Bilt is the platform known for providing rewards for housing payments. We’ve recently seen massive changes at Bilt, including an overhaul of the credit card portfolio, plus new ways that housing rewards are offered.

There are many innovative things about Bilt, including that there’s a Bilt Rent Day promotion on the first day of each month. With a new month being right around the corner, the March 2026 Bilt Rent Day offer has just been revealed, and it includes a big transfer bonus. It also includes a way to redeem Bilt Cash for a bigger transfer bonus.

In this post:

Details of the March 2026 Bilt Rent Day promotion

There are a couple of aspects to the Bilt Rent Day promotion, including the ability to earn bonus points (which is the same every month), plus at least one additional promotion.

Note that Bilt Rent Day promotions are generally valid from 12:00AM ET until 11:59PM PT, so technically you have around 27 hours to take advantage of them.

Earn double Bilt points on Rent Day purchases

Bilt has a portfolio of credit cards, including the no annual fee Bilt Blue Card, $95 annual fee Bilt Obsidian Card, or $495 Bilt Palladium Card (read my Bilt credit card review & comparison).

On the first day of each month, you earn double those rewards on these cards, and earn up to 1,000 bonus points each month. It could be worth strategically making some purchases on the first day of each month to maximize this as much as possible.

For example, with double points, the Bilt Palladium Card offers 4x points on everyday spending on the first day of the month, so that’s pretty awesome.

Get up to a 125% Japan Airlines Mileage Bank transfer bonus

Japan Airlines Mileage Bank is one of Bilt’s transfer partners, and for the March 2026 Rent Day promotion, we’re seeing a transfer bonus. Exclusively on March 1, 2026, Bilt is offering a 25-125% bonus if you transfer points to the program. The size of the bonus that you get depends on your Bilt elite status. Specifically:

- Bilt Blue members can receive a 25% bonus

- Bilt Silver members can receive a 50% bonus

- Bilt Gold members can receive a 75% bonus

- Bilt Platinum members can receive a 100% bonus

- Members can use $135 in Bilt Cash to upgrade their transfer bonus by one elite tier, and Platinum members can get a transfer bonus of up to 125%

For context, Bilt points ordinarily transfer to Japan Airlines at a 1:1 ratio. So to earn anywhere from 1.25 to 2.25 Japan Airlines miles per Bilt point is pretty amazing. Bilt notes how if your Japan Airlines Mileage Bank account is less than 60 days old, there will be up to a seven day hold before you can use your miles to book travel.

When it comes to actually redeeming for travel on Japan Airlines, I’d say the program is sort of valuable:

- Japan Airlines releases the same award space to its own members as it does to partner program members, so that doesn’t provide much of an advantage

- Redemption rates through Japan Airlines Mileage Bank may be a little lower than through partner programs, but given how hard it is to accrue the points, that’s not necessarily the reason you’d want to redeem through the program

- One advantage of Japan Airlines Mileage Bank is that you get access to award space 360 days out, right when the schedule opens, which is ideal in terms of accessing first and business class awards, especially given that the airline consistently opens award seats when the schedule opens

