth tier, I suppose?

Bottom line

Delta is reportedly working on a new premium card, a tier above the current premium card. While we don’t have any additional details as of now, I’d expect this card might have a four-figure annual fee. The question is what kind of perks would be lucrative enough for someone to consider the card.

What do you make of the concept of an even more premium Delta credit card?

Why do I need a credit card statement credit for something I will buy anyway, restaurant etc unless it profits me by a reduced cost or other tangible or intangible benefit. Thus why should I pay more for a card just for statement credits. It just make zero sense and the status hungry will pay, the ones having real money get invited card and don’t care what cost. So a mass product premium card is...

Why do I need a credit card statement credit for something I will buy anyway, restaurant etc unless it profits me by a reduced cost or other tangible or intangible benefit. Thus why should I pay more for a card just for statement credits. It just make zero sense and the status hungry will pay, the ones having real money get invited card and don’t care what cost. So a mass product premium card is shallow and will lead people to spend money for nothing. It’s the same with the evaporating mileage game. 500k miles for a ticket one way is a joke. Regardless how good the carrier and flight is

Curious how much people would pay for a card which allows Delta One lounge access (maybe on flights > some number of hours)? Maybe you only allow certain elite levels to be invited to apply for it. I think I'd pay something fairly significant.

$0. Sky clubs are plenty nice. I’m a $40MM/year managing partner.

It's quite embarassing that you got banned for repeatedly posting death threats, but you're so obsessive that you'll make more burner accounts to post on.

Paul Weiss is back???

He's still in time out, poor kid is so addicted and desperate he just had to try. I've been there but it was with booze, a bit more noble. I'm glad he's up to $40MM a year now. Last week it was just $6MM! Going places.

They make 3-4% PER TRANSACTION on these cards. Who cares about revolving balances. They should be free to use WITH the perks.

I could see Gold status. Delta is not gonna give platinum when you need to have a 5k a year centurion. I want to see a 5:1 MQD ratio instead of 10:1 on reserve would be amazing haha. That would put it close to the spend $25k waiver days and get gold with a 2500 MQD boost then you are basically there to platinum. $1295 fee. But yes I can see your silver for 5000...

I could see Gold status. Delta is not gonna give platinum when you need to have a 5k a year centurion. I want to see a 5:1 MQD ratio instead of 10:1 on reserve would be amazing haha. That would put it close to the spend $25k waiver days and get gold with a 2500 MQD boost then you are basically there to platinum. $1295 fee. But yes I can see your silver for 5000 MQD boost but agree need some faster way to platinum been since 2018.

Has to be at least $1000, if you have all 4 Delta cards it’s $1000 for 10k MQD … Gold. Feel they would make it more and give some coupons or unlimited Delta lounge access or maybe Delta one 4 lounge passes when flying first domestically or some VIP section in the lounge like the centurion does for their black card members.

This is not new. The recent trend is shifting premium credit cards back to the pre-CSR (2016) dynamic.

AMEX Platinum back in the days came with automatic elite status, but there were no credits/coupon books. You wouldn't even be approved if your income level does not meet the published qualifications. It was meant for high spend consumers that values the customer service, travel related services, status symbol - not value.

AMEX Centurion was/is...

This is not new. The recent trend is shifting premium credit cards back to the pre-CSR (2016) dynamic.

AMEX Platinum back in the days came with automatic elite status, but there were no credits/coupon books. You wouldn't even be approved if your income level does not meet the published qualifications. It was meant for high spend consumers that values the customer service, travel related services, status symbol - not value.

AMEX Centurion was/is the top-tier premium credit card with the huge annual fee. The people signing up aren't looking for perks that justify the fee in dollars and cents.

United offers an Economy Plus subscriptions for $600 (Domestic, subscriber only) - $1300 (Global, Subscriber + 8 companion). If AMEX/Delta offers a $1000-$1500 card with a global Comfort+ subscription, there would be some bites. I would sign up at the $1,000 level if I live in a Delta hub.

