Link: Learn more about the Citi® / AAdvantage Business™ World Elite Mastercard®

The Citi® / AAdvantage Business™ World Elite Mastercard® (review) is American’s only co-branded business credit card that’s currently open to new applicants. There’s lots of merit to picking up this card, including an improved welcome offer.

I’ve previously picked up this card, and in this post, I want to explain why I applied, discuss the application restrictions, and share my experience getting approved for the card, for those who may be considering applying this time around.

In this post:

Why I applied for the Citi Business AAdvantage Card

Currently, the Citi AAdvantage Business Card has a limited-time welcome offer of 75,000 AAdvantage miles after spending $5,000 within the first five months. This is a solid bonus, and there are lots of great uses of AAdvantage miles, and you can never have enough of them.

There are many reasons to consider picking up this card. In my case, it came down the bonus miles, plus the benefits that having this card offers in conjunction with the AAdvantage Business program. The AAdvantage Business program lets you earn bonus miles for your small business travel, and it’s easier to actually cash out those miles if you have the Citi AAdvantage Business Card (otherwise there are limits on how many people need to be on your account, and how much they need to spend).

Lastly, picking up the card is about as low risk as it gets, as the card’s $99 annual fee is even waived for the first 12 months. You can’t beat that!

The basics of Citi’s card application restrictions

When it comes to getting approved for the Citi AAdvantage Business Card, there are just a couple of main restrictions to be aware of:

- In line with Citi’s general application restrictions, you can typically be approved for at most one Citi card every eight days, and at most two Citi cards every 65 days

- In line with Citi’s 48-month rule, you can only earn the welcome bonus on this card if you haven’t received a welcome bonus on this exact card in the past 48 months (that timeline is based on when you received the bonus, and not based on when you opened or closed the card)

By the way, let me share one other consideration I had when picking up this card. I was trying to stay under Chase’s 5/24 limit (even though there are mixed reports as to whether it’s still enforced). Fortunately applying for Citi business cards doesn’t count as a further card toward that limit.

My experience applying for the Citi Business AAdvantage Card

As I started my Citi AAdvantage Business Card application, I wasn’t sure what the result would be. My last Citi application was roughly a year prior, and I was outright denied, which was my first card denial in many years. I was worried that might happen again. However, that was a personal card, while this is a business card, and those can often lead to very different outcomes.