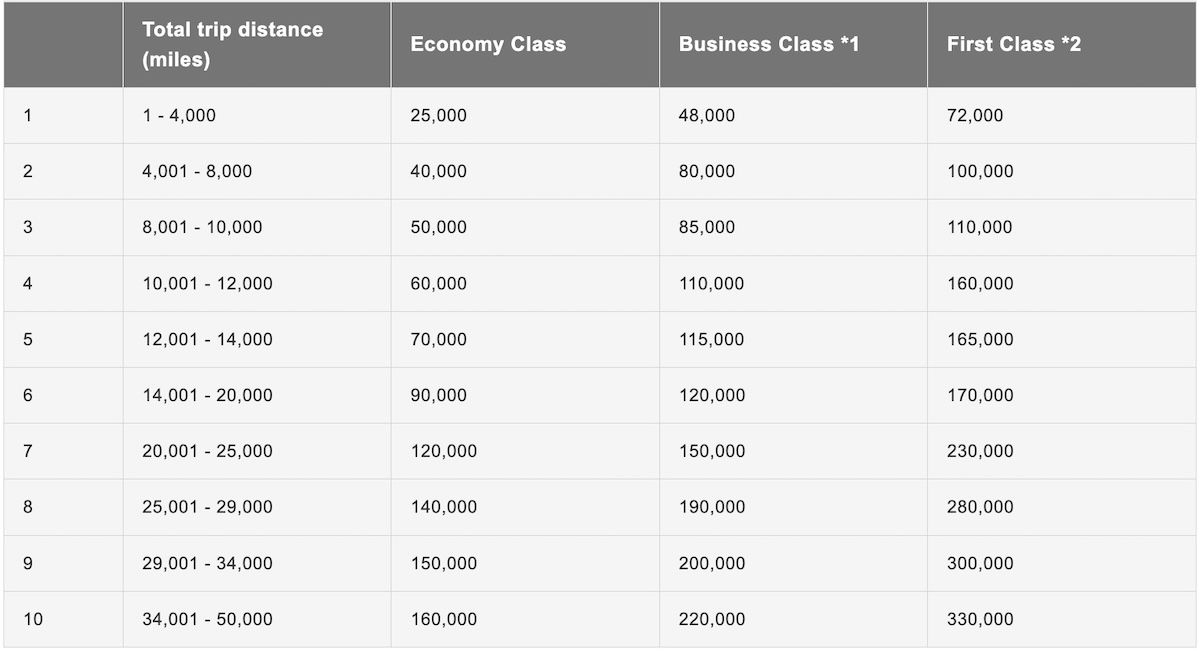

Japan Airlines Mileage Bank also has lucrative redemption rates on other airlines, including oneworld partners, and select non-oneworld partners, like Air France, Emirates, etc. For example, below is the distance based business class award chart.