You can buy the Delta club membership for 695 individual with paid guests or family 1495 for unlimited visits with 2 guests. Need to have status.

Ben, my first thought was the automatic elite status with this super premium card though how high the elite status? Silver? Gold? I doubt platinum or higher. Since, Delta does not let its own elites into their lounges on several factors it may be reversed if you hold this card or even lounge access on all domestic flights just for having the card? Delta granting automatic elite status with a hotel brand? Endless opportunities or...

Ben, my first thought was the automatic elite status with this super premium card though how high the elite status? Silver? Gold? I doubt platinum or higher. Since, Delta does not let its own elites into their lounges on several factors it may be reversed if you hold this card or even lounge access on all domestic flights just for having the card? Delta granting automatic elite status with a hotel brand? Endless opportunities or more like marketing tools to get you to pay for the what one must suppose super higher annual fee. Delta is smart here by seeing who is willing to pay the $795 annual fee for the CSR. Then, they may also match it or go higher.

Why are you all looking at it from the perspective of "How much better will this card be?"

When history tells us that the question will likely be:

"HOW MUCH WORSE will they make their EXISTING cards, to incentivize people to move to this one."

They're likely going to trash the benefits of the Reserve card (they're already told us they will, when Bastian mentioned "we ripped the band-aid off too fast") and so...

Why are you all looking at it from the perspective of "How much better will this card be?"

When history tells us that the question will likely be:

"HOW MUCH WORSE will they make their EXISTING cards, to incentivize people to move to this one."

They're likely going to trash the benefits of the Reserve card (they're already told us they will, when Bastian mentioned "we ripped the band-aid off too fast") and so that the things expected when people originally got that card (unlimited lounge access, upgrade priority, etc) will likely go to the new one.

Absolutely agree. Delta is in the business of making money; as is Amex. Status to wait to get into "more" classy clubs? Super priority list for FC upgrades, with still fewer upgrades? If you can afford the card, you can book FC. All the rest are playing the slots. More sky pesos? Show all your friends your super-duper elite card? (Your former friends.)

I officially call this the Amex Tim Dunn card.

you should call it the "Delta knows how to make money like no one else" card.

Delta makes all the money, and you get none of it. Try therapy for your mental insanity

The new card adds a $0 monthly sense of humor - TD should upgrade to it but his application will be rejected

It's bizarre to me that ANYONE would get a Delta credit card.

It's the worst frequent flyer program in history, and the credit cards are insultingly bad.

I guess if you enjoy spending 500,000 SkyPesos on a single J flight, knock yourself out, but...I genuinely don't get it.

I agree but I still ended up getting the business reserve mostly because of how bad it was in regular economy that one time I wanted to get home early. I had no status and gave up a first class set to get home earlier and ended up in a regular economy seat and my knees were hurting after I got off the plane. So now I am at Silver and that's good enough to...

I agree but I still ended up getting the business reserve mostly because of how bad it was in regular economy that one time I wanted to get home early. I had no status and gave up a first class set to get home earlier and ended up in a regular economy seat and my knees were hurting after I got off the plane. So now I am at Silver and that's good enough to get exit rows at booking and I have been able to get comfort+ the onboard product is good for a US carrier and the skyclubs are nice. The miles are barely an ok proposition with the take off 15 benefit. Can't believe I actually spent $2500 this year with delta to requalify for next year. Focusing on AA this year because of the bogo LP promo on the business card. Shooting for PP so will see what happens.

I admit, there are better cash back cards out there. However not everyone is looking to use skymiles for intl J class. I still get a pretty good return using skymiles for moving the family around the country domestically. The biggest problem Delta will face is that so many of the upgrades are now purchased. It's hard to bring incremental value unless they have more creative plans than I can think of right now for this new card.

Ben, thank you for not calling it an ULTRA premium card.

So platinum; much premium.

Lucky - in terms of the “how premium can a card get…” I am guessing two things are at play

1) Banks are trying to recoup the cost of these cards with higher fees as revolving balances may not have risen as much as hoped

2) Banks are trying to force customers to choose - a few years ago, you could justify holding a few premium cards from different banks. Now - with fees...