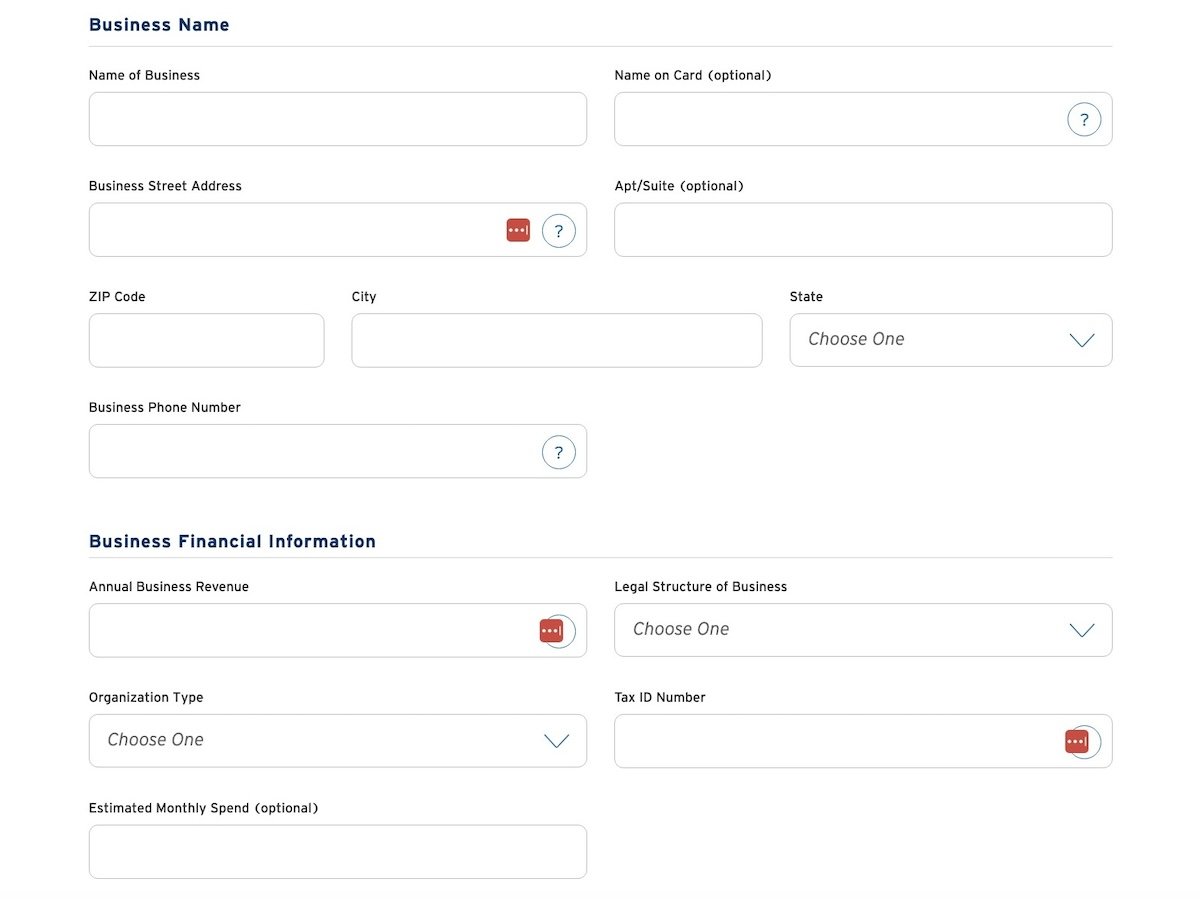

I found the Citi application experience to be straightforward. I just had to enter some basic business information, and then also some basic personal information.

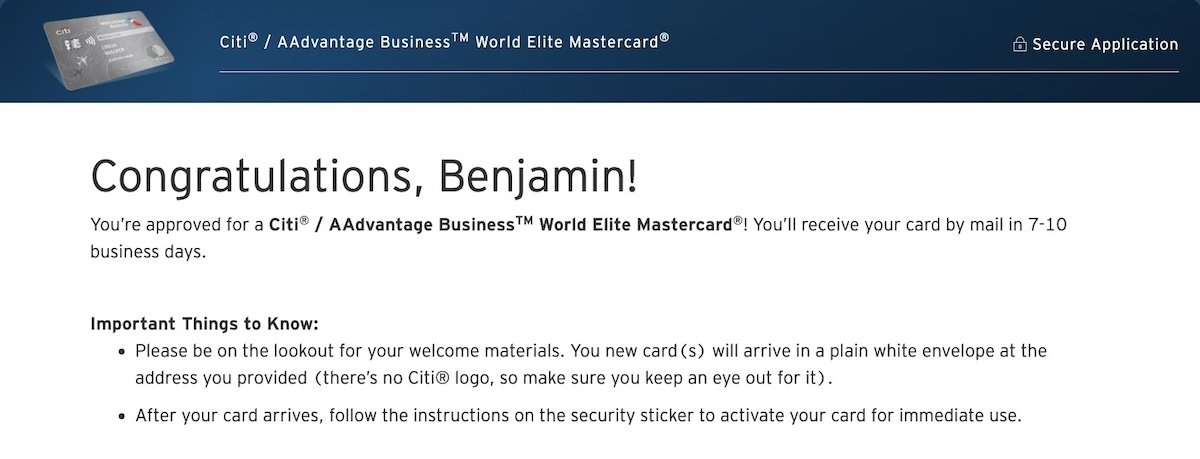

I was pleasantly surprised that upon submitting my application, I received instant approval!

Talk about an easy approval with an incredible welcome bonus and the annual fee waived the first year, plus no impact toward the 5/24 limit. I’ll take it!

Bottom line

The Citi AAdvantage Business Card has an excellent welcome offer. I applied for the card, and was happy to learn that I was instantly approved, especially given my previous denial with Citi.

If you’ve applied for the Citi AAdvantage Business Card, what was your experience like?

I have that pillow in my library along with "Today is a good day" and "Beautiful destinations often lead to everlasting Memories". Qatar will let you take the pillow with you--just ask. Later, they switched from sayings to destinations--I have a number of those too.

Looks like someone is excited to try and get some 2026 World Cup tickets through AA Vacations! :-)

That pillow looks so corny and cheap.