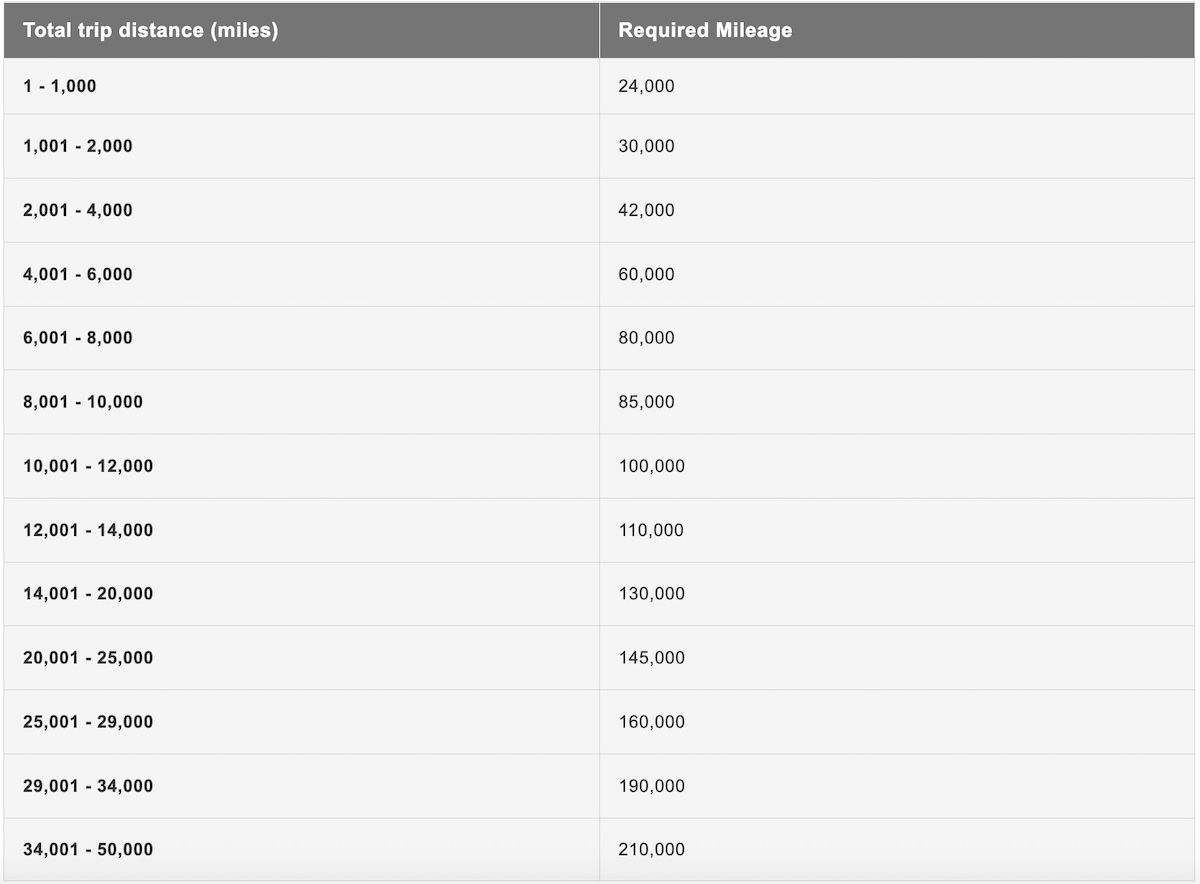

There’s also a oneworld award chart, if you’re traveling on two or more oneworld airlines, with the benefit of multiple stopovers being allowed.

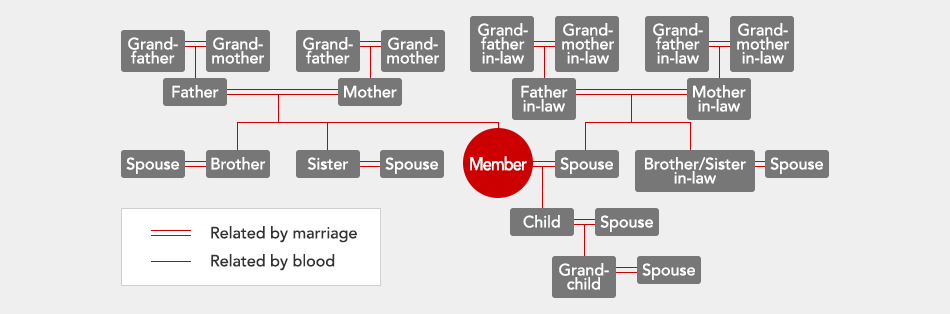

One thing to keep in mind is that Japan Airlines Mileage Bank has restrictions on who you can redeem for. You can only redeem miles for family members, who you are related to by marriage or blood. So if you’re going to participate in Mileage Bank, you’ll definitely want to read up on some of the technicalities before making a transfer, as this isn’t as straightforward as some other programs.

Bottom line

On the first day of each month, Bilt offers a Rent Day promotion. In addition to earning up to double points for purchases, for March 2026, there’s the opportunity to take advantage of a Japan Airlines Mileage Bank transfer bonus. The bonus is based on your elite status, and ranges from 25-125%. On the high end, I think there’s significant value to be had here, though admittedly Japan Airlines can be a bit niche.

Are you taking advantage of the Bilt Rent Day promotion for March 2026?

Miles expire 3y after transfer and cannot extend.

I generally don’t like speculative transfers but I am having a hard time coming up with good reasons not to deplete my 400k BILT point balance by transferring all my BILT points to JL with a 125% bonus. This sort of feels like no brainer territory.

@Ben-

How is availability with Partners such as AA, Air France, BA, Emirates etc with JAL miles? Is the availability based on Saver awards available on the Partners? Thanks

I was surprised to find out that availability is the same between JAL and partners because although this may be the case with saver level awards, I still find a lot of awards that are priced only slightly higher than saver that are only available through the JAL program. The only major drawback to me is not being able to do US - SE Asia awards as a single ticket on JL.