Lucky - in terms of the “how premium can a card get…” I am guessing two things are at play

1) Banks are trying to recoup the cost of these cards with higher fees as revolving balances may not have risen as much as hoped

2) Banks are trying to force customers to choose - a few years ago, you could justify holding a few premium cards from different banks. Now - with fees going so high, more customers are being forced to choose. I am downgrading and basically sock drawering more cards as fees go up. If you have a high income customer, it’s better to get 100% of her spend than 50%, or 25%. Offer her a super premium card that may fit her spend - she may cancel the card from the other bank. So a lot this seems like a market share play. The number of cards per person is going to decrease among those that play this game, with “unprofitable” card accounts being weeded out, and spend per card going up.

Agree on both counts. People with these cards generally aren't likely to revolve balances as the underwriting standards are higher (so far likelier to pay in full every month), and of course you generally can't anyway with the Amex charge cards.

I disagree. I think the assumption is that folks at these net worth and spend levels would not carry balances month to month, but that is not true.

I’m retired but high income (spend $150,000-$200,000 a year on cards but pay them all off monthly). I carry the CSR and Amex Platinum (plus Amex Gold and 12-15 other mid-low AF cards). Personally I don’t have to choose as I get value from all my cards and, even if I didn’t, a $245 AF increase (about the cost of a decent meal) isn’t going to get me to cancel. I’m glad to see so...

I’m retired but high income (spend $150,000-$200,000 a year on cards but pay them all off monthly). I carry the CSR and Amex Platinum (plus Amex Gold and 12-15 other mid-low AF cards). Personally I don’t have to choose as I get value from all my cards and, even if I didn’t, a $245 AF increase (about the cost of a decent meal) isn’t going to get me to cancel. I’m glad to see so many Chase and Amex customers saying they will cancel - FRANKLY they aren’t the banks’ customers and never should have had the cards.

Unless I can redeem a reasonable number of miles for Delta One there is literally nothing that could entice me to this potential card

I'd expect unlimited SkyClub access (potentially with additional barriers removed like the 3 hour before departure rule), priority on upgrades that is higher than Reserve, better MQD earning, and potentially a couple Delta One Lounge passes when flying in First on a non-D1 route.

Yes, some of things make sense to me. I can imagine a couple of D1 lounge passes being attractive to people who fly from NYC, BOS, ATL, or LAX to high-end regional leisure destinations twice a year on top of their business travel. Maybe 1 MQD per $5 and as you say, upgrade priority ahead of someone with the Reserve, assuming same fare class and status level as it is now. Is it for me? No, but I can see it attracting certain people.

No shot anyone gets D1 lounge passes.

That's not even a thing you get w/ credit cards for Flagship or Polaris lounges. And those have been around for much longer. AA or UA would've jumped on that a long time ago.

I could see 2 D1 passes annually very much being on the table. AA and UA are years behind DL in monetizing their CC relationships - a 'super premium' card isn't on the table for them yet.

Aside from unlimited sky club access, i'm not sure what else they could offer that would make the card appealing though. Probably throw in a $200 annual delta credit or something?

No definitely not. The D1 lounges are already quite crowded at JFK.

I really don't see them doing this at all. Delta has been decreasing access to lounges, not increasing them. In fact the whole industry trend has been to tighten lounge access, no reason for them to flood the D1 lounges with domestic shorthaul passengers.

I could see a $999 or $1099 card that is basically the Reserve, but with unlimited SkyClub access (i.e. what the Reserve used to have).

i feel like most people who would be willing to upgrade to that already meet the spend requirement though. just my two cents

i feel like most people who would be willing to upgrade to that already meet the spend requirement though. just my two cents

just my two cents - i feel like most people who would be willing to upgrade to that probably already meet the 75k spend requirement

just my two cents - i feel like most people who would be willing to upgrade to that probably already meet the 75k spend requirement

Your can say that again!