So partners such as AA, BA , Air France are available to book with JAL miles at higher than Saver even though saver awards may not be available? Thanks

"Japan Airlines releases the same award space to its own members as it does to partner program members, so that doesn’t provide much of an advantage"

I would beg to differ that there's not much of an advantage. It may be true that if you can find JL award space at the lowest rate, it will also be available with partners. But their dynamic pricing can often be very valuable and have a lot of...

"Japan Airlines releases the same award space to its own members as it does to partner program members, so that doesn’t provide much of an advantage"

I would beg to differ that there's not much of an advantage. It may be true that if you can find JL award space at the lowest rate, it will also be available with partners. But their dynamic pricing can often be very valuable and have a lot of space for not a ton of additional miles.

I happened to be shopping for flights to Tokyo this morning, and JL had award flights available for 80k SEA-NRT, 70k SFO-NRT for 3 passengers. No way to book those with partners, but I'd say that's a solid deal, especially when you need to book 3 people.

Just adding for clarity that this was business class.

In five years, after some of us have laughed all the way to the bank, the haters will simply express sour grapes and predict Bilt's ultimate bankruptcy.

Friend, this is a good promotion, for those interested in JAL's program. To be clear, I very much want BILT to survive; that said, I'm still saddened by the loss of 1.0, easily earning 1 point per dollar on rent with no fees (after 4 bananas). Personally, I, too, am making the most of 2.0, but, let's be clear, it's a totally different game.

Friend, this is a good promotion, for those interested in JAL's program. To be clear, I very much want BILT to survive; that said, I'm still saddened by the loss of 1.0, easily earning 1 point per dollar on rent with no fees (after 4 bananas). Personally, I, too, am making the most of 2.0, but, let's be clear, it's a totally different game.

I donno why comments duplicate sometimes. It's odd.

Ben, do you think it’s worth doing a speculative transfer? I’m hesitant because of the 36-month hard expiration, but getting a 75% (or 100% if I buy up) bonus is tempting

Doesn’t JAL have a strict expiration policy?

Yes. 36 months after accrual and no way to extend.

I want to book a trip to Japan, but not until 2028. Probably best to not transfer in case something changes with JAL between now and 2027 when I'd book the flights for 2028? Or is this such a great deal that it's worth doing and just holding miles in my JAL account for a year and a few months? It's certainly the best I've ever seen for JAL transfer bonuses.

125% on my 4.33x palladium catch all where are the haters?? Wish they would have done this last year when it launched as I already booked my JAL spring break trip for this year. Guess there's next year?

The vast majority of the $40+ billion in housing payments processed by Bilt are from non-cardholders. Bilt receives 0.8 percent on payments to corporate owners. Well more than the cash coming from WF. Bilt hasn't needed cash from the VCs for nearly three years. The haters don't know Bilt's finances yet they spout as if they do.

Three years?

https://newsroom.biltrewards.com/bilt-raises-250-million-at-over-10-billion-valuation

It hasn't ***needed*** VC money. Early investors typically have non-dulutionary rights that allow them to buy additional shares. Bilt files reports with the SEC. Read them.

@Jack

"The haters don't know Bilt's finances yet they spout as if they do."

Neither do lovers.

No one knows their finances.

But keep defending them. People also did the same for Bernie Madoff.

A trip to Japan (or on JAL) is worth celebrating, any way you slice it, points, cash, etc. Go this year, go again next year. Attempt to see sakura in the spring; go back for kōyō in the fall (I love those Japanese maple tree leaves).

@1990 thoughts????????

Indeed.

One has to wonder why 1990Bot’s thoughts align perfectly with those of Ben …. :-)

Wake me up when there's a Hyatt transfer bonus...

(It'll probably happen only once WOH devalues to the point of becoming IHG/Hilton/Marriott.)

please, no 1990!